Finance

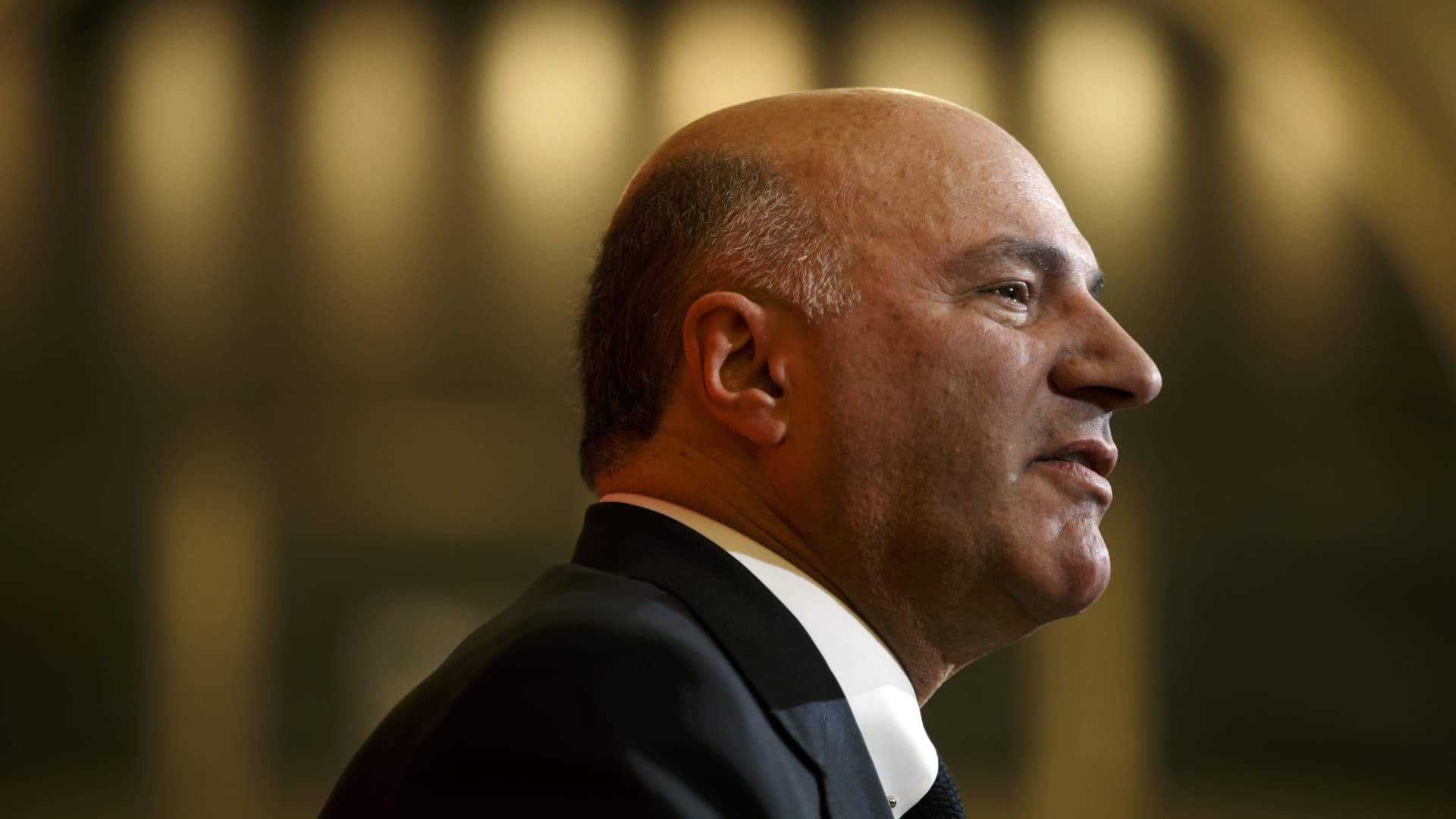

Kevin O’Leary on being dyslexic, where he got his financial chops and why he isn’t really that mean

This story is a part of the Behind the Desk sequence, the place CNBC Make It will get private with profitable enterprise executives to search out out every little thing from how they bought to the place they’re to what makes them get away from bed within the morning to their day by day routines

There’s quite a bit you won’t find out about Kevin O’Leary.

Possibly you did not know the star investor on ABC’s “Shark Tank” grew up dyslexic. Or, possibly you did not know he bought his monetary chops from his Lebanese mom, whom he says “stored a secret [bank] account from each of her husbands, her entire life.”

You may assume he is imply, based mostly largely on his tv persona. O’Leary disputes that assertion. “Individuals name me imply. I do not assume I am imply,” O’Leary, 67, tells CNBC Make It.

As an alternative, O’Leary says, he is merely following recommendation he acquired as a youngster from his late mom Georgette: By no means inform a lie, and you may by no means have to recollect what you mentioned. “In different phrases, I inform it the way in which I see it,” he says.

O’Leary credit that honesty, even when it hurts, to his success — courting again to his first entrepreneurial endeavor, an organization known as Softkey Software program that he launched from his Toronto basement in 1986. The corporate later morphed into the academic software program agency The Studying Firm, which O’Leary and his co-founders offered to Mattel for $4.2 billion in 1999.

Since then, O’Leary has invested in and suggested a slew of companies, from crowdfunding start-up StartEngine to “Shark Tank” firms like DrainWig and Depraved Good Cupcakes. He is additionally a bestselling creator who serves because the chairman of O’Shares ETFs.

The street to get there was removed from simple, he says — from dropping his dad at age seven to creating mulitiple enterprise errors alongside the way in which. Right here, O’Leary talks about rising up with dyslexia, the second that made him a lifelong entrepreneur and why he actually is not that imply.

On rising up with dyslexia: ‘I did not actually have a incapacity. I had a superpower’

I had severe dyslexia once I was younger. I began to fall behind in class in math and studying expertise. However I used to be very lucky to get into an experimental program at McGill College.

It was run by two professors, Sam Rabinovich and Marjorie Golick, who are actually legendary in dyslexia. They taught me that I did not actually have a incapacity. I had a superpower.

At that age, the entire thought was to cut back my nervousness — as a result of I may really learn a e book the other way up within the mirror in entrance of my class. That is one of many attributes sure dyslexics have. As soon as I confirmed them that I can do this, that is how I began studying till it resolved itself.

There are many examples of dyslexics which have achieved nicely in enterprise, later. However they’ve to beat the attributes.

On the second that made him an entrepreneur: ‘For me, it was getting fired … as an ice cream scooper’

Each time I discuss to profitable entrepreneurs, there’s one second of their lives that adjustments their course. For me, it was getting fired at Magoo’s Ice Cream Parlour as an ice cream scooper.

It was the primary and solely job I ever had. I bought fired on the primary day as a result of I did not perceive the concept of the employee-employer relationship. I solely took the job as a result of I needed to be near this woman that I used to be inquisitive about. She was working on the shoe retailer throughout the mall.

On the primary day on the job, the proprietor mentioned, “The ground is totally coated with gum. You have to scrape it off earlier than you permit, and it’s a must to do this day-after-day.” I mentioned, “I can not do this.” I used to be anxious that the woman throughout the mall was gonna see me on my knees, and that was dangerous for my model. So she fired me, and that was the final job I ever had.

I discovered that I can not work for anyone. I’ve to regulate my very own future. I am not in opposition to [the concept of] being an worker, however I can not [personally] do it. That was the course of my ambition from that day on.

On the supply of his monetary chops: ‘My mom … was very hardcore about ensuring she may handle herself and her household’

I feel it has quite a bit to do with my Lebanese mom. Within the Lebanese household hierarchy, matriarchs run the present and so did her grandmother. They set the tone for the household.

My mom was fiercely unbiased. She needed her personal monetary pillar for herself. I feel I inherited that from her: She was very hardcore about ensuring she may handle herself and her household.

She wasn’t an analyst or something. However when she handed away, the executor known as me and mentioned, “You gotta get down right here. Your mom died a really rich lady.”

I had no concept that she stored a secret account from each of her husbands, her entire life. That is simply how she labored.

On one of the best recommendation he ever acquired: ‘By no means inform a lie’

I am going again to one thing my mom taught me once I was a youngster: “By no means inform a lie, and you may by no means have to recollect what you mentioned.” I wasn’t training this again then, however I’ve actually come to comprehend the advantage of it now.

I inform it the way in which I see it. Many individuals do not agree with me, nevertheless it’s those that do not agree with me who get into dialogue and debate, and I feel that is very wholesome.

I do know that will get me the “imply” tag on “Shark Tank.” However when a deal is de facto crappy, it’s best to inform them the reality. Generally, that is very exhausting, however I discover that individuals can scent bull—- a mile away on social media. You have to be sincere, and I feel that engages [people].

I’ve a really giant [following], and I am very inquisitive about what they assume. I quiz them on a regular basis once I wish to determine on one thing. So long as you do not bull—- them, they will be with you for all times.

On the largest false impression about him: ‘I do not assume I am imply’

Finance

Mayfield Village says goodbye to longtime Finance Director Ron Wynne

Mayfield Village Council at its May 20 meeting said goodbye to Finance Director Ron Wynne who decided to leave the village to retire with his family.

Starting in 2009, Ron Wynne saw the village through some troubling times. Most notably when Progressive Insurance decided to leave the village, taking their workers and taxes with them. The hit that the village had to take didn’t pack as much of a punch as it could have, due to Wynne’s planning as he positioned the city to still have a surplus of over $40 million, cushioning the blow.

Mayor Brenda Bodnar said she was sad to see Wynne leave but was happy he would be able to spend more time with his family. She hopes he comes to visit but understands if he’s a little busy.

“Ron, I can honestly say that you have done more for us in 15 years than some do in a lifetime,” Bodnar said during the village council meeting. “I cannot tell you how much you will be missed, but I can assure you that your legacy of sound training and transparent financial management will live on here in the village.

“On a personal level Ron, I can always count on you for straightforward information, clear direction, complete candor, and a wicked sense of humor,” she added. “You are an invaluable friend, and we will all miss you greatly. And while we want you and (wife) Debbie to have an absolute blast in retirement, we hope that you keep in touch.”

Wynne himself said he was happy to be able to play golf and travel a bit. He said that although he doesn’t live in the village, he will definitely stay in touch with his lifelong friends.

“I look forward to retirement and traveling with my family,” Wynne said after the council meeting. “I’ve seen a lot of changes and a lot of positive growth, and I wish the village all the success in going forward.

“I’ve made friends here that are going to be friends way beyond my years here,” he added. “I think they’ve had great leadership in the time that I’ve been here, they have been visionaries in what they want in terms of growing the village and if they keep that up the village will be a great place going forward.”

Mayfield Village has appointed Angie Rich as his replacement, who was sworn in last month.

Finance

Credendo is now a member of Wo·Men in Finance | Credendo

In April 2023, Credendo became a member of Wo·Men in Finance. This organisation was created in 2019 with the aim of accelerating gender balance at all levels within the financial sector.

Why did Credendo become a member?

Through this membership, Credendo wants to further strengthen its inclusive and diverse working environment, in which everyone is able to achieve their full potential. As you can read in our CSR report, supporting social and sustainable projects is important to us. Furthermore, one of our core values is to pay special attention to the mix of different cultures, experiences and backgrounds within our own organisation. It is also part of the Credendo Cares programme, which has been in place since a long time. It is for good reasons that we have earned the Leading Employer Quality Label.

Wo·Men in Finance will help us position ourselves even better in terms of diversity and inclusion.

By becoming a member, we are committing to:

- measuring glass ceilings within Credendo;

- sharing our gender progression at different levels and gender equality initiatives with Wo·Men in Finance;

- participating in the advisory board of Wo·Men in Finance.

Being a member gives us access to:

- 10 yearly workshops organised by Wo·Men in Finance on various themes, ranging from how to use AI inclusively and how to start employee resource groups, to sexism prevention or inclusive job offers;

- free consultancy services such as in-house training or presentations, adaptation of job offers to make them more inclusive, a review of our gender KPIs, etc.;

- our own benchmarking report with personalised advice, comparing our gender results with those of the sector;

- a Febelfin toolbox with 25 tools to improve inclusion.

Credendo is proud to have achieved significant gender diversity. Our workforce is made up of a balanced mix of men and women, with a total of 50.6% women across all subsidiaries. This result is not just a statistic for us. It demonstrates our commitment to equity and inclusion.

Finance

A flood of cheap Chinese exports is putting the entire global economy at risk, France’s finance minister warns

The entire world economy is at risk from a glut of cheap Chinese exports, France’s Finance Minister Bruno Le Maire said in tandem with a barrage of joint criticism from the Group of Seven.

“We have an issue with the economic model in which China is producing more and more cheaper industrial devices because it could be a threat not only for the EU, not only for the US, but for the global world economy,” Le Maire said in an interview with Bloomberg Television. “We need to address that issue.”

Leading industrialized nations are coalescing for a tougher and more united challenge to overcapacities in China, which they say threaten their domestic manufacturers.

G-7 finance chiefs meeting in Stresa, Italy cited the country by name as they agreed to “respond to harmful practices” and “to consider taking steps to ensure a level playing field.” Those words marked an escalation from the sparse and more neutral language on trade they standardly use in communiques.

Their statement followed Washington’s announcement on Friday that President Joe Biden will reimpose tariffs on hundreds of goods imported from China. Meanwhile the EU is nearing the end of an electric-vehicle subsidy investigation that is likely to lead to defensive measures against China’s auto exports.

The EU’s potential levies are expected to be significantly lower than the US’s and based on a different approach within World Trade Organization rules and procedures.

Le Maire said at the G-7 meeting that member countries need to strengthen information exchange and establish a shared assessment of China’s industrial practices. Nonetheless, he insisted that the EU has all the necessary tools to reestablish a level playing field .

“Don’t make any mistake about the determination of the EU countries and the French determination,” Le Maire said.

AI Cooperation

The French minister said he is seeking to preserve gains from years of government policies and investment to build its own industry and technology sectors.

A key priority is Artificial Intelligence, where France intends to preserve its leadership in Europe. That has attracted foreign capital, with Microsoft Corp. announcing €4 billion in investment in French cloud and AI infrastructure this month. Paris-based Mistral AI has also announced a partnership with Microsoft in February.

Asked if he could used state screening rules to prevent foreign investors taking over French tech companies, Le Maire said the point at the moment is to increase cooperation, not to block it.

“We will see what are the options of cooperation between Mistral and Microsoft,” Le Maire said. “For the time being, Microsoft is investing in France, is opening data centers in France and investments of Microsoft in France are most welcome.”

-

Politics1 week ago

Politics1 week agoTrump predicts 'jacked up' Biden at upcoming debates, blasts Bidenomics in battleground speech

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24038601/acastro_STK109_microsoft_02.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24038601/acastro_STK109_microsoft_02.jpg) Technology1 week ago

Technology1 week agoMicrosoft’s Surface AI event: news, rumors, and lots of Qualcomm laptops

-

News1 week ago

News1 week agoA bloody nose, a last hurrah for friends, and more prom memories you shared with us

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘The Substance’ Review: An Excellent Demi Moore Helps Sustain Coralie Fargeat’s Stylish but Redundant Body Horror

-

News1 week ago

News1 week agoVideo: A Student Protester Facing Disciplinary Action Has ‘No Regrets’

-

World1 week ago

World1 week agoIndia’s biggest election prize: Can the Gandhi family survive Modi?

-

World1 week ago

World1 week agoPanic in Bishkek: Why were Pakistani students attacked in Kyrgyzstan?

-

Finance1 week ago

Finance1 week agoSan Bernardino finance director claims she was fired after raising concerns about costly project

/cloudfront-us-east-1.images.arcpublishing.com/gray/DHRBEOGK55ASXJZAE44OVDEL6Y.jpg)