Finance

Finance Deals of the Week: $52M Construction Loan for S.C. Apartments

It was a lighter week on the financing front, but there were still some notable deals that closed including a $52 million construction loan from North River Partners and Amzak Capital Partners on Miami-based One Real Estate Investment’s 316-unit apartment project in Columbia, S.C. Huntington National Bank and Nuveen Green Capital also teamed up to provide a combined $40.5 million construction loan for Stark Enterprises’ build-to-rent residential project in northern Florida. Here are the rest of the deals.

| Loan Amount | Lender | Borrower | Address | Asset | Broker |

|---|---|---|---|---|---|

| $52 million | North River Partners and Amzak Capital Partners | One Real Estate Investment | 4415 Percival Road; Columbia, S.C. | Multifamily | Berkadia’s Brad Williamson, Scott Wadler, Mitch Sinberg and Matt Robbins |

| $41 million | Huntington National Bank and Nuveen Green Capital | Stark Enterprises | 16152 SE 77th Court; Summerfield, Fla. | Build-to-Rent | N/A |

| $29 millon | Bayview Asset Management | ASG Equities | 502 86th Street; Brooklyn, N.Y. | Mixed-Use | Ripco’s Steven Sperandio, Michael Fasano and Jake Weiss |

| $27 million | Citigroup | The Mann Group and True North Management | Nine-building portfolio | Multifamily | JLL’s Scott Aiese and Alex Staikos |

| $27 million | Berkadia | Bozzuto Group | 1200 North Queen Street; Rosslyn, Va | Multifamily | N/A |

Finance Deals of the Week reflect deals closed or announced from April 22 to April 26. Information on financings can be sent to editorial@commercialobserver.com.

502 86th Street, ASG Equities, Berkadia, Bozzuto Group, Huntington National Bank, Nuveen Green Capital, One Real Investment, Ripco, Stark Enterprises, The Mann Group, True North Management

Finance

FIS Launches Embedded Finance Platform for Financial Institutions and Businesses

FIS has launched an embedded finance platform designed for use by financial institutions, businesses and software developers.

The new “Atelio by FIS” platform can help any company collect deposits, move money, issue cards, send invoices, fight fraud, forecast cash flows and better understand customer behavior, the company said in a Tuesday (May 7) press release.

“Our scale, distribution and continued investment in technology have given us the foundation to unlock our financial capabilities to a wider audience and power the next generation of financial innovation,” Tarun Bhatnagar, president of platform and enterprise products at FIS, said in the release.

Atelio delivers existing FIS financial technology via components that are easy to embed in a secure and compliant manner, according to the release.

The platform builds on the company’s history of service to the financial services industry, its technology and its expertise in risk and compliance, offering these resources as a service, the release said.

With these capabilities, financial institutions, businesses and software developers can deliver financial offerings to their customers at the point where they are needed, per the release.

One company that is already building on Atelio is College Ave, which used the platform to launch a new financial product for college students, according to the release.

“We wanted a product that could bring together an account, credit card and payments into a single experience, and Atelio allowed us to offer a custom solution through our platform in a simple and secure process, which has been hugely beneficial to us in meeting our customers’ needs,” Karen Boltz, head of product management at College Ave, said in the release.

PYMNTS Intelligence has found that embedded finance creates better experiences for consumers by making their interactions with brands seamless, convenient and personalized.

This is important because 49% of consumers said they would probably quit an online purchase if they encountered difficulty checking out and a lack of payment choice, according to “How Nonfinancial Brands Can Benefit from Offering Embedded Financial Services,” a PYMNTS Intelligence and Galileo collaboration.

The report also found that 88% of companies that offer embedded finance said it increased customer engagement.

Finance

Taiwan finance group SinoPac enters race in Cambodian banking

TAIPEI — The Taiwanese financial conglomerate SinoPac Holdings is entering the Cambodian banking industry by acquiring a local institution that is majority-held by Western investors, the latest example of the diversification of Taiwanese investment into Southeast Asia.

SinoPac announced over the weekend that its subsidiary Bank SinoPac will acquire 100% of Amret, Cambodia’s largest microfinance deposit-taking institution by total assets, from existing shareholders.

Finance

Do finance transparency laws have a chance in Michigan?

Should lawmakers have to reveal their donors and the amount of money send to them? Republican state Sen. Ed McBroom, (R-Vulcan), certainly thinks so. Dark money accounts shield the finances that lawmakers benefit from, which can also mask any problematic influences behind their campaigns.

-

World1 week ago

World1 week agoRussian forces gained partial control of Donetsk's Ocheretyne town

-

Movie Reviews1 week ago

Challengers Movie Review

-

Politics1 week ago

Politics1 week agoHouse Republicans brace for spring legislative sprint with one less GOP vote

-

World1 week ago

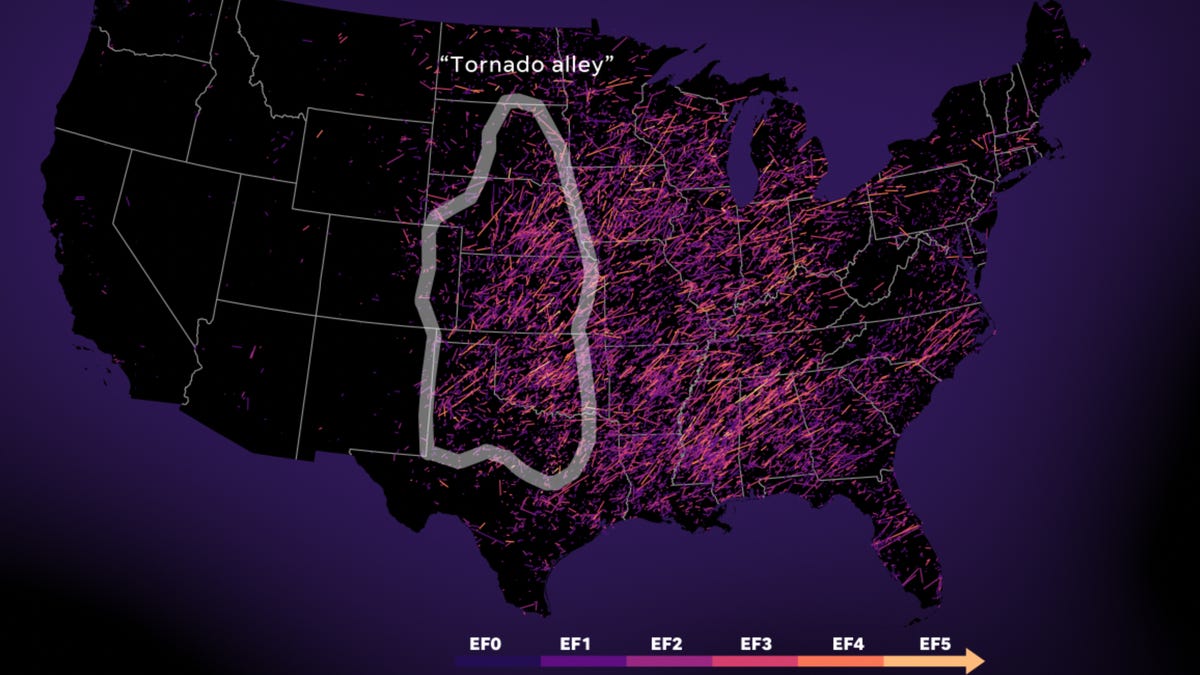

World1 week agoAt least four dead in US after dozens of tornadoes rip through Oklahoma

-

Politics1 week ago

Politics1 week agoWashington chooses its wars; Ukraine and Israel have made the cut despite opposition on right and left

-

Politics1 week ago

Politics1 week agoDems disagree on whether party has antisemitism problem

-

Politics1 week ago

Politics1 week agoAnti-Trump DA's no-show at debate leaves challenger facing off against empty podium

-

Politics1 week ago

Politics1 week agoStefanik hits special counsel Jack Smith with ethics complaint, accuses him of election meddling

/cdn.vox-cdn.com/uploads/chorus_asset/file/25437580/Lenovo_P1_108_1.jpg)