Business

99 Cents Only to close all 371 stores and wind down its business

99 Cents Only Stores will close all 371 of its stores and wind down its business operations after more than four decades, the City of Commerce discount chain announced Thursday.

“This was an extremely difficult decision and is not the outcome we expected or hoped to achieve,” interim Chief Executive Mike Simoncic said in a statement. “Unfortunately, the last several years have presented significant and lasting challenges in the retail environment.”

He cited multiple factors, including the “unprecedented impact” of the COVID-19 pandemic, shifting consumer demand, persistent inflationary pressures and rising levels of shrink — an industry term that refers to loss of inventory attributed to reasons such as shoplifting, employee theft and administrative errors.

Combined, those issues “have greatly hindered the company’s ability to operate,” Simoncic said.

99 Cents Only has stores in California, Arizona, Nevada and Texas and has about 14,000 employees. The privately held company said it had reached an agreement with Hilco Global to liquidate all of its merchandise and dispose of fixtures, furnishings and equipment at its stores. Sales are expected to begin Friday.

Hilco Real Estate is managing the sale of the company’s real estate assets, which are owned or leased.

The announcement by 99 Cents Only reflects a larger weakness in the dollar-store category, said Brad Thomas, equity research analyst at KeyBanc Capital Markets.

Dollar Tree, a Chesapeake, Va., retailer, announced last month that it was closing 600 of its Family Dollar stores this year and an additional 370 in the next few years, he noted.

“It’s been trying times for many, many retailers,” he said. “What’s interesting is that what started out as a boon to retailers in the pandemic, with all those stimulus checks, quickly turned into a very troublesome time.”

Rising wages, inflation and higher losses due to shrinkage have reduced profits for retailers in a deep-discount sector where margins are already extremely low.

99 Cents Only, with its large base of California stores, has been under particular wage pressure, he said. And it’s at a disadvantage compared with larger chains such as market leader Dollar General, which has a store count close to 20,000 — “a sales base and a store base that is multiple times larger than 99 Cents,” Thomas said.

Customers make their way through the crowded parking lot at a 99 Cents Only store in Santa Monica on Friday. The chain has locations in California, Arizona, Nevada and Texas and employs about 14,000 people.

(Genaro Molina / Los Angeles Times)

Last week, Bloomberg reported that 99 Cents Only was considering a bankruptcy filing as it contended with a liquidity shortfall.

Founded in Los Angeles in 1982 by David Gold, 99 Cents Only popularized the single-price retail concept. At the time, dollar stores were seen as dumping grounds for undesirable products, but the Gold family made the stores bright and well-organized, with good-quality merchandise including groceries and household supplies.

“It was an instant success,” Howard Gold, one of David Gold’s sons, recalled Friday; he and his three siblings all worked at 99 Cents Only. “People thought it was government-subsidized because they couldn’t believe the prices.”

For years, it remained one of the few true “dollar” stores, with items priced at 99 cents or less or grouped to sell for a total of 99 cents.

That changed in 2008 when, faced with fast-rising inflation, soaring food and fuel prices, and a higher minimum wage, 99 Cents Only announced that it was straying from its long-standing price strategy.

Three years later, the company announced that it had agreed to be sold in a deal valued at about $1.6 billion, as investors eyed dollar stores that had grown in popularity during the Great Recession. In 2013, Howard Gold and the rest of the family management team departed the company.

Today, with stores scattered around Los Angeles County — among them in Hollywood, Silver Lake, Mid-Wilshire, Santa Monica, Thai Town, North Hollywood and Glendale — the closure of 99 Cents Only will leave a number of large vacant properties in prime locations.

A 99 Cents Only store in Huntington Beach on Friday.

(Allen J. Schaben / Los Angeles Times)

“It’s very sad on many levels, and I’ll just leave it at that,” Gold, now retired and living in Studio City, said of the decision to close the chain his father built.

Other major retailers have also announced store closures in the region lately, including REI in Santa Monica, Macy’s in Simi Valley and several Rite Aid locations.

99 Cents Only did not respond to requests for comment.

Nicolas Kolesnikow, a retired teacher who lives in Westchester, said he was shocked to hear the chain was going out of business. He shops at a 99 Cents Only about four blocks from his house several times a week.

“It’s almost like a corner store for me,” said Kolesnikow, 82.

He might stop by and pick up milk if he runs out, and for longer trips will buy household items and produce such as tomatoes, cucumbers and cilantro before visiting a traditional supermarket with a larger selection.

Kolesnikow said he noticed that some products had become much more expensive in the last year, though there were still bargains.

“I found their prices were working their way up to regular prices,” he said, “and there were fewer shoppers.”

Business

Is It Better to Rent or Buy?

These are the costs on top of rent, such as the fee you pay to a broker and the opportunity cost on your security deposit. But these expenses typically have a negligible impact.

Methodology

The calculator keeps a running tally of the most common expenses of owning and renting. It also takes into account something known as opportunity cost — for example, the return you could have earned by investing your money. (Instead of spending it on a down payment, for example.)

The calculator assumes that the profit you would have made in your investments would be taxed as long-term capital gains and adjusts the bottom line accordingly. The calculator tabulates opportunity costs for all parts of buying and renting. All figures are in current dollars.

Tax law regarding deductions can have a significant effect on the relative benefits of buying. The calculator assumes that the house-related tax provisions in the Tax Cuts and Jobs Act of 2017 will expire after 2025, as written into law. Congress might, however, extend the cuts in their original form, or extend and modify them. You can use the toggle to see how your results may vary if the tax cuts are renewed in full, to get a sense of how big the tax impact might be on your decision.

Buying

Initial costs are the costs you incur when you go to the closing for the home you are purchasing. This includes the down payment and other fees.

Recurring costs are expenses you will have to pay monthly or yearly in owning your home. These include mortgage payments; condo fees (or other community living fees); maintenance and renovation costs; property taxes; and homeowner’s insurance. A few items are tax deductible, up to a point: property taxes; the interest part of the mortgage payment; and, in some cases, a portion of the common charges.

The resulting tax savings are accounted for in the buying total. If your house-related deductions are similar to or smaller than the standard deduction, you’ll get little or no relative tax savings from buying. If your house-related deductions are large enough to make itemizing worthwhile, we only count as savings the amount above the standard deduction.

Opportunity costs are calculated for the initial purchase costs and for the recurring costs. That will give you an idea of how much you could have made if you had invested your money instead of buying your home.

Net proceeds is the amount of money you receive from the sale of your home minus the closing costs, which includes the broker’s commission and other fees, the remaining principal balance that you pay to your mortgage bank and any tax you have to pay on profit that exceeds your capital gains exclusion. If your total is negative, it means you have done very well: You made enough of a profit that it covered not only the cost of your home, but also all of your recurring expenses.

Renting

Initial costs include the rent security deposit and, if applicable, the broker’s fee.

Recurring costs include the monthly rent and the cost of renter’s insurance.

Opportunity costs are calculated each year for both your initial costs and your recurring costs.

Net proceeds include the return of the rental security deposit, which typically occurs at the end of a lease.

Business

Why did Huy Fong, the beloved Sriracha brand, halt production again?

The Sriracha shortage panic has returned.

In what’s become a dreaded tradition in recent years, fans of the beloved spicy chili sauce just got more bad news: The California company that popularized the condiment known for its distinctive fiery red color has halted production until after Labor Day.

Last week, Huy Fong Foods, which is based in Irwindale, sent a letter to its distributors blaming the four-month pause that could eventually snarl the sauce’s supply chain on the recent harvest of red jalapeño peppers.

“We have determined that it is too green to proceed with production as it is affecting the color of the product,” according to the letter, obtained by USA Today.

A representative for Huy Fong declined to comment Friday on the production halt or its cause, but the company said in the letter that it expected to resume production once the next chili season starts in September.

What caused past Sriracha shortages?

Huy Fong buys its peppers from several suppliers in Mexico, where dire drought conditions in recent years have hurt harvests and led to a water crisis so severe that taps ran dry in some towns.

Last spring, during a slowdown in production of the hot sauce — which is packaged in iconic bottles adorned with an image of a rooster and a neon green squeeze top — the company released a statement saying it was “still experiencing a shortage of raw material,” a sign of a dwindling harvest that climate experts warn will increasingly be the norm.

Another big problem with Huy Fong’s supply chain began with a bitter legal battle with the company’s longtime pepper grower.

For decades, the company got its peppers from Underwood Ranches in Ventura County, but the relationship eventually unraveled. In 2017, Huy Fong sued the grower, which quickly filed a cross-complaint accusing the hot sauce empire of a breach of contract that the grower said had cost it more than $20 million in losses.

Two years later, a Ventura County jury sided with the jalapeño farmer, awarding it $23 million.

What’s the beloved brand’s backstory?

David Tran, a Vietnamese refugee who upon arriving in the U.S. couldn’t find a hot sauce he liked, decided to create his own, founding Huy Fong Foods in Chinatown in 1980.

Through the years, he built it into a multimillion-dollar pepper empire that introduced Sriracha to the U.S. The company also makes a chili-garlic sauce and a ground chili paste called sambal oelek, both of which will also be affected by the production halt, USA Today reported. Today, Tran’s version of the company’s most famous sauce, which originated in Si Racha, Thailand, lines grocery shelves across the nation (when it’s in stock) and has won a cult following among devoted fans and foodies alike.

Bon Appétit named Sriracaha as its 2010 ingredient of the year.

How are consumers and competitors reacting?

Several Sriracha diehards posted in dismay this week, saying they planned to stock up before a potential shortage.

One person posted on X, linking to a story about the production halt and adding a message in all caps: “CAN’T WE HAVE ANYTHING NICE ANYMORE?” Someone else wrote that they planned to rush out and buy a case of bottles.

One of Huy Fong’s main competitors, Tabasco, bought the website srirachashortage.com, which redirects to a page on its site showing a large picture of its version of Sriracha, which save for swapping out the label and a gold top for the signature green one, still resembles Huy Fong’s bottle.

On its website, Underwood Ranches, the Ventura County grower that launched its own line of sauces after things went sour with Huy Fong, sells a three-pack of its Sriracha bottles adorned with an image of a dragon for around $27.

A tagline at the bottom of the Underwood site, which the grower indicated was trademarked, reads: “The peppers make the sauce.”

Huy Fong Foods has struggled to find a consistent and reliable supplier for its red peppers since its partnership ended with Underwood Ranches, Underwood said Friday.

“Creating a supply chain like that is far more complicated than people realize,” Underwood said. “The general public just takes for granted when these types of peppers are available. And there’s a much more sophisticated process to when you pick them and how you pick them.”

Business

Original ‘Star Trek’ Enterprise model was lost and found decades later. Now it's the subject of a lawsuit

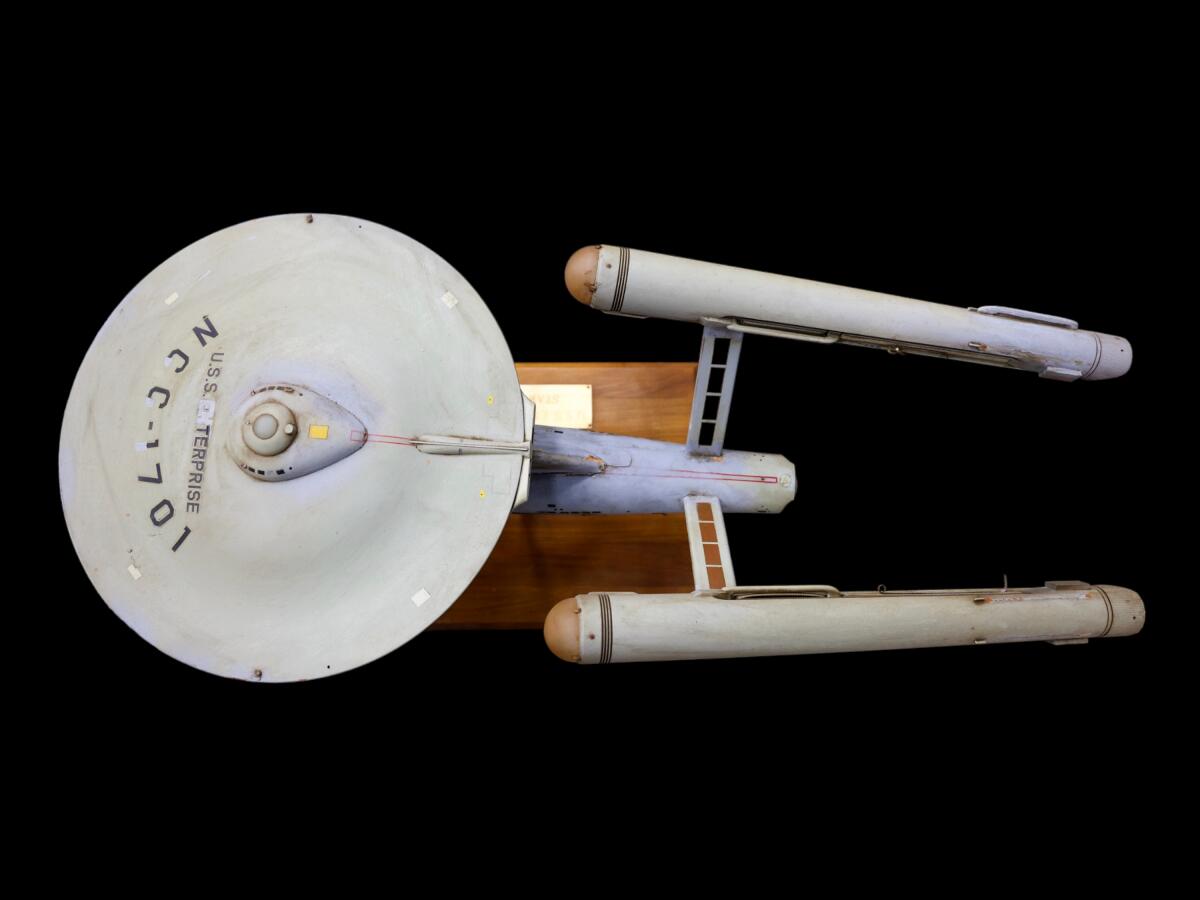

In April, Heritage Auctions heralded the discovery of the original model of the U.S.S. Enterprise, the iconic starship that whooshed through the stars in the opening credits of the 1960s TV series “Star Trek” but had mysteriously disappeared around 45 years ago.

The auction house, known for its dazzling sales of movie and television props and memorabilia, announced that it was returning the 33-inch model to Eugene “Rod” Roddenberry Jr., son of series creator Gene Roddenberry. The model was kept at Heritage’s Beverly Hills office for “safekeeping,” the house proclaimed in a statement, shortly after an individual discovered it and brought it to Heritage for authentication.

“After a long journey, she’s home,” Roddenberry’s son posted on X, (formerly Twitter).

Heritage Auctions Executive Vice President Joe Maddalena, left, with Eugene “Rod” Roddenberry Jr., son of “Star Trek” creator Gene Rodenberry, with the first model of the starship Enterprise.

(Heritage Auctions / HA.com)

But the journey has been far from smooth. The starship model and its celebrated return is now the subject of a lawsuit alleging fraud, negligence and deceptive trade practice, highlighting the enduring value of memorabilia from the iconic sci-fi TV series.

The case was brought by Dustin Riach and Jason Rivas, longtime friends and self-described storage unit entrepreneurs who discovered the model among a stash of items they bought “sight unseen” from a lien sale at a storage locker in Van Nuys last October.

“It’s an unfortunate misunderstanding. We have a seller on one side and a buyer on the other side and Heritage is in the middle, and we are aligning the parties on both sides to get the transaction complete,” said Armen Vartian, an attorney representing the Dallas-based auction house, adding that the allegations against his client were “unfounded.”

The pair claimed that once the model was authenticated and given a value of $800,000, they agreed to consign it to an auction sale with Heritage planned for July 2024, according to the lawsuit. However, following their agreement, they allege the auction house falsely questioned their title to the model and then convinced them, instead of taking it to auction, to sell it for a low-ball $500,000 to Roddenberry Entertainment Inc. According to the suit, Eugene Roddenberry, the company’s CEO, had shown great interest in the model and could potentially provide a pipeline of memorabilia to the auction house in the future.

The model had gone missing for 45 years.

(Heritage Auctions / HA.com)

“They think we have a disagreement with Roddenberry,” said Dale Washington, Riach and Rivas’ attorney. “We don’t. We think they violated property law in the discharge of their fiduciary duties.”

The two men allege they have yet to receive the $500,000 payment.

A surprise discovery in a Van Nuys storage unit

For years, Riach and Rivas have made a living buying repossessed storage lockers and selling the contents online, at auction and at flea markets. In fact, Riach has appeared on the reality TV series “Storage Wars.”

“It’s a roll of dice in the dark,” Riach said of his profession bidding on storage lockers. “Sometimes you are buying a picture of a unit. When a unit goes to lien, what you see is what you get and the rest is a surprise. At a live auction you can shine a flashlight, smell and look inside to get a gauge. But online is a gamble, it’s only as good as the photo.”

Last fall, Riach said he saw a picture of a large locker in an online sale. It was 10 feet by 30 feet, and “I saw boxes hiding in the back, it was dirty, dusty, there were cobwebs and what looked like a bunch of broken furniture,” he said.

Something about it, he said, “looked interesting,” and he called Rivas and told him they should bid on it. Riach declined to say how much they paid.

There were tins of old photographs and negatives of nitrate film reels from the 1800s and 1900s. When Rivas unwrapped a trash bag that was sitting on top of furniture, he pulled out a model of a spaceship. The business card of its maker, Richard C. Datin, was affixed to the bottom of the base.

A Google search turned up that Datin had made “Star Trek” models, although the two men didn’t make the connection to the TV series.

“We buy lots of units and see models all of the time,” Riach said. He thought they would find a buyer and decided to list it on eBay with a starting price of $1,000.

At once, they were deluged with inquiries. Among Trekkies, the long-lost first starship model had attained a mythical status.

The original “Star Trek’’ debuted in 1966 and aired for three seasons. Although its original run was brief, the show has generated numerous films and television spinoffs and is one of the most lucrative entertainment franchises, with an enormous fan base.

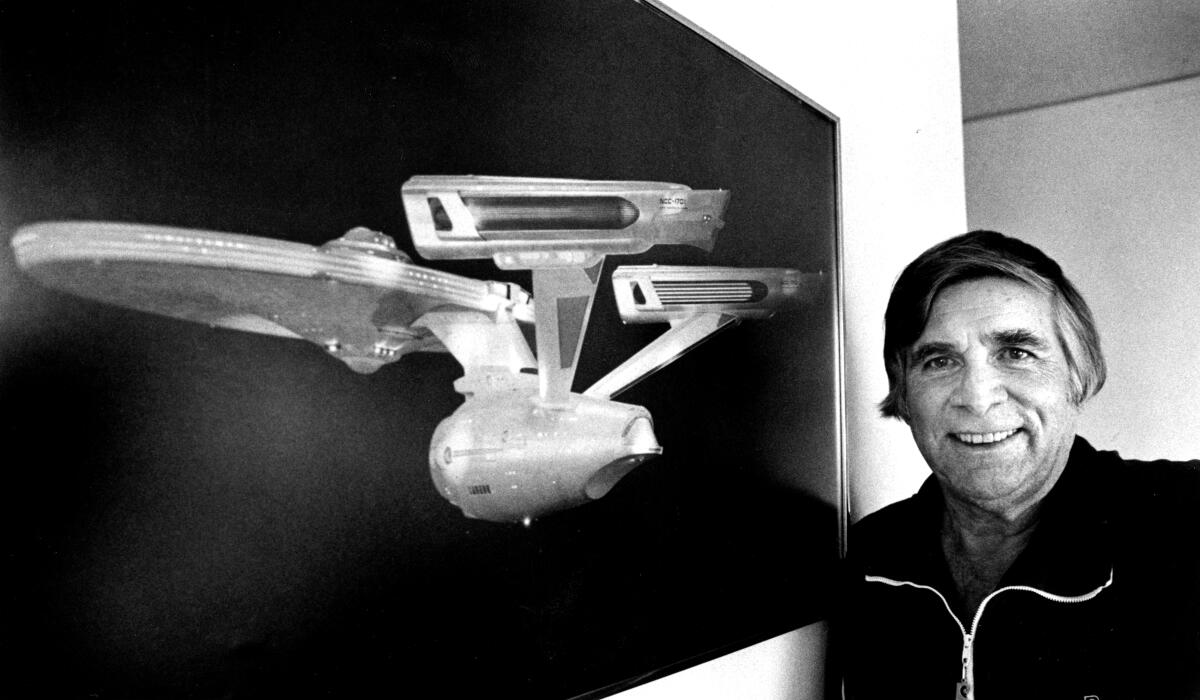

Gene Roddenberry, creator of “Star Trek,” with an image of the starship Enterprise in 1984.

(Ken Lubas / Los Angeles Times)

In 2022, at a Heritage auction of 75 props and items, a Starfleet Communicator from the 1990s series “Star Trek: Deep Space Nine” sold for $27,500 while a pair of Spock’s prosthetic Vulcan ear tips from the original series went for $11,875, more than twice the amount they brought when they were sold in 2017 for $5,100.

The starship’s design was crucial to the series’ success. “If you didn’t believe you were in a vehicle traveling through space, a vehicle that made sense, whose layout and design made sense, then you wouldn’t believe in the series,” Gene Roddenberry said in the 1968 book “The Making of Star Trek,” according to the auction house.

For years, the show’s creator had kept the 33-inch model on his desk. It became the prototype for the 11-foot model used in subsequent episodes. That version was later donated to the Smithsonian National Air and Space Museum. But that first model disappeared around 1978 when the makers of “Star Trek: The Motion Picture” borrowed it.

A missing starship model

In 1979, Roddenberry wrote to then Paramount executive Jeffrey Katzenberg stating that he had “loaned” the model to the studio more than a year earlier.

“My problem is simply that of getting my model back,” Roddenberry wrote, according to a copy provided by Washington. “It is a fairly expensive piece of model making but its real value to me is what it represents.” He added that no one he had spoken with “had the slightest hint as to who got it or what happened to it.”

Roddenberry died in 1991.

After the massive interest sparked by the eBay listing, Riach and Rivas pulled the sale and began researching the model more intently. They discovered the connection between Datin and the TV series but also learned that the original model was the same size as the one they had found and it had gone missing. “I said wow, do we have something here?” said Riach, and then reached out to Heritage.

Riach admitted that “Star Trek” wasn’t really on his radar. He was a die-hard “Star Wars” fan, having collected vintage memorabilia from the space films since he was 8 years old.

But given the treasure he unearthed, he now says, “I love ‘Star Trek.’

“There are people buying storage units for 20 years and you will never find anything this great,” he said. “It’s like buying a lottery ticket. It was a very great find.”

Things took an unexpected twist, Riach said. In March, he and Rivas signed an agreement to sell the model for $500,000 after it was pulled from the planned auction and they were told Roddenberry Entertainment had a “strong claim” to the model’s title and “would tie them up with its ‘powerful legal team.’” But then they were given a new transfer agreement to sign with a new set of terms. Riach declined and, instead, he and Rivas called Washington.

Heritage “moved the goalposts,” said their attorney. Under the new agreement, Riach and Rivas would be paid a “finder’s fee,” which Washington called a “reward,” converting it from a transactional payment to a potentially voluntary payment.

They claimed that by April, when Heritage announced the model had resurfaced, the pair came to believe the house failed to disclose the item’s value was much greater than they had been told.

Joe Maddalena, Heritage’s executive vice president, made public statements calling it “priceless.” “It could sell for any amount and I wouldn’t be surprised because of what it is,” he told the AP. “It is truly a cultural icon.”

They also had not been paid.

On April 28, 10 days after Heritage announced it had returned the model to Roddenberry, Riach and Rivas’ lawyer sent a letter to the auction house’s attorney outlining their claims and asking for the payment promised; they also proposed mediation.

Vartian, the lawyer representing Heritage, said that Riach and Rivas became “impatient” about getting the transaction done, and disputes the house had a fiduciary duty to them.

“This is an arm’s-length business relationship,” Vartian said. “They bring something to the auction house and are trying to get the most possible amount as quickly as possible, that is [Heritage’s] position and what they did.”

Still, Vartian is confident that they will soon conclude the transaction, saying, “Various things including scheduling have taken longer than it would.”

For his part, Riach says this experience is much like that of the crew of the U.S.S. Enterprise — “a strange new world.”

“I’ve never experienced anything like this. I’ve sold fine art at auction and other places, I got my check and went on. I’ve never had this roller coaster.

“Storage is a hard game. Sometimes you win and sometimes you lose,” he added. “We’ve bought a $10,000 unit and everything was complete garbage. But if you play long enough, you can get lucky.”

-

Politics1 week ago

Politics1 week agoThe White House has a new curator. Donna Hayashi Smith is the first Asian American to hold the post

-

News1 week ago

News1 week agoPolice enter UCLA anti-war encampment; Arizona repeals Civil War-era abortion ban

-

Politics1 week ago

Politics1 week agoAdams, NYPD cite 'global' effort to 'radicalize young people' after 300 arrested at Columbia, CUNY

-

World1 week ago

World1 week agoTurkish police arrest hundreds at Istanbul May Day protests

-

News1 week ago

News1 week agoVideo: Police Arrest Columbia Protesters Occupying Hamilton Hall

-

)

) Movie Reviews1 week ago

Movie Reviews1 week agoThe Idea of You Movie Review: Anne Hathaway’s honest performance makes the film stand out in a not so formulaic rom-com

-

News1 week ago

News1 week agoSome Republicans expected to join Arizona Democrats to pass repeal of 1864 abortion ban

-

Politics1 week ago

Politics1 week agoNewsom, state officials silent on anti-Israel protests at UCLA