World

IMF supports imposition of restrictive economic measures in the EU

In an interview with Euronews, the IMF’s Managing Director says that more stringent measures could become the norm given the current economic situation in Europe.

The head of the International Monetary Fund, Kristalina Georgieva, has warned that the eurozone is looking at a prolonged period of high inflation.

In an interview with Euronews, the IMF Managing director says while Europe has shown remarkable resilience in the aftermath of Russia’s invasion of Ukraine and the largest period of trade shock in several decades, economic activity has weakened and inflation “although gradually declining” remains elevated.

“The most important thing for Europe is to get a handle on inflation,” Georgieva says. “Why? Because inflation is bad for growth, and it is a tax on the poor. When we look into the medium long term, critical for Europe is to spur more innovation and create more dynamism.”

The IMF’s biggest concern for the Eurozone is a prolonged period of high inflation that could negatively impact growth the IMF’s latest projections which indicate inflation could stay above the European Central Bank target until mid-2025.

“The EU is a very important player. Globally, the European economy is. If you take the whole 27 members, it is compatible to the United States,” Georgieva says.

“And let’s remember, many of the European economies are small, open economies. If we undermine the engine of growth, that is trade, that would affect negatively the European people.”

Inflation in the European Union reached over 10% last year but is now showing signs of moderation.

The European Central Bank forecasts that inflation will average 5.4% this year and decrease to 2.2% by 2025. However, this forecast is still higher than the ECB’s preferred 2% rate.

World

Cubs Win Again in Wrigley View Rooftop Lawsuit

A federal judge this week denied a motion to send the Chicago Cubs’ lawsuit against Wrigley View Rooftop—a company that provides 200 guests with a view of neighboring Wrigley Field in exchange for fees—to arbitration. U.S. District Judge Sharon Johnson Coleman rejected Wrigley View Rooftop’s request that she reconsider her denial in January of the company’s motion to dismiss.

Last year the Cubs sued Wrigley View Rooftop and company owner Aidan Dunican, claiming that Wrigley View Rooftop engages in illegal conduct by selling seats to watch Cubs games, concerts and other events from an adjacent building. The lawsuit includes claims for misappropriation, unjust enrichment, unfair competition and unauthorized use of Cubs’ trademarks.

Wrigley View Rooftop denies wrongdoing and insists the dispute must be resolved out-of-court through arbitration. The problem with that argument, Coleman explained, is that the relevant arbitration clause expired in 2023.

That clause stems from the Cubs and rooftop businesses near Wrigley Field, including Wrigley View Rooftop, settling previous litigation back in 2004. The settlement agreements, which contemplated rooftop businesses sharing revenue with the Cubs and contained arbitration clauses, were set to expire in 2023. Those businesses, except for Wrigley View Rooftop, accepted the Cubs’ offers to extend the settlements beyond 2023.

Last year–after the expiration of the settlement agreement–Wrigley View Rooftop defied the Cubs by selling tickets to games and using Cubs’ trademarks. The company is continuing to sell tickets in the 2025 MLB season and uses the tagline, “the last Wrigley rooftop to be independently owned and operated!”

Wrigley View Rooftop maintains the arbitration language should survive expiration of the settlement agreement. As Wrigley View Rooftop tells it, the dispute is mainly about use of trademarks without permission and whether the Cubs have a right to demand royalties from Wrigley View Rooftop. The company says this dispute concerns a legal right that “accrued or vested” under the settlement agreement, which contemplated royalties in exchange for trademark usage. The Cubs disagree; the team says a plain reading of the settlement agreement makes clear the arbitration language ended when the agreement expired. The idea of contractual rights and restrictions continuing beyond a contract’s expiration doesn’t add up, the team insists.

Coleman agreed with the Cubs, saying she found Wrigley View Rooftop’s argument “unfounded.” After the settlement agreement expired, the judge explained, the Cubs were “not entitled to collect royalties,” and Wrigley View Rooftop was not “entitled to use” Cubs’ trademarks without permission. Along those lines, Coleman noted, the Cubs “do not allege that the expired” settlement provided a right to collect royalties from Wrigley View Rooftop. Instead, the team argues Wrigley View Rooftop “improperly used the trademarks after the expiration of the Settlement Agreement without providing any royalties” to the Cubs.

According to court filings, pretrial discovery of relevant facts must be completed by the parties by June 12. If the case eventually goes to a jury trial, it could resolve a longstanding property law debate over whether rooftop businesses can lawfully sell seats to watch a live performance taking place in an adjacent and famed building, Wrigley Field, built in 1914.

World

A Berlin doctor has been charged with the killings of 15 patients under palliative care

A doctor in Berlin has been charged with murder over the deaths of 15 patients under palliative care, prosecutors said Wednesday. He is also accused of trying to cover up the evidence by starting fires in their homes.

The doctor was part of a nursing service’s end-of-life care team and was initially suspected in the deaths of just four patients. That number has crept higher since last summer, and investigators now say they’ve found evidence linking him to the deaths of 15 people between September 22, 2021, and July 24 last year.

2 PEOPLE ARE KILLED IN A KNIFE ATTACK IN GERMANY; SCHOLZ SAYS THERE MUST BE CONSEQUENCES

The victims’ ages ranged from 25 to 94. Most died in their own homes.

A doctor in Berlin has been charged with murder over the deaths of 15 patients. (REUTERS/Fabrizio Bensch)

He allegedly administered an anesthetic and a muscle relaxer to the patients without their knowledge or consent. The drug cocktail then allegedly paralyzed the respiratory muscles. Respiratory arrest and death followed within minutes, prosecutors said.

The doctor — a 40-year-old man whose name hasn’t been released, in line with German privacy rules — has been in custody since Aug. 6. Prosecutors said Wednesday that he has not yet responded to the case against him.

The charges were filed to the Berlin state court, which will now have to decide whether to bring the case to trial and if so, when.

Murder charges carry a maximum sentence of life in prison. Prosecutors said they aim to ask the court to establish that the suspect bears particularly severe guilt, meaning that he wouldn’t be eligible for release after 15 years as is usually the case in Germany. They also want him to be banned from his profession for life.

World

Trump touts ‘progress’ in Japan trade talks, as uncertainty roils stocks

Wall Street closes sharply lower as US Federal Reserve chair warns tariffs could lead to slower growth, higher inflation.

United States President Donald Trump has touted “big progress” in trade talks with Japan after making an unexpected intervention in the negotiations, as uncertainty caused by his sweeping tariffs continues to roil stock markets.

Trump made his comments on Wednesday after making the surprise decision to sit in on negotiations between his administration and Japanese officials in Washington, DC.

“A Great Honor to have just met with the Japanese Delegation on Trade. Big Progress!” Trump wrote on Truth Social after the talks, which included US Treasury Secretary Scott Bessent, US Commerce Secretary Howard Lutnick and Economic Revitalization Minister Ryosei Akazawa.

Akazawa said after the meeting that Trump wanted to reach a deal before the end of his 90-day pause on his “reciprocal” tariffs, with the Japanese hoping to see the agreement sealed “as soon as possible.”

Japanese Prime Minister Shigeru Ishiba said the negotiations would not be easy, but the initial rounds of talks had “created a foundation for the next steps”.

Like dozens of other US trade partners, Japan has been hit with a 10 percent baseline tariff in addition to duties of 25 percent on cars, steel and aluminium, which rank among the East Asian country’s top exports.

Japan, a top US security ally and its fourth-largest trade partner, is also facing a targeted 24 percent “reciprocal” tariff under Trump’s “liberation day” trade measures, nearly all of which have been paused until July 9.

“Japan’s industry is so closely integrated in the US economy that everyone is very concerned about the trade talks,” Martin Schulz, chief policy economist at Fujitsu in Tokyo, told Al Jazeera.

“Although there cannot be winners in a trade war, we are also quite optimistic that agreeable results can be achieved. Japan is the largest investor in the US and interested in investing more.”

“If both economies can be kept on a growth track, higher imports from the US become possible,” Schulz added.

The US-Japanese talks came as Wall Street racked up further heavy losses amid continuing uncertainty over Trump’s trade salvoes.

The benchmark S&P 500 closed 2.24 percent lower on Wednesday, while the tech-heavy Nasdaq Composite fell 3.07 percent.

The losses followed a warning by US Federal Reserve Chair Jerome Powell that Trump’s steep tariffs could leave the US economy grappling with weak growth, rising unemployment and higher inflation all at once.

“We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension,” Powell said in a speech to the Economic Club of Chicago on Wednesday, referring to the US central bank’s twin goals of maximum employment and stable prices.

“If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close.”

US stocks have been on a rollercoaster ride since Trump’s inauguration in January, alternating between sharp dips and big jumps amid his back-and-forth tariff announcements.

Financial markets and businesses have been on tenterhooks waiting for signs that the US president is open to watering down or scrapping many of his tariffs in exchange for concessions from US trading partners.

Trump administration officials have said that more than 75 countries have reached out to begin negotiations on trade.

After the latest losses on Wall Street, the S&P 500 and Nasdaq are down about 10 percent and 15 percent, respectively, since the start of the year.

Asian stock markets got off to a better start on Thursday, with Japan’s benchmark Nikkei 225, South Korea’s KOSPI and Hong Kong’s Hang Seng Index each rising more than 0.5 percent in early trading.

-

News1 week ago

News1 week ago3 Are Killed in Shooting Near Fredericksburg, Va., Authorities Say

-

Movie Reviews1 week ago

Movie Reviews1 week agoFilm Review: 'Warfare' is an Immersive and Intense Combat Experience – Awards Radar

-

Culture1 week ago

Culture1 week agoMen’s NCAA Championship 2025: What to know about Florida, Houston

-

Health1 week ago

Health1 week agoAs RFK Jr. Champions Chronic Disease Prevention, Key Research Is Cut

-

Politics1 week ago

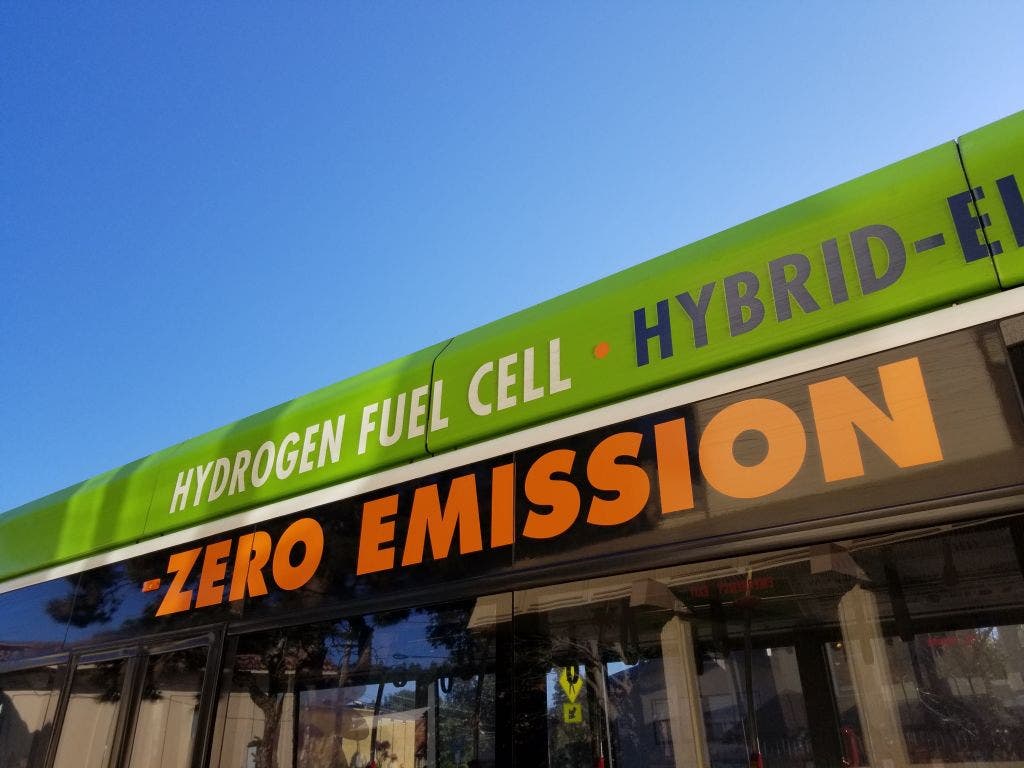

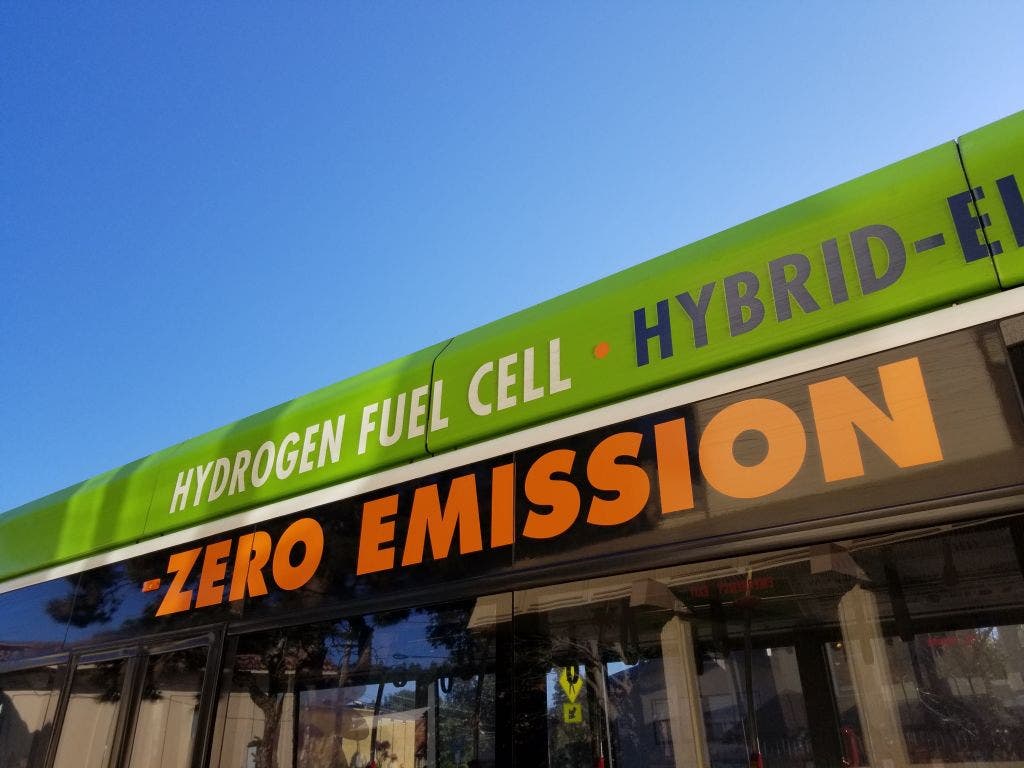

Politics1 week agoH2Go: How experts, industry leaders say US hydrogen is fuel for the future of agriculture, energy, security

-

News1 week ago

News1 week agoBoris Johnson Has Run-In With Feisty Ostrich During Texas Trip

-

World1 week ago

World1 week agoEPP boss Weber fells 'privileged' to be targeted by billboard campaign

-

Technology1 week ago

Technology1 week agoMeta got caught gaming AI benchmarks