Finance

Green finance and advanced technology – a strategic imperative for CFOs

Green finance is a pivotal element in contemporary business strategy. It brings environmental considerations into financial decision-making processes, spanning investing, lending, borrowing, and reporting. Recent research highlights that sustainability is becoming a strategic priority for CFOs. This broadens the notion of green finance into a competitive tool to boost environmentally sustainable practices as well as investments, with the goal of generating positive financial returns, enhancing long-term resilience, and boosting competitiveness.

While the integration of green finance initiatives makes clear fiscal sense, they can become even more impactful when combined with the implementation of advanced technologies like AI. Together, these emerging tools areindispensable allies in an era marked by increasing environmental awareness.

As climate change intensifies and regulatory bodies become more serious about enforcing eco-friendly standards, businesses must adapt or risk falling behind. By adopting green finance and leveraging AI, they can unlock immense potential to enhance efficiency, accuracy, improve access to capital, increase long-term resilience and competitiveness. In short, this powerful combination can help businesses meet evolving expectations and drive tangible results, all while contributing to a more sustainable future. But how should CFOs respond?

More than compliance — how forward-thinking CFOs address green finance

Green finance is now an essential part of modern business strategy, and it is essential to view it as more than just a compliance exercise. This is critical in a world that demands both financial prudence and ecological stewardship.

Rather than treating it as a compulsory exercise, organizations should use green finance as a strategic tool that upholds values and helps organizations achieve their ESG goals. By proactively incorporating green finance into their financial strategies, businesses can ensure sustained success and make a positive impact on the world around them.

CFOs wear three hats integrating Green Finance into their strategic and tactical toolbox:

- As business partners, CFOs create transparency around ESG data, related initiatives etc. In doing so they create awareness which regularly is a starting point for changes in organizational behaviour.

- As business stewards, CFOs protect the company’s assets by highlighting ESG risks and by developing mitigation strategies together with risk owners.

- As transformation agents, CFOs play an important role in helping organizations to embrace ESG as a competitive differentiator while driving Green Finance at the same time which allows for a corresponding transformation inside the finance function.

At IFS, we are committed to delivering value and contributing positively to the environment through innovative software and responsible investments. To ensure accountability we have had a sustainability-linked loan since 2021, tying financing costs directly to our annual performance against ESG objectives, which we report and externally assure to drive accountability and quantify sustainability’s impact.

Manage environmental risks and opportunities

In today’s volatile landscape, businesses are faced with a multitude of challenges, ranging from environmental risks and regulatory changes to market shifts, stakeholder expectations, socio-economic change, and technological innovation. A McKinsey report found that reaching net zero by 2050 may necessitate a 60% increase in capital spending on physical assets. This includes $9.2 trillion per year in investments until 2050, with $6.5 trillion annually allocated to low-emissions assets and infrastructure.

CFOs must be able to assess the potential impacts of these factors on their organization’s financial performance and reputation and develop strategies to capitalize on opportunities and mitigate risks. Also key is the creation of effective ESG reporting models that enable businesses to monitor and report on their environmental performance and progress.

To advance ESG reporting and encourage sustainable practices, it is crucial for CFOs to prioritize green financing and allocate resources toward developing solutions that mitigate environmental impacts. This entails investing in environmentally conscious initiatives, implementing energy-efficient tools, monitoring carbon emissions, and adopting sustainable supply chain management practices. Such measures not only enhance a company’s financial performance but also contribute to a healthier, more sustainable future for all.

Allocate capital to eco-friendly initiatives

In order to uphold your organization’s sustainability goals and achieve financial success, it is important to invest capital in eco-friendly initiatives that yield positive returns. This can involve supporting green projects such as renewable energy, energy efficiency, waste management, and sustainable transportation that reduce your organization’s environmental impact and create value for stakeholders.

Additionally, optimizing financing sources and instruments such as green bonds, green loans, or sustainability-linked loans that offer favorable terms and incentives for green investments is essential. Green finance is all about integrating environmental considerations into financial decision-making processes, aligning with a commitment to delivering value while contributing positively to the environment through innovative software solutions and responsible investments.

Develop solutions that support environmental sustainability

Cultivating practices that promote environmental sustainability is crucial for organizations both inside and outside. This involves creating and utilizing tools and systems that help monitor and reduce your ecological footprint, such as energy consumption, carbon emissions, and water usage. By leveraging advanced technology and cloud software, enterprises can not only meet their ESG requirements, especially in the areas of energy efficiency, carbon emissions tracking, and sustainable supply chain management practices, but achieve goals profitably.

Recent research from IFS revealed that CFOs are keen to prioritize the adoption of AI to enhance insight-driven decision-making capabilities as part of moving to a servitized business model. They recognize that by using AI, they can obtain faster, more accurate and data-led inputs for strategic decisions that impact the bottom line.

One example of how AI can be used to drive green and cost-effective financial decisions is through Planning and Scheduling Optimization software. By leveraging AI-powered PSO and advanced predictive algorithms, businesses can make informed decisions to plan, predict, and minimize unnecessary travel for their mobile workforce. This, in turn, can contribute to reducing an enterprise’s carbon footprint.

Investing in the necessary technologies and infrastructure to collect and analyze data related to your company’s green finance objectives is imperative. AI has the potential to radically improve ESG reporting. By automating manual data, AI can enable auditors to search and investigate large volumes of data, quantifying ESG information quickly and efficiently.

Implementing solutions that drive sustainability

Going further, customers achieve ESG goals profitably by measuring emissions and adopting sustainable manufacturing operations. By leveraging effective data, customers can adopt sustainable and circular manufacturing operations and support regulatory reporting. For example, HEXPOL is implementing IFS’s Cloud ERP solution to help it navigate complex supply chain challenges. By streamlining manufacturing processes and gaining better visibility of performance data, this will improve sustainability, increase operational efficiency, and track environmental impact — a growing focus in the manufacturing industry.

A recent report by Forrester revealed that enterprises that have transformed their digital operations with IFS are reaping significant benefits, amounting to $36.61 million over a period of three years. Approximately 38% of these benefits are related to sustainability, totaling $13.83 million, while others include decreased capital, improved uptime, and quicker time-to-value from their investment.

Adopting sustainable practices can yield benefits beyond process streamlining and cost reduction, such as driving revenue growth through new opportunities, retaining talented employees, attracting new investments, complying with regulations, and fostering innovation.

Sustainable stewardship

Forward-thinking CFOs are essential partners in promoting sustainable financial strategies within their organizations. They must carefully evaluate and manage environmental risks, invest in eco-friendly initiatives, and implement green finance practices to optimize costs. Embracing sustainability as a central component of financial planning is not only necessary for compliance with regulations and reporting standards, but it also promotes a resilient and trustworthy reputation. Effective communication with stakeholders is crucial in today’s business environment, underscoring the importance of transparency and engagement in environmental efforts.

Finance

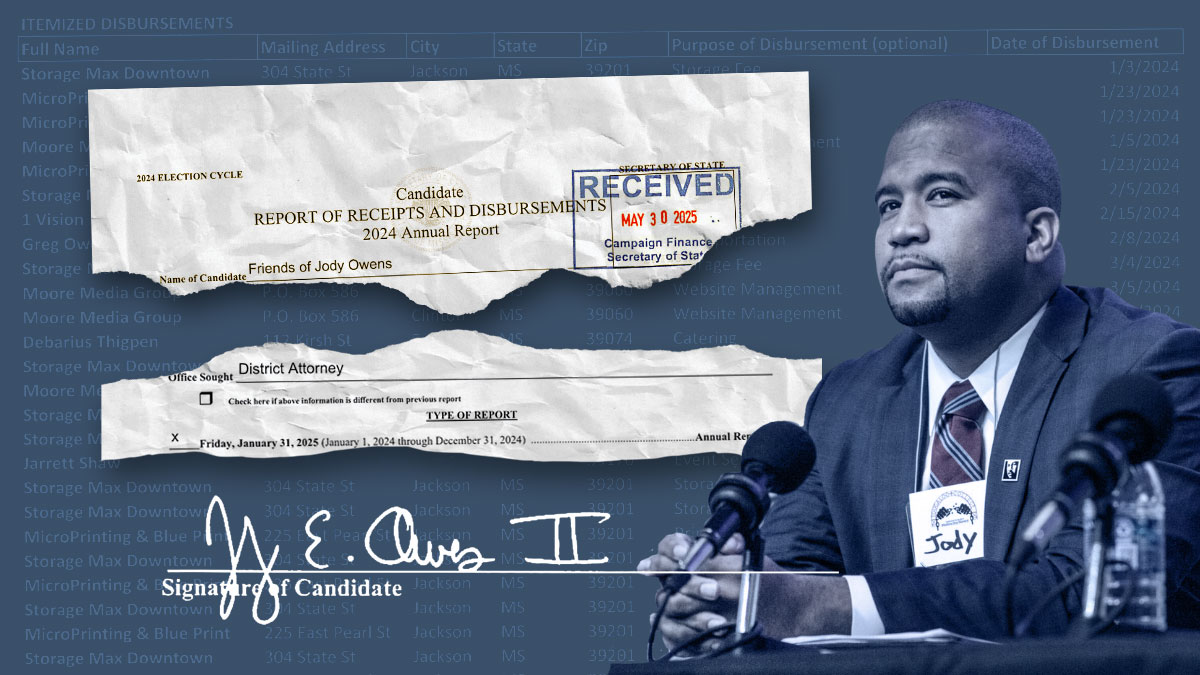

Indicted Jackson prosecutor's latest campaign finance report rife with errors

Finance

Fed independence faces a ‘showdown’ between Trump & the market

00:00 Speaker A

I also want to ask about what’s going on with economic data and the Federal Reserve, guys. Um, Ed, what are you hearing there in D.C.? Right? There is now some reporting out there that Kevin Hassett is kind of the front-runner to potentially take Jay Powell’s place at the Federal Reserve. What are you hearing and what’s the kind of vibe in Washington around this decision?

00:43 Ed

So, Julie, the way I’d view this is that President Trump always loves competition. You know, he came to some of his most recent national prominence by having the Apprentice show. And so, my expectation is that President Trump is going to keep multiple people in the running. Kevin Hassett certainly is in there. Kevin Warsh is in there. I’d put Christopher Waller, who’s already on the Fed board, as well as Treasury Secretary Bessant. I’m watching to see if there’s an opening on the Fed. If a governor steps down, like Michael Barr, now that he’s no longer vice chair for supervision, does one of these individuals get onto the board? I’m also watching for Waller as there are rate decisions here in July and September. Is there going to be a dissent? You generally don’t see dissents among Fed governors, but as you’re auditioning for that role, showing that you would be much more dovish is something that President Trump is going to be looking for and could move him up the list of potential Fed chairs come May of next year.

02:26 Speaker A

Yeah, I think the Apprentice Federal Reserve edition is something that no one asked for, uh, guys. I don’t know, Dory, like, in terms of market reaction to all of this, um, you know, we’ve seen rates kind of remain range-bound here as we get numbers like CPI yesterday and PPI today. But do you think at some point that this competition is going to start to really come to bear in the bond market?

03:25 Dory

Uh, yeah, I think we have a showdown coming. Uh, most people in the marketplace want to preserve the independence of the Fed, and when I say that, I mean that both ways, not just from Trump’s standpoint, but from the Fed’s standpoint. I’ve always said the Fed is, in my mind, Powell being a little political in some of his rate cuts early last year. Having said that, the market has always anticipated for the last couple of years anyway, uh, more rate cuts than actually should have happened or did happen. And I think we’re falling into that trap, and so is Trump as well. I’m kind of a wait-and-see kind of guy right now. I do think the next Fed chair is going to be one of those type of interviews, hey, I’m Donald Trump and I believe this, and if you believe this, I’d like to have you as Fed chair. That points to Hassett being the, uh, being, being there. And, uh, I think that’s going to get some criticism from the market. I think we need that independence. We need good independent valuation. Uh, and, and, you know, I think cutting too soon, soon could be, uh, extremely dangerous when we all know that our deficit is out of control, our debt is out of control, and we don’t want to become a Venezuela.

Finance

Fulton Financial’s (NASDAQ:FULT) Q2: Strong Sales

Regional banking company Fulton Financial (NASDAQ:FULT) reported Q2 CY2025 results topping the market’s revenue expectations , but sales fell by 1.9% year on year to $328.4 million. Its GAAP profit of $0.53 per share was 24.7% above analysts’ consensus estimates.

Is now the time to buy Fulton Financial? Find out in our full research report.

-

Net Interest Income: $254.9 million vs analyst estimates of $255.1 million (5.5% year-on-year growth, in line)

-

Net Interest Margin: 3.5% vs analyst estimates of 3.4% (6.2 basis point beat)

-

Revenue: $328.4 million vs analyst estimates of $318 million (1.9% year-on-year decline, 3.3% beat)

-

Efficiency Ratio: 57.1% vs analyst estimates of 61% (3.9 percentage point beat)

-

EPS (GAAP): $0.53 vs analyst estimates of $0.43 (24.7% beat)

-

Market Capitalization: $3.56 billion

“I’m proud that our team has delivered a new company record, with operating net income of $100.6 million, or $0.55 per diluted share, this past quarter,” said Curt Myers, Chairman and CEO of Fulton.

Tracing its roots back to 1882 in the heart of Pennsylvania, Fulton Financial (NASDAQ:FULT) is a financial holding company that provides banking, lending, and wealth management services to consumers and businesses across five Mid-Atlantic states.

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees.

Over the last five years, Fulton Financial grew its revenue at a solid 8.4% compounded annual growth rate. Its growth beat the average bank company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Fulton Financial’s annualized revenue growth of 8.3% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Fulton Financial’s revenue fell by 1.9% year on year to $328.4 million but beat Wall Street’s estimates by 3.3%.

Net interest income made up 76.1% of the company’s total revenue during the last five years, meaning lending operations are Fulton Financial’s largest source of revenue.

-

News1 week ago

News1 week agoVideo: Clashes After Immigration Raid at California Cannabis Farm

-

News1 week ago

News1 week agoTrump heads to Texas as recovery efforts from deadly flood continue

-

World1 week ago

World1 week agoNew amnesty law for human rights abuses in Peru prompts fury, action

-

Movie Reviews1 week ago

Movie Reviews1 week agoMaalik Movie Review – Gulte

-

Movie Reviews1 week ago

‘Doora Theera Yaana’ movie review: Mansore’s mature take on relationships is filled with relatable moments

-

Politics1 week ago

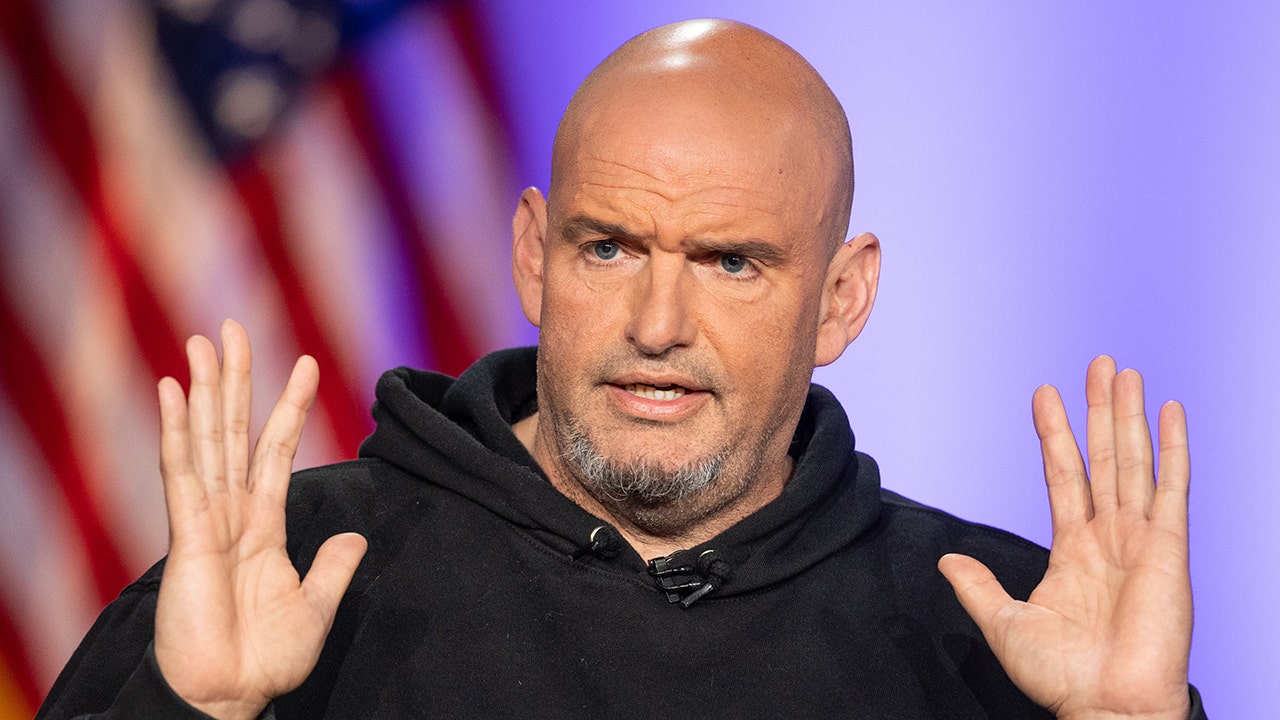

Politics1 week agoDemocrat John Fetterman declares support for ICE, condemning any calls for abolition as 'outrageous'

-

Technology1 week ago

Technology1 week agoIt’s the final day of Prime Day 2025, and the deals are still live

-

Technology1 week ago

Technology1 week agoHere are 58 Prime Day deals you can still nab for $50 or less