- German economy shrinks slightly

- Germany set to suspend debt brake

- Finance minister wants significant “consolidation” in budget

- Economy minister compares debt brake to boxing match

- Majority of Germans oppose suspending debt brake – poll

Finance

Germany signals belt-tightening but no tax rises in budget compromise

/cloudfront-us-east-2.images.arcpublishing.com/reuters/NMDGOOF4X5ND5OSBXWKMGZYAKI.jpg)

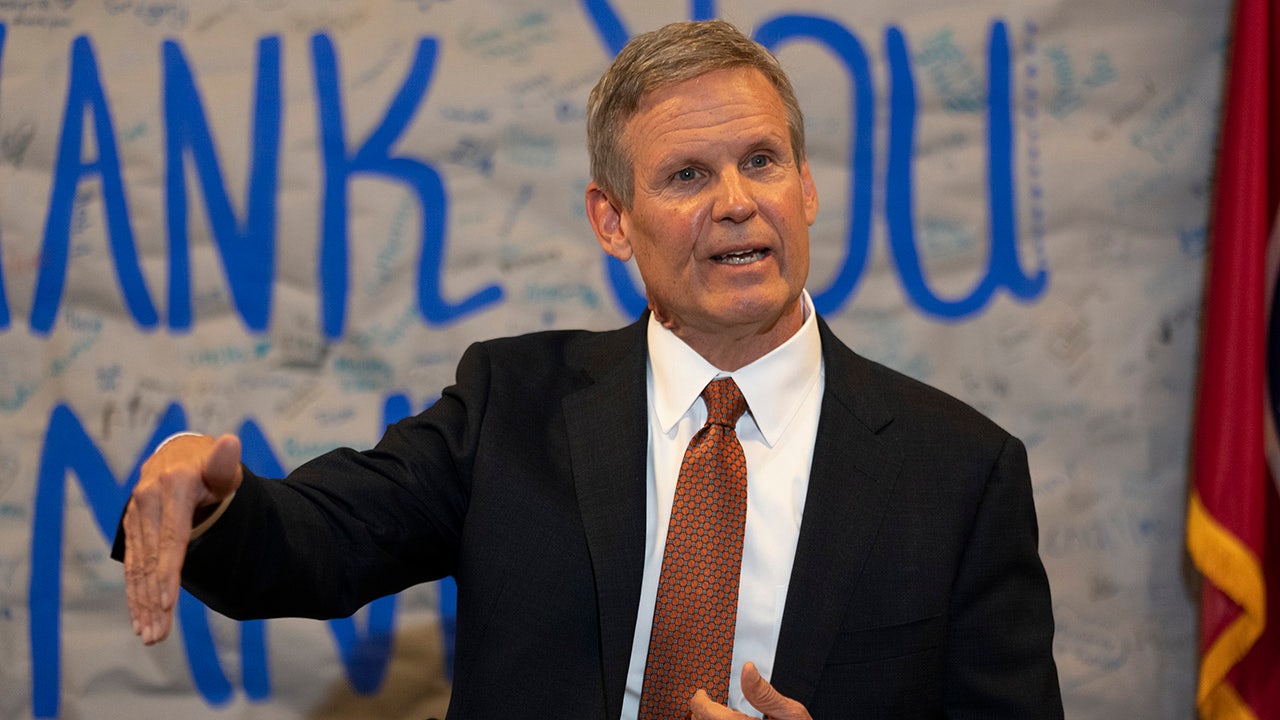

German Finance Minister Christian Lindner attends the weekly cabinet meeting at the Chancellery in Berlin, Germany November 22, 2023. REUTERS/Fabrizio Bensch/File Photo Acquire Licensing Rights

BERLIN, Nov 24 (Reuters) – German Finance Minister Christian Lindner signalled the government would need to make savings worth a double digit billion euros to help solve a budget crisis, though data on Friday showed growth shrinking in Europe’s largest economy.

Lindner plans to lift self-imposed limits on borrowing and present a supplementary budget next week after a constitutional court ruling wiped billions from the federal budget and forced the government to freeze most new spending commitments.

The court ruling, which blocked the government from transferring pandemic funds towards green projects and industry subsidies, has sparked warnings that German companies could be starved of support to keep them globally competitive.

In order to keep backing industry, the fiscally hawkish Lindner ruled out tax rises and said savings would have to be found elsewhere, backed up by reforming the welfare state.

“We are talking about a significant additional need for consolidation,” Lindner told the Handelsblatt newspaper in an interview. “We are talking about double-digit billions, for example to implement the ambitious plans to renew the infrastructure and invest in technology.”

“In a phase of low economic dynamism, the aim must be to relieve the burden on citizens and companies,” he added.

Chancellor Olaf Scholz’s government is set to propose lifting the debt brake, which limits Germany’s structural budget deficit to the equivalent of 0.35% of gross domestic product, by proposing to parliament an “emergency situation” for 2023.

The brake, introduced after the global financial crisis of 2008/09, was first suspended in 2020 to help the government support companies and health systems during the COVID-19 economic fallout.

Lindner had been reluctant to suspend the debt brake mechanism as his party strongly advocates fiscal discipline but relented as the budget turmoil put more strain on Scholz’s fractious three-way coalition.

HANDS TIED IN A BOXING MATCH

The crisis has sparked calls for reforming the debt brake. Economy Minister Robert Habeck from the pro-spending Greens has criticised it as inflexible and as blocking vital support for industry to keep jobs and value creation from moving abroad.

To a standing ovation at a Greens party conference, Habeck questioned whether the debt brake was applicable in changed times from “when climate protection was not taken seriously, wars were a thing of the past, China was our cheap workbench?”

“With the debt brake as it is, we have voluntarily tied our hands behind our backs and are going into a boxing match. Is that how we want to win it? The others have horseshoes wrapped in their gloves and we don’t even have our arms free. It’s clear how that’s going to turn out.”

A poll by the broadcaster ZDF suggested only a minority of Germans, 35%, supported suspending the debt brake however, compared to 61% wanting it to stay in place.

Some 57% wanted the budget shortfall from the court ruling to be covered by spending cuts, 11% favoured tax increases and 23% wanted the state to take on additional debt.

Germany has been among the weakest economies in Europe this year as high energy costs, weak global orders and higher interest rates have taken their toll. Its economy shrank in the third quarter, data showed on Friday.

German business morale however improved for a third straight month in November, the Ifo institute said, adding there had been no impact for the time being from the court ruling.

“The question that naturally arises is whether the rise in the Ifo business climate index is merely a flash in the pan or marks a turn for the better? We don’t really want to believe it,” said VP Bank Chief Economist Thomas Gitzel.

Potential austerity measures resulting from the court decision “are not exactly contributing to greater confidence in future economic development,” added Gitzel.

Reporting by Holger Hansen, Christian Kraemer, Miranda Murray and Rene Wagner; writing by Matthias Williams; Editing by Toby Chopra

Our Standards: The Thomson Reuters Trust Principles.

Continue Reading

Finance

How to stay protected from pig butchering financial scams? Here are 7 key steps

In simpler terms, pig butchering is a version of smishing where scammers use social media platforms for cyber theft. As the name suggests, the victim is being ‘fattened up’ through validation and friendship before ‘butchering’ i.e. stealing of funds. A simple ‘Hi/Hello’ on a social media platform from a stranger’s profile can turn into a big scam.

Also Read: ‘Pig butchering’ scams: Zerodha’s Nithin Kamath explains how these work, shares ways to remain protected

How does the pig butchering scam happen?

Receiving messages or calls from wrong numbers was a rare occurrence a few years back. However, calls, text messages and connection requests from unknown people are becoming a frequent event on social media and dating applications. As the online relationship progresses, the scammer introduces what seems like a golden investment opportunity.

This less recognized yet equally harmful tactic involves fake job offers. Here, scammers prey on job seekers by offering attractive positions, sometimes overseas. They use emotional manipulation to build trust.

Scammers often go the extra mile by creating fake apps and websites that mimic real financial institutions. Throughout the scam, there’s a heavy reliance on emotional manipulation. The scammer might act as a romantic interest or a supportive friend. This emotional connection makes it harder for the victim to doubt their intentions.

Once trust is established and the victim is emotionally invested, significant financial transactions are initiated. Whether it’s through fake investments or fraudulent job offers, the end goal is the same: to drain as much money as possible from the victim.

Also Read: Beware of Scams: Tips for safely investing in the digital world

Important steps to protect from these scams

Stay informed: The first step in protecting yourself from financial fraud is to be aware that these scams exist. Knowing how they work can help you identify and avoid them before it’s too late. Scammers are constantly devising new and sophisticated tactics to exploit vulnerable people, so it’s important to stay vigilant.

Always double-check: If someone online suggests an investment or job, research it thoroughly. Look up the company or offer online, read reviews, and see if it’s recognized by official authorities.

Be vigilant with online friends: Always be cautious when talking to people you just started talking with, especially if they start talking about finances or investments. Avoid discussing financial matters with people online.

Keep personal information to yourself: Never share your personal or financial details like bank account details, passwords, and other sensitive information with someone you’ve just met online. Sharing personal information makes it easier for scamsters to hack into your bank accounts, so be wary of who you share it with.

Never make rushed financial decisions: If you’re being pressured to invest quickly or pay for a job opportunity, that’s a major red flag. Scammers often try to create a sense of urgency, pushing you to act before you have time to think it over. Take the time to verify the legitimacy of any investment or job prospect.

Always check the source: Don’t just take their word for it. Do your research. Look up the company or investment platform they mention. Check for the company’s physical address, licensing information, customer reviews, and social media presence. Cross-reference details across multiple reliable sources.

Get a second option before investing: Before making any investment or sharing personal details, talk to someone you trust like a family member who knows finances, a friend or a professional financial advisor. Sometimes, just talking about it out loud can reveal red flags you might not have noticed initially.

Also Read: Shielding your digital assets: How cyber insurance can provide a safety net in the face of growing cyber threats

Key takeaway

While scammers continue to devise new and sophisticated tactics, arming oneself with awareness, caution, and diligence is the key. By staying alert to the warning signs, verifying the legitimacy of any opportunities presented, and resisting the urge to make rushed decisions, individuals can significantly reduce their risk of becoming victims.

If a proposition or investment opportunity seems too good to be true, trust your instincts and analyse it carefully. It’s better to miss out on a potential opportunity than to lose your hard-earned money to a clever con artist.

Dhiren .V. Dedhia, Head – Enterprise Solutions, CrossFraud

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Catch all the Business News, Market News, Breaking News Events and Latest News Updates on Live Mint.

Download The Mint News App to get Daily Market Updates.

Download The Mint News App to get Daily Market Updates.

More

Less

Published: 27 Apr 2024, 10:31 AM IST

Finance

Britney Spears and Her Father Settle Dispute Over Alleged Financial Misconduct During Conservatorship

Watch Latin American Music Awards

Britney Spears has settled a dispute over legal fees with her dad, and former conservator, Jamie Spears.

The pair settled an enduring debate over Jamie’s legal fees and his management of Britney’s finances in Los Angeles Superior Court on April 25, the New York Times reported Friday afternoon. Britney’s legal team, led by attorney Mathew S. Rosengart, was fighting to keep their client from having to pay her father’s legal bills, mainly on the basis Jamie had allegedly misused his authority as Britney’s conservator — a role he held up until September 2019 — to pay himself $6 million.

Terms of the settlement were not widely disclosed but in a statement issued Friday, Rosengart said Britney had finally fulfilled her goal of obtaining total freedom: “As she desired, her freedom now includes that she will no longer need to attend or be involved with court or entangled with legal proceedings in this matter.” He continued by stating “it has been our honor and privilege to represent, protect, and defend Britney Spears.”

With this move, Jamie and Britney avoid having to go to trial over the alleged financial misconduct during her conservatorship.

Details on the conclusion to this case are sparse in comparison to the media frenzy that first ensued over two years ago. Everything changed for Britney after she publicly addressed a court in Los Angeles on June 23 of 2021, telling the judge that she was “traumatized” and held against her will, with all of her rights stripped away by her conservators, including her father, who at one point she said she wanted jailed. “I just want my life back,” the singer said.

Since leaving the conservatorship ended, Spears has sold over 2 million copies of her best selling memoir, “The Woman in Me,” and has released music with Elton John and Will.i.am. Still, Britney has been adamant that a career in music is no longer a priority of hers. When rumors began circulating that her team was ushering her to put out an album, Britney wrote on Instagram: “They keep saying I’m turning to random people to do a new album … I will never return to the music industry.”

Finance

Finance Deals of the Week: $52M Construction Loan for S.C. Apartments

It was a lighter week on the financing front, but there were still some notable deals that closed including a $52 million construction loan from North River Partners and Amzak Capital Partners on Miami-based One Real Estate Investment’s 316-unit apartment project in Columbia, S.C. Huntington National Bank and Nuveen Green Capital also teamed up to provide a combined $40.5 million construction loan for Stark Enterprises’ build-to-rent residential project in northern Florida. Here are the rest of the deals.

| Loan Amount | Lender | Borrower | Address | Asset | Broker |

|---|---|---|---|---|---|

| $52 million | North River Partners and Amzak Capital Partners | One Real Estate Investment | 4415 Percival Road; Columbia, S.C. | Multifamily | Berkadia’s Brad Williamson, Scott Wadler, Mitch Sinberg and Matt Robbins |

| $41 million | Huntington National Bank and Nuveen Green Capital | Stark Enterprises | 16152 SE 77th Court; Summerfield, Fla. | Build-to-Rent | N/A |

| $29 millon | Bayview Asset Management | ASG Equities | 502 86th Street; Brooklyn, N.Y. | Mixed-Use | Ripco’s Steven Sperandio, Michael Fasano and Jake Weiss |

| $27 million | Citigroup | The Mann Group and True North Management | Nine-building portfolio | Multifamily | JLL’s Scott Aiese and Alex Staikos |

| $27 million | Berkadia | Bozzuto Group | 1200 North Queen Street; Rosslyn, Va | Multifamily | N/A |

Finance Deals of the Week reflect deals closed or announced from April 22 to April 26. Information on financings can be sent to editorial@commercialobserver.com.

502 86th Street, ASG Equities, Berkadia, Bozzuto Group, Huntington National Bank, Nuveen Green Capital, One Real Investment, Ripco, Stark Enterprises, The Mann Group, True North Management

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: The American Society of Magical Negroes

-

News1 week ago

News1 week agoGOP senators demand full trial in Mayorkas impeachment

-

World1 week ago

World1 week agoIf not Ursula, then who? Seven in the wings for Commission top job

-

World1 week ago

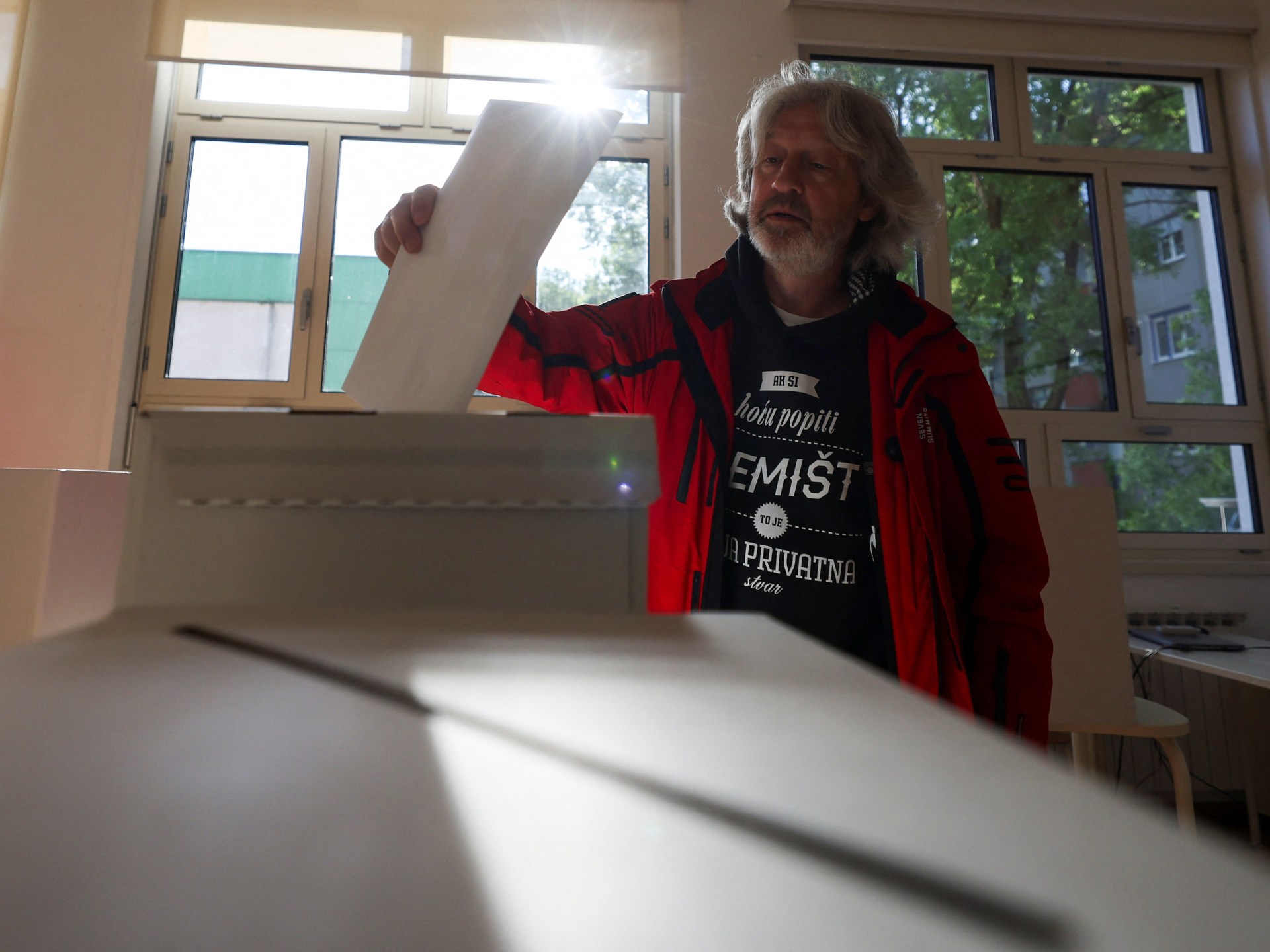

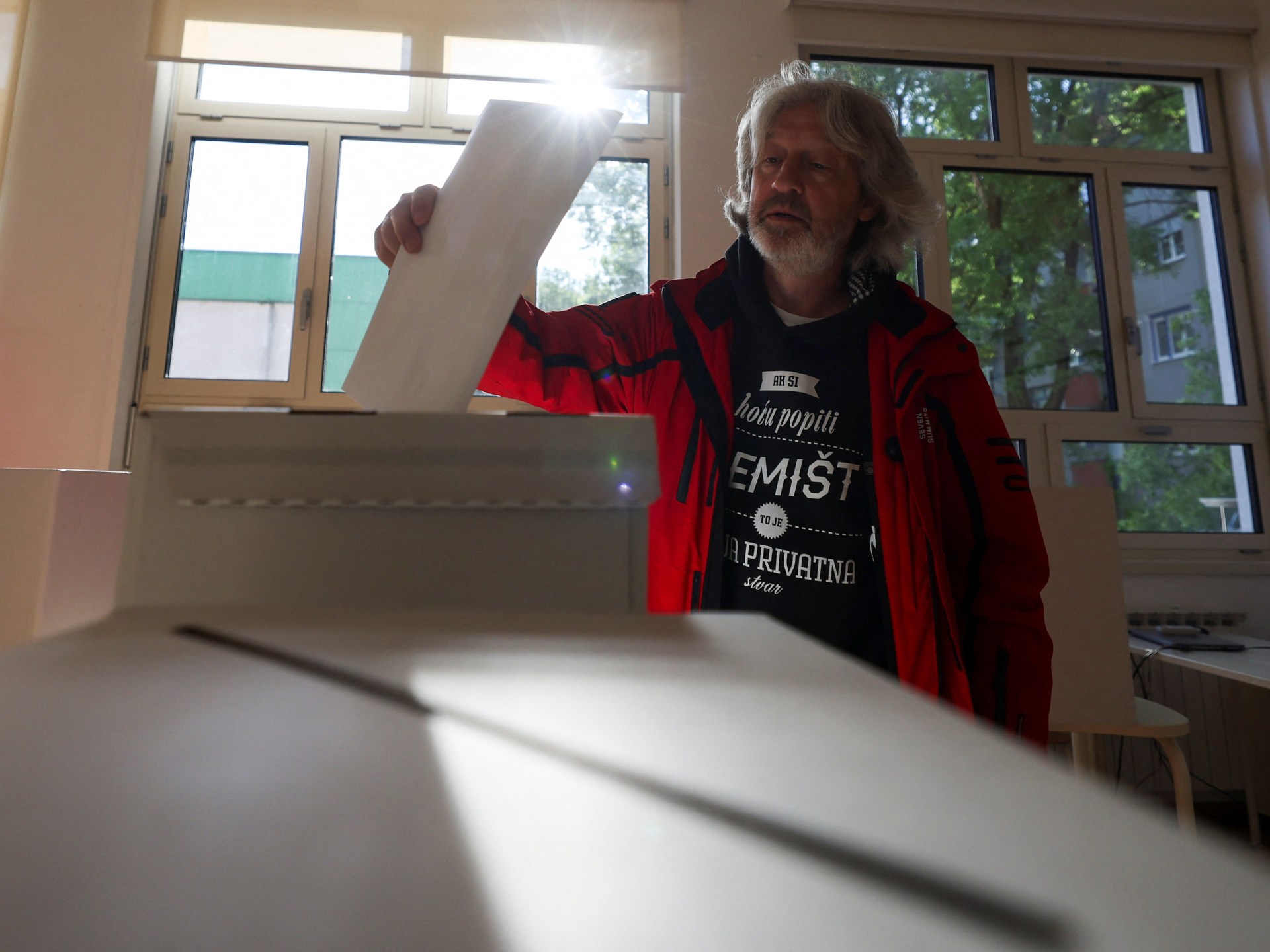

World1 week agoCroatians vote in election pitting the PM against the country’s president

-

World1 week ago

World1 week ago'You are a criminal!' Heckler blasts von der Leyen's stance on Israel

-

Movie Reviews1 week ago

Movie Reviews1 week agoPon Ondru Kanden Movie Review: This vanilla rom-com wastes a good premise with hasty execution

-

Kentucky1 week ago

Kentucky1 week agoKentucky first lady visits Fort Knox schools in honor of Month of the Military Child

-

Politics1 week ago

Politics1 week agoTrump trial: Jury selection to resume in New York City for 3rd day in former president's trial