Between significant tech layoffs and continuing economic headwinds, it was fitting that one of the last major commercial real estate moves of the year in San Francisco was an office building being listed for sale at a massive discount.

San Francisco, CA

A New Era of San Francisco Commercial Real Estate Begins in 2024

The 20-story office tower at 33 New Montgomery St. is being listed at $80 million, a 46% haircut from the $146 million it traded hands for in 2014.

That big drop in valuation—first reported by the San Francisco Chronicle— mirrors larger trends at office properties across San Francisco and the Bay Area, where high vacancy rates and the rising cost of lending have put many owners in a bind and spurred some to cut their losses and offload troubled properties.

An increasing number of those who made investments before the pandemic are now coming out on the losing end heading into 2024. It’s not all bad news. Investors did get a little reprieve heading into the holiday break, with the Federal Reserve signaling it was finally prepared to start lowering interest rates after the new year, thus making money easier to borrow.

But interest rates and office occupancy rates won’t flip overnight. What’s more likely is that 2024 will represent a turning-of-the-page moment in San Francisco, a real estate reset where past expectations are no longer palatable, and well-positioned players enter the game buying low.

End of an Era

Similar to 33 New Montgomery, a 210,000-square-foot office building at 600 Townsend West was listed for sale last month by real estate services firm JLL. The building has been owned by Japanese investor Toda Corp. for over 30 years, and the firm is seeking roughly $74 million for the property roughly a mile southwest of Oracle Park.

While Toda does not appear to be under significant pressure from lenders or facing a lack of cash flow because of low occupancy (JLL’s listing says it is 92% leased)—its price guidance of roughly $350 per square foot does fall in line with a neighboring building recently sold back to one of its original owners at a major discount.

A source with knowledge of the deal said the initial round of bids for the property topped out around $67 million.

Less than two blocks away from Toda Corp.’s property, a different story with a similar outcome is playing out at 410 Townsend St.

There, the building’s previous owner, Clarion Partners, fell behind on a roughly $40 million loan it took out in 2019, the same year it purchased the 76,000 square-foot office for $86 million. For a point of comparison to current market values, that works out to roughly $1,130 per square foot.

According to public records, Clarion handed the property back to its lender this month. Before its value plummeted, the building was home to the likes of TechCrunch, Eventbrite, Zendesk and Adobe. A recent online listing showed that three out of the four floors are available for lease.

Vacancies have also crippled the owners of a historic 16-story building at 995 Market St., just down the street from San Francisco’s new Ikea. According to public records, Bridgeton Holdings has defaulted on a $45 million loan. The departure of WeWork in 2021 left the 90,000-square-foot building more than 80% vacant.

The Next Chapter

Rock-bottom pricing and increasing distress mean that property owners are finally starting to pull the trigger on deals, in a sign of activity likely to ramp up in the year ahead.

For example, at 55 New Montgomery St., the property’s lender actually purchased the building, which had similarly slipped into default in a foreclosure auction. CrossHarbor Capital Partners secured the 100,000-square-foot building for just $15 million, according to public records— a fraction of the $71.4 million loan it issued to the previous owners in 2018.

Falling property values have prompted other parties just last week to settle with lenders for a reduced price instead of the costly and time-consuming foreclosure process.

At the three-building North Park office complex at 560 Davis St., the property’s previous owner, Gaw Capital, swooped in and purchased the existing debt on the building for half-off. Additionally, the new owners saved on transfer tax because the property was handed over in a process known as a “deed in lieu of foreclosure,” according to public records.

Then, there is the interesting case of 115 Sansome St., where the Vanbarton Group won a competitive bid on a building it already owned. The owners reportedly closed an all-cash deal for around $35 million, which is less than the $54 million loan it took from Bank of America in 2016, according to public records.

In doing so, Vanbarton paid off its debt at a price more reflective of the building’s current value.

Local buyers and prospective tenants see the writing on the wall—and to some it spells opportunity.

“Right now, we know we have the best value in town,” said Roger Fields, principal of Peninsula Land & Capital.

In September, Fields purchased his first building in San Francisco, an entirely vacant office tower at 550 California St. At $40.5 million, the property went for less than half the price the previous owner paid 18 years ago.

Fields, alongside a handful of other opportunistic investors, have acquired various buildings in the city at heavily discounted prices over the past year. Since these buyers are not encumbered with the same debt of the previous owners, landlords like Fields can offer lower rents or invest the dollars they saved back into upgrading their properties.

The 13-story building that he bought was once owned and fully occupied by Wells Fargo. Fields wasted no time listing the floors for lease after closing on the purchase.

As of December, he said that his firm is already finalizing a lease with a new tenant, but declined to name them, although he noted the building lends itself to a broad variety of uses.

“To pay that price for a building in great shape, in a location like that, is just unheard of,” Fields said.

But that advantage still runs up against the reality of hybrid office work being here to stay. According to Raise Commercial Real Estate, which brokered the 476,000 square-feet OpenAI lease in October, office leasing activity fell by 33% in 2023 compared to the year prior.

Yet Fields is undeterred.

He said based on conversations with prospective tenants, he believes the work-from-home pendulum will swing back the other way.

“San Francisco has its problems, but it is too beautiful and valuable for those not to be solved eventually,” Fields said. “The Financial District is often lumped in with the other areas of the city with severe issues when it really shouldn’t.”

Questions, comments or concerns about this article may be sent to info@sfstandard.com

San Francisco, CA

St. Anthony's Foundation serves Christmas Day meals in San Francisco

San Francisco, CA

San Francisco hotel workers agree pay rise after 3-month strike

What’s New

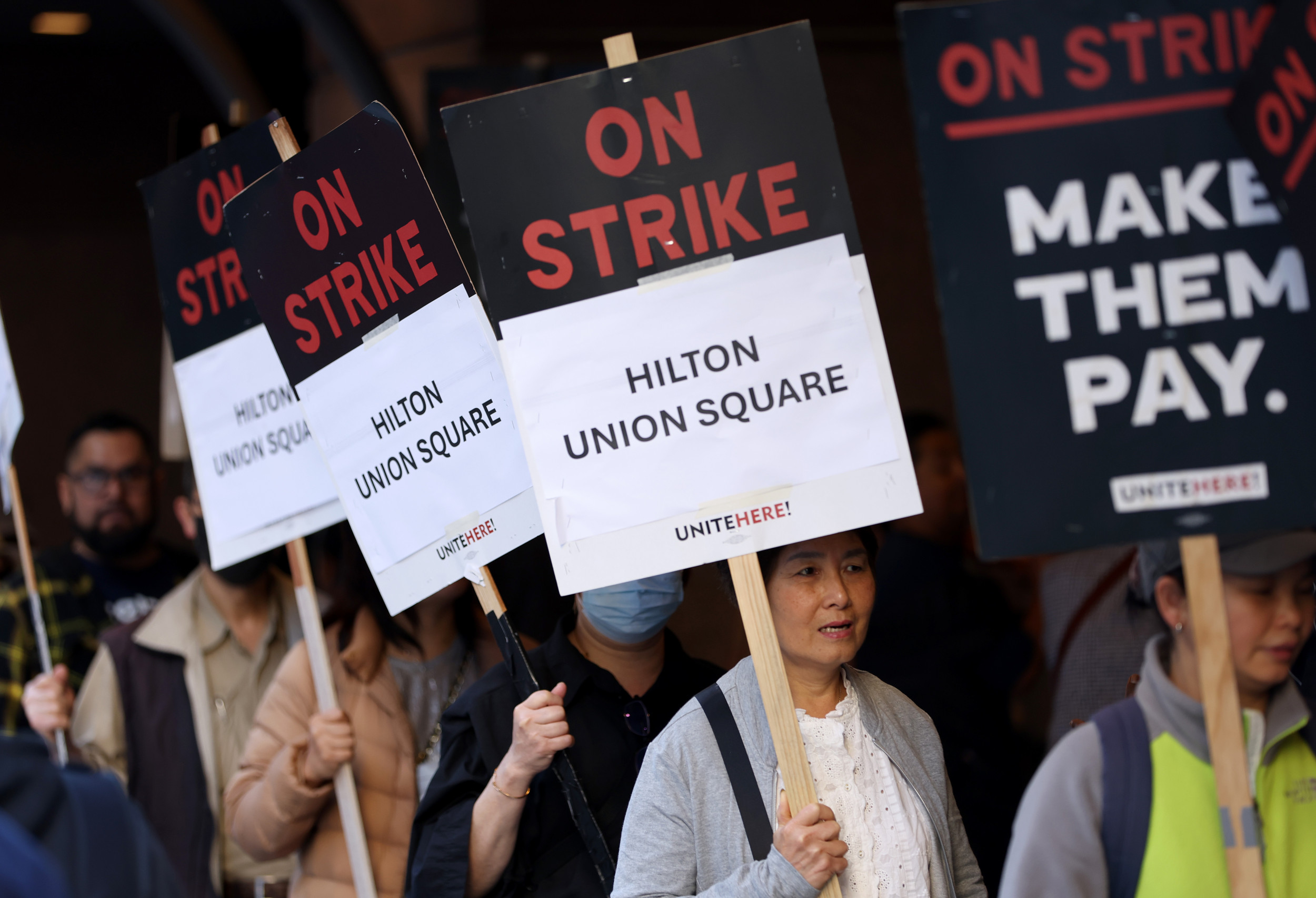

Hilton hotel workers in San Francisco voted on Christmas Eve to approve a new union contract after a 93-day strike, according to the Unite Here Local 2 union.

The union, which represents about 15,000 workers in the region, announced that the deal settles the last of the city’s 2024 hotel strikes, covering approximately 900 Hilton workers.

Newsweek has contacted Unite Here Local 2 and Hilton via email for comment.

Justin Sullivan/ASSOCIATED PRESS

Why It Matters

The new contracts after this year’s strikes establish significant improvements in wages, health care and workload protections for workers at Hilton, Hyatt and Marriott-operated hotels.

The agreements conclude months of labor unrest that involved thousands of workers and disrupted San Francisco’s hotel industry.

What To Know

Hilton workers voted 99.4 percent in favor of the agreement on Christmas Eve, which includes a $3 per hour immediate wage increase, additional raises, and protections against understaffing and increased workloads.

The four-year contract preserves affordable union health insurance and provides pension increases. The deal covers workers at Hilton San Francisco Union Square and Parc 55, with 650 workers having actively participated in the strike.

This agreement follows similar contracts reached with Hyatt workers on Friday and Marriott workers last Thursday, covering a total of 2,500 workers who had been on strike since late September.

What People Are Saying

Bill Fung, a housekeeping attendant at Hilton San Francisco Union Square for 29 years, said: “These 93 days have not been easy, and I’m so proud that my coworkers and I never gave up. We stood together through the rain and cold, and even though there were some hard days, it was all worth it. We will go back to work with our health care, good raises, and the confidence of knowing that when we fight, we win.”

Lizzy Tapia, President of Unite Here Local 2, said: “Hilton, Hyatt, and Marriott workers refused to give up their health care or go backwards – and we proved on the picket line that we’re not afraid of a tough fight. As contract talks begin with the city’s other full-service hotels in the new year, they should know that this is the new standard they must accept for their own employees.”

San Francisco Mayor-elect Daniel Lurie said on X: “All those that have been out on strike will be back to work, and just in time for Christmas. So, things are looking bright as we head into 2025.

What Happens Next

Unite Here Local 2 said it would push for other full-service hotels in San Francisco to adopt the same standards established by the Hilton, Hyatt, and Marriott agreements when contract negotiations resume in 2025.

San Francisco, CA

San Francisco hotel workers approve new contract, ending 3-month strike

SAN FRANCISCO — San Francisco Hilton hotel workers who have been on strike for the past three months voted Tuesday to approve a new union contract.

The approval by Unite Here Local 2 in San Francisco settles the last of three hotel strikes in San Francisco this year, union officials said.

The strikes at Marriott, Hyatt and Hilton hotels throughout the city began in the fall. Marriott workers reached agreements on Thursday, with Hyatt doing the same on Friday.

San Francisco Hyatt Hotel union workers unanimously approve new contract

The Hilton agreement is the same as those ratified by striking Hyatt and Marriott workers last week, according to Ted Waechter, spokesperson for the Unite Here Local 2 union.

The agreement applies to about 900 workers, 650 of which have been on strike for over three months, according to Waechter. The hotels include the Hilton San Francisco Union Square and about 250 workers at Hilton’s Parc 55 hotel, who had been prepared to go on strike.

All the deals with hotels include keeping the workers’ health plan, wage increases, and protections against understaffing and workload increases.

Many of the 2,500 hotel workers had been striking for about 93 days, picketing daily in Union Square, which is the site of a Hilton and the nearby Grand Hyatt on Stockton Street.

SF Hyatt Hotel union workers on strike to vote on ratifying tentative agreement for new contract

“These 93 days have not been easy, and I’m so proud that my coworkers and I never gave up,” said Bill Fung, a housekeeping attendant at the Hilton San Francisco Union Square for 29 years. “We stood together through the rain and cold, and even though there were some hard days, it was all worth it. We will go back to work with our health care, good raises, and the confidence of knowing that when we fight, we win.”

Hilton media representatives did not immediately respond to a request for comment.

San Francisco Mayor-elect Daniel Lurie on Tuesday issued a statement welcoming an end to the strike, saying it came just in time for the holiday season and allows workers to return to work for key events such as the JP Morgan Health Care Conference and NBA All-Star Game.

Unite Here Local 2 represents about 15,000 hotel, airport and food service workers in San Francisco and San Mateo counties and represented the striking hotel workers.

Copyright 2024 by Bay City News, Inc. Republication, re-transmission or reuse without the express written consent of Bay City News, Inc. Is prohibited.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology5 days ago

Technology5 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps

-

News6 days ago

News6 days agoNovo Nordisk shares tumble as weight-loss drug trial data disappoints

-

Politics6 days ago

Politics6 days agoIllegal immigrant sexually abused child in the U.S. after being removed from the country five times

-

Entertainment6 days ago

Entertainment6 days ago'It's a little holiday gift': Inside the Weeknd's free Santa Monica show for his biggest fans

-

Lifestyle6 days ago

Lifestyle6 days agoThink you can't dance? Get up and try these tips in our comic. We dare you!

-

Technology1 week ago

Technology1 week agoFox News AI Newsletter: OpenAI responds to Elon Musk's lawsuit

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology1 day ago

Technology1 day agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

News2 days ago

News2 days agoFrance’s new premier selects Eric Lombard as finance minister