Crypto

Billionaire Charlie Munger: Cryptocurrency is ‘crazy, stupid gambling,’ and ‘people who oppose my position are idiots’

Billionaire investor Charlie Munger is not a fan of cryptocurrency.

The Berkshire Hathaway vice chairman referred to as the type of digital foreign money “nugatory” throughout Wednesday’s annual shareholder assembly of the Day by day Journal Company, a publishing firm the place he is a director.

“Typically I name it crypto ‘crappo,’ typically I name it ‘crypto s—.’ It is simply ridiculous that anyone would purchase these things,” Munger, 99, advised CNBC’s Becky Fast throughout a livestream of the occasion, including: “It’s very completely loopy, silly playing.”

Cryptocurrency’s advocates preserve that digital property provide privateness, safety, higher transaction speeds and decrease prices than conventional monetary establishments.

However Munger, a longtime inventory investor with a internet price of $2.3 billion, would not purchase it. “I believe the individuals who oppose my place are idiots, so I do not assume there’s a rational argument towards my place,” he stated.

Munger’s feedback come amid an avalanche of issues for crypto traders over the previous yr.

The crypto market misplaced roughly $2 trillion final yr. Bitcoin, one of the well-liked cryptocurrencies, misplaced greater than 60% of its worth in 2022. And the implosion of FTX, a now-bankrupt crypto buying and selling platform as soon as valued at $32 billion, has shaken traders’ confidence because the trade feels the ripple results of the corporate’s collapse.

“Many People are coming to appreciate that cryptocurrency is only a speculative mania and the trade is rife with crooks,” James Royal, a principal reporter at Bankrate, tells CNBC Make It. Certainly, simply 8% of People have a constructive view of cryptocurrency as of November, in keeping with the CNBC All-America Financial Survey.

On Wednesday, Munger stated he isn’t pleased with his nation “for permitting this crap.” He is beforehand urged the U.S. authorities to ban cryptocurrencies, and will partially get his want because the crypto trade faces rising regulatory crackdowns.

Elevated scrutiny of crypto-trading corporations and funding advisors are among the many U.S. Securities and Change Fee’s high priorities this yr, as outlined within the company’s “2023 Examination Priorities Report.”

The SEC’s examinations will concentrate on the “provide, sale, advice of or recommendation concerning buying and selling in crypto or crypto-related property,” the report says.

The company voted Wednesday to develop federal guidelines that, if handed into legislation, may require crypto exchanges to carry their property with a federal- or state-chartered financial institution to behave as a custodian over clients’ digital foreign money.

The proposal places crypto corporations in a “no-win” situation, SEC commissioner Mark Uyeda wrote in an announcement on Wednesday. U.S. regulators have already warned banks that coping with crypto exposes them to an array of dangers, together with fraud and rip-off.

“In different phrases, an adviser might custody crypto property at a financial institution, however banks are cautioned by their regulators to not custody crypto property,” Uyeda wrote.

Get CNBC’s free Warren Buffett Information to Investing, which distills the billionaire’s No. 1 finest piece of recommendation for normal traders, do’s and don’ts, and three key investing rules into a transparent and easy guidebook.

Join now: Get smarter about your cash and profession with our weekly e-newsletter

Crypto

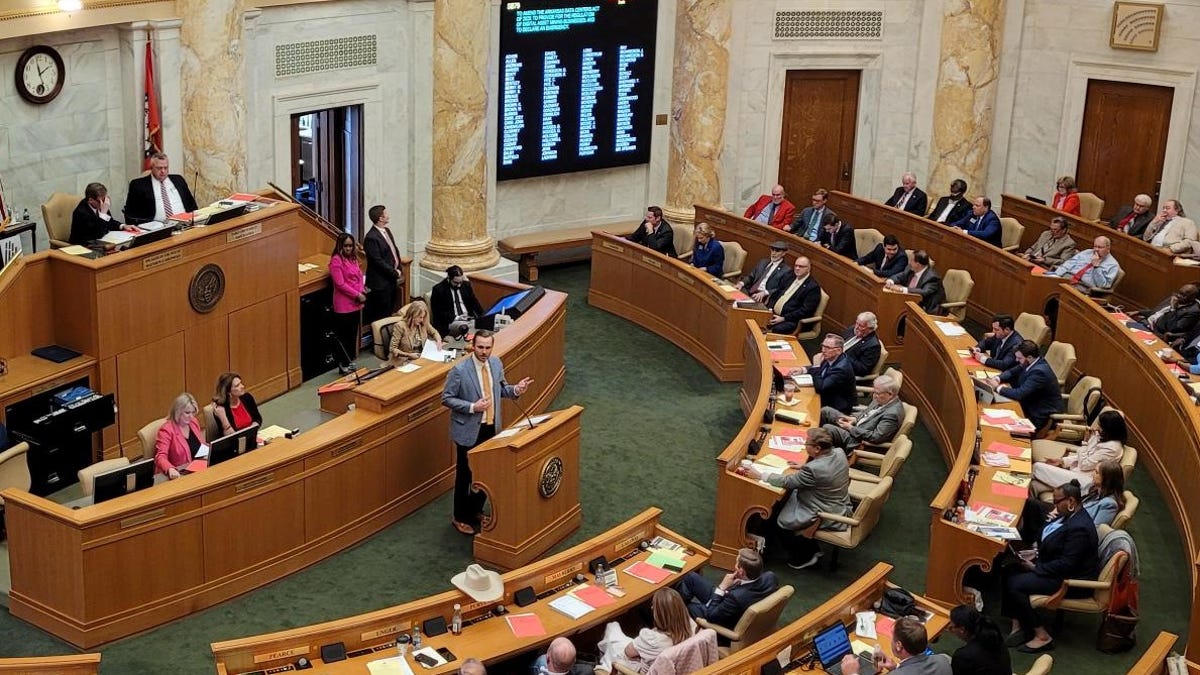

US House to Vote on Crypto Bill

A bill that promises regulatory clarity for digital assets has moved a step closer to a vote in the U.S. House.

The House Committee on Rules said Friday (May 10) that it will consider the Financial Innovation and Technology for the 21st Century (FIT21) Act (H.R. 4763), which means the bill could go to a floor vote later in May, the House Financial Services Committee said in a Friday press release.

“With the floor vote announced today, Congress will take a historic step to provide a clear regulatory framework for digital asset markets,” Patrick McHenry, chairman of the House Financial Services Committee, said in the release. “This legislation will cement American leadership of the global financial system for decades to come and bolster our role as an international hub for innovation.”

Introduced on July 20, FIT21 established federal requirements over digital assets, providing the Commodity Futures Trading Commission (CFTC) with new jurisdiction over digital commodities and clarifying the Securities and Exchange Commission’s (SEC) jurisdiction over digital assets offered as part of an investment contract, according to the release.

The bill also establishes a process for permitting the secondary market trading of digital commodities that were initially offered as part of an investment contract and imposes requirements on entities required to be registered with the CFTC or the SEC, per the release.

Congressman French Hill, one of the legislators who introduced the bill, said in the Friday press release: “After working tirelessly across the aisle and across the nation over the past year to craft a clear, pragmatic regulatory framework for digital assets, I am proud that this landmark legislation is coming to the House floor.”

The cryptocurrency industry has long been asking Washington for more regulatory clarity, and this bill could put the sector on the road to that goal, PYMNTS reported in July when the bill was introduced.

FIT21 would delineate when a cryptocurrency is a commodity or security and assign oversight appropriately between the CFTC and the SEC.

“As the collapse of FTX demonstrated, we need strong consumer protections and a functional regulatory framework to ensure the rapidly growing digital asset ecosystem is safe for investors and consumers while securing America as a leader in blockchain innovation,” Hill said in the Friday press release.

Crypto

Cryptocurrency Hedera Falls More Than 3% In 24 hours By Benzinga

Benzinga – by Benzinga Insights, Benzinga Staff Writer.

Hedera’s (CRYPTO: HBAR) price has decreased 3.16% over the past 24 hours to $0.11, continuing its downward trend over the past week of -5.0%, moving from $0.11 to its current price.

The chart below compares the price movement and volatility for Hedera over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

The trading volume for the coin has tumbled 64.0% over the past week along with the circulating supply of the coin, which has fallen 0.19%. This brings the circulating supply to 35.74 billion, which makes up an estimated 71.48% of its max supply of 50.00 billion. According to our data, the current market cap ranking for HBAR is #30 at $3.80 billion.

Powered by CoinGecko API

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga

Crypto

Crypto Nonprofit Launches PAC to Support Pro-Crypto Politicians in 2024 Elections

A cryptocurrency nonprofit has launched a political action committee (PAC) with the intent to support crypto-friendly politicians in the 2024 House and Senate elections.

What Happened: “Stand With Crypto,” a cryptocurrency nonprofit, has launched a PAC to raise funds from its 440,000 members to support a bipartisan group of candidates, Reuters reported on Wednesday. This move is part of a broader effort by the crypto industry to elect politicians who support crypto and blockchain.

This involvement comes at a time when the industry is under scrutiny, especially after FTX founder Sam Bankman-Fried was found guilty of stealing from customers.

Unlike super PACs, Stand With Crypto’s PAC is established to collect funds for candidates or political causes and cannot receive donations of unlimited size or coordinate directly with campaigns.

See Also: Tom Brady Roasted For Cryptocurrency Investment In Netflix Special: ‘Tom, How Did You Fall For That? Even Gronk Was Like—Me Know That’s Not Real Money’

“The goal is to endorse candidates and support candidates that are protecting the rights of our advocates of Stand With Crypto throughout November,” said Nick Carr, chief strategist at Stand With Crypto.

Why It Matters: Other crypto super PACs such as Fairshake, Defend American Jobs, and Protect Progress have already raised over $110 million this election cycle, according to Federal Election Commission records. The involvement of crypto in politics is not new. Earlier this year, the Fairshake PAC received a significant financial boost from the Winklevoss twins, founders of the Gemini crypto exchange, as part of their larger fundraising efforts.

Former U.S. President Donald Trump has also publicly endorsed cryptocurrency, declaring it a significant election issue, contrasting with President Joe Biden‘s perceived unfamiliarity with the crypto world. This endorsement has led to a surge in the MAGA Coin, a cryptocurrency themed around Trump.

Read Next: Here’s How Much $1,000 Invested In Dogecoin Would be Worth If You Invested When Elon Musk First Tweeted About DOGE

Image by Dall-E

Engineered by Benzinga Neuro, Edited by

Pooja Rajkumari

The GPT-4-based Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you.

Learn more.

-

Politics1 week ago

Politics1 week agoThe White House has a new curator. Donna Hayashi Smith is the first Asian American to hold the post

-

News1 week ago

News1 week agoPolice enter UCLA anti-war encampment; Arizona repeals Civil War-era abortion ban

-

Politics1 week ago

Politics1 week agoAdams, NYPD cite 'global' effort to 'radicalize young people' after 300 arrested at Columbia, CUNY

-

World1 week ago

World1 week agoTurkish police arrest hundreds at Istanbul May Day protests

-

News1 week ago

News1 week agoVideo: Police Arrest Columbia Protesters Occupying Hamilton Hall

-

)

) Movie Reviews1 week ago

Movie Reviews1 week agoThe Idea of You Movie Review: Anne Hathaway’s honest performance makes the film stand out in a not so formulaic rom-com

-

News1 week ago

News1 week agoSome Republicans expected to join Arizona Democrats to pass repeal of 1864 abortion ban

-

Politics1 week ago

Politics1 week agoNewsom, state officials silent on anti-Israel protests at UCLA