Reporting by Rachel Savage and Andrea Shalal, Editing by Jorgelina do Rosario, Karin Strohecker and Toby Chopra

Finance

Zambia poised to sign debt restructuring MoU -finance minister

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VTH2ZNGJIZLQFJWDPHV5G2DYTA.jpg)

[1/2]Zambia’s Finance Minister Situmbeko Musokotwane attends a panel on the fourth day of the annual meeting of the IMF and the World Bank, following last month’s deadly earthquake, in Marrakech, Morocco, October 12, 2023. REUTERS/Susana Vera Acquire Licensing Rights

MARRAKECH, Morocco, Oct 12 (Reuters) – Zambia is poised to sign a Memorandum of Understanding (MoU) on its debt restructuring with official creditors, its finance minister said on Thursday – a key step to securing the next tranche of funding from the International Monetary Fund.

IMF Managing Director Kristalina Georgieva had said earlier on Thursday that Zambia had already signed the MoU, when speaking on a panel at the IMF and World Bank Annual Meetings in Marrakech.

However, clarifying the timeline, Finance Minister Situmbeko Musokotwane said the actual signing had yet to happen, though it was imminent.

“From Managing Director Kristalina’s mouth to god’s ears, the MoU will hopefully be signed next week, we are very close to finalising it,” Musokotwane said in a statement sent to reporters after the event.

Zambia was the first African country to default on its debt in the pandemic era and its restructuring process, which saw it agree broad terms to rework $6.3 billion of debt with official creditors in June, has been beset by delays.

“An agreement on an MoU is nearly finalized and the signing is expected soon. More details will be made available then,” an IMF spokesperson added in a statement after the panel finished.

Our Standards: The Thomson Reuters Trust Principles.

Finance

SC partners IsDB to advance Islamic Capital Market, Social Finance

PETALING JAYA: The Securities Commission Malaysia (SC) today signed a Memorandum of Understanding (MoU) with the Islamic Development Bank (IsDB) Group, paving the way for greater cooperation in Islamic capital market (ICM) and broadening the reach of Islamic fintech and social finance, particularly waqf.

Prime Minister Datuk Seri Anwar Ibrahim and IsDB president and chairman Dr Muhammad Al Jasser, witnessed the signing of the landmark MoU, the first-of-its-kind between the Malaysian capital market regulator and the premier multilateral development bank of the Global South.

The SC chairman, Datuk Seri Dr Awang Adek Hussin and IsDB vice president, finance and chief financial officer, Dr Zamir Iqbal signed the MoU on the sidelines of the IsDB Annual General Meeting 2024 in Riyadh.

Anwar and Muhammad Al Jasser, in their meeting in March 2023, had agreed that regulators, authorities and businesses in Malaysia to work closely with IsDB to explore new areas of collaboration. These include developing and piloting innovative Islamic finance products, promoting the halal industry, and supporting micro, small and medium enterprises (MSMEs).

Under the MoU signed this morning, both the SC and IsDB will collaborate in several key areas. These include facilitating innovation in Islamic fintech, promoting development of Islamic social finance, and encouraging inflow of investments, among others.

It also aims to increase capacity building, knowledge sharing and joint technical projects in key interest areas related to ICM, which can also be capitalised by both institutions for the benefit of other IsDB member countries.

Awang Adek said the synergistic collaboration marked a historic milestone for the SC and IsDB.

“We now intend to broaden and deepen Islamic fintech state of play via scalability and new markets as well as amplify opportunities through social finance including development of waqf assets, by using our respective capital markets and financial development expertise,” he added.

Through greater collaboration, he said both parties can also develop and scale up the MSMEs, in support of their aspirations.

Muhammad Al Jasser said, “Under this MoU, the Securities Commission Malaysia and IsDB will collaborate to enhance Islamic fintech, social finance, and attract foreign investment in private markets. This will enhance the Islamic capital markets not only in Malaysia but also across IsDB Member Countries. This partnership prioritises support for MSMEs and private markets, which are crucial for economic empowerment.”

Awang Adek added that this MoU is also in line with the key strategic initiatives for the Malaysian ICM under the Capital Market Master Plan 3 (2021 – 2025), including expanding the reach of ICM to the broader stakeholders of the economy and embracing collaboration and innovation for growth.

To that end, the SC together with its affiliate, Capital Markets Malaysia recently engaged with various stakeholders in Abu Dhabi, Dubai and Riyadh. This includes lending Malaysia’s voice to reinforcing ICM’s impact and enhancing Malaysia’s global thought leadership.

In several panel sessions in the region, the SC’s executive director of Islamic Capital Market, Sharifatul Hanizah Said Ali spoke about how ICM can be harnessed to structure innovative financing instruments to further advance social impact investing, sukuk issuances and Islamic asset management.

In 2023, the Malaysian ICM grew 4.5% to RM2.4 trillion while sukuk outstanding rose by 7.4% and Shariah-compliant equities by 1.5%.

Malaysia remains the global leader in ICM, particularly in sukuk outstanding as well as Islamic fund management, securing top rankings in global indices including Islamic Fintech Index, the Global Islamic Economy Indicator and the global Islamic Finance Development Indicator for the 10th consecutive year.

Finance

US asset managers increase BTC portfolio allocation as Borroe Finance shines

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Legacy Wealth and United Capital Management have invested $20 million in Bitcoin through Fidelity’s ETF, while Borroe Finance raises nearly $4 million by monetizing future earnings via NFTs.

While US Asset Management firms invest over $40.88 million into FBTC to increase BTC portfolio, Borroe Finance (ROE) continues paving its path to become one of the top defi coins. Given its price trajectory and real-life use cases, ROE has emerged as a beacon of hope to investors.

US asset managers bought Bitcoin through Fidelity’s ETF

As per Eric Balchunas’s tweet on April 23, 2024, it is revealed that two different US investment advisors have bought Bitcoin through Fidelity’s ETF. These were Legacy Wealth Asset Management from Minnesota and United Capital Management from Kansas. They put $20 million to FBTC. So now, they have allocated 6% and 5% of their portfolios.

Reports reveal that these US Asset management firms’ allocations have surpassed $17 million which was invested into BlackRock’s ETF and IBIT. Moreover, United Capital Management’s website also posted a banner of “WE’RE COMING FOR YOUR COINS DEGENS.” But it was taken down soon after.

This influx of around $40.88 million investment in FBTC has boosted spot Bitcoin ETF inflows, dominating in April’s second-week outflows.

Despite making remarkable inflows in the spot Bitcoin ETF, there was barely any impact on the Bitcoin price trend. However, BTC has experienced a noticeable 3.35% surge in the third week of April, trading at around $64,100.

Borroe Finance attracts investors

Borroe Finance is taking the crypto world by storm. It has emerged as a pioneering force in the CrossFi arena, offering an AI-funding marketplace for avid web3 users and businesses. This approach to crowdfunding has become a stand-out for users as well as investors.

That’s why Borroe Finance has been making rapid waves in the presale stages. This ongoing presale success has blown investors’ minds.

Borroe Finance’s platform allows web3 players to generate upfront cash. By converting their future earnings into popular NFTs, these players can trade those NFTs in the secondary marketplace. Additionally, the marketplace is streamlined with a P2P ecosystem for trading convenience.

Moreover, Borroe Finance has adopted many unique approaches in its utility token. Some of them are token burn strategies, liquidity lock mechanisms, and many more, which will boost the value of ROE by stirring demands in the market.

For instance, Borroe Finance has already raised $3.97 million by selling over 298 million ROE tokens. This has showcased ROE’s growing optimism in the market. Anyone willing to buy ROE right now can get it at $0.02.

Once the presale ends, ROE will hit the mainstream market at $0.025. With this price surge, early investors will receive a 150% hike on their investment.

To learn more about Borroe Finance, visit the Borroe Finance Presale, join the Telegram group, or follow Borroe Finance on Twitter.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Finance

Global Innovation Lab for Climate Finance Surpasses 100-Member Organizations – CPI

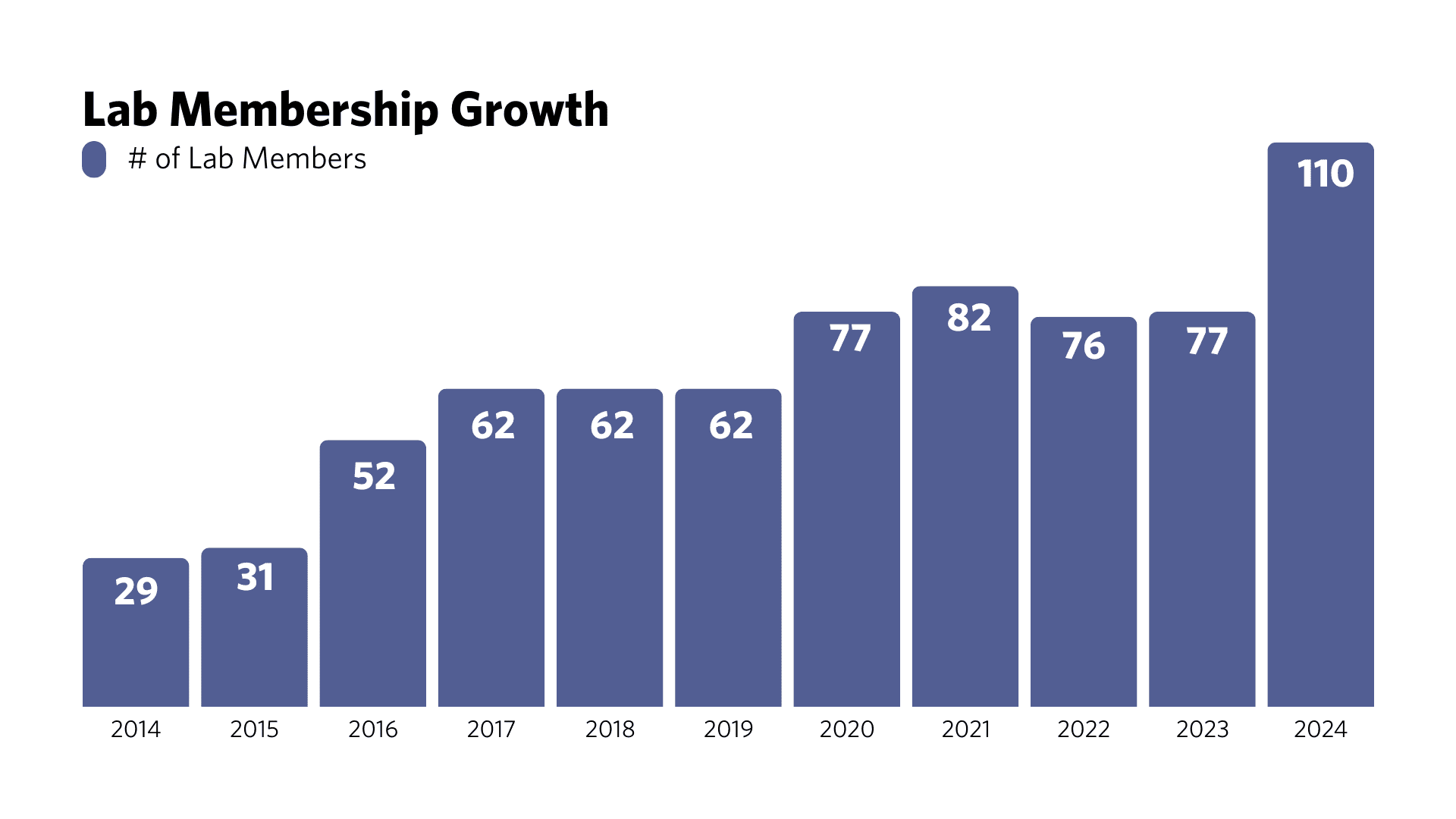

The Global Innovation Lab for Climate Finance (the Lab) proudly announces a significant expansion in its membership. Over 100 distinguished public and private organizations are now joining forces to accelerate climate finance innovation and drive private investments in emerging markets.

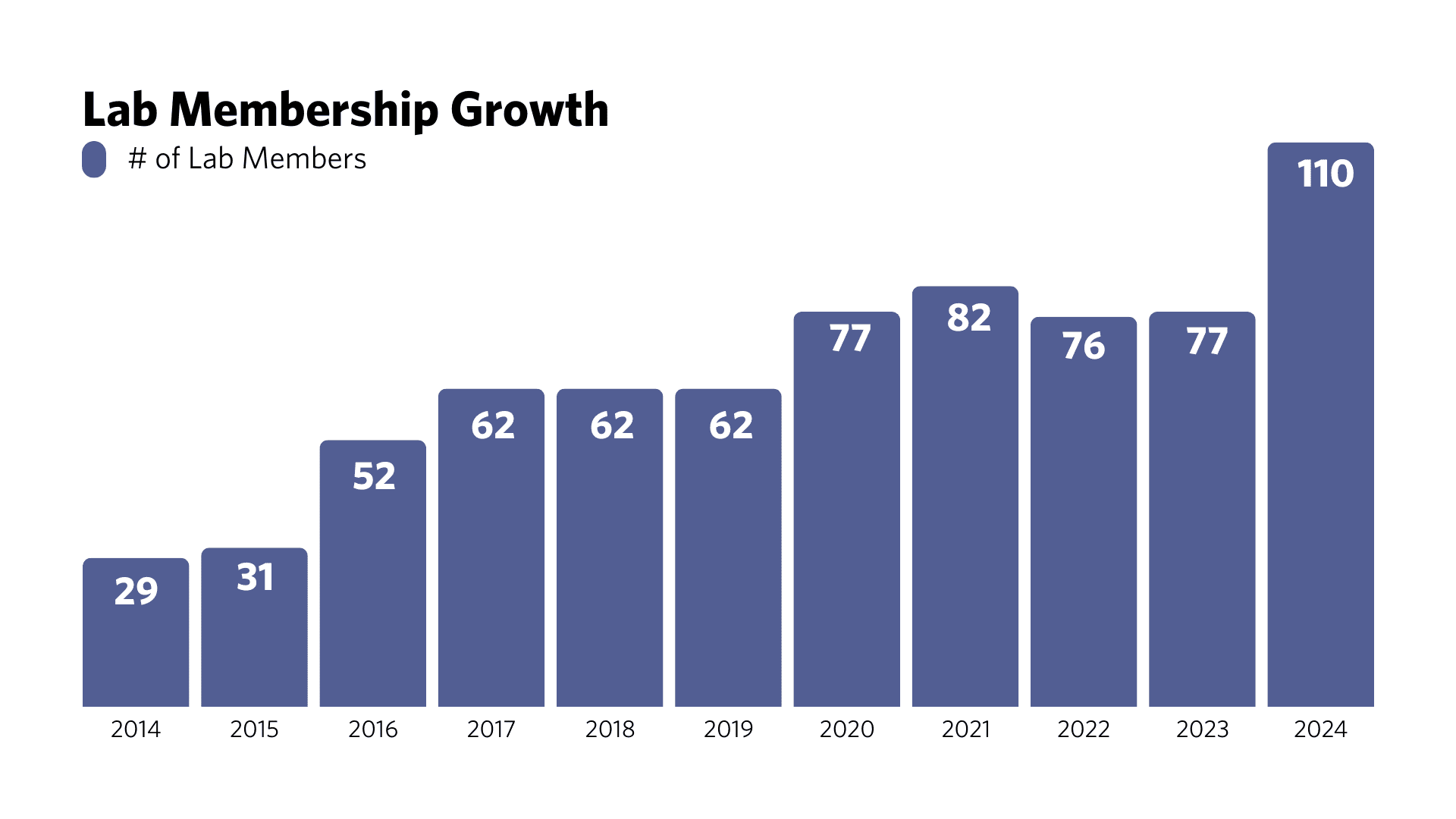

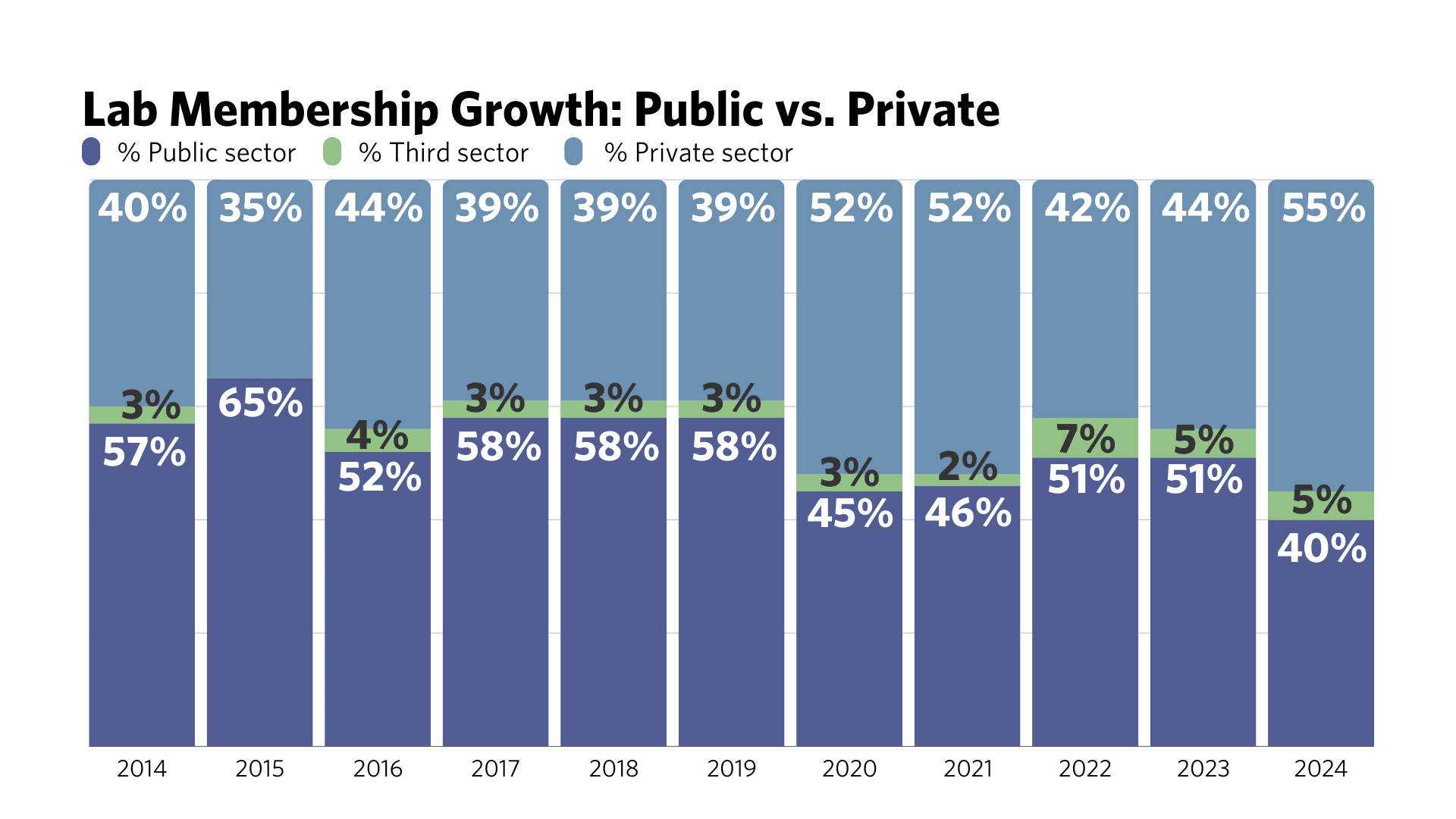

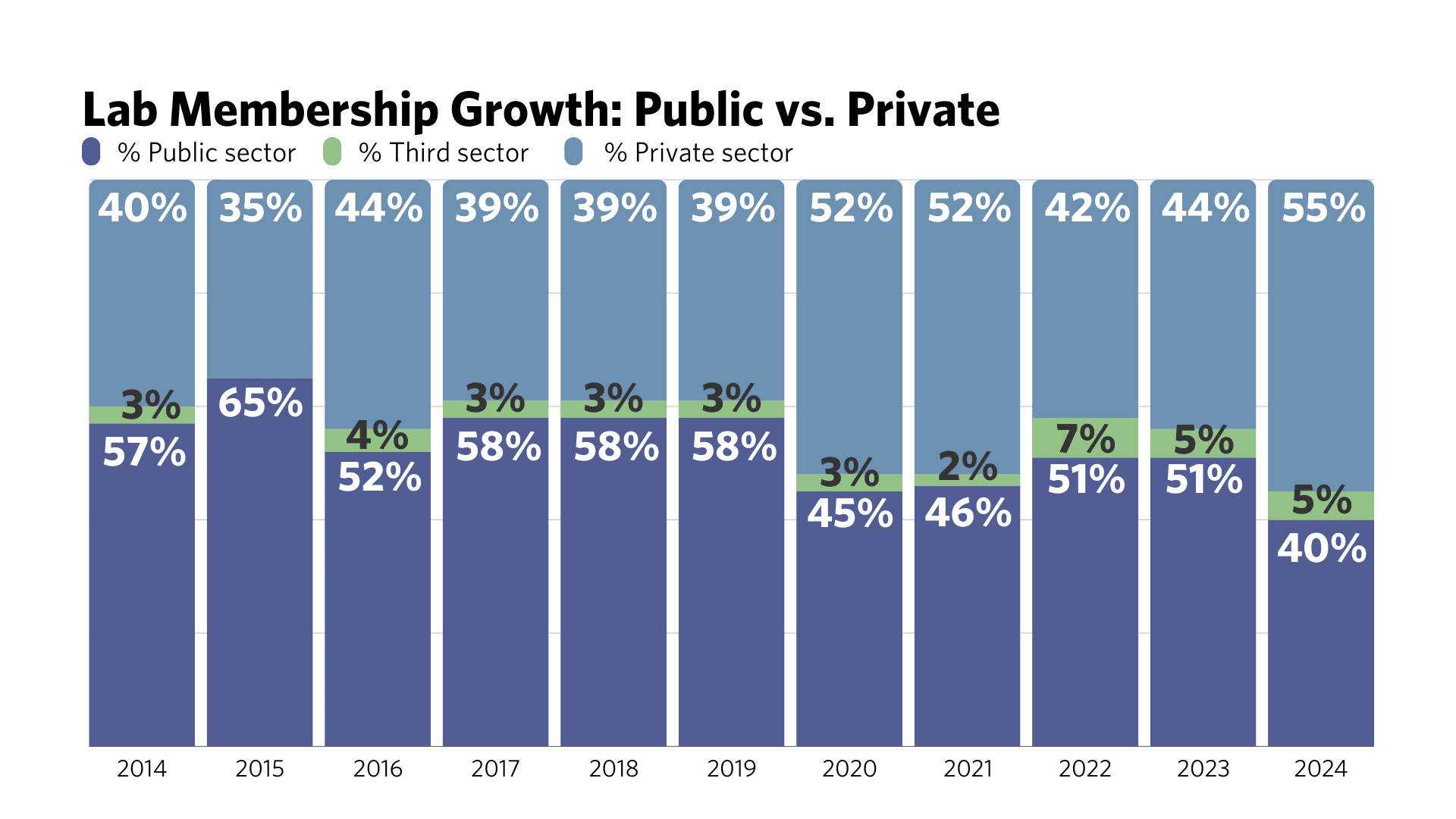

The Lab’s membership has skyrocketed nearly fourfold in 10 years, from 29 organizations at the inaugural Lab meeting in 2014 to 110 global and regional members today. Over the years, the Lab has seen a steady rise in private sector participation, with private members now making up 55% of the total, compared to 41% in 2014.

This growth follows the Lab’s successful launch of regional programs in the Philippines and Latin America and the Caribbean. New regional panel members from these areas join a growing network of experts across existing programs in Brazil, East and Southern Africa, and India. Additionally, the Lab welcomes new global members, strengthening its ability to identify and develop transformative financial instruments.

“We need to see bold ideas come forward and support the teams who pursue them. As a new global member, we are very happy to have supported the selection process of the Lab’s 10th cohort and to contribute to developing these outstanding teams and endeavors. The collaborative spirit among members points to a powerful force for tackling climate challenges,” said Elvira Lefting, Managing Director at Finance in Motion.

A substantial portion of the Lab’s portfolio mobilization figures, which now exceed USD 4 billion, is a result of direct investments from its diverse membership and broader network. The Lab continues to unlock new opportunities through collaborative efforts and scale up impactful climate finance initiatives globally.

“The Lab’s membership is the core driver of the Lab’s success. Our member institutions bring a wealth of expertise, dedicated support, and financial capital to the table, amplifying the Lab’s capacity to catalyze sustainable investments in emerging markets,” said Ben Broché, Climate Policy Initiative’s Associate Director, who leads the Lab’s efforts.

About the Lab

The Global Innovation Lab for Climate Finance identifies, develops, and launches innovative finance instruments that can drive billions in private investment to action on climate change and sustainable development. Bloomberg Philanthropies, the United Nations Development Programme, and the governments of Canada, Germany, the United Kingdom, and the United States fund the Lab’s 2024 programs. Climate Policy Initiative serves as the Secretariat and analytical provider.

For media inquiries or further information, please contact:

Júlio Lubianco

Communications Manager

julio.lubianco@cpiglobal.org

Sam Goodman

Communications Associate

sam.goodman@cpiglobal.org

-

News1 week ago

News1 week agoIs this fictitious civil war closer to reality than we think? : Consider This from NPR

-

World1 week ago

World1 week agoShipping firms plead for UN help amid escalating Middle East conflict

-

Politics1 week ago

Politics1 week agoICE chief says this foreign adversary isn’t taking back its illegal immigrants

-

Politics1 week ago

Politics1 week ago'Nothing more backwards' than US funding Ukraine border security but not our own, conservatives say

-

News1 week ago

News1 week agoThe San Francisco Zoo will receive a pair of pandas from China

-

World1 week ago

World1 week agoTwo Mexican mayoral contenders found dead on same day

-

Politics1 week ago

Politics1 week agoRepublican aims to break decades long Senate election losing streak in this blue state

-

World1 week ago

World1 week agoBrussels, my love? The EU single market is not sexy enough for voters