- Leaders, global organisations, civil society meet in Paris

- Aim to forge a consensus on debt, climate financing

- Development banks urged to risk capital to boost lending

Finance

Leaders head to Paris to give impetus for new global finance agenda

/cloudfront-us-east-2.images.arcpublishing.com/reuters/5N2SRTGHLFM63K5FGV55KPNLNM.jpg)

[1/2]Activists with Glasgow Actions Team and 350.org hold a floating “invisible banner” that will appear to transform the Eiffel Tower into a wind turbine to welcome world leaders on the eve of the Summit for a New Global Financial Pact, at the Trocadero Square in Paris, France, June 21, 2023. The…

PARIS, June 22 (Reuters) – France hosts a summit on Thursday, including African leaders, China’s prime minister and Brazil’s president, to boost crisis financing for low-income countries, reform post-war financial systems and free up funds to tackle climate change.

The “Summit for a New Global Financial Pact”, held in the French capital aims to forge a top-level consensus on how to progress a number of initiatives currently struggling in bodies like the G20, COP, IMF-World Bank and United Nations.

It aims to create multifaceted roadmaps that can be used over the next 18-24 months, ranging from debt relief to climate finance. Many of the topics on the agenda take up suggestions from a group of developing countries, led by Barbados Prime Minister Mia Mottley, dubbed the ‘Bridgetown Initiative’.

“The international financial system is no longer adapted to face financing challenges the world faces today so this is an opportunity to get everyone around the table,” said a senior French diplomat.

The coronavirus pandemic pushed many poor countries into debt distress as they were expected to continue servicing their obligations in spite of the massive shock to their finances.

Africa’s debt woes are coupled with the dual challenge faced by some of the world’s poorest countries of tackling the impacts of climate change while adapting to the green transition.

Wealthy nations have yet to come good on climate finance that they promised as part of a past pledge to mobilize $100 billion a year, a key stumbling block at global climate talks.

Though binding decisions are not expected, officials involved in the summit’s planning said some strong commitments should be made about financing poor countries.

Nearly eighty years after the Bretton Woods Agreement created the World Bank and International Monetary Fund (IMF), leaders aim to squeeze more financing from multilateral lenders for the countries that need it most.

In particular, there should be an announcement that a $100 billion target has been met that will be made available through the International Monetary Fund for vulnerable countries, officials said.

Leaders are set to back a push for multilateral development banks like the World Bank to put more capital at risk to boost lending, according to a draft summit statement seen by Reuters.

Some leaders are expected to lend their weight to long-stalled proposals for a levy on shipping industry emissions ahead of a meeting next month of the International Maritime Organization, officials said.

French Officials say the summit will not aim to bring up the conflict between Ukraine and Russia, which has had an indirect impact on Africa and left some leaders from emerging countries, including Brazilian President Luiz Inacio Lula da Silva unwilling to distance themselves from Moscow.

However, just a few days after the leaders of Senegal, Egypt, Zambia, Uganda, Congo Republic, Comoros and South Africa launched a mediation trip to Ukraine and Russia, French President Emmanuel Macron is likely to use the summit for feedback given most of the same presidents will be attending.

Reporting by John Irish; editing by Philippa Fletcher

Our Standards: The Thomson Reuters Trust Principles.

Continue Reading

Finance

Everton: Premier League club offered loan to complete new stadium

777 Partners agreed to buy current owner Farhad Moshiri’s 94% stake in September, but there is increasing question marks over the takeover following concerning developments around the Miami-based firm.

On Tuesday, Moshiri extended the sales and purchase agreement until the end of this month, giving 777 more time to try to complete the deal.

One of the conditions imposed by the Premier League for 777 to be given the green light is to fund about £100m for the completion of the club’s new stadium.

Costs for the project have spiralled from an initial £500m to more than £800m, which was disclosed in Premier League documents relating to the club’s appeal over their 10-point deduction for breaching financial rules.

GDA Luma describes itself as providing “capital solutions” to companies facing “complex financial and operational challenges”.

Earlier this month, 777 held discussions with the firm to see whether debt financing could be offered.

Finance

Aadhar Housing Finance share price jumps 8% after flat debut. Buy, sell or hold?

Aadhar Housing Finance, a unique retail-oriented home finance company, stands out with its specialization in low-income housing. Today, its shares had a flat listing on the Indian exchanges. Aadhar Housing Finance shares were listed on BSE at ₹314.30 per share mark while the stock listed on NSE at ₹315 apiece, which was almost at par with the upper price band of ₹315 per equity share of the Aadhar Housing Finance IPO. However, the newly listed stock witnessed strong buying post-listing and touched intraday high of ₹341.95 apiece on BSE and NSE. Stock market experts believe that the newly listed stock is a good portfolio stock, and positional investors can hold the stock for the long term.

Aadhar Housing Finance share price outlook

Discussing the listing of Aadhar Housing Finance shares, Prashanth Tapse, Senior VP — Research at Mehta Equities, expressed, “Despite the subdued market conditions, Aadhar Housing Finance’s listing was slightly below street expectations. The company’s focus on the rapidly growing low-income housing segment, which is projected to be the fastest sub-segment within the housing finance industry, has garnered a decent subscription demand. With its reasonable valuations, it presents a promising long-term investment opportunity for conservative investors.”

Also Read: TBO Tek share price dips after bumper debut. Should you buy in this correction?

With a positive outlook for the affordable low-income housing segment, driven by government initiatives such as housing for all and infrastructure status for affordable housing, Aadhar Housing Finance is well-positioned for growth. Its reasonably priced ask valuations compared to industry peers, growing Gross AUM and Net Worth, stable average ticket size of loans, and increasing penetration into tier 4 and tier 5 towns all indicate sound financial health and potential for further expansion. Given the long-term optimistic sector outlook, we recommend allotting investors to “HOLD” for a long-term perspective,” a Mehta Equities expert said.

Reiterating the company’s specialization in low-income housing, Amit Goel, Co-Founder & Chief Global Strategist at Pace 360, stated, “Aadhar Home Finance Ltd. is a retail-oriented home finance company that excels in serving the low-income housing market. It caters to economically weaker consumers with middle-to-low incomes who require small-ticket mortgage loans. Offering a range of mortgage-related loan products, such as loans for acquiring and constructing commercial real estate, home remodelling and extension loans, and loans for purchasing and constructing residential real estate, the company is well-positioned for future growth. We advise investors to consider this potential and hold their investments for medium to long-term rewards.”

“On the financial front, Aadhar Housing Finance reported the second-highest return on equity in FY23 at 15.9%. As we advance, we expect operational performance to improve, led by the dominant low-income housing segment, low cost of borrowing, and higher return ratio among peers. We thus advise investors who have received allotment to hold shares from a medium to long-term perspective,” said Shreyansh Shah, Research Analyst at StoxBox.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Catch all the Business News, Market News, Breaking News Events and Latest News Updates on Live Mint.

Download The Mint News App to get Daily Market Updates.

Download The Mint News App to get Daily Market Updates.

More

Less

Published: 15 May 2024, 11:53 AM IST

Finance

Long-Time Finance Prof Named Interim Dean At Stanford GSB

Peter Demarzo will serve on an interim basis as dean of Stanford’s Graduate School of Business beginning August 1 as the search begins for Jonathan Levin’s replacement. Levin becomes the university’s president that day. Stanford photo

The dean’s office at Stanford Graduate School of Business is moving from economics to finance. As Jonathan Levin, an econ prof and GSB dean since 2016, prepares to move up to the university presidency in August, the B-school has named an interim successor: long-time finance professor Peter Demarzo.

Demarzo, Stanford’s John G. McDonald professor of finance who has taught at the B-school altogether for more than a quarter century, assumes the deanship August 1 and will keep it until a permanent successor to Levin is named.

“Peter will provide important continuity for the school during this transition, and we are grateful to him for being willing to accept this responsibility,” Stanford Provost Jenny Martinez says in a news release.

DEMARZO TEACHES CORPORATE FINANCE & FINANCIAL MODELING

Demarzo earned his Ph.D. and a master’s in operations research from Stanford in the 1980s. He taught at the school for two years in the 1990s, then returned for good in 2000. He teaches MBA and Ph.D. courses in corporate finance and financial modeling; he also founded and serves as faculty co-director of the Stanford LEAD Online Business Program.

Before joining Stanford, Demarzo was on the faculty of UC-Berkeley’s Haas School of Business and Northwestern’s Kellogg Graduate School of Management; he was also a national fellow at the Hoover Institution.

Demarzo’s research is in the areas of corporate finance, asset securitization, financial contracting, and regulation. According to his online bio, “He is co-author of Corporate Finance and Fundamentals of Corporate Finance” and “has served as president of the Western Finance Association and the American Finance Association. He is a fellow of the Econometric Society and the American Finance Association, and a research associate of the National Bureau of Economic Research.”

LEVIN LOOKS ‘TO STANFORD’S FUTURE’

Stanford on April 4 announced that Levin, dean of its business school since 2016, will become president of the university on Aug. 1.

Named Dean of the Year by Poets&Quants in 2022 for his success in bringing stability to a school that had been wracked by scandal, Levin’s more important achievements include putting Stanford in the lead of all business schools on diversity and inclusion, making the GSB the first major institution to publish an annual report on its diversity progress.

“As I look to Stanford’s future, I’m excited to strengthen our commitment to academic excellence and freedom; to foster the principles of openness, curiosity, and mutual respect; and to lead our faculty and students as they advance knowledge and seek to contribute in meaningful ways to the world,” the 51-year-old Levin said in a statement in April.

DON’T MISS STANFORD NAMES BUSINESS SCHOOL DEAN JONATHAN LEVIN ITS PRESIDENT and A DAY IN THE LIFE OF A STANFORD MBA STUDENT

-

Politics1 week ago

Politics1 week agoHouse Dems seeking re-election seemingly reverse course, call on Biden to 'bring order to the southern border'

-

Politics1 week ago

Politics1 week agoFetterman says anti-Israel campus protests ‘working against peace' in Middle East, not putting hostages first

-

News1 week ago

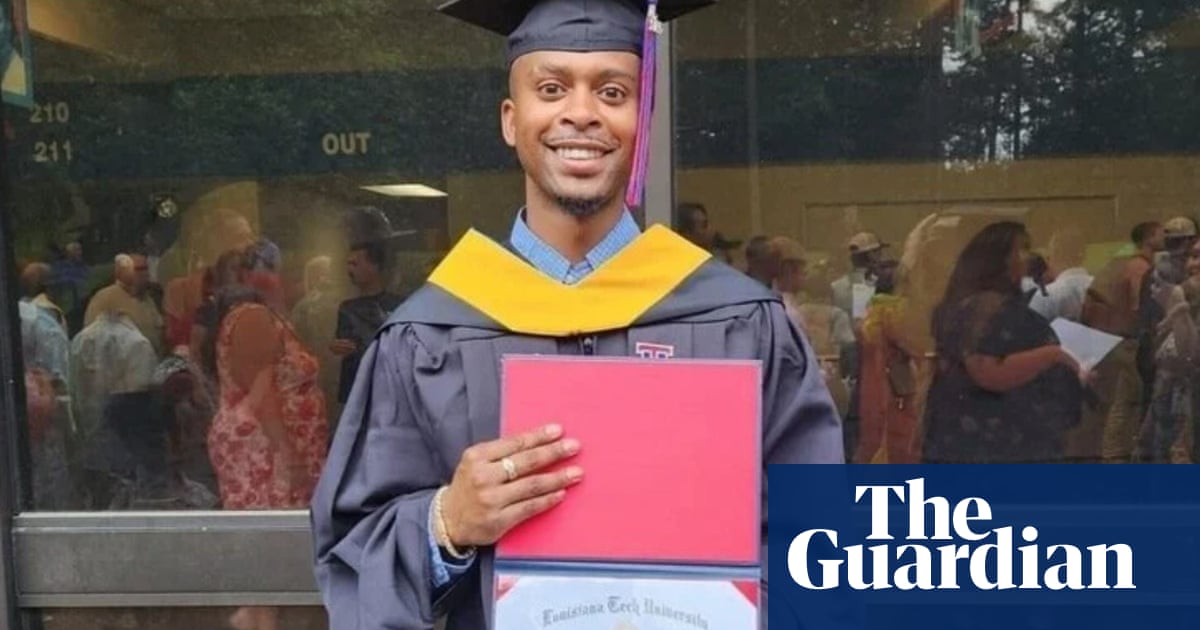

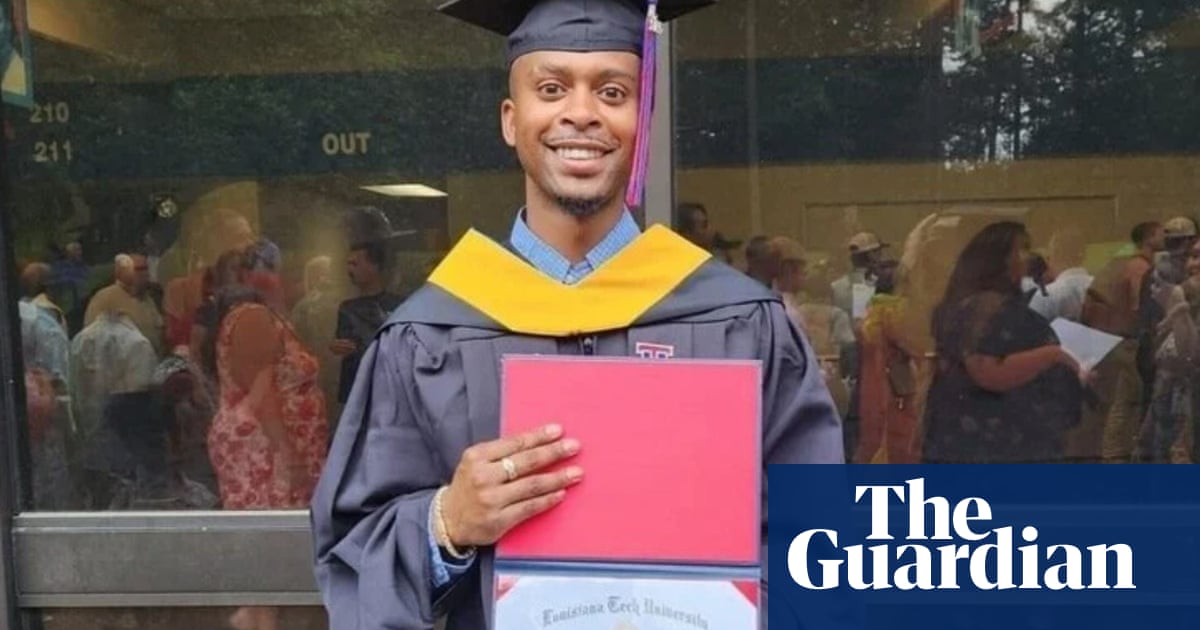

News1 week agoUS man diagnosed with brain damage after allegedly being pushed into lake

-

World1 week ago

World1 week agoGaza ceasefire talks at crucial stage as Hamas delegation leaves Cairo

-

World1 week ago

World1 week agoStand-in Jose Raul Mulino wins Panama presidential race

-

World1 week ago

World1 week agoTech compliance reports, Newsletter

-

News1 week ago

News1 week agoCompass Direct LLC’s 2024 Registration in North Carolina

-

News1 week ago

News1 week agoColumbia University cancels its main commencement ceremony after weeks of turmoil