Crypto

Polygon (MATIC) vs Cardano (ADA) vs RenQ Finance (RENQ), which of these will replace Binance coin (BNB) as the third biggest cryptocurrency

Polygon (MATIC), Cardano (ADA), and RenQ Finance (RENQ) are all extremely regarded cryptocurrencies within the present market, with every having distinctive options and advantages that make them enticing to buyers.

Whereas Binance Coin (BNB) has been a robust contender because the third greatest cryptocurrency, there may be rising hypothesis that one among these three cryptocurrencies might quickly take its place.

Will it’s RenQ Finance (RENQ)? On this article, we’ll take a better take a look at Polygon, Cardano, and RenQ Finance, and discover which of those cryptocurrencies is most definitely to interchange Binance Coin because the third greatest cryptocurrency.

Polygon (MATIC)

Polygon, previously often known as Matic Community, is a Layer 2 scaling resolution for Ethereum that goals to handle the community’s scalability points.

As of writing, Polygon is priced at $1.08, displaying a – 2.41% improve previously 24 hours. Polygon has seen a 43.11% improve in worth this 12 months, though it has skilled some worth corrections. Nonetheless, Polygon nonetheless maintains a market capitalization of over $9.8 billion.

Polygon gives a quick and low-cost resolution for decentralized purposes, making it a preferred selection for builders and buyers alike. Its interoperability with different blockchains and give attention to consumer expertise have made it a robust contender for the title of the third greatest cryptocurrency.

Cardano (ADA)

Cardano is a blockchain platform that goals to offer a safer, scalable, and sustainable infrastructure for decentralized purposes. The platform makes use of a proof-of-stake consensus algorithm, which permits for sooner transaction occasions and decrease vitality consumption than conventional proof-of-work blockchains like Bitcoin.

Cardano has been making waves within the cryptocurrency market with its latest worth positive factors. As of writing, the Cardano worth is at $0.38, displaying a 1.92% change over the previous 24 hours. The token’s market capitalization is at a formidable $13 million, and it has skilled a considerable 55.95% change up to now this 12 months

Cardano’s give attention to sustainability and scalability has made it a beautiful possibility for buyers on the lookout for a extra environmentally pleasant and environment friendly blockchain. Its partnerships with governments and different establishments have additionally helped to extend its credibility and potential for progress.

RenQ Finance (RENQ)

RenQ Finance is a DeFi platform that makes use of AI expertise to offer liquidity to the cryptocurrency market. The platform permits customers to earn rewards by offering liquidity to numerous liquidity swimming pools and has gained loads of consideration resulting from its superior expertise and safe platform.

RenQ Finance has confirmed to be a promising challenge with robust technological capabilities and a transparent roadmap for future progress. Its ongoing presale has seen a rise of 150% and already raised over $4 million, demonstrating robust investor curiosity within the challenge.

RenQ Finance gives a decentralized platform for buying and selling and accessing varied monetary merchandise. Its multi-chain method permits for elevated interoperability, whereas its use of a Layer 2 scaling resolution ensures low transaction prices and quick processing occasions.

Which cryptocurrency is most definitely to interchange Binance Coin because the third greatest cryptocurrency?

Whereas all three cryptocurrencies have promising futures, RenQ Finance (RENQ) is presently the most definitely candidate to interchange Binance Coin because the third greatest cryptocurrency.

Regardless of being in its presale stage, RenQ Finance (RENQ) is poised for important progress sooner or later. With a robust group, progressive options, and various use circumstances, it has the potential to attain a big market capitalization.

Because the decentralized finance (DeFi) area continues to broaden, RenQ Finance is well-positioned to reap the benefits of this progress. As extra buyers search alternatives to take part in DeFi, the demand for RenQ Finance might improve, resulting in an appreciation within the worth of RENQ tokens within the years to return.

Nonetheless, buyers mustn’t additionally overlook the potential of different cryptocurrencies like Polygon and Cardano, which have additionally proven robust potential for progress out there.

Click on Right here to Purchase RenQ Finance (RENQ) Tokens.

Go to the hyperlinks under for extra details about RenQ Finance (RENQ):

Web site: https://renq.io

Whitepaper: https://renq.io/whitepaper.pdf

Crypto

BNY Mellon Enter BTC ETF Markets Amid Cryptocurrency Surge

BNY Mellon, the oldest and largest custodian bank in the United States, has officially announced its venture into Bitcoin (BTC) through investments in ETFs. The firm disclosed in a recent SEC filing its investments in BTC ETFs managed by BlackRock and Grayscale.

The SEC’s historic approval of 11 spot Bitcoin ETFs in January 2024 has reshaped the investment landscape for cryptocurrencies in America. The introduction of these ETFs brought a surge of enthusiasm, pushing Bitcoin to an all-time high of $73,737 in March. BNY Mellon’s involvement is a testament to the growing institutional interest in cryptocurrencies, a trend boosted by these new investment tools.

Moreover, the approval of Bitcoin ETFs in the U.S. has had a domino effect on global markets. Notably, Hong Kong has followed suit, approving its own Bitcoin and Ethereum spot ETFs, set to begin trading on April 30, 2024. This expansion in global financial hubs signifies a broader acceptance and integration of cryptocurrencies into mainstream financial systems.

Market Predictions

Market analysts predict a strong upward trajectory for Bitcoin, with forecasts suggesting a possible climb to $85,195 by late May 2024. This optimism is grounded in the increasing accessibility and investment flexibility provided by ETFs, making Bitcoin more appealing to both seasoned and new investors.

Furthermore, the potential approval of a spot Ethereum ETF in the U.S. could catalyze another significant rally, particularly as Ethereum currently trails its previous highs. The introduction of such a fund could invigorate the market, possibly driving Ethereum to recover and even surpass its former peak prices.

BNY Mellon’s investment in Bitcoin ETFs is a clear indicator of the evolving landscape of financial investments, with major institutions now looking to digital assets as viable investment vehicles. As the landscape continues to evolve, the financial community watches closely, anticipating the next milestones in this digital finance revolution.

Also Read: ARK Dumps ProShares Bitcoin ETF Shares in Massive Sell-Off

Crypto

Avoid Using Unregistered Cryptocurrency Transfer Services, FBI Warned

The FBI in a Thursday warning emphasized the financial risks associated with using unregistered cryptocurrency transfer services, especially considering potential law enforcement actions against these platforms.

The focus of this public service announcement is on crypto transfer platforms that operate without proper registration as Money Services Businesses (MSB) and fail to comply with anti-money laundering regulations mandated by the U.S. federal law.

Such platforms are frequent targets of law enforcement operations, particularly when criminals exploit them for transferring or laundering unlawfully acquired funds, like in the case of ransomware payments.

FBI’s PSA, released on its Internet Crime Complaint Center, cautioned Americans that,

Using a service that does not comply with its legal obligations may put you at risk of losing access to funds after law enforcement operations target those businesses.

The FBI said it had recently conducted law enforcement operations against unregistered cryptocurrency transfer services “that purposely break the law or knowingly facilitate illegal transactions.” It added that these services will continue to be investigated by law enforcement.

Steps to Avoid Using Unregistered Cryptocurrency Transfer Services

For individuals considering the use of cryptocurrency transfer services, “a few simple steps can prevent unintentional use of non-compliant services,” the FBI said. The agency advised the following security tips:

- Checking the registration status as an MSB with the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN).

- Exercising caution with financial services that do not request KYC information (such as name, date of birth, address, and ID) before facilitating money or cryptocurrency transfers.

- Understanding that the presence of an app in an app store does not necessarily signify its legality or compliance with federal requirements.

- Refraining from using services that openly advertise themselves for illegal purposes.

- Exercising vigilance when using cryptocurrency services known to be utilized by criminals for money laundering.

Samourai Wallet’s Unlicensed Money Transmitting Business Busted

The FBI’s warning comes in the wake of the recent crackdown on Samourai, an illicit cryptocurrency transfer platform that offered a crypto mixer service facilitating the laundering of funds obtained through criminal activities.

The Icelandic law enforcement authorities seized Samourai’s domains (samourai[.]io and samouraiwallet[.]com) and web servers. The Google Play Store also removed the Samourai Wallet Android mobile app that was downloaded over 100,000 times, before the seizure was initiated.

The U.S. Department of Justice charged Keonne Rodriguez and William Lonergan Hill, the platform’s founders and operators, with laundering over $100 million from various criminal enterprises through Samourai’s crypto mixing services, accruing approximately $4.5 million in fees.

According to the superseding indictment, “Since the start of the Whirlpool service in or about 2019 and of the Ricochet service in or about 2017, over 80,000 BTC (worth over $2 billion applying the BTC-USD conversion rates at the time of each transaction) has passed through these two services operated by Samourai.”

The DOJ stated, “While offering Samourai as a ‘privacy‘ service, the defendants knew that it was a haven for criminals to engage in large-scale money laundering and sanctions evasion.

“Indeed, as the defendants intended and well knew, a substantial portion of the funds that Samourai processed were criminal proceeds passed through Samourai for purposes of concealment,” the unsealed indictment said.

Media Disclaimer: This report is based on internal and external research obtained through various means. The information provided is for reference purposes only, and users bear full responsibility for their reliance on it. The Cyber Express assumes no liability for the accuracy or consequences of using this information.

Related

Crypto

Bitcoin Surges Globally, Yen Hits Record Low Against Cryptocurrency – TokenPost

In a stunning financial shift, the Japanese yen has reached a 34-year low against Bitcoin, which also hit all-time highs in 14 countries, fueled by optimism surrounding new spot Bitcoin ETFs.

Yen Hits 34-Year Low as Bitcoin Ascends, Spotlighting Global Shift Towards Cryptocurrency

According to Crypto.News, the Japanese yen plunged to a 34-year low as officials sought to contain the economy’s hyperinflation. According to Bloomberg, Japan’s sovereign fiat money suffers mostly from the disparity between local interest rates and those in the United States Federal Reserve rates.

While the Japanese government works through this problem, Bitcoin (BTC) has surpassed the yen in direct monetary worth. On April 25, Google Finance revealed that one Japanese yen equaled 0 Bitcoin.

In February, BTC soared against various fiat currencies, reaching all-time highs in 14 nations. The industry was propelled by optimism about the newly approved spot Bitcoin ETFs.

Following the revelation, many people on social media praised Bitcoin as “sound money” and an innovation capable of cultivating financial independence from the global traditional economic bubble.

Users reaffirmed what BTC maxi Michael Saylor calls “Bitcoin’s superior design,” referencing Satoshi Nakamoto’s protocol, which ensured that only 21 million BTC would exist.

It is impossible to surpass this limit because it is hard-coded into the Bitcoin blockchain. A halving controls inflation by lowering the number of new tokens in circulation. The halving occurred last week, with Bitwise CIO Mat Hougan opining that the event would largely benefit BTC’s market value in the long term.

Bitcoin Reaches New Heights in 14 Countries Amidst Currency Volatility and Economic Shifts

In a February report, Bitcoin has set an all-time high in 14 countries, including Turkey, Argentina, Egypt, Pakistan, Nigeria, Japan, and Lebanon, despite selling 25% down from its top of $69,000.

The contradictory position highlights the considerable devaluation of these countries’ currencies versus the United States dollar (USD) over the last two years. The global financial market has been extremely unpredictable in recent years, as cryptocurrencies such as Bitcoin have grown in many countries as a hedge against economic uncertainty.

For example, the Lira has devalued dramatically in Turkey, with the USD/TRY exchange rate rising from roughly 7.80 in November 2021 to 31.02. Similarly, the Argentine peso has fallen dramatically, from around 98 to more than 838 versus the US dollar in the same period.

The developments reflect these countries’ greater economic issues and inflationary pressures, contributing to Bitcoin’s growing popularity as an alternative investment and store of value.

Even in Japan, famed for its strong economy, the yen has devalued from roughly 104 to 150 versus the US dollar, indicating a loss of purchasing power.

Since Bitcoin’s birth, the USD has fallen six orders of magnitude versus BTC, showing cryptocurrency’s meteoric rise in the global financial scene. Once considered a digital curiosity, Bitcoin has evolved into a vital asset for investors seeking refuge from currency depreciation and economic uncertainty.

Photo: Microsoft Bing

TokenPost | [email protected]

<Copyright © TokenPost. All Rights Reserved. >

-

World1 week ago

World1 week agoIf not Ursula, then who? Seven in the wings for Commission top job

-

News1 week ago

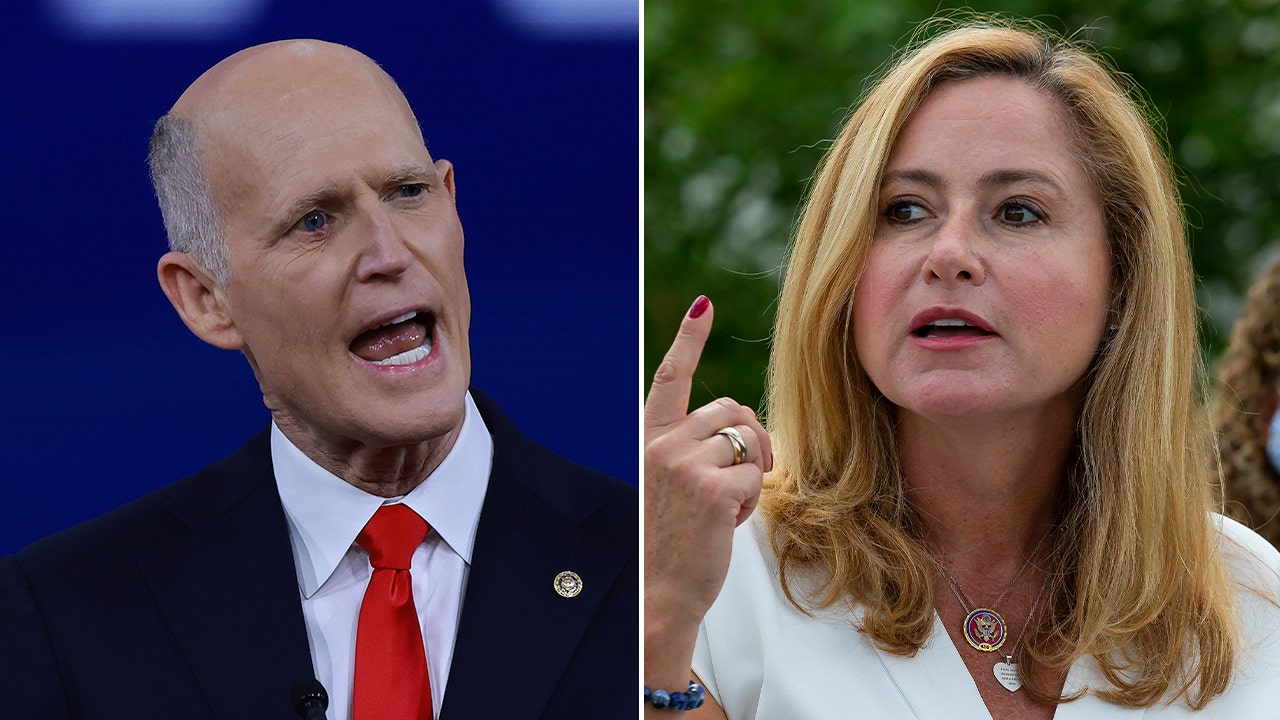

News1 week agoGOP senators demand full trial in Mayorkas impeachment

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: The American Society of Magical Negroes

-

Movie Reviews1 week ago

Movie Reviews1 week agoFilm Review: Season of Terror (1969) by Koji Wakamatsu

-

World1 week ago

World1 week agoCroatians vote in election pitting the PM against the country’s president

-

World1 week ago

World1 week agoAnd the LUX Audience Award goes to… 'The Teachers' Lounge'

-

World1 week ago

World1 week ago'You are a criminal!' Heckler blasts von der Leyen's stance on Israel

-

Politics1 week ago

Politics1 week agoTrump trial: Jury selection to resume in New York City for 3rd day in former president's trial