Finance

Opinion | How infrastructure borrowing can benefit Hong Kong for decades to come

This proposal makes sense. Hong Kong’s public debt to gross domestic product ratio is extremely low by international standards; the government therefore has the space and creditworthiness to borrow more – even though interest rates today are higher. There is also a strong economic case to rely on debt financing for infrastructure projects which incur costs today but generate benefits for the next few decades.

Nonetheless, there are concerns among some that such borrowing only deepens the government’s financial hole, burdens future generations, and masks the precarity of government finances. Rather than dismiss these concerns as invalid or ignorant, the government should engage seriously with them and, in so doing, build society’s trust in its ability to manage Hong Kong’s finances well. This is also an opportunity to educate the public on why borrowing for infrastructure is not only necessary, but may even be desirable in the current macroeconomic context.

Necessary and desirable

The first principle of public financial management that the Treasury should convey is that all deficits have to be financed eventually. In this, the government has to choose between three unpalatable options: raising taxes, cutting spending, or borrowing. Raising taxes – particularly the introduction of a Goods and Services Tax (GST) – is probably something that Hong Kong must do eventually.

That leaves increased public sector borrowing as the least bad option to finance Hong Kong’s infrastructure plans.

The second idea that the Treasury should convey is that borrowing is the more efficient and equitable way of financing infrastructure. It is more efficient because the benefits of infrastructure development accrue over many years – even decades – and so it makes sense to finance that development over a similar time frame. Just as households make costly capital purchases (such as a property) by taking a 30-year loan rather than pay for it entirely with cash, it is also more efficient for the government to finance infrastructure projects (which generate a stream of benefits over many years) using debt.

Debt financing is also more equitable because future generations are the major beneficiaries of these infrastructure projects. Future generations are likely to be richer than current generations, so it is only fair that future generations pay at least part of the costs. Meanwhile, paying for these projects with cash upfront represents a large subsidy from past and current generations of Hongkongers to future, richer generations. This is highly regressive. Unless one is extremely pessimistic about Hong Kong’s future – and believes that future Hongkongers would be poorer than today’s Hongkongers – debt financing is much fairer in terms of intergenerational equity.

A debt sustainability framework

While increased borrowing is a better way to finance infrastructure development, this does not mean the government should be allowed to borrow as much as it wants or to spend however it likes. To build public trust, the Treasury should put in place, and articulate, a set of principles to ensure debt sustainability. Such a framework would also assuage concerns that the Hong Kong government is becoming a less prudent or capable steward of public funds.

The first principle is that debt financing should be used only for infrastructure projects in which assets that can be valued are created. This is critical because debt financing creates liabilities for future generations of Hongkongers. Good financial management requires that these liabilities be matched with corresponding, long-term assets. This rule also means the government should borrow only for capital, not operating, expenditures.

Second, alongside the budget (that shows the government’s income and expenditure of the coming financial year), the Treasury should also present a debt sustainability report which shows the government’s outstanding liabilities and the estimated value of the assets. This need not be done for all the state’s assets and liabilities, only for those that result from its borrowing. The first two principles would address concerns that issuing debt boosts the government’s revenue for the year but masks (future) debt repayment obligations.

Why Hong Kong’s economy needs to become more than just China’s superconnector

Why Hong Kong’s economy needs to become more than just China’s superconnector

Third, to the extent possible, the bonds the government issues should be linked to specific projects rather than be used for unspecified capital expenditure. While public funds are fungible (movable across various uses), this practice would require the government to make a strong case for the projects that it is borrowing for, and not rely only on its overall creditworthiness, to borrow at lower interest rates. This practice would also improve financial transparency and support the market’s scrutiny of the government’s development projects. Done well, this would establish Hong Kong as an issuer of high-quality government bonds, helping the city attract more capital through its bond market.

This principle does not mean the government would be barred from issuing bonds not linked to specific projects. But if it does so, it should have to explain why. Without this principle, governments always prefer more discretion over rules that constrain their flexibility or freedom of manoeuvre.

Finally, there should be a rule that sets a cap on the total stock of debt that the Hong Kong government owes, as well as a rule that limits (as a percentage of GDP) the amount of debt the government can issue in any one financial year. This would assure the public and financial markets that the government is still a disciplined steward of public funds.

Donald Low is Senior Lecturer and Professor of Practice, and Director of Leadership and Public Policy Executive Education, at the Hong Kong University of Science and Technology. He was formerly Director of Fiscal Policy at the Ministry of Finance in Singapore.

Finance

Mother’s Day 2024: Five useful tips to manage finances for a caregiver woman

In the words of American writer Washington Irving, “A mother is the truest friend we have, when trials heavy and sudden fall upon us; when adversity takes the place of prosperity; when friends desert us; when trouble thickens around us, still will she cling to us, and endeavour by her kind precepts and counsels to dissipate the clouds of darkness, and cause peace to return to our hearts.”

As Mother’s Day approaches, it’s a poignant moment to recognize the unsung heroes among us—mothers who find themselves balancing the demands of caring for both their children and ageing parents. In this modern era, characterised by its unique blend of emotional, physical, and financial challenges, mothers stand at the intersection of caregiving and financial stewardship.

For these mothers, the responsibility of managing their family’s financial well-being can feel like navigating uncharted waters. From juggling medical emergencies to providing for their children’s future, the burden can be overwhelming. However, amidst these challenges, there are practical strategies that can offer solace and stability.

Here are some actionable steps for managing finances as a mother caring for both ageing parents and children, especially on this occasion of Mother’s Day:

Support fund and health insurance for parents

In an era of escalating healthcare costs, having robust health insurance coverage is essential. Setting up a dedicated parents’ support fund, alongside investing in health insurance, can provide a safety net for unforeseen medical expenses. This fund should be distinct from contingency funds and can be invested in instruments such as arbitrage or liquid funds for liquidity and stability.

Maximising post-retirement funds for elderly parents

Many elderly parents may have traditionally favoured investments in real estate, gold, or traditional insurance plans. Assisting elderly parents in diversifying their post-retirement investments can ensure a steady income stream while safeguarding their financial security. Investing in avenues like Senior Citizens Savings Scheme (SCSS), annuity plans, or Pradhan Mantri Vaya Vandana Yojana can provide regular income while safeguarding capital, ensuring lower pressure on your financial status.

Protecting their wishes by facilitating parental will drafting

While it is painful to think of the finality of old age, encouraging parents to draft a will enables them to retain control over their assets. This can facilitate a smooth transition of assets, reducing the likelihood of disputes among heirs.

Investing today for a better future for children

For mothers managing the financial well-being of their children, investing early in children’s futures through equity SIPs can harness the power of compounding, laying a strong financial foundation for their education and beyond. Further, instilling financial discipline in children from an early age and involving them in discussions about family finances can impart valuable lessons about responsible money management, making them capable of handling their finances optimally in their adulthood.

Avoid high-risk products and follow prudent paths to prosperity

While striving for financial security, it’s prudent to steer clear of high-risk investment ventures and opt for well-understood, diversified portfolios.

By implementing these practical strategies and fostering open communication, mothers can navigate the challenges of caring for ageing parents and children while safeguarding their own financial well-being. Here’s to the mothers who embody strength, resilience, and unwavering love. Celebrating the ONE woman who shaped your world and believed in you, always – Happy Mother’s Day!

Anupama Sharma is Executive Director, 360 ONE Wealth.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates.

More

Less

Published: 12 May 2024, 10:25 AM IST

Finance

State mobilises resources to boost private sector as economic growth driver: Finance Minister – Dailynewsegypt

Finance Minister Mohamed Maait has reiterated President Abdel Fattah Al-Sisi’s commitment to implementing robust measures to ensure the nation’s economic, financial, and food stability, which are fundamental components of Egypt’s comprehensive national security strategy amidst the current global and regional challenges. These efforts aim to enhance the government’s capacity to elevate the standard of living for its citizens and fulfil their essential, developmental, and public service requirements.

Speaking at the economic forum organized by the Egyptian Association for Political Economy, Statistics, and Legislation, under the theme “Navigating the Egyptian Economy: Regional and Global Perspectives… Addressing Food Economy Challenges,” Maait highlighted that the ongoing global crises underscore the soundness of Egypt’s approach in harnessing collective efforts to bolster state capabilities. This is achieved by meeting strategic agricultural development goals, which include providing citizens with quality products at reasonable prices, thereby ensuring food security and shielding the nation from international and regional market volatility. This is in line with the political leadership’s initiative to broaden agricultural and food production projects aimed at self-reliance and boosting export figures, as well as maintaining sustainable strategic reserves of vital commodities for six months.

Maait added that the government has embarked on a series of reformative actions to reshape the economic landscape and foster recovery, prioritizing agricultural and industrial output and exports in the next phase. The state is fully committed to deploying its resources to fortify the private sector’s role as the main propellant of economic growth, ensuring a more robust structure and agility in adapting to both external and internal economic perturbations, as part of the economic reform agenda backed by the IMF and global development allies.

The programme, which is garnering increased investment interest, is predicated on sustained fiscal prudence, aiming to achieve a primary budget surplus of 3.5% of GDP and setting deficit and debt ratios on a declining path, with a debt ceiling not surpassing 88.2% in the forthcoming fiscal year. International credit rating agencies have conveyed optimism regarding the prospects of the Egyptian economy, recognizing the potential for more invigorating opportunities for local and international investors. They have favourably evaluated Egypt’s new economic direction and foresee a potential upgrade in the country’s credit rating in 2024.

The Finance Minister elucidated that the government is collaborating with investors to alleviate the financial load of fostering agricultural and industrial ventures by continuing the interest rate support initiative, offering financing provisions of approximately EGP 120bn for these sectors. The national treasury is allocating EGP 8bn annually to cover the interest rate differential for beneficiaries, alongside budgetary provisions in the upcoming fiscal year to assist farmers, reinforcing the agricultural domain and fortifying Egypt’s food system.

He noted that the Egyptian economy has been grappling with intricate challenges over the past four years, exacerbated by the succession of regional and global crises. These difficulties are further intensified by the severe consequences of the ongoing conflict in Gaza, tensions in the Red Sea area, and other forms of instability in the Middle East, coupled with the adverse effects of the conflict in Ukraine.

The geopolitical unrest and regional as well as international disputes have engendered a volatile economic environment marked by decelerated economic activities, diminishing growth and investment rates, and escalating inflation on both the global and domestic fronts. This has manifested in increased financing and developmental costs, particularly due to the central bank’s tightening monetary policies, rising interest and exchange rates, and elevated transportation and logistics expenses, leading to augmented production and import costs, as well as higher prices for essential commodities, food, and services, while also considering the ramifications of the COVID-19 pandemic.

Maait pointed out that the nation’s overall fiscal intake has suffered in the last four years, owing to reduced economic dynamism and the detrimental impacts of international and regional discord on certain economic sectors like tourism, manufacturing, exports, Suez Canal revenues, and foreign investments. Expenditures have surged to unprecedented levels to counteract the severe economic jolts and mitigate their inflationary impacts, with swift interventions and extraordinary social protection measures targeting the most vulnerable segments of society, including low and middle-income households, and bolstering the sectors most affected by the economic upheaval.

Finance

Russian PM Proposes New Ministers, Retains Ministers of Finance, Economy

-

News1 week ago

News1 week agoPolice enter UCLA anti-war encampment; Arizona repeals Civil War-era abortion ban

-

News1 week ago

News1 week agoSome Florida boaters seen on video dumping trash into ocean have been identified, officials say

-

Education1 week ago

Education1 week agoVideo: President Biden Addresses Campus Protests

-

World1 week ago

World1 week agoUN, EU, US urge Georgia to halt ‘foreign agents’ bill as protests grow

-

World1 week ago

World1 week agoEuropean elections: What do voters want? What have candidates pledged?

-

World1 week ago

World1 week agoIn the upcoming European elections, peace and security matter the most

-

Movie Reviews1 week ago

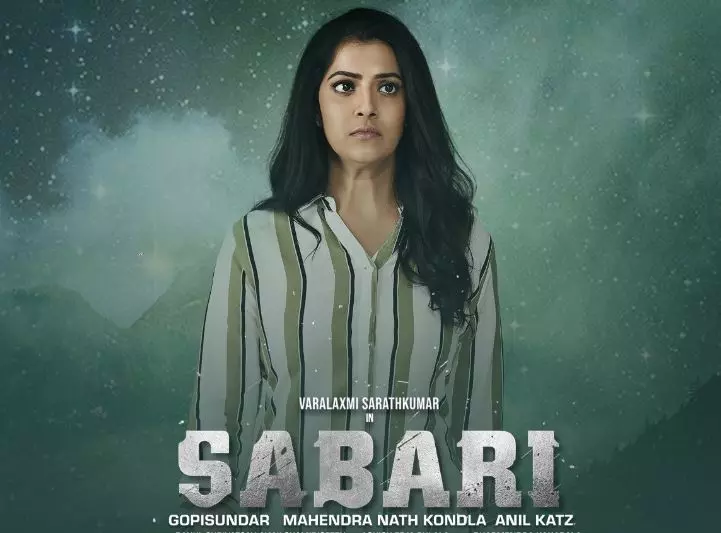

Movie Reviews1 week agoSabari Movie Review: Varalaxmi Proves She Can Do Female Centric Roles

-

Politics1 week ago

Politics1 week agoAustralian lawmakers send letter urging Biden to drop case against Julian Assange on World Press Freedom Day