Crypto

Bitcoin Surges Globally, Yen Hits Record Low Against Cryptocurrency – TokenPost

In a stunning financial shift, the Japanese yen has reached a 34-year low against Bitcoin, which also hit all-time highs in 14 countries, fueled by optimism surrounding new spot Bitcoin ETFs.

Yen Hits 34-Year Low as Bitcoin Ascends, Spotlighting Global Shift Towards Cryptocurrency

According to Crypto.News, the Japanese yen plunged to a 34-year low as officials sought to contain the economy’s hyperinflation. According to Bloomberg, Japan’s sovereign fiat money suffers mostly from the disparity between local interest rates and those in the United States Federal Reserve rates.

While the Japanese government works through this problem, Bitcoin (BTC) has surpassed the yen in direct monetary worth. On April 25, Google Finance revealed that one Japanese yen equaled 0 Bitcoin.

In February, BTC soared against various fiat currencies, reaching all-time highs in 14 nations. The industry was propelled by optimism about the newly approved spot Bitcoin ETFs.

Following the revelation, many people on social media praised Bitcoin as “sound money” and an innovation capable of cultivating financial independence from the global traditional economic bubble.

Users reaffirmed what BTC maxi Michael Saylor calls “Bitcoin’s superior design,” referencing Satoshi Nakamoto’s protocol, which ensured that only 21 million BTC would exist.

It is impossible to surpass this limit because it is hard-coded into the Bitcoin blockchain. A halving controls inflation by lowering the number of new tokens in circulation. The halving occurred last week, with Bitwise CIO Mat Hougan opining that the event would largely benefit BTC’s market value in the long term.

Bitcoin Reaches New Heights in 14 Countries Amidst Currency Volatility and Economic Shifts

In a February report, Bitcoin has set an all-time high in 14 countries, including Turkey, Argentina, Egypt, Pakistan, Nigeria, Japan, and Lebanon, despite selling 25% down from its top of $69,000.

The contradictory position highlights the considerable devaluation of these countries’ currencies versus the United States dollar (USD) over the last two years. The global financial market has been extremely unpredictable in recent years, as cryptocurrencies such as Bitcoin have grown in many countries as a hedge against economic uncertainty.

For example, the Lira has devalued dramatically in Turkey, with the USD/TRY exchange rate rising from roughly 7.80 in November 2021 to 31.02. Similarly, the Argentine peso has fallen dramatically, from around 98 to more than 838 versus the US dollar in the same period.

The developments reflect these countries’ greater economic issues and inflationary pressures, contributing to Bitcoin’s growing popularity as an alternative investment and store of value.

Even in Japan, famed for its strong economy, the yen has devalued from roughly 104 to 150 versus the US dollar, indicating a loss of purchasing power.

Since Bitcoin’s birth, the USD has fallen six orders of magnitude versus BTC, showing cryptocurrency’s meteoric rise in the global financial scene. Once considered a digital curiosity, Bitcoin has evolved into a vital asset for investors seeking refuge from currency depreciation and economic uncertainty.

Photo: Microsoft Bing

TokenPost | [email protected]

<Copyright © TokenPost. All Rights Reserved. >

Crypto

Top Cryptocurrency Gainers and Losers of the Week

Insights into recent surges and dips, and the importance of caution in investment

Cryptocurrency Gainers and Losers of the Week: Cryptocurrency markets are famously volatile, with prices soaring and dipping on a regular basis. In this week’s recap, we delve into the top cryptocurrency gainers and losers of the week, examining the factors behind their impressive surges or significant dips.

Top Gainers:

Helium

Price: US$5.39

Surge in 7days: 41.33%

Market Cap: US$30,168,995

During the week, the decentralized wireless network Helium has demonstrated an outstanding growth. Such a rapid growth might be associated with the increased demand for the services of the network, including IOT applications. Since Helium is rather unique in its way of arranging a global, decentralized wireless network, it has attracted the attention of the investors looking for the most innovative products in the cryptocurrency market.

Optimism

Price: US$2.83

Surge in 7days: 16.12

Market Cap: US$470,387,039

Layer 2 scaling solution for Ethereum, Optimism has recorded an exceptional gain in its price within the last week. This significant growth emerges at a time of increasing interest in layer 2 solutions to tackle the present scalability problem Ethereum experiences. The technology developed by Optimism makes the process on Ethereum better while lowering transaction fees and increasing the network’s throughput .

Axelar

Price: US$1.24

Surge in 7days:11.29%

Market Cap: US$43,249,928

Recently, the price of Axelar, a decentralized network aiming to connect various blockchain ecosystems, has skyrocketed. This phenomenon is caused by the growing need for interoperability solutions in the cryptocurrency industry. With abundant blockchain networks the issue of efficient communication or asset transfer over separate systems arise, and therefore the interest in such projects as Axelar increases.

Wormhole

Price: US$0.7299

Surge in 7days: 10.45%

Market Cap: US$339,987,856

Wormhole, a cross-chain communication protocol, has risen in trading price over the past week. This growth clearly indicates that the market recognizes the importance of interoperability solutions in the cryptocurrency industry. Investors are beginning to flock to projects that offer ways to quickly exchange assets and data among a variety of blockchains and tackle this critical issue.

Starknet

Price: US$1.29

Surge in 7days: 7.86%

Market Cap: US$167,854,564

Starknet, the layer 2 scaling solution for StarkWare, has recently experienced a rapid increase in its price. More specifically, the layer 2 solutions have recently drawn more attention to solve Ethereum scalability issues. Starknet facilitates security and privacy of decentralized applications on the Ethereum network and thus been considered an attractive investment option.

Top Losers:

Pendle

Price: US$4.44

Dip in 7days: 26.04%

Market Cap: US$78,101,979

Pendle — a protocol that tokenizes future yield — has experienced a dip in its price over the past week. Possible reasons for the dip include profit-taking by investors following a period of rapid price appreciation and concerns about the project’s long-term fundamentals. As with all cryptocurrency projects, investors should conduct their own research and assess the risks involved before putting their money in a token like Pendle.

Stacks

Price: US$2.07

Dip in 7days: 23.79%

Market Cap: US$170,055,324

Recently, the price of Stacks, a blockchain that makes smart contracts possible on Bitcoin, has dropped sharply. This decline in value may be driven by market sentiment, profit booking, or ethical concerns about the advancement of the initiative. Projects that concentrate in this sector face significant hurdles and concerns, and investors should be wary of them.

ORDI

Price: US$35.43

Dip in 7days: 18.59%

Market Cap: US$179,099,369

Over the past week, the decentralized identity protocol ORDI has witnessed a notable dip. Various factors may be contributing to this dip, such as market dynamics, regulatory uncertainty, or other particularities linked to the development of this project. Ultimately, the cryptocurrency market is a rapidly changing environment; as a result, projects such as ORDI have ample opportunities and challenges to ensure the broad and general adoption of the given technology in the future.

Theta Network

Price: US$2.03

Dip in 7days: 17.81%

Market Cap: US$56,591,821

Theta Network — a decentralized video delivery network — has seen its price drop substantially recently. This drop could be the response of market dynamics, concerns about the level of competition in the sector, or specific improvements in the ecosystem building on Theta. As people continue to look for decentralized video delivery solutions, Theta Network will have a chance to capture a share of the market.

Hedera

Price: US$0.09864

Dip in 7days: 16.86%

Market Cap: US$225,149,589

Hedera — a decentralized public network — has seen a significant drop in its price over the past week. The decline could be an indicator of market trends, profit-taking by investors, or doubts about the project’s prospects. As with all cryptocurrencies, investors should research the risks before putting their funds in this token.

To conclude, the cryptocurrency market is currently volatile, and its prices have been updating serially. The top cryptocurrency gainers and losers of the week speaks of some specific projects that have massively gained over the past few days while others have equally lost a lot. Therefore, for investors that desire to conduct business within such a dynamic market, it is necessary to make in-depth research, methodize specific risks and remain up-to-date with the current trends in the cryptocurrency world.

Crypto

'Dogecoin Killer' Shiba Inu Burn Rate Spikes 800%, Crypto Market Rallies As Sentiment Soars And More: This Week In Cryptocurrency

The week was a rollercoaster ride for the cryptocurrency market. The crypto world was buzzing with news, from Shiba Inu’s surging burn rate to speculation of certain altcoins becoming irrelevant. Major cryptocurrencies like Bitcoin BTC/USD, Ethereum ETH/USD, and Dogecoin DOGE/USD ended April with heavy losses, but the market sentiment soared as the new week began. Let’s dive into the details.

‘Dogecoin Killer’ Shiba Inu Burn Rate Spikes 800%

Shiba Inu experienced a resurgence in its burn rates, with an 800% surge and millions of coins burned in recent transactions prompting positive market sentiment and an increase in prices. Read the full article here.

Altcoins’ Fate: Strong Performers or Irrelevant?

Pseudonymous crypto trader “Cold Blooded Shiller” questions whether the market is beginning to phase out certain altcoins in favor of stronger performers and Bitcoin. He notes that while Bitcoin’s strength is undeniable, there’s an interesting separation among altcoins. Meme coins like Dogwifhat, Pepe, and Floki Inu have seen significant gains, but will they maintain their momentum? Read the full article here.

See Also: Bitcoin, Ethereum, Dogecoin Rally, As Market Sentiment Soars On Macro Data: ‘Above $67,000 We Fly Like A

Heavy Losses for Bitcoin, Ethereum, Dogecoin in April

April ended on a sour note for major cryptocurrencies. Bitcoin, Ethereum, and Dogecoin closed the month with losses of 16%, 19%, and 40%, respectively. The new Hong Kong Bitcoin ETFs, contrary to bullish expectations, may turn out to be a “complete failure,” according to finance and crypto newsletter, WhaleWire. Read the full article here.

Are Dogecoin and Shiba Inu Due for a Bounce?

Despite a turbulent month, traders remain optimistic about Dogecoin and Shiba Inu. Chart analyst Ali Martinez predicts a bullish breakout for Shiba Inu SHIB/USD, while crypto trader YG Crypto analyzes Dogecoin’s recent performance, which saw a dramatic 40% price drop. Read the full article here.

Crypto Market Rallies as Sentiment Soars

Despite the losses in April, the cryptocurrency market started May on a positive note. Major cryptocurrencies are trading higher, with Bitcoin bouncing well above the $60,000 mark. Read the full article here.

Read Next: Dogecoin Is ‘Primed For Higher’ But Pepe Is ‘On A Moon Mission,’ Exclaims Trader

Image: Eivind Pedersen from Pixabay

Engineered by

Benzinga Neuro, Edited by

Anan Ashraf

The GPT-4-based Benzinga Neuro content generation system exploits the

extensive Benzinga Ecosystem, including native data, APIs, and more to

create comprehensive and timely stories for you.

Learn more.

Crypto

Cryptocurrency Price Analysis: SHIB, DOGE, and XRP Face Varied Challenges

Throughout much of the month, the majority of top assets maintained a sideways trajectory. While some experienced marginal upticks, others contended with declines. Let’s delve into the price analysis of Shiba Inu (SHIB), Dogecoin (DOGE), and Ripple (XRP). Shiba Inu (SHIB)Coin Edition’s evaluation of SHIB’s 4-hour chart revealed a bearish signal. Specifically, attention was drawn to the Exponential Moving Average (EMA), where the 20 EMA (yellow) crossed below the 9 EMA (blue)—a phenomenon known as a death cross. Moreover, SHIB’s price lingered beneath these indicators, signaling a diminishing strength for the token. Presently, there’s a prospect of SHIB’s price descending

-

News1 week ago

News1 week agoFirst cargo ship passes through new channel since Baltimore bridge collapse

-

World1 week ago

World1 week agoHaiti Prime Minister Ariel Henry resigns, transitional council takes power

-

Movie Reviews1 week ago

Movie Reviews1 week agoAbigail Movie Review: When pirouettes turn perilous

-

World1 week ago

World1 week agoEU Parliament leaders recall term's highs and lows at last sitting

-

Politics1 week ago

Politics1 week ago911 call transcript details Democratic Minnesota state senator’s alleged burglary at stepmother's home

-

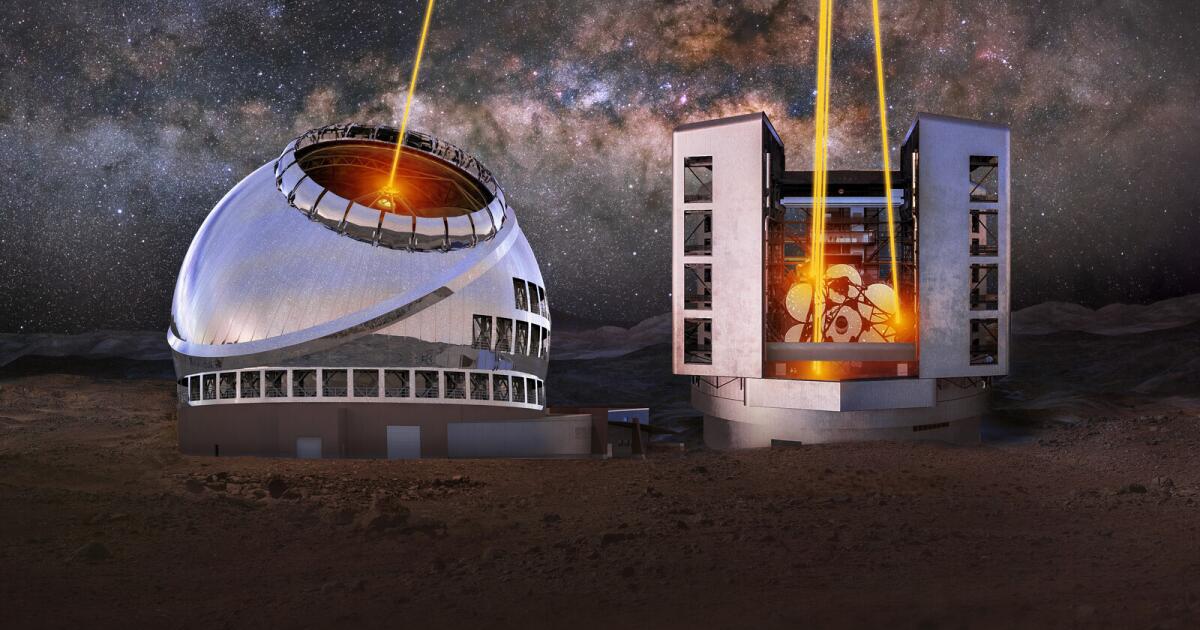

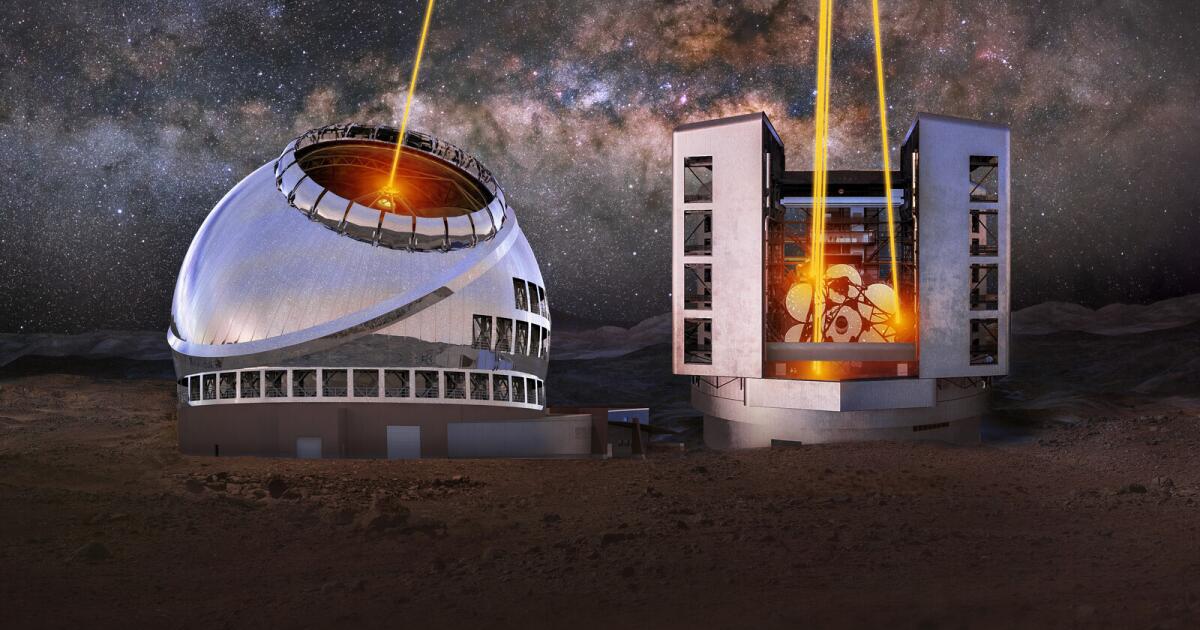

Science1 week ago

Science1 week agoOpinion: America's 'big glass' dominance hangs on the fate of two powerful new telescopes

-

Politics1 week ago

Politics1 week agoGOP lawmakers demand major donors pull funding from Columbia over 'antisemitic incidents'

-

World1 week ago

World1 week agoHamas ‘serious’ about captives’ release but not without Gaza ceasefire