Wisconsin

Wisconsin borrower risks; high-interest installment loans

Wisconsin borrower dangers; high-interest installment loans

A decade in the past, when debtors wanted fast money in Wisconsin, they have been extra more likely to get a short-term payday mortgage with a excessive rate of interest. Now, likelihood is greater they’ll get a special sort of mortgage that comes with its personal dangers.

MILWAUKEE – A decade in the past, when debtors wanted fast money in Wisconsin, they have been extra more likely to get a short-term payday mortgage with a excessive rate of interest. Now, likelihood is greater they’ll get a special sort of mortgage that comes with its personal dangers.

As guidelines round payday loans have tightened across the nation, the variety of storefront lenders providing payday loans in Wisconsin has steadily declined. A lot of those self same lenders are actually providing longer-term installment loans.

In April 2021, Michael Coloso says he was homeless when he walked right into a Examine n’ Go retailer on S. Layton Avenue in Milwaukee to ask for a mortgage.

“So, I may have someplace to remain, like a resort,” mentioned Coloso.

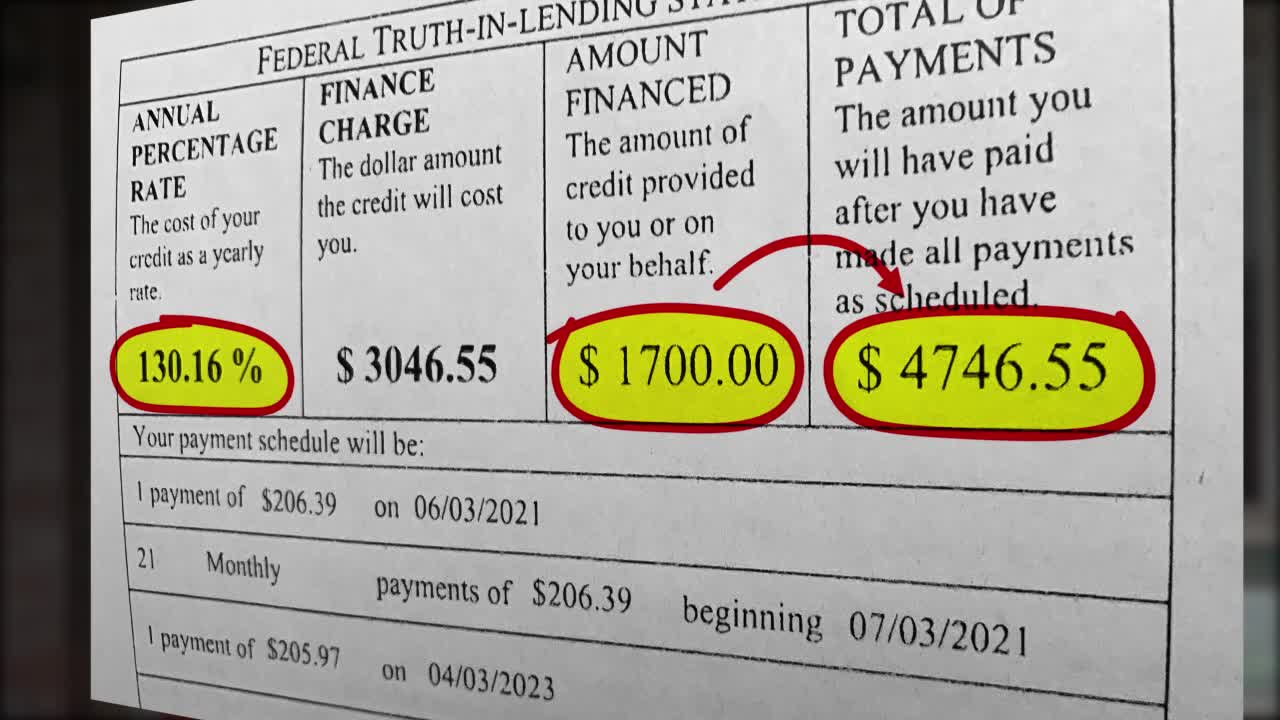

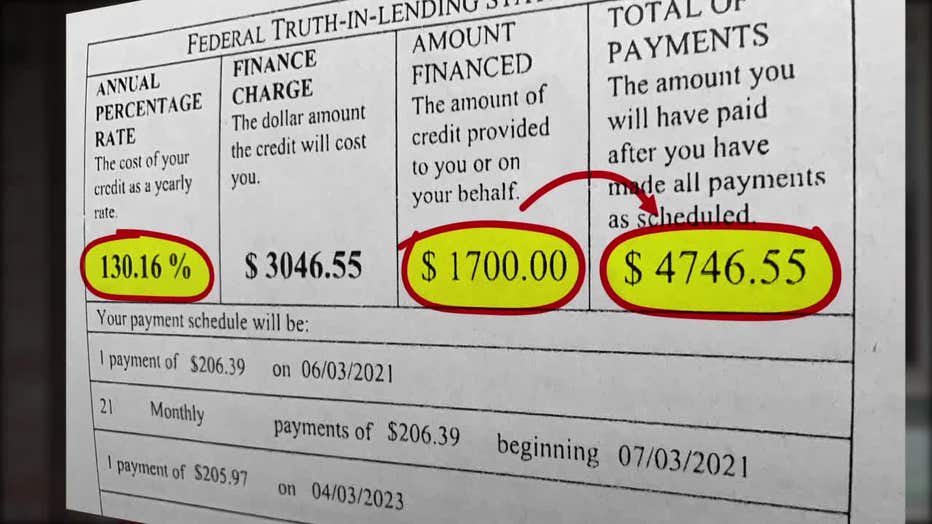

Coloso obtained a $1,700 mortgage. His contract is for 21 month-to-month funds at an APR of 130%. By the point all funds are made, Coloso may have paid again $4,746.55.

Coloso says he didn’t perceive the phrases of the mortgage when he signed the settlement. Examine n’ Go disagrees.

“I do imagine that, , that they … make the most of seniors. If they’ll’t actually perceive what’s happening,” Coloso informed Contact 6.

SIGN UP TODAY: Get each day headlines, breaking information emails from FOX6 Information

Coloso obtained one thing referred to as an installment mortgage. It’s nothing new, besides that it’s grow to be a extra widespread choice at storefront lenders. When not issued by a standard financial institution or credit score union, an installment mortgage will be like a payday mortgage in that it’s fast money and the rate of interest will be excessive.

Payday loans and installment loans are sometimes confused with each other in dialogue. In Wisconsin, a payday mortgage is a smaller, short-term mortgage with a 90-day-limit, capped at $1,500 or 35% of a buyer’s earnings. Loans that take longer to pay-off are typically installment loans.

Storefront lenders who challenge installment loans are usually not topic to the identical degree of scrutiny or oversight as conventional monetary establishments in Wisconsin, and don’t should observe the identical disclosure guidelines.

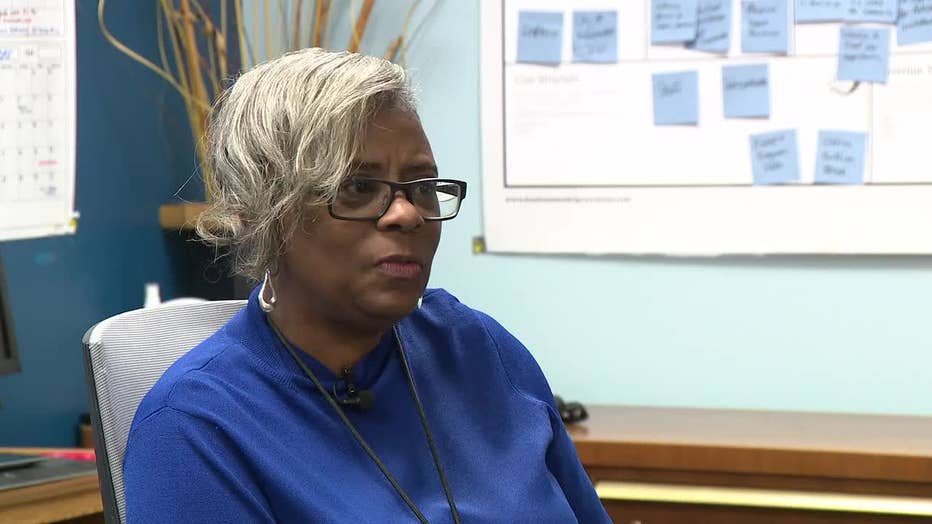

“They actually do cater to people who could have some credit score points up to now. Or, could not have any collateral,” mentioned Constance Alberts, director of Financial institution On Higher Milwaukee.

Financial institution On Higher Milwaukee is a non-profit that helps with private funds. Alberts says she’s listening to from extra individuals turning to high-interest installment loans.

“After we are in an emergency, worrying, dire scenario, we normally will pull on whoever goes to present [the loan] first,” Alberts informed Contact 6.

Contact 6 reached out to Examine n’ Go about Coloso’s mortgage. It referred Contact 6 to its web site, which says installment loans are a substitute for making use of for a bank card or taking out a payday mortgage.

“They’ve longer phrases and better mortgage quantities and are designed that will help you take management of issues in a means that works greatest for you,” the web site states.

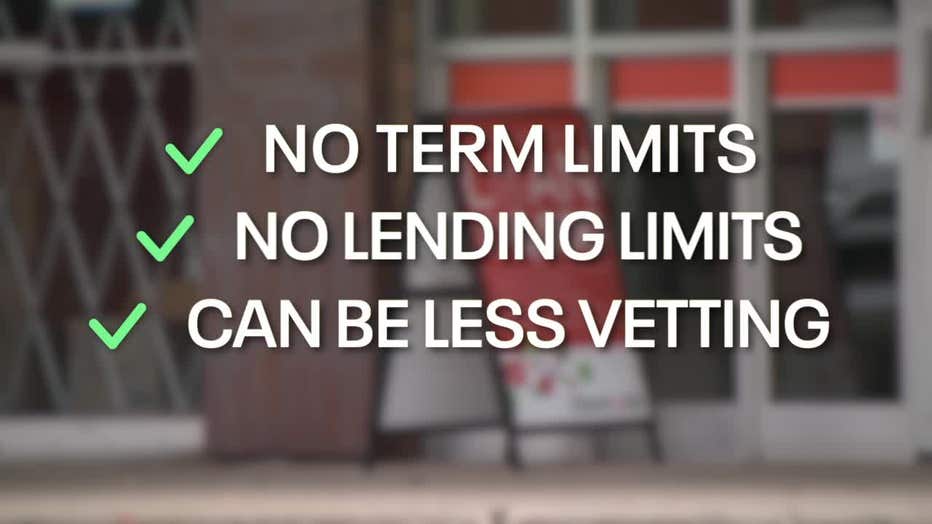

Michael Lawton on the Wisconsin Division of Monetary Establishments says in contrast to payday loans, installment loans at storefront lenders haven’t any time period limits, nor lending limits. In comparison with conventional banks, they’ve much less vetting of the borrower.

FREE DOWNLOAD: Get breaking information alerts within the FOX6 Information app for iOS or Android

“The installment loans don’t have the identical restrictions,” mentioned Lawton. “Many of the [storefront] lenders have restructured their product to be extra the installment mortgage, versus the payday.”

DFI knowledge exhibits 31 mortgage corporations in Milwaukee are licensed by the state to offer installment loans, in comparison with 8 payday lenders who can lengthen each payday and installment loans. The DFI knowledge doesn’t embrace licensed on-line lenders who can even lend to Milwaukee residents.

Wisconsin doesn’t cap the quantity of curiosity a storefront lender can cost, although lawmakers have tried placing ahead resolutions.

Sheila Stevens is a non-public investigator in Oak Creek whom Coloso trusts. She wrote to FOX6 in regards to the installment mortgage on his behalf.

“He mainly had are available as a result of he had paid extra money than lent, and he didn’t perceive why,” mentioned Stevens. “I do know you’ve helped individuals up to now.”

Contact 6 organized a gathering between Coloso, Financial institution on Higher Milwaukee and the Riverworks Monetary Clinic. The Riverworks clinic gives one-on-one monetary teaching.

“Did you assume you have been simply paying the $1,700 again?” Alberts requested Coloso.

“Yeah,” Coloso responded.

Alberts instructed Coloso to file a shopper criticism with the state, stating he didn’t perceive the transaction. Coloso filed the criticism on-line with Stevens’ assist.

Examine n’ Go responded to the criticism and mentioned “.. Notes taken on the time … point out this fee was confirmed with Mr. Coloso.”

The letter goes on to say, “Mr. Coloso has been using CNG’s mortgage providers intermittently … CNG respectfully disagrees Mr. Coloso didn’t perceive the transaction or was taken benefit of.”

Riverworks Monetary Clinic remains to be working with Coloso towards a “wholesome monetary consequence.”

Rose Oswald Poels, President of the Wisconsin Bankers Affiliation, tells Contact 6:

“There’s excessive demand for small-dollar credit score, which 4 in 10 People not with the ability to cowl an emergency expense that prices $400 with out promoting a possession or borrowing cash. [Storefront lenders] have quick phrases and egregious rates of interest, so the price of borrowing may be very excessive…

“… shoppers are inspired to work with their native financial institution as a trusted and accountable supply of choices. Financial institution present honest, handy, and sustainable loans which are higher for assembly the short-term credit score wants of shoppers.”

Lawton says if debtors want a fast mortgage and a storefront lender is their most suitable choice, it recommends purchasing round to get the very best fee.

Wisconsin

Wisconsin 8th Grader Saves Students on School Bus After Driver Passes Out: 'Made Me Feel Good'

:max_bytes(150000):strip_icc():focal(714x345:716x347)/acie-holland-III-042624-4ed388ea936743f8a463fd8d27874b40.jpg)

- Acie Holland III took over the bus’ steering wheel after the driver temporarily lost consciousness, preventing a potential tragedy

- In a letter to parents, the school principal praised the eighth-grader for his “compassion and leadership” during the incident

- “He’s capable of almost anything,” father Acie Holland II said of his son

An eighth-grade student in Wisconsin stopped a school bus from veering into an oncoming lane after the bus driver experienced a medical emergency on April 24, said officials.

In a letter sent to school district parents, Glen Hills Middle School principal Anna Young praised 14-year-old Acie Holland III’s quick thinking in averting a potential tragedy for the students and the driver.

She said that the bus driver experienced a temporary loss of consciousness while on her school bus route.

Never miss a story — sign up for PEOPLE’s free daily newsletter to stay up-to-date on the best of what PEOPLE has to offer, from celebrity news to compelling human interest stories.

“Acie recognized that the driver was not responsive so he rushed to move her foot off the gas, applied the brake, and securely parked the bus,” Young wrote. “He contacted 911 and ensured younger students were okay and instructed them to contact their parents.

“He also sought out his grandmother, who is a nurse, to support the situation,” the principal’s letter continued. “The driver regained consciousness and called Riteway dispatch, who sent their safety team and an alternate bus driver to complete the route.”

In an interview with NBC affiliate WTMJ, Holland said that at the time of the incident, he was looking at his phone when he felt the bus accelerating.

Glendale-River Hills School District

“And I looked at the bus driver because she went past my stop and I looked and I seen her head just go down,” he recalled to the outlet.

Per ABC affiliate WISN, Holland grabbed the steering wheel before calling 911 for help. “Then I get us to the curb,” he added, “and I hit the brakes close and then when we hit the curb, I turned the wheel all the way because I didn’t know where the parking brake was.”

Holland’s father, Acie Holland II, expressed pride in his son’s heroics, telling WTMJ, “It didn’t [faze] me because I know that he’s capable of almost anything.”

In an April 25 Facebook post, the Glendale-River Hills School District hailed the student as a hero, writing, “The District would like to recognize eighth grader, Acie Holland III for his extreme bravery during an alarming bus incident this past Wednesday. Thank you for your quick thinking and calm response, Acie! We are so proud of you! 🤩🙌”

The student also told WISN that the experience has boosted him on a personal level. “[It] made me feel good that I know that I saved people,” Holland said, “and I know I feel more confident now and brave.”

Young concluded her letter by saying that the Glen Hills school community could not be any prouder of Holland. “The compassion and leadership that we see him exhibit daily was taken to the next level on his bus ride home yesterday,” she wrote. “We are grateful that all of our Glen Hills students are safe and are wishing their driver a healthy recovery.”

Wisconsin

Wisconsin is the last state that may prosecute Trump’s fake electors, but AG Josh Kaul is mum

Video shows fake electors meeting in the Wisconsin Capitol

A newly released video shows the gathering of Wisconsin’s fake electors on Dec. 14, 2020, in the state Capitol.

Dane County Circuit Court records

After Arizona became the fourth state to bring charges against fake electors involved in the Trump campaign’s alleged scheme to overturn the 2020 presidential election Wednesday night, eyes turned to the three remaining states where the effort took place: New Mexico, Pennsylvania, and Wisconsin.

Officials in New Mexico and Pennsylvania have said they are unlikely to prosecute Trump allies who sent documents to then-Vice President Mike Pence purporting to certify Trump won the election in their state, because those fake electors placed certain limits on their claims. That leaves Wisconsin as the state most likely still to pursue charges.

Prosecutors had already filed charges in Michigan, Nevada, and Georgia. In Georgia, defendants include Trump himself, former White House Chief of Staff Mark Meadows and former New York City Mayor Rudy Giuliani. And Trump is facing federal charges in Washington, D.C. for conspiracy and obstruction related to the nationwide fake elector scheme. Trump has asked the Supreme Court to declare him immune from those charges.

The top law enforcement official in Wisconsin hasn’t tipped his hand on whether his office is investigating the issue at all, but he also hasn’t ruled out prosecution.

Gillian Drummond, a spokesperson for Wisconsin Attorney General Josh Kaul, a Democrat, said the department “does not confirm or deny the existence of an investigation, except in unique public safety circumstances” but that Kaul “believes that those who committed crimes in an effort to unlawfully subvert the outcome of an election should be held accountable.”

Wisconsin was key in the Trump campaign’s fake elector scheme

Ten Wisconsin Republicans signed a document falsely saying they were “the duly elected and qualified electors” for the state, that they had met in Madison, and all had voted for Trump. But they weren’t duly elected or qualified because voters in Wisconsin chose Biden by a margin of just under 21,000 votes.

The fake elector scheme was largely rooted in on a memo that came out of Wisconsin, where a recount in the close race was underway, according to the U.S. Department of Justice indictment of Trump. The memo advocated that a slate of Trump electors should meet and vote for him in case Trump won the recount.

The indictment said Trump’s campaign and others “took the Wisconsin memo and expanded it” to states that Trump said he was contesting, “even New Mexico, where the defendant had lost by more than ten percent of the popular vote.”

Biden won the recount, and Wisconsin’s governor, Democrat Tom Evers, declared Biden’s electors the legitimate ones from the state.

The fake electors wrote in their certificate that they met and voted for Trump on Dec. 14, 2020, the same day that the state supreme court rejected the Trump campaign’s legal challenge. State officials continued rejecting the false claim that Trump won Wisconsin.

While the 10 Wisconsin fake electors have not faced criminal charges, two of the legitimate electors from 2020 sued them along with two lawyers, Jim Troupis and Kenneth Chesebro, involved in the scheme. The Republicans settled the case.

“This is a scheme to overturn the election that was launched here in Wisconsin and then metastisized to those other six states,” said Jeff Mandel, a lawyer with the left-leaning group Law Forward, which represented the legitimate electors. He called Troupis and Chesebro “the linchpins of the scheme for the whole nation.”

Electors in Pennsylvania and New Mexico unlikely to face charges

In Pennsylvania and New Mexico, the fake electors didn’t claim to be the real electors, only the electors whose votes should be counted if Trump succeeded in getting their states to reverse his loss − an important legal caveat.

Pennsylvania’s Trump electors wrote that their votes for Trump should only be counted “if, as the result of final non-appealable court order or other proceeding prescribed by law, we are ultimately recognized as being the duly elected and qualified electors.”

That language represented a watering-down of the original fake electors scheme that Trump’s campaign sought, and was something the campaign didn’t want catching on with other states, according to the Department of Justice’s indictment of Trump for his efforts to overturn the election.

“Though their rhetoric and policy were intentionally misleading and purposefully damaging to our democracy, based on our initial review, our office does not believe this meets the legal standards for forgery,” the office of then-Attorney General Josh Shapiro wrote in a statement to Lancaster Online. Shapiro, a Democrat, is now the governor.

Likewise, New Mexico’s Trump electors wrote that their filing was prepared “on the understanding that it might later be determined that we are the duly and elected qualified electors.”

The office New Mexico Attorney General Raúl Torrez performed an investigation but said the conditional language “prevents the filing of criminal charges.” Instead, Torrez, a Democrat, asked the state legislature to pass new laws safeguarding the state’s elections.

Charges in Arizona, Georgia, Michigan and Nevada range from forgery to racketeering

The grand jury in Georgia handed down the most sweeping and serious case involving the fake elector scheme. The case charged 19 people — including Trump, Meadows and Giuliani — in a racketeering case under a law usually reserved for Mafia bosses.

The Arizona grand jury charged 18 people — including 11 fake electors, Meadows and Giuliani — with crimes including conspiracy and forgery. The indictment lists Trump as an unindicted co-conspirator.

Michigan Attorney General Dana Nessel, a Democrat, charged 16 people with counts that included conspiracy to commit forgery and publishing a false record. The indictment named Trump as an unindicted co-conspirator.

In Nevada, a grand jury indicted six fake Trump electors, several of whom were state Republican officials.

Wisconsin

Pat Kelsey has his PG in Wisconsin transfer Chucky Hepburn

Balloon Glow Magic(TM) reached unprecedented heights on Thursday with the commitment of Wisconsin transfer point guard Chucky Hepburn.

For me, this is the addition that takes me from “there are some really nice pieces and this could be a surprisingly fun year” to “I am daydreaming in the middle of a late April Thursday about what this team might be capable of accomplishing next winter.”

Hepburn is a three-year starter at point guard for Wisconsin, where he was one of the biggest recruiting wins in program history. After three stellar seasons withe the Badgers, he’ll arrive in Louisville and instantly provide the Cardinals with an enormous boost on both ends of the floor.

Defensively, it’s simple: Hepburn is one of the best on-ball defenders in all of college basketball, and he has been for three years. Pat Kelsey loves to pressure the ball at the point of attack, a technique which only works if you have an absolute dog at the top of your defense. That’s precisely what Hepburn is.

Offensively, Hepburn is one of the best floor generals in the sport. He can score if need be, but he’s also an elite facilitator — posting an average of 3.9 assists against just 1.2 turnovers per game this past season.

Louisville had elite playmakers before the addition of Hepburn. What they didn’t have was a guy who, when things have gotten a little bit dicey and the opposing team has upped its pressure in the closing minutes of a game, a guy the Cards could hand the ball to in the backcourt and say, “ok everyone else get out of the way.”

Hepburn doesn’t rattle, and he has the skills to go hand-in-hand with that mindset.

This is a big, big addition for Kelsey and everyone who is desperate to see Louisville basketball back to looking like Louisville basketball as soon as humanly possible.

Let’s go.

-

World1 week ago

World1 week agoIf not Ursula, then who? Seven in the wings for Commission top job

-

News1 week ago

News1 week agoGOP senators demand full trial in Mayorkas impeachment

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: The American Society of Magical Negroes

-

Movie Reviews1 week ago

Movie Reviews1 week agoFilm Review: Season of Terror (1969) by Koji Wakamatsu

-

World1 week ago

World1 week agoCroatians vote in election pitting the PM against the country’s president

-

World1 week ago

World1 week agoAnd the LUX Audience Award goes to… 'The Teachers' Lounge'

-

World1 week ago

World1 week ago'You are a criminal!' Heckler blasts von der Leyen's stance on Israel

-

Politics1 week ago

Politics1 week agoTrump trial: Jury selection to resume in New York City for 3rd day in former president's trial