Finance

Federal budget 2024: A personal finance report card

An unpopular government takes on today’s biggest personal finance challenges in the federal budget released Tuesday. Here’s a report card that grades the budget on how it affects you and your household.

Taxes: C-

The headline budget measure is an increase in the inclusion rate for capital gains to two-thirds from one-half for gains above $250,000, starting June 25. A capital gain occurs when you sell an asset for more than you paid. The inclusion rate is the portion of the gain that is taxable.

Raising the capital gains inclusion rate addresses tax fairness, given that wealthy people benefit more from capital gains than those with middle and lower incomes. But this is a move that complicates an already overly complex tax system and provides a disincentive to invest at a time when economic productivity and growth are weak. Also, there’s potential for a wide swath of the population to be affected.

The government estimates the change in the inclusion rate would affect 40,000 people in 2025, or 0.13 per cent of the population of tax filers, with average gross income, including capital gains, of $1.4-million. But among those who would potentially be exposed to the higher inclusion rate are people selling cottages and investment properties, as well as those with significant investments outside registered plans.

The capital gain on sale of a principal residence remains tax-free. Now, the government is providing a disincentive to invest in additional real estate. Introducing the higher inclusion rate in June gives people time to realize capital gains now and use the current inclusion rate.

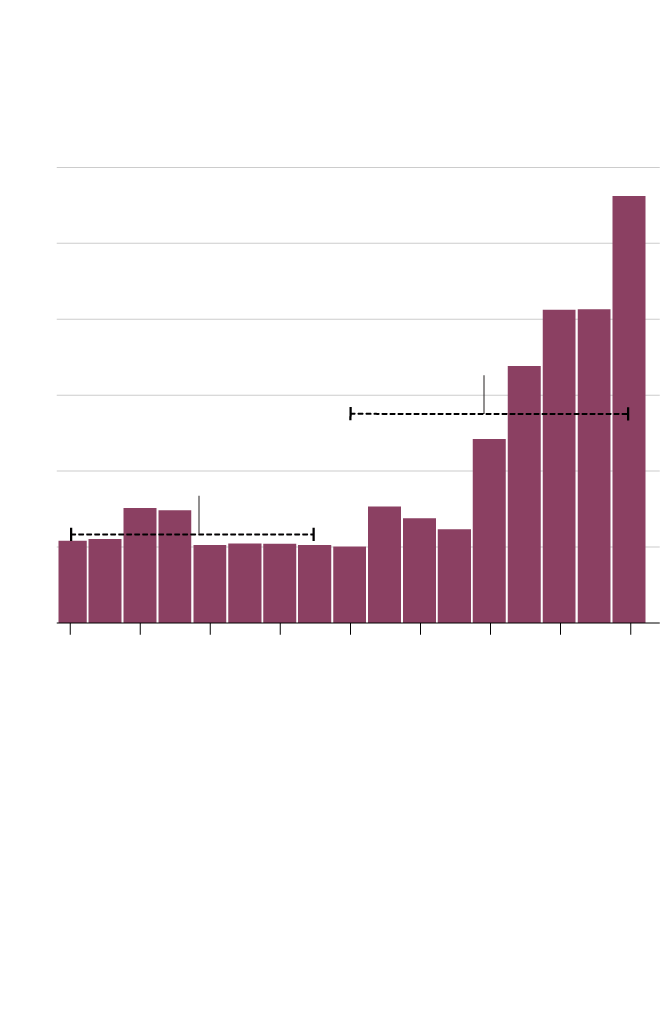

Federal housing investments

since the 2008 global financial crisis

Billions of dollars

Note: Amounts for 2007-08 until 2022-23 are actuals, as available. Amount for 2023-24 is an estimate, and subject to change. Amounts are on a cash basis. Amounts include Canada Mortgage and Housing Corporation (CMHC) programming only, and do not include: homelessness programming; energy efficiency programs delivered through Natural Resources Canada; tax measures; cost-matching provided by provinces and territories; or investments that support distinctions-based Indigenous housing strategies.

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

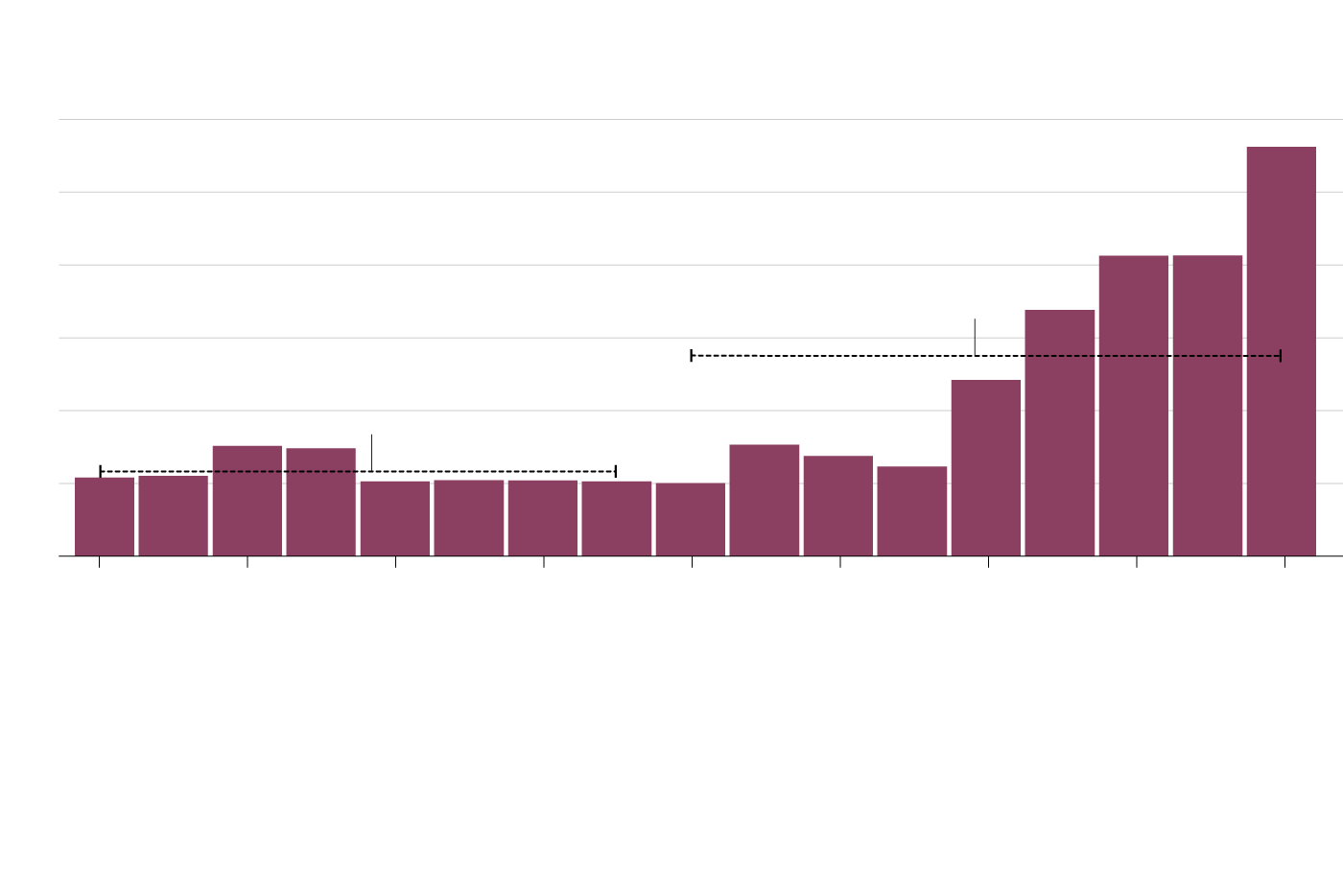

Federal housing investments

since the 2008 global financial crisis

Billions of dollars

Note: Amounts for 2007-08 until 2022-23 are actuals, as available. Amount for 2023-24 is an estimate, and subject to change. Amounts are on a cash basis. Amounts include Canada Mortgage and Housing Corporation (CMHC) programming only, and do not include: homelessness programming; energy efficiency programs delivered through Natural Resources Canada; tax measures; cost-matching provided by provinces and territories; or investments that support distinctions-based Indigenous housing strategies.

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

Federal housing investments since the 2008 global financial crisis

Billions of dollars

Note: Amounts for 2007-08 until 2022-23 are actuals, as available. Amount for 2023-24 is an estimate, and subject to change. Amounts are on a cash basis. Amounts include Canada Mortgage and Housing Corporation (CMHC) programming only, and do not include: homelessness programming; energy efficiency programs delivered through Natural Resources Canada; tax measures; cost-matching provided by provinces and territories; or investments that support distinctions-based Indigenous housing strategies.

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

Housing: B

The government has set a goal of building 3.9 million homes by 2031, which in pure economic terms should help affordability. Build supply to satisfy demand and prices should stabilize over time. For now, there are only niche measures to help first-time buyers cope with high mortgage rates and home prices that averaged just under $700,000 in the national resale market last month.

Extensive help to young buyers would result in home prices rising – that’s a done deal. But making 30-year mortgages available to rookie buyers purchasing newly built homes with a down payment of less than 20 per cent would typically save only $100 to $300 per month in rough terms. This measure takes effect Aug. 1.

Modest down payment help is coming through an immediate boost in the amount first-time buyers can withdraw from a registered retirement savings plan under the federal Home Buyers’ Plan. The limit goes to $60,000 from $35,000, and HBP users will temporarily have three years added to the current two-year grace period for starting repayment of money into an RRSP. The longer grace period applies to withdrawals under the HBP in 2022 through 2025.

Junk fees: C

Lots of talk about working with various parties to address nuisance fees in areas such as telecom, airline tickets and concerts, but also a few nuggets of concrete action. Examples include a prohibition on telecom companies charging an extra fee to customers to switch carriers, and a $10 cap on the amount banks can charge in non-sufficient funds fees. Banks would also have to alert customers the NSF fee is being charged and provide a grace period to avoid the fee by depositing additional funds.

Open banking: D

There were hopes the government would announce a legislative framework for open banking, which holds the promise of increasing competition in financial services and fostering new apps and tools to help people manage their money. However, the budget simply provided funding for a three-year study of open banking oversight by the Department of Finance. With open banking, consumers could securely share personal bank account data with other financial players.

In a somewhat more immediate move, the budget disclosed that the federal Financial Consumer Agency of Canada is in negotiations with banks to increase offerings of accounts with fees ranging from zero to $4 per month. One goal is to include more transactions in these accounts without extra costs.

Saving for a postsecondary education: A

File this one under small but helpful. Eligible children born in 2024 and beyond will have a registered education savings plan automatically set up for them by age 4. Kids who qualify would receive up to $2,000 in total via the Canada Learning Bond, which is available to low-income families to help save for a child’s postsecondary education. Eligibility for the CLB payment is based on parental income.

Are you a young Canadian with money on your mind? To set yourself up for success and steer clear of costly mistakes, listen to our award-winning Stress Test podcast.

Finance

Hermon High Seniors teach finance to fourth graders

HERMON, Maine (WABI) – Hermon High School Seniors taught fourth graders the basics of finance.

“We’re reading a book, and it talks about things you can spend with a dollar, things you can spend with $10, and it’s like penny candy or balloons. So, in our presentation, it talks about how you can either save your money or you can buy something, you want to spend or save it up for something important, or you can spend your dollar and buy 25 pieces of penny candy, or like it kind of just shows an example within our presentation of real-life situations,” said Saige Lang, Senior, Hermon High School.

The aim was to have the kids leave with a grasp of the value of money.

“They don’t have the physical cash. They might get a check from somebody that’s older, but they don’t see their parents using cash. So many people don’t spend with cash now. So, it’s so important that they know the value of cash, and, you know, you swipe it, it still is your money being spent,” explained Hermon High School Career Prep Teacher, Margie Deabay.

They say it’s important to teach the subject at an early age.

“It’s important because it’s good to teach kids young. It’s good to start them out young so they can start picking it up as it goes on. It’s better to, I feel like it’s better to learn young than it is now, like as a senior in high school.”

“If we wait until high school, I don’t want to say it’s too late, but it is kind of to get all the kids come to high school and they are so used to swiping cards, it’s so important for them to learn at an early age. That you know the value of money.”

Copyright 2024 WABI. All rights reserved.

Finance

SC partners IsDB to advance Islamic Capital Market, Social Finance

PETALING JAYA: The Securities Commission Malaysia (SC) today signed a Memorandum of Understanding (MoU) with the Islamic Development Bank (IsDB) Group, paving the way for greater cooperation in Islamic capital market (ICM) and broadening the reach of Islamic fintech and social finance, particularly waqf.

Prime Minister Datuk Seri Anwar Ibrahim and IsDB president and chairman Dr Muhammad Al Jasser, witnessed the signing of the landmark MoU, the first-of-its-kind between the Malaysian capital market regulator and the premier multilateral development bank of the Global South.

The SC chairman, Datuk Seri Dr Awang Adek Hussin and IsDB vice president, finance and chief financial officer, Dr Zamir Iqbal signed the MoU on the sidelines of the IsDB Annual General Meeting 2024 in Riyadh.

Anwar and Muhammad Al Jasser, in their meeting in March 2023, had agreed that regulators, authorities and businesses in Malaysia to work closely with IsDB to explore new areas of collaboration. These include developing and piloting innovative Islamic finance products, promoting the halal industry, and supporting micro, small and medium enterprises (MSMEs).

Under the MoU signed this morning, both the SC and IsDB will collaborate in several key areas. These include facilitating innovation in Islamic fintech, promoting development of Islamic social finance, and encouraging inflow of investments, among others.

It also aims to increase capacity building, knowledge sharing and joint technical projects in key interest areas related to ICM, which can also be capitalised by both institutions for the benefit of other IsDB member countries.

Awang Adek said the synergistic collaboration marked a historic milestone for the SC and IsDB.

“We now intend to broaden and deepen Islamic fintech state of play via scalability and new markets as well as amplify opportunities through social finance including development of waqf assets, by using our respective capital markets and financial development expertise,” he added.

Through greater collaboration, he said both parties can also develop and scale up the MSMEs, in support of their aspirations.

Muhammad Al Jasser said, “Under this MoU, the Securities Commission Malaysia and IsDB will collaborate to enhance Islamic fintech, social finance, and attract foreign investment in private markets. This will enhance the Islamic capital markets not only in Malaysia but also across IsDB Member Countries. This partnership prioritises support for MSMEs and private markets, which are crucial for economic empowerment.”

Awang Adek added that this MoU is also in line with the key strategic initiatives for the Malaysian ICM under the Capital Market Master Plan 3 (2021 – 2025), including expanding the reach of ICM to the broader stakeholders of the economy and embracing collaboration and innovation for growth.

To that end, the SC together with its affiliate, Capital Markets Malaysia recently engaged with various stakeholders in Abu Dhabi, Dubai and Riyadh. This includes lending Malaysia’s voice to reinforcing ICM’s impact and enhancing Malaysia’s global thought leadership.

In several panel sessions in the region, the SC’s executive director of Islamic Capital Market, Sharifatul Hanizah Said Ali spoke about how ICM can be harnessed to structure innovative financing instruments to further advance social impact investing, sukuk issuances and Islamic asset management.

In 2023, the Malaysian ICM grew 4.5% to RM2.4 trillion while sukuk outstanding rose by 7.4% and Shariah-compliant equities by 1.5%.

Malaysia remains the global leader in ICM, particularly in sukuk outstanding as well as Islamic fund management, securing top rankings in global indices including Islamic Fintech Index, the Global Islamic Economy Indicator and the global Islamic Finance Development Indicator for the 10th consecutive year.

Finance

US asset managers increase BTC portfolio allocation as Borroe Finance shines

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Legacy Wealth and United Capital Management have invested $20 million in Bitcoin through Fidelity’s ETF, while Borroe Finance raises nearly $4 million by monetizing future earnings via NFTs.

While US Asset Management firms invest over $40.88 million into FBTC to increase BTC portfolio, Borroe Finance (ROE) continues paving its path to become one of the top defi coins. Given its price trajectory and real-life use cases, ROE has emerged as a beacon of hope to investors.

US asset managers bought Bitcoin through Fidelity’s ETF

As per Eric Balchunas’s tweet on April 23, 2024, it is revealed that two different US investment advisors have bought Bitcoin through Fidelity’s ETF. These were Legacy Wealth Asset Management from Minnesota and United Capital Management from Kansas. They put $20 million to FBTC. So now, they have allocated 6% and 5% of their portfolios.

Reports reveal that these US Asset management firms’ allocations have surpassed $17 million which was invested into BlackRock’s ETF and IBIT. Moreover, United Capital Management’s website also posted a banner of “WE’RE COMING FOR YOUR COINS DEGENS.” But it was taken down soon after.

This influx of around $40.88 million investment in FBTC has boosted spot Bitcoin ETF inflows, dominating in April’s second-week outflows.

Despite making remarkable inflows in the spot Bitcoin ETF, there was barely any impact on the Bitcoin price trend. However, BTC has experienced a noticeable 3.35% surge in the third week of April, trading at around $64,100.

Borroe Finance attracts investors

Borroe Finance is taking the crypto world by storm. It has emerged as a pioneering force in the CrossFi arena, offering an AI-funding marketplace for avid web3 users and businesses. This approach to crowdfunding has become a stand-out for users as well as investors.

That’s why Borroe Finance has been making rapid waves in the presale stages. This ongoing presale success has blown investors’ minds.

Borroe Finance’s platform allows web3 players to generate upfront cash. By converting their future earnings into popular NFTs, these players can trade those NFTs in the secondary marketplace. Additionally, the marketplace is streamlined with a P2P ecosystem for trading convenience.

Moreover, Borroe Finance has adopted many unique approaches in its utility token. Some of them are token burn strategies, liquidity lock mechanisms, and many more, which will boost the value of ROE by stirring demands in the market.

For instance, Borroe Finance has already raised $3.97 million by selling over 298 million ROE tokens. This has showcased ROE’s growing optimism in the market. Anyone willing to buy ROE right now can get it at $0.02.

Once the presale ends, ROE will hit the mainstream market at $0.025. With this price surge, early investors will receive a 150% hike on their investment.

To learn more about Borroe Finance, visit the Borroe Finance Presale, join the Telegram group, or follow Borroe Finance on Twitter.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

-

World1 week ago

World1 week agoShipping firms plead for UN help amid escalating Middle East conflict

-

Politics1 week ago

Politics1 week agoICE chief says this foreign adversary isn’t taking back its illegal immigrants

-

Politics1 week ago

Politics1 week ago'Nothing more backwards' than US funding Ukraine border security but not our own, conservatives say

-

News1 week ago

News1 week agoThe San Francisco Zoo will receive a pair of pandas from China

-

World1 week ago

World1 week agoTwo Mexican mayoral contenders found dead on same day

-

World1 week ago

World1 week agoBrussels, my love? The EU single market is not sexy enough for voters

-

Politics1 week ago

Politics1 week agoRepublican aims to break decades long Senate election losing streak in this blue state

-

World1 week ago

World1 week agoEU sanctions extremist Israeli settlers over violence in the West Bank