Reporting by Rachel Savage and Jorgelina do Rosario; editing by Giles Elgood

Finance

Zambia, bilateral creditors agree debt rework memorandum of understanding – finance ministry

/cloudfront-us-east-2.images.arcpublishing.com/reuters/UIF23H3DKJMW3LTMH5LZDJ4QYY.jpg)

Zambia’s Finance Minister Situmbeko Musokotwane attends a panel on the fourth day of the annual meeting of the IMF and the World Bank, following last month’s deadly earthquake, in Marrakech, Morocco, October 12, 2023. REUTERS/Susana Vera Acquire Licensing Rights

MARRAKECH, Morocco, Oct 14 (Reuters) – Zambia has agreed a memorandum of understanding (MoU) with its bilateral creditors on restructuring about $6.3 billion of debt, almost three years after the southern African country defaulted, the finance ministry said on Saturday.

Zambia was the first African country to default on its debt in the pandemic era and its restructuring process saw it agree broad terms to rework the debt with official creditors including China and members of the Paris Club of creditor nations in June.

“Each official creditor will now begin their internal process to sign the MoU. Following the signing of the MoU, the terms will be implemented through bilateral agreements with each member of the OCC (Official Creditor Committee),” a ministry statement said.

The agreements will include an average extension of debt maturities of more than 12 years, with interest rates set at 1% during the next 14 years and up to 2.5% after that. There is a mechanism to increase payments if Zambia’s economy performs better than expected.

Zambia will pay about $750 million in the next decade compared to almost $6 billion that was due to official creditors before the debt restructuring.

“The next step is to secure a comparable agreement with our private creditors,” Zambia’s finance minister, Situmbeko Musokotwane, said.

Zambia is committed to remaining in arrears to its commercial external creditors, the ministry said, until it secures a debt deal with comparable terms to the official creditor agreement.

The copper producer’s commercial creditors include international bondholders, who are owed more than $3 billion.

The country is currently in formal talks with a bondholder creditor committee to restructure more than $3 billion of overseas bonds.

The discussions kicked off earlier in October, so for now the creditors are restricted from trading the country’s notes. Zambia has three outstanding dollar bonds maturing in 2022 , 2024 and 2027 , currently trading at 52-58 cents on the dollar.

It is unclear how long the signing of the agreements between Zambia and each bilateral creditor is going to take.

“We are grateful to all our official creditors, especially the co-chairs of the committee, China and France, and vice-chair South Africa, for their commitment to help resolve Zambia’s debt overhang,” Musokotwane said.

On Thursday, International Monetary Fund (IMF) Managing Director Kristalina Georgieva said Zambia had signed the MoU with official creditors, which was later walked back by Zambia’s finance minister and the IMF.

Our Standards: The Thomson Reuters Trust Principles.

Finance

Global Innovation Lab for Climate Finance Surpasses 100-Member Organizations – CPI

The Global Innovation Lab for Climate Finance (the Lab) proudly announces a significant expansion in its membership. Over 100 distinguished public and private organizations are now joining forces to accelerate climate finance innovation and drive private investments in emerging markets.

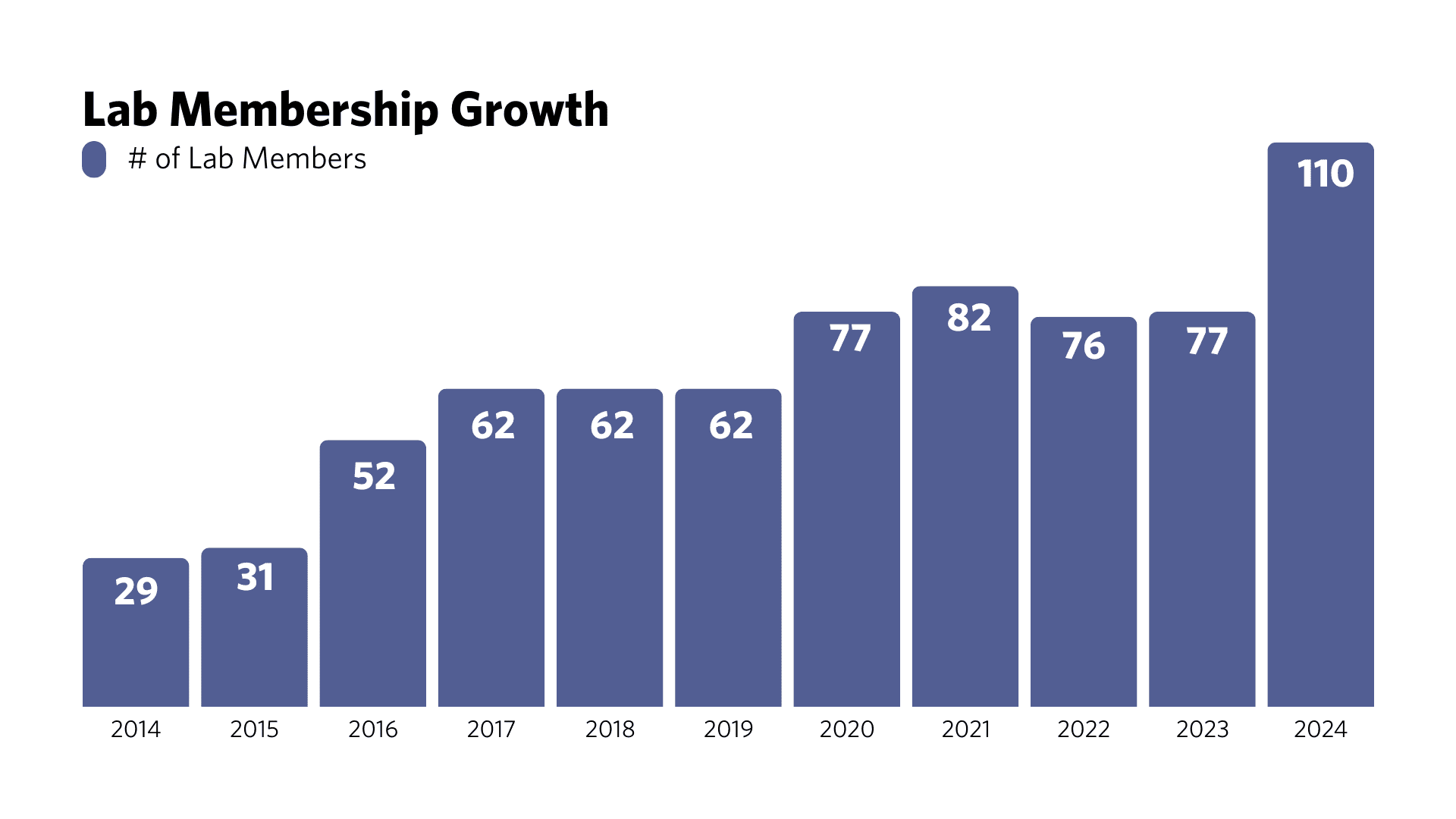

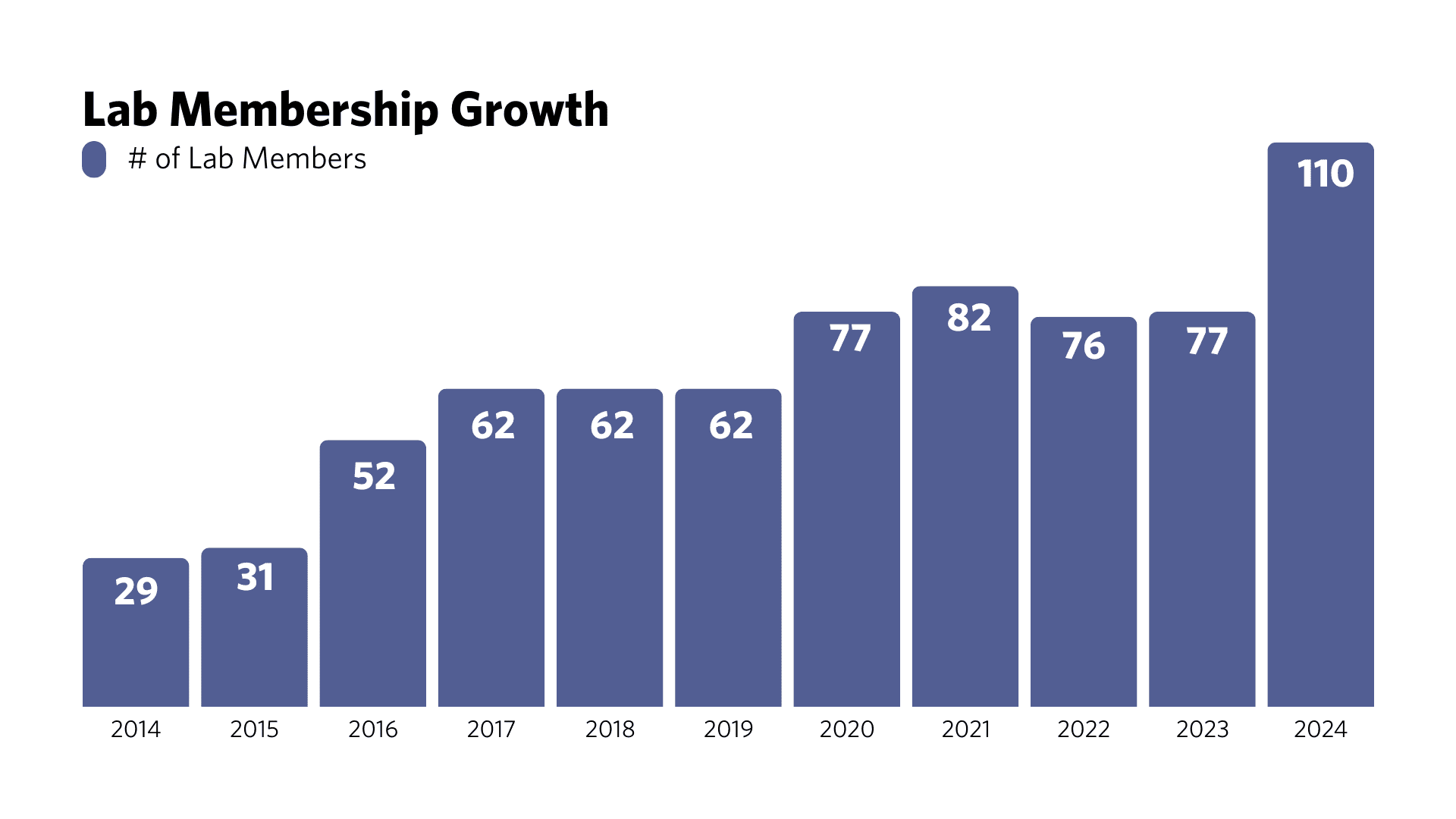

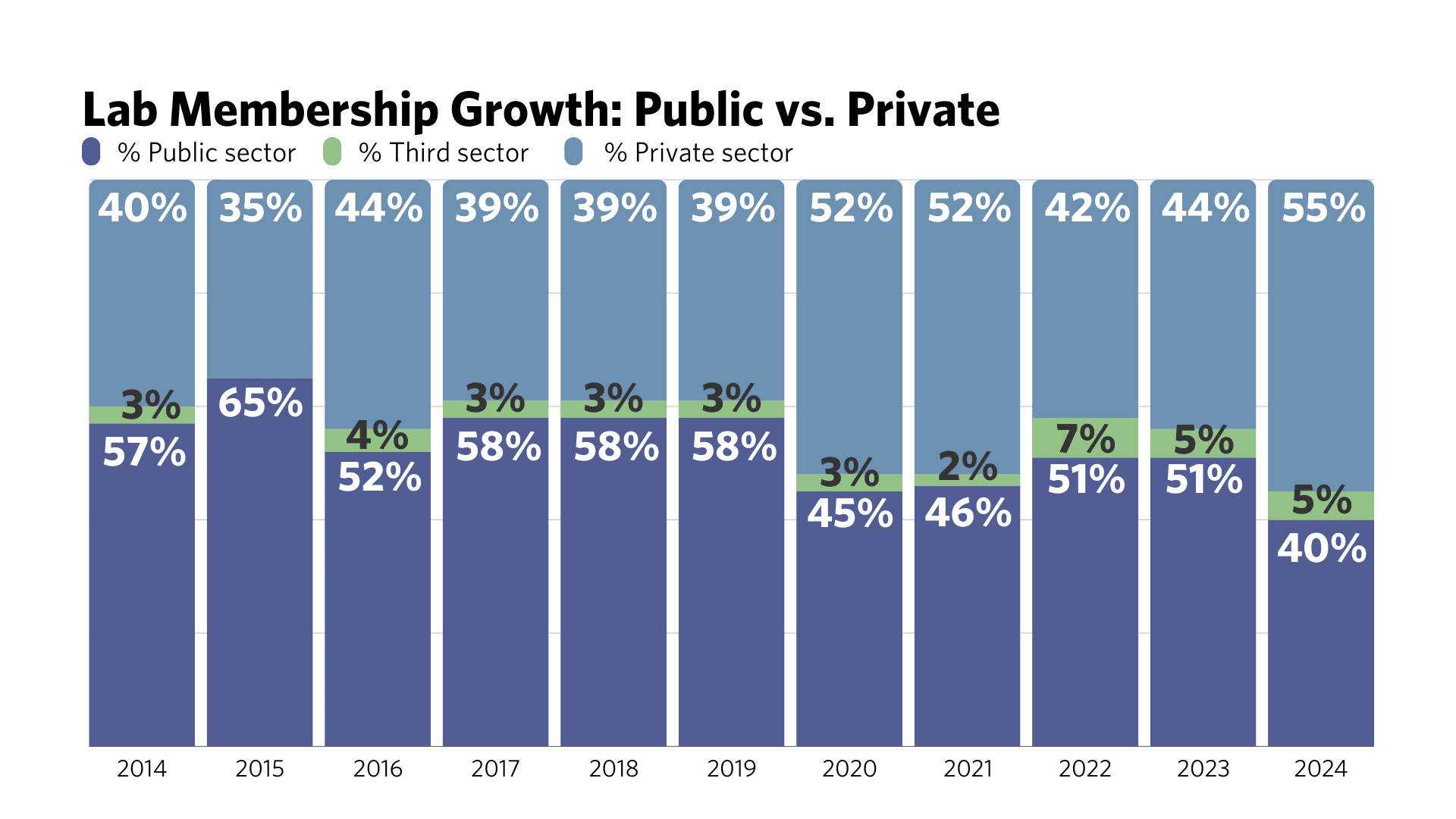

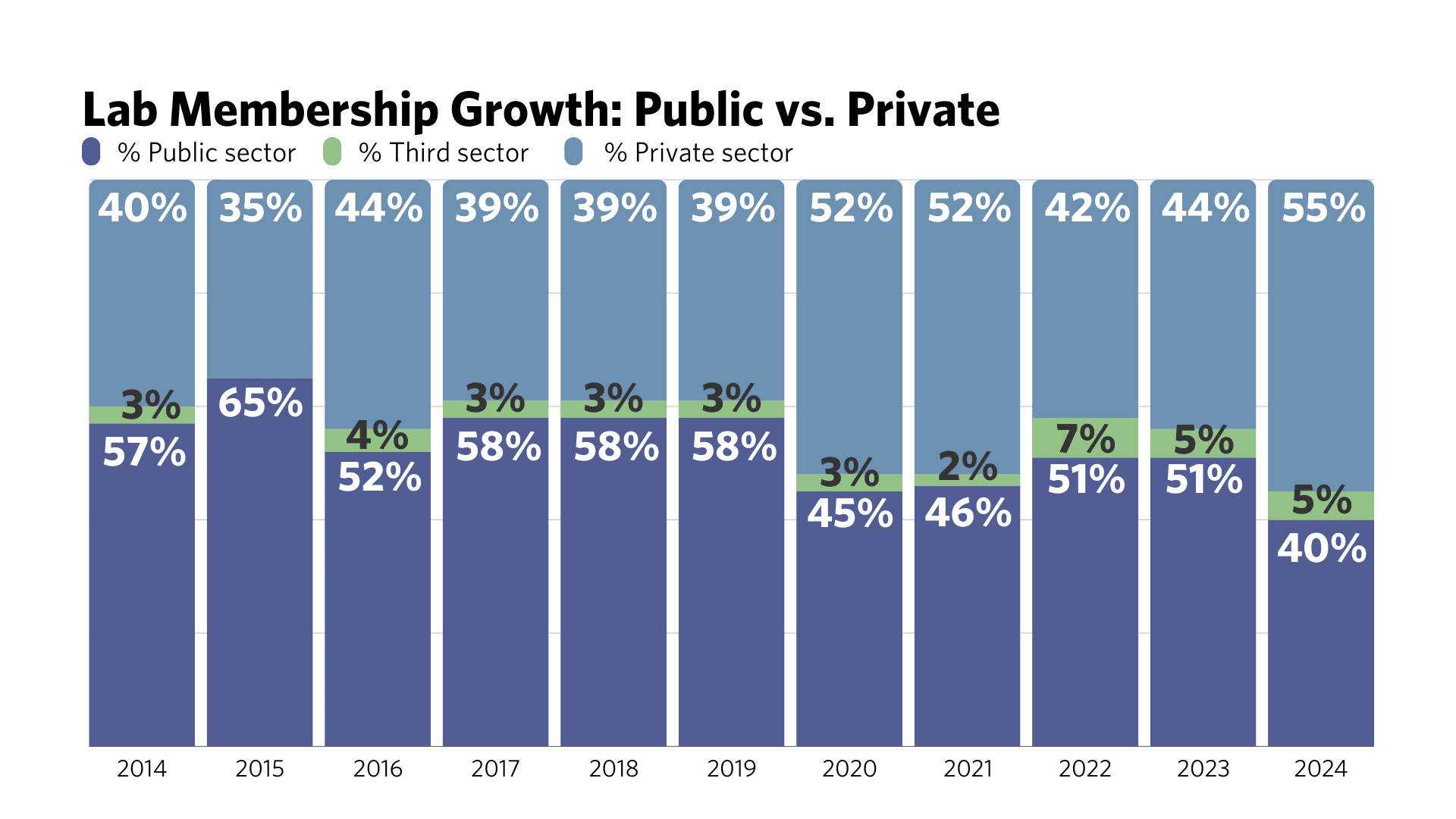

The Lab’s membership has skyrocketed nearly fourfold in 10 years, from 29 organizations at the inaugural Lab meeting in 2014 to 110 global and regional members today. Over the years, the Lab has seen a steady rise in private sector participation, with private members now making up 55% of the total, compared to 41% in 2014.

This growth follows the Lab’s successful launch of regional programs in the Philippines and Latin America and the Caribbean. New regional panel members from these areas join a growing network of experts across existing programs in Brazil, East and Southern Africa, and India. Additionally, the Lab welcomes new global members, strengthening its ability to identify and develop transformative financial instruments.

“We need to see bold ideas come forward and support the teams who pursue them. As a new global member, we are very happy to have supported the selection process of the Lab’s 10th cohort and to contribute to developing these outstanding teams and endeavors. The collaborative spirit among members points to a powerful force for tackling climate challenges,” said Elvira Lefting, Managing Director at Finance in Motion.

A substantial portion of the Lab’s portfolio mobilization figures, which now exceed USD 4 billion, is a result of direct investments from its diverse membership and broader network. The Lab continues to unlock new opportunities through collaborative efforts and scale up impactful climate finance initiatives globally.

“The Lab’s membership is the core driver of the Lab’s success. Our member institutions bring a wealth of expertise, dedicated support, and financial capital to the table, amplifying the Lab’s capacity to catalyze sustainable investments in emerging markets,” said Ben Broché, Climate Policy Initiative’s Associate Director, who leads the Lab’s efforts.

About the Lab

The Global Innovation Lab for Climate Finance identifies, develops, and launches innovative finance instruments that can drive billions in private investment to action on climate change and sustainable development. Bloomberg Philanthropies, the United Nations Development Programme, and the governments of Canada, Germany, the United Kingdom, and the United States fund the Lab’s 2024 programs. Climate Policy Initiative serves as the Secretariat and analytical provider.

For media inquiries or further information, please contact:

Júlio Lubianco

Communications Manager

julio.lubianco@cpiglobal.org

Sam Goodman

Communications Associate

sam.goodman@cpiglobal.org

Finance

Finance minister Buggana says Dhone took center-stage in terms of development in the entire state in the last five years | Hyderabad News – Times of India

The finance minister who is confident of securing his hat-trick victory at the Dhone assembly constituency in Nandyal district in the upcoming elections, is pitted against former union minister of state for railways Kotla Jayasurya Prakash Reddy of the TDP.

Embarking on a door-to-door election campaign at Peapully mandal on Sunday, Buggana asked the people to introspect about why his opponent Kotla Jayasurya Prakash Reddy and his family, never reached out to the people of the constituency in the last 15 years.

“Leaders belonging to various faction groups who lost their lives and their families completely shattered should all realise why the different faction groups are now setting aside their differences and joining hands with the sole motive to defeat me. Won’t such power-thirsty people revive faction at the Dhone assembly constituency, where no major faction related violence was reported in the last decade”, Buggana questioned the people.

Explaining to the voters about the financial benefits disbursed to the people of the Dhone assembly constituency in the last five years, besides the numerous development projects executed during the YSRCP regime, the finance minister appealed to the people to pledge support to him and the YSRCP to carry forward the development in the next five years too.

Finance

Saudi Arabia's Vision 2030 projects to be adjusted as needed, finance minister says – Times of India

Speaking at the World Economic Forum’s special meeting on Global Collaboration, Growth and Energy for Development in Riyadh, Mohammed Al Jadaan said the kingdom’s focus is on ensuring the quality of future economic growth, and recognises that the challenges it faces require flexibility.

“There are challenges… we don’t have ego, we will change course, we will adjust, we will extend some of the projects, we will downscale some of the projects, we will accelerate some of the projects,” Jadaan said.

Saudi Arabia is accelerating efforts to diversify its economy away from oil under a plan known as Vision 2030. It aims to develop sectors such as tourism and industry, expand the private sector and create jobs.

Non-oil activities vastly outperformed oil sector expansion last year growing by 4.4%, while the overall economy shrank by 0.8 per cent on the back of cuts to oil production and lower prices.

Saudi Arabia is projected to grow 2.6 per cent this year, a downward revision from 4 per cent forecast in October, the IMF said in its latest regional outlook report on the back of continued output cuts.

In the medium term, non-oil growth is expected to come in over 5 per cent a year, Jadaan said in February, although the kingdom is likely to continue to rely on hydrocarbon revenue to drive investments into expanding non-oil activities.

On Sunday, Jadaan re-emphasised the role of an expanded private sector in delivering Vision 2030.

“Vision 2030 is about empowering the private sector. The government role is to be out of business – the government role is to make policies to enable the private sector but not to actually do the business.” The Arab World’s largest economy needs oil at $96.2 to balance its 2024 budget, the IMF forecast.

-

Kentucky1 week ago

Kentucky1 week agoKentucky first lady visits Fort Knox schools in honor of Month of the Military Child

-

News1 week ago

Maryland high school student arrested after authorities discovered a 129-page document detailing school shooting plan, police say | CNN

-

World1 week ago

World1 week agoIranian media says three drones downed after explosions heard in Isfahan

-

World1 week ago

World1 week agoShipping firms plead for UN help amid escalating Middle East conflict

-

Politics1 week ago

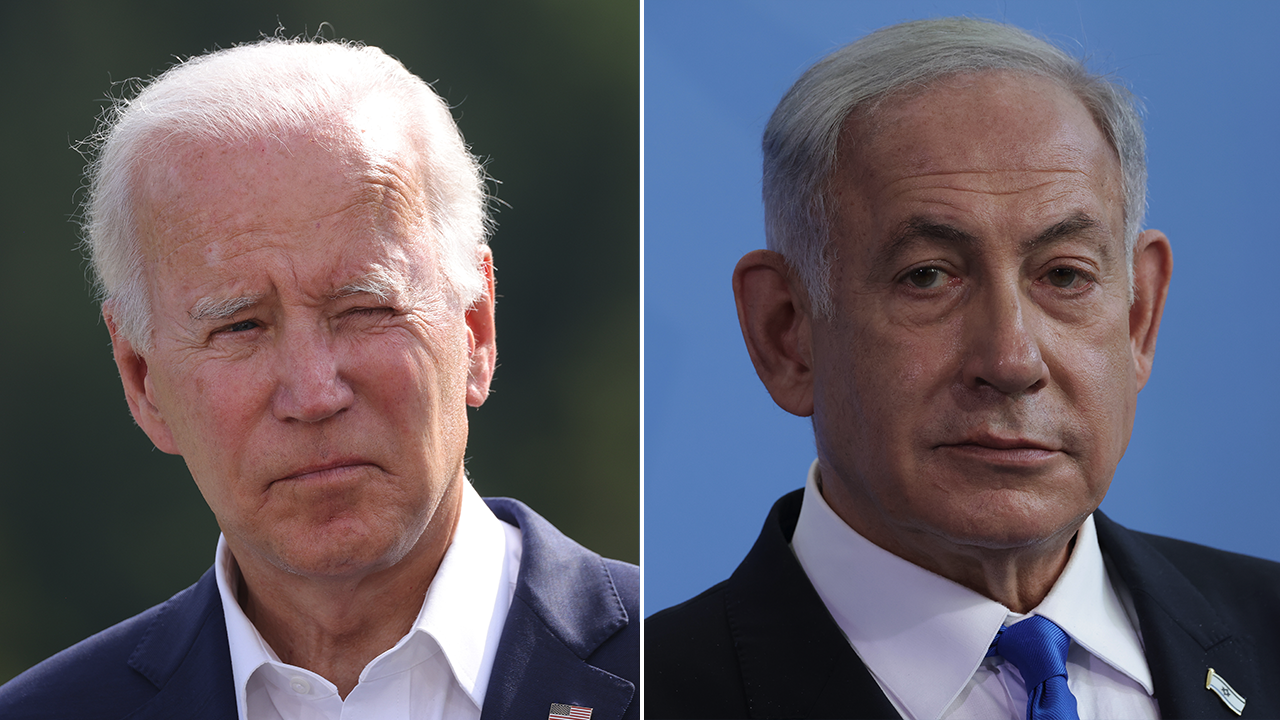

Politics1 week agoIsrael hits Iran with 'limited' strikes despite White House opposition

-

Politics1 week ago

Politics1 week agoICE chief says this foreign adversary isn’t taking back its illegal immigrants

-

News1 week ago

News1 week agoThe San Francisco Zoo will receive a pair of pandas from China

-

Politics1 week ago

Politics1 week ago'Nothing more backwards' than US funding Ukraine border security but not our own, conservatives say

/cloudfront-us-east-2.images.arcpublishing.com/reuters/W4FR7SY5IVIHJCEV4VVWJUR6MI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/EDG6KXYIC5JLZBYKIG2E2SLZ6A.jpg)