Crypto

Solana Cryptocurrency Outlook Post-FTX Bankruptcy

|

Key Takeaways

- The collapse of the FTX crypto alternate is having a ripple impact on the whole crypto trade; casualties pile up because the chapter proceedings start.

- Sam Bankman-Fried (SBF) supported the Solana blockchain and used it to construct his personal decentralized alternate.

- Whereas Solana was as soon as poised to be a menace to Ethereum, the blockchain has seen SOL, its native token, plummet in worth resulting from macroeconomic components and scandals which have introduced down the whole crypto ecosystem.

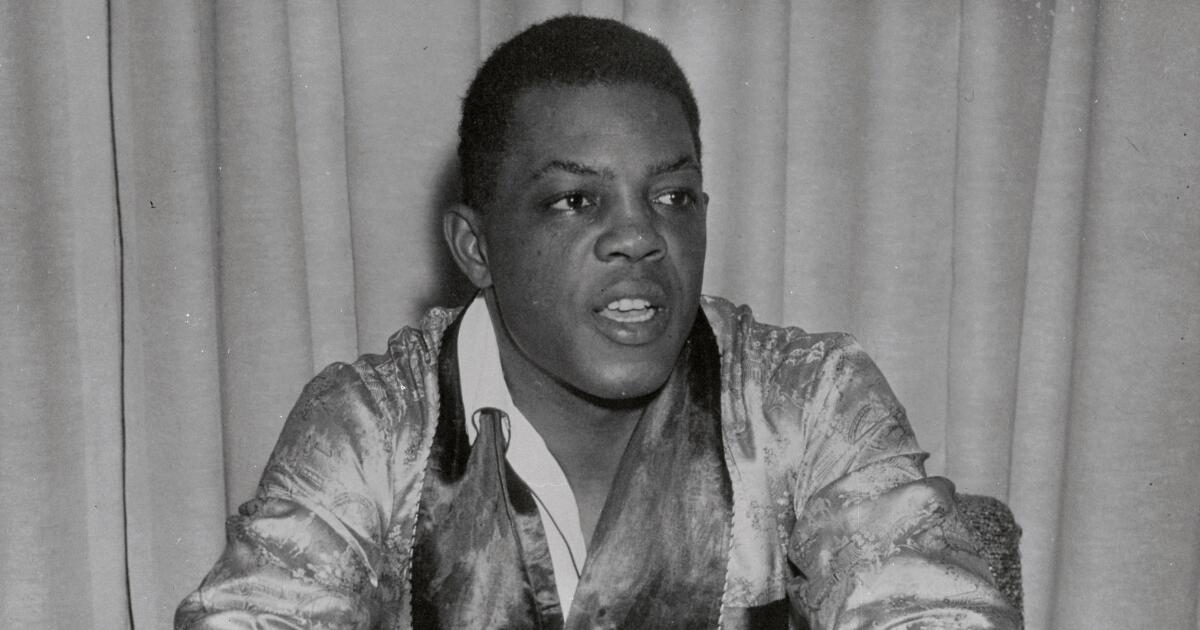

It doesn’t really feel prefer it was so way back after we noticed Sam Bankman-Fried on the duvet of so many magazines touting his plan to donate nearly all of his wealth. Many people thought-about SBF to be the final word “Crypto Robin Hood.”

SBF was additionally pushing many different initiatives within the cryptocurrency area. A type of secondary ventures he promoted was the Solana blockchain.

The Solana blockchain is understood for providing a platform with fast transaction occasions and cheap charges. Solana was speculated to be an “Ethereum killer” however that hasn’t occurred, and it gained’t.

Solana noticed its native token SOL drop by at the very least 30% at occasions after the FTX collapse since SOL was Alameda’s second-largest holding. We’ll have a look at the Solana cryptocurrency outlook within the wake of the FTX chapter.

What occurred to FTX?

Earlier than evaluating the Solana, we should handle what occurred with FTX. The crypto alternate had a valuation of $32 billion at the beginning of 2022 with a slew of high-profile movie star endorsements. Most individuals within the crypto neighborhood thought it was too huge to fail.

When a report revealed that FTX didn’t have the correct funds in reserves, clients rushed to money out their investments since they have been rightly nervous it will be the subsequent crypto platform to go bankrupt. In flip, this led to a liquidity crunch.

When it got here out that Binance, a rival crypto alternate, would not buy the alternate in a last-ditch effort to put it aside, FTX had no alternative however to file for chapter safety on November 11.

Bankman-Fried was usually hyping up Solana. The bankrupt alternate even had $982 million in SOL, the native cryptocurrency of the Solana blockchain. There have been fears that FTX and Alameda Analysis would begin unloading SOL tokens to lift liquidity.

The FTX meltdown has had a big influence on the general cryptocurrency area. Investor confidence is low. Traders concern additionally grew round initiatives related to SBF and FTX given the doable fallout from the chapter proceedings.

What’s the connection between SBF and Solana?

Through the summer time, SBF carried out an unique interview with Fortune journal. In it, he shared that he felt Solana was essentially the most underrated token. The story talked about how SBF’s counterintuitive investing technique would both construct him an empire or finish in a catastrophe.

The latter occurred and SBF at present sits behind bars.

SBF hyped Solana and the community for years, each personally and professionally. When Solana Labs raised $314.2 million in the summertime of 2021, Alameda Analysis, a crypto hedge fund based by SBF himself, invested closely.

SBF additionally began constructing a decentralized alternate referred to as Serum on the Solana blockchain. It was identified to many within the crypto area that SBF had invested loads of cash by way of his firms in SOL tokens.

Whereas SOL was Alameda’s second largest funding, the buying and selling agency additionally actively invested in different initiatives on the blockchain. Alameda invested in Serum (SRM), MAPS (MAPS), and Ogyxen (OXY) through the Solana blockchain.

How did FTX influence Solana?

After loads of hypothesis, the staff at Solana launched a weblog put up that addressed the monetary ties between Solana, FTX, and Alameda Analysis. The Solana Basis confirmed that they’d about $1 million value of money or equal property on the FTX platform as of November 6.

This was across the time when FTX needed to pause buyer withdrawals because it grew to become clear that they didn’t have the funds. These funds are actually caught on FTX and are pending the outcomes of what occurs subsequent with the chapter process.

The Solana Basis reported that these funds are equal to lower than 1% of the funds, so it’s not a dire scenario.

In accordance with Solana Compass, the Alameda Analysis liquidators now possess tons of of thousands and thousands of {dollars} value of SOL. Primarily based on the report, Alameda Analysis beforehand had management of 48,636,772 SOL tokens, that are value about $643,000,000 now.

Nevertheless, the weblog put up from the staff at Solana talked about that FTX and Alameda bought over 50.5 million SOL from the inspiration. They wrote that a good portion of the SOL could be locked up in month-to-month unlock schedules till 2028.

Are you totally confused? It’s unattainable to invest what is going to occur with these SOL tokens in the course of the chapter proceedings. Moreover, the article that Solana launched additionally confused how the FTX collapse did not influence the safety of the blockchain.

What occurred to Solana?

Solana, together with each different main cryptocurrency token, has been hit onerous by macroeconomic components impacting the whole area, negatively.

Final November, the worth of ether peaked at practically $4,900, whereas bitcoin hit virtually $69,000. Then it grew to become clear that inflation was hovering, which meant that the Fed must elevate charges to chill off the financial system.

As a substitute of performing as a hedge towards inflation, it turned out that cryptocurrency was one other speculative asset that might fluctuate primarily based on macroeconomic situations.

The worth of SOL is hovering round $14.00 as of mid-December, which is down over 91% for the 12 months and drastically decrease than the all-time excessive of $259.99.

What’s subsequent for Solana and Crypto?

Quite a few components are at play right here, and plenty of crypto fans are bracing themselves for an prolonged crypto winter.

For starters, we’ve got to see how the chapter proceedings play out. Then we even have to attend and see to find out the influence of the speed hikes from the Fed, working to chill down inflation.

We will anticipate two issues for Solana and crypto basically.

Extra worth volatility

It’s secure to say that as extra information comes out in regards to the fallout of the FTX chapter, there can be additional volatility and worth swings. The fallout will ship waves all through the crypto area for the subsequent 12 months or so.

We don’t anticipate crypto costs to stabilize within the close to future.

Additional rules

We will not ignore the significance of rules. The White Home, SEC, and even the Fed have emphasised the significance of regulating crypto. Now, many inside the trade are asking for them as nicely, which might not have been the case even six months in the past.

Michael Saylor, an advocate for bitcoin, lately spoke on this matter after the FTX debacle, stating, “The way forward for the trade is registered digital property traded on regulated exchanges, the place everybody has the investor protections they want.”

We do not know what these crypto rules will appear like, however we do know that this area desperately wants extra scrutiny.

How must you be investing?

Investing in digital property is dangerous, even throughout the very best of occasions. The final 12 months or so has proven us that investing in crypto comes with a substantial amount of uncertainty that’s not for these unready to deal with the unprecedented volatility.

If you wish to put money into cryptocurrency, take into account Q.ai’s Tech Rally Package or Rising Tech Package. Each kits assist unfold threat throughout industries and use AI to allocate portfolio weights every week throughout the tech firms that underly the crypto market, tech ETFs, massive tech firms, and small tech firms.

You too can activate Portfolio Safety to assist defend your features and cut back losses, it doesn’t matter what trade you put money into. Should you’re trying to keep away from crypto altogether, you may look to Q.ai’s Valuable Metals or Massive Cap Kits to attend out this unprecedented crypto volatility on extra stable footing.

Obtain Q.ai in the present day for entry to AI-powered funding methods. While you deposit $100, we’ll add a further $100 to your account.

Crypto

Ethereum ETFs imminent after amended S-1s (Cryptocurrency:ETH-USD)

Liliya Filakhtova

Seven financial firms eyeing exchange-traded funds linked to Ethereum (ETH-USD) amended their S-1 filing on Friday, raising expectations of an imminent launch of the first set of ETFs tied to the second-largest cryptocurrency.

According to the industry publication CryptoSlate, Franklin Templeton, VanEck, Invesco Galaxy, BlackRock (BLK), 21Shares, Grayscale, and Fidelity filed updated S-1 documents for their respective funds, while Bitwise did not amend its registration statement.

Among the eight prospective issuers, Franklin Templeton and VanEck announced their ETF fees at 0.19% and 0.20%, respectively.

The filings mark a key step in launching the products after the SEC cleared Ethereum (ETH-USD) ETFs in May in response to applications from firms including Nasdaq (NDAQ), Intercontinental Exchange’s (ICE) NYSE, and Cboe Global Markets (CBOE).

With the amended filings complete, crypto investors will eagerly wait for a potential final approval from the SEC to clear the launch, which, according to Bloomberg ETF analyst Eric Balchunas, could be as early as July 2. “Anyway, that’s basically a wrap. Ball in SEC’s court now,” he wrote on X.

Crypto

Attorney General warns of cryptocurrency scams at event in The Villages

This week, we hosted a Cryptocurrency Scams Symposium in The Villages and recognized the top Seniors vs. Crime volunteers.

Florida is proud to be home to more than 5.5 million seniors. Unfortunately, there are bad actors who try to prey on older Floridians. Our Cyber Fraud Enforcement Unit presented to seniors at the symposium about how to avoid falling victim to cryptocurrency scams.

Protecting Florida’s seniors is one of our top priorities, and we are also grateful for all our Senior Sleuth volunteers’ efforts on behalf of older Floridians.

Last year, Senior Sleuths assisted more than 9,100 Florida seniors, put in more than 11,200 hours of free services and recovered more than $2.6 million. Since 2019, Seniors vs. Crime is responsible for recovering more than $10.5 million.

At the end of the symposium, we named five Super Senior Sleuths, one from each region of Florida for their outstanding work for their fellow seniors.

We also recognized our Senior Sleuth Advocate of the Year, John McLaughlin. Logging more than 10 years as a Seniors vs. Crime volunteer, John uses his background as a law enforcement officer to assist seniors and solve high-value cases.

By assisting those who have been taken advantage of and teaching seniors how to protect themselves from scams and exploitation, we are continuing to build a Stronger, Safer Florida.

Ashley Moody is attorney general of Florida.

Crypto

Electrocoin launches new cryptocurrency exchange platform, Electrocoin Trade

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Croatia’s top crypto exchange, Electrocoin, launches Electrocoin Trade, a crypto exchange platform for EU clients.

One of the biggest cryptocurrency exchange services in Croatia, Electrocoin, has recently launched their new cryptocurrency exchange platform called Electrocoin Trade, providing services for natural and legal clients in the EU.

The platform includes two core services – cryptocurrency exchange and trading service without prior registration to the platform, and cryptocurrency exchange and trading service for registered users. This way, and following the recent regulatory development in the area of crypto regulation, Electrocoin introduced the new custodial model to their service, allowing them to act as a custodian for the assets clients chose to hold on their Electrocoin Trade accounts. By registering with Electrocoin Trade, users get to entrust their cryptocurrencies for safekeeping to a highly regulated platform, as they also get access to additional trading and user experience benefits such as lower trading fees and cryptocurrency portfolio monitoring.

Regardless of the new service, Electrocoin decided to keep the old service as well – any adult citizen in the EU can buy, sell, or trade cryptocurrencies up to 1000 euros without verification or prior registration on the platform. This way, Electrocoin wanted to ensure their existing and future users had an option where they could still access crypto even if they would rather not register with the new platform. This service is possible due to regulatory approval for KYC-less money exchange under certain thresholds.

The platform supports cross-chain transfers and coin-to-coin swaps through a variety of protocols, including ERC-20, Polygon, BEP-20, and many more. Furthermore, with the release of the new platform, Electrocoin has also introduced one new service – paying bills with cryptocurrencies. Users of the platform can use their cryptocurrencies to settle any invoice that can be paid by bank transfer within the EU/SEPA zone. That being said, utility bills such as electricity, water, or internet, or even personal expenses such as vehicles or even real estate, can be paid with cryptocurrencies – as long as the payment recipient has a bank account number.

Electrocoin was founded back in 2014 and has since become an industry leader, introducing PayCek, a crypto payment processor, in 2018. and now the new cryptocurrency exchange platform. The company is committed to communication with the regulator and today, they count over 250,000 successful transactions, along with 24/7 available customer support with an average chat response time of one minute. Electrocoin Trade positions itself as a competitor to other top-tier European cryptocurrency exchanges, with the feature enabling the cryptocurrency exchange without prior identification specifically standing out.

To get started, visit the Electrocoin Trade website.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

-

Politics1 week ago

Politics1 week agoPresident Biden had front row seat to dog, Commander, repeatedly biting Secret Service agents: report

-

News1 week ago

News1 week ago171,000 Traveled for Abortions Last Year. See Where They Went.

-

Politics1 week ago

Politics1 week agoTrump travels to DC to meet with congressional Republicans, speak with nation's top business executives

-

News7 days ago

News7 days agoIt's easy to believe young voters could back Trump at young conservative conference

-

World7 days ago

World7 days agoSwiss summit demands 'territorial integrity' of Ukraine

-

Politics1 week ago

Politics1 week agoBiden’s ’pre-9/11 posture’ to blame for ISIS migrants slipping through cracks: expert

-

World1 week ago

World1 week agoRussian warships in Cuba: Is it a port of call or show of strength?

-

World1 week ago

World1 week agoElection aftermath – MEPs to watch on economic and financial policy