Business

Retirement is a lot harder now. Here’s how people are making it work

Retirement: The phrase conjures up ideas of stress-free on a tropical seashore, taking part in with grandkids and taking on birdwatching or gardening.

However the nature of retirement as a dependable reward for a lifetime of labor is altering with the unsure occasions. Many Individuals discovered themselves compelled into an early retirement after they misplaced their jobs through the COVID-19 pandemic. Unable to seek out new employment, they pinched their pennies and bunkered down at house.

For some, the excessive mortality price of COVID-19 in seniors and the unpredictability of the world gave them resolve to benefit from the years of life that they had left. Others, flummoxed by the sudden drop of their 401(okay)s and the rising price of requirements, opted to place off retiring and even return to the job market.

“What that is displaying folks is that they will’t rely on the final a number of years the place the inventory market just about simply grew,” stated David John, a senior strategic coverage advisor on the AARP Public Coverage Institute. “There’s extra of a fear issue there to guarantee that they’ve a big quantity.”

1 / 4 of Individuals suppose they’ll must delay their retirement due to inflation, based on a BMO Harris ballot, and a survey of retirees by AARP discovered 29% are both presently figuring out of economic necessity or anticipate they’ll have to seek out work in some kind.

Renee Ward, who runs a nationwide job financial institution referred to as Seniors4Hire, stated her group has seen an uptick in folks attempting to come back out of retirement or retirees needing to complement their revenue.

“They’re apprehensive and simply need to hedge their bets,” Ward stated.

The labor power of individuals ages 75 and older is anticipated to just about double by 2030, based on Bureau of Labor Statistics projections. And amongst these ages 55 and older, the variety of full-time workers in Could 2022 was the best it’s been in information courting to 1986.

What’s clear is that retirement is not a easy finish level for most individuals. These 11 tales seize a number of the diverse varieties retirement takes right this moment.

‘Perhaps I ought to have stayed at my job longer’

Rising up as a Black particular person in Los Angeles, Steven Wright puzzled whether or not he’d dwell to see previous age, having seen so lots of his friends die prematurely. So when Wright stood on the retirement ceremony hosted by his spouse, Angela, in 2018, he figured he was prepared for all times after work at age 62.

“Retirement isn’t what I anticipated,” says Steven Wright. He needs he’d sought skilled monetary recommendation earlier than strolling away at age 62.

(Francine Orr / Los Angeles Instances)

Wright had a pension and was instructed he had lifetime medical protection from 32 years of working for the town of Los Angeles within the Division of Transportation, most not too long ago within the particular occasions unit, the place he helped route site visitors throughout presidential visits, amongst different duties.

He deliberate to spend a lot of his time mentoring younger males, instructing them easy methods to fish on his boat and speaking to them about easy methods to obtain their objectives, as his grandfather had performed for him.

4 years later, Wright needs he had sought skilled monetary recommendation as a substitute of counting on steering from the town that was, he says, missing in substance and element.

“Lots of issues I might have thought-about are issues that I didn’t take into consideration till I used to be retired, which is actually too late,” Wright stated. “Questions like how a lot inflation will there be? How excessive are costs going to be? Now that I’m really feeling it and seeing what it’s like, retirement isn’t what I anticipated.”

Wright went again to work, as a paralegal at a Los Angeles legislation agency. “I’ve been doing that just about to remain afloat,” Wright stated. “I’ve thought, ‘Perhaps I ought to’ve stayed on at my job longer till retirement age.’ It was a great job.”

Wright’s boat, a 21-foot cuddy cabin, stays moored at dock, identical to his fishing/mentoring ministry. “I’ll by no means go away that dream behind, however I do know I’m not going to have the ability to do it tomorrow,” he stated.

‘I don’t need to be that particular person’

“It might be good to finally have the American dream,” Christie Sasaki, 54, stated. “Retire in the future after quite a few years of labor.”

Sasaki’s been working since she was 16 and has spent most of these years at Pavilions, a grocery chain owned by Vons. She made her means up from the underside to her present position as a front-end supervisor.

Christie Sasaki, 54, works as a front-end supervisor at Pavilions however desires of discovering a job “with ardour and pleasure” as soon as she’s maximized her pension.

(Allen J. Schaben / Los Angeles Instances)

With a great pension plan and years of placing 10% of her paycheck into her 401(okay), Sasaki had deliberate to go away when she reached her “golden 85” — when her age plus her years vested with the corporate totals 85, permitting her to get the utmost payout from her pension. Her 401(okay) plan doesn’t have an employer match.

She didn’t intend to cease work totally however was trying ahead to discovering some form of job “with ardour and pleasure, you recognize, one thing that introduced lots of happiness to my life.”

However her golden 85 flew by in December, and she or he doesn’t suppose she will be able to go away fairly but. Her daughter is barely 14, and she or he’s the breadwinner of the household whereas her husband focuses on child-rearing. Her husband retired 12 years in the past at age 53 after reaching his golden 90, additionally at Pavilions, the place he labored as an evening crew supervisor.

Then the inventory market plummeted in June and she or he realized the cash she had invested in her 401(okay) wasn’t one thing she might rely on in the meanwhile.

“That introduced a tear to my eye after I noticed that,” Sasaki stated.

For now, Sasaki plans to remain at Pavilions no less than till her daughter graduates from highschool, serving to her by school if doable. However at the back of her thoughts, she’s at all times questioning: Will her financial savings ever be sufficient?

Sasaki stated she’s seen older people come into her retailer, many on meals stamps, and have to alter the best way they eat due to their revenue.

“I don’t need to be that one that has to buy at my retailer and purchase nothing however actually excessive carbed-up meals or, you recognize, day-old stuff,” Sasaki stated. “It’s simply actually unhappy.”

‘I nonetheless really feel a bit bit of hysteria’

Walnut resident Susan Trigueros has been retired for less than the final two months and already she’s desirous about issues she thought she’d left behind for good: the lengthy record of work-related contacts she made working for an power firm, her work on many boards and associations. Briefly, she’s desirous about the entire folks and locations that would assist her go away retirement.

Susan Trigueros, proven along with her husband, Mario, says she should remind herself to belief her monetary planner, who has assured her that she has saved sufficient even for a worst-case situation.

(Irfan Khan / Los Angeles Instances)

Trigueros, 63, is apprehensive she didn’t save sufficient earlier than calling it quits on her profession. “I’ve financial savings, a terrific pension, however I believe I began saving too late,” Trigueros stated. “You by no means have full confidence about it. I maintain myself accountable for not doing a greater job saving. I didn’t do it till I used to be in my 30s.”

She’s additionally apprehensive about having the ability to meet the wants of her massive household.

“My husband and I’ve seven youngsters and nearly eight grandchildren; yet another on the best way,” she stated. “My sister and I cut up look after our 90-year-old mom, who has extreme dementia. I’m involved about her well-being. I fear about all of my household that means.”

With inflation and the price of dwelling additionally weighing on her thoughts, Trigueros has needed to remind herself that she has labored with a monetary advisor and must belief his judgment.

“He did eventualities for me, greatest and worst case. And even within the worst case situation, I’ll be OK, he says, however I nonetheless really feel a bit bit of hysteria,” she stated. “That anxiousness is why I’m already desirous about probably returning to work. I’ve gained lots of abilities that I imagine may very well be marketable.”

Trigueros added, “I believe I might most likely seek the advice of. I might most likely work half time serving to younger folks obtain their potential, though at this level, I’m simply attempting to get pleasure from, or get acclimated to, retirement.”

‘I assumed I had just a few extra years to work’

Shari Biagas spends time along with her son, Joshua Duviella, who lives in Washington. Biagas hopes to dwell nearer to him after he and his girlfriend calm down.

(Shari Biagas)

When Shari Biagas was laid off from her healthcare data expertise supervisor job in Temple, Texas, in Could 2021, she didn’t anticipate to retire simply but.

She beloved her job and had deliberate to proceed working there so long as she might. Then her employer outsourced the IT division.

“I didn’t suppose that I’d be retiring at 62, early,” Biagas stated. “The concept of being laid off was by no means in my thoughts ever. … I actually thought I had no less than just a few extra years to work.”

Biagas looked for employment elsewhere with out success. Well being points made it troublesome for her to work as effectively. By January, she had determined to embrace early retirement.

However she is aware of her present funds received’t final her ceaselessly.

Biagas nonetheless has two years left on her automobile funds and about seven years on the mortgage for her home, which she purchased with no down fee in 2006, proper earlier than the housing bubble burst.

She estimates her 401(okay) and money financial savings will final her possibly 5 years, and she or he’s already drawing from her Social Safety.

She’s hoping to get a part-time distant job, probably as a proofreader or one thing within the medical area — Biagas spent eight years as a nurse in a hospital oncology unit. Till then, she’s attempting to get pleasure from her retirement whereas protecting prices low.

“Spending extra time with buddies — that’s just about it,” Biagas stated. “I’ve not performed any touring. I do learn and play video games to maintain my thoughts working.”

‘My precedence was being a mother or father’

At the beginning of 2021, Maryann O’Connor offered her home and moved in with two of her buddies in Cumberland, R.I. They take turns cooking, watch MSNBC collectively and name themselves the “Golden Ladies.”

After adopting and elevating three youngsters on her personal, the 66-year-old doesn’t know when she’ll ever be capable to retire. She began her personal enterprise in 2007, DaiNell Bookkeeping and Consulting, changing into self-employed to make money working from home and maintain her youngsters. Earlier than that, O’Connor labored in finance for organizations together with an government teaching firm and a college.

Maryann O’Connor, 66, lives with two different ladies and her two canine in Rhode Island. They offered their homes and moved in collectively at the beginning of 2021 to economize.

(Maryann O’Connor)

She has some retirement financial savings in an IRA invested within the inventory market, however not a lot.

“I’ve at all times thought of [saving for retirement], however being a single mother or father, my precedence was being a mother or father,” O’Connor stated.

Her youngsters are all of their 20s. They’re nonetheless “getting established themselves,” however she hopes they may be capable to assist her out financially as soon as she will get older.

With COVID-19 decimating lots of her small-business purchasers, her bookkeeping firm is a fraction of what it was once. She additionally began a journey enterprise for girls — proper earlier than the pandemic hit.

Since then, she’s been working to rebuild each companies whereas beginning one other that helps folks handle care for his or her aged relations.

“I wished to retire 10 years in the past however I’m hoping to have the ability to help myself no less than until I’m 70 to get the complete Social Safety,” O’Connor stated.

‘Is right this moment the day you’re going to retire?’

Los Angeles Dodgers followers Melisa and Paul Marks sit of their memorabilia-filled lounge in Huntington Seaside.

(Wesley Lapointe / Los Angeles Instances)

After working for Southern California Fuel Co. for 27 years, Melisa Marks had a troublesome choice to make.

In the previous few years, she witnessed buddies her age move away and colleagues get most cancers. Her husband, who retired 5 years in the past from the Orange County Hearth Authority, would ask her each morning: “Is right this moment the day you’re going to retire?”

“I don’t suppose that I need to keep working and never be capable to get pleasure from what I have already got,” Marks, 58, stated.

So she sat down with a monetary planner and checked out her pension, her husband’s pension, years of 401(okay) contributions, and her personal financial savings squared away on prime of that. She will be able to’t take from her pension or 401(okay) but with no penalty, in order that they must survive on her husband’s pension and private financial savings in the interim.

They nonetheless had 12 years of funds left on their home in Huntington Seaside, however their monetary planner stated they need to proceed paying it off progressively since that they had a great rate of interest.

Marks checked out her insurance policy in addition to her web and TV plans to ensure they had been getting the perfect charges and paying just for what they actually wanted. She saved about $300 a month by simply doing that, she stated.

With reduction, Marks loved her first day of retirement Aug. 1.

“My father handed away early this 12 months, and I simply hope I’m in a position to be one of many ones in his household the place he was in a position to be retired longer than he labored,” Marks stated. “I don’t suppose there’s most likely too many in that group.

‘I look ahead to having fun with grandkids’

For the document:

12:04 p.m. Sept. 29, 2022A earlier model of this text misspelled Rosa Aleman’s title as Rose. It additionally stated her month-to-month pension profit will improve by $2.82 for each hour she works for the lodge; that determine is definitely what the lodge pays into the pension fund, not the incremental improve in her profit.

After 23 years as a room attendant on the Beverly Hilton lodge, Rosa Aleman plans to retire when she turns 65 in six years.

Beneath her present union contract, staff like Aleman would accrue a month-to-month pension advantage of $1,000 for each 15 years labored, stated Maria Hernandez, a spokesperson for Unite Right here Native 11 who translated the interview.

Rosa Aleman stands in entrance of the Beverly Hilton, the place she has labored for 23 years.

(Wesley Lapointe / Los Angeles Instances)

For many years, Aleman has supplied for her mom and siblings in El Salvador, so she doesn’t have a lot in private financial savings. She plans to depend on her pension and no matter she will be able to get from Social Safety when she retires. Her husband is in search of work after being fired from a nonunion job that “left him with nothing,” Aleman stated.

“I’m involved in regards to the inflation round retirement, however what considerations me extra is studying about lots of people who occurred to move away earlier than they retire,” Aleman stated. “I hope to have the ability to retire to get pleasure from the remainder of my life.”

In her post-retirement plans, her daughter, who’s incomes her grasp’s diploma at UCLA, performs a big position.

“I look ahead to hopefully having fun with any grandkids that my daughter offers me when she will get married,” Aleman stated.

‘My physique and thoughts instructed me it was time’

William Strachan, 68, was adamant about not delaying retirement too lengthy.

“I discover that individuals in the event that they retire after 65 or in the event that they retire after 70, they simply lose one thing in them,” stated Strachan, who’s single and lives with a miniature schnauzer named DJ.

“As soon as the pandemic hit, that form of simply blew life aside,” says William Strachan, seen right here at his house in Ontario along with his canine, DJ.

(Irfan Khan / Los Angeles Instances)

He retired proper on schedule, at age 64, in February 2018. “I used to be prepared,” he stated. “My physique and my thoughts instructed me it was time.”

However the timing quickly proved not superb. “As soon as the pandemic hit, that form of simply blew life aside,” he stated.

As a substitute of touring throughout Europe and visiting household in Maryland, Strachan bunkered down at house with the remainder of the nation and made probably the most of his retirement at house. He does landscaping in his yard, works out with a private coach twice per week and attends church on Sundays.

Financially, Strachan had been getting ready for some time. He has a pension with the Los Angeles County Staff Retirement Assn. after working as a registered nurse for the county, incapacity cash from the U.S. Division of Veterans Affairs, and a bit little bit of Social Safety on prime of that.

He doesn’t have any cash within the inventory market. However as a member of SEIU Native 721, he had one other financial savings account with a 4% match from the county that he contributed to through the years, and he cashed it out to speculate the cash in his home, which he bought in Ontario in 2003.

Strachan began his profession within the Navy as a hospital corpsman however left on a medical discharge after a surgical procedure gone awry. He received his bachelor’s diploma and his registered nursing license, finally working at Los Angeles County-USC Medical Heart for 26 years.

Even when retirement hasn’t been fairly the best way he pictured it, he has no regrets about leaving the workforce when he did. Being a registered nurse “might be very exhausting mentally and bodily,” Strachan stated. “My mind was burned out.”

‘I form of let the expertise move me by’

A forklift operator since 2004, Jerry Williams didn’t know a lot about discovering work on-line. He didn’t even personal a pc.

“I’m a forklift driver,” Williams stated. “Why do I’ve to discover ways to search for jobs on computer systems? That’s what I assumed.”

Then Williams, who lives in Grand Prairie, Texas, misplaced his job in a dispute along with his boss. Out of the blue, his lack of tech savvy was stopping him from saving for a greater retirement.

“That is no person’s fault however mine. I form of let the expertise move me by,” he stated. “None of that is an excuse. I simply let it slip by.”

Nonetheless, as an skilled driver in an economic system that lives on warehousing and distribution, he wasn’t too apprehensive. When he started to listen to about job openings by Seniors4Hire, he figured his four-month search was near an finish.

As a substitute, he saved listening to rejections or that the place had already been crammed.

“A staffing company referred to as me and stated, ‘We’ve received a job for you. Simply are available and fill out the paperwork,’” Williams stated. “I did that and after they [saw] my age, they stated the job wasn’t accessible anymore. Two days later, I discover the identical job listed that they stated wasn’t there anymore. It’s been like that lots. It’s discrimination.”

It was an excessive amount of for Williams to endure. “I’ve utilized for Social Safety,” he stated. “If one thing lastly does come up, I’ll return to work, however for now, I’m performed.” Will probably be a really frugal retirement, however Williams had already determined he might dwell with lower than he deliberate to have.

“Retirement’s not going to be a lot, simply what I must dwell comfortably, my form of comfy,” Williams stated. “Good and simple, espresso on the porch within the morning, groceries in the home and gasoline in my truck. I’ll be alright with that if I’ve to be.”

‘Oh gosh, this isn’t good’

Larry Smith’s monetary planner is aware of him because the form of cautious shopper who likes to double- and triple-check all the pieces. Because the second for retirement drew close to, Smith, 64, thought-about, waited and finally determined that the timing was not proper in 2018, 2019 and once more in 2020 and 2021.

In March, the L.A. resident lastly instructed his boss on the L.A. County Sanitation District, the place he labored as an engineer, that he was planning to retire on the finish of September. “In fact, that’s when the inflation tales turned a drumbeat,” he stated. “I assumed, ‘Oh gosh, this isn’t good.’”

Smith’s pension is ready to rise slowly, as much as 2% a 12 months, with the primary improve not coming till 2024.

Nonetheless, Smith pressed on along with his plans, too weary of the stress and uncertainty of his job. He had put in 30 years towards his pension; it must be sufficient.

“Whenever you come to work within the morning, you suppose you’re going to do one factor, and it seems to be one thing you by no means noticed coming,” he stated. “I name it the hamster wheel, and I wished to leap off.”

Giving him pause was the thought that he would possibly must depend on his pension for an additional 30 years; longevity runs in his household. “I assumed, ‘If I’m going to want extra money, the time after I can earn the cash is now, as a result of much less individuals are going to rent me after I’m 75,” he stated.

Used to Smith’s second-guessing, his monetary advisor has assured him it must be OK with out supplemental revenue.

“She’s telling us, ‘You’re going to wind up with cash you’ll be able to go away to somebody.’ I perceive what she’s doing and I type of imagine it. I imply I do, I assume, in my logical mind, I imagine it, however in my emotional mind, I simply fear, nonetheless.”

‘This 12 months form of threw us off observe’

As a profession human sources skilled, Genevieve Vigil continuously beat the drum in regards to the significance of 401(okay) contributions.

Genevieve Vigil and her husband, Bruce Adler, pause for a selfie en path to their thrice-weekly stroll in Sign Hill.

(Bruce Adler)

“I used to be at all times petitioning administration to do higher matches, to have cheap administration charges,” she stated. “I used to be at all times speaking to each worker about benefiting from the corporate matching your contributions: ‘That is free cash.’”

One one that wanted to listen to that message was her husband. “He didn’t at all times maximize his 401(okay) deduction. However he actually improved.”

With a pool of financial savings and untouched IRAs, Vigil prevented taking Social Safety earlier than her seventieth birthday to maximise the profit, and her husband was planning on doing the identical. However now they’re pondering he’ll faucet his Social Safety starting in November, when he turns 69.

“We’re doing that due to what’s occurred to the inventory market, and due to inflation and costs,” she stated. “This 12 months form of threw us off observe.”

Though neither is considering working once more, they aren’t slowing down and taking it simple both. She takes free water aerobics courses 4 occasions per week, they usually stroll 4 miles 3 times per week in Sign Hill.

“The day will come the place we are able to’t do any of these issues, so we would as effectively do them till we are able to’t,” she stated.

Business

TV series based on Shohei Ohtani interpreter gambling scandal in the works at Lionsgate

Lionsgate Television is developing a scripted series based on the real-life gambling scandal involving Dodgers superstar Shohei Ohtani’s interpreter.

The show will follow Ohtani’s story — his meteoric rise in the MLB, his 10-year, $700-million contract with the Dodgers and then the devastating news that his interpreter, Ippei Mizuhara, had allegedly stolen $17 million from him to pay off gambling debts.

The Dodgers fired Mizuhara after learning of the allegations. Mizuhara, 39, has agreed to plead guilty to one count each of bank fraud and signing a false tax return. He faces up to 33 years in prison for the two crimes.

The series will be produced by Tony Award winner Scott Delman, known for “The Book of Mormon” and “Raisin in the Sun,” and sports journalist Albert Chen, Santa Monica-based Lionsgate said Thursday.

“This is Major League Baseball’s biggest sports gambling scandal since Pete Rose — and at its center is its biggest star, one that MLB has hitched its wagon on,” Chen said in a statement. “We’ll get to the heart of the story — a story of trust, betrayal and the trappings of wealth and fame.”

The Ohtani series is just the latest in a long list of TV shows and movies that have been ripped from the headlines. The 2018 rescue of a soccer team from a cave in Thailand was the subject of two movies, a Netflix series and documentary and a National Geographic documentary. Last year’s “Dumb Money” was based on the real-life Gamestop stock saga, one of several Hollywood projects that were launched to capitalize on the meme stock sensation.

Business

L.A. County to offer discounted home internet to lower-income residents in some neighborhoods

With the federal government poised to slash subsidies for internet service, L.A. County has started work on a wireless broadband network that will deliver high-speed connections for as little as $25 a month.

The county announced this week that it had signed a contract with WeLink of Lehi, Utah, to build the network and offer the service in East Los Angeles, Boyle Heights and South Los Angeles. Qualified households will be offered a $40-per-month discount on WeLink’s rates, meaning they could obtain the basic 500-megabits-per-second service for $25 a month.

The contract brings a new internet provider to neighborhoods now served mainly by Spectrum and AT&T, which also offer discounted service for lower-income residents — though at much lower speeds. But it will take months for WeLink to build its network, which will rely on a series of rooftop antennas connected to the internet through existing fiber-optic lines.

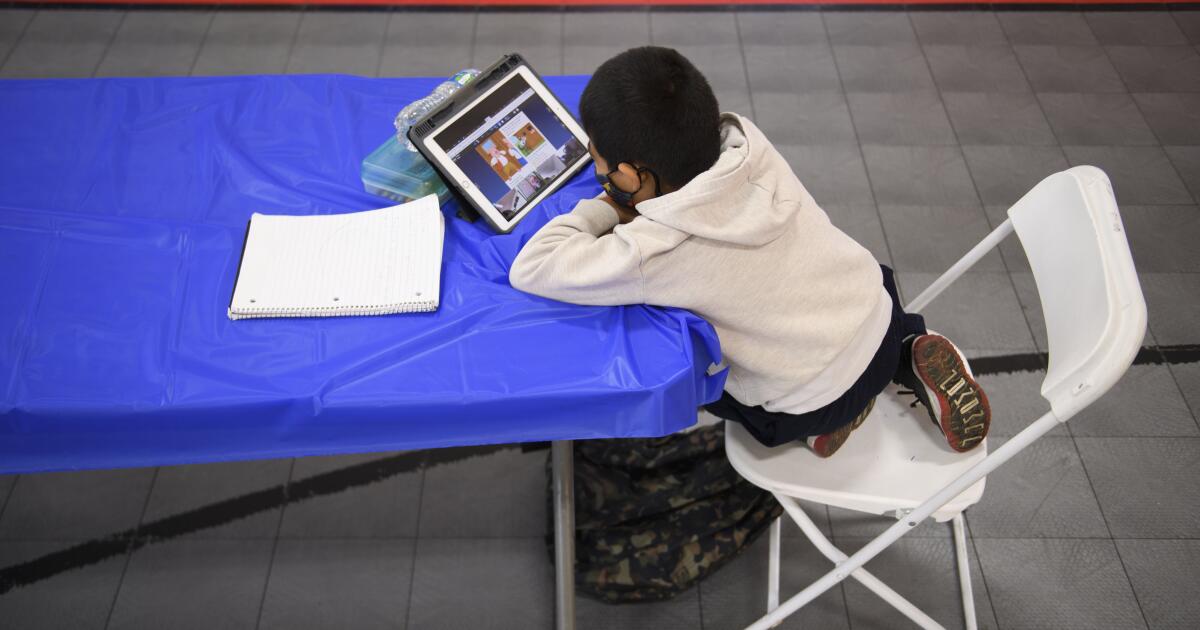

The looming loss of federal subsidies is a much more immediate problem. Unless Congress renews its funding, the Affordable Connectivity Program will be lapsing this month, terminating a $30-per-month benefit that has allowed 23 million lower-income households to obtain broadband service at little or no cost.

L.A. County has more of these subsidy recipients than any other county in the country — 983,000 households, said Eric Sasaki, manager of major programs for the county’s Internal Services Department. The county’s enrollment, he said, is higher than that in 45 states.

The county’s deal with WeLink has similar roots to the Affordable Connectivity Program, which grew out of the emergency broadband subsidy program the federal government launched at the height of the COVID-19 pandemic.

In 2021, Sasaki said, the L.A. County Board of Supervisors decided to explore ways to bring high-speed internet quickly to lower-income neighborhoods where more than 20% of the homes weren’t connected. Concerned about kids struggling to attend online classes, the county looked at putting wireless internet hubs at libraries, parks and even restaurant chains before deciding to conduct demonstration projects in four regions: East L.A./Boyle Heights, South L.A., the northern part of the San Fernando Valley, and five cities in the southeastern part of the county.

The county has received $50 million in federal funds for the projects, but about $45 million will go to the East L.A. and South L.A. rollouts, Sasaki said.

“We are also looking for additional funding sources to help execute additional projects,” he said.

The demonstration projects “are kind of a proof of what is possible,” Sasaki said. “The idea was that these would be sustainable and long term.”

WeLink’s service area in East L.A. and South L.A. covers more than 275,000 households and small businesses within 68 square miles.

All or part of the following communities are to be served:

East Los Angeles, Boyle Heights, Lincoln Heights, Montecito Heights, El Sereno, Adams-Normandie, University Park, Historic South-Central, Exposition Park, Vermont Square, South Park, Central-Alameda, Chesterfield Square, Harvard Park, Vermont-Slauson, Florence, Florence-Firestone, Manchester Square, Vermont Knolls, Gramercy Park, Westmont, Vermont Vista, Broadway-Manchester, Green Meadows, Watts, Athens, Willowbrook, West Rancho Dominguez and Walnut Park.

The company plans four tiers of service, with equal speeds for uploads and downloads: $65 a month for 500 Mbps, $75 for 1 gigabyte per second, $85 for 2 Gbps, and $99 for small-business connections. Installation and a router will be included, WeLink Chief Executive Luke Langford said.

Qualified homes will receive a $40-a-month discount on the residential tiers. The initial plan is to use the same eligibility requirement the federal government uses for the Affordable Connectivity Program: households earning up to 200% of the federal poverty level, which would be $30,120 for a single individual or $62,400 for a family of four. If the federal program is extended, qualified households would be able to receive the WeLink service at no cost.

If the program is not extended, WeLink and the county will come up with an alternative metric, Langford said, adding that his company is comfortable offering the discounts under the current terms.

The contract calls for WeLink to provide discounted service to 50,000 households. Sasaki said the county would be thrilled if that many homes signed up for the $25 monthly service; if there is even more demand, he said, the county will look for ways to support it.

Surveys show that lower-income households are less likely to have a home internet connection not because the service isn’t available, but mainly because it’s not affordable. Other problems include not having a computer or knowing how to use one, as well as a lack of awareness about programs that can help users overcome these hurdles.

Sasaki said the county plans to address those issues with programs to supply free laptops and technical assistance from “digital navigators” in the communities being served.

It wasn’t an explicit goal of the community broadband program to spark more competition among internet providers, but that’s happening with the WeLink deployment. And if Spectrum and AT&T lower their prices in response, Sasaki and Langford said, that’s another way the project will benefit targeted communities.

WeLink uses unlicensed spectrum in the 60-gigahertz band of frequencies, which means it doesn’t need to obtain permits for the airwaves or tear up streets for new fiber-optic lines. It will also design the network in a way that reduces the number of antennas required to carry data.

Those steps should speed construction of the network, Langford said. But WeLink still has to strike deals to mount its antennas on rooftops, lights and street poles, he said, as well as to use the fiber-optic lines that will connect its network to the internet.

Langford said he expects a “relatively modest” number of customers to be offered service by the end of the year, with the bulk of the deployment going live in 2025 and beyond. People interested in the service can sign up for updates at the WeLink website.

The very high frequencies used by WeLink can transmit an enormous amount of data, but unlike the lower frequencies used by radio stations and cellphones, they don’t travel well through walls. Langford said WeLink installers will either use new cables or a building’s existing wiring to connect the rooftop antennas to routers inside customers’ homes and businesses.

Founded in 2018, WeLink has built networks serving parts of Las Vegas, Phoenix, Dallas, Washington, D.C., and Los Angeles, Langford said.

Business

LAist staffers offered buyouts ahead of possible layoffs at public radio station

Journalists at LAist have been offered buyouts ahead of a potential round of layoffs at the local public radio station that broadcasts under the call sign KPCC-FM (89.3).

Kristen Muller, chief content officer at LAist, informed donors by email on Thursday that the company is pursuing a “voluntary buyout program for current employees” in an effort to prevent cuts. All full- and part-time staffers who work at least 24 hours per week are eligible for buyouts.

LAist reporter Caitlin Hernández posted an excerpt from the memo online, along with a link for listeners who wish to donate to the nonprofit parent network Southern California Public Radio.

“Our hope is that these buyouts will be enough to shrink the gap and avoid layoffs, but that remains unclear,” Muller wrote. “In a commitment to transparency, we will continue to share updates with you as the situation evolves.”

In a statement provided Thursday to The Times, Muller said LAist is “facing a significant budget shortfall” ranging from $4 million to $5 million over the next two years. She cited a decline in advertising, dried-up investment reserves, digital monetization issues “and overall cost increases that have not kept pace with revenue.”

“We have reduced all non-salary expenses as much as possible,” the statement read.

“This does not mean we are retreating from our cross-platform ambitions, or our desire to be a daily digital habit for Southern Californians seeking trustworthy news and information,” it continued. “In fact, our work has never been more vital, and we are committed to its growth.”

LAist is not the only SoCal media organization that has been struggling.

In March, the Long Beach Post laid off nine staffers after newsroom employees moved to unionize and went on strike to protest the impending cuts. Former and striking Long Beach Post journalists have since formed their own media outlet, the Long Beach Watchdog.

According to the Watchdog, the National Labor Relations Board is investigating allegations that the Long Beach Post and the Long Beach Business Journal retaliated against workers for moving to unionize under the Media Guild of the West. The Times has asked a Post representative for comment.

The Los Angeles Times also has undergone layoffs in recent months. The Times cut more than 100 staffers — roughly 20% of the newsroom — in March, citing heavy financial losses.

-

Politics1 week ago

Politics1 week agoStefanik hits special counsel Jack Smith with ethics complaint, accuses him of election meddling

-

Politics1 week ago

Politics1 week agoThe White House has a new curator. Donna Hayashi Smith is the first Asian American to hold the post

-

World1 week ago

World1 week agoTurkish police arrest hundreds at Istanbul May Day protests

-

Politics1 week ago

Politics1 week agoAdams, NYPD cite 'global' effort to 'radicalize young people' after 300 arrested at Columbia, CUNY

-

News1 week ago

News1 week agoVideo: Police Arrest Columbia Protesters Occupying Hamilton Hall

-

News1 week ago

News1 week agoSome Republicans expected to join Arizona Democrats to pass repeal of 1864 abortion ban

-

News1 week ago

News1 week agoPolice enter UCLA anti-war encampment; Arizona repeals Civil War-era abortion ban

-

Politics1 week ago

Politics1 week agoNewsom, state officials silent on anti-Israel protests at UCLA

/cdn.vox-cdn.com/uploads/chorus_asset/file/22173543/IMG_6828_3.jpg)