Finance

Explainer: How Britain is exploiting Brexit to reform finance?

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JYIT42UUZ5M4PGFWLCRL2LUGJA.jpg)

LONDON, Dec 9 (Reuters) – Britain proposed over 30 reforms on Friday to bolster the Metropolis of London’s function as a world monetary centre, now outdoors the European Union and going through competitors from Amsterdam, Paris and Frankfurt, in addition to New York and Singapore.

IS THIS BIG BANG 2.0?

Not fairly, nevertheless it marks a swing within the regulatory pendulum from years of accelerating financial institution capital necessities and tightening shopper protections, to considering what tweaks are wanted to make guidelines work higher for Britain after Brexit.

Initially trailed as a Large Bang 2.0 on the identical scale as far-reaching Eighties reforms of share buying and selling, the modifications have now been dubbed the “Edinburgh Reforms” after the town the place they have been formally unveiled by finance minister Jeremy Hunt.

The federal government has toned down its rhetoric, insisting there will probably be no ‘race to the underside’, huge departure from worldwide norms, or scrapping investor protections, however that regulators ought to assist the monetary sector’s worldwide competitiveness.

Hunt mentioned it could be flawed name the reforms a Large Bang given the necessity to keep away from ‘unlearning’ classes from the 2008 world monetary disaster and underscored the independence of regulators.

“The Metropolis doesn’t wish to see deregulation. Right this moment’s bulletins are a sign of an evolution, reasonably than revolution,” mentioned Alasdair Haynes, CEO of Aquis inventory alternate.

WHAT’S RING-FENCING ALL ABOUT?

Britain has already introduced an easing of capital guidelines for insurers and is now turning to banks.

Since January 2019 banks have needed to ring-fence their deposit-taking arms with a cushion of capital to insulate them towards blow-ups of their riskier actions.

Banks have complained the foundations are too strict and hinder smaller ones from competing with larger lenders within the mortgage market. The federal government mentioned it can observe suggestions from a overview it commissioned and amend the foundations.

The federal government will seek the advice of mid-2023 on exempting banks with out main funding banking actions from the foundations, and on elevating the deposits threshold which triggers compliance with ringfencing guidelines, from 25 billion kilos to 35 billion kilos.

ARE BANKERS NOW OFF THE HOOK?

It is not again to pre-financial disaster ‘lite-touch’.

The federal government had already introduced it can scrap an EU cap on banker bonuses, although different curbs on how bonuses are paid are anticipated to stay.

Britain launched guidelines in 2016 to make senior bankers, including senior officers at insurers in 2018, straight accountable for the choices they take after few people have been punished for misconduct that led to the worldwide monetary disaster when taxpayers bailed out lenders.

It was feared as a software to publicly disgrace bankers by placing “heads on sticks”, however to date there have been few investigations or enforcement instances. Bankers say regulators additionally take too lengthy to provide the inexperienced mild to senior appointments.

The federal government will overview this senior managers and certification regime within the first quarter of 2023, with no indication but of the dimensions of any modifications.

WHAT ABOUT MARKETS?

There will probably be a raft of critiques as London seeks to meet up with New York in listings.

Matters underneath overview embody the foundations on short-selling, or bets that the value of inventory will fall. The federal government proposes to scrap outright an EU-era “PRIIPs” explanatory doc given to buyers, changing it with an alternate framework.

There will probably be an business taskforce to look at the case for halving the time it takes to settle a inventory commerce from two working days to 1, a transfer already deliberate in america.

Guidelines on prospectuses that firms give to buyers after they record on an alternate will probably be overhauled, together with a reform of guidelines for securitisation.

The federal government commits to setting up guidelines for a “consolidated tape” by 2024, to offer market costs for buyers to examine on finest offers throughout buying and selling platforms.

The federal government will act on suggestions from a overview into bettering how listed firms faucet buyers for recent funds.

There will probably be a overview of EU guidelines which require brokers to itemise charges for inventory selecting analysis and executing inventory orders, often called ‘unbundling’ – a rule the EU has already partially reversed. There will even be trials for a wholesale market venue that operates on an intermittent foundation to enhance firms’ entry to capital earlier than they publicly record.

AND GREEN FINANCE?

The federal government will seek the advice of on bringing environmental, social and governance (ESG) firm rankings suppliers underneath the regulatory internet.

The rankings are extensively utilized by buyers for selecting firms which tout ‘inexperienced’ credentials, however they aren’t regulated. The Monetary Conduct Authority mentioned it could encourage regulation centered on transparency, good governance, administration of conflicts of curiosity, and strong methods and controls.

WILL THERE BE A BRITCOIN?

Prime Minister Rishi Sunak, when he was finance minister, referred to as for a “Britcoin” or digital pound for sooner funds.

The federal government will seek the advice of with the Financial institution of England in coming weeks on a digital pound for retail use.

Reporting by Huw Jones;Enhancing by Elaine Hardcastle

Our Requirements: The Thomson Reuters Belief Rules.

Finance

US asset managers increase BTC portfolio allocation as Borroe Finance shines

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Legacy Wealth and United Capital Management have invested $20 million in Bitcoin through Fidelity’s ETF, while Borroe Finance raises nearly $4 million by monetizing future earnings via NFTs.

While US Asset Management firms invest over $40.88 million into FBTC to increase BTC portfolio, Borroe Finance (ROE) continues paving its path to become one of the top defi coins. Given its price trajectory and real-life use cases, ROE has emerged as a beacon of hope to investors.

US asset managers bought Bitcoin through Fidelity’s ETF

As per Eric Balchunas’s tweet on April 23, 2024, it is revealed that two different US investment advisors have bought Bitcoin through Fidelity’s ETF. These were Legacy Wealth Asset Management from Minnesota and United Capital Management from Kansas. They put $20 million to FBTC. So now, they have allocated 6% and 5% of their portfolios.

Reports reveal that these US Asset management firms’ allocations have surpassed $17 million which was invested into BlackRock’s ETF and IBIT. Moreover, United Capital Management’s website also posted a banner of “WE’RE COMING FOR YOUR COINS DEGENS.” But it was taken down soon after.

This influx of around $40.88 million investment in FBTC has boosted spot Bitcoin ETF inflows, dominating in April’s second-week outflows.

Despite making remarkable inflows in the spot Bitcoin ETF, there was barely any impact on the Bitcoin price trend. However, BTC has experienced a noticeable 3.35% surge in the third week of April, trading at around $64,100.

Borroe Finance attracts investors

Borroe Finance is taking the crypto world by storm. It has emerged as a pioneering force in the CrossFi arena, offering an AI-funding marketplace for avid web3 users and businesses. This approach to crowdfunding has become a stand-out for users as well as investors.

That’s why Borroe Finance has been making rapid waves in the presale stages. This ongoing presale success has blown investors’ minds.

Borroe Finance’s platform allows web3 players to generate upfront cash. By converting their future earnings into popular NFTs, these players can trade those NFTs in the secondary marketplace. Additionally, the marketplace is streamlined with a P2P ecosystem for trading convenience.

Moreover, Borroe Finance has adopted many unique approaches in its utility token. Some of them are token burn strategies, liquidity lock mechanisms, and many more, which will boost the value of ROE by stirring demands in the market.

For instance, Borroe Finance has already raised $3.97 million by selling over 298 million ROE tokens. This has showcased ROE’s growing optimism in the market. Anyone willing to buy ROE right now can get it at $0.02.

Once the presale ends, ROE will hit the mainstream market at $0.025. With this price surge, early investors will receive a 150% hike on their investment.

To learn more about Borroe Finance, visit the Borroe Finance Presale, join the Telegram group, or follow Borroe Finance on Twitter.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Finance

Global Innovation Lab for Climate Finance Surpasses 100-Member Organizations – CPI

The Global Innovation Lab for Climate Finance (the Lab) proudly announces a significant expansion in its membership. Over 100 distinguished public and private organizations are now joining forces to accelerate climate finance innovation and drive private investments in emerging markets.

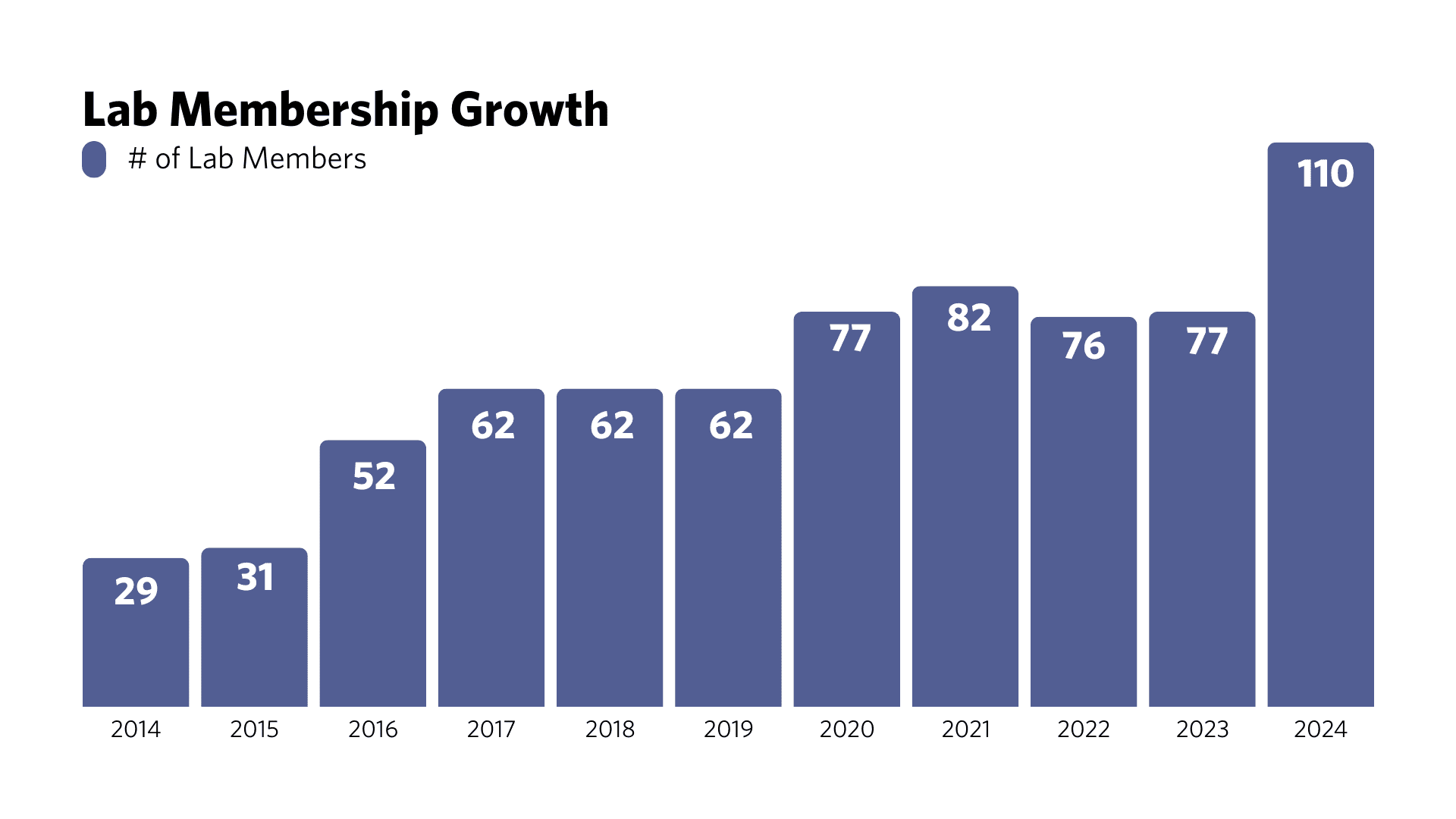

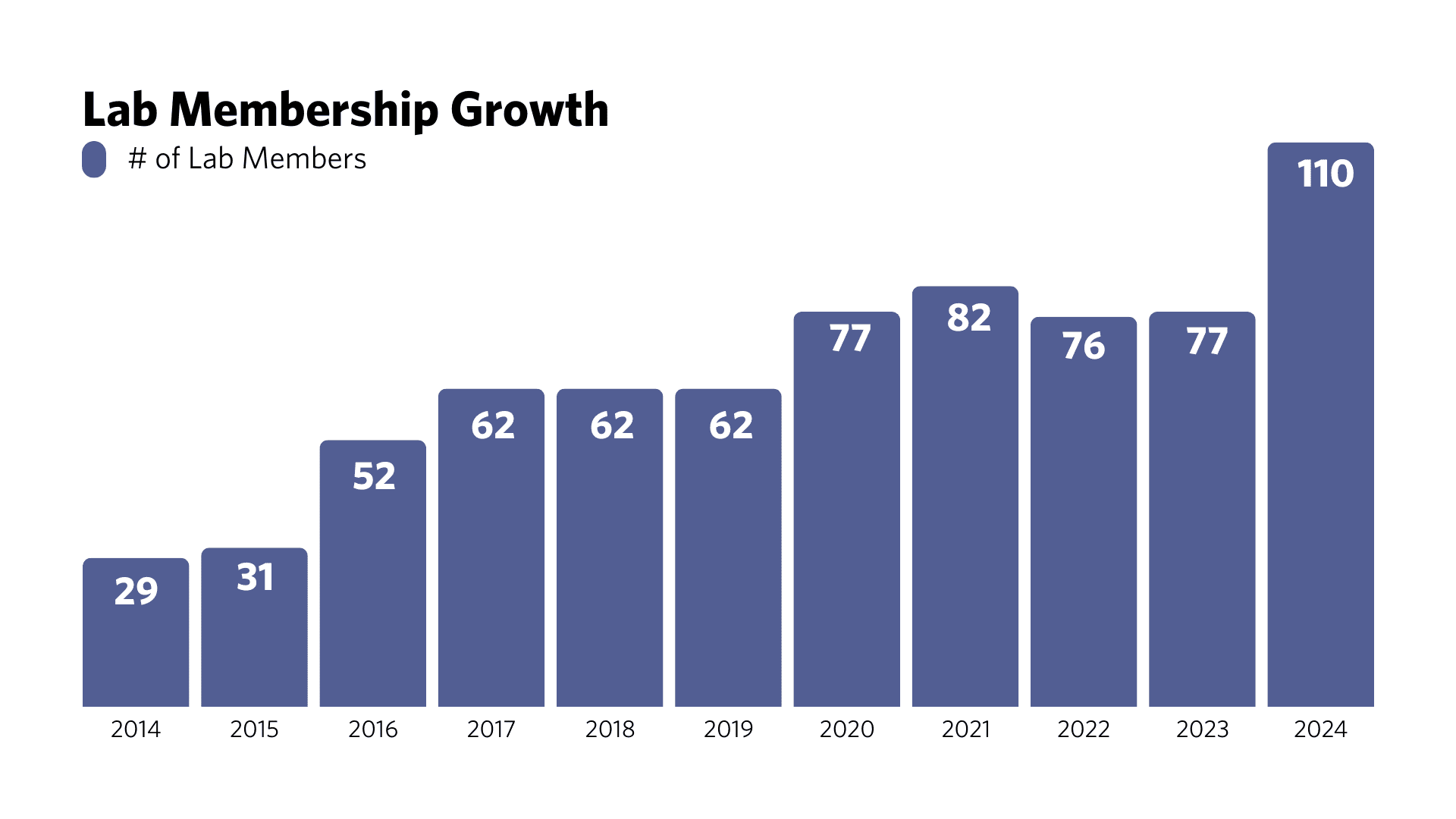

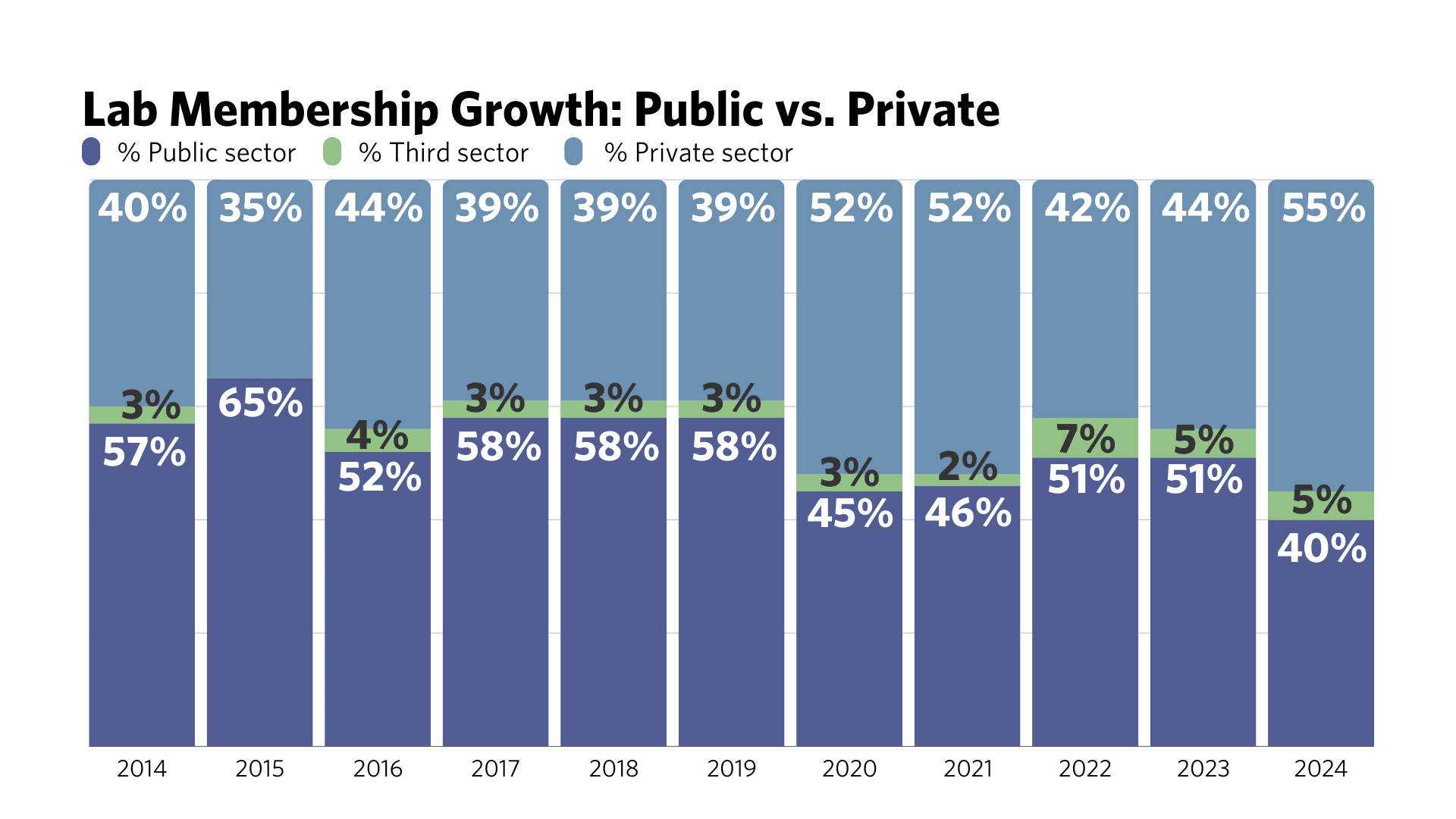

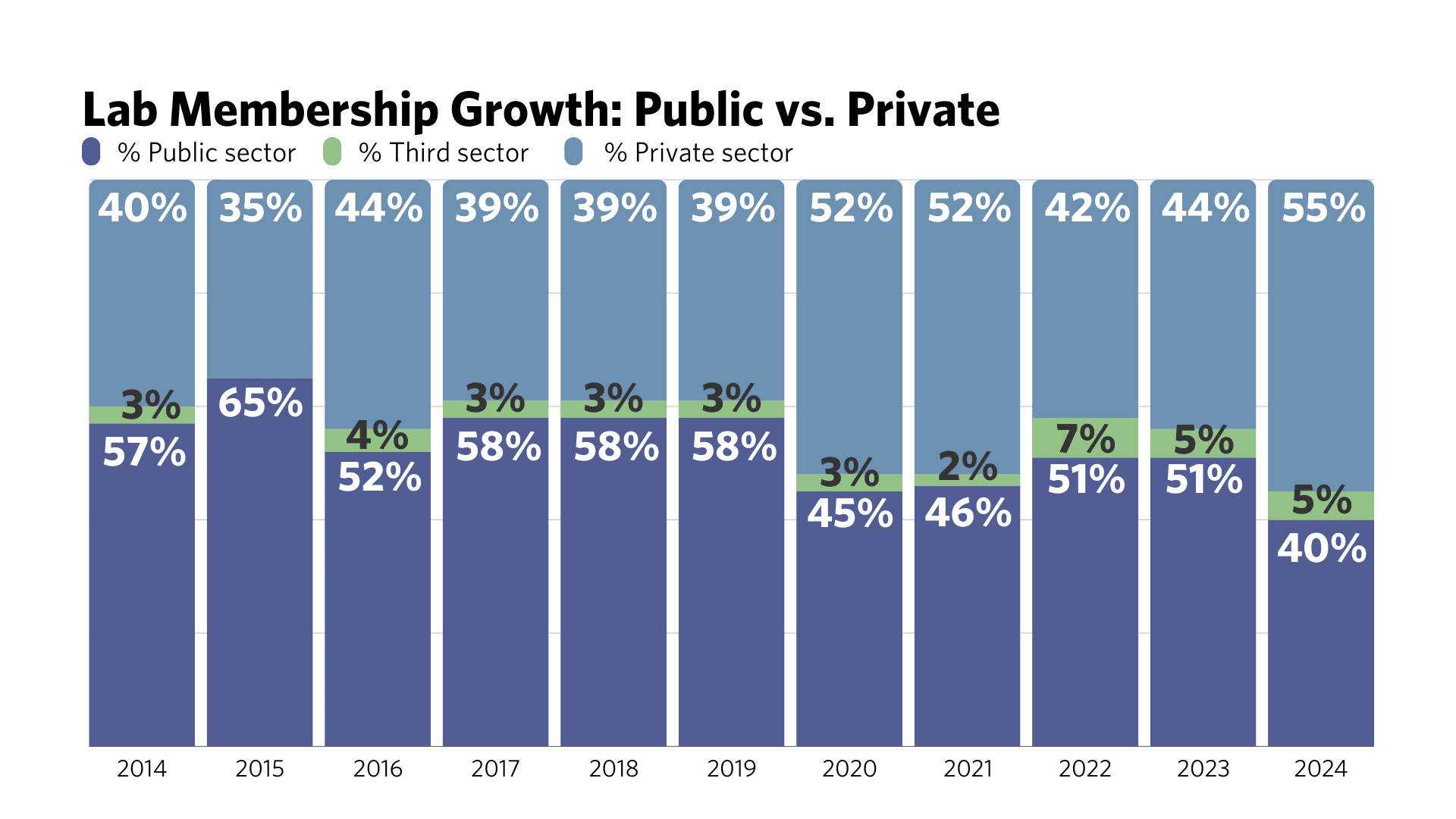

The Lab’s membership has skyrocketed nearly fourfold in 10 years, from 29 organizations at the inaugural Lab meeting in 2014 to 110 global and regional members today. Over the years, the Lab has seen a steady rise in private sector participation, with private members now making up 55% of the total, compared to 41% in 2014.

This growth follows the Lab’s successful launch of regional programs in the Philippines and Latin America and the Caribbean. New regional panel members from these areas join a growing network of experts across existing programs in Brazil, East and Southern Africa, and India. Additionally, the Lab welcomes new global members, strengthening its ability to identify and develop transformative financial instruments.

“We need to see bold ideas come forward and support the teams who pursue them. As a new global member, we are very happy to have supported the selection process of the Lab’s 10th cohort and to contribute to developing these outstanding teams and endeavors. The collaborative spirit among members points to a powerful force for tackling climate challenges,” said Elvira Lefting, Managing Director at Finance in Motion.

A substantial portion of the Lab’s portfolio mobilization figures, which now exceed USD 4 billion, is a result of direct investments from its diverse membership and broader network. The Lab continues to unlock new opportunities through collaborative efforts and scale up impactful climate finance initiatives globally.

“The Lab’s membership is the core driver of the Lab’s success. Our member institutions bring a wealth of expertise, dedicated support, and financial capital to the table, amplifying the Lab’s capacity to catalyze sustainable investments in emerging markets,” said Ben Broché, Climate Policy Initiative’s Associate Director, who leads the Lab’s efforts.

About the Lab

The Global Innovation Lab for Climate Finance identifies, develops, and launches innovative finance instruments that can drive billions in private investment to action on climate change and sustainable development. Bloomberg Philanthropies, the United Nations Development Programme, and the governments of Canada, Germany, the United Kingdom, and the United States fund the Lab’s 2024 programs. Climate Policy Initiative serves as the Secretariat and analytical provider.

For media inquiries or further information, please contact:

Júlio Lubianco

Communications Manager

julio.lubianco@cpiglobal.org

Sam Goodman

Communications Associate

sam.goodman@cpiglobal.org

Finance

Finance minister Buggana says Dhone took center-stage in terms of development in the entire state in the last five years | Hyderabad News – Times of India

The finance minister who is confident of securing his hat-trick victory at the Dhone assembly constituency in Nandyal district in the upcoming elections, is pitted against former union minister of state for railways Kotla Jayasurya Prakash Reddy of the TDP.

Embarking on a door-to-door election campaign at Peapully mandal on Sunday, Buggana asked the people to introspect about why his opponent Kotla Jayasurya Prakash Reddy and his family, never reached out to the people of the constituency in the last 15 years.

“Leaders belonging to various faction groups who lost their lives and their families completely shattered should all realise why the different faction groups are now setting aside their differences and joining hands with the sole motive to defeat me. Won’t such power-thirsty people revive faction at the Dhone assembly constituency, where no major faction related violence was reported in the last decade”, Buggana questioned the people.

Explaining to the voters about the financial benefits disbursed to the people of the Dhone assembly constituency in the last five years, besides the numerous development projects executed during the YSRCP regime, the finance minister appealed to the people to pledge support to him and the YSRCP to carry forward the development in the next five years too.

-

Kentucky1 week ago

Kentucky1 week agoKentucky first lady visits Fort Knox schools in honor of Month of the Military Child

-

World1 week ago

World1 week agoShipping firms plead for UN help amid escalating Middle East conflict

-

News1 week ago

News1 week agoIs this fictitious civil war closer to reality than we think? : Consider This from NPR

-

Politics1 week ago

Politics1 week agoICE chief says this foreign adversary isn’t taking back its illegal immigrants

-

Politics1 week ago

Politics1 week ago'Nothing more backwards' than US funding Ukraine border security but not our own, conservatives say

-

News1 week ago

News1 week agoThe San Francisco Zoo will receive a pair of pandas from China

-

World1 week ago

World1 week agoTwo Mexican mayoral contenders found dead on same day

-

Politics1 week ago

Politics1 week agoRepublican aims to break decades long Senate election losing streak in this blue state

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/N25JQMRBVNBM7M4VJKLIRTKF2Q.png)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/QLSANFH2N5CFBP5DXWTDU6TUDQ.png)

:quality(70)/d1hfln2sfez66z.cloudfront.net/12-13-2023/t_06566ba26b6c432da33cc196017f08b1_name_Chatt.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/W4FR7SY5IVIHJCEV4VVWJUR6MI.jpg)