Finance

Powell signals 0.50% rate hike in December, citing need to ‘moderate’ pace

Federal Reserve Chair Jerome Powell set the desk for a 50-basis level price hike on the Fed’s December coverage assembly, saying in a speech on Wednesday it is sensible to “reasonable” price hikes because the Fed approaches its estimated peak in benchmark rates of interest.

“It is sensible to reasonable the tempo of our price will increase as we strategy the extent of restraint that shall be enough to deliver inflation down,” Powell mentioned in a speech on the Brookings Establishment in Washington. “The time for moderating the tempo of price will increase could come as quickly because the December assembly.”

Powell added: “The complete results of our fast tightening thus far are but to be felt.”

Powell reiterated the tempo of price hikes isn’t as necessary as how a lot additional the Fed will increase its benchmark rate of interest, and for the way lengthy the central financial institution will maintain charges at elevated ranges.

The Fed has raised the goal vary for its benchmark rate of interest by 0.75% at every of its final 4 conferences. On the present goal vary of three.75%-4%, the Fed’s benchmark rate of interest is on the highest stage since 2007.

“It’s seemingly that restoring value stability would require holding coverage at a restrictive stage for a while,” mentioned Powell. “Historical past cautions strongly in opposition to prematurely loosening coverage. We’ll keep the course till the job is finished.”

Powell mentioned he thinks it’s seemingly the Fed might want to increase charges “considerably” increased than estimated in September, and that there was “appreciable uncertainty about what price shall be enough.”

“We have to increase rates of interest to a stage that’s sufficiently restrictive to return inflation to 2 p.c,” he mentioned. Powell’s feedback largely echo what the Fed Chair mentioned throughout his press convention in November in addition to minutes from the central financial institution’s final coverage assembly.

Regardless of some promising developments on the inflation entrance, Powell mentioned, “we now have a protracted solution to go in restoring value stability.” Powell dubbed his speech a progress report on the Fed’s efforts to revive inflation to its 2% objective. The Fed Chair mentioned inflation stays “far too excessive.”

Whereas inflation knowledge in October confirmed a decline, Powell cautioned this was solely a single month’s knowledge level. An information level which adopted upside surprises over the earlier two months.

The Fed will get a learn on inflation from its favored inflation gage — the non-public consumption expenditures index – on Thursday morning. The buyer value index for November shall be launched on December 13, the day the Fed’s subsequent two-day coverage assembly begins.

Click on right here for the newest financial information and financial indicators that will help you in your investing selections

Learn the newest monetary and enterprise information from Yahoo Finance

Obtain the Yahoo Finance app for Apple or Android

Observe Yahoo Finance on Twitter, Fb, Instagram, Flipboard, LinkedIn, and YouTube

Finance

Britney Spears and Her Father Settle Dispute Over Alleged Financial Misconduct During Conservatorship

Watch Latin American Music Awards

Britney Spears has settled a dispute over legal fees with her dad, and former conservator, Jamie Spears.

The pair settled an enduring debate over Jamie’s legal fees and his management of Britney’s finances in Los Angeles Superior Court on April 25, the New York Times reported Friday afternoon. Britney’s legal team, led by attorney Mathew S. Rosengart, was fighting to keep their client from having to pay her father’s legal bills, mainly on the basis Jamie had allegedly misused his authority as Britney’s conservator — a role he held up until September 2019 — to pay himself $6 million.

Terms of the settlement were not widely disclosed but in a statement issued Friday, Rosengart said Britney had finally fulfilled her goal of obtaining total freedom: “As she desired, her freedom now includes that she will no longer need to attend or be involved with court or entangled with legal proceedings in this matter.” He continued by stating “it has been our honor and privilege to represent, protect, and defend Britney Spears.”

With this move, Jamie and Britney avoid having to go to trial over the alleged financial misconduct during her conservatorship.

Details on the conclusion to this case are sparse in comparison to the media frenzy that first ensued over two years ago. Everything changed for Britney after she publicly addressed a court in Los Angeles on June 23 of 2021, telling the judge that she was “traumatized” and held against her will, with all of her rights stripped away by her conservators, including her father, who at one point she said she wanted jailed. “I just want my life back,” the singer said.

Since leaving the conservatorship ended, Spears has sold over 2 million copies of her best selling memoir, “The Woman in Me,” and has released music with Elton John and Will.i.am. Still, Britney has been adamant that a career in music is no longer a priority of hers. When rumors began circulating that her team was ushering her to put out an album, Britney wrote on Instagram: “They keep saying I’m turning to random people to do a new album … I will never return to the music industry.”

Finance

Finance Deals of the Week: $52M Construction Loan for S.C. Apartments

It was a lighter week on the financing front, but there were still some notable deals that closed including a $52 million construction loan from North River Partners and Amzak Capital Partners on Miami-based One Real Estate Investment’s 316-unit apartment project in Columbia, S.C. Huntington National Bank and Nuveen Green Capital also teamed up to provide a combined $40.5 million construction loan for Stark Enterprises’ build-to-rent residential project in northern Florida. Here are the rest of the deals.

| Loan Amount | Lender | Borrower | Address | Asset | Broker |

|---|---|---|---|---|---|

| $52 million | North River Partners and Amzak Capital Partners | One Real Estate Investment | 4415 Percival Road; Columbia, S.C. | Multifamily | Berkadia’s Brad Williamson, Scott Wadler, Mitch Sinberg and Matt Robbins |

| $41 million | Huntington National Bank and Nuveen Green Capital | Stark Enterprises | 16152 SE 77th Court; Summerfield, Fla. | Build-to-Rent | N/A |

| $29 millon | Bayview Asset Management | ASG Equities | 502 86th Street; Brooklyn, N.Y. | Mixed-Use | Ripco’s Steven Sperandio, Michael Fasano and Jake Weiss |

| $27 million | Citigroup | The Mann Group and True North Management | Nine-building portfolio | Multifamily | JLL’s Scott Aiese and Alex Staikos |

| $27 million | Berkadia | Bozzuto Group | 1200 North Queen Street; Rosslyn, Va | Multifamily | N/A |

Finance Deals of the Week reflect deals closed or announced from April 22 to April 26. Information on financings can be sent to editorial@commercialobserver.com.

502 86th Street, ASG Equities, Berkadia, Bozzuto Group, Huntington National Bank, Nuveen Green Capital, One Real Investment, Ripco, Stark Enterprises, The Mann Group, True North Management

Finance

Shriram Finance Q4 Results: PAT jumps 49% YoY to Rs 1,946 crore, NII rises 20%

Its net interest income (NII) rose 20% YoY to Rs 5,336 crore as against Rs 4,446 crore in the same period previous year.

While the profit figure was close to the Street estimates, NII was above expectations. The NBFC announced a final dividend of Rs 15 per share which will be paid to eligible shareholders before August 28.

Net interest margin (NIM) rose from 8.99% in Q3 to 9.02% in Q4 and provisions were up 1% sequentially to Rs 1,261 crore.

Shriram Finance’s total assets under management as on March-end increased 21.10% sequentially and stood at Rs 224,861.98 crore at the end of the quarter.The earning per share (basic) increased by 48.23% and was Rs 51.79 as against Rs 34.94 recorded in the same period of the previous year.Shares of the NBFC were trading 1% higher at Rs 2515 on the BSE on Friday.Also Read: Bajaj Finserv Q4 Results: PAT jumps 20% YoY to Rs 2,119 crore

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: The American Society of Magical Negroes

-

World1 week ago

World1 week agoIf not Ursula, then who? Seven in the wings for Commission top job

-

News1 week ago

News1 week agoGOP senators demand full trial in Mayorkas impeachment

-

World1 week ago

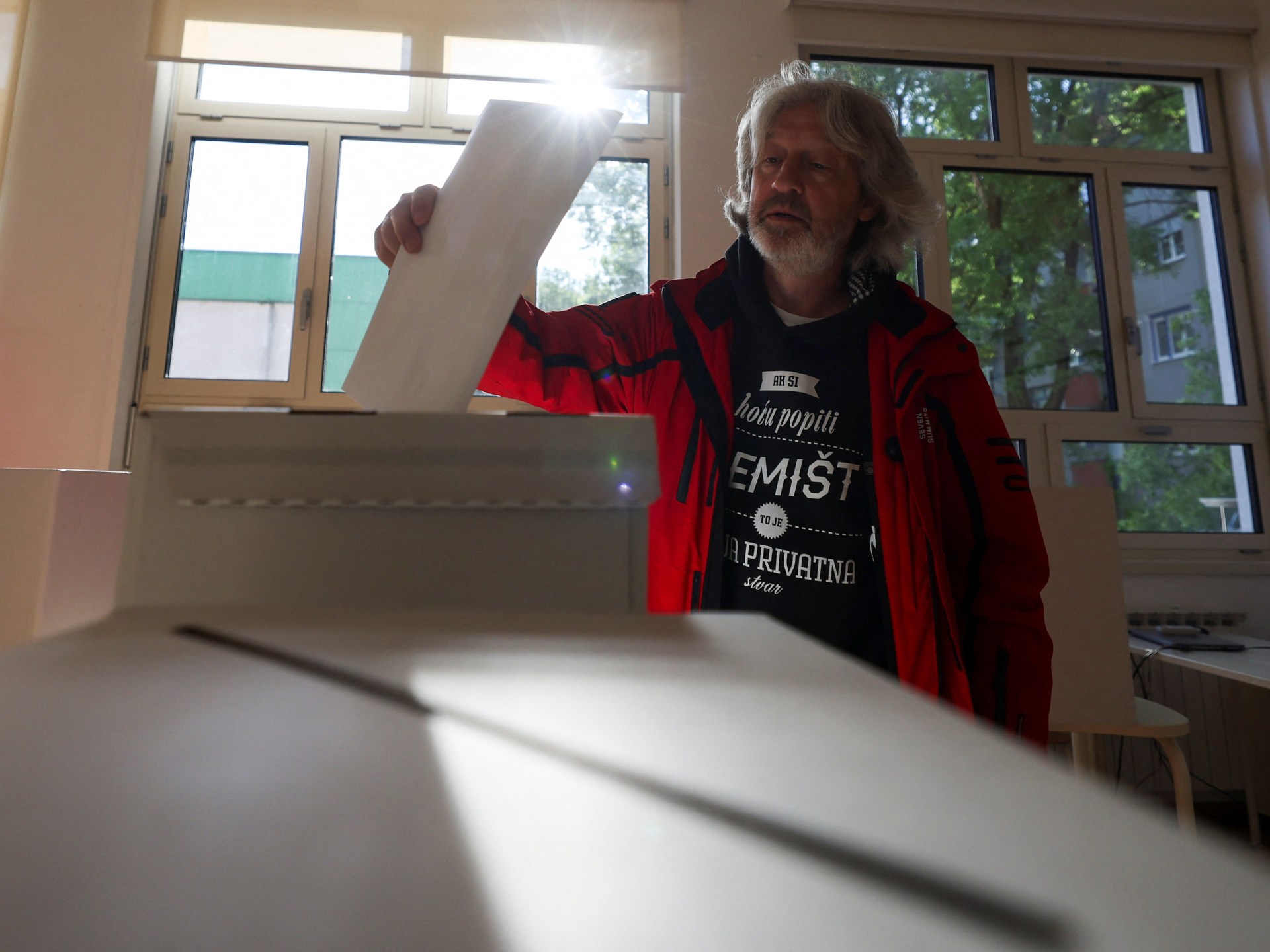

World1 week agoCroatians vote in election pitting the PM against the country’s president

-

World1 week ago

World1 week ago'You are a criminal!' Heckler blasts von der Leyen's stance on Israel

-

Politics1 week ago

Politics1 week agoTrump trial: Jury selection to resume in New York City for 3rd day in former president's trial

-

Movie Reviews1 week ago

Movie Reviews1 week agoPon Ondru Kanden Movie Review: This vanilla rom-com wastes a good premise with hasty execution

-

Kentucky1 week ago

Kentucky1 week agoKentucky first lady visits Fort Knox schools in honor of Month of the Military Child