Business

Where Cowboys Fly and Cattle Set Sail: An Epic Food Journey

WATERLOO STATION, Australia — The helicopter swung all the way down to a cluster of Brahman cattle, hovering shut sufficient for the daybreak solar to be seen of their eyes. Born and bred on a fenceless expanse of golden grass and purple dust within the Australian outback, the place horses, dingoes and crocodiles share the land, these animals are wild sufficient to cost a chopper.

However not this time. After some defiant staring from a bull, the herd turned towards a landmark known as Revolver.

“Strain and launch,” stated Jake Mason, the helicopter’s pilot, as he pulled again into the massive blue sky of northern Australia. “You present them what you need, then allow them to do it.”

It was the beginning of a protracted and strange meals journey not often seen by outsiders. Ultimately, most of the cattle at Waterloo Station would find yourself on big vans known as street trains to cross the outback, then on boats to Indonesia, the place they’d be fattened and slaughtered in line with pointers mixing Islamic practices with Western concepts of animal welfare.

Few provide chains provide as distinct a cultural mix — and few nations ship extra reside animals abroad than Australia, exporting 1,000,000 cattle a 12 months, on common, since 2017.

To critics, the observe is needlessly merciless. In 2011, Australian officers briefly suspended the commerce over issues about mistreatment, principally as soon as the cattle reached Indonesia. However in an more and more fragmented world, each nations have doubled down on what, of their view, quantities to a mannequin of globalization. Northern Australia has ample land to lift cattle, however not sufficient inexpensive feed to convey them to their full weight; Indonesia has loads of agricultural waste for feedlots, and 275 million people who find themselves hungry for beef, from Islamic butchers.

“There’s a excellent symbiosis,” stated Invoice Farmer, a former Australian ambassador to Indonesia who oversaw an trade evaluation after the momentary shutdown. “It really fits each nations very nicely.”

Epic scale and geography outline the transfer from open vary to dinner plate.

Australia’s Northern Territory is usually known as the final frontier. It’s a scorching, fierce wilderness twice as huge as Texas with a inhabitants of fewer than 250,000. Within the N.T., you’re a idiot if you happen to don’t drive with two spare tires and tons of water. Final December, a pair who had been misplaced for days walked almost 40 miles earlier than discovering assist after their automotive received caught in a flood.

Reside export gives about 13,000 jobs out this manner. And at ports and cattle stations, the enterprise, which started within the nineteenth century, tends to be unfold out.

The biggest ranch in the USA, King Ranch in Texas, is 825,000 acres. The biggest cattle station in Australia is 5.85 million acres, whereas the most important within the N.T. sprawls throughout 4 million.

Waterloo Station, whereas thought-about comparatively small, is roughly 3 times as giant as New York Metropolis. A few dozen individuals name the place dwelling. Rocky ravines line the panorama. Electrical energy comes from a diesel generator. Youngsters are taught by what are nonetheless known as governesses, and grunt work is shared — employees and homeowners alike wash their very own dishes.

It’s the same state of affairs at big neighboring stations like Bunda, the place distances might be laborious to fathom. Rounding up tens of hundreds of cattle requires flying far and vast to search out just a few animals, then just a few hundred.

“There’s a helicopter pilot and a bull runner I do know who does 1,000 kilometers a day,” stated Troy Setter, chief government of Consolidated Pastoral Firm, which owns Bunda. At 600 miles, that’s farther than Paris to Prague.

At Waterloo, flying can be the one means for cowboys to do their work. Hamish Brett, 45, usually pilots his personal helicopter between the three properties he owns as the top of Brett Cattle Firm. Practically half the members of the younger workers have helicopter licenses or are getting them.

“It’s a great ability to have on this atmosphere,” Mr. Brett stated.

It is usually harmful. His mother and father purchased Waterloo in 2004 from John Quintana, an American rodeo champion. Mr. Quintana was killed when his small airplane crashed in 2013. Mr. Brett’s older brother, Dougal, died after a helicopter crash in 2015 at Waterloo.

Throughout muster season in late August, Mr. Brett, who can be a licensed veterinarian, was joyful to point out two guests round for every week — often on the bottom.

For many pilots, that’s the place the educational begins. Mr. Mason, who’s a heli-muster chief at simply 23, spent six years on horses and bikes studying how the thoughts of a cow or bull works. He spends so many hours within the air now that he can simply maneuver his two-seat flying machine, a bubble of glass with an engine, as if it have been a toy.

“Cattle wish to go the place the water flows,” he stated whereas flying with a reporter, talking with the laconic tempo of a grizzled ranch hand. “They wish to go downhill.” Lengthy pause. “The place the river goes.”

As soon as the cattle clustered at a water level, Mr. Mason flew particularly near information the group into fenced-off yards. He usually left the smallest calves behind — those close to moms with “huge bagged-up udders.” It was a small act of compassion that he stated was frequent within the heli-muster ranks.

However even for steak lovers, the scenes that adopted have been extra wince inducing.

In tight quarters, the smallest calves have been branded, castrated and vaccinated. Lockie Kallis, 23, the lead stockman, additionally reduce the horns off them to maintain them from hurting individuals or each other, creating a gentle drip of blood.

The “weaners,” cattle large enough to be readied for export, have been moved out by truck to a quarantine station nearer to Darwin. Mr. Brett — taking part in his veterinary position — walked via their ranks, eyeing them for signs of sickness: snot within the nostril, indicators of fatigue.

One other jaunt by street landed them on the port. At daybreak, the complete wharf appeared to rattle with cattle clomping out of two-tier vans and onto a slim ramp resulting in the Girolando Specific. The livestock provider, inbuilt 2014, appeared like an oil tanker crossbred with a cruise ship. Its windowless decks can maintain about 4,000 cattle.

Staff moved the startled Brahman alongside by standing behind them and yelling or banging the facet of the truck, since cattle are particularly delicate to noise, till they boarded the boat.

Advocacy teams insist that the journey is unethical. “There are inherent dangers with transport, and if you add a sea voyage to that, it accelerates these dangers exponentially,” stated Jed Goodfellow, the coverage director for the Australian Alliance for Animals.

Tom Dawkins, chief government of the Northern Territory Livestock Exporters Affiliation, stated that shedding even a single animal was pricey and undesirable. Darwin is nearer to Indonesia than to Sydney. The Girolando’s journeys, usually to Jakarta or Lampung, final about 4 days.

Delivery sheep from Australia to the Center East takes longer and is taken into account extra problematic, with a mortality price of round 0.21 %. The mortality price for cattle shipped abroad from Australia final 12 months was 0.08 %, in line with authorities figures.

Andrew Fisher, the director of the Animal Welfare Science Middle on the College of Melbourne’s Veterinary College, stated most of the cattle add weight in transit, an indication that they don’t discover the journey particularly aggravating.

Indonesian slaughterhouses have proved more durable to handle. In 2011, an investigative report on Australian tv confirmed cattle struggling towards employees attempting to chop their throats.

Dr. Fisher stated the handful of slaughterhouses featured within the report lacked the services to correctly management the animals — they have been constructed for smaller Indonesian breeds.

“It was a really troublesome state of affairs for each man and animal,” Dr. Fisher stated.

The suspension that adopted, lasting greater than a month, infuriated Australia’s cattle stations and Indonesia’s slaughterhouses. In a class-action lawsuit filed by cattle stations, it grew to become clear that the federal government might have centered narrowly on problematic slaughterhouses.

The Bretts, who have been lead plaintiffs, estimated that they’d misplaced out on gross sales of tens of hundreds of cattle. In 2020, the choose overseeing the class-action case dominated towards the federal government, and the Bretts have been awarded about $2 million. Different firms are awaiting payouts.

Within the meantime, a lot has modified. A pilot program with extra monitoring is now the trade normal, with digital tags on each mooing export’s ear to trace deaths and slaughterhouse practices. Probably the most important shift included including nonlethal beautiful to the method — knocking the animals out earlier than they’re killed, a observe that some Muslim nations don’t think about halal, however that Indonesia has discovered to be in step with Islamic observe.

“When it comes to slaughter, it’s getting higher and higher,” stated Fauzan Khumaidi, a technical adviser for Nice Large Pineapple, an Indonesian pineapple behemoth that sells its rinds to native feedlots. “It’s not an issue for the slaughterhouses to satisfy the Australian coverage.”

Many station homeowners fear that extra regulation is coming, that the life they love will finally be outlawed. It’s an excessive amount of of a throwback and too world, they are saying — can a world of pristine locavore meals photographs on Instagram make room for the grime and logistics of worldwide cattle elevating and killing?

“These days, individuals in cities haven’t any connection to the land,” Mr. Brett stated after mustering.

However for now a minimum of, the attract of station life — and a type of globalization amongst neighboring democracies that principally works — stays as sturdy because the mud cloud winds that blow via the Northern Territory. The Australian authorities has not moved to limit reside cattle exports, whilst New Zealand not too long ago determined to ban livestock export by sea. At Waterloo and elsewhere, Brahman herds are rising and being readied for the journey north.

Business

Amid homeowner insurance crisis, consumer advocates and industry clash at hearing

The fault lines running through California’s spiraling homeowners insurance crisis were on display Tuesday at a state hearing, where consumer advocates clashed with industry firms over a plan to allow insurers to use complex computer models to set premiums — a move state officials say will attract insurers to the market.

State Insurance Commissioner Ricardo Lara has proposed allowing insurers to employ so-called catastrophe modeling, which uses algorithms that predict the future risk properties face from wildfires, when setting the price of policies. Currently, rates are based on an insurance company’s past losses, which insurers increasingly dismiss as insufficient in light of the widespread acceptance that climate change has thrust California into a more dangerous future by causing more wildfires.

The models, which are in use in other states, are a key element of Lara’s strategy to moderate price increases by allowing more accurate calculation of risks while persuading insurers to do business in neighborhoods prone to wildfires. The move comes amid a recent stream of insurers exiting the California market with announcements they are not renewing policies or have stopped writing new ones.

Consumer groups worried at the hearing that the draft regulations would not allow enough scrutiny of the models, while several consulting firms that have developed them expressed concern about protecting their intellectual property.

“The algorithms and artificial intelligence that private ‘black box’ catastrophe models use will simply be tools for insurance company price gouging unless California mandates real transparency into how they impact prices and imposes real rules of the road regarding their design and use,” said Carmen Balber, executive director of Consumer Watchdog, an L.A. advocacy group that led the campaign for passage of Proposition 103, the 1988 measure that requires homeowners and auto insurers to get state approval for rate hikes.

The group, like other consumer advocates who spoke at the hearing, called on Lara to work with the state’s academic and insurance experts to develop a “public model,” in which all the factors that go into the computer simulations are available for everyone to review. Such a model could be used to set rates or benchmark privately developed models.

The draft regulations require those who want to review the models to sign nondisclosure agreements, which Consumer Watchdog has alleged will prevent its staff members from discussing the models among themselves.

Julia Borman, a director at Verisk, a company that builds computer models used by insurers, expressed concern that the draft proposal put forth by Lara would allow for a review by “countless participants and create the opportunity for an infinite timeline,” while not safeguarding companies from having their models ripped off by others

Michael Soller, the state Department of Insurance’s deputy commissioner for communications, said Lara has publicly stated that the draft rules will allow for the development of public catastrophe models, which the department might then use to evaluate the insurers’ proprietary models.

The proposal to allow catastrophe models is part of Lara’s larger Sustainable Insurance Strategy announced last fall. Other elements include righting the finances of the state’s Fair Access to Insurance Requirements plan, an insurer of last resort that has been deluged with new policyholders since insurers started pulling back from the market. He also wants to allow insurers to include in premiums the cost of reinsurance, which they purchase to protect themselves from disasters.

Catastrophe models are already allowed in California for pricing policies that cover earthquakes and fires caused by quakes. Along with wildfires, under the proposed regulations, the use of the models would also be permitted for insurance covering terrorism, floods and some other types of coverage.

Gerald Zimmerman, senior vice president of government and industry relations at Allstate, which stopped selling new homeowners insurance policies in the state in 2022, said that adopting Lara’s strategy would be a game changer. “Allstate will begin writing new homeowner insurance policies in nearly every corner of California,” he said.

Other speakers at the three-hour hearing included insurance agents and local officials, as well as homeowners groups, which want to ensure that catastrophe models take into account steps taken by homeowners and government agencies to reduce fire risks, such as by making homes more fire-resistant and reducing brush in a community. Although the draft regulations call for doing so, several speakers complained that such mitigation efforts had not been reflected in recent premium increases.

The Insurance Department plans to review Tuesday’s remarks in preparing for the release of a new set of proposed regulations. Lara has the support of Gov. Gavin Newsom, who issued a letter calling for the commissioner to move quickly to resolve the crisis. The regulations do not require legislative approval or the governor’s signature.

“We will review all public comments while staying on track to implement all changes this year, so insurance companies start writing more policies in all areas,” Soller said.

Business

Column: After a years-long pause, the FCC resurrects 'network neutrality,' a boon for consumers

In the midst of its battle to extinguish the Mendocino Complex wildfire in 2018, the Santa Clara County Fire Department discovered that its internet connection provider, Verizon, had throttled their data flow virtually down to zero, cutting off communications for firefighters in the field. One firefighter died in the blaze and four were injured.

Verizon refused to restore service until the fire department signed up for a new account that more than doubled its bill.

That episode has long been Exhibit A in favor of restoring the Federal Communications Commission’s authority to regulate broadband internet service, which the FCC abdicated in 2017, during the Trump administration.

This is an industry that requires a lot of scrutiny.

— Craig Aaron, Free Press, on the internet service industry

Now that era is over. On Thursday, the FCC — now operating with a Democratic majority — reclaimed its regulatory oversight of broadband via an order that passed on party lines, 3-2.

The commission’s action could scarcely be more timely.

“Four years ago,” FCC Chair Jessica Rosenworcel observed Thursday as the commission prepared to vote, “the pandemic changed life as we know it. … Much of work, school and healthcare migrated to the internet. … It became clear that no matter who you are or where you live, you need broadband to have a fair shot at digital age success. It went from ‘nice to have’ to ‘need to have.’ ”

Yet the commission in 2017 had thrown away its own ability to supervise this essential service. By categorizing broadband services as “information services,” it relinquished its right to address consumer complaints about crummy service, or even collect data on outages. It couldn’t prevent big internet service providers such as Comcast from favoring their own content or websites over competitors by degrading the rivals’ signals when they reached their subscribers’ homes.

“We fixed that today,” Rosenworcel said.

The issue the FCC addressed Thursday is most often viewed in the context of “network neutrality.” This core principle of the open internet means simply that internet service providers can’t discriminate among content providers trying to reach your home or business online — they can’t block websites or services, or degrade their signal, slow their traffic or, conversely, provide a better traffic lane for some rather than others.

The principle is important because their control of the information highways and byways gives ISPs tremendous power, especially if they control the last mile of access to end users, as do cable operators such as Comcast and telecommunications firms such as Verizon. If they use that power to favor their own content or content providers that pay them for a fast lane, it’s consumers who suffer.

Net neutrality has been a partisan football for more than two decades, or ever since high-speed broadband connections began to supplant dial-up modems.

In legal terms, the battle has been over the classification of broadband under the Communications Act of 1934 — as Title I “information services” or Title II “telecommunications.” The FCC has no jurisdiction over Title I services, but great authority over those classified by Title II as common carriers.

The key inflection point came in 2002, when a GOP-majority FCC under George W. Bush classified cable internet services as Title I. In effect, the commission stripped itself of its authority to regulate the nascent industry. (Then-FCC Chair Michael Powell subsequently became the chief Washington lobbyist for the cable industry, big surprise.)

Not until 2015 was the error rectified, at the urging of President Obama. Broadband was reclassified under Title II; then-FCC Chair Tom Wheeler was explicit about using the restored authority to enforce network neutrality.

But that regulatory regime lasted only until 2017, when a reconstituted FCC, chaired by a former Verizon executive Ajit Pai, reclassified broadband again as Title I in deference to President Trump’s deregulatory campaign. The big ISPs would have geared up to take advantage of the new regime, had not California and other states stepped into the void by enacting their own net neutrality laws.

A federal appeals court upheld California’s law, the most far-reaching of the state statutes, in 2022. And although the FCC’s action could theoretically preempt the state law, “what the FCC is doing is perfectly in line with what California did,” says Craig Aaron, co-CEO of the consumer advocacy organization Free Press.

The key distinction, Aaron told me, is that the FCC’s initiative goes well beyond the issue of net neutrality — it establishes a single federal standard for broadband and reclaims its authority over the technology more generally, in ways that “safeguard national security, advance public safety, protect consumers and facilitate broadband deployment,” in the commission’s own words.

Although Verizon’s actions in the 2018 wildfire case did not violate the net neutrality principle, for instance, the FCC’s restored regulatory authority might have enabled it to set forth rules governing the provision of services when public safety is at stake that might have prevented Verizon from throttling the Santa Clara Fire Department’s connection in the first place.

Until Thursday, the state laws functioned as bulwarks against net neutrality abuses by ISPs. “California helped discourage companies from trying things,” Aaron says. Indeed, provisions of the California law are explicit enough that state regulators haven’t had to bring a single enforcement case. “It’s been mostly prophylactic,” he says — “telling the industry what it can and can’t do. But it’s important to have set down the rules of the road.”

None of this means that the partisan battle over broadband regulation is over. Both Republican FCC commissioners voted against the initiative Thursday. A recrudescence of Trumpism after the November election could bring a deregulation-minded GOP majority back into power at the FCC.

Indeed, in a lengthy dissenting statement, Brendan Carr, one of the commission’s Republican members, repeated all the conventional conservative arguments presented to justify the repeal of network neutrality in 2017. Carr painted the 2015 restoration of net neutrality as a liberal plot — “a matter of civic religion for activists on the left.”

He asserted that the FCC was then goaded into action by President Obama, who was outspoken on the need for reclassification and browbeat Wheeler into going along. Leftists, he said, “demand that the FCC go full-Title II whenever a Democrat is president.”

Carr also depicted network neutrality as a drag on profits and innovation in the broadband sector. “Broadband investment slowed down after the FCC imposed Title II in 2015,” he said, “and it picked up again after we restored Title 1 in 2017.”

Carr chose his time frame very carefully. Examine the longer period in which net neutrality has been debated at the FCC, and one finds that broadband investment crashed after a Republican-led FCC reclassified broadband as an information service in 2002, falling to $57 billion in 2003 from $111.5 billion in 2001.

Investment did decline between 2015, when net neutrality rules were reinstated, and 2017, when they were rescinded — by a minuscule 0.8%. It hasn’t been especially robust since then — as of 2002 it was still running at only about 92% of what it had been two decades earlier.

As the FCC observed in Thursday’s order, “regulation is but one of several factors that drive investment and innovation in the telecommunications and digital media markets.”

The commission cited consumer demand and the arrival of new technologies, among others. Strong, consistent regulation, moreover, opens the path for new competitors with new ideas and innovations — and can bring prices down for users in the process.

The truth is that network neutrality has been heavily favored by the public, in part because examples of ISPs abusing their power were not hard to find. In 2007, Comcast was caught degrading traffic from the file-sharing service BitTorrent, which held contracts to distribute licensed content from Hollywood studios and other sources in direct competition with Comcast’s pay-TV business.

In 2010, Santa Monica-based Tennis Channel complained to the FCC that Comcast kept it isolated on a little-watched sports tier while giving much better placement to the Golf Channel and Versus, two channels that compete with it for advertising, and which Comcast happened to own. The FCC sided with the Tennis Channel but was overruled by federal court.

Even barring a change at the White House, the need for vigilant enforcement will never go away; ISPs will always be looking for business models and manipulative practices that could challenge the FCC’s oversight capabilities, especially as cable and telecommunications companies consolidate into bigger and richer enterprises and combine content providers with their internet delivery services.

“This is an industry,” Aaron says, “that requires a lot of scrutiny.”

Business

How athletes and entertainers like Shohei Ohtani get financially duped by those they trust

R. Allen Stanford is among the most brazen white-collar criminals — and he’s paying dearly for it. The former financier is in the 14th year of a 110-year prison sentence after being convicted in 2012 for selling $7 billion in fraudulent certificates of deposits in the Caribbean island of Antigua.

He also was required to pay a judgment of $5.9 billion, much of which was intended to go to victims of his crimes. Among those affected by his elaborate Ponzi scheme were seven Major League Baseball stars: Greg Maddux, Johnny Damon, Bernie Williams, J.D. Drew, Andruw Jones, Jay Bell and Carlos Peña.

The players invested in certificates of deposit offered by Stanford’s company, and it was that easy to have their bank accounts frozen in 2009 by the U.S. Securities and Exchange Commission while authorities investigated the case despite putting their trust in advisors with stellar reputations and a wealth of experience.

Damon complained during spring training that year that he couldn’t pay bills and told a personal trainer that he’d pay him when “all this stuff gets resolved.”

The questions lingered for months: How long would the accounts be frozen and would funds be confiscated?

“This certainly shakes up every athlete out there,” Robert Boland, professor of sports business at New York University, said at the time. “They’re all thinking: ‘Who’s guarding my money?’ ”

The Stanford episode might have prompted a reckoning inside MLB clubhouses, but the lesson didn’t stick with the entire next generation of players.

Shohei Ohtani has so far been cleared of wrongdoing in the recent illegal gambling probe that resulted in his interpreter, Ippei Mizuhara, being charged with bank fraud for stealing $16 million from Ohtani’s bank account to pay gambling debts. But the Dodgers and former Angels superstar was unaware of the theft until investigators uncovered wire transfers from his account to a bookie and Mizuhara admitted to Ohtani after a Dodgers team meeting March 20 in Seoul that he’d stole the money.

Ohtani was repeatedly described by authorities as a “victim,” but the extent to which the Japanese player was seemingly oblivious about his personal finances and blindly trusting Mizuhara is jarring at first glance. The federal complaint also says that Ohtani’s high-powered agent and financial advisors from Creative Artists Agency allowed Mizuhara to dissuade them from overseeing the account from which he stole.

“In this particular situation, it’s somebody who’s relying on someone to interpret an entire language to them, so they could be taking advantage of documents, wire transfers, all kinds of things that the other person doesn’t understand but is trusting that they have their best interests at heart,” said Kristin Lee, owner of the athletic and entertainment business management firm KLBM. “That’s rather predatory, and blatantly taking advantage of a very vulnerable person.”

Wealth management experts say athletes and entertainers who squander enormous sums fall into three interconnected buckets: They are naive about or inattentive to their finances; they make risky investments; they overspend on family, friends and expensive toys.

An eye-opening Sports Illustrated study in 2009 that included interviews with athletes, agents and financial advisors found that 78% of former NFL players had gone bankrupt or were under financial stress within two years of retirement and 60% of NBA players were broke within five years of retirement.

“Only those you trust completely can rip you off completely.”

— Diana B. Henriques, financial journalist

Wealthy athletes in nearly every sport as well as famous entertainment figures have experienced the same misfortune. NFL quarterback Mark Sanchez and MLB pitcher Jake Peavy were fleeced of millions of dollars by financial advisor Ash Narayan, who was sentenced in 2020 to 37 months in federal prison. Narayan gained the players’ trust because he was active in the Fellowship of Christian Athletes.

Former heavyweight champion Mike Tyson, once worth about $400 million, declared bankruptcy in 2003 when he was still boxing. Prominent entertainment figures have been fleeced by business managers (Judy Garland, Leonard Cohen, Alanis Morissette) or fallen prey to questionable investment opportunities (Robert De Niro, Ben Stiller, Jack Nicholson).

“It’s a heartbreaking tale that’s played out time and time and time again,” said Diana B. Henriques, financial journalist and author of “The Wizard of Lies: Bernie Madoff and the Death of Trust.” “Regardless of the industry, a person’s lucrative talent, lack of financial expertise and sudden access to wealth primes them as a candidate for a scam.

“Whether you’re an athlete, artist, surgeon or even a Silicon Valley entrepreneur, a con artist’s ideal victim is someone who knows very little about money but has a great deal of it,” she added. “You have a brilliant career that’s taken off and you’re making a ton of money from something you love to do, but you’ve never had to deal with this amount of wealth before.

“So it’s tempting when someone says, ‘Let me make it simple for you. Let me handle this messy, complex, confusing stuff so you can focus all your creative energy on being great and getting greater.’ ”

This strategic positioning of finances as a distraction to a star’s performance in their chosen field makes them particularly susceptible. Ohtani acknowledged as much in his only public comments since Mizuhara was charged with bank fraud: “I’m very grateful for the Department of Justice’s investigation,” he said. “For me personally, this marks a break from this, and I’d like to focus on baseball.”

Dodgers designated hitter Shohei Ohtani walks to the dugout after being stranded at second base in the eighth inning against the Washington Nationals on Wednesday.

(Robert Gauthier / Los Angeles Times)

In fact, it isn’t uncommon for the rich and famous to be blissfully unaware of their money’s movements. Take the musician Sting, who was notified by an anonymous tip that his former accountant, Keith Moore, had stolen more than $9 million from the British rock star over four years in order to invest in global schemes and stave off personal bankruptcy.

“He’d created something like 70 different bank accounts in different countries,” Sting said in a 2002 interview with the Independent. “And the money was coming in different denominations — Deutschemarks, Japanese yen — from different sources … touring, recording, publishing, merchandising, TV appearances. So for that kind of money to be siphoned away is not that surprising. And since it took forensic accountants about two years to sort through the complexities, how could a bass player figure it out?”

In cases like Sting’s, “It’s a fractional deceit that happens over the years, where somebody skims off a little bit here and there from a bunch of different types of accounts with different assets in them, and it adds up to a lot of stolen money,” Lee said.

Such complex financial structures often are entrusted to a family member or close friend. Comedian and actor Dane Cook had millions stolen by his half-brother Darryl McCauley, who was convicted of larceny, embezzlement and forgery. Singer-songwriter Jewel said last year on “The Verywell Mind” podcast that her mother and former manager, Nedra Carroll, stole $100 million from her.

“Only those you trust completely can rip you off completely,” Henriques said.

Billy Joel sued his ex-brother-in-law and former manager Frank Weber for unauthorized loans to Weber’s companies, secret investments in speculative ventures and mortgages on the copyrights for his songs — losses that initially went unnoticed and totaled $30 million.

“It was much more of an emotional betrayal for me than financial, because this was somebody I trusted so much,” Joel said in a 2013 interview with the New York Times Magazine. “I always had this sense that OK, I’m an artist and I shouldn’t have to be concerned about something as banal as money, which is baloney. It’s my job. It’s what I do. I didn’t pay any attention to it, and I trusted other people, and I got screwed.”

Billy Joel performs at the 66th Grammy Awards at Crypto.com Arena on Feb. 4.

(Robert Gauthier / Los Angeles Times)

Athletes started signing contracts worth millions in the 1980s. It’s no coincidence that financial predators began to gravitate toward them around that time. One of the earliest instances involved Lakers great Kareem Abdul-Jabbar and several other NBA stars, including Ralph Sampson and Alex English.

Dubious investments initiated by the players’ former business manager, Thomas M. Collins, included Arabian horses and oil wells in addition to hotel and restaurant ventures.

The prize acquisition was the venerable Balboa Inn in Newport Beach, where Errol Flynn, Humphrey Bogart, Gary Cooper and other Hollywood stars once gathered. But the partnership that owned that hotel and others went bankrupt.

Abdul-Jabbar sued Collins, his sole representative for six years, and others for $59 million, charging negligence, fraud and breach of trust, triggering a flurry of legal action.

Collins countersued, claiming that Abdul-Jabbar owed him $382,050 in unpaid commissions and fees. English sued Abdul-Jabbar, and had him served with papers in the Lakers’ locker room. Abdul-Jabbar added English to his suit against Collins and had those papers served while English sat on the bench during a game.

Lakers center Kareem Abdul-Jabbar shoots a sky hook in a game against the Utah Jazz in Las Vegas on April 5, 1984.

(Lennox McLendon / Associated Press)

The players had given Collins power of attorney in administering their financial affairs even though his only background in finance was an entry-level position at an investment information service. Ed Butowsky, managing partner of wealth management advisory firm Chapwood Investments, said giving power of attorney to anybody is usually foolish.

“The responsibility lies with these athletes, they should not parcel out that responsibility,” he said. “They should know where their money is, how much they have, where the account statements go and so on. If they don’t, it’s their own fault.”

NBA stars Antoine Walker, Latrell Sprewell, Vin Baker and Shawn Kemp each spent close to $100 million not long after retiring in the 2000s, much of it from excessive partying and showering family and friends with cash. And let’s not forget Allen Iverson, who went broke despite earning nearly $200 million in salary and endorsements and is hanging on to reach his 55th birthday seven years from now when he will receive $32 million from Reebok, thanks to a lifetime contract he signed with the shoe company in 2001.

Those cautionary tales have made an impact, Butowsky said. Fewer athletes and entertainment figures are spending ungodly amounts on jewelry, cars and handouts to friends.

“You have some one-off situations, but because of the publicity, people have become a lot more careful about wild expenditures,” Butkowsky said. “But they are still trusting the wrong people to make financial decisions.”

Financial planners often suggest that wealthy clients create a diverse portfolio. Athletes and entertainers often make the mistake of putting too much money into one venture. Butowsky calls it the “front row” mistake.

“A lot of them see some entrepreneur sitting in the front row at a basketball game and want to know what they did to make it,” he said. “But the idea that they are going to replicate that? It’s not going to happen. The very same thing that got a few people rich gets 20 to 30 times that many people broke.”

Though technological advancements have made it arguably harder for scammers to get away with thefts — “People probably used to be able to shuffle papers around, white things out and make photocopies, but now, everything is maintained in some sort of online system with a solid trail around it,” Lee said — athletes and entertainers still need to stay vigilant to prevent themselves from becoming the next headline-making victim.

“These dubious schemes are absolutely not going away,” Henriques said. “Part of it is that we devote so little attention to basic financial literacy in this country. We don’t train young people to have even the most basic knowledge about how finance works. … No one wants to hear that with great wealth comes great responsibility, but it’s true.”

Sometimes investors are fortunate. The seven MLB players who unwittingly invested $10 million in Stanford’s phony certificates of deposit in 2008 sold their shares before the Ponzi scheme collapsed, according to Kevin Sadler, lead counsel for the receivership appointed by the court to recover as much of Stanford’s ill-gotten gains as possible.

Maddux, a Hall of Fame pitcher who earned $153.8 million during a 23-year career, made the largest profit: $169,000 in 10 months on an investment of $3.5 million. Damon made the least, $70 in two months on an investment of $400,000.

However, the players were among hundreds of investors who had bank accounts frozen until they agreed to return their profits to the receivership. All seven players gave back their profits in December 2009, Sadler said, a small amount of the $2.7 billion that will have been recovered by this summer. About 45% of the principal investments stolen by Stanford will have been returned to the approximately 18,000 fraud victims.

“Starting at zero, to be able to return this much, I really do think it is remarkable,” Sadler said. “It’s taken 15 years, so I don’t think saying the recovery is monumental is overkill or hype.”

In most cases involving fraudulent investments, little if anything is recovered, he said. And when it comes to athletes and entertainers with immense earnings, the money lost is often well into the millions.

“How does a person blow that much money?” Sadler said. “You can do it. It’s possible. You don’t even have to try that hard. You can actually blow it quite easily.”

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: The American Society of Magical Negroes

-

World1 week ago

World1 week agoIf not Ursula, then who? Seven in the wings for Commission top job

-

News1 week ago

News1 week agoGOP senators demand full trial in Mayorkas impeachment

-

Movie Reviews1 week ago

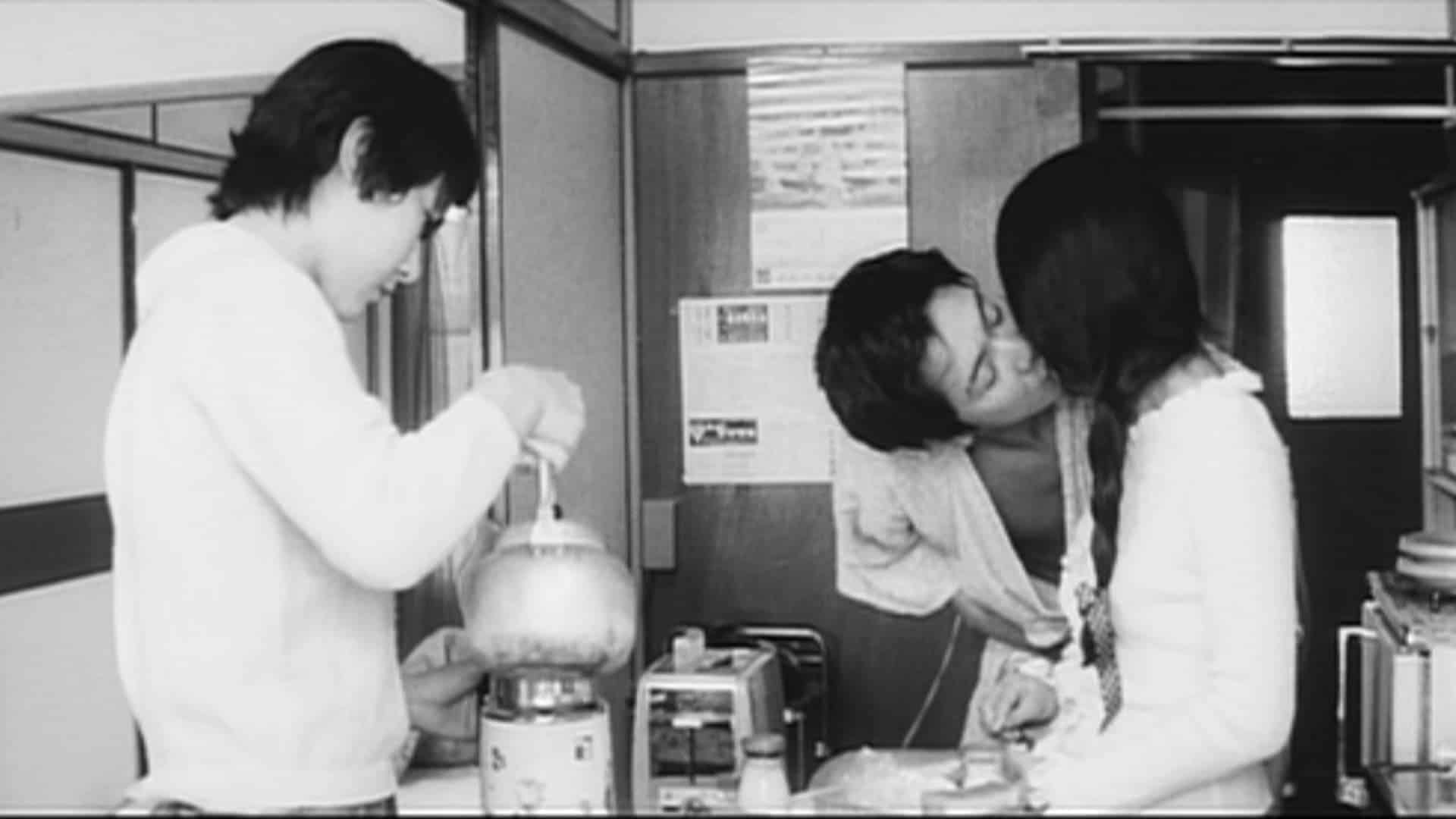

Movie Reviews1 week agoFilm Review: Season of Terror (1969) by Koji Wakamatsu

-

World1 week ago

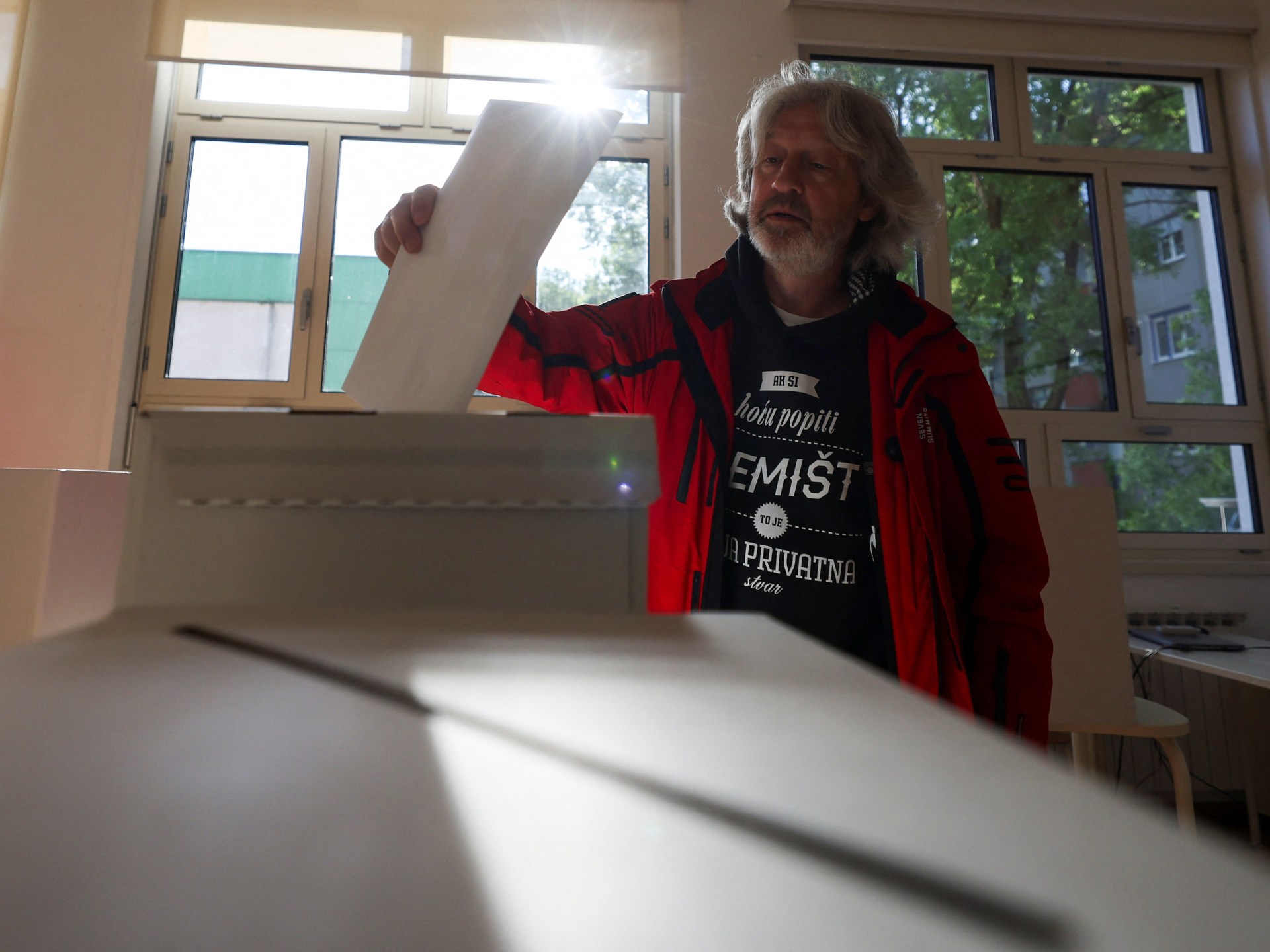

World1 week agoCroatians vote in election pitting the PM against the country’s president

-

World1 week ago

World1 week ago'You are a criminal!' Heckler blasts von der Leyen's stance on Israel

-

Politics1 week ago

Politics1 week agoTrump trial: Jury selection to resume in New York City for 3rd day in former president's trial

-

Movie Reviews1 week ago

Movie Reviews1 week agoPon Ondru Kanden Movie Review: This vanilla rom-com wastes a good premise with hasty execution