Tags on this story

Chains, Crypto, crypto funds, Cryptocurrencies, Cryptocurrency, digital cash, Digital Currencies, electronics, funds platform, Funds processor, Retailers, tech shops, Ukraine, ukrainian, Whitebit, Whitepay

Ukrainians will be capable to buy electronics and different merchandise with digital cash because of a service offered by Whitepay. The fee processor, established by the Ukrainian-born digital asset change Whitebit, has just lately carried out crypto funds within the nation’s largest tech shops.

Whitepay, one of many platforms working as a part of crypto change Whitebit’s ecosystem, has launched cryptocurrency funds for the merchandise supplied by main Ukrainian tech shops, the crypto information outlet Forklog unveiled.

Among the many electronics retailers, whose prospects will now reap the benefits of the brand new service, are Tehnoezh (Техно Їжак in Ukrainian) and Stylus, which handle main on-line platforms within the sector, the report particulars.

The combination permits patrons to make use of greater than 130 completely different digital currencies for his or her purchases. The plan is to broaden the listing of supported digital cash sooner or later.

Ukrainian crypto holders will be capable to pay with digital belongings by the suitable varieties on the on-line shops, or at bodily places by particular level of sale (POS) terminals put in by Whitepay. The fee processor will preserve the system and supply buyer help.

Cryptocurrencies have gained vital recognition amongst Ukrainians prior to now few years, with their nation turning into a frontrunner in Japanese Europe when it comes to adoption. Kyiv has taken steps to control the business, and since Russia invaded the nation in late February, the federal government and volunteer teams have been counting on crypto donations to finance their protection and humanitarian efforts.

The Estonia-headquartered Whitebit, a serious European crypto change originating from Ukraine, has been a participant in such efforts. Earlier this yr, the buying and selling platform signed a memorandum of cooperation with the nation’s Ministry of International Affairs to offer help to its Anti-Disaster Middle and help Ukrainian refugees by its consultant workplaces overseas.

Different crypto corporations have additionally supplied assist. The world’s largest digital asset change by day by day buying and selling quantity, Binance, issued a particular crypto card for Ukrainians pressured to depart their properties behind as a result of ongoing army battle with Russia.

You possibly can help Ukrainian households, youngsters, refugees, and displaced individuals by donating BTC, ETH, and BNB to Binance Charity’s Ukraine Emergency Reduction Fund.

Do you suppose electronics retailers in different international locations within the area will introduce crypto funds within the close to future? Inform us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Kardasov Movies

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

In a stunning financial shift, the Japanese yen has reached a 34-year low against Bitcoin, which also hit all-time highs in 14 countries, fueled by optimism surrounding new spot Bitcoin ETFs.

Yen Hits 34-Year Low as Bitcoin Ascends, Spotlighting Global Shift Towards Cryptocurrency

According to Crypto.News, the Japanese yen plunged to a 34-year low as officials sought to contain the economy’s hyperinflation. According to Bloomberg, Japan’s sovereign fiat money suffers mostly from the disparity between local interest rates and those in the United States Federal Reserve rates.

While the Japanese government works through this problem, Bitcoin (BTC) has surpassed the yen in direct monetary worth. On April 25, Google Finance revealed that one Japanese yen equaled 0 Bitcoin.

In February, BTC soared against various fiat currencies, reaching all-time highs in 14 nations. The industry was propelled by optimism about the newly approved spot Bitcoin ETFs.

Following the revelation, many people on social media praised Bitcoin as “sound money” and an innovation capable of cultivating financial independence from the global traditional economic bubble.

Users reaffirmed what BTC maxi Michael Saylor calls “Bitcoin’s superior design,” referencing Satoshi Nakamoto’s protocol, which ensured that only 21 million BTC would exist.

It is impossible to surpass this limit because it is hard-coded into the Bitcoin blockchain. A halving controls inflation by lowering the number of new tokens in circulation. The halving occurred last week, with Bitwise CIO Mat Hougan opining that the event would largely benefit BTC’s market value in the long term.

Bitcoin Reaches New Heights in 14 Countries Amidst Currency Volatility and Economic Shifts

In a February report, Bitcoin has set an all-time high in 14 countries, including Turkey, Argentina, Egypt, Pakistan, Nigeria, Japan, and Lebanon, despite selling 25% down from its top of $69,000.

The contradictory position highlights the considerable devaluation of these countries’ currencies versus the United States dollar (USD) over the last two years. The global financial market has been extremely unpredictable in recent years, as cryptocurrencies such as Bitcoin have grown in many countries as a hedge against economic uncertainty.

For example, the Lira has devalued dramatically in Turkey, with the USD/TRY exchange rate rising from roughly 7.80 in November 2021 to 31.02. Similarly, the Argentine peso has fallen dramatically, from around 98 to more than 838 versus the US dollar in the same period.

The developments reflect these countries’ greater economic issues and inflationary pressures, contributing to Bitcoin’s growing popularity as an alternative investment and store of value.

Even in Japan, famed for its strong economy, the yen has devalued from roughly 104 to 150 versus the US dollar, indicating a loss of purchasing power.

Since Bitcoin’s birth, the USD has fallen six orders of magnitude versus BTC, showing cryptocurrency’s meteoric rise in the global financial scene. Once considered a digital curiosity, Bitcoin has evolved into a vital asset for investors seeking refuge from currency depreciation and economic uncertainty.

Photo: Microsoft Bing

TokenPost | [email protected]

<Copyright © TokenPost. All Rights Reserved. >

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

BlackRock‘s iShares Bitcoin Trust IBIT has seen its record-breaking streak of inflows come to an end on Wednesday.

What Happened: According to data from SoSoValue, IBIT recorded no net inflows for the day, snapping a 71-day stretch of continuous investment.

On Wednesday, spot Bitcoin ETF flows saw net outflows totaling $121 million, signaling a turbulent day for cryptocurrency investments.

Notably, Grayscale’s Bitcoin Trust ETF (GBTC) registered the most substantial single-day outflow, withdrawing $130 million.

Contrasting this, Fidelity Wise’s Origin Bitcoin Fund FBTC emerged as the frontrunner for inflows, attracting $5.61 million in a single day, followed closely by the collaborative ETF from Ark Invest and 21Shares

ARKB, which saw an influx of $4.17 million.

www.benzinga.com/events/digital-assets

Also Read: Jack Dorsey Wants To Make Bitcoin Mining As Easy As Plugging In A Lamp: Here’s How

Hong Kong Steps Into The Crypto ETF Arena

The news of BlackRock’s pause coincides with a significant development in the Asian market.

HashKey Exchange announced the completion of the first-ever cryptocurrency subscription for Bitcoin and Ethereum spot ETFs offered by Hong Kong-based Bosera International and HashKey Capital.

This subscription model allows for redemption without immediate sale of the underlying assets, potentially offering cost and liquidity benefits to investors.

Hong Kong’s foray into cryptocurrency ETFs marks a potential turning point for the Asian market.

These ETFs are expected to begin trading on the Hong Kong Stock Exchange on April 30, providing investors in the region with a new avenue for cryptocurrency exposure.

What’s Next: The Benzinga Future of Digital Assets event, scheduled for Nov. 19, will convene industry leaders, analysts, and investors to discuss these critical developments.

This conference presents a unique opportunity to gain insights into the future of Bitcoin ETFs, cryptocurrency subscriptions, and the broader digital asset ecosystem.

Don’t miss out on this chance to stay ahead of the curve in this rapidly changing market.

Read Next: Why Is MOG Crypto Coin Going Up? Trader Sees ‘Billions’ As Price Target

Image: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

If not Ursula, then who? Seven in the wings for Commission top job

GOP senators demand full trial in Mayorkas impeachment

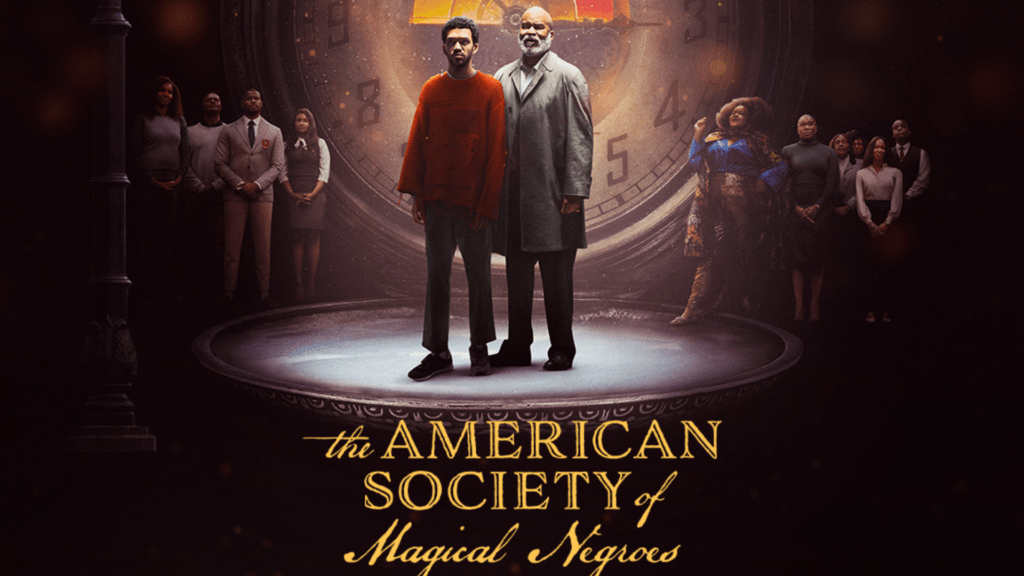

Movie Review: The American Society of Magical Negroes

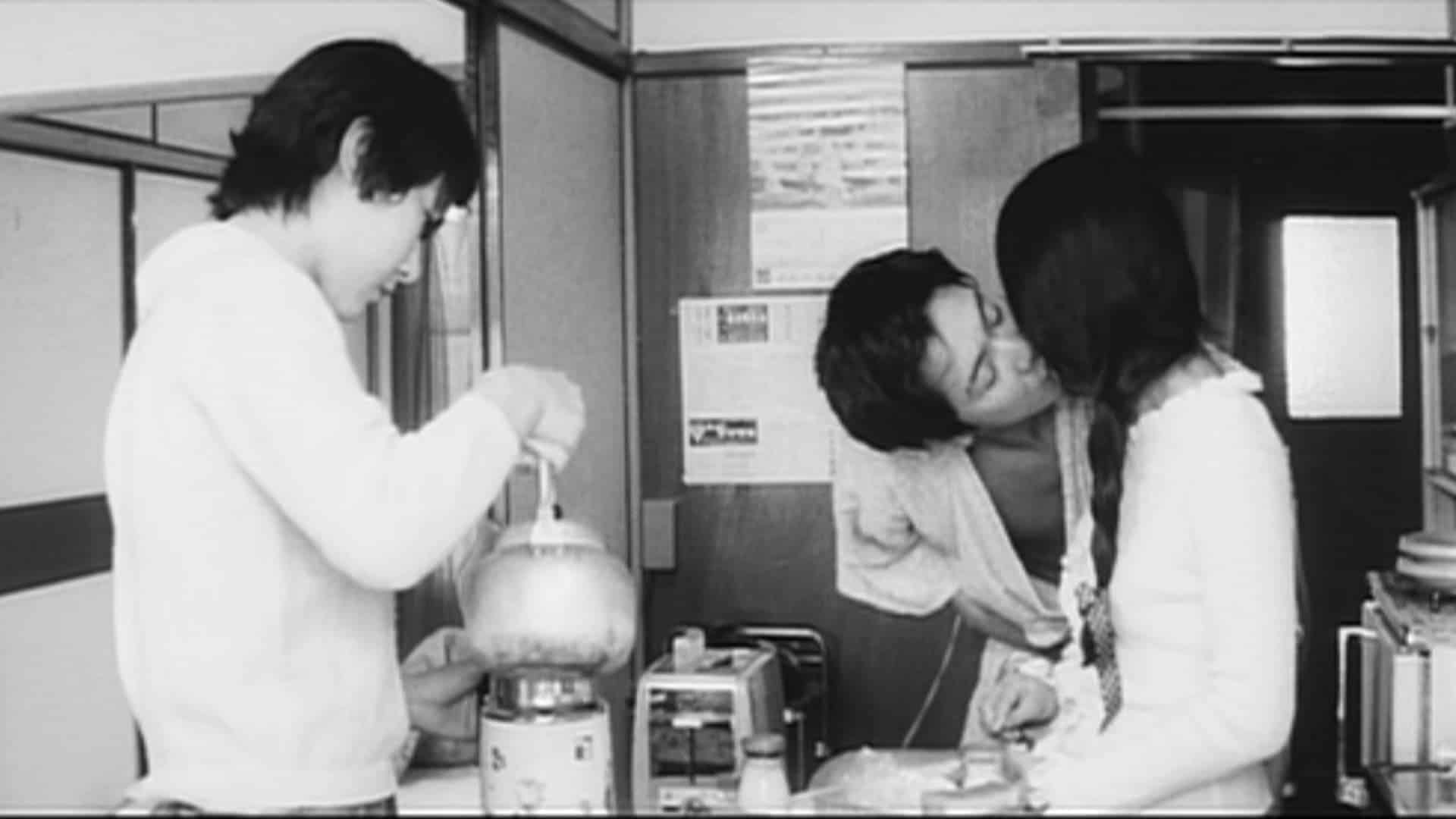

Film Review: Season of Terror (1969) by Koji Wakamatsu

Short Film Review: For the Damaged Right Eye (1968) by Toshio Matsumoto

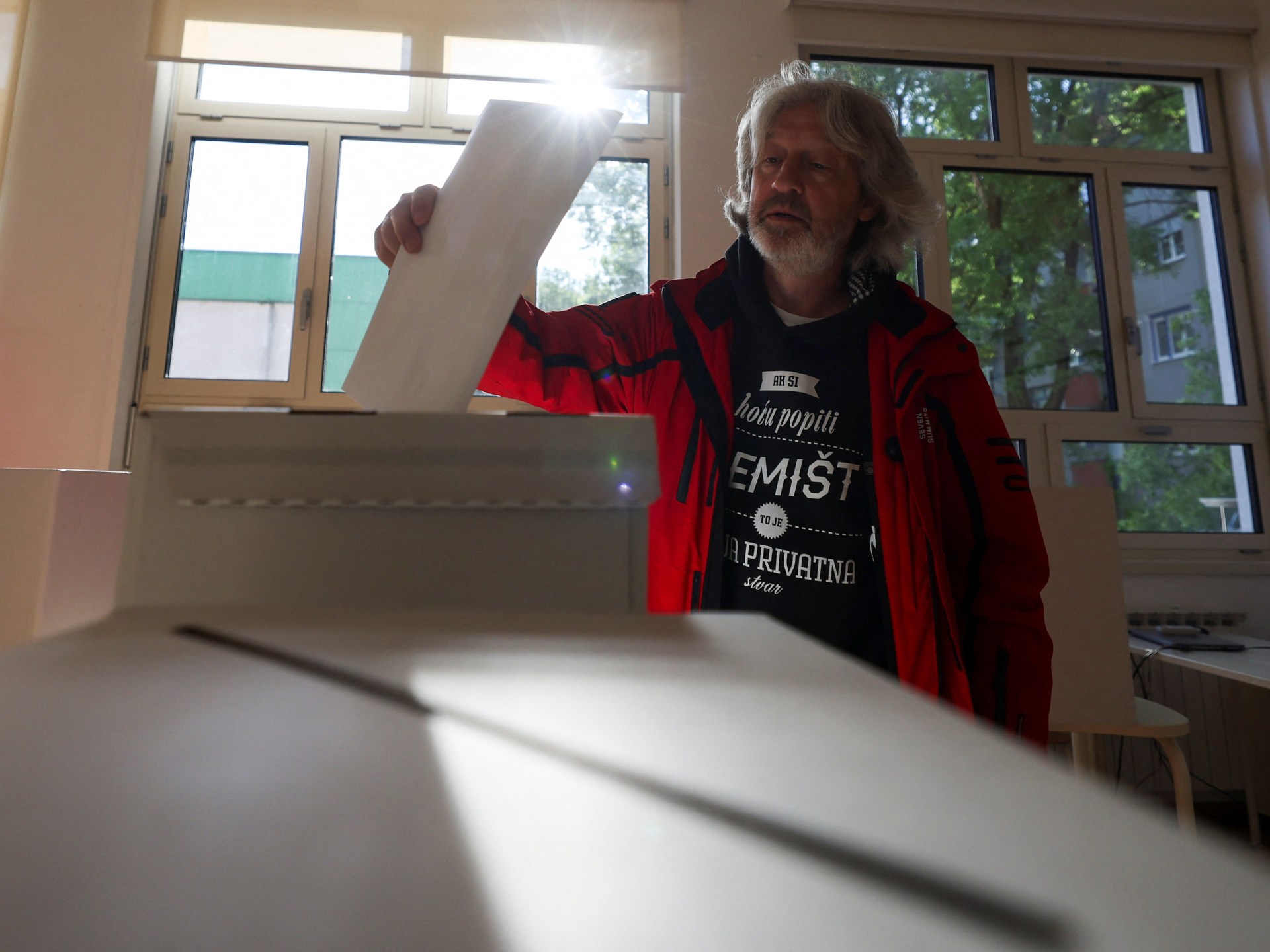

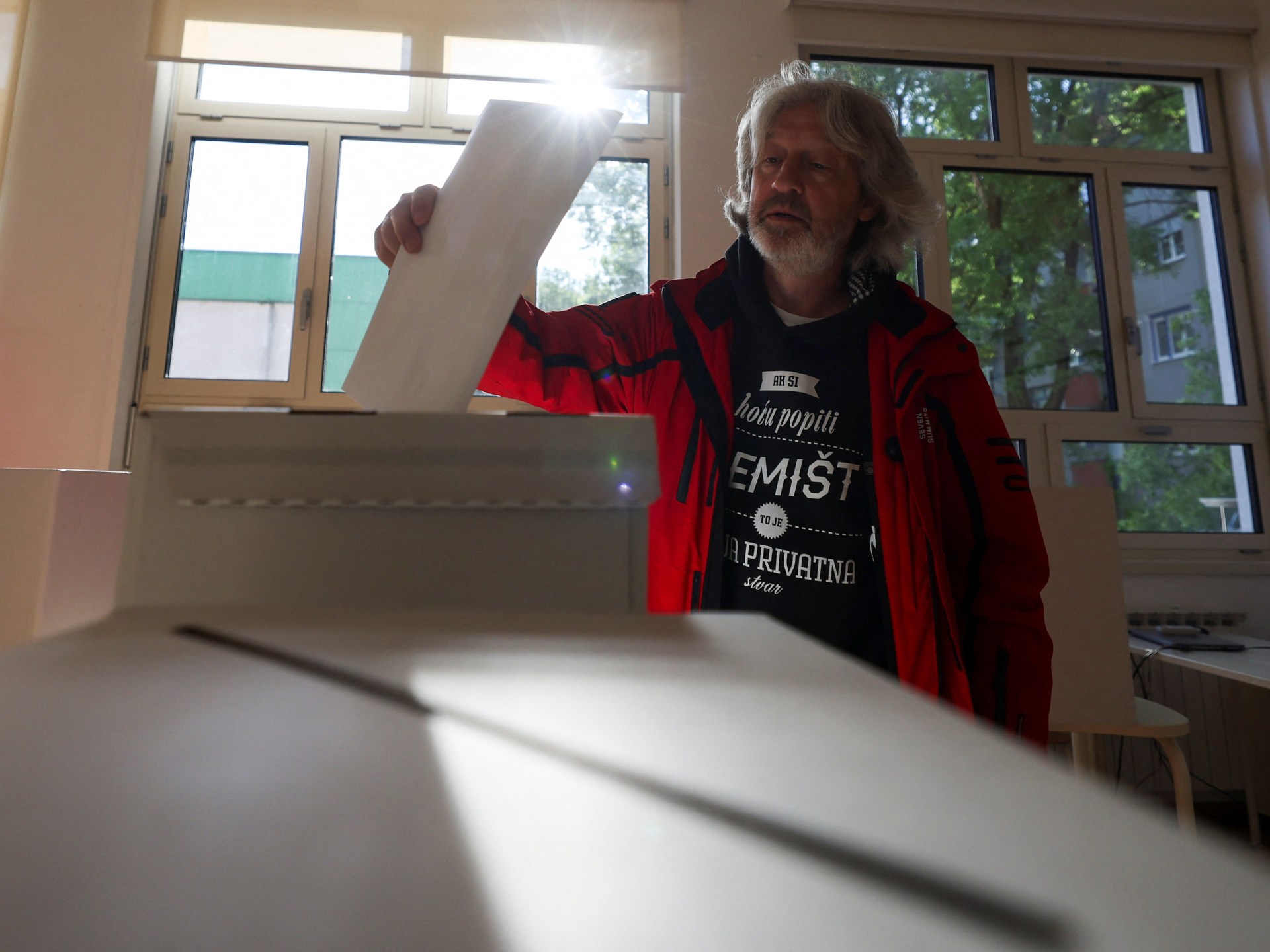

Croatians vote in election pitting the PM against the country’s president

'You are a criminal!' Heckler blasts von der Leyen's stance on Israel

Trump trial: Jury selection to resume in New York City for 3rd day in former president's trial