Crypto

Israel Seizes Crypto Accounts It Claims Belong to Hamas, ISIS

The Israeli authorities is taking motion in opposition to crypto accounts it has deemed suspicious, closing down dozens on one of many largest platforms for the digital foreign money.

Israel’s Nationwide Bureau for Counter Terror Financing (NBCTF) has seized round 190 accounts on Binance, a cryptocurrency alternate platform, for alleged ties to the Palestinian group Hamas, in keeping with a report by Reuters primarily based on paperwork launched by the nation’s anti-terror authorities. Israel additionally claimed that two of the accounts belonged to the extremist group ISIS.

Israeli authorities just lately introduced that they confiscated over half 1,000,000 Israeli shekels in digital currencies from accounts it claims fall below “foreign money alternate firms within the service of Hamas.” Underneath Israeli legislation, the ministry has the fitting to grab and confiscate property it deems could possibly be linked to terrorism actions.

One of many paperwork states that the Israeli overseas ministry deemed this essential to “thwart the exercise of the terrorist group the Islamic State (ISIS) and impair its skill to additional its targets.”

The crypto agency Binance responded to Reuters’ report, claiming that the information group was “leaving out essential details to suit their narrative.” In its assertion, Binance claimed that it had been working carefully with counter-terrorism authorities to help their investigations and seize the allegedly suspicious accounts. The corporate additionally acknowledged that its insurance policies adjust to “anti-money laundering and counter terrorism financing necessities.”

Binance doesn’t wish to be related to the teams talked about by the Reuters report, clarifying that “unhealthy actors don’t register accounts below the names of their felony enterprises.” Due to this fact, the corporate wouldn’t have identified who the accounts belonged to.

The cryptocurrency platform has been below hearth just lately after being sued by the U.S. Commodity Futures Buying and selling Fee for allegedly breaking worth buying and selling guidelines.

Crypto

Stripe Brings Back Crypto Payments Via USDC Stablecoin

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Crypto

BlackRock's Spot Bitcoin ETF Sees Zero Inflows, As Net Outflows Tally $130M On Wednesday

BlackRock‘s iShares Bitcoin Trust IBIT has seen its record-breaking streak of inflows come to an end on Wednesday.

What Happened: According to data from SoSoValue, IBIT recorded no net inflows for the day, snapping a 71-day stretch of continuous investment.

On Wednesday, spot Bitcoin ETF flows saw net outflows totaling $121 million, signaling a turbulent day for cryptocurrency investments.

Notably, Grayscale’s Bitcoin Trust ETF (GBTC) registered the most substantial single-day outflow, withdrawing $130 million.

Contrasting this, Fidelity Wise’s Origin Bitcoin Fund FBTC emerged as the frontrunner for inflows, attracting $5.61 million in a single day, followed closely by the collaborative ETF from Ark Invest and 21Shares

ARKB, which saw an influx of $4.17 million.

www.benzinga.com/events/digital-assets

Also Read: Jack Dorsey Wants To Make Bitcoin Mining As Easy As Plugging In A Lamp: Here’s How

Hong Kong Steps Into The Crypto ETF Arena

The news of BlackRock’s pause coincides with a significant development in the Asian market.

HashKey Exchange announced the completion of the first-ever cryptocurrency subscription for Bitcoin and Ethereum spot ETFs offered by Hong Kong-based Bosera International and HashKey Capital.

This subscription model allows for redemption without immediate sale of the underlying assets, potentially offering cost and liquidity benefits to investors.

Hong Kong’s foray into cryptocurrency ETFs marks a potential turning point for the Asian market.

These ETFs are expected to begin trading on the Hong Kong Stock Exchange on April 30, providing investors in the region with a new avenue for cryptocurrency exposure.

What’s Next: The Benzinga Future of Digital Assets event, scheduled for Nov. 19, will convene industry leaders, analysts, and investors to discuss these critical developments.

This conference presents a unique opportunity to gain insights into the future of Bitcoin ETFs, cryptocurrency subscriptions, and the broader digital asset ecosystem.

Don’t miss out on this chance to stay ahead of the curve in this rapidly changing market.

Read Next: Why Is MOG Crypto Coin Going Up? Trader Sees ‘Billions’ As Price Target

Image: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Crypto

Telegram users targeted in cryptocurrency scam, Kaspersky reports

Scammers are exploiting the rising popularity of Telegram and its associated cryptocurrency, Toncoin (TON), to execute a highly scalable scheme design to pilfer the digital tokens from unsuspecting users. Kaspersky researchers have discovered the operation, which has been active since November 2023, and warns that it is a growing threat.

Victims are being lured into the scheme via an invitation to join an “exclusive earning program” received from a contact in their list. The invitation leads them to an unofficial Telegram bot, falsely touted as a cryptocurrency storage solution. The victims are then instructed to link it to a legitimate wallet and to buy Toncoins through official channels such as the official Telegram bot or through cryptocurrency exchanges.

After duping victims into purchasing the coins, scammers push them to buy so-called ‘boosters’ using a separate bot, stating that this is the step needed to commence earning. The ‘boosters’, likened to those seen in online games, are misleadingly marketed as tools that allow users to capitalise on their coins further. “This scheme resembles boosters in online games – by purchasing one, the user gains additional advantages,” explains Olga Svistunova, Senior Web Content Analyst at Kaspersky. Once bought these ‘boosters’ cost victims their cryptocurrency, and the money lost is irreversible.

Following the purchase of the scam ‘boosters’, users are manipulated into propagating the scheme. They are encouraged to create a private Telegram group with their friends and acquaintances, share a specially generated referral link and a video with instructions on earnings. The scammers claim that at least five people should join the private group via the referral link before a victim can start earning. They are also told that they will receive payment for each friend invited and will make a commission from each of the fraudulent ‘boosters’ purchased by those they have referred.

Alluding to the potential scale of the scam, the Telegram Open Network (TON) was developed by the Durov brothers and is now backed by an independent community. Telegram itself has reached 900 million monthly users and ranks globally as the 6th most used and 6th most downloaded app. This expansive user base increases both the potential pool of victims and the likely impacts of the scheme.

Kaspersky experts have urged all users to exercise caution when encountering offers of quick riches, even if they are received from friends or acquaintances. Avoid transferring cryptocurrency to unknown or suspicious wallets, and consider comprehensive protection for your digital assets, such as Kaspersky Premium which alerts you to suspicious websites and guards your wallet against scammers, miners and other threats. Staying updated and informed about the latest fraudulent schemes is another effective protective measure.

-

World1 week ago

World1 week agoIf not Ursula, then who? Seven in the wings for Commission top job

-

Movie Reviews1 week ago

Movie Reviews1 week agoFilm Review: Season of Terror (1969) by Koji Wakamatsu

-

News1 week ago

News1 week agoGOP senators demand full trial in Mayorkas impeachment

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: The American Society of Magical Negroes

-

Movie Reviews1 week ago

Movie Reviews1 week agoShort Film Review: For the Damaged Right Eye (1968) by Toshio Matsumoto

-

World1 week ago

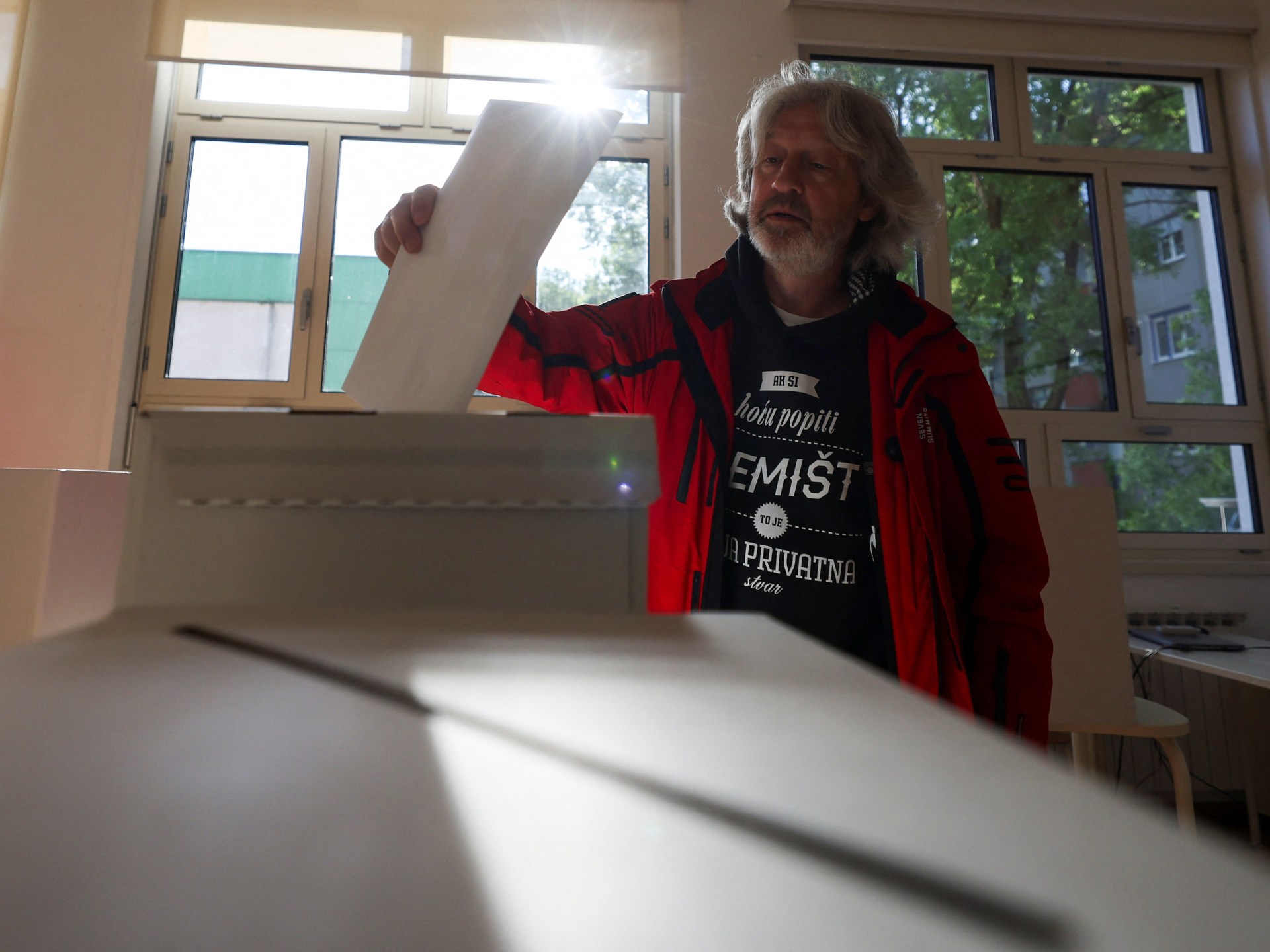

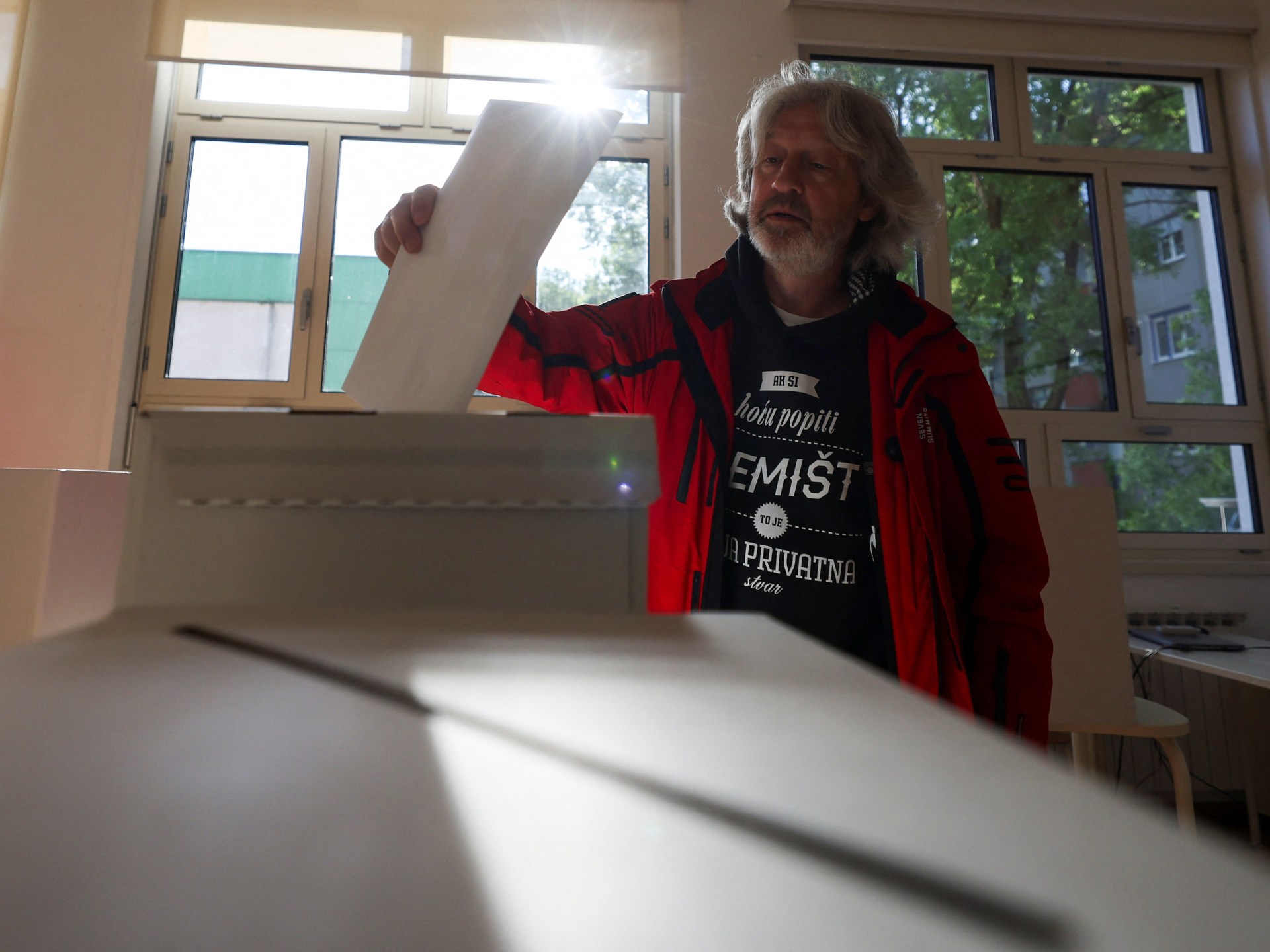

World1 week agoCroatians vote in election pitting the PM against the country’s president

-

World1 week ago

World1 week ago'You are a criminal!' Heckler blasts von der Leyen's stance on Israel

-

Politics1 week ago

Politics1 week agoTrump trial: Jury selection to resume in New York City for 3rd day in former president's trial

:focal(0x0:3000x2000)/static.texastribune.org/media/files/145abb4aabd8e5a67a98c612aa59639b/Crystal%20Mason%20LBS%20TT%2002.jpg)