South Dakota regulators questioning NorthWestern Vitality’s nuclear vitality research plans in February have been fast to ask whether or not the utility’s Montana clients can be sharing the prices.

NorthWestern approached South Dakota’s utility fee Feb. 8, asking for approval to invoice clients for a nuclear energy plant research. The corporate indicated that it had already carried out a month’s work with international consultancy Roland Berger and deliberate to satisfy a Might software deadline for federal subsidies.

The trail for nuclear energy in Montana is difficult, the utility advised South Dakota regulators. In each states, NorthWestern identifies nuclear energy as an choice to exchange retiring coal-fired energy crops, ought to it’s pressured to take action by regulators, although In Montana the utility is getting ready to double the quantity of owned coal energy in its portfolio.

Dave Marston: The ‘vitality hole’ no person needs to tussle with

“NorthWestern has not recognized a date sure for nuclear in Montana, solely the chance. However to be prepared for the chance, NorthWestern has modeled retirement eventualities that embody including nuclear in 2030 and 2035,” the corporate advised the South Dakota Public Utility Fee.

Persons are additionally studying…

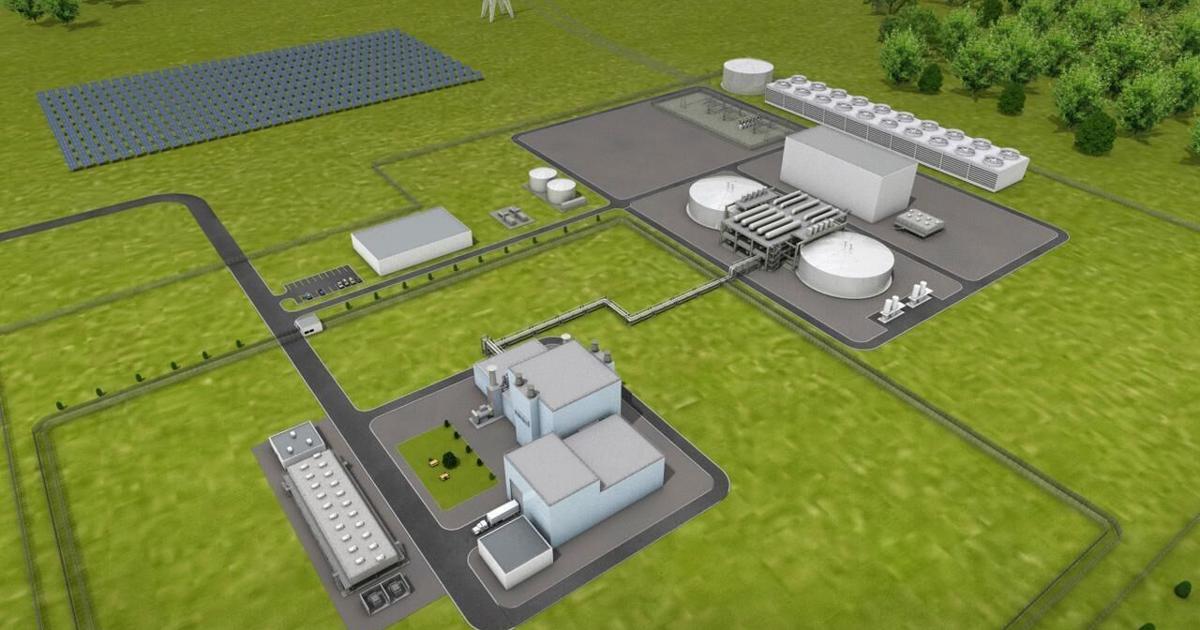

In January, NorthWestern CEO Brian Hen hinted to a Helena viewers that the present web site of Colstrip Energy Plant may very well be appropriate for a nuclear reactor after Colstrip closes, probably by the tip of the last decade.

“Guess what an awesome location to construct a non-carbon emitting useful resource can be? Colstrip has implausible transmission, constant transmission that serves us at present. It has a extremely expert workforce, who actually may very well be educated in different assets down the highway, ” Hen advised the viewers.

Wyoming nuclear plant delayed, tentative begin date pushed to 2030

Each the development timeline offered by the utility, in addition to the value don’t mirror the present struggles of nuclear energy crops. NorthWestern’s Jeff Decker advised South Dakota regulators a 320 megawatt energy plant would seemingly price between $1.2 billion and $1.6 billion, far lower than present nuclear energy initiatives, that are presently costing far more, and taking for much longer to construct than deliberate.

“Even when it’s the in a single day price that doesn’t embody escalation, or financing prices, that is approach too low, per kilowatt,” mentioned David Schlissel, director of useful resource planning evaluation on the Institute for Vitality Economics and Monetary Evaluation. “It’s approach too low. No plant like this has been constructed or operated. It’s simply over-optimistic hype to get cash to do a research on a challenge. Prudence would say wait till others have constructed these reactors, see how a lot they price and the way nicely they work.”

Requested the way it got here up with its price estimate, NorthWestern provided a ready assertion that didn’t try a solution.

Bringing nuclear energy to Montana dearer than initially forecast

“In South Dakota, NorthWestern Vitality utilized for an accounting order related to a nuclear research invoice. NorthWestern Vitality has not made any determination whether or not to proceed to develop carbon-free nuclear technology,” mentioned Jo Dee Black, a NorthWestern spokesperson. “Relatively, this research is meant to assist NorthWestern Vitality perceive the evolving expertise and its prices.”

Regionally, the nuclear reactor challenge that’s furthest alongside, with inflation driving up price estimates, is the NuScale small modular reactor partnership with Utah Related Municipal Energy Methods. The estimated worth of the 462-megawatt reactor has elevated 75% from $5.3 billion to $9.3 billion. The worth of the facility to cowl the invoice has risen from $58 per megawatt hour to $89.

UAMPS members are municipal-based monopoly utilities, who make good companions for the cutting-edge initiatives as a result of utility clients are “captive” that means they can not store round for a greater deal and can be obligated to cowl reactor prices.

A bigger scale challenge by Georgia Energy has seen its estimated worth improve from $14 billion to $30 billion with a completion date delayed 6 years.

TerraPower introduced in December that it was delaying its plans for a reactor in Wyoming by two years as a result of Russia was its lone gasoline supply and the rogue nation’s struggle with Ukraine is complicating provide.

Group warns small nuclear reactors come up brief on guarantees

In Washington, small modular reactor developer X-energy Reactor Firm introduced that it was withdrawing plans to construct a reactor on the federal authorities’s Hanford nuclear web site close to the Tri-Cities. The Washington reactor was to be X-energy’s first, an indication challenge that can now be relocated to a Dow Chemical web site on the Gulf Coast, in response to the corporate.

X-energy’s reactor challenge was just like the one described by NorthWestern to the South Dakota PUC, an 80 MW reactor that may very well be scaled as much as 320 MW in what X-energy described as a 4-pack of reactors. X-energy was chosen by the Division of Vitality to obtain as much as $1.2 billion to develop a reactor and gasoline fabrication facility by 2030. The reactor is a 76 MW capability small modular unit.

Following a merger earlier this 12 months, X-energy’s new proprietor, Ares Acquisition Corp., issued a cautionary word with the Securities and Trade Fee warning traders concerning the dangers of investing in initiatives like theirs.

X-energy (Xe-100 Brief Know-how Explainer) – courtesy of X-energy

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23935558/acastro_STK103__01.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25826211/lorealcellbioprint.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25832751/2192581677.jpg)