Crypto

Cryptocurrency Price on May 7: Bitcoin falls below $63,700; Shiba Inu, Dogecoin tank 5%

As of 12:14 p.m., Bitcoin was trading 1% lower at $63,649, while Ethereum experienced a 3.5% drop to $3,068. Additionally, altcoins like BNB (-1.1%), Dogecoin (-4.9%), Toncoin (2.6%), Cardano (3.3%), Avalanche (-3.1%), and Shiba Inu (-5.2%) followed suit in the downward trend.

The crypto market sentiment was further impacted by news of significant transfers from FTX-associated addresses and a Wells Notice issued to Robinhood by the SEC, alleging unauthorized digital asset trading categorized as securities.

Crypto Tracker

CoinDCX Research Team noted, “In the short term, both BTC and ETH show bearish price action, though the higher time frame remains bullish. BTC needs to reclaim the $67,000 level, while ETH must surpass $3,250 to regain momentum.”Also Read: Grayscale Bitcoin Trust’s shares jump after first inflow since JanuaryStablecoins accounted for $69.86 billion in volume, representing 91.12% of the total crypto market’s 24-hour volume, according to CoinMarketCap.Within the same timeframe, Bitcoin’s market cap rose to $1.253 trillion, with BTC volume surging by 67.8% to $30.57 billion.Vikram Subburaj, CEO of Giottus, analyzed Bitcoin’s technicals, stating, “Bitcoin, after breaching $65,000 briefly, is consolidating above $63,500 today. The asset has found strong support at the 0.5 fib extension ($60,700), aligned with its 100-day MA at $60,850. Its RSI levels continue to improve towards a neutral territory. Bitcoin can consolidate at these levels for a few more days before it holds $65,000 and turns bullish.”

Regarding Cardano, Rajagopal Menon, Vice President at WazirX, remarked, “Cardano is looking at an accumulation phase which means the network could see more buying activity in the coming days, creating a potential for a price surge. Its technical indicators are favourable and all signs point to a buying activity for investors in the coming days.”

In Tuesday’s trade, Cardano saw a 3.3% decline to $0.4476. Over the past month, the crypto token dropped by 24%, yet it rallied by 17% over the last year.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Crypto

Argentina Collaborates with El Salvador to Enhance Cryptocurrency Adoption and Regulation

The Argentine government is collaborating with El Salvador to gain insights from its experience with Bitcoin adoption and other cryptocurrency activities. The National Securities Commission (CNV) of Argentina met with El Salvador’s National Commission of Digital Assets (CNAD) to discuss crypto adoption and regulation in both countries, according to an official CNV announcement. On May 23, CNV president Roberto Silva, vice president Patricia Boedo, and CNAD president Juan Carlos Reyes reviewed El Salvador’s experience as the first nation to make Bitcoin legal tender in September 2021. The meeting focused on exchanging views and strategies regarding cryptocurrency use in global economies,

Crypto

Iggy Azalea Hints at Interest in Cryptocurrency

Arslan Butt

Index & Commodity Analyst

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.

Crypto

Bitcoin price today: drops to $67k on inflation fears, Ether rally cools By Investing.com

Investing.com– Bitcoin price fell slightly on Tuesday, while a rally in no.2 token Ether also cooled as anticipation of key inflation readings this week kept traders largely risk averse, especially towards crypto.

Hype over the approval of an exchange-traded fund that directly tracks Ether also took a back seat, especially as the Securities and Exchange Commission now has to engage with fund managers over their applications to list such a potential product.

The SEC had last week approved applications from major exchanges to list a spot Ether ETF, which triggered a sharp rally in the token and broader crypto markets.

fell 1.3% in the past 24 hours to $67,901.9 by 01:15 ET (05:15 GMT). sank 2% to $3,844.48, also retreating from two-month highs hit over the weekend.

Rate fears mount ahead of inflation data

Fears of high-for-longer U.S. interest rates remained squarely in focus, especially ahead of key data due later this week.

The reading is the Federal Reserve’s preferred inflation gauge, and is likely to factor into the central bank’s outlook on rates.

Sentiment towards crypto and other risk-driven assets was battered by growing fears that the Fed will keep rates high for longer, especially after a string of officials warned that sticky inflation will delay any monetary easing.

This notion also kept Bitcoin trading comfortably within a trading range established over nearly three months, and also limited bigger gains in Ether.

High rates bode poorly for speculative assets such as crypto, given that they limit liquidity that can be invested in the space, and also push up the attractiveness of conventional, low-risk investments such as the dollar and Treasuries.

Crypto prices took little advantage of a mild drop in the on Monday.

Before the PCE data, inflation readings from , and are also due this week.

Crypto price today: altcoins, memecoins subdued

Broader crypto prices saw little action, as trading volumes were also subdued on account of market holidays in the U.S. and the UK.

Altcoins and rose less than 1% each, while meme tokens and traded in a flat-to-low range.

-

Movie Reviews1 week ago

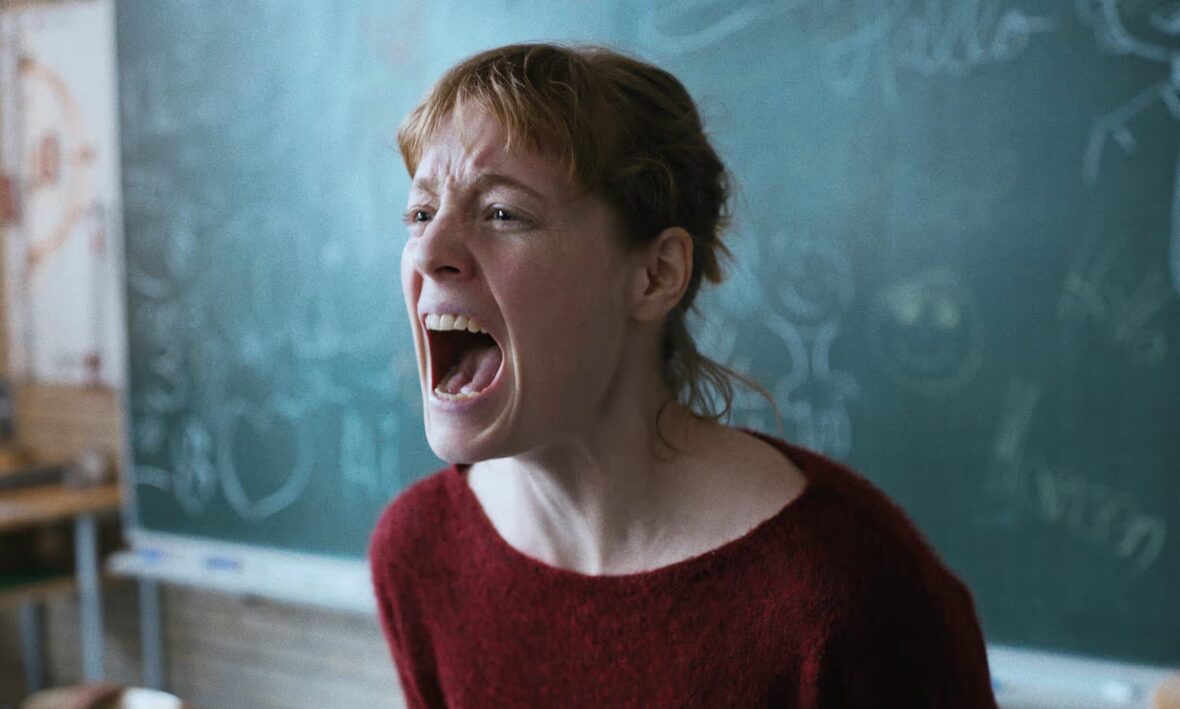

Movie Reviews1 week ago‘The Substance’ Review: An Excellent Demi Moore Helps Sustain Coralie Fargeat’s Stylish but Redundant Body Horror

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘Rumours’ Review: Cate Blanchett and Alicia Vikander Play Clueless World Leaders in Guy Maddin’s Very Funny, Truly Silly Dark Comedy

-

Culture1 week ago

Culture1 week agoFrom Dairy Daddies to Trash Pandas: How branding creates fans for lower-league baseball teams

-

News1 week ago

News1 week agoVideo: A Student Protester Facing Disciplinary Action Has ‘No Regrets’

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘Blue Sun Palace’ Review: An Intimate, Affecting and Dogma-Free Portrait of Chinese Immigrants in Working-Class New York

-

World1 week ago

World1 week agoPanic in Bishkek: Why were Pakistani students attacked in Kyrgyzstan?

-

Politics1 week ago

Politics1 week agoAnti-Israel agitators interrupt Blinken Senate testimony, hauled out by Capitol police

-

Politics7 days ago

Politics7 days agoMichael Cohen swore he had nothing derogatory on Trump, his ex-lawyer says – another lie – as testimony ends