Finance

Colombian green, benchmark bonds likely this year -finance minister

/cloudfront-us-east-2.images.arcpublishing.com/reuters/YSDDLBIIPVPEZPCJFMFXULGR5U.jpg)

WASHINGTON, April 14 (Reuters) – Colombia is trying to difficulty a inexperienced bond earlier than the top of 2023, seemingly in {dollars}, and will faucet conventional credit score markets once more this yr if borrowing prices fall, Finance Minister Jose Antonio Ocampo mentioned on Friday.

He mentioned the quantities weren’t set but, however that the inexperienced bond could be smaller than a $2.2 billion benchmark issuance from his authorities earlier this yr.

“We do not want extra financing for 2023. Al 2023 amortizations are lined, and even a part of subsequent yr’s. We do not want it, but it surely could possibly be handy,” he mentioned in Washington on the sidelines of the Worldwide Financial Fund and World Financial institution spring conferences.

Ocampo mentioned “when rates of interest come down” could be a very good time to market new bonds, seemingly within the second half of this yr, aiming for yields to be beneath the 7.5% of the latest issuance.

“We’re pondering inexperienced and social bonds,” he mentioned, “we’re working with the (Inter-American Improvement Financial institution) and the World Financial institution.”

PENSION REFORM

Ocampo mentioned views {that a} pension reform proposed by the federal government might decrease its means to finance itself have been “utterly unsuitable,” as any demand misplaced for native bonds from non-public pension funds could be absorbed by a brand new authorities pension fund.

Beneath the proposal, the federal government’s fund will soak up contributions from as much as 3 times the minimal wage, with staff incomes greater than that in a position to direct the remaining to present non-public funds.

The reform proposes that beginning in 2025, 20% of contributions to the federal government pension fund will go to a financial savings fund that may enhance that proportion progressively each 10 years.

Goldman Sachs mentioned in a March report that the reform offered a major fiscal danger for the federal government’s native financing plan. Non-public pension funds are the most important holders of native public debt, with some $26 billion, or barely greater than 25% of the overall.

Ocampo, rumored to be leaving the federal government of left-leaning President Gustavo Petro, mentioned when requested concerning the length of his time in workplace: “I’ve my public service go away from Columbia College till June of subsequent yr.”

Reporting by Jorgelina do Rosario and Rodrigo Campos; further reporting by Nelson Bocanegra

Our Requirements: The Thomson Reuters Belief Ideas.

Finance

Sagar Doshi of Nuvama recommends buying these three stocks tomorrow

Stock Market News: The Indian stock market benchmark indices, Sensex and Nifty 50, began the financial year 2024-2025 on a positive note. Both the frontline indices gained over a percent in the month of April.

On Tuesday, the domestic equity indices succumbed to fag-end selloff and ended lower for the day. The benchmark Nifty 50 and Bank Nifty hit their record high on April 30.

The Sensex ended 188.50 points, or 0.25%, lower at 74,482.78, while the Nifty 50 settled 38.55 points, or 0.17%, lower at 22,604.85.

Investors now watch out for the US Federal Reserve meeting outcome for further clues on interest rate cuts.

The Indian stock market is closed on Wednesday, May 1, on account of Maharashtra Day.

Read here: Share market holidays 2024: Is Indian stock market closed on 1st May?

Nifty 50 Outlook by Sagar Doshi

Nifty hit a fresh all time high on the last trading day of calendar month – April 2024 ending with MTD gains of 1.24%. A huge round of short covering was seen on index futures from the FII desk, where they cut the short position from 99,000 to less than half of 45,000 contracts.

Initial targets of 22,700+ have been complete and Nifty could consolidate between 22,550 and 22,800 for this truncated week. Any breakdown below 22,550 is likely to allow further negative views on the index. For now a range bound view is likely to play out for the week to come while broader markets are likely to steal the show on the buying front, said Sagar Doshi, Senior Vice President- Research, Nuvama Professional Clients Group.

Also Read: April Market Review: Nifty 50 soars for 3rd straight month, gains 1.2%; metal index top performer

Bank Nifty Outlook

Bank Nifty dropped close to 750 points from its intraday highs in the last hour of trade on Tuesday, negating its outperformance of this week over the Nifty. Yesterday’s price action suggests that an underperformance of Bank Nifty over the Nifty is likely to continue for the next couple of trading sessions which is likely to drag the index lower towards 48,600 odd, Doshi said.

Erosion of futures premium in the start of fresh derivative series is also suggesting some cool off on long positions for the index. Bank Nifty has also completed its Fibonacci Extension targets of 49,800 and faced rejection from the same. All of these point towards an underperformance for the coming week on the index, he added.

Also Read: Stocks to buy or sell: Sumeet Bagadia recommends 5 breakout stocks for tomorrow

Top Stock Recommendations by Sagar Doshi

On top stock recommendations, Sagar Doshi has recommended three stocks for tomorrow – L&T Finance, Prestige Estates Projects and Lupin.

L&T Finance | BUY | Stop Loss: ₹161.00 | Target: ₹179.00

L&T Finance shares witnessed a change in trend early 2023 as the stock gave a breakout from the trendline active since the all-time high. Since then, all swing breakouts have resulted in a favorable trade. L&T Finance stock has also been an outperformer in the sector. A swing breakout with a rise in volumes indicates the reinforcement of bullish momentum.

Prestige Estates Projects | Buy | Stop Loss: ₹1,330 | Target: ₹1,475

Prestige Estates Projects shares have registered a fresh all time high close for itself. Momentum indicator has also crossed its previous swing high indicating bullish momentum in the stock.

Lupin | Buy | Stop Loss: ₹1,587.00 | Target: ₹1,760

Lupin share price ended its 1 month consolidation as prices closed above ₹1,640 for the first time since mid-March. A positive cross over in momentum indicator affirms this bullish swing is likely to continue further.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates.

More

Less

Published: 01 May 2024, 08:08 AM IST

Finance

Litigation Finance Limits Advance in Louisiana With New Governor

Two Louisiana bills that put the brakes on the burgeoning litigation finance industry have advanced through initial hurdles, as lawmakers hope to take advantage of a change in governors after last year’s effort fell short with a veto.

One bill requires parties to disclose litigation finance agreements within 60 days after filing a civil action. The state House approved that measure, and it is pending with the Senate Judiciary Committee.

The second bill requires parties to disclose the presence of litigation finance in lawsuits if a foreign entity is the source of funding. That legislation cleared the state Senate and the House Committee on Civil Law and Procedure and needs approval by the full House.

The bills are part of a push in several states to restrict the practice of investors paying for the cost of lawsuits in return for a piece of the proceeds in successful cases. The US Chamber of Commerce is pushing for legislation, saying the $15.2 billion litigation finance industry encourages frivolous lawsuits.

Democratic Governor John Bel Edwards last year vetoed legislation sent to him by the Republican-controlled House and Senate in Louisiana, saying the bill to require disclosure of litigation finance favored large corporations in civil suits. Republican lawmakers, who again hold majorities in both state bodies, hope for a different result this year with a member of their party, Jeff Landry, as the governor.

Republican Representative Emily Chenevert this year has modeled her disclosure bill (HB336) on the one Edwards vetoed. It allows parties to redact the dollar amount financed, makes the contracts subject to discovery and bars funders from directing or influencing litigation.

“The appetite was there already within the legislature and so now it’s like, let’s attempt this and let’s see with a new House and some new senators what could happen,” Chenevert said in an interview. “Let’s do this again, give it another shot.”

Chenevert’s bill was deferred in the Senate Judiciary Committee after the chairman announced that there were 56 proponents and 67 opponents in attendance in line to speak at a hearing. A new date has not yet been scheduled.

The second bill (SB355), introduced by the state Senate majority leader, Jeremy P. Stine, requires disclosure of litigation financed by governments in foreign countries of concern to the state Attorney General, such as China, Russia and Iran. It mirrors legislation brought forward at the federal level last year by Senator John Kennedy (R-La.) and House Speaker Mike Johnson (R-La.).

Other bills

Litigation finance bills have faced mixed results in state legislatures. Earlier this year, Indiana enacted legislation into law that blocks foreign entities from funding lawsuits.

West Virginia updated an existing law to include litigation finance. The statute requires investors to provide a copy of contracts to consumers and does not allow firms to assign or securitize a contract to another party, among other regulations.

In Florida, a bill requiring disclosure of litigation finance agreements and of foreign investments stalled in the House. A bill in Kansas is pending and would allow discovery of litigation funding agreements.

The US Chamber backs the state efforts and earlier this month warned of the risks of litigation finance.

With outside funding, “plaintiffs face minimal risk in bringing forward claims, legitimate or not,” Matt Webb, a senior vice president for the Chamber’s Institute for Legal Reform, wrote in a post. “This dynamic often pressures businesses to settle out of court to avoid the costs and uncertainties of protracted litigation, even when the claims against them lack merit.”

In Louisiana, the Chamber backs Chenevert’s bill though calls Stine’s proposal “under inclusive.” The Stine proposal “addresses foreign funding only, but there are plenty of ways frankly that foreign dollars could be put into US investment vehicles and influences litigation,” said Nathan Morris, a vice president at the Chamber’s legal reform institute.

Litigation finance has defenders in state houses.

“The Chamber’s intentionally approaching states where there is not litigation financing, such as Louisiana, in an attempt to pass a bill that can then be used as a domino in support of national regulation,” said Dai Wai Chin Feman, managing director at funder Parabellum Capital.

He spoke out against Chenevert’s bill as a representative of the industry’s trade group, the International Legal Finance Association, but described Stine’s bill as “acceptable to our industry.”

Finance

Carbon markets could finance green wastewater infrastructure for a huge win-win-win

Green wastewater-treatment infrastructure could save billions of dollars and avert millions of tons of carbon emissions in the United States in the coming decades, according to a new study.

To facilitate this, wastewater treatment could be folded into carbon markets, moving water quality from a local to a globally traded resource, the study suggests.

Conventional wastewater-treatment facilities such as sewage plants that remove nutrients like nitrogen and phosphorus from wastewater are known as “gray” infrastructure. Such facilities currently account for 2% of U.S. energy use and 45 million metric tons of carbon emissions annually.

Wastewater-treatment standards are likely to become more stringent in the future, which will increase the power needed for water treatment, and the corresponding carbon emissions—especially because gray-infrastructure technologies able to meet these standards are energy-intensive and not terribly efficient.

In the new study, researchers investigated the potential for different forms of green wastewater-treatment infrastructure to contribute to water quality standards. Green approaches range from reducing the amount of fertilizer spread on farmland to creating human-made wetlands to filter water before it enters a river.

As well as reducing the need to beef up wastewater treatment plants, such approaches could address non-point source pollution from fertilizer runoff, urban development, and wildfires.

The researchers gathered data on nutrients coming into more than 22,000 wastewater treatment facilities throughout the contiguous United States. Then they calculated the emissions, costs, and treatment capabilities of standard wastewater treatment plants compared to green infrastructure of various sorts.

Utilities in the United States are already allowed to trade point-source for non-point source water quality improvements. But these mechanisms haven’t been used very widely. So the researchers investigated the potential for carbon markets to provide a source of capital to finance green wastewater infrastructure.

Essentially this approach would trade on the carbon-reducing potential of green infrastructure, with the water quality benefits coming along for the ride.

Green wastewater-treatment infrastructure could save $15.6 billion and 30 million metric tons of carbon emissions over four decades, the researchers report in the journal Nature Communications Earth & Environment.

Green wastewater infrastructure designed to achieve the most stringent water quality standards could sequester more than 4.2 million metric tons of carbon emissions per year and generate revenue of $679 million per year via carbon markets.

The main limitation on green treatment methods’ ability to remove nutrients is a lack of agricultural land in some areas, and the fact that not all green technologies can be used in all areas. “While green treatment methods can only treat less than 40% of nitrogen and 25% of phosphorus needed in the United States, this would still represent a large decrease in infrastructure compared to the scenario where green treatment methods are not used,” the researchers write.

Green wastewater-treatment infrastructure has lower carbon emissions than gray infrastructure in every water basin across the country—although it is not carbon-negative everywhere.

Nor are green treatment technologies cheaper than gray ones everywhere. But when potential carbon financing revenues are accounted for, basins where green technologies are cheaper account for 94.6% of nitrogen and 91.9% of phosphorus treated in the contiguous United States. Much of the cost of green infrastructure comes from the need to pay farmers to implement the technologies, in some cases yearly.

“As the grid evolves with less environmental impact, carbon credits generated by offsetting gray infrastructure with green infrastructure will be reduced,” the researchers write, “which mean that the window of opportunity for leveraging carbon markets to incentivize a shift from gray to green infrastructure may be limited.” They are now conducting additional studies to develop the carbon-credit methodology.

Source: Limb B.J. et al. “The potential of carbon markets to accelerate green infrastructure based water quality trading.” Communications Earth & Environment 2024.

Image: ©Anthropocene Magazine

Our work is available free of charge and advertising. We rely on readers like you to keep going. Donate Today

-

Education1 week ago

Education1 week agoVideo: Dozens of Yale Students Arrested as Campus Protests Spread

-

World1 week ago

World1 week agoEU sanctions extremist Israeli settlers over violence in the West Bank

-

Politics1 week ago

Politics1 week agoDemocrats hold major 2024 advantage as House Republicans face further chaos, division

-

Politics1 week ago

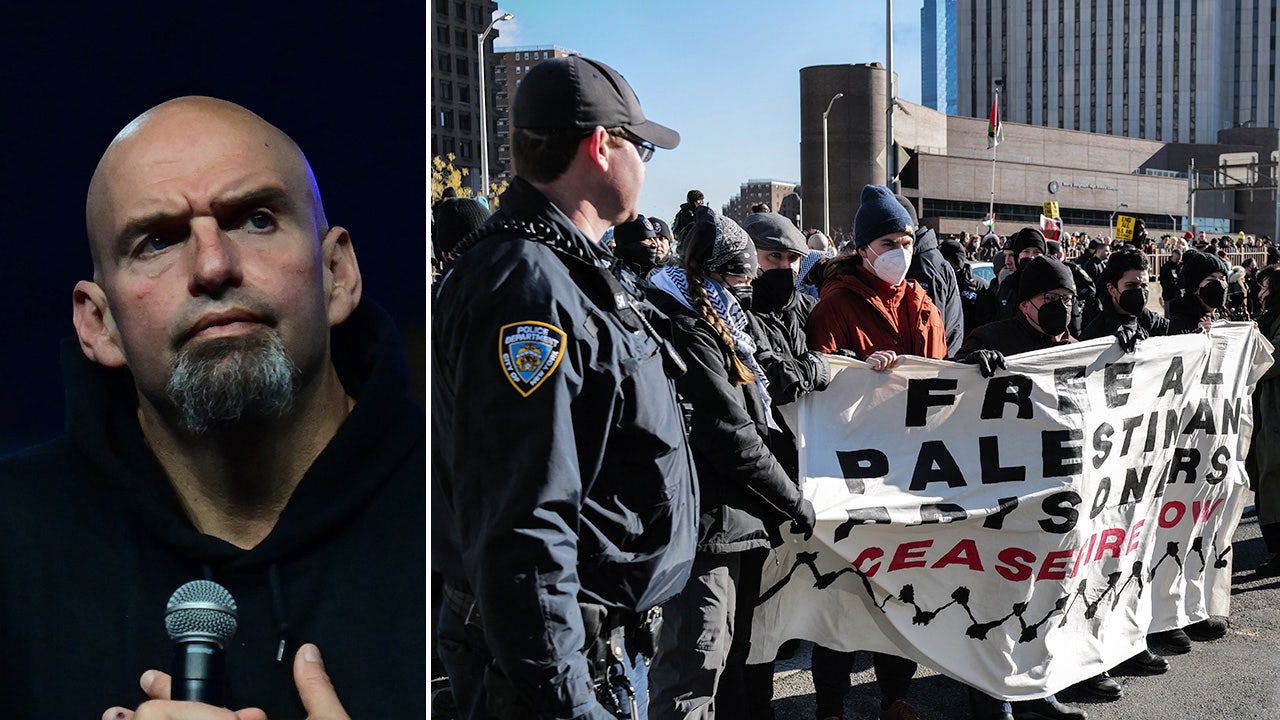

Politics1 week agoFetterman hammers 'a–hole' anti-Israel protesters, slams own party for response to Iranian attack: 'Crazy'

-

World1 week ago

World1 week agoPeriod poverty still a problem within the EU despite tax breaks

-

Politics1 week ago

Politics1 week agoA battle over 100 words: Judge tentatively siding with California AG over students' gender identification

-

Movie Reviews1 week ago

Movie Reviews1 week agoShort Film Review: Wooden Toilet (2023) by Zuni Rinpoche

-

News1 week ago

News1 week agoUniversal Studios Tram Crashes, 15 Injured, 1 Critical