Business

A sign of the times: Tearing down an emptying O.C. office complex to build a warehouse

In the hierarchy of commercial real estate, office space has long been king.

Developers and landlords lived by the conventional wisdom that there was no better use for your square footage than business offices because they commanded higher rents than industrial spaces.

Simple math, the thinking went.

Well, not so simple anymore. At least in Santa Ana, where a perfectly good office complex is being demolished in a dramatic demonstration of how weak the office rental market has become and how deep the demand for Amazon-style distribution centers runs in Southern California.

The owners of the shiny glass building on Harbor Boulevard close to John Wayne Airport made the counterintuitive calculation that they will be better off owning warehouses than trying to wrangle tenants willing to pony up for conference rooms and corner offices.

“We had to make a strategic shift,” said Dan Broder, who is in charge of the redevelopment by Kearny Real Estate Co., owner of the property formerly known as Elevate @Harbor.

Lagging post-pandemic occupancy rates prompted owners of the office complex formerly known as Elevate @Harbor in Santa Ana to tear it down and build a warehouse.

(Lawrence M. Pierce)

The shift was prompted in large part by the COVID-19 pandemic, which contributed nationwide to shrinking office populations and rising demand for home delivery of all manner of goods. Four years on, overall demand for offices remains well below pre-pandemic levels, raising questions about how many buildings built for white-collar labor still have a viable economic future.

“There are a lot of office owners looking at their properties and wondering if those properties still make sense as offices,” said Michael Soto, Southern California research director for real estate brokerage Savills.

Some have decided they don’t, and the result has been a shrinking inventory of offices over the last year in several U.S. markets, including Orange County, Savills said in a recent report.

While those in urban centers making the decision to get out of the office game increasingly have looked to convert unloved offices to apartments, in some areas warehouses are hard to come by and, consequently, bring a premium, Soto said.

Orange County is prime territory for such switches, he said, because while it is still suburban in nature, it is densely developed with few empty sites available to build new distribution centers.

“There’s real pressure to redevelop older office buildings,” Soto said.

The incentive to redevelop Kearny’s property was enhanced by its location in an industrial district, which spared the company from having to go through time-consuming and challenging process of getting it rezoned for industrial use.

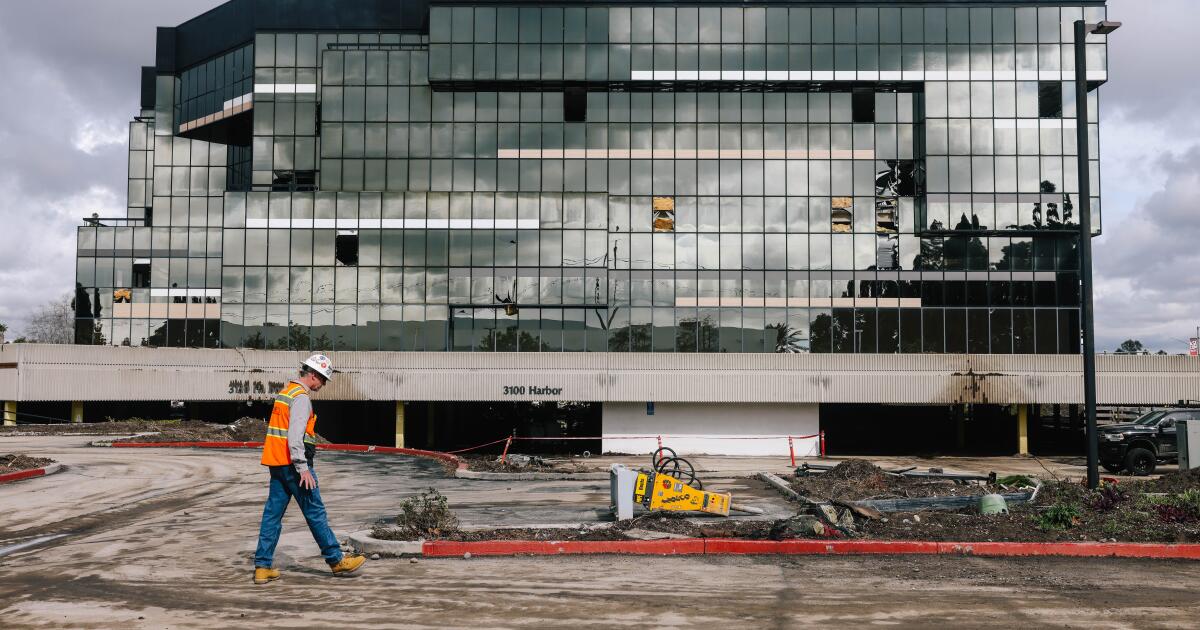

Demolition is underway of an office complex on Harbor Boulevard in Santa Ana that will be replaced by a distribution center.

(Dania Maxwell/Los Angeles Times)

It was a different world for office landlords in 2018, when Kearny bought the office campus for nearly $35 million. The landlord took over a property that was almost fully leased, Broder said. And even though a large tenant was set to move out, Kearny was unconcerned because there was every reason to expect the vacancy would be an opportunity to sign new tenants at higher rents.

Kearny announced that it would spend about $15 million to upgrade the property into a campus-like setting with landscaped grounds, a fitness center and 24-hour access meant to appeal to tenants in creative fields such as technology. Marketing materials boasted that South Coast Plaza shopping center was nearby.

Then came the pandemic, and by early 2022, with occupancy rates hovering at about 60% and the office rental market losing ground, Kearny started to discuss converting the property to another use, Broder said. He declined to disclose further financial aspects of the project.

Kearny negotiated lease terminations with its tenants and set about to knock down the building that dates to 1982 and replace it with Harbor Logistics Center, a far less sleek 163,000-square-foot warehouse and distribution complex designed by SKH Architect set to be complete by the end of the year.

It’s intended to be a “last-mile” facility, Broder said, for goods arriving from elsewhere to be distributed to the surrounding community.

Last-mile facilities have “dramatically” increased in value in recent years and provide “solid rent growth” for their owners, the commercial real estate trade group NAIOP said, as e-commerce businesses such as Amazon compete to deliver within one day of a customer order or even on the same day it is placed.

Frequently ordered goods can be delivered more quickly from a compact nearby warehouse than from a farther-away sprawling fulfillment center such as those found in the Inland Empire.

Meanwhile, office rentals and onsite attendance by tenants continued to lag in in Southern California in 2023 as companies have tried to balance hybrid work policies with their desire for more employee engagement, real estate services company CBRE said in a recent report.

The value of office buildings has been falling nationwide, with average property values down by at least 25% from a year ago, according to a February report by real estate data provider CommercialEdge.

Rendering of the less sleek 163,000-square-foot warehouse and distribution complex that will replace the office complex.

(SKH Architect)

“The downward trend in office valuation is more pronounced in older and less ideally located buildings,” the report said, perhaps such as the aging campus Kearny is knocking down.

“This is not a one-off,” Soto said of the landlord’s switch from office to industrial use of its property. “Especially in dense suburban markets like Orange County where land is expensive, we are going to see more of this.”

Business

Should You Get a Heat Pump? Take Our 2-Question Quiz.

Heat pumps are the future of home heating. They’re essentially two-way air-conditioners that use electricity to heat in the winter — as well as cool in the summer — and are typically far more efficient than other systems. They reduce household greenhouse gas emissions significantly.

They may also save you money on your monthly bills if you own a home. Answer just two questions below and we’ll give you a rough estimate:

What do you heat with currently?

Where do you live?

Answer the two questions and we’ll see how much you can save. Or, keep reading.

Don’t know what a heat pump is? You may already have seen one. It looks a lot like a typical air-conditioner, with a big box that sits just outside a house; inside, you might see small boxes mounted to the wall, or a single large indoor unit, out of sight, connected to vents.

In winter, heat pumps transfer heat from outside to inside. (Even in very cold temperatures, it’s still possible to extract heat from the air outside.) In summer, they do the opposite.

Because of how efficiently they do this, heat pumps are a critical piece of the green energy transition: One estimate suggests putting a heat pump in every home could reduce U.S. emissions by 5 to 9 percent.

They’re expensive to install but often qualify for subsidies. And they can save some homeowners hundreds or thousands of dollars each year by lowering their utility bills, for both heating and cooling.

But that’s not yet true for everyone, everywhere.

Share of households that would…

These numbers, and the information in the quiz above, come from a New York Times analysis that combines data on fuel and electricity costs around the country with estimates of how much energy it takes to heat many different kinds of houses, from research done by the National Renewable Energy Laboratory.

More than 80 percent of U.S. households would probably see their bills go down if they installed a heat pump.

But the rest would probably end up with higher bills — mostly people who use natural gas right now, given its low cost.

Nearly all households heating with propane, fuel oil or older electric forms of heating would save money by switching to a heat pump, but only about two-thirds of those currently on natural gas would.

How you currently heat is one major factor in your potential savings; the others are where you live and how the cost of electricity compares with other fuels in your area.

For households that currently heat with expensive fuels like propane and fuel oil, a heat pump is almost always a good bet. This is why Maine, which relies on fuel oil, has become a big adopter.

And a heat pump is significantly more efficient than electric furnaces or baseboards. The savings are biggest in the parts of the country that stay colder, longer. But there’s money to be saved in the South, too, in both the mild winters and the hot summers: South Carolina and Florida have some of the current highest rates of heat pump usage.

For households that currently heat with less expensive natural gas, however, the financial picture is much more mixed. Whether you save — or lose — depends heavily on your geography. And the savings are often smaller.

In the South, electricity is relatively cheap, and temperatures are mild. That makes switching from natural gas to a heat pump an easier sell. Modern heat pumps work in very cold temperatures, but they operate at their highest efficiency during mild weather.

In colder parts of the country, heat pumps are somewhat less efficient. They also give you central cooling, which can raise prices in the summer if you relied on fans before.

But the biggest problem in the North isn’t the weather — it’s the difference between the cost of electricity and the cost of gas.

On average, a heat pump is three to four times as efficient as a natural gas furnace. That means if electricity is only twice as expensive as natural gas for the same amount of energy, a heat pump is a good deal — as is the case in Georgia. But when electricity is five times as expensive as gas, as in Michigan, it’s a much harder sell.

Ratio of electricity to natural gas cost, for the same amount of energy

These are just averages, and other factors will influence your actual financial picture. For one, prices for both electricity and gas vary a lot within states. Rates in some places can also change depending on the time of day or the season, and some utilities offer lower rates specifically for heat pump customers. We also can’t know exactly how prices will rise or fall next year — we can only make guesses based on previous years’ costs.

Your choice should also take into account how well insulated your house is; whether you have solar panels; the efficiency level of the heat pump you’re considering; and whether you keep your boiler or furnace as a backup in colder temperatures, known as a “dual fuel” setup. Many households even in colder parts of the country, with high electricity costs, could still see savings from a heat pump. These are all things our calculations can’t help you with. The only way to be certain is to ask a contractor. (Ideally more than one.)

How long you’re going to stay in your house is important too: Heat pumps have high upfront costs, sometimes twice as much as that of a new gas furnace. Many states and utilities offer rebates to help: Massachusetts homeowners can get $10,000. (Republicans in Congress ended a federal tax credit that gave $2,000 or more toward a heat pump installation, though heat pumps installed this year still qualify.)

And if you already have central air for cooling, a heat pump is more likely to make financial sense. Installing one may be more expensive than replacing your furnace — or your central air-conditioning — but it can be cheaper than replacing both.

Despite their price tags, heat pumps have outsold furnaces for three years running, according to data from the Air-Conditioning, Heating, and Refrigeration Institute.

Heating units sold in the U.S.

Meanwhile, summers are getting hotter. If you don’t have central air yet, you might want it at some point.

And if you’re thinking about climate change in addition to your finances, switching to a heat pump will cut most houses’ carbon emissions significantly.

Median household emissions reduction from installing a heat pump

In some very cold places, the emission reductions are huge: The median house in Minnesota could emit around five fewer tons of carbon each year by switching to a high-efficiency heat pump, according to modeled data from the National Renewable Energy Laboratory. That’s a greater reduction than if you went car-free for a year (if you drive a gas car). And it’s around one-third of the average U.S. resident’s greenhouse gas emissions in a year.

Paradoxically, some of the places where a heat pump could slash emissions the most — including parts of the Northeast and Midwest — are the places where it could be a financial detriment right now. Still, for some, paying a little extra to reduce their carbon footprint might be worth it.

About the data

Cost calculations use a 2024 dataset from ResStock, a model of the U.S. housing stock by the National Renewable Energy Laboratory (NREL). ResStock contains estimates of the amount of energy it would take to heat and cool houses with an original heating source and with a heat pump. Houses that currently have a heat pump were excluded.

The dataset includes homes that did not have central cooling before the heat pump, which raises costs after the transition. It also relies on weather data collected from 1991 to 2005.

For electricity and natural gas prices, the Upshot used 2023 state-level sales, revenue and customer data from the Energy Information Administration (EIA) and prior NREL research to calculate the cost per unit of energy. For propane and heating oil, the Upshot used EIA data from 2023 on state-by-state prices, or a national average if data was missing.

The Upshot assigned a basic Energy Star heat pump (SEER2 15.2, HSPF2 7.8) to houses in warmer climates and a higher-efficiency cold climate heat pump (SEER2 19, HSP2 9.8) to colder areas. Both have supplemental electric heating.

For county-level results, the Upshot used county-only data when there were at least 50 houses using that fuel in that county, and state-level medians when there were fewer.

Business

These California metro areas are among the most AI-ready in the nation

Despite suggestions it has been losing its edge, California is way ahead of others when it comes to the hottest technology right now: artificial intelligence.

The regions around San Francisco, San José and Los Angeles are among the best prepped for AI in the country, according to a report released Wednesday by the Brookings Institution.

The Washington think tank dubbed the San Francisco and San José metropolitan areas “superstars” when it comes to AI readiness. Three out of the top 10 city regions most ready for AI are in California, according to the report. No other state has more than one region in the top 10. Texas had none in Brookings’ top 10. Austin was ranked 11th.

With tech giants such as Google, Meta and Nvidia headquartered in the area and OpenAI securing a record-breaking $40 billion in funding this year, it’s no surprise that the Bay Area cities dominate.

“They really are in a class of their own, given the sheer scale, dominant big tech headquarters, massive research labs and venture capital,” said Mark Muro, a senior fellow at the metropolitan policy program at Brookings, who co-wrote the study.

Los Angeles, home to top-tier universities, film studios, defense tech startups, social networks and dating apps, is also a big AI contender. The Los Angeles metro area, which includes Long Beach and Anaheim, is part of the second-highest cluster of AI-ready regions Brookings calls “star hubs,” the report said.

The analysis shows how California metropolitan areas are among the most prepared for AI, technology with the potential to reshape industries as diverse as healthcare and entertainment. The San Diego metro area was also part of a cluster deemed more ready for AI. It was ranked 12th.

Brookings examined venture capital funding, AI job postings, the number of computer science degree holders, patents and other data. The information gathered about 387 metro areas provided insight about whether certain places have more or less AI talent, innovation and adoption.

After analyzing this data, the think tank clustered metro areas into six different groups, indicating which are the most AI-ready. The groups are superstars, star hubs, emerging centers, focused movers, nascent adopters and others. Two metro areas are considered superstars while 28 are star hubs.

The less AI-ready groups lagged behind when it came to major tech employers, computer science graduates, patents, contracts and other factors. Metro areas that included Stockton, Modesto, Visalia and Bakersfield in California were part of the “others” cluster.

Rural counties and small metro areas fell behind when it came to AI talent and innovation, the report said. The number of AI startups and venture capital funding were “virtually nonexistent” in these areas.

AI has the potential to create new jobs, but it could also displace mundane and tedious tasks, reshaping the job market. Making sure that AI doesn’t just put tech workers and other people out of work is one downside more AI-ready metro areas will have to watch out for, Muro said.

Mass layoffs in the tech industry, the release of AI tools that can code and do other tasks, and executive remarks have heightened concerns that companies will shrink their workforce.

Metropolitan areas that included New York, Boston, Washington, Chicago, Atlanta and Seattle were also deemed more AI-ready than other places. Several Texas metropolitan areas that encompass Austin, Dallas, Houston or San Antonio are part of the “star hubs” cluster.

The region around New York was ranked No. 1 for AI readiness for the sheer volume of talent, AI job postings and high-performance computing usage. But researchers also considered other factors such as a region’s density when coming up with clusters and wanted to highlight the Bay Area’s advantage.

The tech industry is growing in Texas, where Austin bears the nickname “Silicon Hills.” Some of the world’s largest tech companies, including Google, Meta and Amazon, have offices in Austin. And some entrepreneurs, including Elon Musk, have moved the headquarters of their companies to Texas in recent years.

The Austin area has a large pool of computer science, engineering and math graduates, but the San Francisco Bay Area still has more AI startups, venture capital deals, patents and U.S. worker profiles with AI skills, data from Brookings show.

The AI economy is massively concentrated on the West Coast, but cities throughout the United States are catching up. The Bay Area, Muro said, will probably remain a central AI hub in the future.

“They will likely not displace the importance of the Bay Area, but they will complement it,” he said.

Business

Commentary: Stephen Miller says Americans will live better lives without immigrants. He's blowing smoke

Stephen Miller, the front man for Donald Trump’s deportation campaign against immigrants, took to the airwaves the other day to explain why native-born Americans will just love living in a world cleansed of undocumented workers.

“What would Los Angeles look like without illegal aliens?” he asked on Fox News. “Here’s what it would look like: You would be able to see a doctor in the emergency room right away, no wait time, no problems. Your kids would go to a public school that had more money than they know what to do with. Classrooms would be half the size. Students who have special needs would get all the attention that they needed. … There would be no fentanyl, there would be no drug deaths.” Etc., etc.

No one can dispute that the world Miller described on Fox would be a paradise on Earth. No waiting at the ER? School districts flush with cash? No drug deaths? But that doesn’t obscure that pretty much every word Miller uttered was fiction.

The leaders in Los Angeles have formed an alliance with the cartels and criminal aliens.

— Trump aide Stephen Miller concocts a fantasy about L.A.

The gist of Miller’s spiel — in fact, the worldview that he has been espousing for years — is that “illegal aliens” are responsible for all those ills, and exclusively responsible. It’s nothing but a Trumpian fantasy.

Let’s take a look, starting with overcrowding at the ER.

The issue has been the focus of numerous studies and surveys. Overwhelmingly, they conclude that undocumented immigration is irrelevant to ER overcrowding. In fact, immigrants generally and undocumented immigrants in particular are less likely to get their healthcare at the emergency room than native-born Americans.

In California, according to a 2014 study from UCLA, “one in five U.S.-born adults visits the ER annually, compared with roughly one in 10 undocumented adults — approximately half the rate of U.S.-born residents.”

Among the reasons, explained Nadereh Pourat, the study’s lead author and director of research at the UCLA Center for Health Policy Research, was fear of being asked to provide documents.

The result is that undocumented individuals avoid seeking any healthcare until they become critically ill. The UCLA study found that undocumented immigrants’ average number of doctor visits per year was lower than for other cohorts: 2.3 for children and 1.7 for adults, compared with 2.8 doctor visits for U.S.-born children and 3.2 for adults.

ER overcrowding is an issue of long standing in the U.S., but it’s not the result of an influx of undocumented immigrants. It’s due to a confluence of other factors, including the tendency of even insured patients to use the ER as a primary care center, presenting with complicated or chronic ailments for which ER medicine is not well-suited.

While caseloads at emergency departments have surged, their capacities are shrinking.

According to a 2007 report by the National Academy of Sciences, from 1993 to 2003 the U.S. population grew by 12%, hospital admissions by 13% and ER visits by 26%. “Not only is [emergency department] volume increasing, but patients coming to the ED are older and sicker and require more complex and time-consuming workups and treatments,” the report observed. “During this same period, the United States experienced a net loss of 703 hospitals, 198,000 hospital beds, and 425 hospital EDs, mainly in response to cost-cutting measures.”

President Trump’s immigration policies during his first term suppressed the use of public healthcare facilities by undocumented immigrants and their families. The key policy was the administration’s tightening of the “public charge” rule, which applies to those seeking admission to the United States or hoping to upgrade their immigration status.

The rule, which has been part of U.S. immigration policy for more than a century, allowed immigration authorities to deny entry — or deny citizenship applications of green card holders — to anyone judged to become a recipient of public assistance such as welfare (today known chiefly as Temporary Assistance for Needy Families, or TANF) or other cash assistance programs.

Until Trump, healthcare programs such as Medicaid, nutrition programs such as food stamps, and subsidized housing programs weren’t part of the public charge test.

Even before Trump implemented the change but after a draft version leaked out, clinics serving immigrant communities across California and nationwide detected a marked drop off in patients.

A clinic on the edge of Boyle Heights in Los Angeles that had been serving 12,000 patients, I reported in 2018, saw monthly patient enrollments fall by about one-third after Trump’s 2016 election, and an additional 25% after the leak. President Biden rescinded the Trump rule within weeks of taking office.

Undocumented immigrants are sure to be less likely to access public healthcare services, such as those available at emergency rooms, as a result of Trump’s rescinding “sensitive location” restrictions on immigration agents that had been in effect at least since 2011.

That policy barred almost all immigration enforcement actions at schools, places of worship, funerals and weddings, public marches or rallies, and hospitals. Trump rescinded the policy on inauguration day in January.

The goal was for Immigration and Customs Enforcement, or ICE, agents “to make substantial efforts to avoid unnecessarily alarming local communities,” agency officials stated. Today, as public shows of force and public raids by ICE have demonstrated, instilling alarm in local communities appears to be the goal.

The change in the sensitive locations policy has prompted hospital and ER managers to establish formal procedures for staff confronted with the arrival of immigration agents.

A model policy drafted by the Emergency Medicine Residents Assn. says staff should request identification and a warrant or other document attesting to the need for the presence of agents. It urges staff to determine whether the agents are enforcing a judicial warrant (signed by a judge) or administrative warrant (issued by ICE). The latter doesn’t grant agents access to private hospital areas such as patient rooms or operating areas.

What about school funding? Is Miller right to assert that mass deportations will free up a torrent of funding and cutting class sizes in half? He doesn’t know what he’s talking about.

Most school funding in California and most other places is based on attendance. In California, the number of immigrant children in the schools was 189,634 last year. The total K-12 population was 5,837,700, making the immigrant student body 3.25% of the total. Not half.

In the Los Angeles Unified School District, the estimated 30,000 children from immigrant families amounted to about 7.35% of last year’s enrollment of 408,083. Also not half.

With the deportation of immigrant children, the schools would lose whatever federal funding was attached to their attendance. Schools nationwide receive enhanced federal funding for English learners and other immigrants. That money, presumably, would disappear if the pupils go.

What Miller failed to mention on Fox is the possible impact of the Trump administration’s determination to shutter the Department of Education, placing billions of dollars of federal funding at risk. California receives more than $16 billion a year in federal aid to K-12 schools through that agency. Disabled students are at heightened risk of being deprived of resources if the agency is dismantled.

Then there’s fentanyl. The Trump administration’s claim that undocumented immigrants are major players in this crisis appears to be just another example of its scapegoating of immigrants. The vast majority of fentanyl-related criminal convictions — nearly 90% — are of U.S. citizens. The rest included both legally present and undocumented immigrants. (The statistics comes from the U.S. Sentencing Commission.)

In other words, deport every immigrant in the United States, and you still won’t have made a dent in fentanyl trafficking, much less eliminate all drug deaths.

What are we to make of Miller’s spiel about L.A.? At one level, it’s echt Miller: The portrayal of the city as a putative hellscape, larded with accusations of complicity between the city leadership and illegal immigrants — “the leaders in Los Angeles have formed an alliance with the cartels and criminal aliens,” he said, with zero pushback from his Fox News interlocutor.

At another level, it’s a malevolent expression of white privilege. In Miller’s ideology, the only obstacles to the return to a drug-free world of frictionless healthcare and abundantly financed education are immigrants. This ideology depends on the notion that immigrants are raiding the public purse by sponging on public services.

The fact is that most undocumented immigrants aren’t eligible for most such services. They can’t enroll in Medicare, receive premium subsidies under the Affordable Care Act, or collect Social Security or Medicare benefits (though typically they submit falsified Social Security numbers to employers, so payments for the program are deducted from their paychecks).

A 2013 study by the libertarian Cato Institute found that low-income immigrants use public benefits for which they’re eligible, such as food stamps, “at a lower rate than native-born low-income residents.”

If there’s an impulse underlying the anti-immigrant project directed by Miller other than racism, it’s hard to detect.

Federal Judge Maame Ewusi-Mensah Frimpong, who last week blocked federal agents from using racial profiling to carry out indiscriminate immigration arrests in Los Angeles, ruled that during their “roving patrols” in Los Angeles, ICE agents detained individuals principally because of their race, that they were overheard speaking Spanish or accented English, that they were doing work associated with undocumented immigrants, or were in locations frequented by undocumented immigrants seeking day work.

Miller goes down the same road as ICE — indeed, by all accounts, he’s the motivating spirit behind the L.A. raids. Because he can’t justify the raids, he has ginned up a fantasy of immigrants disrupting our healthcare and school programs, and the corollary fantasy that evicting them all will produce an Earthly paradise for the rest of us. Does anybody really believe that?

-

Culture1 week ago

Culture1 week agoTry to Match These Snarky Quotations to Their Novels and Stories

-

News6 days ago

News6 days agoVideo: Trump Compliments President of Liberia on His ‘Beautiful English’

-

Finance1 week ago

Do you really save money on Prime Day?

-

Technology1 week ago

Technology1 week agoApple’s latest AirPods are already on sale for $99 before Prime Day

-

News1 week ago

News1 week agoTexas Flooding Map: See How the Floodwaters Rose Along the Guadalupe River

-

Business1 week ago

Companies keep slashing jobs. How worried should workers be about AI replacing them?

-

News5 days ago

News5 days agoVideo: Clashes After Immigration Raid at California Cannabis Farm

-

Politics1 week ago

Politics1 week agoJournalist who refused to duck during Trump assassination attempt reflects on Butler rally in new book