Business

Column: Cereal for dinner? It's one way to beat supermarket inflation

Every once in a while, Shardreata Moore gets a Subway coupon in the mail, and she knows she won’t have to worry about her next three meals.

“I get a $7.99 footlong and have them cut it in threes,” the retiree told me.

Moore, who was having lunch at the Sherman Oaks East Valley Senior Center, says she goes to Subway to order a chicken sandwich on whole grain bread, with spinach, cucumbers and tomatoes. That way, she gets some protein and at least a few fresh vegetables without a trip to the grocery store, where inflation is a killer.

On a tight budget, Moore said, “It’s difficult to eat healthy.”

California is about to be hit by an aging population wave, and Steve Lopez is riding it. His column focuses on the blessings and burdens of advancing age — and how some folks are challenging the stigma associated with older adults.

Ann Picanza, another retiree, was in full agreement and happy to share her cost-cutting strategies, one of which is to take advantage of the daily free lunch at the senior center. On Thursday, the offering was chicken, brown rice, vegetables and fresh fruit.

Shardreata Moore, 67, left, and Ann Picanza, in her 70s, look for bargains on the deal racks at a market in Sherman Oaks.

(Genaro Molina / Los Angeles Times)

When she does go grocery shopping, Picanza said, it’s not as simple as taking the bus to one store and filling a basket. She ricochets around from store to store, coupons in hand, seeking bargains as if on a treasure hunt.

“It’s difficult, and I have to buy things I didn’t use to,” Picanza said. “I used to enjoy buying a piece of meat in the Pavilions, but now, what can you do? I still want meat, and so I buy these pies that have meat in them, for $1.49.”

According to the AARP, food insecurity among older adults is on the rise, and “one out of 10 seniors is at risk of going hungry.” The consumer price index, compiled monthly by the U.S. Bureau of Labor Statistics, indicates a bit of inflation relief at the supermarket, but still, prices are up about 25% over the last four years. In January of this year, prices for sugar, oil, fruits and vegetables ticked up slightly, bakery products declined slightly, and meat, fish, poultry and egg prices were flat.

Even amid signs that inflation is on the decline, it’s a central topic in the presidential campaign, and people on fixed incomes are particularly hard hit by rising utility, housing and food costs.

Of course, when it comes to grocery prices, a president can’t just wave a wand at the checkout stand. Inflation is tied to rising labor costs, continued post-pandemic supply chain interruptions, avian flu and the impact of extreme weather — heat waves, wildfires and flooding — on global food production.

So prices rise and fall, mostly the former, and none of the changes escape the notice of older adults I spoke to over the last few days. At the Vons in Eagle Rock, Sylvia Millis and Vernon Bowman grabbed a hunk of tri-tip, a cheaper cut of meat, and considered some fresh fruit, eyeballing price tags.

“I do watch prices, because we have other things to pay for,” said Millis, a retired teacher. “We had a whole new gas line put in last month, and the month before that, it was a whole new water line. You’re not quite sure what’s coming down the line.”

Kris Gaine had a pack of ground beef in her cart, with a 30%-off sticker.

Shardreata Moore visits a senior center during the week where she can get a free meal. “It’s tough over the weekend,” Moore says.

(Genaro Molina / Los Angeles Times)

“I shop the specials and use a club card,” said Gaine, who is no rookie when it comes to collecting coupons. “Oh, I used to be the queen. Remember when they had double coupons?”

Gaine said that when she retired several years ago from 40-plus years in ticketing and subscriptions at downtown L.A. arts venues, she was financially set.

“Not now,” she said. “Inflation has overtaken my pension and Social Security. I stand here and shake my head on most of my visits to the grocery store.”

For thousands of low- and moderate-income older adults, the food offerings at the centers run by Valley InterCommunity Council (VIC) are a lifeline. In partnership with the L.A. Department of Aging, free hot, healthy lunches are served Monday through Friday at the Sherman Oaks East Valley location and the Alicia Broadous-Duncan Multipurpose Senior Center in Pacoima.

VIC also distributes care packages from the Los Angeles Food Bank, delivers to homebound seniors and connects clients to the state’s CalFresh program, which offers monthly stipends for nutritious food at supermarkets.

Beverly Ventriss, VIC’s president and chief executive, said female “solo agers” are particularly hard hit by inflation. They often outlive their husbands, who take their pensions to the grave. And traditionally, women earned lower salaries than men, so their retirement benefits often don’t measure up.

“Basically, I don’t shop. It’s cheaper for me to eat out,” Mary Green said at the Pacoima center, explaining that she gets meals priced as low as $5 with coupons from Burger King, Carl’s Jr. and Panda Express. “I live alone, and it’s cheaper for me to not use the utilities, and I don’t have to mess up the kitchen.”

She knows it’s not the healthiest way to eat, but she gets balanced meals at the senior center. And a tight budget is a tight budget.

“My gas bill is killing me,” said Sara Guerrero, a regular visitor at the Pacoima center. “I had to give up cooking my delicious pork chops. They’re too expensive now.”

Gail Martin, who was working the front desk at the senior center, told me two food items keep her alive.

“I eat a lot of cereal, I’m not going to lie,” she said, explaining that store-brand cereal — “not the real Cheerios” — has replaced meat for her at lunch and dinner. “And I eat cups of soup, cups of noodles. I eat those a lot.”

At the Sherman Oaks center, Moore said she’s been hammered by a rent increase from $1,190 to $1,400 a month. With free lunches served only on weekdays, she doesn’t eat three meals on weekends. Picanza said she’s handling the mortgage on her condo, but she’s getting pinched by rising homeowners association fees.

When Moore and Picanza had finished their lunch, they piled into my car and we drove to a nearby Ralphs to see what was on sale. Just inside the front door, they went straight to a section of big bins heaped with sale items. Ken’s Steak House salad dressing was reduced from $3.49 to $2.49. Classico pasta sauce was knocked down a dollar, to $1.99 per jar. And Progresso soup, regularly $2.79, was $1.79.

Shardreata Moore, left, and Ann Picanza leave the market with some of their bargains.

(Genaro Molina / Los Angeles Times)

“You have to check the dates,” Moore said, examining a can. She also found some discounted salmon and ground beef, and reminded us that the older it gets, the lower the price.

Smart shoppers also are checking for what’s known as shrinkflation, the sneaky trend called out by President Biden in his State of the Union Speech, to keep prices level but skimp on what’s in the bag.

In the produce section of the store, Picanza was disappointed that a big bag of refrigerated broccoli she has bought for $5.99 had gone up to $6.50.

In another aisle, she picked up a loaf of whole-grain sliced bread, checked the price and frowned.

“This isn’t on sale, it’s $3.29,” she said. “But it’s the bread I like.”

Picanza said she might ask the manager to mark it down.

“She would do it too,” Moore said.

Picanza scanned the store, looking for help. Fighting inflation is not for the meek of heart. The equity gap only gets wider, and you have to pretend you don’t know you’re living in the strongest economy in the world and continue to forge ahead.

steve.lopez@latimes.com

Business

Federal labor investigators say L.A. poultry plant used child labor and tried to cover it up

A federal judge issued a temporary restraining order on Monday to block a poultry processing plant in the city of Irwindale from using “oppressive” child labor.

The order came after investigators with the U.S. Department of Labor filed a lawsuit on Saturday alleging the poultry processor and its affiliated companies illegally employed children under the age of 18 to debone raw meat with sharp knives.

The department is seeking action forcing involved companies to forfeit money they made from selling products processed in facilities where minors were allegedly made to work in dangerous conditions.

The judge’s order involves three companies in the San Gabriel Valley — L & Y Food, Moon Poultry and JRC Culinary Group — that are all either owned, operated or managed by Fu Qian Chen Lu, who is also named in the lawsuit.

The Labor Department said in court documents that the companies continued to deliver and sell products even after agreeing to voluntarily refrain from shipping products following accusations of their use of child labor, and refused to provide information to investigators.

The companies hid 794 boxes of processed chicken and seven 1500-pound bins of chicken from investigators visiting the Irwindale facility, according to the court filings .

Federal officials and the poultry companies have presented dueling narratives of the child labor allegations.

Gregory W. Patterson, an attorney representing Chen Lu and other defendants named in the suit, accuses the Labor Department of planting an underage worker in the facility as part of its investigation, a claim the department has dismissed as “baseless.”

The crackdown by federal investigators comes as some of the country’s biggest consumer brands have come under broad scrutiny for child labor in their domestic supply chains amid revelations that children are working throughout American manufacturing and food production.

Investigators discovered children deboning poultry at the plant after visiting the facility in the city of Irwindale on Mar. 20 for a civil search warrant, the lawsuit said. Operators of the facility continued to process products, even after the Labor Department raised objections during its search warrant, in violation of federal laws prohibiting sale of products “tainted by child labor,” according to the lawsuit.

The “hot goods” provision of the Fair Labor Standards Act prohibits companies from selling products from locations flagged for child labor use in the prior 30 days.

U.S. District Judge Otis D. Wright II in his Monday decision issued a temporary restraining order requiring the businesses to stop using child labor, provide the Labor Department with information it is requesting related to its investigation, and refrain from shipping any poultry from facilities accused of employing child labor.

“In light of the immediacy of irreparable harm pending the Court’s review of this action, the Court finds a temporary restraining order warranted,” Wright wrote in his order on Monday.

Barring immediate action, he said, companies named in the lawsuit “will continue to employ oppressive child labor to the risk of minors’ life and limb; hot goods may enter the stream of commerce; and Defendants will continue to thwart Plaintiff’s investigation.”

Patterson, the attorney representing Chen Lu and other defendants, said in an emailed statement that the labor department had a 17-year-old “gain employment with Moon Poultry under false pretenses by presenting a fake government identification” and “directed this person to work in a hazardous area of the Moon Poultry facility in Irwindale.”

Patterson alleged that the Labor Department aimed to manufacture a child labor claim to “strengthen its negotiating hand” in an investigation about overtime wages that had not been paid to workers.

“The defense counsel’s allegations are false. The Labor Department has previously responded to the defense counsel on this issue, but he has nevertheless chosen to press his baseless claims,” said Marc Pilotin, regional solicitor for the Labor Department, in an emailed statement.

The Labor Department has investigated other poultry processing plants in California in recent months.

In December, federal investigators found grueling working conditions at two poultry plants in City of Industry and La Puente operated by Exclusive Poultry Inc. as well as other “front companies” owned by Tony Elvis Bran.

Children as young as 14 stood for long hours cutting and deboned poultry and operating heavy machinery, the labor department said. The workers came primarily from Indigenous communities in Guatemala.

The poultry processor, which supplies grocery stores including Ralphs and Aldi, was ordered to pay nearly $3.8 million in fines and back wages.

An investigation published in early February by the Fresno Bee detailed dangerous and sometimes deadly conditions for primarily Latino immigrant workers at Pitman Farms in the Central Valley, which produces the Mary’s Free Range Chicken brand.

Business

Money Talk with Liz Weston: Managing mortgage debt in retirement

Dear Liz: My husband and I are Gen Xers who are renting. We have enough cash from the sale of our last home to make a small down payment on another. If we moved to a more affordable community, we could manage the payments, but it would still be a stretch. That scenario would not have bothered me 10 years ago, but now I’m close to 50. Is it a good idea to take on a mortgage at this point? What is the best way to ensure I can afford to keep the roof over my head when I can no longer work full time?

Answer: Having a mortgage in retirement used to be uncommon, but that’s no longer the case. The Joint Center for Housing Studies of Harvard University found 41% of homeowners 65 and older had a mortgage in 2022, compared with 24% in 1989. Among homeowners 80 and over, the percentage with mortgages rose from 3% to 31%.

The amounts owed have skyrocketed as well. Median mortgage debt for those 65 and older rose more than 400%, from $21,000 to $110,000 (both figures are in 2022 dollars). Median mortgage debt for those 80 and over increased more than 750%, from $9,000 to $79,000.

Mortgage debt doesn’t have to be a crisis if you can afford the home and the payments don’t cause you to run through your retirement savings too quickly. In fact, some retirees are better off hanging on to their loans. It may not make sense to prepay a 3% mortgage when you can earn 5% on a certificate of deposit, for example. Paying off a mortgage early also could leave you “house rich and cash poor,” with not enough savings to deal with emergencies and later-life expenses.

But the key is affordability. A mortgage that’s a stretch now might become easier to afford if your income rises, which was almost a given when you were younger. Now, however, you’re approaching the “dangerous decade” of your 50s, when many people wind up losing their jobs and failing to ever regain their former pay, according to a study by ProPublica and the Urban Institute.

Renting has its risks as well, of course. You aren’t building equity and you typically have little control over rent increases, other than to move.

For help in sorting through your options, consider talking to a fee-only, fiduciary advisor. Among the most affordable options are accredited financial counselors and accredited financial coaches, who typically are well-versed in the money issues facing middle-class Americans. You can get referrals from the Assn. for Financial Counseling & Planning Education at www.afcpe.org.

Dear Liz: I’m a CPA and getting conflicting answers from the Social Security office about a case I’m working on. Both clients are 70 and they’re considering legal separation or divorce. She took Social Security at 62 and receives about $1,500 a month before deductions. He started Social Security at 70 and receives about $4,600. How would her Social Security change at his death or their divorce, if she doesn’t remarry?

Answer: Based on the amounts involved, both parties are receiving their own retirement benefits and those aren’t affected by divorce, said William Reichenstein, a principal at Social Security Solutions, a claiming strategy site. (If the wife were receiving spousal benefits, those would continue after divorce as long as the marriage lasted at least 10 years and she did not remarry.)

If the husband dies and they haven’t divorced, the wife would be entitled to survivor benefits equal to his full monthly benefit amount ($4,600, plus any future cost of living increases). If they divorce and the marriage lasted at least 10 years, she also would be entitled to his full amount. Remarriage wouldn’t affect her divorced survivor benefit since she’s over 60, Reichenstein said.

Liz Weston, Certified Financial Planner®, is a personal finance columnist for NerdWallet. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com.

Business

99 Cents Only to close all 371 stores and wind down its business

99 Cents Only Stores will close all 371 of its stores and wind down its business operations after more than four decades, the City of Commerce discount chain announced Thursday.

“This was an extremely difficult decision and is not the outcome we expected or hoped to achieve,” interim Chief Executive Mike Simoncic said in a statement. “Unfortunately, the last several years have presented significant and lasting challenges in the retail environment.”

He cited multiple factors, including the “unprecedented impact” of the COVID-19 pandemic, shifting consumer demand, persistent inflationary pressures and rising levels of shrink — an industry term that refers to loss of inventory attributed to reasons such as shoplifting, employee theft and administrative errors.

Combined, those issues “have greatly hindered the company’s ability to operate,” Simoncic said.

99 Cents Only has stores in California, Arizona, Nevada and Texas and has about 14,000 employees. The privately held company said it had reached an agreement with Hilco Global to liquidate all of its merchandise and dispose of fixtures, furnishings and equipment at its stores. Sales are expected to begin Friday.

Hilco Real Estate is managing the sale of the company’s real estate assets, which are owned or leased.

The announcement by 99 Cents Only reflects a larger weakness in the dollar-store category, said Brad Thomas, equity research analyst at KeyBanc Capital Markets.

Dollar Tree, a Chesapeake, Va., retailer, announced last month that it was closing 600 of its Family Dollar stores this year and an additional 370 in the next few years, he noted.

“It’s been trying times for many, many retailers,” he said. “What’s interesting is that what started out as a boon to retailers in the pandemic, with all those stimulus checks, quickly turned into a very troublesome time.”

Rising wages, inflation and higher losses due to shrinkage have reduced profits for retailers in a deep-discount sector where margins are already extremely low.

99 Cents Only, with its large base of California stores, has been under particular wage pressure, he said. And it’s at a disadvantage compared with larger chains such as market leader Dollar General, which has a store count close to 20,000 — “a sales base and a store base that is multiple times larger than 99 Cents,” Thomas said.

Customers make their way through the crowded parking lot at a 99 Cents Only store in Santa Monica on Friday. The chain has locations in California, Arizona, Nevada and Texas and employs about 14,000 people.

(Genaro Molina / Los Angeles Times)

Last week, Bloomberg reported that 99 Cents Only was considering a bankruptcy filing as it contended with a liquidity shortfall.

Founded in Los Angeles in 1982 by David Gold, 99 Cents Only popularized the single-price retail concept. At the time, dollar stores were seen as dumping grounds for undesirable products, but the Gold family made the stores bright and well-organized, with good-quality merchandise including groceries and household supplies.

“It was an instant success,” Howard Gold, one of David Gold’s sons, recalled Friday; he and his three siblings all worked at 99 Cents Only. “People thought it was government-subsidized because they couldn’t believe the prices.”

For years, it remained one of the few true “dollar” stores, with items priced at 99 cents or less or grouped to sell for a total of 99 cents.

That changed in 2008 when, faced with fast-rising inflation, soaring food and fuel prices, and a higher minimum wage, 99 Cents Only announced that it was straying from its long-standing price strategy.

Three years later, the company announced that it had agreed to be sold in a deal valued at about $1.6 billion, as investors eyed dollar stores that had grown in popularity during the Great Recession. In 2013, Howard Gold and the rest of the family management team departed the company.

Today, with stores scattered around Los Angeles County — among them in Hollywood, Silver Lake, Mid-Wilshire, Santa Monica, Thai Town, North Hollywood and Glendale — the closure of 99 Cents Only will leave a number of large vacant properties in prime locations.

A 99 Cents Only store in Huntington Beach on Friday.

(Allen J. Schaben / Los Angeles Times)

“It’s very sad on many levels, and I’ll just leave it at that,” Gold, now retired and living in Studio City, said of the decision to close the chain his father built.

Other major retailers have also announced store closures in the region lately, including REI in Santa Monica, Macy’s in Simi Valley and several Rite Aid locations.

99 Cents Only did not respond to requests for comment.

Nicolas Kolesnikow, a retired teacher who lives in Westchester, said he was shocked to hear the chain was going out of business. He shops at a 99 Cents Only about four blocks from his house several times a week.

“It’s almost like a corner store for me,” said Kolesnikow, 82.

He might stop by and pick up milk if he runs out, and for longer trips will buy household items and produce such as tomatoes, cucumbers and cilantro before visiting a traditional supermarket with a larger selection.

Kolesnikow said he noticed that some products had become much more expensive in the last year, though there were still bargains.

“I found their prices were working their way up to regular prices,” he said, “and there were fewer shoppers.”

-

Kentucky1 week ago

Kentucky1 week agoKentucky first lady visits Fort Knox schools in honor of Month of the Military Child

-

Movie Reviews1 week ago

Movie Reviews1 week agoFilm Review: Challengers – The Knockturnal

-

News1 week ago

Maryland high school student arrested after authorities discovered a 129-page document detailing school shooting plan, police say | CNN

-

World1 week ago

World1 week agoIranian media says three drones downed after explosions heard in Isfahan

-

World1 week ago

World1 week agoShipping firms plead for UN help amid escalating Middle East conflict

-

News1 week ago

News1 week agoVideo: Kennedy Family Endorses President Biden

-

Politics1 week ago

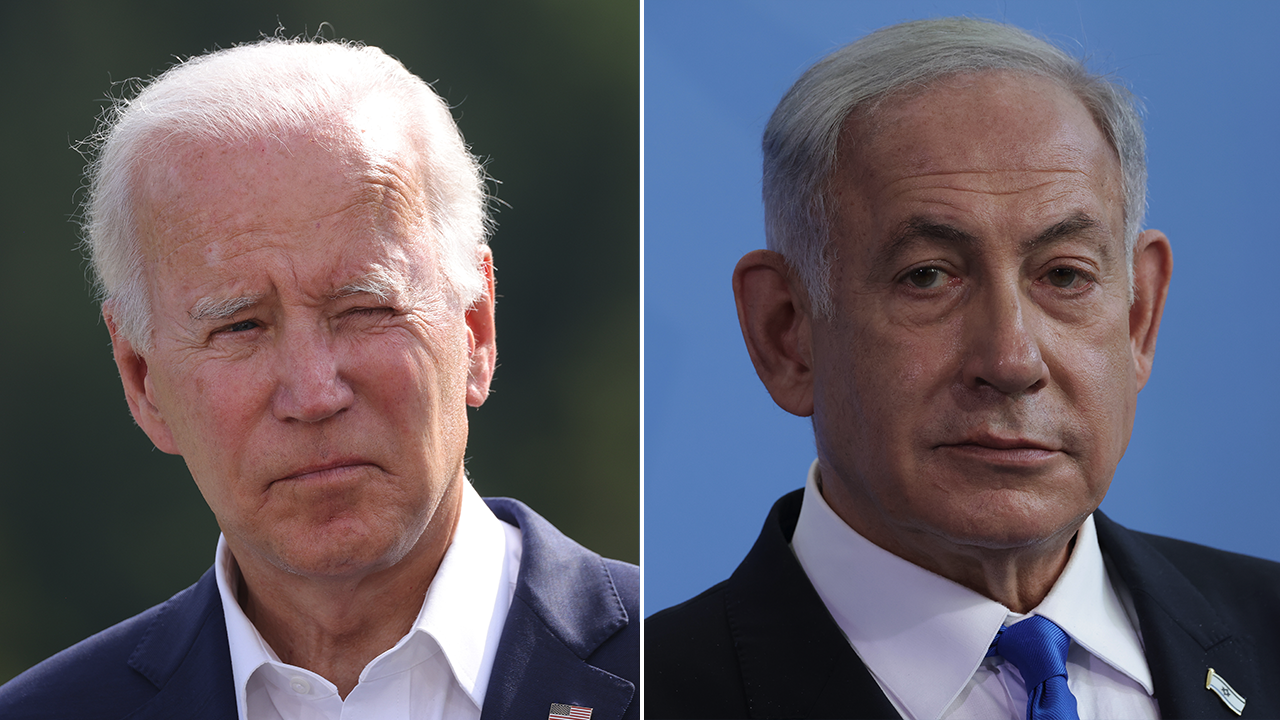

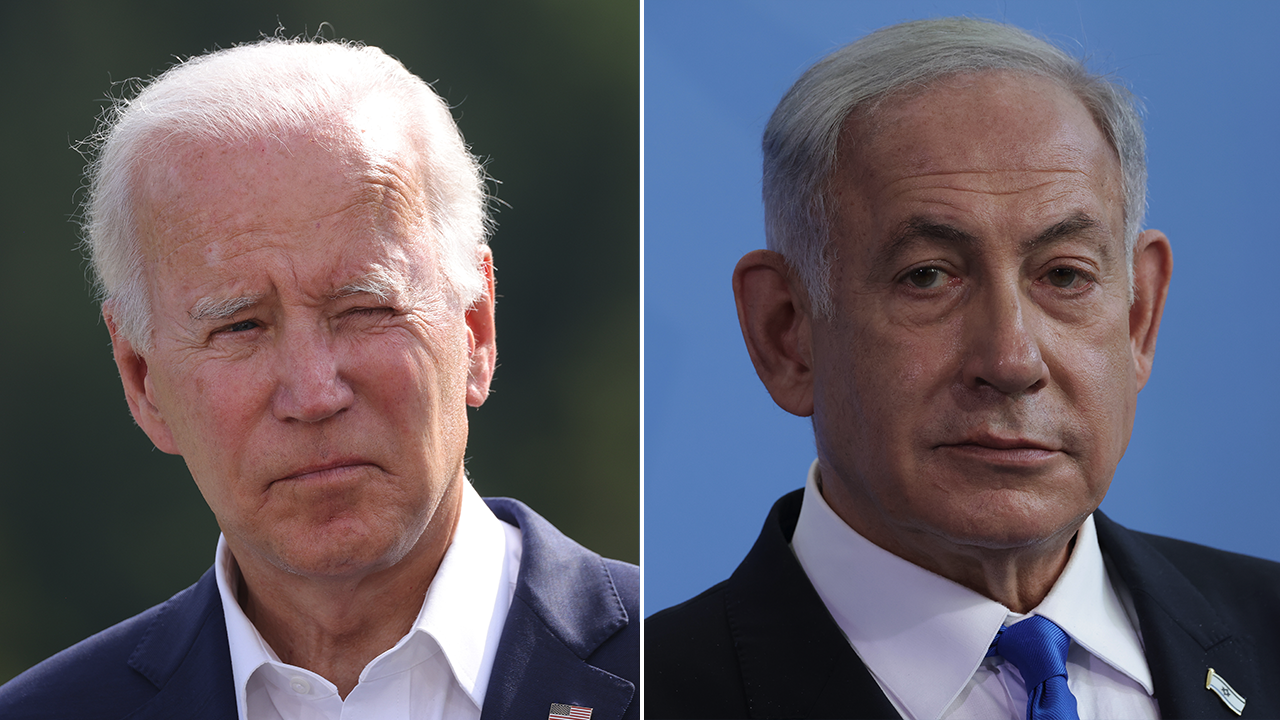

Politics1 week agoIsrael hits Iran with 'limited' strikes despite White House opposition

-

News1 week ago

News1 week agoThe San Francisco Zoo will receive a pair of pandas from China