Crypto

Bitcoin Price | Ethereum Price: Top cryptocurrency prices today: Bitcoin, Ethereum, Avalanche, Cardano rally up to 14%

Nonetheless, it is going to be too early to conclude if the downtrend within the digital token market is over.

Barring Tron, a decentralized blockchain, all crypto tokens have been buying and selling sharply greater on Tuesday. Cardano zoomed greater than 14 per cent, whereas Ethereum rose 6 per cent. Bitcoin, Avalanche and XRP gained 5 per cent every.

The worldwide cryptocurrency market cap was buying and selling greater on the $1.32 trillion mark, leaping as a lot as 5 per cent within the final 24 hours. Nonetheless, the full cryptocurrency buying and selling quantity zoomed over 65 per cent to $91.07 billion.

What’s cooking in India

The Centre is planning a contemporary session paper on cryptocurrency quickly, although a regulation on the digital belongings is prone to take extra time, secretary of financial affairs Ajay Seth has stated.

Talking about cryptocurrency, Seth on Monday instructed reporters, “Our session paper is pretty prepared. We’ve got gone right into a deep dive into this.” He didn’t point out when it’s prone to be put out. Sources stated that it may be anticipated in August.

Knowledgeable’s take

Bitcoin broke its consolidation by buying and selling above $31,000 prior to now 24 hours. Bitcoin revived a bit after an extended bearish development, stated Edul Patel, CEO and Co-founder of Mudrex.

“Alternatively, Ethereum’s transaction charges are at one-year low, which could assist regain its value. The promoting value decreases a bit as patrons return to the market,” he added.

The current promoting strain has eased up and Bitcoin has topped the $31,000 mark with quantity nearly doubling within the final 24 hours. This reveals the renewed curiosity within the digital asset market, stated Kunal Jagdale, Founder, BitsAir Alternate.

“The token was merely in need of $32,000 ranges and if this degree is sustained, $35,000 is the following main resistance for the most important token. Apparently, we have now bottomed out in the interim and should make a brief restoration within the meantime.”

World updates

- As motorists complain about gasoline charges being too (expletive deleted) excessive, crypto merchants are coping with the other: Ethereum’s gasoline charges are at a document low, Sam Reynolds experiences.

- DeFi software Mirror Protocol, which is constructed on Terra, is allegedly struggling one other exploit, in keeping with pseudonymous ‘Mirroruser’ who posted on the Terra Analysis Discussion board Could 28, 2022.

Tech View by Giottus Crypto Alternate

AAVE is the native and governance token of the Aave platform. It’s a decentralized protocol used for lending and borrowing cryptocurrencies. Lenders can earn curiosity on their crypto holdings by depositing them in specifically created liquidity swimming pools whereas debtors can use their crypto as collateral to get a flash mortgage from these liquidity swimming pools. AAVE is presently buying and selling at $118 with an 18% every day achieve although it’s nonetheless 60% down from its 2022 excessive.

AAVE has been forming a falling wedge sample recently, signaling an impending bullish momentum. The start of April noticed AAVE reaching its April excessive of $259 and dealing with rejection concurrently at a long-term trendline resistance to create decrease lows by means of April and early Could.

By mid-Could, AAVE had misplaced 72% of its April excessive. Nonetheless, AAVE efficiently examined its long-term trendline help at $70. It has now damaged above the trendline resistance and the falling wedge sample to register an upward momentum overcoming the .236 Fibonacci retracement degree of $110.

For AAVE to maintain its upward momentum, it must overcome the psychological resistance degree of $120. The subsequent key resistance will then be $140. In case of a attainable downturn, AAVE can be testing help at $85 and $68.

Main Ranges

Resistance: $120, $140

Help: $110, $85, $68

(Views and suggestions given on this part are the analysts’ personal and don’t symbolize these of ETMarkets.com. Please seek the advice of your monetary adviser earlier than taking any place within the asset/s talked about.)

Crypto

When Melania Trump’s cryptocurrency token wiped $5 billion from Donald Trump’s memecoin – The Times of India

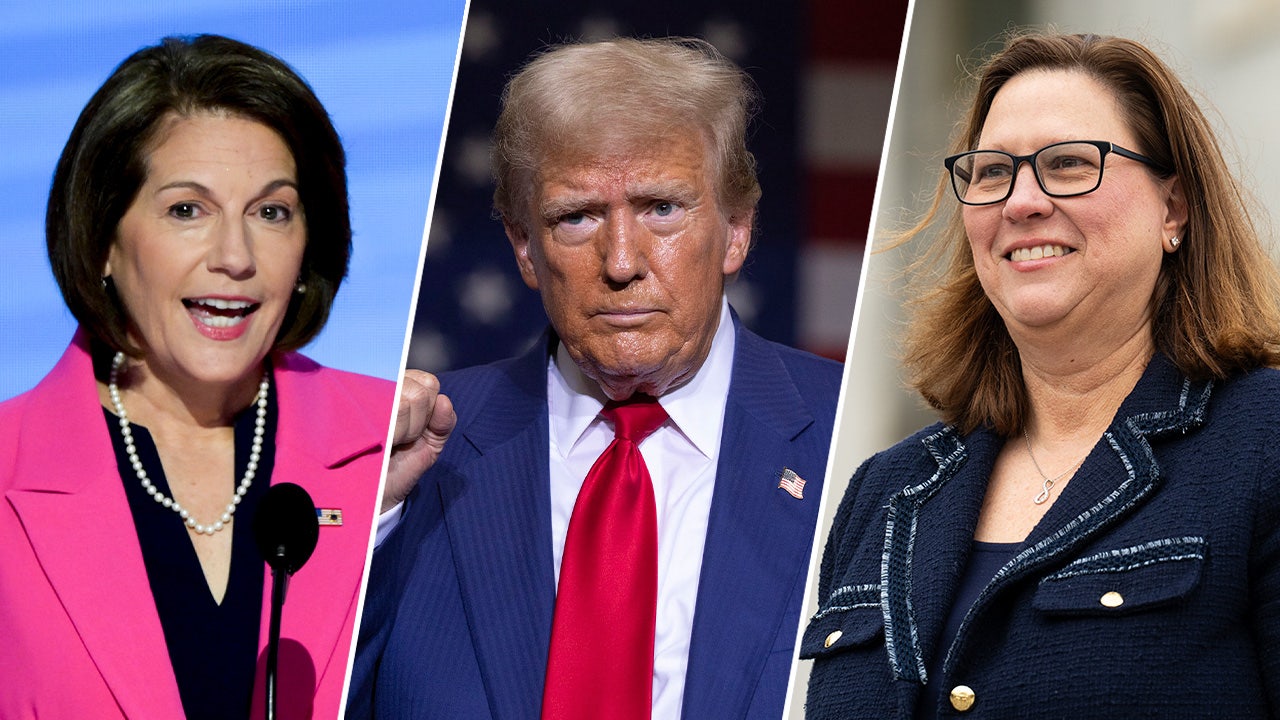

Donald Trump’s cryptocurrency token dropped 38% in value on Friday after his wife Melania Trump launched her own competing digital coin, erasing $5 billion from the token’s market capitalization just days before his presidential inauguration.

The TRUMP token’s price fell from $74.60 to $45.90 within 40 minutes of Melania Trump announcing her own MELANIA token, according to CoinMarketCap data. Meanwhile, the First Lady-elect’s new cryptocurrency skyrocketed to a $6.14 billion market value within two hours of launch.

“It’s time to celebrate everything we stand for: WINNING! Join my very special Trump Community,” Donald Trump posted on social media on January 17, promoting his token. The marketing featured Trump with a raised fist alongside “FIGHT FIGHT FIGHT,” referencing his response to an assassination attempt during a July political rally.

Over 45,000 digital wallets have purchased the MELANIA token since its launch Thursday evening, though blockchain analytics platform Bubblemaps reported that nearly 90% of the token supply is held in a single wallet, contradicting the project’s claimed distribution structure.

Critics warn these politically-linked tokens could enable undue influence from special interests and foreign entities. “If people want to gamble, I don’t really care,” said Lee Reiners, a former Federal Reserve economist now at Duke University. “What I care about is when this crypto bubble bursts — and it will burst — it will end up impacting people across the economy even if they don’t have direct investment in crypto.”

Supporters view the Trump memecoin as symbolic of the incoming president’s pro-cryptocurrency stance, which contrasts with the perceived hostility of the outgoing Biden administration. Trump has pledged to implement crypto-friendly regulations and has appointed industry advocates to key government positions.

The TRUMP token initially sold for $10 before surging to $70 by Sunday morning. The token’s website claims 35% was distributed to the team, with other allocations for treasury, community, public sale and liquidity.

Crypto

$MELANIA Meme Coin launched: How to buy Melania Trump’s cryptocurrency – check quick guide – The Times of India

$MELANIA meme coin: US President elect Donald Trump’s wife Melania Trump has launched her own cryptocurrency, the $MELANIA meme coin, early Monday, shortly after her husband’s launch of the $TRUMP memecoin.

Melania Trump announced the launch on X (formerly Twitter), posting: “The Official Melania Meme is live! You can buy $MELANIA now.” This announcement generated significant engagement, resulting in increased token value.

For those wishing to acquire $MELANIA tokens, here is a detailed acquisition process:

Solana-Compatible Wallet for $MELANIA meme coin

According to an ET report, the first requirement is establishing a Solana-compatible digital wallet if you haven’t already. Recommended platforms include Phantom and Solflare, which offer secure storage and management of your $MELANIA tokens.

$MELANIA meme coin Official website launched

Access the coin’s official platform at melaniameme.com, where you’ll find comprehensive information about the token and purchase options.

Wallet Integration

Select the “Connect Wallet” option on the website to establish a connection with your Solana-compatible wallet, enabling direct platform interaction and transaction management.

$MELANIA Token Acquisition Methods

The platform offers two primary purchase methods:

Credit Card Transactions: Direct purchases are available using credit cards. Simply input your card information as requested, and the tokens will transfer to your linked wallet.

Cryptocurrency Exchange (SOL): Alternatively, use Solana (SOL) tokens for purchases. If you lack SOL, acquire it through cryptocurrency exchanges before proceeding with your $MELANIA token purchase via the website.

(Disclaimer: The above article is for information purposes only. It should not be seen as a recommendation to buy)

Crypto

Trump’s meme coin creates billions from thin air, rattles cryptocurrency market – The Times of India

A digital token debuted by President-elect Donald Trump has rattled the cryptocurrency market, attracting billions of dollars of trading volume while stoking concerns about conflicts of interest.

Trading under the “Trump” ticker on the Solana blockchain, the token’s market value surged to $15 billion over the weekend, data from CoinMarketCap show, after the Republican touted it on his social media accounts on Friday.

The digital asset’s market capitalization then slid below $10 billion on Sunday in New York after Trump’s wife Melania also unveiled a coin, drawing traders who seek to capitalize on rapidly shifting speculative demand for memes.

Meanwhile, the wider crypto market struggled over the weekend, including a dip in the largest token, Bitcoin, and a shaper retreat for second-ranked Ether. SOL, the cryptoasset associated with the Solana digital ledger hosting the Trump meme coins, bucked the trend and posted a rally.

Speculative flows

The “size of the capital flowing” to the Trump token left most other coins trading “poorly” outside of SOL and some related assets, said Sydney-based Richard Galvin, co-founder of hedge fund DACM.

The website for the president-elect’s token describes it as the “the only official Trump meme.” The project’s art features an illustration of the incoming US president with his fist in the air — a reference to his response in the aftermath of an attempt on his life during a campaign rally last year.

The small print on the website states the president-elect’s token isn’t intended to be an “investment opportunity, investment contract, or security of any type.” Still, crypto-minded Trump fans immediately started buying. Major exchanges like Coinbase Global Inc. and Binance Holdings Ltd. said during the weekend they intended to list the token on their platforms.

The website for Melania’s project also says that the token isn’t supposed to be an investment opportunity or security, adding that “Melania memes are digital collectibles intended to function as an expression of support for and engagement with the values embodied by the symbol MELANIA.”

Trump’s embrace

Trump made explicit overtures to the crypto industry in the months before and after his election. Bloomberg News has previously reported that he’s considering an executive order designating the asset class a “national priority.”

The president-elect’s previous forays into crypto include profitable collections of nonfungible tokens, digital collectibles that show him in a variety of poses and costumes, including as a superhero. Along with his sons, he’s also endorsed World Liberty Financial, a project that has been much-hyped but for which details remain scarce.

Representatives for Trump didn’t return requests for comment.

Crypto is notorious for meme coins, tokens with questionable inherent value that sometimes briefly surge if they catch a social media tailwind before sliding as attention turns elsewhere.

The Trump token traded at about $39 as of 7:30am on Monday in Singapore, down from an earlier peak of $75.35. Bitcoin slid to $100,000, Ether changed hands at $3,161 and a cooling SOL rally left the digital asset at roughly $240.

-

Science1 week ago

Science1 week agoMetro will offer free rides in L.A. through Sunday due to fires

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23935558/acastro_STK103__01.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23935558/acastro_STK103__01.jpg) Technology1 week ago

Technology1 week agoAmazon Prime will shut down its clothing try-on program

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25826211/lorealcellbioprint.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25826211/lorealcellbioprint.jpg) Technology1 week ago

Technology1 week agoL’Oréal’s new skincare gadget told me I should try retinol

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25832751/2192581677.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25832751/2192581677.jpg) Technology5 days ago

Technology5 days agoSuper Bowl LIX will stream for free on Tubi

-

Business6 days ago

Business6 days agoWhy TikTok Users Are Downloading ‘Red Note,’ the Chinese App

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25835602/Switch_DonkeyKongCountryReturnsHD_scrn_19.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25835602/Switch_DonkeyKongCountryReturnsHD_scrn_19.png) Technology3 days ago

Technology3 days agoNintendo omits original Donkey Kong Country Returns team from the remaster’s credits

-

Culture2 days ago

Culture2 days agoAmerican men can’t win Olympic cross-country skiing medals — or can they?

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24774110/STK156_Instagram_threads_1.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24774110/STK156_Instagram_threads_1.jpg) Technology7 days ago

Technology7 days agoMeta is already working on Community Notes for Threads