Although growth in the Eurozone is back, geopolitical risks posed by the conflicts in Ukraine and the Middle East remain, along with tighter financial conditions and the reshaping of the political landscape across Europe.

S&P Global released its Eurozone economic outlook for Q3 2024 on Monday morning, highlighting that growth in the Eurozone has returned mainly due to a fall in energy and commodities prices.

This is likely to allow gross domestic product (GDP) growth to increase from 0.7% this year to 1.4% in 2025, a slight rise from the 1.3% predicted by S&P Global in March. Eurozone inflation is also expected to come back to the European Central Bank (ECB)’s 2% target by mid-2025, if present conditions remain more or less constant.

Productivity bouncing back, wages growing at a slower pace and profit margins stabilising should also contribute significantly to cooling inflation. It’s expected to average 2.2% next year, coming down from around 2.4% this year.

The Eurozone economy has also mostly achieved a soft landing because last winter was milder-than-expected resulting in a knock-on effect on key sectors such as construction. S&P also expects consumer spending to bounce back in the latter half of the year, as retail energy prices abate further, benefiting consumers directly.

However, the report also highlights that the risks of higher inflation, tighter financial conditions and lagging growth have increased since March 2024.

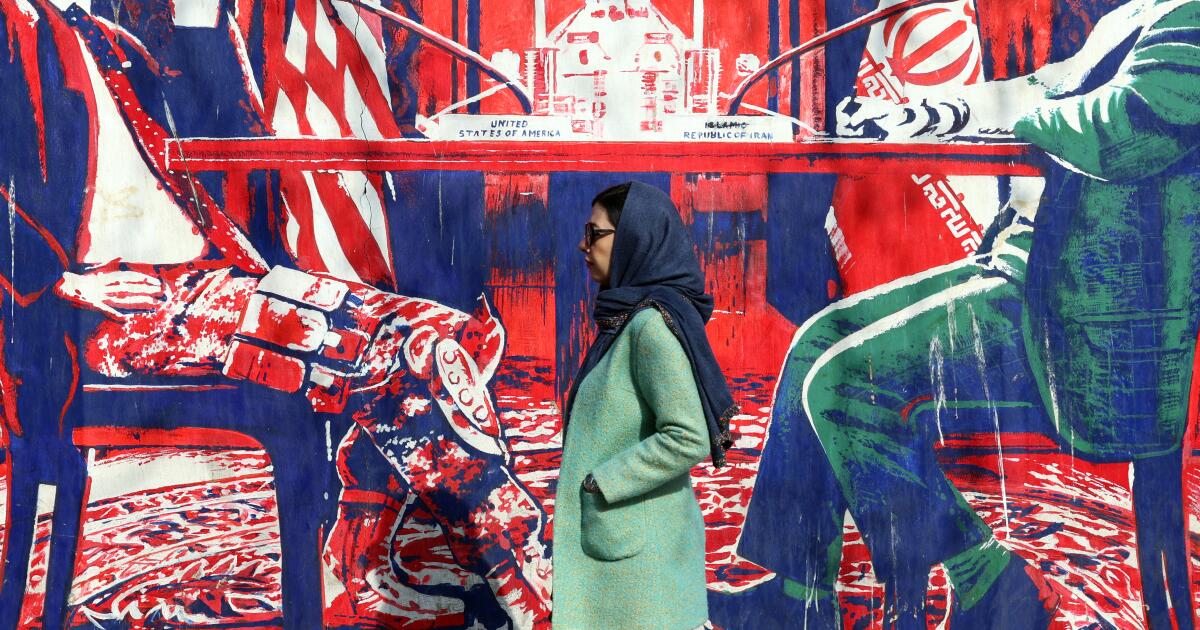

The report also says, “The geopolitical conflicts in the Middle East and Ukraine remain the main risks weighing on our immediate economic outlook. That aside, other pockets of risks have intensified in recent months. These concern the decoupling of monetary policies on both sides of the Atlantic, political uncertainty in Europe and the worsening of Europe’s economic relations with China.”

What are some of the risks for Q3 2024?

Political instability also remains a concern, especially in the wake of the recent EU elections. Regarding this, S&P Global’s chief EMEA economist, Sylvain Broyer told Euronews, “We can definitely see some political uncertainty extending more from the national consequences of the European Parliament elections, rather than the elections themselves, with the French snap elections being at the top of everyone’s minds.

“They are a source of uncertainty and that can definitely undermine confidence and then make the recovery in investments that we expect in 2025 more fragile.”

Another major risk that could be seen in the next few months is the possibility of escalating EU-China tensions, sparked off mainly due to the EU considering tariffs on Chinese electric vehicles, in order to protect and promote European automobiles.

The report says, “In terms of trade, China is Europe’s second most important partner after the US. It accounts for 10% of total EU exports and 22% of EU imports, around half of which are products that are critical to the European economy.”

Coming to how high these tensions could possibly go, Broyer said, “It is obvious that trade relationships between Europe and China are deteriorating and it is very likely that they will get even worse. I don’t think that this will escalate to a full-blown trade war. I also don’t expect the EU-China trade relations to worsen as much as the US-China trade relations.

This is because the European economy and the Chinese economy are highly interdependent and the respective supply chains are much more intertwined than China is with the US supply chain. For instance, Europe is definitely reliant on China for the import of critical products, such as solar panels, necessary for the green transition, but China is also very dependent on European technology, not just for cars, but also for other transport equipment and electronics.

Almost 15% of the value added by European companies to electronics is exported to China, so that shows the degree of interconnectedness.”

There has also been an increasing risk of more European companies leaving the continent’s biggest stock exchanges in order to list elsewhere, in the US or in Asia.

“This is definitely a sign that European financial markets are too fragmented, too national, too expensive for issuers and for retail investors. To cut a long story short, Europe needs to move forward on the Capital Markets Union, and that is definitely a top priority for the next commission”, says Broyer.

Similarly, he also believes that streamlining financial and other regulations is key, to make sure that European companies are actually supported and empowered to meet the green transition goals.

Coming to what the EU can do to attract more investment in the continent, as well as retain companies wishing to leave for the US and other markets, Broyer emphasises that this is not just a case of Europe wanting to win over external competition. It is also about the continent returning to its own previous higher productivity levels, seen in the last few years.

There could also be a few challenges for the ECB to continue on its rate-cutting path in the near future, according to Broyer.

ADVERTISEMENT

ADVERTISEMENT

“The needle of the ECB is inflation and the central bank needs to see more progress on wage growth and the most domestic parts of core inflation, in the services prices. Another element which is becoming more and more obvious is the Fed. The longer the Fed waits and doesn’t deliver much guidance on when and by how much it will start cutting rates, the more it is a problem for the ECB to cut rates further.”

Broyer highlights that this decoupling in monetary policy between the ECB and the US Federal Reserve became increasingly obvious in the first three months of the year.

“European investors have already shifted $50 billion into the US treasury market and probably, it will accelerate in the second and third quarter, so that’s definitely one limitation for the ECB, even if this issue of decoupling monetary policy is a smaller one for central banks generally,” he said.

Why is Spain expected to see strong growth this year?

The Spanish economy is expected to grow more than Germany in Q3, for a variety of reasons. The report emphasises: “Lower energy costs helped the German economy to emerge from recession in the first quarter of 2024, thanks to a recovery in production in energy-intensive sectors such as the chemicals industry. However, the German economy still lags other large European economies in terms of growth.

“Spain, noticeably, continues to beat expectations, with GDP growth accelerating for the third consecutive quarter to 0.7% quarter-on-quarter. The post-pandemic normalisation of tourism is not the only reason for this. Industrial production is continuously expanding in Spain. Last year, consumer spending was the main driver of growth, adding one percentage point of a 2.5 percentage-point increase in Spain’s GDP.

ADVERTISEMENT

ADVERTISEMENT

“Second-round effects on core inflation have also been more muted in Spain than in many other countries. Stronger employment growth, stimulated by labour market reforms aimed at replacing limited-term employment contracts with open-ended ones, is another explanation. The dynamism in employment does not hinder productivity growth, in contrast to the other three major economies of the Eurozone, Germany, France and Italy.”