Beijing and Washington began high-stakes trade negotiations in Geneva on Saturday as Chinese official media reiterated calls for the US to lift its tariffs on exports from the country to show its “sincerity”.

The meeting between Chinese negotiators led by Vice-Premier He Lifeng and a US team headed by Treasury secretary Scott Bessent comes a day after Donald Trump signalled his openness to cutting tariffs on China to de-escalate their trade war.

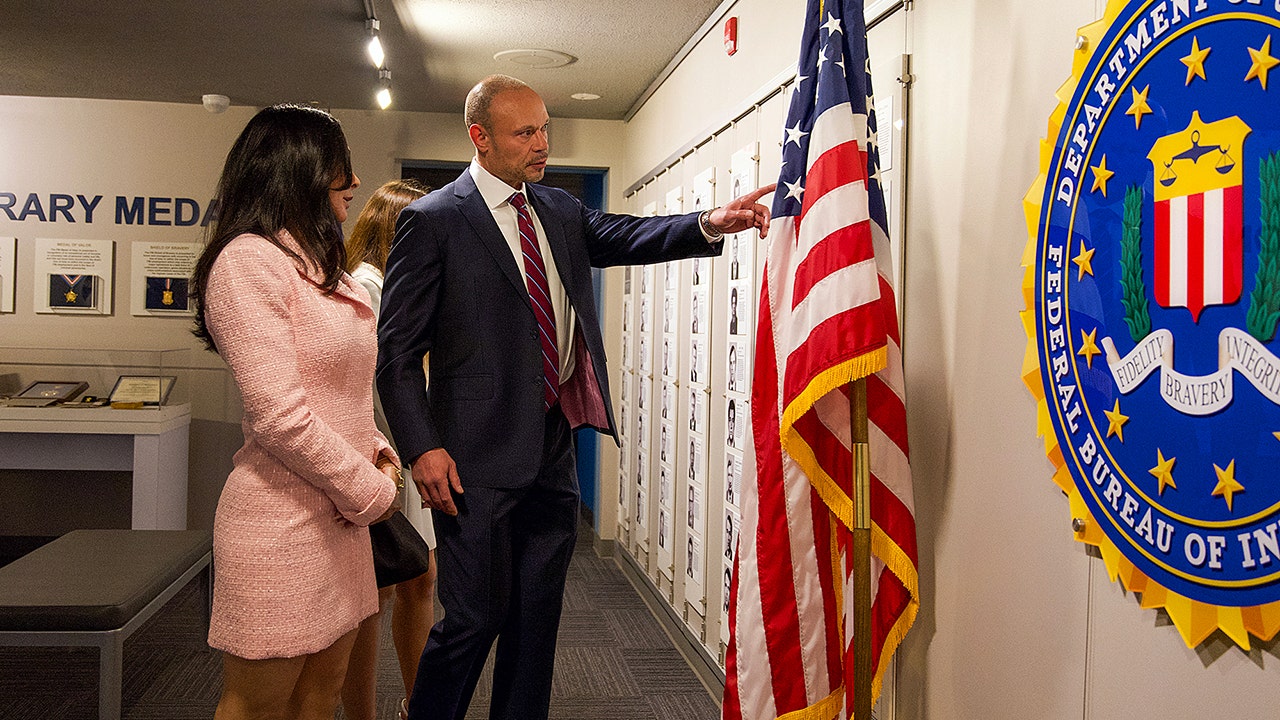

“High-level economic and trade talks between China and the United States began in Geneva,” state news agency Xinhua said in a brief statement on the meeting, which is expected to last two days. It did not provide further details on He’s team. Bessent is being accompanied by trade representative Jamieson Greer in the talks.

Late Saturday, a person familiar with the matter said the talks had convened for the day and would resume on Sunday.

In a post on his Truth Social platform, Trump said the two sides had negotiated “a total reset negotiated in a friendly, but constructive, manner.”

On Friday, Trump suggested the US could cut its tariffs to 80 per cent on Chinese goods from 145 per cent, while calling on Beijing to open its markets to American products. But he added it was up to Bessent.

People familiar with the matter said it was important not to take Trump literally and that the figure was probably a negotiating tactic.

Washington and Beijing have engaged in tit-for-tat tariff measures since Trump placed levies on China in February. Bessent later said that the overall level of tariffs in both directions amounted to a de facto trade embargo that was “not sustainable”.

Ahead of the talks, Bessent lowered expectations of a big economic and trade deal. He said the talks were focused on reducing tariffs in both directions to create space for longer-term negotiations that would focus on more than just the US trade deficit.

The Chinese Communist party’s nationalist tabloid, the Global Times, on Saturday repeated calls from Beijing for the US to lower tariffs to lay the groundwork for talks.

“The US should make preparations and take actions on issues such as correcting its wrong practices and lifting the unilateral tariffs,” it quoted the country’s commerce ministry as saying.

A resolution “hinges on whether Washington can demonstrate the necessary sincerity in talks”, the Global Times said.

It repeated a Chinese saying that “to untie the bell, you need the person who tied the bell” — meaning the person who created a problem is responsible for resolving it. However, Trump has said that he was not willing to unilaterally reduce tariffs.

Beijing is also concerned about a US trade deal with the UK, the first struck by Washington after it imposed “reciprocal” tariffs on partners last month.

As part of the agreement, the UK has accepted strict US security requirements for its steel and pharmaceutical industries, in what diplomats see as a template that Washington could use to exclude China from other countries’ strategic supply chains.

China trade data for April showed international commerce remained resilient despite US tariffs, largely because of higher shipments to third countries, especially some in south-east Asia that are known as conduits for Chinese exports to the US.

Before agreeing to the weekend trade talks, there were several weeks of debate in Beijing about the best way to manage Trump’s demands, with some officials opposed to talks before the US took good faith measures such as cutting tariffs, according to two people briefed on the discussions.

One of the people said that some officials were also concerned about the signal it would send to other countries if Beijing decided to negotiate, believing it might lessen their resolve to stand fast alongside China in upholding the WTO led trade order.

Chinese officials are most worried about the US pushing its allies to form a new trade order without it.

China this week sought to make an example out of India for favouring the US in its dealings, imposing anti-dumping duties of up to 166.2 per cent on imports of an Indian pesticide, Cypermethrin.

Aside from tackling dumping, the action was intended to warn other countries not to use China as a bargaining chip in trade talks with the US, said Yuyuan Tantian, a social media account affiliated with China’s state broadcaster CCTV.

It pointed to a decision by New Delhi to impose a 12 per cent temporary tariff on some imported steel last month, with China the “main target”, on the same day that JD Vance, US vice-president, visited India.

“Many analysts have pointed out that India’s move is likely to cater to the United States’ crackdown on China’s manufacturing industry,” said Yuyuan Tantian.