Connecticut

Pandemic put tax burden on CT’s poorest, report shows

Connecticut’s already regressive tax system swung even more sharply onto the backs of its poorest residents during the coronavirus pandemic’s first year, according to a new fairness study from Gov. Ned Lamont’s administration.

The lowest-earning 10% effectively spent almost 40% of their income in 2020 to cover state or municipal tax burdens, more than five times the rate faced by Connecticut’s highest earners – and two-and-a-half times the statewide average, according to the tax incidence analysis released Thursday by the Department of Revenue Services.

The 39.9% state and municipal tax rate effectively paid by the poorest 10% also is up dramatically from the nearly 26% rate assigned to that same group by a 2022 DRS tax fairness study, which analyzed data from 2019.

Meanwhile, taxpayers in the two middle groups paid 13% and 11.5%, respectively, of their income to cover tax burdens in 2020, up from 9.2% and 8.6% in 2019.

“This latest study just confirms what people in Connecticut have been feeling in their wallets for the last several years — a dangerous combination of historic inflation, an upside-down tax system and an extreme disinvestment in critical public services and infrastructure,” said Norma Martinez-HoSang, director of Connecticut For All, a coalition of more than 80 labor, faith and civic organizations that has advocated for higher tax rates on wealthy households and corporations to finance relief for low- and middle-income families.

The study breaks Connecticut’s earners into deciles, or groups that earned 10% of all statewide income.

For example, it took the poorest 883,552 tax filers to earn about $19.3 billion, which was 10% of all statewide earnings in 2020. This the group that paid almost 40% of its income to state and municipal tax burdens.

Unlike in past reports, the administration did not include a projected income range for the households in this group. But dividing $19.3 billion by 883,552 filers yields a rough average income of slightly more than $21,843 per year.

The second decile includes the next-highest earners, another 316,630 filers, who also made $19.3 billion. Their effective tax rate was 19.8%, and their average income was $60,960.

MORE STORIES IN BUDGET/ECONOMY

CT lawmakers, Lamont add $17 million to winter heating assistance

CT legislators to consider adding $13.5M for winter heating assistance

The highest decile, the top 10%, involves 478 filers that earned $19.3 billion. This is the group that paid 7.3%, or less than one-fifth the rate of the poorest decile, and earned an average of $40.3 million.

Roughly two-thirds of all revenues generated by state and local government combined in 2020 came from property, sales and other taxes that largely are regressive in nature, the study found.

A regressive tax does not adjust rates based on a household or business’s earnings or wealth. A progressive levy, such as the state income tax, features multiple rates that collect more as the filer’s income increases.

A second problem with regressive taxes is that responsibility for the bill can more easily be shifted, something that’s particularly burdensome for poor households, the study found.

For example, renters effectively pay some or all their landlords’ property taxes. Gasoline distributors shift wholesale fuel tax burdens onto service stations, which pass the full cost on to motorists.

As a supplement, the report also covered a second methodology that relies upon only half of the tax burden shifts that the primary section of the report assumes. But even under this scaled back version, the lowest earning 10% of filers pay an effective rate of almost 33%, while the richest 10% pay 7.3% and the statewide average is 13.4%.

Lamont, a Greenwich businessman and fiscally moderate Democrat who says higher tax rates would prompt Connecticut’s wealthy to flee the state, said through a spokeswoman that his administration has been and continues to work to make the state’s overall tax system more progressive.

“Gov. Lamont is strongly committed to making our tax structure more progressive so that all Connecticut residents have an opportunity to succeed here,” spokeswoman Julia Bergman said. “That’s why, in recent years, the governor and the legislature have cut taxes for working families, boosted the Earned Income Tax Credit and expanded exemptions on certain pension and annuity earnings to benefit seniors.”

Bergman was referencing a series of tax changes enacted last year that represented the single-largest state income tax cut in Connecticut history, a package expected to save low- and middle-income families $200 to $400 each next fiscal year, more than $415 million in total.

Lamont and legislators also enacted a broad package of tax cuts in 2022 that included temporary relief, such as a 13-month gasoline tax holiday and an income tax rebate for households with children. But it also expanded a state income tax credit that offsets a portion of municipal property tax burdens and reduced the statewide property tax cap on motor vehicles from 45 mills to 32.46 mills. (One mill generates $1 of tax revenue for every $1,000 of assessed property value.)

Because tax fairness studies routinely lag several years of tax data, the recent relief Lamont approved is not included in the latest analysis.

“There’s definitely value in looking at this [study], but also I think the next set of studies will really tell the tale in terms of the progressivity that’s been implemented by this governor,” said Department of Revenue Services Commissioner Mark Boughton.

But critics counter that Connecticut’s tax system has overburdened the poor and middle class for decades, and recent relief won’t reverse an overall trend toward worsening inequity. They say economic damage caused by the pandemic continues even now, while the 40-year high in national inflation reached in mid-2022 also set Connecticut families back.

“We expect Gov. Lamont to respond with a reminder of recent tax cuts, which will have little impact on our state’s extreme economic inequities,” Martinez-HoSang said, adding that an income tax surcharge on the capital gains earnings of Connecticut’s wealthiest families could create significant economic change.

Connecticut Voices for Children, a progressive, New Haven-based policy think-tank, renewed its call Thursday for a new state income tax credit for low- and middle-income filers with children. It argues this credit could channel $300 million annually to assist about 80,000 kids.

Connecticut Voices’ executive director, Emily Byrne, said her group has just begun its review of the latest tax fairness report but said the overall problem the General Assembly faces is clear.

“The report not only reaffirms that our state’s tax system is regressive, but it also reaffirms why this report is so important,” she said, “because it allows the legislature to make informed decisions. … It’s also clear that more families need help.”

The Yankee Institute, a conservative fiscal policy group in Hartford, had just begun its review of the tax study late Friday. But spokesman Bryce Chinault said, “This report demonstrates why the recent income tax reforms were so important to Connecticut residents, and why the fiscal guardrails are vital to building upon that success.”

Those “guardrails” are a reference to caps on spending and borrowing and other savings programs that have helped reduce state debt by billions of dollars since 2020, which advocates say enables state government to channel more resources to cities and towns.

Members of the legislature’s tax-writing Finance, Revenue and Bonding Committee received the report Thursday morning, and leaders said the 77-page analysis would get close attention in the coming weeks.

But both Sen. John Fonfara, D-Hartford, who co-chairs the panel, and Rep. Holly Cheeseman of East Lyme, ranking House Republican on finance, said it’s clear Connecticut must find a way to ease property tax burdens.

The property tax generated nearly $12 billion in revenue in 2020, more than any other state or municipal tax did, and represented 38% of all tax revenue raised in Connecticut that year.

Fonfara pushed two years ago to boost rates on Connecticut’s richest families and on large corporations and set up a new fund to support economic development and other services in the state’s poorest cities. It was blocked by Lamont and other fiscal moderates and conservatives.

House Speaker Matt Ritter, D-Hartford, brokered a compromise that abandoned the tax hikes but authorized $175 million in annual bonding for urban investment that began in the 2022-23 fiscal year and runs through 2026-27.

The property tax “punishes those who have the least income,” Fonfara said Thursday, adding that the high mill rates in Connecticut’s urban centers make it very hard to attract commercial and industrial development. “It pits one town against another.”

Connecticut

Connecticut takes aim at the college affordability crisis — 'We're trying to do everything we can,' governor says

Hartford, Connecticut

Sean Pavone | Istock | Getty Images

When it comes to improving access to higher education, each state is largely left to its own devices. Some are trying a broader array of tactics than others.

Connecticut, for example, recently rolled out several programs to establish pathways to college and lower the debt burden.

Connecticut has also maintained one of the largest wealth gaps in the country for years. The state is hoping its college aid endeavors could help change that.

Getting a degree offers the best shot at social mobility, according to Anthony Carnevale, director of Georgetown’s Center on Education and the Workforce, which could help narrow the income divide.

Still, these plans have mostly flown under the radar. “We have these incentive programs, but nobody knows about them,” Connecticut Gov. Ned Lamont told CNBC.

Here’s a closer look at three of those initiatives — and how they’ve fared so far.

Free college program

“We’re trying to do everything we can to make education less expensive to start with,” Lamont said.

Like a growing number of states, Connecticut recently introduced a free tuition program for students attending community college either full- or part-time. In Connecticut, students receive “last-dollar” scholarships, meaning the program pays for whatever tuition and fees are left after federal aid and other grants are applied.

Since the program started, in the 2020-21 academic year, nearly 34,000 students have participated.

Free college is one of the best ways to combat the college affordability crisis, some experts say, because it appeals more broadly to those struggling in the face of rising college costs, rather than the student loan burden after the fact. A federal effort has yet to get off the ground, although President Joe Biden continues to push for free community college nationwide and included it in his $7.3 trillion budget for fiscal 2025.

However, critics say that lower-income students, through a combination of existing grants and scholarships, already pay little in tuition to two-year schools, if anything at all.

Further, free college programs do not generally cover books or other expenses, such as room and board, that lower-income students also struggle with.

Automatic admission program

To make a four-year degree more accessible, Connecticut introduced an automatic admission program to some Connecticut colleges for high school seniors in the top 30% of their class.

The program, signed into law in 2021, aims to make it easier for high school students, especially those from underserved communities, to go to college. In the most recent application cycle, 2,706 students were offered direct admission through the program.

More from Personal Finance:

FAFSA fiasco may cause drop in college enrollment, experts say

Harvard is back on top as the ultimate ‘dream’ school

This could be the best year to lobby for more college financial aid

Connecticut State Colleges and Universities Chancellor Terrence Cheng said the free-tuition program and the automatic admissions program “are just two examples of steps CSCU and the state have taken to remove barriers to higher education, particularly for first-generation college and minoritized students.”

And yet, for lower-income students, the cost can still be a deterrent, said Sandy Baum, senior fellow at Urban Institute’s Center on Education Data and Policy.

“Both admitting students and telling them how easy it is to pay for it is most helpful, but for students on the margin, they face so many expenses in addition to tuition they will still need to overcome,” Baum said.

Student loan payment tax credit

Next up, the state is rolling out a student loan repayment program to lessen graduates’ debt burden.

In 2019 Lamont signed Public Act 19-86, which created a new tax credit for Connecticut employers who help pay off their employees’ student loans. The tax credit was expanded in 2022 and will be implemented in the months ahead.

“It helps the student, it pays down their debt, makes it very predictable [and] gives businesses an incentive to hire, so it’s a great economic development driver,” Lamont said.

Still, some graduates already pay little or nothing through the federal government’s income-driven repayment plans, Baum said, so borrowers may be better served with a salary increase. “If employers paid more, that would be a lot more fair.”

Ultimately, these programs are all helpful to some degree, but successfully narrowing the wealth gap — in Connecticut and elsewhere — should include assistance for students while they are in college, Baum said.

Improving student outcomes by providing academic and social support in addition to financial aid is the best way to level the playing field, she said.

Many young adults start college, fewer finish. “Rather than focusing on getting people in the door … getting people through is going to have a much bigger impact,” Baum said.

Subscribe to CNBC on YouTube.

Connecticut

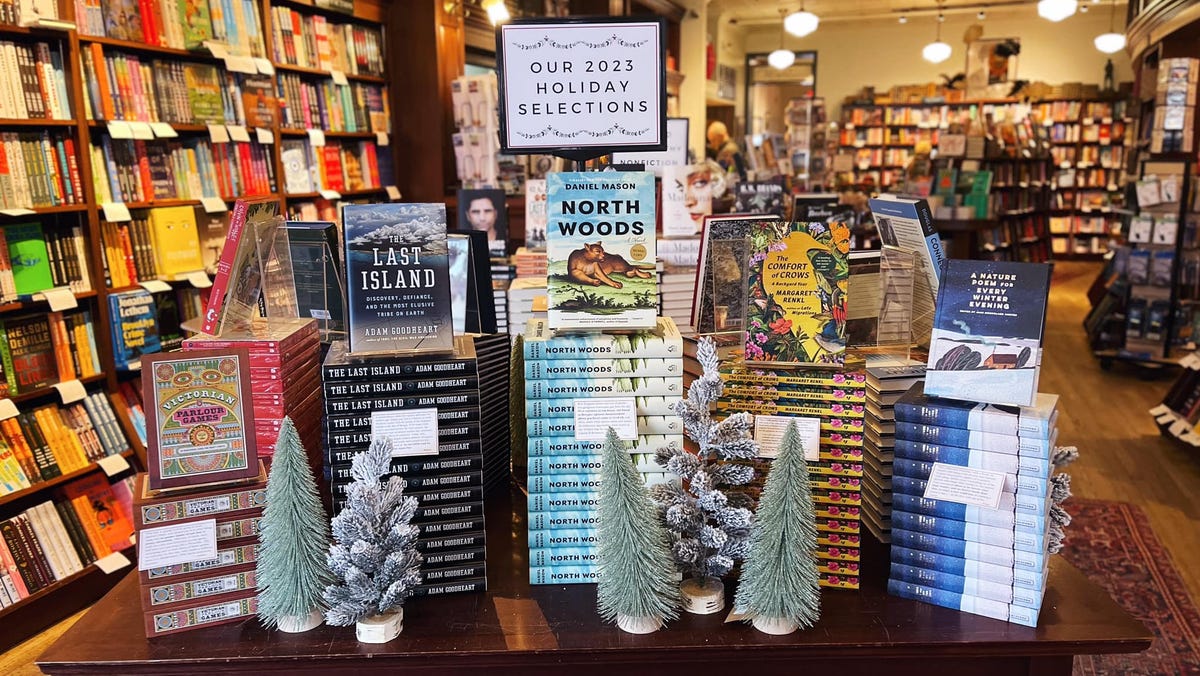

Meet RJ Julia Booksellers, a local bookstore housed in a 105-year-old Connecticut building

Independent bookstores are the heartbeats of their communities. They provide culture and community, generate local jobs and sales tax revenue, promote literacy and education, champion and center diverse and new authors, connect readers to books in a personal and authentic way, and actively support the right to read and access to books in their communities.

Each week we profile an independent bookstore, sharing what makes each one special and getting their expert book recommendations.

This week we have RJ Julia Booksellers in Madison, Connecticut!

RJ Julia Booksellers opened 30 years ago as an independent bookstore with a mission to be a place where words matter, where writer meets reader and where the ambiance and book selection creates an opportunity for discovery.

The store hosts more that 300 events each year and has won several major awards, including Publishers Weekly Bookseller of the Year, Lucile Pannell award for bookselling excellence, Connecticut Magazine Best Bookstore, Connecticut Retailers Award for Community Commitment, the Advocate’s Best Bookstore and the New Haven Business Small Business Award.

The building was built in 1919, and has been home to several businesses. When RJ Julia founder Roxanne J. Coady bought the building in 1989, it was carefully restored. Today, the beautiful historic building is filled with restored or replicated features, like the tin tile ceiling, as well as tributes to the businesses that lived there before RJ Julia.

Marketing Manager Elizabeth Bartek revealed her favorite section. “The entire second floor is dedicated to young readers,” she said. “Including ‘A Room of One’s Own,’ featuring a wide variety of young adult novels!”

Bartek says indie bookstores are a vital part of creating and sustaining community and connection.

“At our indie bookstore, we have built an enduring community. We’ve watched children become parents, celebrated as long-time customers became grandparents, and watched families grow and change, experiencing both joy and sadness. Together, by shopping locally and supporting independently-owned businesses, we can preserve that sense of place and connection.

“The continued enthusiasm and loyalty from our customers allows us to be proud passionate members of our community — to continue employing local townspeople, paying taxes in our community, and donating to local nonprofits.”

RJ Julia has an event scheduled nearly every day of the week! Fans of Erik Larson can find him in store on May 23, where he’ll be discussing his latest title “The Demon of Unrest.” If a story time is more your style, Amy Guglielmo will read her new Lucille Ball biography, “Lucy!”, and lead a craft session on June 1.

You can find the details for these events and more on RJ Julia’s events calendar!

Check out these books recommended by the RJ Julia staff:

“The Mysteries” by Bill Watterson

“The Museum of Ordinary People” by Mike Gayle

Connecticut

Wild video shows smash-and-grab thieves trash Connecticut jewelry store

A pair of masked thieves armed with heavy hammers committed a brazen midday smash-and-grab heist at a jewelry store in Connecticut Thursday afternoon.

Police in Westport said on Facebook they’re searching for the culprits, who drove away in a black BMW sedan after bashing in several display cases at Lux Bond & Green.

“Employees of the store reported two individuals wearing masks and gloves entered the store with sledgehammers and began smashing display cases with sledgehammers,” cops said. “The employees safely retreated to the rear of the store and had no interaction with the suspects.”

How much merchandise the thieves stole wasn’t immediately clear. The store did not immediately respond to a request for comment.

-

Politics1 week ago

Politics1 week agoThe White House has a new curator. Donna Hayashi Smith is the first Asian American to hold the post

-

News1 week ago

News1 week agoPolice enter UCLA anti-war encampment; Arizona repeals Civil War-era abortion ban

-

)

) Movie Reviews1 week ago

Movie Reviews1 week agoThe Idea of You Movie Review: Anne Hathaway’s honest performance makes the film stand out in a not so formulaic rom-com

-

News1 week ago

News1 week agoSome Florida boaters seen on video dumping trash into ocean have been identified, officials say

-

World1 week ago

World1 week agoUN, EU, US urge Georgia to halt ‘foreign agents’ bill as protests grow

-

World1 week ago

World1 week agoIn the upcoming European elections, peace and security matter the most

-

Education1 week ago

Education1 week agoVideo: President Biden Addresses Campus Protests

-

World1 week ago

World1 week agoArizona Senate repeals near-total 1864 abortion ban in divisive vote