Business

Did Dodgers underestimate value of Shohei Ohtani's first homer? It may be worth $100,000

A baseball falls from the sky and into a fan’s hands. Or at least it comes to rest near their feet and they reach down and secure it. The fan has taken possession of something that might have monetary value. It is theirs to do with as they wish.

Ambar Roman’s seat in the Dodger Stadium right-field pavilion April 3 became the resting point of Shohei Ohtani’s first home run as a Dodger. The 28-year-old Whittier woman picked up the ball and her world became a swirl.

Roman and her husband, Alexis Valenzuela, say Dodgers security personnel persuaded her to surrender the ball for a bat, a ball and two caps, all autographed by Ohtani. Why? Ohtani wanted the genuine article and told reporters after the game, “For me, it’s a very special ball, so I’m thankful.”

Two experts at auction houses that regularly auction baseball memorabilia said the ball is worth approximately $100,000, while the signed merchandise Roman received in exchange for the ball would sell for less than $10,000.

The current bid for Mike Trout’s 2024 opening day home run baseball is $7,010.00. The MLB hologram sticker authenticated the ball.

(MLB)

Gary Cypres, founder of the Sports Museum of Los Angeles and owner of the greatest collection of Dodgers memorabilia anywhere, said, “I might be willing to pay a little more than the $100,000” but that other Dodgers collectors probably would pay $50,000 to $75,000.

Roman and Valenzuela said the Dodgers told her the ball would be worthless if she took it home because it would not be “authenticated,” a word with a precise meaning regarding sports memorabilia in general and a baseball hit into the stands in particular. The Dodgers have disputed that, saying she was only told that the ball could not be authenticated by MLB.

The couple also said Dodgers personnel would not allow Valenzuela to participate in his wife’s negotiation and did not escort them to the parking lot with their Ohtani-autographed merchandise, resulting in a public relations black eye for a franchise generally regarded as operating with class and in the best interests of its fan base.

The episode isn’t over: Roman and her family are invited to Dodger Stadium on Friday — on her birthday, no less! — during which she will receive more memorabilia and premium seats for giving the ball to Ohtani, who a Dodgers official said is expected to meet her. Onlookers undoubtedly will be calculating whether her haul is roughly equivalent to the six-figure valuation.

Fans applaud Shohei Ohtani as he heads to the dugout after hitting his first homer with the Dodgers.

(Allen J. Schaben / Los Angeles Times)

The Dodgers also said they’re going to analyze how they interact with fans who secure milestone baseballs.

“We’re excited to host them again for a special night and give them a special Dodger experience,” said Lon Rosen, the Dodgers’ executive vice president and chief marketing officer. “And we’re going to review the process.”

Still, the episode raised questions. Did the Dodgers drop the ball by not providing Roman with authentication? If Roman had left the stadium with the ball, would it be worth less at an auction because it wasn’t authenticated? Is the ball authenticated as Ohtani’s first home run even now, in Ohtani’s possession?

And, how does authentication work, anyway?

Fake sports memorabilia and forged autographs were rampant in the 1990s, prompting the FBI to launch a probe called “Operation Bullpen.” San Diego Padres great Tony Gwynn was recruited to participate because he’d flagged several items in a Padres gift shop that featured his forged signature.

The investigation resulted in the convictions of more than 50 people and the dismantling of a dozen or so forgery rings by 2001, the same year Major League Baseball implemented an authentication protocol to protect fans and players alike from fake items in the burgeoning memorabilia market.

Rangers catcher Jonah Heim with the authenticated baseball that was the last out of the 2023 World Series. The authentication hologram sticker is visible at the top of the ball.

(MLB)

The technology used by MLB authenticators — most of whom are current or former law enforcement officers with chain-of-custody training — has evolved. Today, an authenticator sits in each dugout of every game, witnesses the use of every conceivable item from baseballs to bats to bases to lineup cards to uniforms to gloves, and affixes a tamper-proof numbered hologram to identify its authenticity.

An exception? Balls that fly off a bat and into the stands. Chain-of-custody integrity can be compromised as soon as a ball leaves the field. Therefore, home runs such as Ohtani’s initial blast as a Dodger cannot be authenticated — at least not through the strict MLB protocol.

This is where the Dodgers’ version of what transpired with Roman diverges. She told The Times’ Bill Plaschke that the Dodgers informed her that if she kept the ball, the team would not authenticate it and the ball would be worthless. Two Dodgers executives who requested anonymity because of the sensitive nature of the topic said Roman was told the ball could not be authenticated, period. It had nothing to do with whether she chose to take it home or not.

In fact, even in Ohtani’s possession, the ball is not MLB authenticated. Common sense might dictate that video captured Roman holding the ball and celebrating, and that moments later Dodgers security personnel made a beeline to her seat and whisked her away with the ball.

Does anyone really believe she somehow swapped out the ball for another official major league ball that never kissed Ohtani’s lumber?

“The authentication program has a strict rule about not authenticating a ball once it goes into the stands because we know fans bring balls to games and can also get balls from batting practice,” said an MLB spokesman who requested anonymity because they weren’t authorized to speak on the record. “Above all else though, the program does not allow for authenticating balls in the stands because it is a chain-of-custody and witness-based program.”

Although the Dodgers may have underestimated the potential value of Ohtani’s first home run with the team and the interest it would generate, MLB makes the decisions pertaining to authentication.

MLB could have implemented “covert marking,” an I-spy-like term meaning that baseballs used during Ohtani’s at-bats would have been marked ahead of time with a combination of letters and numbers. However, the authentication official said covert marking is reserved for milestones, not for “player firsts” such as Ohtani’s first Dodger homer.

Recent examples include career home runs Nos. 500, 600 and 700; career hit number 3,000; the final hits by Derek Jeter and David Ortiz; and the last out at old Yankee Stadium. Cost, the spokesman said, has never been a consideration.

The practice was utilized when Barry Bonds chased Hank Aaron’s career record of 755 home runs in 2007 and most recently was used ahead of Aaron Judge’s 62nd home run in 2022 and Albert Pujols’ 700th career homer that same season.

“The fans that caught the balls were brought under the stadium and had the balls authenticated once the covert marking was confirmed by the authenticator in a private, secure area,” the spokesman said. “This was and always is agnostic of the [fans’] plans for the ball.”

Any item authenticated by MLB can be verified on a website by typing in the hologram identification combination — usually two letters and six numbers.

Before holograms and staff authenticators, memorabilia was authenticated primarily through a photo match. The jersey a player purportedly wore during a milestone moment, for example, could be matched against a photo of the player wearing the jersey in that game. The system wasn’t perfect, but it was better than blindly taking someone’s word.

The technological advances and resources MLB and other leagues have put into authentication is appreciated by David Kohler, owner and president of Orange County-based SCP Auctions for 45 years.

“One of the best things to happen in the thriving memorabilia market is authentication and the authentication process,” he said. “It’s real. Authentication is why prices have gone up. There is a process and it’s great. It makes our job easier.”

Kohler said that while the Dodgers are “a class organization,” the MLB authenticator could have assisted Roman had she opted to keep the ball by making sure the one she left the stadium with was the same one she might later have sold at auction.

“They should have brought the authenticator in there, and he could have marked the ball,” he said. “Then let her go home with the ball and figure it out over the next few days.”

Shohei Ohtani’s first Dodgers homer was caught by Ambar Roman. Experts says the ball is worth about $100,000, while the signed merchandise Roman got from the Dodgers in exchange for the ball would sell for less than $10,000.

(Allen J. Schaben / Los Angeles Times)

The Dodgers might get a chance soon to implement any new policies pertaining to fans and valuable baseballs. Ohtani is one home run from tying former New York Yankees slugger Hideki Matsui for most MLB home runs by a Japanese player at 175, so the next two he hits could pique the interest of Japanese collectors as well as those in the United States.

What’s worth more than the baseballs Ohtani hits to reach milestone home runs? The bats. “Historically, bats from a value standpoint do much better in auctions than balls,” Cypres said.

Kohler and other auction executives can’t rely solely on sports leagues to provide authentication of memorabilia that customers want to buy and sell. They have developed inventive ways of establishing to a compelling degree that an item is everything the seller says it is.

Many items come with a letter of authenticity from the original owner. The 2000 NBA championship ring auctioned by Kobe Bryant’s parents in 2013 is an example: The ring has been sold three times since but continues to be accompanied by the original LOA signed by Kobe’s mother, Pam Bryant.

Several companies offer authentication services that promise to verify autographs, grade trading cards and issue certificates of authenticity. That might not be as ironclad as an MLB hologram sticker, but it weeds out obvious fakes.

The last home run Bonds hit — No. 762 — came Sept. 7, 2007, at Coors Field after MLB ceased supplying his games with covertly marked balls. A scramble for the ball occurred in the stands and MLB refused to authenticate it because of the confusion and lack of conclusive video evidence.

Jameson Sutton ended up with the ball but it wasn’t clear that the home run was Bonds’ last until the season ended three weeks later, at which point its value skyrocketed — if the ball could be authenticated. Enter Kohler, who commissioned a lie detector test that Sutton passed. The lie detector report accompanied the ball, which sold at SCP auction for $377,000 in April 2008.

SCP also auctioned a bat used by Lou Gehrig to hit his last home run, a spring training blast in 1939. Gehrig went homerless in eight games that regular season before retiring because of complications with amyotrophic lateral sclerosis, what would come to be known as Lou Gehrig’s disease.

Upon returning to the dugout, Gehrig handed the bat to a Yankees bat boy named Bing Russell, who became a popular television actor. His son is actor Kurt Russell and a grandson is former major leaguer Matt Franco, whose mom, Jill, kept the bat in an umbrella closet for years.

“My grandfather would bring out that bat every time we had people over and the conversation turned to baseball,” Matt Franco said. “He’d pass it around the table and he’d tell stories about all the guys on those teams.”

Jill Franco eventually auctioned the bat through SCP, and Kohler reached out to the Hillerich & Bradsby Co. to confirm it was one of the last models shipped to Gehrig. The venerable bat-making company keeps meticulous records, and an invoice shows the shipment of four bats in August 1938. It was Gehrig’s last order.

The most famous home run ball never found was the one hit by Kirk Gibson to win Game 1 of the 1988 World Series, voted by Times readers as the greatest moment in Dodgers history. The Dodgers commemorated the home run in 2018 by painting in blue the seat — Row D, Seat 88, Section 302 — where the ball is believed to have landed. Gibson even signed the seat.

On Gibson’s behalf, SCP auctioned all other memorabilia associated with the iconic hit — Gibson’s bat, helmet and uniform — bringing in a cool $1 million. The ball, however, is lost in the mist of pre-authenticator history.

“We’ve had people say they have the ball, but it never leads to anything,” Kohler said. “Authenticating it would be extremely difficult, almost impossible.”

Any self-respecting MLB authenticator no doubt would agree.

Business

Wonderful Co. sues to halt California card-check law that made it easier to unionize farmworkers

The Wonderful Co. is escalating its battle against unionization of its job sites, looking to halt a new state law intended to streamline the farmworker unionization process. The move comes two months after the United Farm Workers utilized the provision to become the collective bargaining representative for employees of the company’s massive grapevine nursery in Kern County.

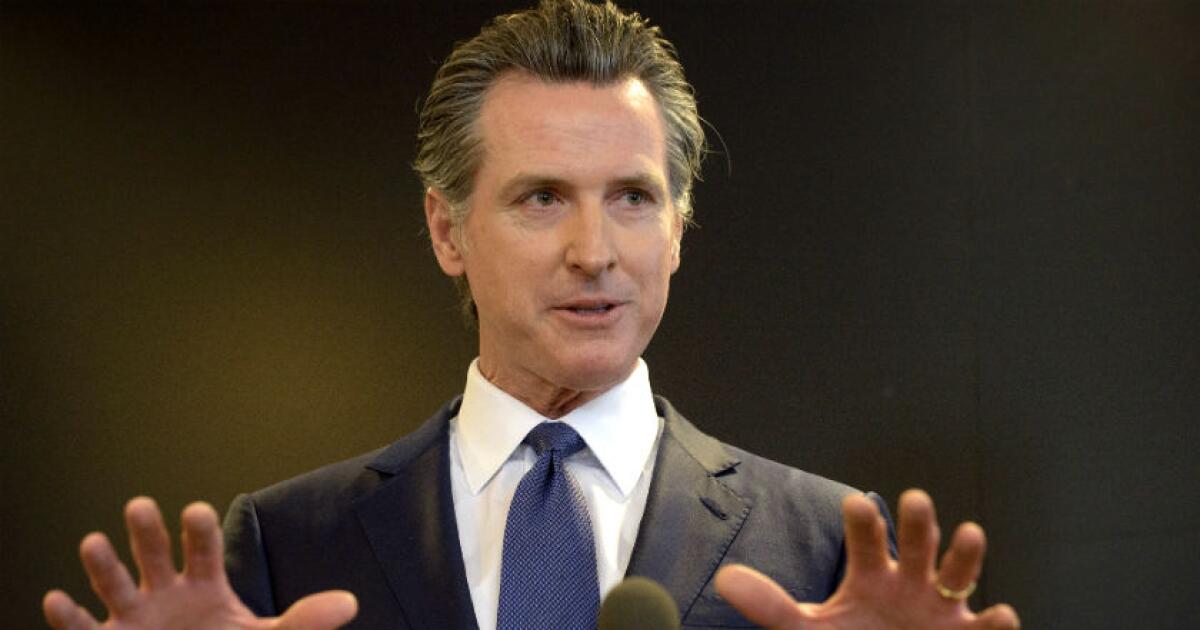

Wonderful, the $6 billion agricultural powerhouse owned by Stewart and Lynda Resnick, said Monday it is suing the state Agricultural Labor Relations Board, challenging the constitutionality of the state’s so-called card-check system, which Gov. Gavin Newsom signed into law in 2022. Under its provisions, a union can organize farmworkers by inviting them to sign authorization cards at off-site meetings, without notifying an employer, rather than voting by secret ballot at a designated polling place.

The company, whose portfolio includes such well-known brands as FIJI Water, Wonderful Pistachios and POM Wonderful, alleges in its lawsuit that the law deprives employers of due process on multiple fronts. Among them: forcing a company to enter a collective bargaining agreement even if it has formally appealed the ALRB’s certification of a union vote and presented what it believes is evidence that the voting process was fraudulent.

Wonderful said it was compelled to file its lawsuit now because, under the card-check law, the company faces a June 3 deadline to reach a collective bargaining agreement or have one dictated by the ALRB.

“Having been compelled into a constitutionally unlawful procedure that imposes a constitutionally illegitimate certification, Wonderful has no meaningful way to obtain plain, speedy or complete relief other than through an order of this Court declaring that, on its face, [this section of the labor code] is unconstitutional,” the lawsuit said.

The lawsuit, to be heard in Kern County Superior Court, seeks to enjoin the ALRB from enforcing the card-check law’s provisions.

The ALRB did not immediately respond to the The Times’ request for comment.

A spokesperson for Newsom’s office said staff members were still reviewing the complaint, but included in the response Newsom’s comments when he signed the legislation. “California’s farmworkers are the lifeblood of our state, and they have the fundamental right to unionize and advocate for themselves in the workplace,” his statement said in part.

UFW spokesperson Elizabeth Strater said the union was not surprised by Wonderful’s move.

“This is an unfortunate tactic, but it’s not surprising,” Strater said. “They’ll do pretty much anything to prevent workers from being empowered.”

William B. Gould IV, a professor of law emeritus at Stanford Law School, described the card-check system as “an excellent statute to challenge” because of the confusion and ambiguity surrounding some of its provisions and the “potential for contacts between organizers and employees” that could raise questions about whether workers were acting with free choice.

While he predicted Wonderful would have a “difficult time” making its case in California, he said the company could be aiming to take its argument to the conservative-leaning U.S. Supreme Court.

“To paraphrase Frank Sinatra, now we’re in a situation where anything goes,” said Gould, who served as chair of the ALRB from 2014 to 2017.

The lawsuit is the latest salvo in what’s been a tumultuous dispute over the UFW’s unionization campaign at the nation’s largest grapevine nursery.

In late February, the union filed a petition with the labor relations board, asserting that a majority of the 600-plus farmworkers at Wonderful Nurseries in Wasco had signed authorization cards and asking that the UFW be certified as their union representative.

Within days, Wonderful hit back with an explosive allegation: The company accused the UFW of baiting farmworkers into signing the authorization cards while helping them apply for $600 in federal relief for farmworkers who labored during the pandemic. And it submitted nearly 150 signed declarations from nursery workers saying they had not understood that by signing the cards they were voting to unionize.

The ALRB acknowledged receiving the worker declarations; nonetheless, the regional director of the labor board moved forward three days later to certify the union’s petition. She has said in subsequent hearings that she felt she had to move quickly under the timeline laid out in the card-check law, and that at the time she did not think the statute authorized her to investigate allegations of misconduct.

Wonderful appealed the certification, alleging the UFW engaged in fraud to obtain employee signatures on authorization cards. The UFW countered that Wonderful had intimidated workers into making false statements and had brought in a labor consultant with a reputation as a union buster to manipulate their emotions in the weeks that followed.

A hearing on Wonderful’s objections has been playing out before an independent hearing examiner for the past three weeks. The lawsuit seeks to pause the hearing, pending the outcome of the card-check suit.

The UFW, meanwhile, is pursuing its own complaint against Wonderful. The union has filed a formal complaint of unfair labor practices with the ALRB, alleging Wonderful held mandatory meetings where company leaders urged employees to reject the union, circulated an anti-union petition and misrepresented the union’s intentions.

Business

Gov. Newsom seeks faster review of insurance rate hikes. What to know

With insurers continuing to pull back from the California’s homeowners’ market, Gov. Gavin Newsom wants to speed up the process by which the companies have their requests for rate hikes reviewed.

The governor said Friday that he is backing a bill that would require the Department of Insurance to complete reviews of proposed premium increases within 60 days to halt any more exits from the market. Here’s what to know:

What exactly did the governor say?

Newsom said that immediate steps need to be taken to stabilize the market, which has seen insurers not renew existing policyholders, stop writing new policies or pull out of the market entirely — sending many homeowners to the insurer of last resort, the state’s FAIR Plan, which is now on the hook for more than $300 billion in payouts. Newsom said he was “deeply mindful” of the burdens placed on the plan.

The governor said he had considered issuing an executive order, but instead is proposing a bill that would require the Insurance Department to speed up its review process of premium rate-hike requests.

“We need to stabilize this market. We need to send the right signals. We need to move,” he said.

Isn’t there already an insurance reform package being hashed out in Sacramento?

Insurance Commissioner Ricardo Lara is holding hearings on his Sustainable Insurance Strategy, a set of comprehensive regulations intended to stabilize rates and make it more attractive for insurers to write homeowners policies, especially in wildfire areas such as hillsides and canyons.

However, these regulations won’t become law until the end of the year — a deadline sought by the governor, assuming it can be met.

“It should not take this long for emergency regulations,” Newsom said. “We can’t wait until December.”

How would this bill fit into the larger set of reforms?

Lara has reached a grand bargain with the insurance industry to make the market more attractive, though details are still being worked out.

The plan would allow insurers to include the cost of reinsurance they buy to protect themselves from large fires and other catastrophes into premium costs. It also would allow them to set rates using sophisticated algorithms to predict the risk and cost of future fires, rather than just base them on past events. It’s unclear how an insurer’s application for an expedited rate approval this year would fit into the proposed reforms.

Has Lara reacted to the governor’s proposal?

The commissioner tweeted Friday that his department has taken “significant steps forward” to implement his planned reforms but more needs to be done — and that his department is working with the governor and the Legislature “on critical budget language that keeps us on track to get the job done.”

What do consumer groups have to say?

Jamie Court, president of Consumer Watchdog, said he didn’t understand the proposal, worrying that it would be a “rubber stamp” on proposed rate increases.

He noted that Proposition 103, the landmark 1988 initiative that gives the insurance commissioner authority to review rate hikes, already mandates that they are conducted within 60 days except in certain circumstances. Those circumstances include requests for rate increases exceeding 7% for homeowners insurance, which allow consumers to seek a hearing, or the commissioner’s own decision to conduct a hearing.

What is the insurance industry’s reaction

Rex Frazier, president of the Personal Insurance Federation of California, a trade group of property and casualty insurers, said despite the promise of 60-day rate reviews under Proposition 103, they are taking longer. He said the Insurance Department will often request that insurers waive their rights to a speedy decision or face an administrative hearing, which can lead to extensive delays. However, Frazier withheld comment on the governor’s proposal until the draft language is released.

What are the next steps?

Newsom’s office will release the draft bill, which will be carried by a member of the Legislature and be included in the process for adopting the state budget, which the Legislature must approve by June 15. Newsom made his remarks Friday in outlining plans for a revised $288-billion budget, which calls for a series of cutbacks to close a nearly $45-billion shortfall.

Business

The Battle for The Streets of New York

On a recent morning, the intersection of East 77th Street and Lexington Avenue presented a vivid illustration of the tumult.

A taxi trying to make a left turn had to maneuver around a Verizon crew digging up the asphalt. A box truck was parked in the bus lane, and the M102 bus, with its accordionlike belly, was forced to change lanes and snake around it.

Dozens of people streamed out of the subway and into the crosswalk. A man pushing a double stroller navigated between the subway entrance and a sidewalk compost box. A woman’s shopping cart wheels got stuck in a crack in the sidewalk. CitiBikes and delivery bikes whizzed by. A cargo bike stopped in front of a FedEx truck that was unloading packages next to a bike lane.

Lively, energetic streets make city living attractive — people to watch, windows to browse, benches to sit on, trees for shade.

But lately, New York City streets are teetering between lively and unlivable. Residents clash over traffic, noise, parking, 5G towers and heaps of trash. Most years, far fewer pedestrians get killed by motorists than in generations past, but last year was the deadliest year for cyclists since 1999.

Still, people who have thought deeply about the state of the city’s streets believe dramatic improvement may be on the way — if New York is willing to seize the moment.

That’s because the city is about to embark on the nation’s first congestion pricing plan, charging most drivers $15 to enter much of Manhattan below 60th Street — and forcing many commuters to find a different way into the city.

The aim is to reduce car traffic in one of the world’s busiest commercial districts and raise money for public transportation.

People, bikes and vehicles compete for space on New York City’s streets.

Karsten Moran for The New York Times

“I think this could be the catalyst for a streets renaissance in New York,” Janette Sadik-Khan, New York City’s former transportation commissioner, said in a recent interview.

“We have to talk about how we’re going to reclaim that space and make it work for people.”

Of course, congestion pricing, too, comes with a fight. The plan is supposed to start in June, but it faces several lawsuits brought by elected officials and residents from across the region, who describe it as ill-conceived and unfair to commuters who drive because public transit isn’t robust enough to serve their needs.

“They don’t drive because they want to,” said Susan Lee, a member of a coalition called New Yorkers Against Congestion Pricing. “They don’t want to sit in traffic.”

Could congestion pricing actually reduce the number of cars in the city to a dramatic extent? If so, what would take their place?

There are other ideas and experiments in the works for taming New York’s streets, and they raise questions of their own. Could a proposal to ban parking close to intersections improve public safety? Will the Sanitation Department’s garbage containerization plan make sidewalks cleaner? Is there a way to keep package delivery trucks from blocking the streets? Must 5G technology create public eyesores in residential neighborhoods?

In the months ahead, The New York Times will examine the debates raging in neighborhoods all over the city about who and what gets to take up space on New York’s streets and sidewalks.

How did we get here?

Orchestrating the flow of traffic and pedestrians has been a complicated and emotional project for centuries.

New York City’s streets were laid out before anyone knew how they would ultimately be used — long before cars were even invented. The first city planners could not have anticipated Uber vehicles, let alone Amazon deliveries or commuters on electric scooters.

In New York’s earliest days, the streets were a free-for-all. People walked or rode horses. There were no crosswalks or stoplights; if you had to cross the street, you simply walked across the street.

Traffic on Broadway in 1859 consisted of pedestrians, horse-drawn carts and streetcars.

William Notman, via Getty Images

Soon, horse-drawn vehicles used the streets alongside pedestrians, and people dashed between them. (Later, New Yorkers dodged streetcars in much the same way, giving the Brooklyn baseball team its name.)

The arrival of bicycles neatly encapsulated the city’s ever-shifting debate over how the streets should be used — and by whom.

By the 1890s, the streets were full of bikes. Men and women took to cycling through the city so quickly — and dangerously — that it was called “scorching.”

About 100 years later, in 1987, speeding bike messengers were deemed so dangerous that bicycles were banned from Midtown — temporarily.

Today, the city encourages residents and visitors to ride bikes. New York has bike lanes and a flourishing bike share program, plus an explosion of food delivery powered by e-bikes. The renewed popularity has also come at a grave cost: Last year 30 cyclists were killed on city streets, and 395 were severely injured.

“It’s hard to say whether it’s the best of times or the worst of times for bicycling,” said Jon Orcutt, the director of advocacy at Bike New York and the former policy director at the city’s Department of Transportation. “More people are doing it than ever.”

“If you’re not killed — squished like a bug — you can bike across town in 10 minutes,” he added. “It’s easy. It’s really efficient.”

Enter the car — and the car crash

On the evening of Sept. 13, 1899, Henry Hale Bliss, a 69-year-old real estate broker, was riding a Manhattan streetcar on his commute home.

At 74th Street and Central Park West, Mr. Bliss stepped from the streetcar and into the street, where he was immediately hit by a taxi. He died on the scene and is recognized as the first person in the United States to be killed by a car. There is a plaque at the intersection commemorating his death.

“At the end of the Gilded Age, right before World War I, suddenly, there were motor vehicles everywhere,” said James Nevius, an author and New York historian.

The development meant people could move around faster — but it also put more people in danger.

In 1920, there were about 200,000 registered vehicles in New York City; by 1925 that number had more than doubled. A century later, that figure is two million.

This scene of Park Avenue near 57th Street was typical of 1930s traffic. Over 10 million cars went through the Holland tunnel in 1930.

George Rinhart/Corbis, via Getty Images

And yet New Yorkers are still using the same streets that were laid out generations ago. In Manhattan, the rigid street grid was designed in 1811. Avenues are 100 feet across. Cross streets are 60 feet wide, including the space for sidewalks on both sides.

That’s 720 inches in which to fit not just cars but also pedestrians, baby strollers, trash, compost, scaffolding, bicycles, e-bikes, scooters, skateboards, package delivery trolleys, garbage trucks, delivery trucks, food carts, 5G towers, dining sheds, trees, CitiBike docks, buses, taxis, ambulances and on-street parking.

It’s like a giant game of Tetris — except all the pieces just won’t fit.

In fact, some of the pieces are growing larger: In the past decade, the average vehicle got 12 percent longer and 17 percent wider. (Cars’ blind spots have also gotten larger.)

And the number of pieces just keeps expanding. New York City’s population reached 8.8 million in 2020, and the New York region is now home to nearly 19 million people. The city’s population has dropped some in the past few years, but city officials believe that recent population estimates have significantly underestimated the number of newly arrived migrants, which, by some counts, is over 180,000.

Taming the streets

Even as New York’s streets and sidewalks have become more chaotic, there are also plenty of examples of the opposite: moments when the city has tamed the traffic and found new uses for its old spaces.

Over the past 10 to 15 years, sweeping pedestrian plaza initiatives — detouring cars and encouraging space for sitting and strolling — have gradually changed the landscape, from the Jackson Heights neighborhood in Queens to Times Square.

Times Square was once full of traffic. In May 2009, the city closed Broadway to cars and set out lawn chairs, the start of the area’s transformation to pedestrian plaza.

Damon Winter/The New York Times

The Open Streets program restored pedestrian-first streets, free of cars and safe enough for strolling, chatting and letting kids ride bikes.

The coronavirus pandemic ushered in a chance to rethink public spaces, and the absolute quiet on the streets during lockdown was a reminder that the city isn’t inherently noisy, but traffic is.

And there are plenty of other places to look for inspiration: In Bogotá, Stockholm, London and Paris, certain streets are being closed to cars. There is an effort in Europe to avoid the oversize pickup trucks and SUVs that make American roads so deadly. Paris has designated “school streets” where cars have been removed to make way for children. Cycling is flourishing in Europe; emissions are down.

In New York, Ms. Sadik-Khan, the former transportation commissioner, is among the people thinking deeply about the future of streets — and she is optimistic.

“There’s a new generation of New Yorkers who’ve never known a city without protected bike lanes and bike share,” Ms. Sadik-Khan said. “More people than ever are working from home. Commuting patterns are in flux. There’s the opportunity to make a new deal for people getting around.”

What will a “new deal” look like? And will New Yorkers be on board?

No matter what happens, change doesn’t come without a fight — and many of the battles will be fought street by street and block by block.

Over the next few months, we will take a close look at some of these street fights — and we’re eager to hear about yours, too.

Use this form to tell us what you think about the state of New York City’s streets.

-

News1 week ago

A group of Republicans has united to defend the legitimacy of US elections and those who run them

-

Politics1 week ago

Politics1 week agoHouse Dems seeking re-election seemingly reverse course, call on Biden to 'bring order to the southern border'

-

World1 week ago

World1 week ago‘It’s going to be worse’: Brazil braces for more pain amid record flooding

-

Politics1 week ago

Politics1 week ago'Stop the invasion': Migrant flights in battleground state ignite bipartisan backlash from lawmakers

-

World1 week ago

World1 week agoGerman socialist candidate attacked before EU elections

-

World1 week ago

World1 week agoSpain and Argentina trade jibes in row before visit by President Milei

-

Politics1 week ago

Politics1 week agoRepublicans believe college campus chaos works in their favor

-

Movie Reviews1 week ago

Movie Reviews1 week agoExhuma Movie Review: An effective horror film steeped in myth, legends, and realism