Crypto

Where We See Crypto Mining Stocks Headed (Cryptocurrency:BTC-USD)

NiseriN

This article will compare, from a technical perspective, a few of the crypto mining stocks we follow closely at Crypto Waves. Specifically, we will take a look at (RIOT), (MARA), (CIFR), (CLSK), (HUT), (BITF), (HIVE), and (BTBT).

Since the summer highs, stock prices in the above list have lost between 56%-64% of their value from peak to (current) trough, in under three months! In roughly the same time frame, BTC has dropped 21.75% (from peak to (current) trough).

From a technical standpoint observing key oscillators, this class of stocks has reached very oversold levels, but are they investable? In our view on that matter, no. However, that does not mean the same as us ruling out the prospect of some very high return swing trades developing to the upside. In their current patterns, we view upside trades as quite speculative but we will lay out conditions for a prospective more attractive upside setup in a few of the miners.

The business of crypto mining is essentially companies hoping to capture the surplus value from generating newly minted coins vs. the cost of “mining” the block, which would convey to the “miner” newly minted coins as a reward. The costs consist of investment in capital expenditure in “Mining Rigs,” which are dedicated computer systems designed to perform the complex calculations required for mining. These rigs consist of multiple high-performance graphics processing units (GPUs) or application-specific integrated circuits (ASICs) that can handle the intense computational workload. The main operating cost is the power required to perform the computational workload.

Bitcoin (BTC-USD) undergoes a halving cycle roughly every four years. The event is referred to as a “halving” because when it takes place, the reward for each block mined is reduced to half of what it was preceding the event. The next expected halving is roughly six months away. Though we will not provide a deep dive into performance metrics of this industry, at the current BTC price and mining reward, this is not a profitable industry.

Much like precious metals miners, the earnings of these crypto mining businesses are strongly correlated to market prices in the underlying commodity being mined, in this case, we are primarily talking about Bitcoin.

Our thesis on BTC remains bullish. Fibonacci support ranges down to the $20k region, and so long as no sustained or meaningful break below this region develops, our confident expectation is for BTC to climb to the $40k-$49k region. Though I have less conviction about BTC moving directly above the 2021 high, and into $100k+ territory, without any breaks below the 2022 low, a technical setup has emerged for this prospect.

That said, while the thesis in BTC is more confidently bullish, especially in the long run, in which we do have strong conviction about moves well north of $100k, we can’t convey a strong investment grade thesis for the miners.

From a technical standpoint, though most miners had enormous gains from the pandemic lows into all-time highs and have held higher lows in the retrace into last year’s low, the patterns do not convey any confident prospect of reaching new all-time highs. Similarly, though the bounces from the 2022 lows into this year’s high have produced staggering gains, the patterns do not convey a confident prospect of exceeding the 2023 highs, let alone all-time highs.

The only positive aspects to report are that:

-

the charts are very oversold (but certainly can continue to become more oversold) and

-

(more importantly) some of these charts are displaying very corrective patterns in their declines off the 2023 highs. This is suggestive of these securities prospectively holding a higher low (above the 2022 low) and forming another rally segment to exceed the 2023 highs but without confidence to reach or exceed the all-time highs.

In the group with corrective decline patterns are the following tickers: MARA and CIFR. On the other hand, there are RIOT, HIVE, and BTBT. These all appear to have formed impulses from the summer highs which is very challenging to a prospective sustained bullish thesis, beyond a dead cat bounce. What’s particularly peculiar with RIOT and BTBT is that, while these have retraced considerably less of their rallies from last year’s low (while their patterns are most suggestive of downside follow-through), which sends a mixed message of sorts.

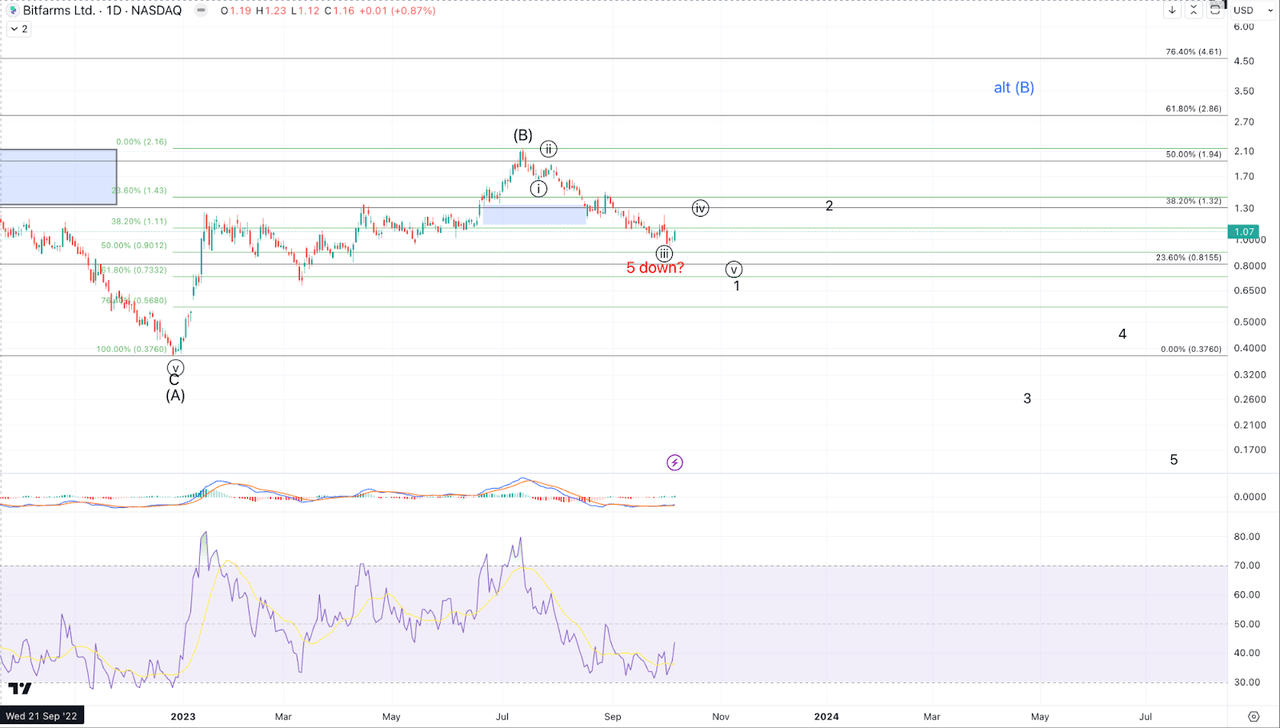

Of the remaining names mentioned near the heading of the article, HUT and BITF have patterns that appear to favor general downside continuation (with some corrective bounces) but that are less clearly impulsive to the downside. BITF possibly has 5 waves down already, but another corrective bounce followed by a lower low would make that pattern significantly more resolute (see below).

Lastly, we have CLSK. CLSK still has just three waves down from this summer’s high but is developing a potential impulse to the downside. Nevertheless, if price maintains above the 61.8% Fibonacci retrace and takes out some key resistance, a setup to the upside for considerable gains should not yet be ruled out.

Regarding all of the aforementioned names: Every single one is still maintaining its 61.8% retracement of the rally from the 2022 low into the summer 2023 highs (See charts below). So long as price is above those key levels, I can’t get strongly bearish. However, I do want to distinguish between those that are currently providing stronger signals of caution (RIOT, HIVE, and BTBT) and those that are better candidates, from an Elliott Wave perspective, for bigger bull runs in late 2023 and early 2024 (MARA and CIFR).

In summary, in the current posture, MARA and CIFR appear the least bad, even though MARA’s retrace is towards the larger end of the spectrum. All that said, a corrective decline is not sufficient, in our view, to start speculating with some positive expected value on the long side. What will be needed are micro impulsive rallies through resistance. Below we will review in detail some general conditions regarding price fluctuations in the coming weeks that would enable bullish setups to develop in MARA and CIFR. Though we’re skeptical about CLSK we have included it as well as the bullish potential is still intact albeit more farfetched.

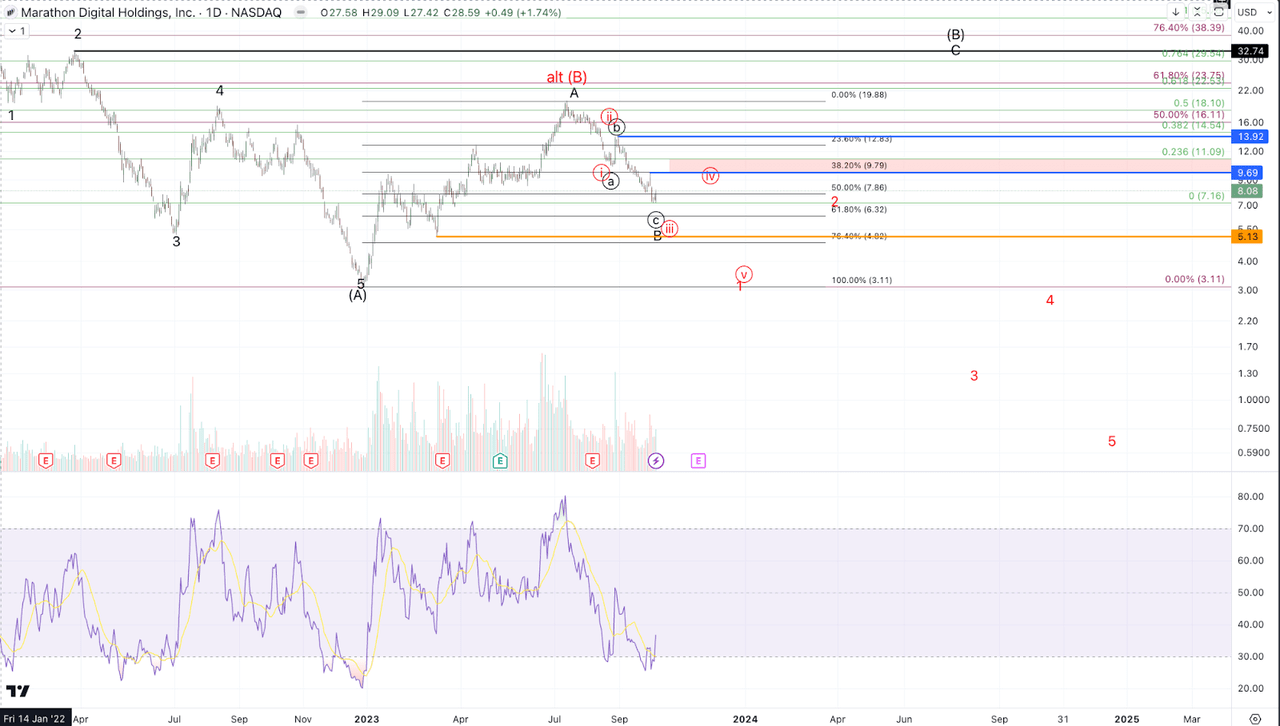

MARA (Marathon Digital Holdings, Inc.)

From the low near the end of 2022 to the 2023 high, MARA stock gained 540% and is currently (as of this writing) up 160%. From an Elliott Wave pattern perspective, MARA is interpreted to be forming a larger corrective move, in which the initial portion completed into the summer highs. The correction since then appears to be forming a higher low to set up a move to $32+ to test the March 2022 high. (Shown with the black labels on the accompanying chart)

As stated above, this is not a high confidence forecast (yet), but should price maintain support in a corrective decline and then develop impulsively to the upside from above $5~, a move to $32 is the preferred interpretation. The alternative thesis (displayed in red) is that price has completed its corrective bounce off the 2022 low and is starting a larger decline to under $2.

At a micro level, a move meaningfully over $9.70 is needed to establish at least a temporary low in place. That said, Fibonacci resistance for downside continuation sits between $10-$11.10. Ultimately, to become more confidently bullish from the current low, we’ll need to see a 5 wave rally up through the late August high of $14. Should such a move develop, I would consider pullbacks possible buying opportunities for a rally to $32-plus. Key levels to watch, should price decline further, are $6.32, which is the key Fibonacci 61.8% retrace, and $5.13, which is the March temporary low from which price launched. Sustained breaks below these levels reduce odds of upside continuation as per the black count.

Jason Appel (Crypto Waves)

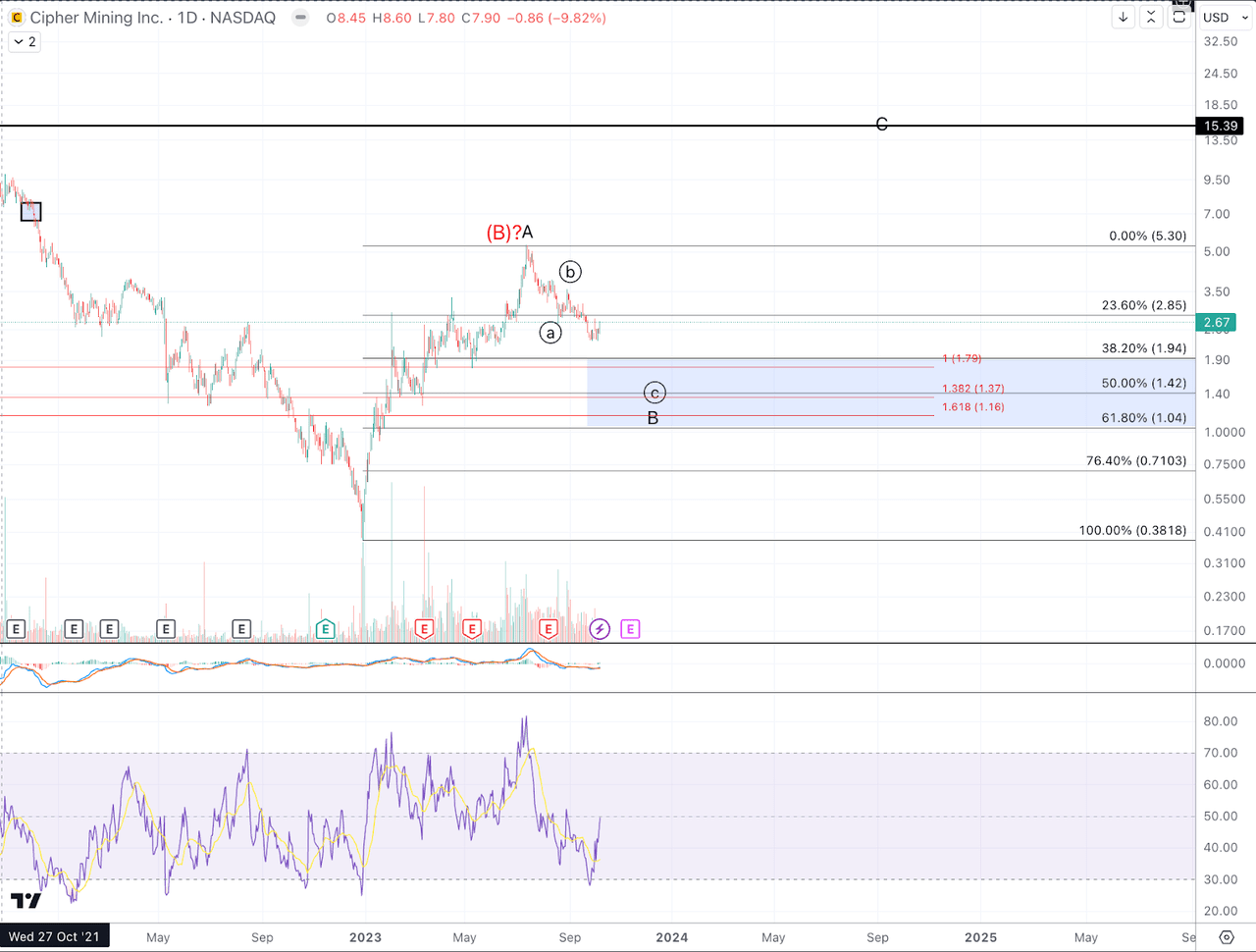

CIFR (Cipher Mining Inc.)

Cipher has so far produced the most shallow retrace of the bunch.

From the low near the end of 2022 to the 2023 high, CIFR stock gained 1288% and is currently (as of writing) up 600% from the 2022 low.

From a technical perspective (displayed in the black-lettered labels in the accompanying chart), Cipher appears to be forming a larger bounce in which the initial portion completed into the summer highs and with price pulling back correctively to form a higher low. Thus far, CIFR has retraced the least of its rally in the first half of the year, not yet having reached the key 38.2% Fibonacci retracement level. It’s reasonably likely that while price remains below $3.15, CIFR can see further extension downward into key confluence support in the $1.25-$1.80 region. That said, so long as price does not make a sustained break below $1, a rally back up to test near the all-time high at $15.39 looks like a viable prospect. All that said, for a confident set up to trade to the long side, traders will want to see a price turn up impulsively from the Fibonacci support region (roughly $1-$1.95) and take out some resistance. Considering that this decline from the July high still appears incomplete, we do not yet have key resistance levels to take out to establish a prospective low in place.

Jason Appel (Crypto Waves)

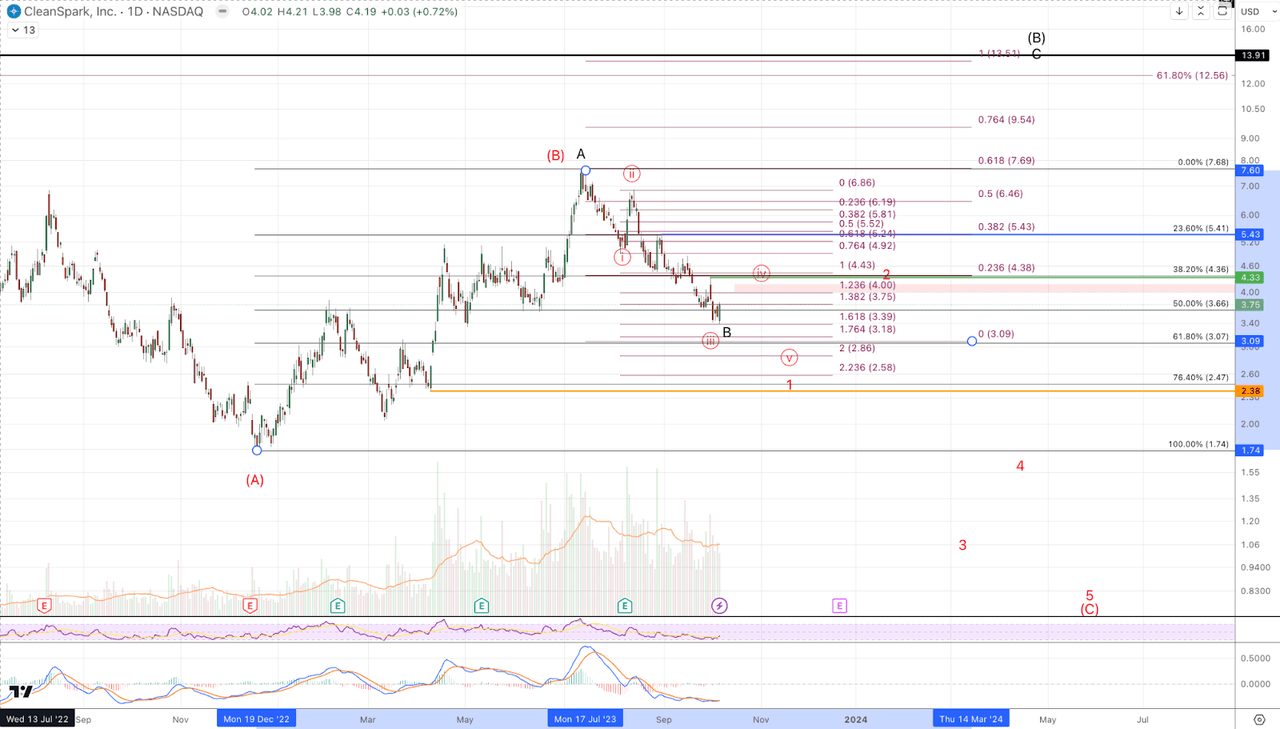

CLSK (CleanSpark, Inc.)

From the low near the end of 2022 to the 2023 high, CLSK stock gained 340% and is currently (as of writing) up 115%. The action counts best as 3 waves up which does not provide a high confidence prospect for upwards continuation. However, so far CLSK only has three waves down into Fibonacci support, which keeps alive the potential for another segment up to form a larger corrective move. Specifically, this entails a large degree 3 wave move in which the initial wave completed into the summer highs and price forming a higher low to set up a move to around $14 to test the March 2022 high. (This prospective path is displayed in black on the accompanying chart.)

As stated above, this is not a high confidence forecast (yet), but should price maintain support in a corrective decline and then develop impulsively to the upside from above $3~, a move to $14 ($13.91) is the preferred scenario though we should note this is even more speculative than with MARA. The alternative thesis (displayed in red) is that price has completed its corrective bounce off the 2022 low and is starting a larger decline to under $1.

Though the broad strokes appear set up like MARA, CLSK is in a more concerning posture. Though the decline down from the July high is still just three waves, the move is setting up more impulsively to the downside which is cause for concern to those entertaining a possible trade to the upside. On the micro level, it’s reasonable that the bounce from last week’s low continues higher and $4-$4.20 is the resistance region to watch. Should price rally correctively to resistance and then produce a lower low under $2.85, price will have a 5 wave impulsive decline from the summer highs, which suggests downside continuation as per the red count to become the favored perspective.

For the bullish case to assert itself, ideally, the low is in or perhaps one more low early this week that maintains the 61.8% Fibonacci retracement around $3 ($3.07). For a more advantageous long side setup, we will want to see an impulsive rally that resoundingly exceeds $4.33 with follow through above $5.45. At that point we’d see pullbacks as potential buying opportunities for a more reasonable prospective rally to $14.

Jason Appel (Crypto Waves)

More charts below (RIOT, HIVE, HUT, BTBT, BITF)

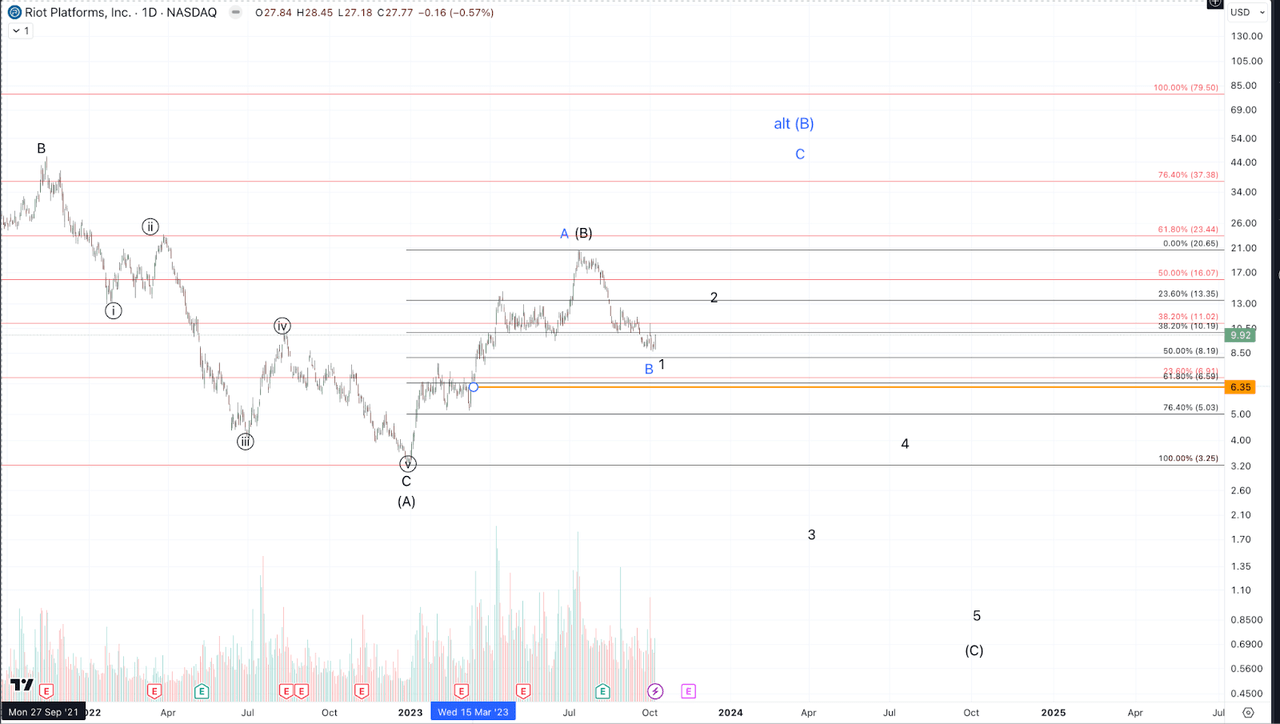

RIOT

Jason Appel (Crypto Waves)

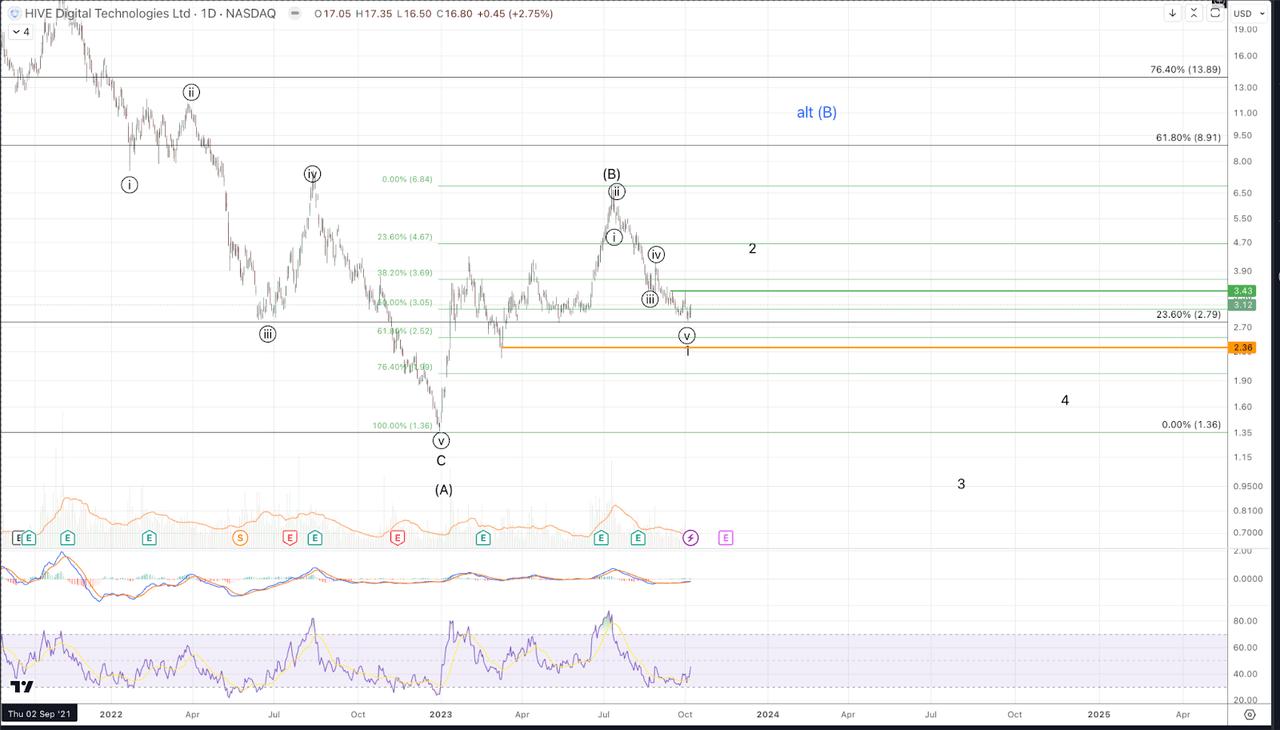

HIVE

Jason Appel (Crypto Waves)

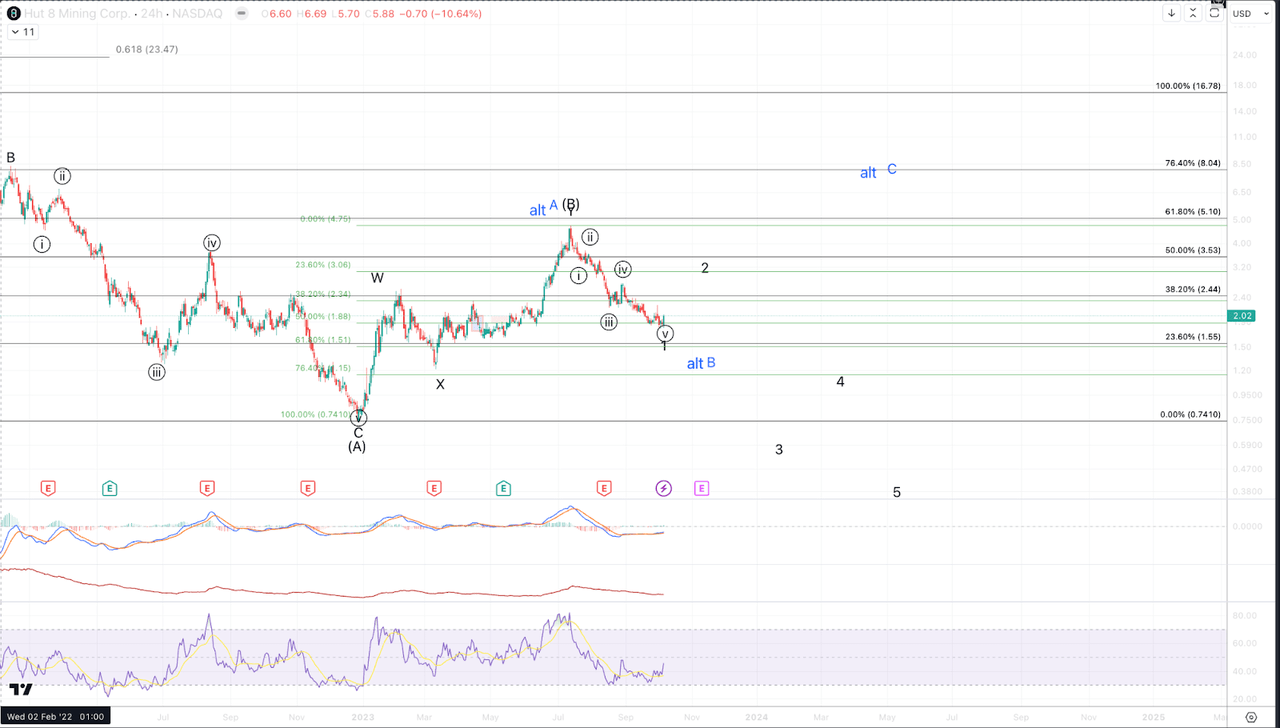

HUT

Jason Appel (Crypto Waves)

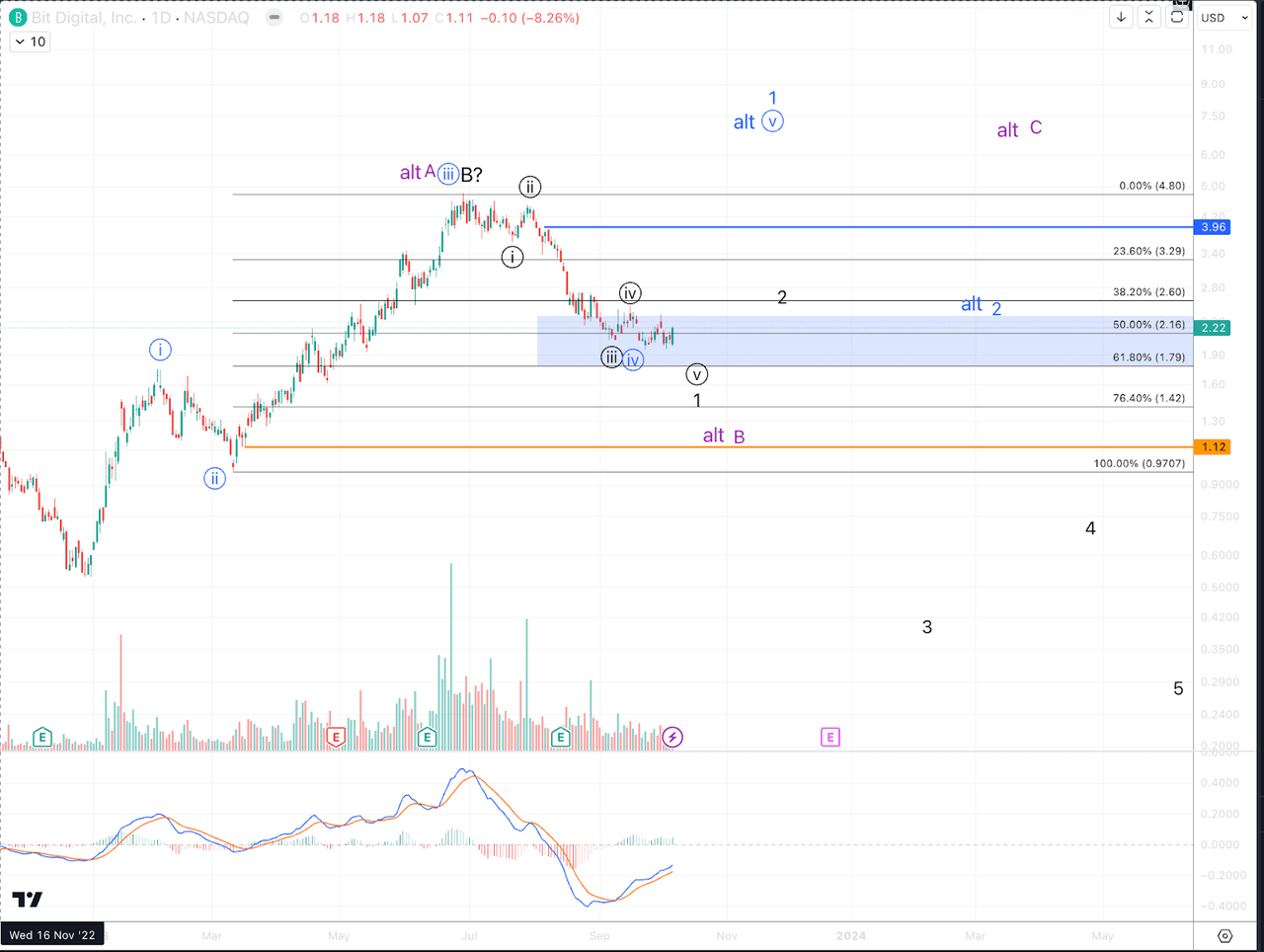

BTBT

Jason Appel (Crypto Waves)

BITF

Jason Appel (Crypto Waves)

Crypto

Own crypto, Bitcoin, or NFTs? You may have to report it on your tax return. What to know

Most meme coins not under SEC jurisdiction: Peirce

Head of the SEC Crypto Task Force and SEC Commissioner Hester Peirce gives her take on meme coins and says the SEC will look at the facts and circumstances, but says most meme coins probably don’t have a home in the current set of regulations.

Bloomberg

Digital assets transactions from Bitcoin, XRP, other cryptocurrencies and non-fungible tokens (NFTs) must be reported on taxpayer’s tax returns. The Internal Revenue Service says that income from digital assets like Bitcoin and other tokens is taxable.

Millions of Americans use cryptocurrency. About 17% of U.S. adults say they have ever invested in, traded or used a cryptocurrency, according to 2024 findings from the Pew Research Center.

As tax season nears its end, here’s what to know about reporting report crypto such as Bitcoin to the IRS.

You may have to report cryptocurrency and NFTs on your tax return

The IRS says that individuals who sold crypto, received it as payment, or had other digital asset transactions must accurately report it on their tax return.

This includes convertible virtual currency and cryptocurrency, stablecoins, and non-fungible tokens (NFTs). For tax purposes, the agency treats digital assets as property, not currency.

All taxpayers must answer this digital assets question on your tax return

The “Yes” or “No” digital assets question listed on federal income tax returns must be answered correctly:

“At any time during the tax year, did you: (a) receive (as a reward, award or payment for property or services); or (b) sell, exchange, or otherwise dispose of a digital asset (or a financial interest in a digital asset)?”

According to an IRS, you answer “yes” if you received digital assets (crypto, Bitcoin, NFTs) as payment for property or services, from a reward or award, from mining, staking and similar activities, and more criteria.

If you’re unsure how to respond to the digital assets question, the IRS provides a questionnaire to help determine how to answer it. Generally, if you had any digital asset transactions, you check “yes,” but if not, you check “no.”

Which federal forms have the digital asset question?

Everyone who files must answer the digital asset question that appears at the top of these forms:

How to report digital asset income

Taxpayers must report all income related to their digital asset transactions, the IRS notes, regardless of whether they result in a taxable gain or loss. Here’s what the agency recommends when reporting crypto and other digital asset transactions.

- Keep records and documentation of any purchases, receipts, sales and exchanges, among other things.

- Calculate the gain or loss of a digital asset and its transaction.

- Determine the basis of a digital asset (typically the cost in U.S. dollars).

- Report it on the correct form, which depends on the type of transaction.

When is the tax filing deadline?

The general deadline to file a federal return with the IRS is just days away, on April 15, 2025. For state taxes, the deadline in Ohio is also April 15, with an extension filing deadline of October 15, 2025.

Crypto

Sen. Cruz Applauds Signing of Cryptocurrency Resolution into Law | U.S. Senator Ted Cruz of Texas

WASHINGTON, D.C. – U.S. Sen. Ted Cruz (R-Texas) released a statement following President Trump signing his Congressional Review Act (CRA) resolution regarding Decentralized Finance (DeFi). This resolution overturns an Internal Revenue Service (IRS) rule on cryptocurrency that would have defined certain developers as “brokers” for reporting and taxation.

Upon the CRA being signed into law, Sen. Cruz said, “This rule would have undermined American leadership on cryptocurrency and I am grateful to President Trump for signing my resolution into law. The resolution is a victory for innovation, privacy, and economic freedom. We are protecting the developers who are building the future of cryptocurrency, making clear that the United States will not cede digital leadership to China, and preserving the ability of Americans to conduct transactions without government interference.”

Sen. Cruz is the leader in the U.S. Senate on advancing cryptocurrency.

- Sen. Cruz introduced the Facilitate Lower Atmospheric Released Emissions (FLARE) Act, incentivizing entrepreneurs and crypto miners to use natural gas that would otherwise be stranded.

- Sen. Cruz introduced the Anti-CBDC Surveillance State Act, legislation that prohibits the Federal Reserve from issuing a central bank digital currency (CBDC). This bill passed with overwhelming bipartisan support.

- Sen. Cruz previously introduced legislation in 2022 and 2023 to prohibit the Federal Reserve from developing a direct-to-consumer central bank digital currency, which could be used as a financial surveillance tool by the federal government.

- Sen. Cruz authored the Adopting Cryptocurrency in Congress as an Exchange of Payment for Transactions Resolution, also known as the ACCEPT Resolution.

- Sen. Cruz introduced an amendment to repeal a provision from the 2021 infrastructure package that created new reporting requirements for many cryptocurrency and blockchain companies in both the 117th and 118th Congresses.

###

Crypto

Should You Buy Bitcoin While It's Under $85,000? | The Motley Fool

Bitcoin’s price has fallen 25% from a recent all-time high. Is this a buying opportunity or the start of another crypto winter?

Bitcoin (BTC 7.46%) soared to an all-time high of $106,182 per coin in January. With the fourth Bitcoin halving firmly in the rearview mirror and a more crypto-friendly regime in the White House, the original cryptocurrency looked ready to skyrocket like it did in 2020 and 2017.

But it hasn’t worked out that way. Bitcoin is down to $79,200 as of this writing on April 8. That’s a hair-raising 25% price crash, well ahead of the S&P 500 (^GSPC 9.52%) stock market tracker’s 19% drop.

Is this the start of a three-year crypto winter like the one you saw after the 2017 peak, or is it a temporary pullback like in the spring of 2021? Nobody knows for sure, but here’s how I look at the Bitcoin situation today.

Bitcoin’s volatile roller coaster

Bitcoin has a long history of extreme volatility. The oldest cryptocurrency swung from $785 per coin at the start of 2017 to $19,345 in mid-December. About one year after that, it ended 2018 at $3,880 per coin. The S&P 500 gained a modest 12% over that period, which looks like a horizontal line by comparison:

Bitcoin Price data by YCharts

The recent price swings are actually quite modest from a historical perspective. The cryptocurrency’s daily standard deviance is about 2.7% in 2025. This volatility measure was twice that size in 2017 and just astronomical in 2009 and 2010:

Data source: Coin Codex. Chart by the author.

Past performance is no guarantee of future results, but this volatility chart shows a couple of helpful trends.

- Bitcoin’s volatility tends to rise and fall in the same four-year cycle as the underlying halving process. Things calm down during each crypto winter, followed by a sharp spike in the year after each halving event. As a reminder, the fourth halving took place in April 2024. Bitcoin may be due for a much more volatile price chart in 2025.

- The current year-to-date volatility is comparable to last year’s, which was one of the least fickle years in Bitcoin’s history. The price swings over the past week or so should boost the volatility rating, especially if the wilder changes continue.

- This chart lumps price jumps together with price drops as a single value. But there is a certain mountain-like shape to Bitcoin’s cyclical tendencies, with game-changing jumps typically followed by a long, slow drop back to a somewhat higher plateau than the previous cycle’s.

- The introduction of spot Bitcoin exchange-traded funds (ETFs) appears to have disrupted the standard pattern a bit, pre-loading Bitcoin’s chart with a short-lived price increase in the spring of 2024. The 2024 election results also gave most crypto names an unusual price boost. Other than these events in the run-up to 2025, the leading cryptocurrency still looks ready for the usual price gains in the second year of each halving turn.

Not just fancy chart art

You didn’t come here for the math, and I can’t blame you for distrusting Bitcoin’s charting patterns. Technical analysis is more performance art than financial science, and the chart-based musings above are kinda-sorta an example of that nonsense.

Then again, I’m also basing the discussion on more than the basic chart squiggles. There are reasons for Bitcoin’s four-year cyclicality, because the economic model of producing more coins keeps changing at that pace. Every turn of the wheel is unique, as the economic environment around the crypto sector keeps changing. Still, the halving events make a real difference — hard to predict with pinpoint accuracy, but still useful as a guiding rule of thumb.

My two Satoshis (digital micro-cents): Why Bitcoin’s future still looks bright

And after all of that, I’m convinced that Bitcoin will recover from the recent price cuts. It could take a few months, and there may be more pain to come, but I’ll be shocked if the tide doesn’t turn in the second half of 2025.

This digital currency was designed as a secure long-term storage facility for monetary value, also known as wealth. Strategy (MSTR 23.44%) chairman and co-founder Michael Saylor will talk your ear off on that topic while turning every possible stone to buy more Bitcoin for the company. One of my college-age kids just started her investment journey with an early Roth IRA account, and about 2% of that portfolio holds a popular Bitcoin ETF.

I’m no Saylor-style Bitcoin maximalist, but a small amount of exposure to the original crypto name seems appropriate for most investors. Getting in below $85,000 per coin is a serious discount from just three months ago, making the cryptocurrency about 25% more interesting.

-

News1 week ago

News1 week agoSupreme Court Rules Against Makers of Flavored Vapes Popular With Teens

-

News1 week ago

News1 week agoNYC Mayor Eric Adams' corruption case is dismissed

-

Technology1 week ago

Technology1 week agoHere’s how you can preorder the Nintendo Switch 2 (or try to)

-

News1 week ago

News1 week agoTrump to Pick Ohio Solicitor General, T. Elliot Gaiser, for Justice Dept. Legal Post

-

Politics1 week ago

Politics1 week agoFBI flooded with record number of new agent applications in Kash Patel's first month leading bureau

-

World1 week ago

World1 week ago‘A historic moment’: Donald Trump unveils sweeping ‘reciprocal’ tariffs

-

Sports1 week ago

Sports1 week agoDeion Sanders defied doubters and returns to Colorado with a $10M per year deal. What’s next?

-

World1 week ago

World1 week agoCommission denies singling out NGOs in green funding row