Finance

As it happened: Hong Kong budget – all property curbs scrapped to boost market

Themed “Advance with Confidence. Seize Opportunities. Strive for High-quality Development”, the budget blueprint unveiled in the morning included a series of measures to spur growth.

All of the decade-old cooling measures aimed at curbing speculation were scrapped with immediate effect to revive Hong Kong’s depressed property market, with lived-in home prices falling for the ninth straight month in January to a level last seen in 2016.

Fresh funding was earmarked for energising tourism while salary and profit taxes were reduced to ease the financial burden on the public and small and medium-sized enterprises amid the government’s dire financial health.

The financial secretary pledged to take a more targeted approach to spending this year and ditch consumption vouchers for residents as the city’s deficit ballooned to HK$101.6 billion (US$12.9 billion), potentially leaving Hong Kong’s fiscal reserves at their lowest in a decade.

Reporting by Jeffie Lam, Denise Tsang, Lo Hoi-ying, Sammy Heung, Elizabeth Cheung, Lilian Cheng, Natalie Wong, Oscar Liu, Connor Mycroft, Jess Ma, Ambrose Li and Harvey Kong

Finance

Waaree Energies partners Ecofy for low-cost finance to rooftop solar customers

Waaree Energies Ltd, India’s largest solar PV module manufacturer, has partnered with Ecofy, a non-banking finance company backed by Eversource Capital, to provide low-cost, hassle-free finance to homeowners and MSMEs adopting rooftop solar systems.

Waaree Energies Ltd, India’s largest solar PV module manufacturer, has collaborated with Ecofy, a non-banking finance company backed by Eversource Capital, to provide low-cost, hassle-free finance to homeowners and MSMEs adopting rooftop solar systems. Ecofy has committed INR 100 crore into the partnership.

The partnership will leverage Waaree Energies’ solar expertise and Ecofy’s digital financing solutions to accelerate the solarisation of over 10,000 rooftops across households and MSMEs, contributing to the government’s target under PM Surya Ghar Yojana 2024.

Kailash Rathi, head of partnerships and co-lending at Ecofy, said, ” Over the past 15 months, Ecofy has empowered over 5000 rooftop solar customers. We have invested heavily in this segment enabling penetration through product innovation and instant approvals. As the country prepares for the peak solar season, the collaboration between Ecofy and Waaree is expected to act as a catalyst, and aid in accelerating solar adoption and penetration across diverse segments of society.”

Pankaj Vassal, president-sales at Waaree Energies, said, “By integrating our solar solutions with Ecofy’s financing platform, we are working towards removing barriers and aiding in accelerating the adoption of solar power across households and businesses. Ultimately, this is expected to empower more people to embrace the benefits of clean energy while collectively building a greener, more environmentally-conscious India.”

Waaree Energies had an installed PV module manufacturing capacity of 12 GW, as of June 30, 2023 (Source: CRISIL Report). It has four solar module manufacturing facilities in India, with international presence.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Finance

Global Finance Leaders Expect AI to Unlock Deeper, Faster Audits

Global companies increasingly use artificial intelligence to produce their financial statements and expect auditors to leverage the technology further to spot fraud and speed up their reviews, a new international survey shows.

The fast-evolving technology will help auditors predict trends and scan short-seller reports and consumer trends for market shifts and risks. “That’s where the additional rigor and the reliability and the quality is going to come in,” said Larry Bradley, global head of audit for KPMG International.

The Big Four firm released the results of its survey of 1,800 business leaders and corporate directors on …

Finance

Campaign finance offender lost seven bids for office but wins mercy from elections panel • Rhode Island Current

A perennial candidate for state and local office will be the first offender of state campaign finance requirements to have his fines reduced.

The Rhode Island Board of Elections on Tuesday voted 3-0 to slash financial penalties owed by former candidate Daniel Grzych by nearly 90%. Grzych, a Providence resident, ran unsuccessfully as an independent for seven state and local races spanning 2002 to 2014. He previously owed more than $71,000 in fines to the state elections board for submitting late the regular financial reports required during his time as a candidate.

Now, he’ll owe just $6,600 — three times the amount he spent over the five campaigns during which he missed reporting deadlines. The board’s decision Tuesday marks the first time using newly enacted regulation change giving the appointed elections panel more leeway to reduce fines for offenders. The rule change adopted in 2023 relies on a formula based on the number of violations to cap fines at a lower amount while letting the elections board close campaign finance accounts so fees don’t keep accruing.

Under the formula included in the updated state rules, Grzych could have had his fine reduced to about $28,000, said Ric Thornton, the board’s campaign finance director.

However, given Grzych’s actual spending during his span of failed candidacies — amounting to $2,200, all of which was self-funded — Ray Marcaccio, the board’s attorney suggested an even lower fine.

“The purpose for the regulation is to make sure whatever we do by way of fine and penalty is proportional to the offense that occurred,” Marcaccio said. “The way the statute was written, a lot of these daily amounts continue to accrue almost exponentially.”

Indeed, 93% of the $6.1 million in unpaid financial penalties for late or missing campaign reports as of September come from just 15% of the offenders, with many of the top violators unable to pay, or unreachable, according to data provided by Thornton. Grzych once held the dubious distinction of a spot in the top 10 list of violators with the largest outstanding fines, according to an Associated Press story in 2015. As of September 2023, Grzych dropped to the 25th ranking, though the amount of overdue penalties was unchanged.

In an only-in-Rhode Island moment, former Rep. John DeSimone, who defeated Grzych in the 2012 Democratic primary for the House District 5 seat, is now the attorney for his former political opponent. The pair appeared together before the Board of Elections to explain the circumstances that led to Grzych’s late filings and subsequent lack of response to notices about his overdue payments.

“He never had a sophisticated campaign,” DeSimone said. “As I recall, he had a dump truck that he put signs on and drove it around. That was the extent of his campaign.”

Grzych also explained how personal health issues as well as responsibilities caring for ailing family members swallowed his attention over the ensuing 20 years, making him unaware of the overdue fines for late campaign finance reports, despite the many certified mail notices he was sent.

“I don’t want to say I was dumb, but I didn’t know all the facts,” Grzych, 71 said. “ I lost track of a lot of things over the last 20-something years.”

He never had a sophisticated campaign. As I recall, he had a dump truck that he put signs on and drove it around. That was the extent of his campaign.

– Former Rep. John DeSimone, attorney representing Daniel Grzych

He is also facing foreclosure for the Providence home he owns with two other people, after they stopped making payments on their $170,000 mortgage loan beginning in 2020, according to the complaint filed by HSBC Bank in June 2023 in Providence County Superior Court. As of Tuesday, $230,000 remains on the mortgage payment, though a pending agreement selling the property for $320,000 is expected to close soon, John DeSimone said.

The Rhode Island Board of Elections, which is named as a party of interest in the case because it has a lien on the property stemming from Grzych’s outstanding fines, has spent more than $1,000 on court and legal fees as well as certified mail notifying Grzych of his outstanding fines, Thornton said.

Board member Louis DeSimone abstained from the vote due to the appearance of conflict of interest; he is John DeSimone’s first cousin, though he said they have no economic ties. Board members Diane Mederos, Randall Jackvony and Michael Connors were absent from the meeting.

Prior to the vote, the board also met behind closed doors for 45 minutes to discuss the foreclosure case, but did not take any votes shared during the public session.

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX

-

Movie Reviews1 week ago

Challengers Movie Review

-

Politics1 week ago

Politics1 week agoHouse Republicans brace for spring legislative sprint with one less GOP vote

-

World1 week ago

World1 week agoAt least four dead in US after dozens of tornadoes rip through Oklahoma

-

Politics1 week ago

Politics1 week agoStefanik hits special counsel Jack Smith with ethics complaint, accuses him of election meddling

-

Politics1 week ago

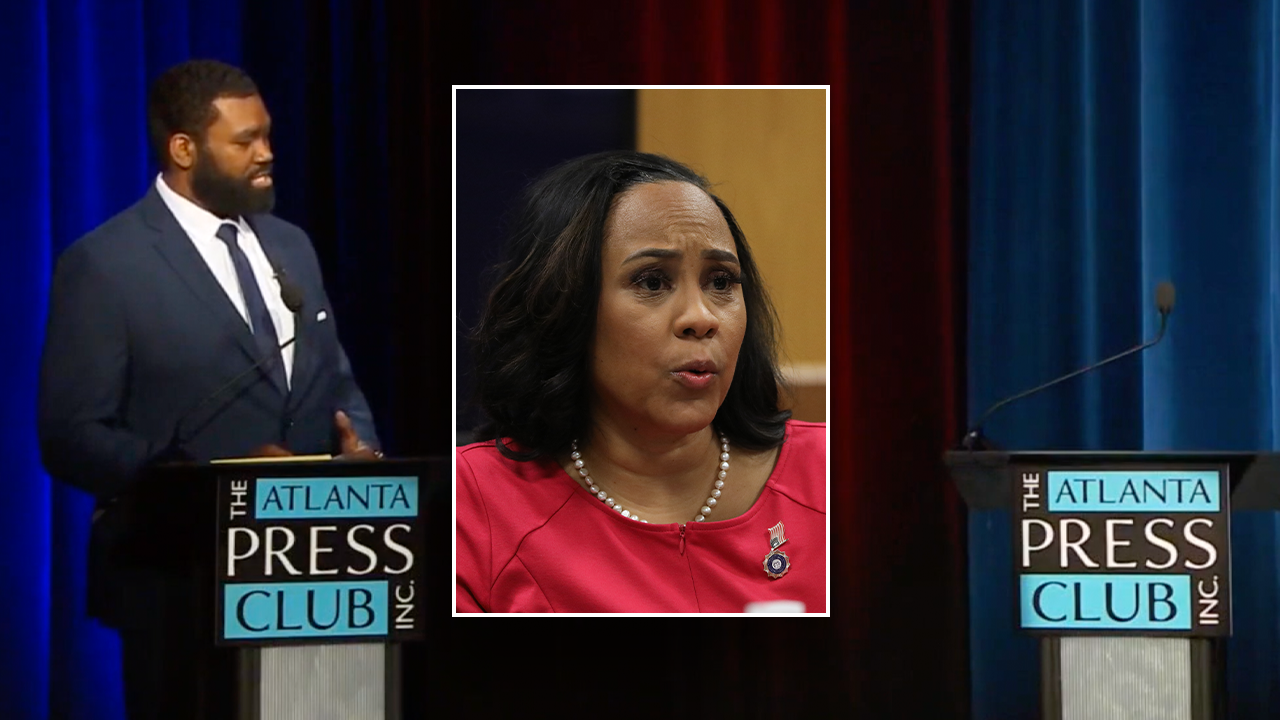

Politics1 week agoAnti-Trump DA's no-show at debate leaves challenger facing off against empty podium

-

News1 week ago

News1 week agoAs student protesters get arrested, they risk being banned from campus too

-

World1 week ago

World1 week agoNine on trial in Germany over alleged far-right coup plot

-

News1 week ago

News1 week agoVideo: Police Arrest Columbia Protesters Occupying Hamilton Hall

/cdn.vox-cdn.com/uploads/chorus_asset/file/24016883/STK093_Google_06.jpg)