Iowa

Iowa City site among few turning food scraps into compost

IOWA CITY, Iowa (AP) — Jennifer Jordan walks as much as a 250-foot mound of compost on a sunny morning on the Iowa Metropolis Landfill and Recycling Heart.

She spears it with a thermometer and smiles because the gauge soars to 160 levels Fahrenheit, nearly 70 notches above the out of doors temperature.

“Is that not so cool?” marvels Jordan, town’s useful resource administration superintendent. “That is the method. That is Mom Nature.”

The pile is made up of meals scraps, like eggshells and banana peels, and yard waste, like lifeless wooden and mown grass. However it does not stink. Even within the winter, the sped-up strategy of pure decomposition generates sufficient warmth to transform what was as soon as Johnson County residents’ leftovers into wealthy soil.

However the metropolis is working out of area to show the 11,500 tons of yard and meals waste it collects yearly into soil. It is amongst two large-scale composting websites in Iowa that settle for meals, although meals scraps makes up 20% of the state’s waste stream.

Meaning Iowans ship an estimated 556,313 tons of compostable meals to landfills every year, in response to the latest estimates. It not solely takes up area and stinks up the air, but in addition generates methane, a greenhouse gasoline.

However even when extra Iowans determined to kind their meals waste, the state’s present composting infrastructure would not be able to processing it.

The Iowa Metropolis Press-Citizen reviews that simply six services are permitted by the state to just accept greater than two tons of compost per week, and two of them settle for meals scraps. One other 77 websites course of compost — not essentially together with meals — however cannot cross the two-ton weekly threshold.

None of that is information to Jennifer Trent, program supervisor on the Iowa Waste Discount Heart. She’s additionally the vice chairman of the U.S. Composting Council.

“Once I began taking a look at methods to divert meals from the landfill by way of composting (in Iowa), I observed an enormous deficit. However it appeared really easy to me for a municipality to start out one thing,” she stated. “And I came upon, it is positively not the low-hanging fruit, it is clear up on the high of the tree, and it is an issue that we now have to unravel.”

Iowa handed a legislation stopping yard waste from ending up in landfills in 1991 and, consequently, kickstarted a checkerboard of yard waste composting packages.

Solely eight states have carried out legal guidelines to stop meals waste from ending up in landfills, in response to the U.S. Composting Council.

Trent stated, when she started focusing on meals waste discount with the IWR about 10 years in the past, she discovered the common particular person did not learn about meals waste composting and its implications for the local weather.

That has now modified, she stated, though there’s work to be accomplished.

“Persons are studying about it, persons are listening to about it, and I feel it is simply taken an academic consciousness to make a distinction,” she stated.

Employees at Iowa Metropolis’s compost web site take the piles’ temperatures twice every week to make sure they’re sizzling sufficient for microorganisms to interrupt down the fabric and kill illness pathogens.

If the temperature reaches 185 levels Fahrenheit, they unfold out the waste to chill down; when it is too sizzling and dry, it may possibly begin on hearth. In addition they need to examine oxygen ranges month-to-month and “flip” the piles — basically stirring them in order that they cook dinner evenly like dinner within the crockpot.

The mounds vary from mild to darkish brown relying on their stage within the course of. It is a highly effective demonstration of nature. Jordan remembers a name from the close by metropolis of Coralville hoping to eliminate a truckload of lifeless fish. They as soon as obtained a tanker load of rotten eggs.

In each instances, they have been composted efficiently.

The method as a complete takes a couple of 12 months. On the finish, the fertile soil is checked for secure ranges of ammonia and carbon dioxide. It is offered for $20 a ton — one cent per pound. On common, the middle sells 2,600 tons a 12 months.

Theresa Stiner, a senior environmental specialist with the Iowa Division of Pure Assets, stated the company needs to encourage composting, however on the similar time “shield the atmosphere the place it is taking place.”

Runoff from poorly managed compost services can endanger the atmosphere; soil that outcomes from the method should be secure to be used.

A big composting facility in Eddyville closed final summer season after violating a number of allow laws, together with by permitting runoff to get into the bottom. Locals complained of being unable to open their home windows or spend time open air as a result of scent, in response to native information protection.

Trent, with the IWR, stated the power “smelled to excessive heaven” and consequently, broken the fame of composting within the space.

“I began getting telephone calls on a regular basis from firms and companies in search of someplace to ship their meals waste, and I simply needed to inform them, there’s nowhere. It is all being landfilled once more,” she stated.

Trent wish to see the two-ton composting restrict elevated so it is simpler to open and develop composting companies — nonetheless with the environmental protections written in. Because it stands, the method of getting a allow to go above that threshold is pricey and cumbersome, she stated.

Plans are within the works to evaluate the state laws, Stiner stated.

The DNR has obtained a lot of requests for variances to the present laws, Stiner stated, which is a sign it could possibly be time for an replace. Meaning somebody asks to bypass a regulation, assuming they’ll show they will not hurt the atmosphere within the course of.

“(The laws) simply should be introduced up to the mark with what different states are doing and the present state of composting is,” she stated.

Different states enable for extra curbside packages and industrial-scale composting services, whereas Iowa Metropolis’s program is uncommon for the state.

The primary half of the method means spending months working internally to draft the up to date laws, she stated.

Then, a proper nine-month course of begins. That features getting approval from the Iowa Environmental Safety Fee, a nine-person board appointed by the governor. The updates would even be introduced to the Administrative Guidelines Overview Committee inside the Iowa Legislature.

Kaveh Mostafavi is CEO of the Compost Ninja, a personal firm in Iowa. He seemed into getting a allow for a large-scale compost facility however determined it was too costly.

The corporate collects meals scraps for composting in Des Moines, however and not using a native choice to carry them to, drives the waste again to Iowa Metropolis. He stated he hopes to put money into electrical autos to scale back the environmental influence.

“We’re tremendous fortunate that we now have the Iowa Metropolis landfill that takes the meals scraps,” he stated. “They’ve essentially the most nutritious, superb compost on the finish. However on the finish of the day, the infrastructure does not exist to do that on a large scale.”

The Iowa Metropolis composting web site bought a allow to transcend two tons weekly within the late 2000s. It happened after a bunch of College of Iowa college students pushed for a meals scrap compost program and labored with town and college to check the way it may work.

Because of this, town launched a “curbside” program in 2017 to make it simpler for the common resident to compost meals waste. Folks dwelling in single-family houses to four-plex residences can request a 25- or 95-gallon compost bin to accompany their recycling and trash pickup for an additional $2 month-to-month.

About half of town’s households take part, Jordan stated.

As well as, the $45 to $50 per-ton price to “tip” rubbish into the landfill goes towards the composting program. In different phrases, because the compost program continues to develop, it loses cash.

The town is within the midst of determining methods to develop its area for composting, understanding it’s already working out.

And that there is extra to be collected.

Obtain our apps right now for all of our newest protection.

Get the newest information and climate delivered straight to your inbox.

Iowa

Iowa businesses will see $1.2 billion unemployment tax cut under bill sent to Kim Reynolds

Watch Iowa Gov. Kim Reynolds propose unemployment insurance tax cuts

Iowa Gov. Kim Reynolds propose cutting unemployment insurance taxes in half to be more competitive with surrounding states.

- Iowa lawmakers have passed Gov. Kim Reynolds’ bill to cut unemployment taxes for businesses, resulting in more than a $1 billion tax cut over five years.

- The bill would cut in half the amount of wages on which businesses pay unemployment taxes, as well as lower the maximum unemployment tax rate from 7% to 5.4% and reduce the number of tax tables.

- Republicans said Iowa’s high unemployment trust fund balance shows the state is over-collecting, while Democrats said the bill gives corporations a tax break and fails to help workers.

Iowa businesses will see a nearly $1.2 billion tax cut on the money they pay into the state’s unemployment trust fund under a proposal lawmakers passed and is headed to Gov. Kim Reynolds for her signature.

In a statement, Reynolds said Iowa’s unemployment tax “has needlessly punished Iowa businesses.”

“Our unemployment trust fund balance is at an all-time high of nearly $2 billion, while the duration of unemployment claims is at a record low of around nine weeks,” she said. “We’re clearly over-collecting.”

Reynolds called for the unemployment tax cut in her Condition of the State address in January. The bill would cut in half the amount of wages on which businesses pay unemployment taxes, as well as lower the maximum unemployment tax rate from 7% to 5.4% and reduce the number of tax tables.

Those taxes flow into Iowa’s unemployment trust fund, which pays unemployment benefits to workers when they are laid off.

“Passing this bill means nearly $1 billion in savings over five years for Iowa businesses of all sizes,” Reynolds said. “Thank you to our legislators and key stakeholders for their support to help attract new business to Iowa and place existing businesses on a level playing field with our neighboring states.”

The Iowa Senate voted 32-16 along party lines on May 14 to pass the bill, Senate File 607. House lawmakers followed a few hours later with a party-line vote of 60-27.

Democrats said the bill gives businesses a tax break while doing nothing to help workers.

“Fundamentally, my Democratic colleagues and I do not believe that we should be helping our employers on the backs of our workers,” said Senate Minority Leader Janice Weiner, D-Iowa City.

Democrats seek to restore unemployment benefits cut by Republicans in 2022

Democrats argued the tax cuts for employers are possible because of a 2022 law passed by Republicans that cut the maximum number of weeks Iowans can receive benefits from 26 weeks to 16.

They offered amendments to restore Iowa to 26 weeks of unemployment benefits, or 39 weeks in the case of a plant closure. Republicans voted the proposals down.

Sen. Janet Petersen, D-Des Moines, read a list of Iowa companies that have laid off workers this year.

“These are real Iowans facing real job losses just this year,” she said. “And instead of helping them, you want to pull money out of Iowa’s unemployment insurance system to give another corporate tax break to companies that are laying them off.”

Sen. Adrian Dickey, R-Packwood, said Iowans still get 26 weeks of unemployment benefits if there is a plant closure, although that number is down from 39 weeks before the 2022 law.

“When a business does close its doors and goes out of business, we have been compassionate about that issue by moving that to six months of unemployment benefits,” he said.

Sen. Molly Donahue, D-Cedar Rapids, urged Republicans to “stand behind workers.”

“Our unemployment system is rigged for the employers, particularly with this bill,” she said. “It is the workers who hold businesses up and we need to do better by those workers, not give even more breaks to the employers who are laying them off.”

Dickey said the 2022 law included changes that has helped Iowa Workforce Development get Iowans back to work sooner after they are laid off, lowering the state’s average unemployment duration to nine weeks.

“The Republican Party has been the party to stand up for Iowa workers,” he said. “We are the party that wants our workers to aspire more than desiring an unemployment check.”

How much would Iowa employers save in unemployment taxes?

According to an analysis by the nonpartisan Legislative Services Agency, businesses would see a $1.18 billion tax cut over five years if the bill becomes law.

That would amount to roughly $200 to $250 million less that businesses pay into the unemployment trust fund each year, according to the agency’s estimates.

- 2026: $193.2 million

- 2027: $229.4 million

- 2028: $241.2 million

- 2029: $253.5 million

- 2030: $266.3 million

The Legislative Services Agency estimates that Iowa’s unemployment trust fund balance will rise to $2.06 billion in 2026, the first year lower tax rates would take effect. In 2030, the agency estimates the trust fund balance will stand at $1.78 billion.

Will businesses use the savings to help employees?

The bill says employers should use any savings they receive from the tax cuts to pay for employee salaries or benefits or to use as an alternative to unemployment benefits during periods of seasonal layoffs.

House Democrats tried to amend the bill to make that mandatory.

Rep. J.D. Scholten, D-Sioux City, said “knowing what you should do and actually doing it are two different things.”

“Coming into session I came with a mindset that I should eat healthy, but that didn’t happen,” Scholten said, getting laughs from his colleagues.

Corporations should take care of workers, he added, “but that’s not reality.”

“Let me be clear: billionaires do not work harder than the working class,” Scholten said. “It’s bills like this that put a thumb on the scale towards billionaires and towards multinational corporations.”

Rep. David Young, R-Van Meter, said the Democrats’ amendment would create a mandate on businesses and could prevent them from spending money on new equipment or other ways of improving the business.

“While many of us would like to see and encourage employers to use all the savings from the bill on their employees, businesses may need flexibility in difficult economic times,” he said. “And this could actually result in harm to employees instead by tying the hands of employers to strengthen and grow their business.”

Iowa has nearly $2 billion in its unemployment trust fund

Iowa had $1.95 billion in its unemployment trust fund as of May 12.

As of Jan. 1, 2024, Iowa ranked ninth in the country for unemployment trust fund balance, at $1.8 billion, ahead of more populous states.

Democrats pointed out that Reynolds used $727 million in federal COVID-19 relief funds to shore up the fund during the pandemic.

Sen. Zach Wahls, D-Coralville, said it’s a good thing that Iowa has a high trust fund balance, raising concerns about what could happen if a recession hits.

“When the whole point of the fund is to be ready for a rainy day and you see storm clouds on the horizon, you want that fund to be full,” he said. “Because what you don’t want is to have to raise taxes when you’re headed into a recession to make up for a shortfall.”

Dickey said the unemployment trust fund is structured so that if the fund dips below a certain level, businesses move to a higher tax rate so the fund is replenished.

“I don’t agree that those scenarios are coming from an economic standpoint,” he said. “But if they are, the fund is structured to handle those situations.”

How does Iowa’s unemployment insurance taxable wage base compare with other states?

Iowa currently taxes businesses on about $39,500 of an employee’s wages.

That ranks Iowa 12th in the country for its taxable wage base for unemployment insurance.

Iowa’s wage base is the second-highest among surrounding states, second to Minnesota ($43,000).

Reynolds’ proposal would cut that number in half, meaning Iowa would tax businesses on about $19,800 of an employee’s wages.

Iowa would still tax more wages than South Dakota ($15,000), Wisconsin ($14,000), Kansas ($14,000), Illinois ($13,916), Missouri ($9,500), Michigan ($9,000) and Nebraska ($9,000).

The governor’s proposal would also lower the top rate paid by employers from 7% to 5.4%, reducing both the tax itself and the base they pay the taxes on.

(This story was updated because an earlier version included an inaccuracy.)

Stephen Gruber-Miller covers the Iowa Statehouse and politics for the Register. He can be reached by email at sgrubermil@registermedia.com or by phone at 515-284-8169. Follow him on X at @sgrubermiller.

Iowa

Pete Buttigieg slams President Trump at Iowa town hall

-

Now Playing

Pete Buttigieg slams President Trump at Iowa town hall

01:15

-

UP NEXT

Damaging details about Biden’s mental fitness in new book

01:15

-

Trump kicks off high-stakes mideast trip in Saudi Arabia

02:34

-

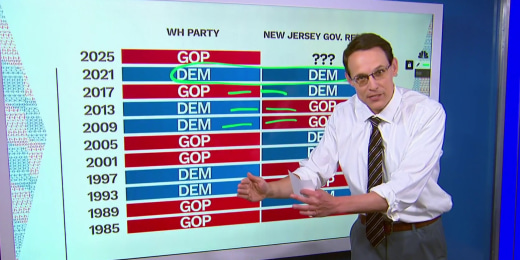

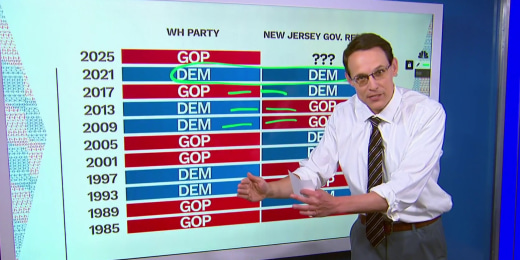

Kornacki: Trump is the ‘X factor’ in both NJ gubernatorial party primaries

04:54

-

Reconciliation bill ‘a step in the right direction,’ says House Ways & Means Cmte. member

08:34

-

White House ‘not concerned’ about potential business conflicts as Trump visits the Middle East

16:13

-

Trump kicks off Middle East trip with visit to Saudi Arabia

03:54

-

Georgia college student in ICE custody following mistaken traffic stop

02:32

-

Trump announces end to Syrian sanctions

01:47

-

Stocks soar after trade war with China cools amid negotiations

02:09

-

Trump: Only a ‘stupid’ person would say ‘no’ to luxury jet from Qatar

02:20

-

Newsom calls for homeless camps to be cleared across California

06:13

-

Trump to accept new Air Force One from Qatar

03:20

-

House GOP agenda bill targets ‘significant cuts and structural changes’ to Medicaid

03:20

-

Qatar gifting a jet to Trump administration ‘opens up possibility’ of security concerns

08:56

-

Pharmaceutical industry ‘pushing back’ against Trump executive order to lower drug prices

03:26

-

U.S. and China tariff reduction could ‘de-ice’ business between the two countries

15:48

-

Transportation Secy. Duffy says FAA will ‘fully fast-track’ airport fixes

02:10

-

Trump announces cuts to prescription drug prices

00:40

-

Trump says Hamas is set to release American hostage Edan Alexander

01:36

-

Now Playing

Pete Buttigieg slams President Trump at Iowa town hall

01:15

-

UP NEXT

Damaging details about Biden’s mental fitness in new book

01:15

-

Trump kicks off high-stakes mideast trip in Saudi Arabia

02:34

-

Kornacki: Trump is the ‘X factor’ in both NJ gubernatorial party primaries

04:54

-

Reconciliation bill ‘a step in the right direction,’ says House Ways & Means Cmte. member

08:34

-

White House ‘not concerned’ about potential business conflicts as Trump visits the Middle East

16:13

Iowa

Randy Feenstra launches exploratory committee as he weighs gubernatorial run in 2026

Rep. Randy Feenstra on the budget, Pete Hegseth, and Governor rumors

Rep. Randy Feenstra talks about the budget, Pete Hegseth, and a possible run for Governor during a tour of the Iowa Veterans Home in Marshalltown.

Republican U.S. Rep. Randy Feenstra has launched an exploratory committee as he signals strong interest in running for governor of Iowa in 2026.

“Since Governor (Kim) Reynolds announced her decision not to seek re-election, Iowans from every corner of the state and walk of life have asked me to run,” he said in a statement Tuesday, May 13. “The outpouring of encouragement and my desire to continue giving back to our great state has brought me to today’s announcement. I want to thank Governor Reynolds for her strong, conservative leadership for Iowa.”

Feenstra is in his third term representing Iowa’s 4th Congressional District, which spans 36 counties in northwest Iowa and along the full western edge of the state. It is, by far, the state’s most conservative congressional district, which could give him an edge with likely Republican primary voters.

He won the seat in 2020 after ousting longtime U.S. Rep. Steve King in a Republican primary. And he handily won reelection in 2022 and 2024 as an incumbent.

Feenstra filed the paperwork necessary for a gubernatorial campaign May 12 with Iowa’s Ethics and Campaign Disclosure Board.

In a release, he touted his commitment to supporting Republican President Donald Trump’s agenda.

“I’ve stood with President Trump and fought against Joe Biden’s radical policies,” he said in a statement. “I’ve led the fight to stop Communist China from buying our farmland and backed President Trump every step of the way as we’ve secured the border. I’m fighting every day to renew the Trump Tax Cuts, protect the family budget, and support our main street businesses. As governor, I will stand with President Trump, defeat the left, and help usher in America’s next golden age.”

He said he will begin raising money and having conversations with Iowans around the state.

If Feenstra does enter the race, he would do so with a strong financial advantage. He’s legally allowed to transfer the money from his congressional fundraising accounts into a state campaign for governor. He reported ending the last quarter with about $1.6 million in cash on hand that could help seed a gubernatorial campaign.

The seat opened after Republican Gov. Kim Reynolds made a surprise announcement in April that she would not seek reelection in 2026.

Former Republican state Rep. Brad Sherman had said prior to Reynolds’ announcement that he would run for governor.

Multiple other Republicans have signaled their interest in the race since Reynolds’ announcement. They include Attorney General Brenna Bird, state Agriculture Secretary Mike Naig, state Sen. Mike Bousselot, House Speaker Pat Grassley and state Rep. Bobby Kaufmann. Bousselot has also launched a formal exploratory committee.

Democratic state Auditor Rob Sand announced May 12 he would seek his party’s nomination.

Sand also enters the race with a sizeable financial advantage. He announced at the end of last year he had raised more than $8 million. And he announced May 13 that his campaign had raised $2.25 million in his campaign’s first 24 hours.

Democrats sought to undermine Feenstra’s potential candidacy after news broke that he had filed paperwork with the state.

“Whether in Washington or Des Moines, Congressman Randy Feenstra has been a reliable foot soldier for the misguided partisans and insiders ruining our state,” Iowa Democratic Party Chair Rita Hart said in a statement. “Meanwhile, Iowa is now 49th in economic growth and losing manufacturing jobs while Rep. Feenstra has failed to deliver a farm bill, voted to gut Medicaid, and supported Iowa’s unaccountable voucher program that’s jeopardizing Iowa’s fiscal budget. We need a new direction and Randy Feenstra is just more of the same failed leadership.”

Feenstra is scheduled to hold his annual fundraiser, the Feenstra Family Picnic, May 30 in Sioux Center alongside U.S. Rep. Jim Jordan, R-Ohio.

Brianne Pfannenstiel is the chief politics reporter for the Des Moines Register. Reach her at bpfann@dmreg.com or 515-284-8244. Follow her on X at @brianneDMR.

-

Austin, TX5 days ago

Austin, TX5 days agoBest Austin Salads – 15 Food Places For Good Greens!

-

Education1 week ago

Education1 week agoIn Alabama Commencement Speech, Trump Mixes In the Political

-

Technology1 week ago

Technology1 week agoBe careful what you read about an Elden Ring movie

-

Culture1 week ago

Culture1 week agoPulitzer Prizes 2025: A Guide to the Winning Books and Finalists

-

Technology6 days ago

Technology6 days agoNetflix is removing Black Mirror: Bandersnatch

-

Education1 week ago

Education1 week agoUniversity of Michigan President, Santa Ono, Set to Lead University of Florida

-

World6 days ago

World6 days agoThe Take: Can India and Pakistan avoid a fourth war over Kashmir?

-

News6 days ago

News6 days agoReincarnated by A.I., Arizona Man Forgives His Killer at Sentencing