Pennsylvania

With Pennsylvania in its sights, WVU Medicine kickstarts health insurer

Pennsylvania

Pennsylvania airport rolls out facial recognition technology | Today in Pa.

Want a say in the news? Email Claudia at todayinpa@pennlive.com to have your thoughts on the stories covered here or on PennLive heard.

You can listen to the latest episode of “Today in Pa” on any of your favorite apps including Alexa, Apple, Spotify, Stitcher and YouTube. Episodes are available every weekday on PennLive. Feel free to subscribe, follow or rate “Today in Pa.” as you see fit!

A judge that released a fentanyl dealer last year on non-monetary bond has been barred from overseeing arraignments. Voter turnout during the primary elections this week was rather abysmal. An airport has rolled out facial recognition technology to screen passengers (although this isn’t making the process faster, mind). Finally, this Pennsylvania’s go-to bagel order.

Those are the stories we cover in the latest episode of “Today in Pa.,” a daily weekday podcast from PennLive.com and hosted by Claudia Dimuro. “Today in Pa.” is dedicated to sharing the most important and interesting stories pertaining to Pennsylvania that lets you know, indeed, what’s happening today in Pa.

Today’s episode refers to the following articles:

If you enjoy “Today in Pa.,” consider leaving us a review on Apple Podcasts or on Amazon. Reviews help others find the show and, besides, we’d like to know what you think about the program, too.

As sponsored by Renewal by Anderson of Central PA.

Pennsylvania

Oh, La La! Pennsylvania Court Rules Perrier Is A Soft Drink—And Taxable

Perrier water

getty

Sales tax on food and beverages can be complicated. While five states do not have a sales tax (Alaska, Delaware, Montana, New Hampshire, and Oregon), the rules in states that do impose a sales tax can vary. Sometimes, all it takes is an add-on or leaving the premises to cause an item to go from nontaxable to taxable (and vice versa). In a recent Pennsylvania sales tax case, the question came down to carbonation.

Facts

On June 1, 2019, Jennifer Montgomery purchased a single 16-ounce bottle of Perrier from Sheetz.

(For the uninitiated, Sheetz is a chain of convenience stores—most of which also sell gas—owned by the Sheetz family. What started as a one-store operation in western Pennsylvania in the 1950s is now a 700+ store enterprise in several states. Importantly, as a resident of eastern Pennsylvania, it’s incumbent upon me to mention that, for decades, a Sheetz vs. Wawa debate has raged in the Keystone State. That question wasn’t resolved in this court action but has been resolved for many in the court of public opinion.)

On June 14, 2019, Montgomery purchased another bottle of Perrier from Sheetz. Sheetz collected and remitted a total of 24 cents in sales tax each time. Afterward, Montgomery filed refund petitions with the Pennsylvania Department of Revenue Board of Appeals (Department) seeking a refund of sales tax based upon her belief that Perrier is natural mineral water and not subject to sales tax in the Commonwealth.

(Montgomery also initiated a class action complaint against Sheetz in the Court of Common Pleas of Allegheny County, alleging the same. The class action was stayed pending the Department’s decision.)

On October 31, 2019, the Department issued a decision and order denying Montgomery’s refund petitions. The Department concluded that Perrier is carbonated water and subject to sales tax.

Montgomery appealed the decision to the Board, which affirmed the denial of the refund petitions on a different basis.

Law & Guidance

Under Pennsylvania tax law, a six percent sales tax is imposed at retail of tangible personal property.

The tax law also excludes “the sale at retail or use of water” (as a public policy note, water is considered a necessity). The exclusion does not apply to soft drinks. Soft drinks are defined as “[a]ll nonalcoholic beverages, whether carbonated or not, such as soda water, ginger ale, coca cola, lime cola, Pepsi cola, Dr. Pepper, fruit juice when plain or carbonated water, flavoring or syrup is added, carbonated water, orangeade, lemonade, root beer or any and all preparations, commonly referred to as ‘soft drinks.’”

The Department also issues informal guidance, such as statements of policy. One of those statements focused on the taxation on the sale and preparation of food and beverages provides that a soft drink is a “nonalcoholic beverage, in either powder or liquid form, whether or not carbonated, such as soda water, ginger ale, colas, root beer, flavored water, artificially carbonated water, orangeade, lemonade, juice drinks containing less than 25% by volume of natural fruit or vegetable juices, and similar drinks. The term does not include fruit and vegetable juices containing at least 25% by volume of natural fruit or vegetable juice. The term does not include coffee, coffee substitutes, tea, cocoa and milk or non-carbonated drinks made from milk derivatives.”

The guidance also makes clear that soft drinks are subject to sales tax.

Montgomery’s Argument

Montgomery argued that Perrier is excluded from sales tax because it is natural mineral water. She claimed that other guidance, including the statement of policy, is unambiguous that water, including natural mineral water, is not subject to sales tax. She argues that “there is no dispute that Perrier is a sparkling natural mineral water.”

She also claimed that the Department’s informal guidance clarifies that all non-flavored mineral water is exempt from tax and does not distinguish between carbonated and non-carbonated mineral water. She claims that it is well settled that the exclusionary provision must be construed against the Commonwealth and in favor of the taxpayer. That would mean, she argued, that Perrier is sparkling natural mineral water, not carbonated water, and is excluded from sales tax.

Montgomery also argued that Perrier does not qualify for sales tax as a soft drink because it is not artificially carbonated. Noting that the definition in the statement of policy includes “artificially carbonated water,” Montgomery urged the Court to conclude that Perrier contains natural carbonation and is exempt from tax.

Commonwealth’s Arguments

The Commonwealth argued that Perrier is not exempt from tax as water, but is carbonated water. That means, they said, that it falls squarely within the definition of soft drink and is subject to sales tax.

The term “carbonate” means “to combine or infuse with carbon dioxide.” The Commonwealth maintained that Perrier is carbonated water because it is manufactured by combining a specific amount of filtered or scrubbed carbonic gas with still water in an industrial plant setting. The Commonwealth further argued that the process used to carbonate Perrier is the same process used to carbonate Coca-Cola

Coca-Cola

Finally, the Commonwealth alleged that because Montgomery didn’t have statutory support for her argument, she improperly relied on the statement of policy and other sources—none of which, they claim, supports a finding that Perrier is exempt from tax. The statutory language makes no qualifications for naturally or artificially carbonated water. Instead, the tax laws simply provide that carbonated water, whether naturally or artificially carbonated, is subject to sales tax. That means, the Commonwealth says, even if the Court concludes that Perrier is “naturally carbonated water,” it is still not exempt under the plain language of the law.

Discussion

Judge Wolf says the arguments “bubble down to one question”—whether Perrier is water and exempt from sales tax.

The Court agrees that the tax law unambiguously exempts the sale at retail of water from sales tax. However, the Court disagreed that Perrier qualifies as water.

The Court then offered a science—and geography lesson—of its own, finding:

- Perrier is sourced from non-flavored mineral water.

- Perrier comes from underground natural springs near the village of Vergeze in Provence, France.

- The water in the natural springs from which Perrier is collected is naturally carbonated.

- Perrier’s carbonic gas and water are independently harvested from different depths within the same geologic formation.

- The carbonic gas and water in Perrier, collected from natural springs, are combined at the bottling plant.

- Before the combination, the water in Perrier is chilled, all of the air is removed (a process called deaeration,) and any carbonation is stripped out.

- Before carbonation, filters or scrubbers remove natural elements and impurities in the carbonic gas and ensure a consistent carbonation level.

- Similarly, before the combination, impurities are removed from the water.

- The water then goes through one of two processes—either a carbonated tank or an in-line carbonation process—where carbonic gas is added to the water and the carbonation levels are adjusted to reach the desired amount for the product.

- The processes used are the same as those for making soft drinks like Coca-Cola and Pepsi. There is no alternative process for carbonating beverages.

- Following these processes, the product is bottled for sale.

VERGEZE, FRANCE – OCTOBER 27: Perrier bottles move down the automated bottling line at the Perrier factory October 27, 2004 in Vergeze, France. (Photo by Gilles Mingasson/Getty Images)

Getty Images

The Court found that when a consumer purchases a bottle of Perrier, the non-flavored mineral water has carbonation.

A finding that mineral water with carbonation is not carbonated water “flies directly in the face of the plain language of the Code,” which treats water and carbonated water differently for sales tax purposes. Perrier, they ruled, is carbonated water as a matter of law and is subject to sales tax as a soft drink.

The Court also rejects Montgomery’s argument that only artificially carbonated water may be taxed as a soft drink. The definition of soft drink in the Code does not contain any natural or artificial qualifications, so Judge Wolf wrote that the argument “does not hold water in the face of the clear and unambiguous statutory language.”

Conclusion

This sort of analysis is often necessary to parse complicated sales tax laws. The taxability (or not) can often turn on something as simple as it did here: bubbles.

In this case, the Court concluded that Perrier is carbonated water and subject to sales taxation as a soft drink. So, drink up, Pennsylvania—just be prepared to pay tax if you’re craving a Perrier.

(Don’t you feel smarter already?)

The case is Jennifer Montgomery v. Commonwealth of Pennsylvania (No. 336 F.R. 2020).

Pennsylvania

Pennsylvania Lawmakers Press Liquor Regulator About State’s Ability To Run Marijuana Shops During Joint Legalization Hearing

Two Pennsylvania legislative panels held a joint hearing to discuss marijuana legalization on Thursday, with multiple lawmakers asking the state’s top liquor regulator about the prospect of having that agency run cannabis shops.

Members of the House Health Committee and Liquor Control Committee heard testimony from a series of experts who also discussed issues such as impaired driving, workplace drug policies and the need for product testing in a legal market.

Rep. Dan Frankel (D), chair of the Health Committee, has previously raised the possibility of pursuing legalization through a state-run model similar to the one Pennsylvania currently has for alcohol. Several lawmakers took the opportunity to ask Pennsylvania Liquor Control Board (PLCB) Executive Director Rodrigo Diaz about that concept at this latest hearing.

He was asked about the capacity of PLCB being able to manage enhanced ID checks, security, tax collection product approvals and more. Diaz signaled that the board would find a way to address the various concerns, but he stressed that “we don’t advocate—we will do what you tell us.”

“What we’re asking you though is to be cognizant of these issues that you’re raising and address them so that we’re not just making it up,” he said, adding that regulators want “clear guidance as to how you want us to address those kinds of issues.”

Frankel also said at the hearing that the panel has “wrestled with” how to navigate the workplace safety issue and ensuring that any future policies “create an environment where people are safe and not wrongly accused of being impaired.”

Another witness, Ryan Vandrey, who is a professor of behavioral pharmacology at Johns Hopkins University, walked the committee through alternatives to urine- or blood-based drug tests, including cognitive impairment tests. He also took another member’s question about how legalization could mitigate the prevalence of unregulated products in the market.

“That is one of the strongest arguments for broader legalization of regulated cannabis products, because there’s been a proliferation of unregulated cannabinoid products that are essentially the same and, in some cases, even stronger or more impairing than delta-9 THC,” he said.

“I don’t think they entirely go away and they’ll still exist as a market, but the market would be much smaller,” Vandrey said. “Research has showed that that’s happened—that those products are much less available and less likely to be used in states where adult-use cannabis has been legalized.”

Frankel said in closing remarks that the hearing “helped educate us in a very meaningful way, and we are taking this seriously as we develop a piece of legislation to look at adult-use.”

This was the latest in a series of legalization hearings in the Keystone State, though normally they are convened by the House Health Subcommittee on Health Care. About two weeks ago, members of that panel had a conversation centered on social justice and equity considerations for reform.

That took place days after Rep. Amen Brown (D) filed a marijuana legalization bill that he described as “grounded in safety and social equity.”

At a prior meeting last month, members focused on criminal justice implications of prohibition and the potential benefits of reform.

At another hearing in February, members looked at the industry perspective, with multiple stakeholders from cannabis growing, dispensing and testing businesses, as well as clinical registrants, testifying.

At the subcommittee’s previous cannabis meeting in December, members heard testimony and asked questions about various elements of marijuana oversight, including promoting social equity and business opportunities, laboratory testing and public versus private operation of a state-legal cannabis industry.

And during the panel’s first meeting late last year, Frankel said that state-run stores are “certainly an option” he’s considering for Pennsylvania, similar to what New Hampshire Gov. Chris Sununu (R) recommended for that state last year, though a state commission later shied away from that plan.

Meanwhile, the cannabis proposal the Brown filed in the House this month is an identical companion to a bipartisan Senate cannabis legalization measure that was introduced last year.

— Learn more about our marijuana bill tracker and become a supporter on Patreon to get access.

Marijuana Moment is tracking more than 1,400 cannabis, psychedelics and drug policy bills in state legislatures and Congress this year. Patreon supporters pledging at least $25/month get access to our interactive maps, charts and hearing calendar so they don’t miss any developments.

—

While Pennsylvania lawmakers have put forward legalization bills in the past, it’s not clear what might serve as the vehicle for reform this year.

Gov. Josh Shapiro (D) once again proposed legalization as part of his budget request in February, seeking to establish a system that would be implemented starting this summer. But while he suggested certain parameters such as having the Department of Agriculture regulate the program, there’s not legislative text yet.

Last month, the Independent Fiscal Office (IFO) released a report that found the state stands to generate $271 million in annual revenue if marijuana is legalized and taxed according to the governor’s proposal—but it would have been more if the commonwealth hadn’t been lapped by other neighboring states that have already enacted the reform.

Meanwhile, House Appropriations Committee Chairman Jordan Harris (D) said in a recent interview that it’s “high time” to legalize marijuana and lay the groundwork for businesses in the state to export cannabis to other markets if federal law changes—and he sees a “real opportunity” to do so.

However, the committee’s minority chairman, Rep. Seth Grove (R), said he’s doubtful that the Democratic-controlled House will be able to craft and deliver legalization legislation that could advance through the GOP majority Senate.

Pennsylvania lawmakers also recently advanced a pair of bills meant to prevent police from charging medical cannabis patients with impaired driving without proof of intoxication.

A Republican senator in Pennsylvania introduced a bill last week meant to remove state barriers to medical marijuana patients carrying firearms after previewing the legislation and soliciting co-sponsors earlier this year.

In December, the governor signed a bill to allow all licensed medical marijuana grower-processors in the state to serve as retailers and sell their cannabis products directly to patients. Independent dispensaries could also start cultivating their own marijuana.

A poll released in February found that about two-thirds of Pennsylvania voters in the state support enacting marijuana legalization.

Key Congresswoman Says ‘Now Is The Time’ To Pass Marijuana Banking Bill, Despite McConnell’s ‘Concerns’

-

World1 week ago

World1 week agoIf not Ursula, then who? Seven in the wings for Commission top job

-

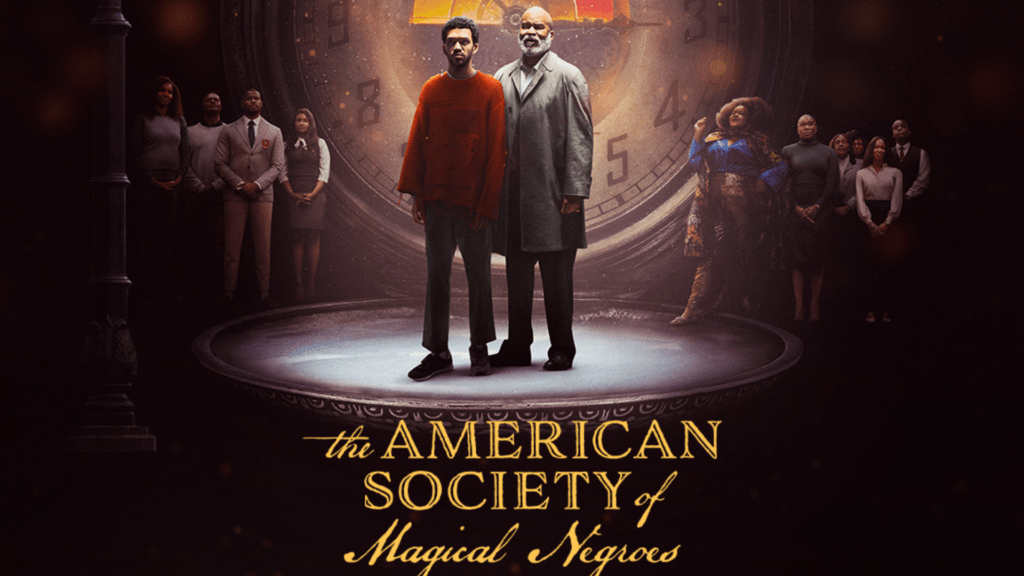

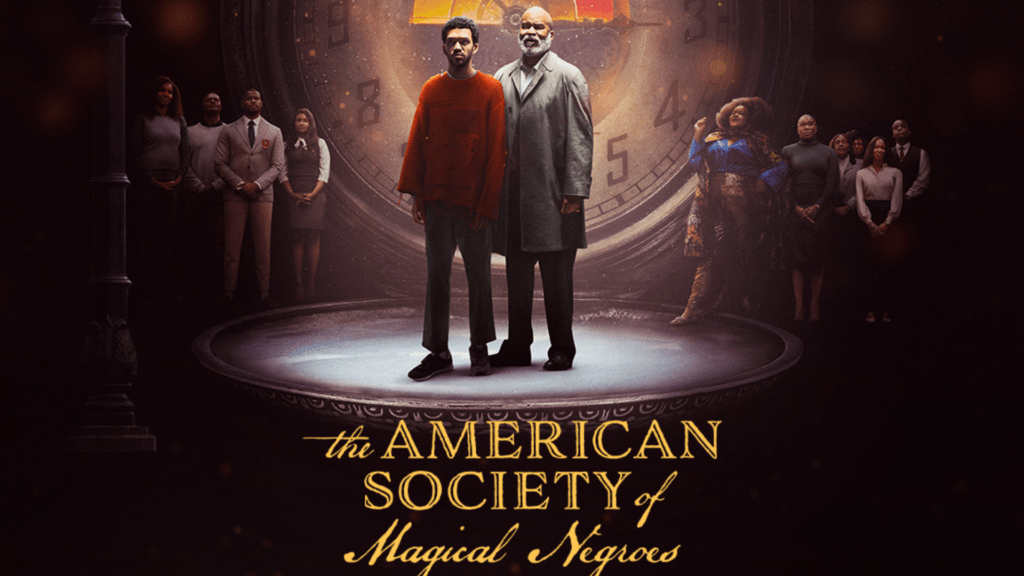

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: The American Society of Magical Negroes

-

News1 week ago

News1 week agoGOP senators demand full trial in Mayorkas impeachment

-

Movie Reviews1 week ago

Movie Reviews1 week agoFilm Review: Season of Terror (1969) by Koji Wakamatsu

-

World1 week ago

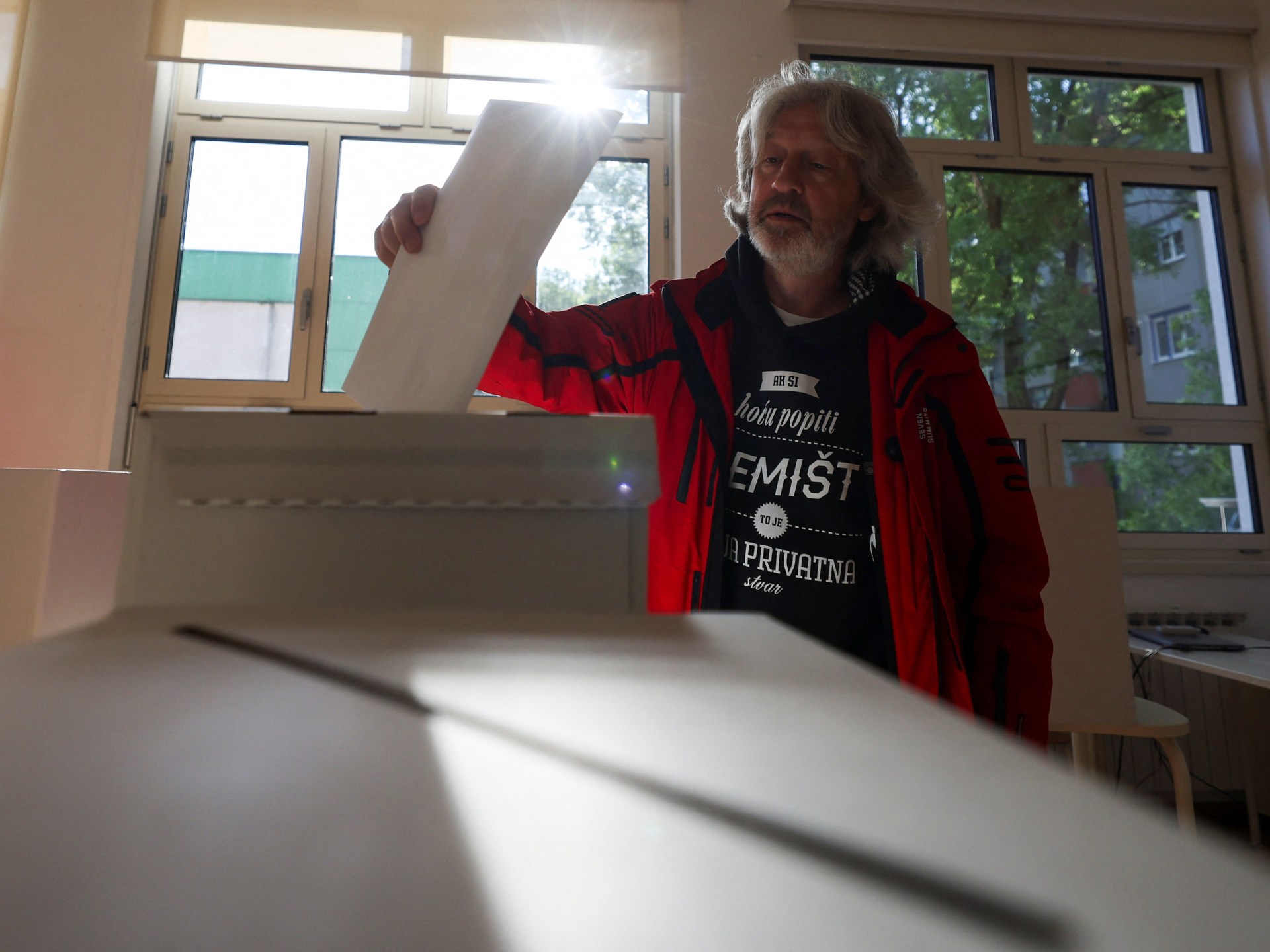

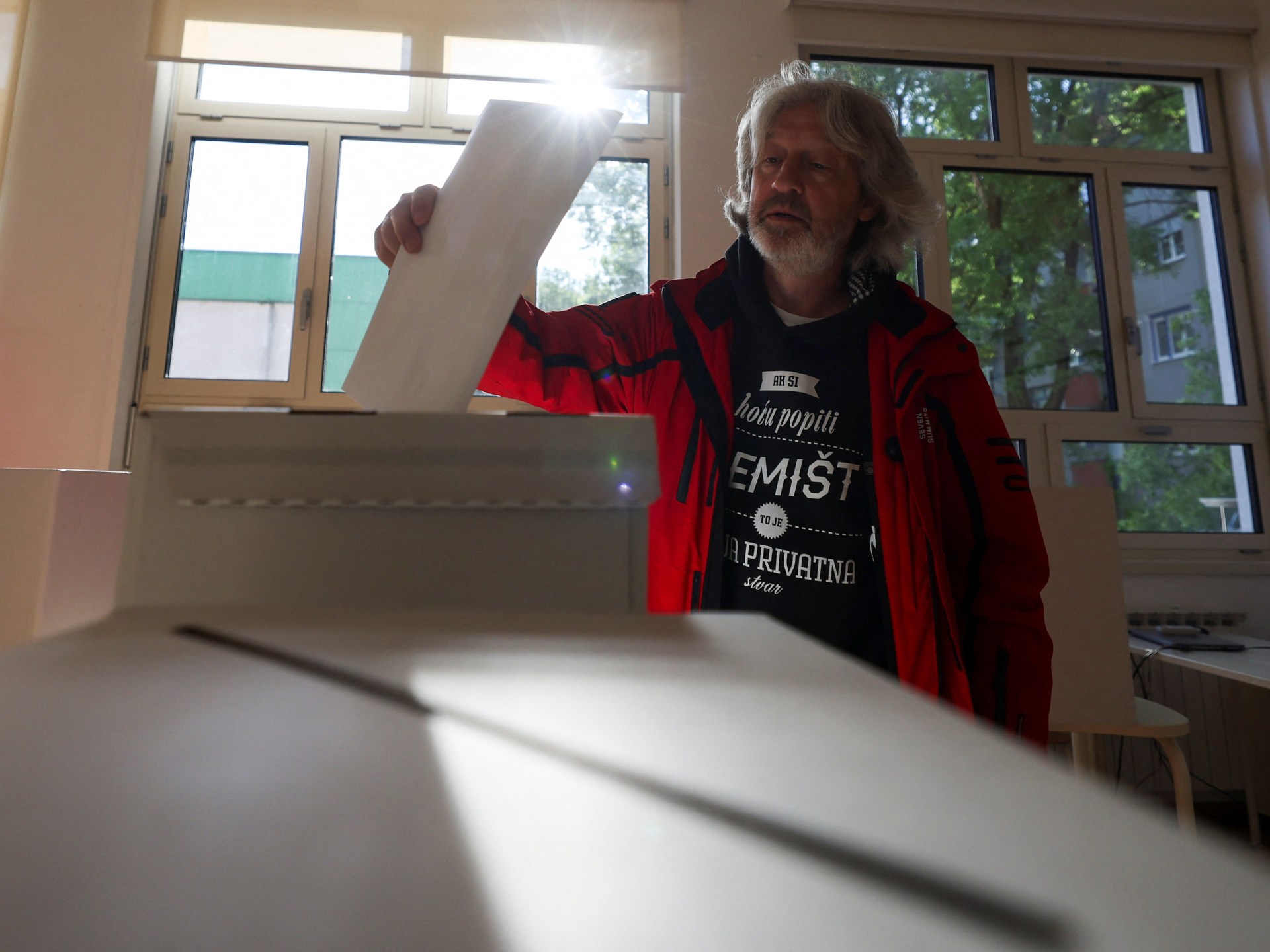

World1 week agoCroatians vote in election pitting the PM against the country’s president

-

World1 week ago

World1 week ago'You are a criminal!' Heckler blasts von der Leyen's stance on Israel

-

Politics1 week ago

Politics1 week agoTrump trial: Jury selection to resume in New York City for 3rd day in former president's trial

-

World1 week ago

World1 week agoAnd the LUX Audience Award goes to… 'The Teachers' Lounge'

:max_bytes(150000):strip_icc():focal(714x345:716x347)/acie-holland-III-042624-4ed388ea936743f8a463fd8d27874b40.jpg)