Finance

Philanthropy can have ‘multiplier effect’ on finance for climate efforts

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/MNQP5WDMBADKMUXYBJWKVOAWP4.jpg)

Better funding for options to assist to mitigate the results of local weather change — particularly in creating economies — could possibly be sourced if extra philanthropic cash was directed in the direction of it, in accordance with the Cop28 consultant for enterprise and philanthropy.

Badr Jafar, who can also be chief government of Crescent Enterprises, was in Davos final week to assist construct on the thought of making a world philanthropy alliance within the build-up to the Cop28 summit, being held within the UAE this yr, to help efforts to ease the results of local weather change.

“I’m a real believer within the catalytic potential for philanthropy to maneuver all of our international programs to deal with points associated to humanity and habitat,” he advised The Nationwide.

“The large alternative goes to return [when] we’re in a position to create platforms for cross fertilisation, not simply partnering capital, but additionally concepts and studying. And that’s what this new platform that we hope to launch at Cop28 might be, a world alliance.”

Local weather philanthropy is a rising however under-represented space of giving and funding. The World Financial Discussion board organised a number of discussions on the topic at its annual assembly in Davos final week.

In keeping with the WEF, the share of complete international philanthropy devoted to local weather mitigation is lower than 2 per cent a yr. Of the roughly $810 billion of complete philanthropic giving in 2021, solely about $7.5 billion to $12.5 billion was earmarked for local weather mitigation.

In Davos, the discussion board launched, with US local weather envoy John Kerry, the Giving to Amplify Earth Motion initiative to assist unlock the $3 trillion of financing wanted annually to succeed in internet zero, reverse nature loss and restore biodiversity by 2050.

Mr Jafar mentioned the worldwide local weather philanthropy alliance he needs to assist create would deal with supporting creating economies in addition to growing the scale of the sector.

“There are optimistic pattern strains to the extent that within the final 5 years the [climate philanthropy] quantity has tripled. So, it’s getting into the precise course, for quite a few causes,” he mentioned.

“The overwhelming majority of that cash is invested in adaptation financing in North America and Europe. Lower than 10 per cent of all adaptation financing goes to Africa and Latin America mixed. So there’s additionally an imbalance throughout the 2 per cent, which is already very low.”

In Davos, Mr Jafar, with the Prince Albert II of Monaco Basis, co-hosted a high-level occasion on local weather and nature philanthropy.

I’m a real believer within the catalytic potential for philanthropy to maneuver all of our international programs to deal with points associated to humanity and habitat

Badr Jafar, Cop28 consultant for enterprise and philanthropy

This introduced collectively a various group together with Majid Al Suwaidi, director basic of Cop28, Cherie Blair, founding father of the Cherie Blair Basis for Ladies, Andre Hoffmann, vice-chairman of Roche, and Rohini Nilekani, chair of Rohini Nilekani Philanthropies.

“Philanthropy, when deployed strategically, could be nimble, could be versatile, could be danger tolerant, and generally is a lot extra equitable in the best way during which it is dispersed,” Mr Jafar mentioned.

“And because of this it has a novel attribute and the potential to create a multiplier impact, in partnership with blended finance, in partnership with enterprise capital, and authorities capital.”

Mr Jafar can also be the founding patron of the Centre for Strategic Philanthropy on the College of Cambridge and the Strategic Philanthropy Initiative at NYU Abu Dhabi.

The worldwide local weather crises through the years – in photos

A key alternative lies in with the ability to use philanthropic cash to leverage different types of capital, he mentioned.

“Among the information that the centres have been placing collectively, have [highlighted] … a few nice case research that present that like in enterprise capital … a number of the first cash in won’t be an enormous amount of cash, however you look and see what over time that cash has been in a position to obtain when it comes to transformational technique of innovation inside that firm, enterprise or sector.”

That is additionally a novel second to make the most of trillions of {dollars} which are a part of an epic intergenerational wealth switch.

“This new technology is far more in tune with the interconnectedness of the [climate related] challenges but additionally to the impression on their very own enterprise,” he mentioned.

Up to date: January 26, 2023, 3:03 AM

Finance

Shriram Finance Q4 Results: PAT jumps 49% YoY to Rs 1,946 crore, NII rises 20%

Its net interest income (NII) rose 20% YoY to Rs 5,336 crore as against Rs 4,446 crore in the same period previous year.

While the profit figure was close to the Street estimates, NII was above expectations. The NBFC announced a final dividend of Rs 15 per share which will be paid to eligible shareholders before August 28.

Net interest margin (NIM) rose from 8.99% in Q3 to 9.02% in Q4 and provisions were up 1% sequentially to Rs 1,261 crore.

Shriram Finance’s total assets under management as on March-end increased 21.10% sequentially and stood at Rs 224,861.98 crore at the end of the quarter.The earning per share (basic) increased by 48.23% and was Rs 51.79 as against Rs 34.94 recorded in the same period of the previous year.Shares of the NBFC were trading 1% higher at Rs 2515 on the BSE on Friday.Also Read: Bajaj Finserv Q4 Results: PAT jumps 20% YoY to Rs 2,119 crore

Finance

Japan ready to take necessary steps on yen movements: finance chief

Japan is closely watching currency movements and is ready to take all necessary steps, Finance Minister Shunichi Suzuki said Friday, amid market caution about intervention to slow the yen’s fall to 34-year lows against the U.S. dollar.

Suzuki said he is “concerned” about the negative aspect of the weaker yen, while noting that it also has a positive side. He declined to say when and what specific steps the government would take against excessive volatility in the currency market.

“In line with our policy, the government will continue to monitor currency market developments closely and take all necessary steps” against excessive yen fluctuations, he told reporters.

The yen’s weakness stems from the still wide interest rate differential between Japan and the United States, despite the Bank of Japan’s decision last month to increase interest rates for the first time in 17 years. Financial markets have pared back expectations that the U.S. Federal Reserve will start cutting rates as early as June after a series of robust economic data.

A weak yen inflates import costs for resource-scarce Japan and accelerates inflation, while boosting the overseas earnings of Japanese exporters in yen terms.

“We are concerned about the negative side of the weaker yen,” Suzuki said, adding that responding to rising prices is a major priority for the government.

His comments came ahead of the conclusion Friday of the BOJ’s two-day policy meeting, with attention focused on the Japanese central bank’s assessment of the impact of the yen’s recent depreciation on the economy, particularly inflation.

Some market participants say the yen could fall further depending on the outcome, boosting the likelihood of a yen-buying, dollar-selling intervention by Japan.

Japanese authorities have warned of “appropriate” action to rectify rapid yen movements in recent days, but the yen has already passed the 155 line, viewed by market players as a threshold that could prompt the government to step in.

Related coverage:

Dollar at 34-yr. highs in upper 155 yen as intervention line tested

BOJ to check effects of rate hike amid weak yen at policy meeting

Japan’s inflation slows to 2.6% in March but rate hike still likely

Finance

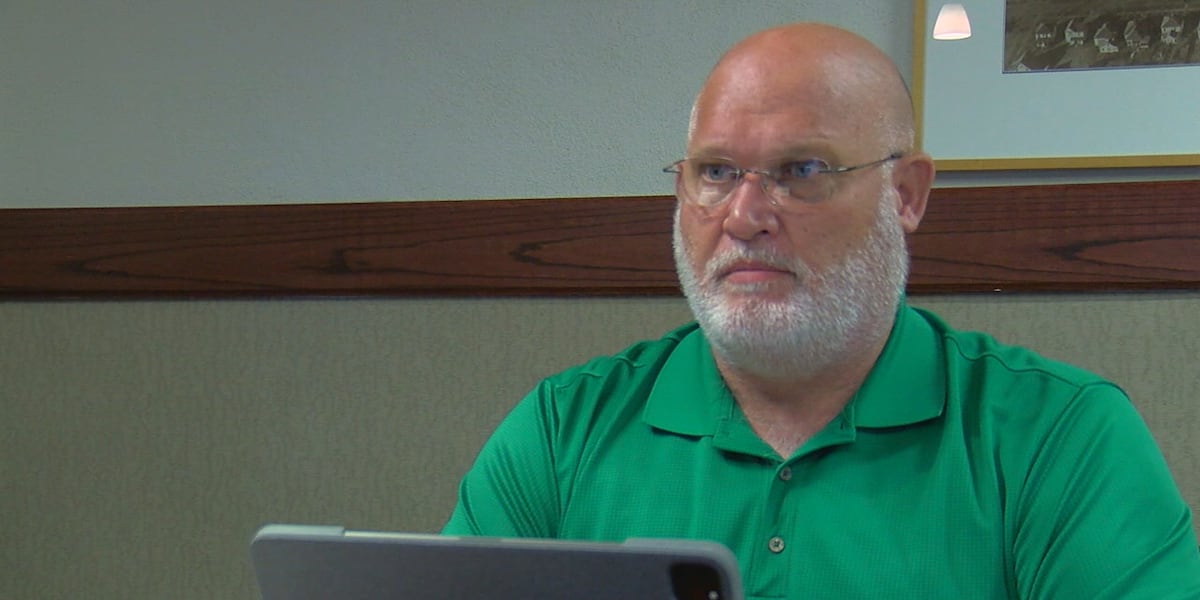

City of Lawton Finance Director resigns, search underway to fill role

LAWTON, Okla. (KSWO) – The City of Lawton has announced the resignation of Finance Director Joe Don Dunham.

In a statement sent to 7News, city officials say that Dunham tenured his resignation back on March 28.

The city also stated that a search to fill the vacancy is currently underway with Kristin Huntley serving as the Interim Finance Director.

We will bring you updates as we learn more.

Copyright 2024 KSWO. All rights reserved.

-

World1 week ago

World1 week agoIf not Ursula, then who? Seven in the wings for Commission top job

-

News1 week ago

News1 week agoGOP senators demand full trial in Mayorkas impeachment

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: The American Society of Magical Negroes

-

Movie Reviews1 week ago

Movie Reviews1 week agoFilm Review: Season of Terror (1969) by Koji Wakamatsu

-

Movie Reviews1 week ago

Movie Reviews1 week agoShort Film Review: For the Damaged Right Eye (1968) by Toshio Matsumoto

-

World1 week ago

World1 week agoCroatians vote in election pitting the PM against the country’s president

-

World1 week ago

World1 week ago'You are a criminal!' Heckler blasts von der Leyen's stance on Israel

-

Politics1 week ago

Politics1 week agoTrump trial: Jury selection to resume in New York City for 3rd day in former president's trial