Nevada

Man Held in Hourslong Las Vegas Strip Resort Standoff to Face Judge on Kidnapping, Fugitive Charges

Nevada

Nevada lawmakers push to restore full gambling loss deduction after GOP blocks senate fix

WASHINGTON (KOLO & AP) — Nevada lawmakers are ramping up efforts to restore a tax deduction they say is essential to protecting the state’s gaming industry—after Senate Republicans blocked an attempt to undo a provision buried in President Trump’s massive new budget law.

The change, set to take effect in 2026, limits gamblers to deducting only 90% of their losses against their winnings. Under current law, gamblers who itemize can deduct 100% of losses, dollar for dollar, up to the amount of their winnings.

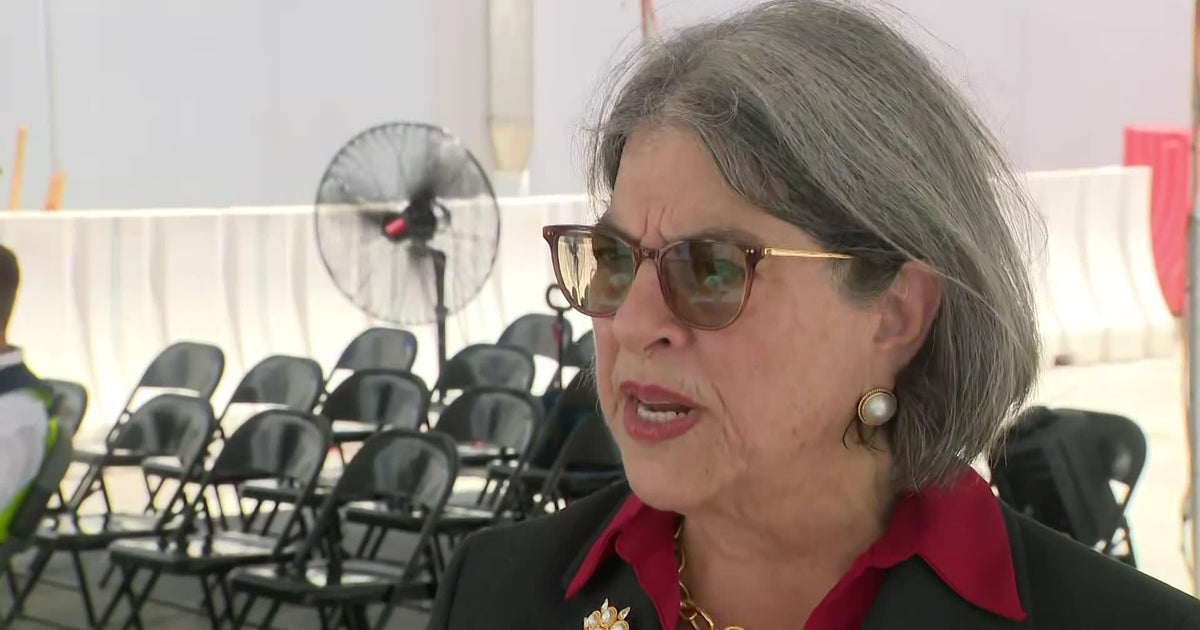

Senator Catherine Cortez Masto (D-Nev.) tried to reverse the change on the Senate floor Thursday, requesting unanimous consent for a bill that would restore the full deduction. But Senator Todd Young (R-Ind.) objected, stalling the measure and intensifying criticism from Cortez Masto and other Democrats.

“This makes no sense and it will do irreparable harm to our country’s gaming industry—especially in Nevada,” Cortez Masto said, warning the provision could drive events like the World Series of Poker offshore and into illegal markets.

Though her effort failed, Cortez Masto reintroduced the measure in committee, where it has bipartisan support. Nevada Rep. Dina Titus (D) introduced a House version called the Fair Bet Act, also co-sponsored by Republican Rep. Mark Amodei.

“The Senate got us into this mess,” Titus said in a statement. “Now it’s time for both chambers to unite behind my bipartisan Fair Bet Act to ensure that average and high-stakes gamblers do not pay taxes on money they never won.”

A Hidden Provision with Big Consequences

The provision in question was part of the 900-page “One Big Beautiful Bill Act,” signed into law by President Trump last week. It includes sweeping tax cuts and spending changes, many of which lawmakers admit they’re only now beginning to fully understand.

“This new amendment would end professional gambling in the U.S. and hurt casual gamblers too,” pro poker player Phil Galfond warned on social media ahead of the bill’s passage.

Some lawmakers—including Sen. Ron Wyden, the top Democrat on the Senate Finance Committee—say they weren’t aware the gambling provision was in the bill until just days before the vote.

“Now I see Republican senators walking all over the Capitol saying they didn’t even know anything about this policy,” Wyden said. “When you rush a process like this and cram in policies you haven’t thought through, you risk serious consequences.”

The change could disproportionately impact professional gamblers and high-stakes players who itemize. For example, under the new law, someone who wins and loses $100,000 in the same year would still owe taxes on $10,000—despite breaking even.

Budget Tradeoffs and Political Gridlock

Republicans say the gambling deduction change was necessary to comply with reconciliation rules, allowing them to pass the legislation without Democratic support. It’s expected to raise $1.1 billion in tax revenue over eight years, according to the Congressional Budget Office, though the bill overall will add nearly $3.3 trillion to the deficit.

Sen. Young said he supports the change but would only consider undoing it if Democrats agreed to other provisions in return. “I strongly support the underlying bill, but will have to object unless you can agree to my request,” he said on the Senate floor.

Despite the setback, Cortez Masto says she’s not giving up. “I’m disappointed, but I’m not done,” she said. “We’ll continue to work to try to get S2230 passed. It’s just common sense.”

Copyright 2025 KOLO. All rights reserved.

Nevada

Nevada woman sentenced to 4 years for insurance policy scam

LAS VEGAS, Nev. (KOLO) – A Nevada woman has been sentenced to more than four years in prison for a $3.7 million fine art insurance policy scam.

The DOJ says that 59-year-old Tonja Van Roy of Las Vegas defrauded a lender out of millions by submitting bogus applications for fine art insurance for commercial clients but instead used the money for herself.

Van Roy will also be required to pay $1.8 million in restitution and pled guilty to one count of wire fraud on Jan. 6.

Van Roy operated a Northridge, California based insurance company specializing in art collections called Pegasus Insurance. From January 2021 to December 2023, Van Roy created and submitted dozens of fraudulent finance agreements to AFCO Credit Corp, an Illinois-based provider of insurance premium finance. According to the DOJ, Van Roy did this to finance insurance policies she claimed to have sold to art galleries.

The DOJ says Van Roy made up the insurance policy numbers and forged electronic signatures for fictitious insureds. She then used the money to fund her lifestyle, which included payments on dozens of credit cards.

When the loans came due, Van Roy submitted additional fraudulent finance agreements to AFCO and used the proceeds from the new loans to make it appear as though the old loans were paid.

“[Van Roy] embarked on a sophisticated, multiyear scheme to borrow fraudulently over $3.7 million dollars using her insider’s knowledge of the insurance industry,” prosecutors argued in a sentencing memorandum. “[She] has more than 25 years of experience working as an insurance agent, during which time she sold countless insurance policies and worked for many different insurance agencies before founding her own; she had an expert’s understanding of the industry, which allowed her to manipulate her victims and avoid detection for years.”

Copyright 2025 KOLO. All rights reserved.

Nevada

Nevada Senate Republicans slam ‘lack of transparency’ in regulatory panel

‘);

Exposing officials and agencies keeping public records from the public.

‘;

2023 YEAR IN REVIEW

‘;

CLICK HERE FOR MORE

‘;

REMEMBERING 9/11: 20 YEARS LATER ‘;

Looking back at the 2001 terror attacks and how they affected Las Vegas and the world.

‘;

Read more

‘;

MEET THE UNFORGETTABLE CLASS

‘;

‘; 2021

‘; ‘; ‘;

Harry Reid

(1939-2021)

‘; ‘;

‘;

Senate leader and Nevada political titan

‘; Read more ‘; ‘;

HENRY RUGGS

DEADLY CRASH ‘; ‘;

‘;

CLICK FOR MORE

‘; ‘;

Sheldon Adelson

(1933-2021)

‘; ‘;

‘;

Las Vegas visionary and Philanthropist.

‘; Read more ‘; ‘;

Tony Hsieh

(1973-2020) ‘; ‘;

‘;

Ex-Zappos and Downtown Project CEO left a lasting impression on Las Vegas.

‘; Read more

‘; ‘;

VEGAS REAWAKENING

‘;

A year after the pandemic began, the first weekend of spring showed a perfect storm of promise for Las Vegas’ recovery and brought optimism that visitors would indeed return to the city

‘;

Read more

‘;

Sign up for our free RJ politics email alerts. ‘};

Sign up for our free RJ Politics newsletter.

‘};

Sign up for our free newsletter below.’};

pScript.src = “https://embed.sendtonews.com/player3/embedcode.php?fk=” + fkId;

} else {

pHtml = $(“”);

pScript.src = “https://embed.sendtonews.com/player3/embedcode.js?fk=” + fkId + ‘&cid=5945&offsetx=0&offsety=0&floatwidth=400&floatposition=bottom-right’;

pScript.setAttribute(‘data-type’, ‘s2nScript’); //pScript[‘data-type’] = ‘s2nScript’;

}

elem.append(pHtml);

elem.append(pScript);

},

insertVideoExco: function(player_id) {

var elem = $(‘#stn-in-article-player’);

elem.addClass(‘rj-fuel-77’);

var pHtml = $(”,{‘class’:’embed-responsive embed-responsive-16by9′});

pHtml.append($(”,{‘class’:’embed-responsive-item’,’id’:player_id}));

var click_url=”/7at7/?utm_campaign=7at7&utm_medium=insert_widget&utm_source=article_page”;

var f_title = $(”,{‘class’:’f-title’}).append(

$(‘‘,{‘href’:click_url, ‘alt’:’7at7′}).append(

$(‘‘,{‘html’:’Watch 7@7 — now streaming’})

)

);

//var f_desc = $(”,{‘class’:’f-desc’,’html’:’exco ArticleStreaming id: c1be8808-a095-4573-8738-5987c99028cc’})

elem.append(pHtml);

elem.append(f_title);

//elem.append(f_desc);

var fjs = document.getElementsByTagName(‘script’)[0];

var js = document.createElement(‘script’);

js.className=”exco-player”;

js.src=”https://player.ex.co/player/”+player_id;

js.setAttribute(‘programmatic’, ‘true’);

fjs.parentNode.insertBefore(js, fjs);

var exco_tmr_count_story = 500;

var exco_tmr_check_story = setInterval(function () {

exco_tmr_count_story–;

console.log(‘rj_exco_t_story:’+exco_tmr_count_story+’_exco_player:’+typeof(ExCoPlayer));

if ( ‘undefined’ !== typeof(ExCoPlayer) ) {

console.log(‘rj_exco_connect:’+typeof(ExCoPlayer.connect(player_id)));

if ( ‘undefined’ !== typeof( ExCoPlayer.connect(player_id) ) ) {

clearInterval(exco_tmr_check_story);

var exco_api_story = ExCoPlayer.connect(player_id);

exco_api_story.init({

‘playbackMode’: ‘play-in-view’, //auto-play, click-to-play, play-in-view

‘mute’: true,

//’autoPlay’: true,

});

exco_api_story.on(‘player-ready’, function(data) {

console.log(‘rj_exco_story_on_player_ready’, data);

exco_api_story.play();

});

exco_api_story.on(‘player-load’, function(data) {

console.log(‘rj_exco_story_on_player_load’, data);

exco_api_story.play();

});

exco_api_story.on(‘player-playing’, function(data) {

console.log(‘rj_exco_story_on_play’, data); //does not fire on first auto play have to call .play()

});

exco_api_story.on(‘content-start’, function(data) {

console.log(‘rj_exco_story_on_content_start’, data);

if (dataLayer) {

dataLayer.push({

‘event’: ‘rjvideo’,

‘gtm.videoProvider’: ‘exco’,

‘gtm.videoTitle’: data.title,

‘gtm.videoUrl’: data.src,

‘gtm.videoDuration’: data.duration,

‘gtm.videoStatus’: ‘progress’, //start, progress, complete

‘gtm.videoPercent’: 1,

‘videoPlayerId’: data.playerId,

‘videoId’: data.id,

});

}

});

exco_api_story.on(‘content-progress’, function(data) {

console.log(‘rj_exco_story_on_content_progress’, data);

if (dataLayer) {

dataLayer.push({

‘event’: ‘rjvideo’,

‘gtm.videoProvider’: ‘exco’,

‘gtm.videoTitle’: data.title,

‘gtm.videoUrl’: data.src,

‘gtm.videoDuration’: data.duration,

‘gtm.videoStatus’: ‘progress’,

‘gtm.videoPercent’: data.progress,

‘videoPlayerId’: data.playerId,

‘videoId’: data.id,

});

}

});

exco_api_story.on(‘content-end’, function(data) {

console.log(‘rj_exco_story_on_content_end’, data);

if (dataLayer) {

dataLayer.push({

‘event’: ‘rjvideo’,

‘gtm.videoProvider’: ‘exco’,

‘gtm.videoTitle’: data.title,

‘gtm.videoUrl’: data.src,

‘gtm.videoDuration’: data.duration,

‘gtm.videoStatus’: ‘progress’,

‘gtm.videoPercent’: 100,

‘videoPlayerId’: data.playerId,

‘videoId’: data.id,

});

}

});

}

}

if (exco_tmr_count_story == 0) {

clearInterval(exco_tmr_check_story);

}

}, 100);

},

insertVideoFuel: function(channelId) {

/*

var _setting;

var u, param;

param = ‘file_path=Fuel Front Image Url.xlsx’;

//param += ‘&site_id=WebDevPublic’;

//param += ‘&sheet_name=api_do_not_change’;

param += ‘&range=all’;

param += ‘&method=read’;

u = ‘/wp-json/rj/v2/api?name=microsoft&end_point=/excel_data¶m=’+encodeURIComponent(param);

$.ajax({

type: ‘GET’,

url: u,

cache: true,

dataType: ‘json’,

success: function (response) {

if ( response.status == 1 && response.response && response.response.data ) {

_setting = response.response.data;

}

},

error: function (xhr, ajaxOptions, thrownError) {

console.log(‘rj_xhr.status:’ + xhr.status + ‘_error:’ + thrownError);

}

});

*/

var img_url=”https://res.cloudinary.com/review-journal/image/upload/f_auto,q_auto,c_scale,w_1200/v1611081380/webdev/New7at7onGray.jpg”; //response.feed.entry[0][‘gsx$imageurl’][‘$t’];

//var description = _setting[1][3];//response.feed.entry[0][‘gsx$description’][‘$t’];

var elem = $(‘#stn-in-article-player’);

//if we do not add this info google will detect this fuel video without proper data need to fix in search console

elem.attr({

‘itemscope’: ”,

‘itemprop’: ‘VideoObject’,

‘itemtype’: ‘https://schema.org/VideoObject’,

})

.append($(‘‘,{‘itemprop’:’description’,’content’:’7 minutes of local non-stop news, free for all users.’}))

.append($(‘‘,{‘itemprop’:’name’,’content’:’7@7 Articles Channel’}))

.append($(‘‘,{‘itemprop’:’thumbnailUrl’,’content’:img_url}))

.append($(‘‘,{‘itemprop’:’uploadDate’,’content’:’2021-01-18T00:00:00+00:00′}))

.append($(‘‘,{‘itemprop’:’contentUrl’,’content’:’https://fuel-streaming-prod01.fuelmedia.io/v1/sem/’+channelId+’.m3u8′}));

//’https://fuel-streaming-prod01.fuelmedia.io/player/1.0/player.min.js’; //https://fuel-streaming-prod01.fuelmedia.io/player/v3/fuel.js

var pScript = document.createElement(“script”);

pScript.type=”text/javascript”;

pScript.src=”https://fuel-streaming-prod01.fuelmedia.io/player/v3/fuel.js”;

//pScript.async = true;

pScript.setAttribute(‘id’, ‘fuel-player-script’);

elem.append(pScript);

elem.addClass(‘rj-fuel-77’);

var fuel_float=”true”;

if (localStorage.getItem(‘rjIsSubscribed’) === ‘1’ || document.body.classList.contains(‘logged-in’)) {

console.log(‘fuel_disabled_float’);

fuel_float=”false”;

; }

var pHtml = $(‘

var click_url=”/7at7/?utm_campaign=7at7&utm_medium=insert_widget&utm_source=article_page”;

var f_title = $(”,{‘class’:’f-title’}).append(

$(‘

$(‘‘,{‘html’:’Watch 7@7 — now streaming’})

)

);

//var f_desc = $(”,{‘class’:’f-desc’,’html’:description})

elem.append(pHtml);

elem.append(f_title);

//elem.append(f_desc);

//var is_android = /(android)/i.test(navigator.userAgent);

if (true) {

var tmr = setInterval(function() {

document.getElementsByTagName(‘fuel-video’)[0].player.play();

clearInterval(tmr);

},1000);

}

},

videoIDs: {

//’category-local’: {‘id’: ‘c1be8808-a095-4573-8738-5987c99028cc’, ‘provider’:’exco’},

//’category-business’: {‘id’: ‘c1be8808-a095-4573-8738-5987c99028cc’, ‘provider’:’exco’},

‘category-local’: {‘id’: ‘81814da7-67fe-4e54-be92-55046afbb3bb’, ‘provider’:’fuel’},

‘category-business’: {‘id’: ‘81814da7-67fe-4e54-be92-55046afbb3bb’, ‘provider’:’fuel’},

‘category-formula-1’ : {‘id’: ‘fds27xag’},

‘tag-coronavirus’: {‘id’: ‘u37v495p’, ‘app_id’: ‘QpkVQUhA’},

‘category-politics-and-government’: {‘id’: ‘kqRvD0a8’},

‘tag-mc-opinion’: {‘id’: ‘ohls3BOc’}, //’kqRvD0a8′; 2023-03-21_14:30

‘tag-mc-crime’: {‘id’: ‘kqRvD0a8’},

‘tag-2020-election’: {‘id’: ‘kqRvD0a8’},

‘rj-main-category–science-and-technology’: {‘id’: ‘j88hQyle’, ‘app_id’: ‘kVqKLwXg’},

‘tag-mc-news’: {‘id’: ‘pCyFtg5f’, ‘app_id’: ‘QpkVQUhA’},

‘rj-main-category–raiders’: {‘id’: ‘bpswZwKM’, ‘app_id’: ‘k07ZZ08J’},

‘tag-mc-sports’: {‘id’: ‘dbx2WkwF’, ‘app_id’: ‘k1Vj5iYY’},

‘rj-main-category–food’: {‘id’: ‘3DQjoZb7’, ‘app_id’: ’40kxsoyw’},

‘tag-mc-entertainment’: {‘id’: ‘YBuF2XdP’, ‘app_id’: ‘7oJQh6dl’},

‘tag-mc-live-well’: {‘id’: ‘KED23a4w’}, //’31shkzyP’; 2023-03-21_14:30

‘tag-mc-life’: {‘id’: ‘aaWqdJ5u’, ‘app_id’: ‘m5zMjg65’},

‘tag-mc-autos’: {‘id’: ‘kag2nBSV’, ‘app_id’: ‘4bdELTqB’},

‘tag-mc-homes’: {‘id’: ‘R0zQNouh’, ‘app_id’: ‘nvYRBPOO’}, // ‘tag-mc-homes’: {‘id’: ‘HPa6ehMQ’}

‘rj-story-full’: {‘id’: ‘81814da7-67fe-4e54-be92-55046afbb3bb’, ‘provider’:’fuel’}

},

getVideoId: function() {

//var fkId = false,

var vdo_k = false;

for (var checkClass in stnInArticleVideo.videoIDs) {

if (stnInArticleVideo.wrapper.hasClass(checkClass)) {

//fkId = videoIDs[checkClass].id;

vdo_k = checkClass;

break;

}

}

return vdo_k; //fkId;

},

run: function() {

var vdo_id;

stnInArticleVideo.wrapper = $(‘article.rj-story.rj-story-full’);

if (stnInArticleVideo.wrapper && stnInArticleVideo.canInsertVideo()) {

var vdo_k = stnInArticleVideo.getVideoId();

if (vdo_k) {

if (stnInArticleVideo.videoIDs[vdo_k].hasOwnProperty(‘provider’)) {

switch(stnInArticleVideo.videoIDs[vdo_k].provider) {

case ‘fuel’:

stnInArticleVideo.insertVideoFuel(stnInArticleVideo.videoIDs[vdo_k].id);

break;

case ‘exco’:

stnInArticleVideo.insertVideoExco(stnInArticleVideo.videoIDs[vdo_k].id);

break;

}

} else {

vdo_id = stnInArticleVideo.videoIDs[vdo_k].id;

var userAgent = navigator.userAgent;

if ( (userAgent.indexOf(‘RJApp’) > -1) && (stnInArticleVideo.videoIDs[vdo_k].app_id) ) {

vdo_id = stnInArticleVideo.videoIDs[vdo_k].app_id;

}

stnInArticleVideo.insertVideo(vdo_id);

}

}

}

}

};

stnInArticleVideo.run();

});

//}

‘;

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘livewell’).html(html);

return;

}

if ($(‘.rj-story-sponsored-full’).length>0) {

return;

}

if ($(‘.rj-story-full’).hasClass(‘tag-telles-murder-trial’)) {

html=””;

html += ”;

html += ‘‘;

html += ‘Robert Telles On Trial: Full Coverage‘;

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘telles_murder’).html(html);

return;

}

if ($(‘.rj-story-full’).hasClass(‘tag-jeff-german-murder’) || $(‘.rj-story-full’).hasClass(‘tag-remembering-jeff-german’)) {

html=””;

html += ”;

html += ”;

html += ‘

‘;

‘;

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘jeff_german’).html(html);

return;

}

if ($(‘.rj-story-full’).hasClass(‘tag-what-are-they-hiding’)) {

html=””;

html += ”;

html += ”;

html += ‘

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘2023-year-in-review’).html(html);

return;

}

if ($(‘.rj-story-full’).hasClass(‘tag-2023-year-in-review’)) {

html=””;

html += ”;

html += ”;

html += ‘

html += ‘

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘2023-year-in-review’).html(html);

return;

}

if ($(‘.rj-story-full’).hasClass(‘tag-msg-sphere’)) {

html=””;

html += ”;

html += ”;

html += ‘

‘;

‘;

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘tag-msg-sphere’).html(html);

return;

}

if ($(‘.rj-story-full’).hasClass(‘tag-911-anniversary’)) {

html=””;

html += ”;

html += ”;

html += ‘

html += ‘

html += ‘

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘anniversary-911’).html(html);

return;

}

if ($(‘.rj-story-full’).hasClass(‘tag-class-of-2021’)) {

html=””;

html += ”;

html += ”;

html += ‘

html += ‘

html += ‘

html += ‘

‘;

‘;

html += ‘

html += ‘

html += ‘

html += ‘

‘;

‘;

html += ‘

html += ‘

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘class-2021’).html(html);

return;

}

if ($(‘.rj-story-full’).hasClass(‘tag-2022-election’)) {

html=””;

html += ”;

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘election-2022’).html(html);

return;

}

if ($(‘.rj-story-full’).hasClass(‘tag-harry-reid-1939-2021’)) {

html=””;

html += ”;

html += ”;

html += ‘

html += ‘

html += ‘

html += ‘

html += ‘

‘;

‘;

html += ‘

html += ‘

html += ‘

html += ‘

html += ‘

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘harry-reid’).html(html);

return;

}

if ($(‘.rj-story-full’).hasClass(‘tag-henry-ruggs’)) {

html=””;

html += ”;

html += ”;

html += ‘

html += ‘

html += ‘

html += ‘

html += ‘

‘;

‘;

html += ‘

html += ‘

html += ‘

html += ‘

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘henry-ruggs’).html(html);

return;

}

if ($(‘.rj-story-full’).hasClass(‘category-homicides’)) {

html=””;

html += ”;

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘homicides’).html(html);

return;

}

if ($(‘.rj-story-full’).hasClass(‘tag-sheldon-adelson’)) {

html=””;

html += ”;

html += ”;

html += ‘

html += ‘

html += ‘

html += ‘

html += ‘

‘;

‘;

html += ‘

html += ‘

html += ‘

html += ‘

html += ‘

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘sheldon-adelson’).html(html);

return;

}

if ($(‘.rj-story-full’).hasClass(‘tag-tony-hsieh’)) {

html=””;

html += ”;

html += ”;

html += ‘

html += ‘

html += ‘

html += ‘

html += ‘

‘;

‘;

html += ‘

html += ‘

html += ‘

html += ‘

html += ‘

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘tony-hsieh’).html(html);

return;

}

if ($(‘.rj-story-full’).hasClass(‘tag-vegas-weekend’)) { //vegas-reawakening

html=””;

html += ”;

html += ”;

html += ‘

html += ‘

html += ‘

html += ”;

html += ”;

$(‘.nlsm-small’).addClass(‘vegas-reawakening’).html(html);

return;

}

//add newsletters embed

var default_category_to_show = [‘News’, ‘Local’, ‘Life’, ‘Crime’];

var newsletter_1st_lv = [];

newsletter_1st_lv[‘default’] = {‘id’:’starting_point,pm_update’, ‘track_name’:’StartingPoint’, ‘title’:’LOCAL NEWS YOUR WAY‘, ‘subtitle’:’Sign up for our free daily Morning and Afternoon Update newsletters.’};

newsletter_1st_lv[‘Sports’] = {‘id’:’sports’, ‘track_name’:’Sports’, ‘title’:’SPORTS NEWS YOUR WAY‘, ‘subtitle’:’Sign up for our free Sports Update newsletter.’};

newsletter_1st_lv[‘Business’] = {‘id’:’business’, ‘track_name’:’Business’, ‘title’:’BUSINESS NEWS YOUR WAY‘, ‘subtitle’:’Sign up for our free Business Update newsletter.’};

newsletter_1st_lv[‘Entertainment’] = {‘id’:”,’alert_id’:’entertainment’, ‘track_name’:’Entertainment’, ‘title’:’WANT THE LATEST ON LAS VEGAS ENTERTAINMENT?‘, ‘subtitle’:’Sign up for free entertainment email alerts’};

//newsletter_1st_lv[‘Nevada Preps’] = {‘id’:’nevada_preps’, ‘title’:’HIGH SCHOOL SPORTS YOUR WAY‘, ‘subtitle’:’Stay up to date with our free Nevada Preps newsletter.’};

//newsletter_1st_lv[‘Investigations’] = {‘id’:’rj_investigates’, ‘title’:’INVESTIGATIVE NEWS YOUR WAY‘, ‘subtitle’:’Sign up for our free RJ Investigates newsletter.’};

var cat_has_subcat = [‘News’,’Business’,’Entertainment’,’Sports’, ‘Opinion’];

var newsletter_2nd_lv = [];

newsletter_2nd_lv[‘Politics and Government’] = {‘id’:”,’alert_id’:’political’, ‘track_name’:’Political’, ‘title’:’LOCAL, REGIONAL AND NATIONAL POLITICS COVERAGE‘, ‘subtitle’:’

//newsletter_2nd_lv[‘Politics and Government’] = {‘id’:’political’, ‘title’:’ELECTION 2020: BE INFORMED’, ‘subtitle’:’

//newsletter_2nd_lv[‘Debra J. Saunders’] = {‘id’:’44’, ‘title’:’YOUR WEEKLY POLITICAL FIX‘, ‘subtitle’:’Sign up for our free DC-LV newsletter with political stories from the swamp to the Strip.’};

//newsletter_2nd_lv[‘CES 2021’] = {‘id’:’ces’, ‘title’:’CES 2021: STAY IN THE KNOW’, ‘subtitle’:’

//newsletter_2nd_lv[‘TV’] = {‘id’:’tv_briefing’, ‘title’:’GET YOUR TV LISTINGS‘, ‘subtitle’:’Your Weekly TV Briefing.’};

//newsletter_2nd_lv[‘UNLV’] = {‘id’:’unlv_rebel_news’, ‘title’:’UNLV SPORTS YOUR WAY‘, ‘subtitle’:’Stay up to date on the Rebels with our free newsletter.’};

newsletter_2nd_lv[‘Rodeo’] = {‘id’:’rodeo_nfr’, ‘track_name’:’RodeoNFR’, ‘title’:’RODEO NEWS YOUR WAY‘, ‘subtitle’:’Don’t miss any of the action! Click here for full NFR coverage or Sign up for our free newsletter below’};

newsletter_2nd_lv[‘Raiders News’] = {‘id’:’vegasnation’, ‘track_name’:’VegasNation’, ‘title’:’WANT EVEN MORE RAIDERS NEWS?‘, ‘subtitle’:’Sign up for our free Vegas Nation newsletter.’};

newsletter_2nd_lv[‘Golden Knights’] = {‘id’:”,’alert_id’:’golden_knights’, ‘track_name’:’GoldenKnights’, ‘title’:’WANT MORE KNIGHTS IN YOUR DAY?‘, ‘subtitle’:’Sign up for free Golden Knights email alerts for all the latest updates’};

var main_cat=””;

var m_hierarchy = [];

var m_cat = [];

var m_hl_cat=””;

if (window.dataLayer[0].metrics) {

main_cat = window.dataLayer[0].metrics.section; //National Finals Rodeo

m_hierarchy = window.dataLayer[0].metrics.hierarchy.split(‘ | ‘); //”Sports | Rodeo | National Finals Rodeo”

m_cat = window.dataLayer[0].metrics.categories; //[“National Finals Rodeo”,”Rodeo”,”Sports”]

m_hl_cat = window.dataLayer[0].metrics[‘hl-category’]; //Sports

}

var i, k, found, newsletter;

newsletter = false;

found = false;

if (default_category_to_show.includes(m_hl_cat)) {

newsletter = newsletter_1st_lv[‘default’];

}

if (newsletter_1st_lv.hasOwnProperty(m_hl_cat)) {

newsletter = newsletter_1st_lv[m_hl_cat];

}

// check main category

if (newsletter_2nd_lv.hasOwnProperty(main_cat)) {

found = true;

newsletter = newsletter_2nd_lv[main_cat];

}

if (!found) {

// check in hierarchy (main category hierarchy)

i = m_hierarchy.length;

while (!found && i >= 0) {

i–;

if (i > 0) {

if (newsletter_2nd_lv.hasOwnProperty(m_hierarchy[i])) {

found = true;

newsletter = newsletter_2nd_lv[m_hierarchy[i]];

}

} else {

// i=0, check first level

if (newsletter_1st_lv.hasOwnProperty(m_hierarchy[i])) {

found = true;

newsletter = newsletter_1st_lv[m_hierarchy[i]];

}

}

}

}

if (!found) {

// check in category

i = m_cat.length;

while (!found && i > 0 && cat_has_subcat.includes(m_hl_cat)) {

i–;

if (newsletter_2nd_lv.hasOwnProperty(m_cat[i])) {

found = true;

newsletter = newsletter_2nd_lv[m_cat[i]];

}

}

}

if (newsletter !== false && !$(‘.rj-story-full’).hasClass(‘tag-hide-newsletter’) && !$(‘.rj-story-full’).hasClass(‘ rj-story-sponsored-full’)) {

var alert_id = ”;

if (newsletter.alert_id) {

alert_id = newsletter.alert_id;

}

html=””;

html += ”;

html += ”;

html += ”;

$(‘.nlsm-small’).html(html);

}

//});

})(jQuery);

-

Business1 week ago

Business1 week agoSee How Trump’s Big Bill Could Affect Your Taxes, Health Care and Other Finances

-

Culture1 week ago

Culture1 week ago16 Mayors on What It’s Like to Run a U.S. City Now Under Trump

-

Science1 week ago

Science1 week agoFederal contractors improperly dumped wildfire-related asbestos waste at L.A. area landfills

-

Politics6 days ago

Politics6 days agoVideo: Trump Signs the ‘One Big Beautiful Bill’ Into Law

-

News1 week ago

News1 week agoVideo: Who Loses in the Republican Policy Bill?

-

Politics1 week ago

Politics1 week agoCongressman's last day in office revealed after vote on Trump's 'Big, Beautiful Bill'

-

Technology1 week ago

Technology1 week agoMeet Soham Parekh, the engineer burning through tech by working at three to four startups simultaneously

-

World6 days ago

World6 days agoRussia-Ukraine war: List of key events, day 1,227