Editing by Jeffrey Goldfarb and Aditya Sriwatsav

Finance

Breakingviews – Wall Street cues a lesson in Ivory Tower finance

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VQJNDZNYAJK5LABH6S3RXXUKYI.jpg)

Demonstrators take part at Harvard University in Cambridge, Massachusetts, U.S., October 14, 2023. REUTERS/Brian Snyder Acquire Licensing Rights

NEW YORK, Oct 20 (Reuters Breakingviews) – Wall Streeters are trying to teach universities a lesson, but may provide them with a broader understanding of economics instead. Billionaire investors Marc Rowan and Bill Ackman are enraged over controversial positions on the Middle East at their respective alma maters, the University of Pennsylvania and Harvard. In doing so, they have drawn attention to the unsavory money-go-round in U.S. higher education and provided an opportunity for the system to become a freer market.

Leading American colleges are powered by affluence. The median family income for Harvard students is nearly $169,000, or about 2.5 times the U.S. average. Fewer than 2% of graduates came from poor upbringings and went on to become wealthy, according to Opportunity Insights, a research group at Harvard. Basically, the university is fully aware the rich help the rich stay rich.

Efforts have been made to change, including by rejecting the standardized testing that favors applicants who can, among other things, afford pricey preparation courses. Stockpiles of cash donated by Rowan, Ackman and other alumni also should theoretically make such institutions more accessible, but haven’t. The fair value of Harvard’s roughly $50 billion endowment is nearly twice as much as it was in 2009. Yet tuition and fees, at almost $75,000 annually, have increased by 58% over the same span, faster than the wider rate of inflation.

One reason is the willingness of attendees to borrow heavily for a diploma. Top-notch colleges have the luxury of abiding such debt partly because of the supply and demand curve taught in Economics 101. The eight Ivy League schools, for example, accept fewer than 6% of applicants. Many don’t pay full fare out of pocket to matriculate, but their family wealth suggests there’s more work to do.

Investment firms, like Rowan’s Apollo Global Management (APO.N) and Ackman’s Pershing Square, exacerbate the problem. Elite universities funnel many graduates to lucrative careers in finance and consulting, and studies have shown that social class often predetermines success. Roughly 30% of students from the Harvard class of 2022 earn more than $110,000; many will inevitably send checks back to Cambridge, Massachusetts.

These donations sustain the vicious loop, in part by providing access to the best students and teachers. Rowan and Ackman being irked by the universities supporting an event with antisemitic speakers and student groups blaming Israel for the Hamas attacks suggests academic prestige has its limits, however. And yet Rowan urging fellow grads to stop sending money might helpfully force colleges to rethink their business models.

Ideally, Ivory Towers would price education closer to its actual value rather than what people are willing to pay. Merit might carry more weight than wealth. Students could seek jobs based on skills and interests rather than future earnings potential. In the end, it would help curb some of the undue power wielded by the upper class.

Follow @thereallsl on X

CONTEXT NEWS

Apollo Global Management Chief Executive Marc Rowan has called on University of Pennsylvania President Liz Magill and Chair of the Board of Trustees Scott Bok to resign over a decision to allow antisemitic speakers at a university-supported Palestine Writers Literary Festival.

Rowan, who also urged fellow alumni to stop making donations, on Oct. 11 made public an op-ed he wrote for the student newspaper that went unpublished. He is chairman of the board of advisors at Penn’s business school, Wharton.

Since then, other large donors including Renaissance Technologies’ David Magerman, Estee Lauder heir Ronald Lauder and politician Jon Huntsman have said they will withdraw their funding.

Separately, former Treasury Secretary Larry Summers and Pershing Square founder Bill Ackman have criticized Harvard University after it failed to distance itself from a group of students who blamed Israel for the Hamas attacks against the country.

Ackman is demanding that Harvard release the names of students behind organizations that signed a letter saying they hold the “Israeli regime entirely responsible for all unfolding violence.”

Our Standards: The Thomson Reuters Trust Principles.

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

Finance

Global Innovation Lab for Climate Finance Surpasses 100-Member Organizations – CPI

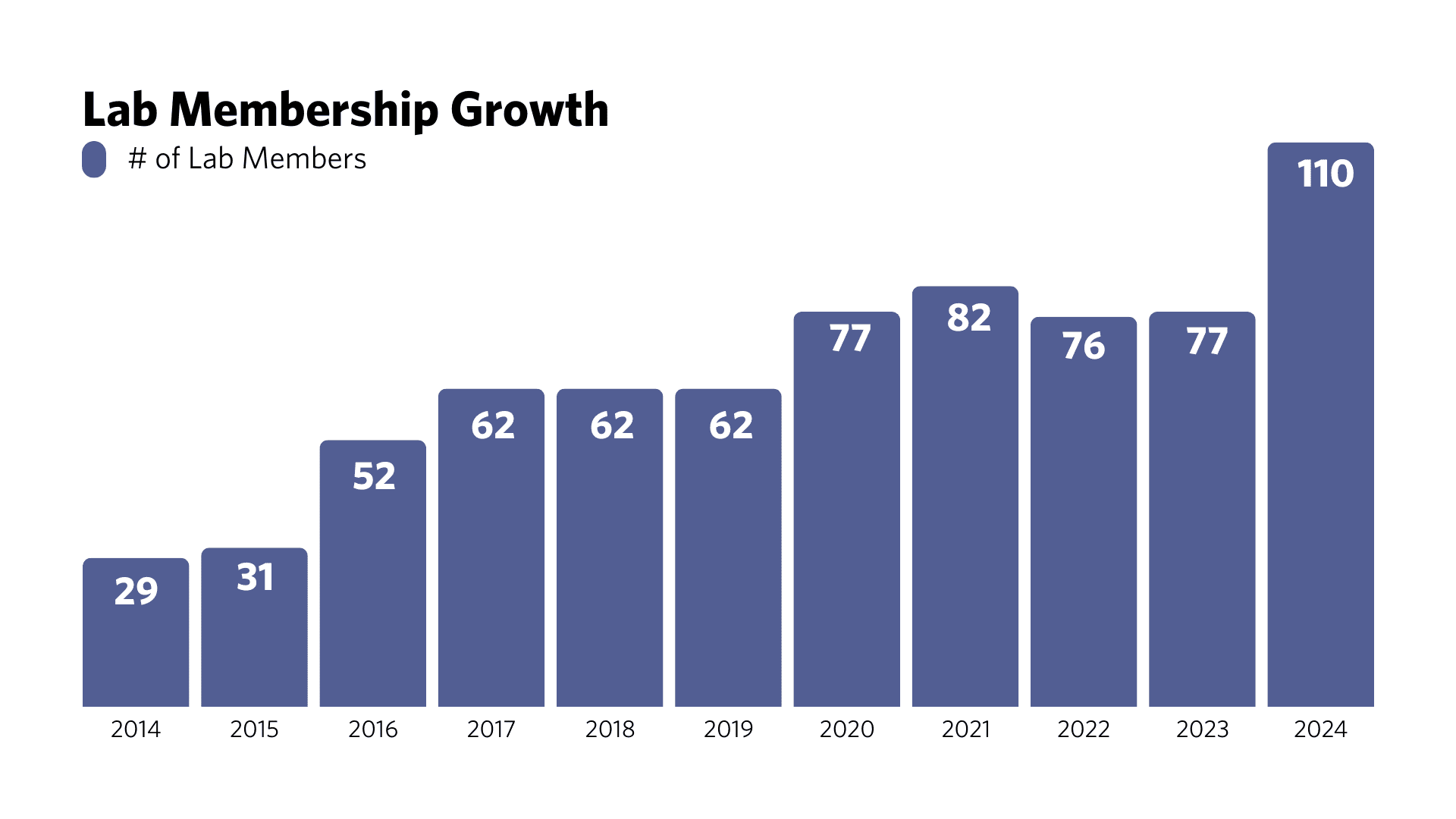

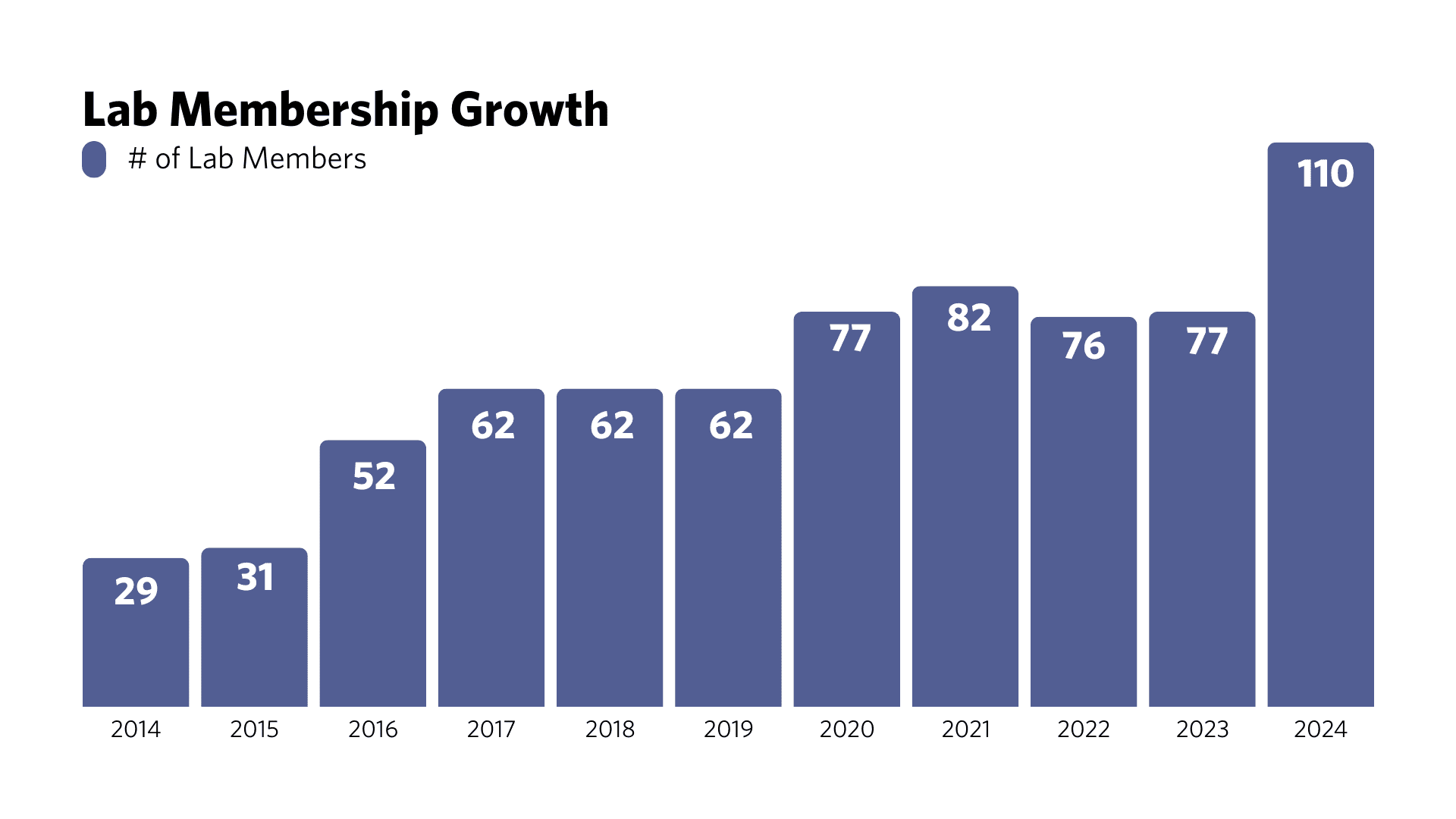

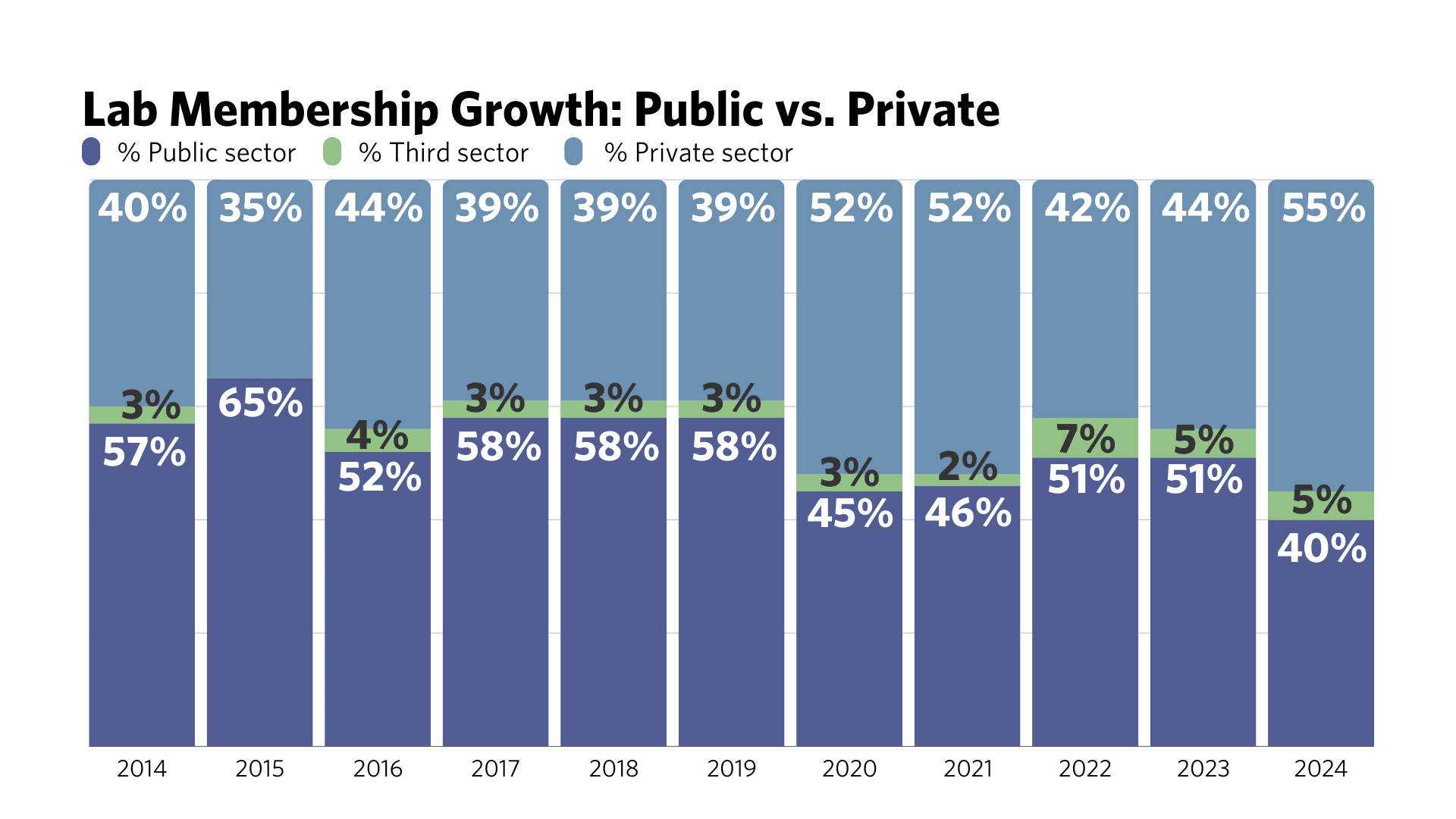

The Global Innovation Lab for Climate Finance (the Lab) proudly announces a significant expansion in its membership. Over 100 distinguished public and private organizations are now joining forces to accelerate climate finance innovation and drive private investments in emerging markets.

The Lab’s membership has skyrocketed nearly fourfold in 10 years, from 29 organizations at the inaugural Lab meeting in 2014 to 110 global and regional members today. Over the years, the Lab has seen a steady rise in private sector participation, with private members now making up 55% of the total, compared to 41% in 2014.

This growth follows the Lab’s successful launch of regional programs in the Philippines and Latin America and the Caribbean. New regional panel members from these areas join a growing network of experts across existing programs in Brazil, East and Southern Africa, and India. Additionally, the Lab welcomes new global members, strengthening its ability to identify and develop transformative financial instruments.

“We need to see bold ideas come forward and support the teams who pursue them. As a new global member, we are very happy to have supported the selection process of the Lab’s 10th cohort and to contribute to developing these outstanding teams and endeavors. The collaborative spirit among members points to a powerful force for tackling climate challenges,” said Elvira Lefting, Managing Director at Finance in Motion.

A substantial portion of the Lab’s portfolio mobilization figures, which now exceed USD 4 billion, is a result of direct investments from its diverse membership and broader network. The Lab continues to unlock new opportunities through collaborative efforts and scale up impactful climate finance initiatives globally.

“The Lab’s membership is the core driver of the Lab’s success. Our member institutions bring a wealth of expertise, dedicated support, and financial capital to the table, amplifying the Lab’s capacity to catalyze sustainable investments in emerging markets,” said Ben Broché, Climate Policy Initiative’s Associate Director, who leads the Lab’s efforts.

About the Lab

The Global Innovation Lab for Climate Finance identifies, develops, and launches innovative finance instruments that can drive billions in private investment to action on climate change and sustainable development. Bloomberg Philanthropies, the United Nations Development Programme, and the governments of Canada, Germany, the United Kingdom, and the United States fund the Lab’s 2024 programs. Climate Policy Initiative serves as the Secretariat and analytical provider.

For media inquiries or further information, please contact:

Júlio Lubianco

Communications Manager

julio.lubianco@cpiglobal.org

Sam Goodman

Communications Associate

sam.goodman@cpiglobal.org

Finance

Finance minister Buggana says Dhone took center-stage in terms of development in the entire state in the last five years | Hyderabad News – Times of India

The finance minister who is confident of securing his hat-trick victory at the Dhone assembly constituency in Nandyal district in the upcoming elections, is pitted against former union minister of state for railways Kotla Jayasurya Prakash Reddy of the TDP.

Embarking on a door-to-door election campaign at Peapully mandal on Sunday, Buggana asked the people to introspect about why his opponent Kotla Jayasurya Prakash Reddy and his family, never reached out to the people of the constituency in the last 15 years.

“Leaders belonging to various faction groups who lost their lives and their families completely shattered should all realise why the different faction groups are now setting aside their differences and joining hands with the sole motive to defeat me. Won’t such power-thirsty people revive faction at the Dhone assembly constituency, where no major faction related violence was reported in the last decade”, Buggana questioned the people.

Explaining to the voters about the financial benefits disbursed to the people of the Dhone assembly constituency in the last five years, besides the numerous development projects executed during the YSRCP regime, the finance minister appealed to the people to pledge support to him and the YSRCP to carry forward the development in the next five years too.

Finance

Saudi Arabia's Vision 2030 projects to be adjusted as needed, finance minister says – Times of India

Speaking at the World Economic Forum’s special meeting on Global Collaboration, Growth and Energy for Development in Riyadh, Mohammed Al Jadaan said the kingdom’s focus is on ensuring the quality of future economic growth, and recognises that the challenges it faces require flexibility.

“There are challenges… we don’t have ego, we will change course, we will adjust, we will extend some of the projects, we will downscale some of the projects, we will accelerate some of the projects,” Jadaan said.

Saudi Arabia is accelerating efforts to diversify its economy away from oil under a plan known as Vision 2030. It aims to develop sectors such as tourism and industry, expand the private sector and create jobs.

Non-oil activities vastly outperformed oil sector expansion last year growing by 4.4%, while the overall economy shrank by 0.8 per cent on the back of cuts to oil production and lower prices.

Saudi Arabia is projected to grow 2.6 per cent this year, a downward revision from 4 per cent forecast in October, the IMF said in its latest regional outlook report on the back of continued output cuts.

In the medium term, non-oil growth is expected to come in over 5 per cent a year, Jadaan said in February, although the kingdom is likely to continue to rely on hydrocarbon revenue to drive investments into expanding non-oil activities.

On Sunday, Jadaan re-emphasised the role of an expanded private sector in delivering Vision 2030.

“Vision 2030 is about empowering the private sector. The government role is to be out of business – the government role is to make policies to enable the private sector but not to actually do the business.” The Arab World’s largest economy needs oil at $96.2 to balance its 2024 budget, the IMF forecast.

-

Kentucky1 week ago

Kentucky1 week agoKentucky first lady visits Fort Knox schools in honor of Month of the Military Child

-

News1 week ago

Maryland high school student arrested after authorities discovered a 129-page document detailing school shooting plan, police say | CNN

-

World1 week ago

World1 week agoIranian media says three drones downed after explosions heard in Isfahan

-

World1 week ago

World1 week agoShipping firms plead for UN help amid escalating Middle East conflict

-

Politics1 week ago

Politics1 week agoIsrael hits Iran with 'limited' strikes despite White House opposition

-

Politics1 week ago

Politics1 week agoICE chief says this foreign adversary isn’t taking back its illegal immigrants

-

News1 week ago

News1 week agoThe San Francisco Zoo will receive a pair of pandas from China

-

Politics1 week ago

Politics1 week ago'Nothing more backwards' than US funding Ukraine border security but not our own, conservatives say