Crypto

1 Top Cryptocurrency to Buy Before It Soars 1,600%, According to Chamath Palihapitiya | The Motley Fool

The billionaire venture capitalist is still bullish on Bitcoin.

Chamath Palihapitiya, the billionaire co-founder of the venture capital firm Social Capital, believes Bitcoin‘s (BTC -0.49%) price will hit $500,000 by late 2025. That’s a lofty price target, but it isn’t too surprising considering that Palihapitiya previously predicted Bitcoin’s price could eventually hit $1 million in the future.

Bitcoin trades at about $58,000, so it would need to rally about 760% to hit $500,000 and more than 1,600% to reach $1 million. At $1 million, Bitcoin’s market cap would exceed $21 trillion, eclipsing physical gold’s current market cap of $17 trillion. It would also make Bitcoin more valuable than all of the Magnificent Seven companies combined.

Image source: Getty Images.

Does that bullish prediction make any sense? Let’s review Palihapitiya’s thesis and the other catalysts to see if Bitcoin can become the world’s most valuable asset.

How much Bitcoin does Chamath Palihapitiya own?

In 2011, Palihapitiya said he previously bought 100,000 Bitcoins at an average price of less than $100. In 2013, he said he still held $5 million in Bitcoin and would be willing to invest another $10 milion to $15 million in the cryptocurrency.

But in a 2021 interview, Palihapitiya said he had spent 2,739 of those Bitcoins ($1.6 million at the time) on an empty plot of land near Lake Tahoe in 2014. That was a pretty bad deal, since those coins would be worth a whopping $159 milion today.

In a conference call in 2020, Palihapitiya said Social Capital had bought Bitcoin throughout 2013, while it was still trading between $13 and $1,200. However, he has never disclosed exactly how much Bitcoin he or his firm actually own.

Palihapitiya’s case for Bitcoin

Palihapitiya has stayed bullish on Bitcoin over the past few years. In early 2021, he declared that its price would reach $200,000 over the next five to 10 years. Later that year, he claimed Bitcoinhad “effectively replaced gold.”

Earlier this year, Palihapitiya raised his near-term outlook to $500,000 by 2025 and reiterated his belief that it could eventually reach $1 million per coin. He believes two main catalysts will drive that rally: Bitcoin’s halving this April, which reduced the rewards for mining by half, and the increased adoption of Bitcoin as a reserve asset.

Bitcoin’s halving occurs every four years, and it’s already happened four times. Palihapitiya points out that after each halving, Bitcoin’s price rallies to new highs as its supply tightens up and it attracts more attention from institutional investors.

He says that if Bitcoin merely replicates its gains from after its third halving in 2020, it could reach $500,000 and $1 million. The approvals of the first 11 spot price Bitcoin exchange-traded funds (ETFs) this January could support that growth by making it even easier for retail and institutional investors to invest in Bitcoin. Meanwhile, the strength of the U.S. dollar, the devaluation of other currencies, and rampant inflation could drive more countries to adopt Bitcoin as a reserve asset. That’s how Bitcoin’s market cap might eventually match or surpass gold’s valuation.

Other catalysts on the horizon

Another major catalyst for Bitcoin and the broader cryptocurrency market would be lower interest rates. Higher rates drove many investors away from cryptocurrencies and other speculative investments over the past two years, but interest rate cuts would likely draw them back to “blue chip” cryptocurrencies like Bitcoin.

Bitcoin, which the Securities and Exchange Commission (SEC) now defines as a commodity, should also face fewer regulatory headwinds. Former President Donald Trump wants the U.S. to create a “strategic Bitcoin stockpile” and become the “Bitcoin superpower of the world” if he wins the presidential election this November. Vice President Kamala Harris also recently hired three pro-crypto advisors to her campaign, which hints at a departure from President Biden’s rigid crypto policies.

Should you follow Chamath Palihapitiya’s lead?

Chamath Palihapitiya’s outlook for Bitcoin is actually conservative compared to other bullish investors. Ark Invest’s Cathie Wood claims its price will reach $3.8 million by 2030, while MicroStrategy‘s (MSTR 0.84%) executive chairman Michael Saylor expects the cryptocurrency’s price to balloon to $13 million by 2045.

We should take Palihapitiya’s estimates with a grain of salt, since he would certainly profit from a big spike in Bitcoin prices. That said, I personally believe Bitcoin’s price will stabilize and gradually rise as the recent halving, spot price ETFs, and expectations for lower rates limit its downside potential. I’m not sure if it will soar to $500,000 or $1 million, but I have some exposure to Bitcoin through ETFs and wouldn’t be too surprised if its price doubled or tripled in the near future.

Crypto

Law enforcement warns about the dangers of crypto scammers

KANSAS CITY, Mo. (KCTV) – An increasing number of people in the metro have been cheated out of their money through cryptocurrency scams. Scammers can get you even if you don’t use it.

Cryptocurrency scams have stolen billions worldwide and can snatch up your savings, too. Now, law enforcement has stepped up their game to help you stop it.

With a Bitcoin ATM at his gas station, Alfredo Antolin has seen many times firsthand, how people come to make transactions after they have received a phone call but don’t realize they have been scammed.

“I try to tell all the employees in there if they’re older and they’re on the phone, please check in with them,” Antolin said. “And make sure that they’re doing it on their own. That they know what they’re doing and they have their own account and they’re not pushing it to someone else’s.”

In 2023, the Federal Reserve Estimated 18 million adults in America used cryptocurrency, a 3% drop compared to the year before. Now in Clay County, Prosecutor Zach Thompson has seen a rise in scam cases.

“Scammers will direct investors to an online investing platform with the promise of a giant return when in fact they’re actually just stealing that person’s money,” Thompson explained. “The second type of scam, someone will call up their victim and pressure them to pay their bill with cryptocurrency.”

Lately, law enforcement has also seen thieves and drug dealers use digital assets to hide their dark money from the law. Now, investigators have gotten new training to track it down.

“It’s going to go over the basics of cryptocurrency so investigators can recognize potential evidence when they’re out in the field,” Thompson said.

Brian Karman led the course. And wants the public to know they can help you. So, never be afraid to report it.

“We have to take that report, we have to get that into the hands of the detective,” Karman said. “So, we can track those stolen funds and recoup those losses.”

Investigators notice more young people fall for scams like this than the elderly. If you do get involved, they advise you to use U.S.-based crypto companies which have more oversight.

Copyright 2024 KCTV. All rights reserved.

Crypto

Styx Stealer Malware Targets Cryptocurrency Users

Check Point Research has recently uncovered a new type of malware called ‘Styx Stealer’, which poses a serious threat to cryptocurrency users.

This malware, which surfaced in April, is reported to be more advanced than the older ‘Phemedrone Stealer’. It comes with enhanced features that make it particularly dangerous for those involved in digital currencies.

According to the research, Styx Stealer works by intercepting cryptocurrency transactions. When a user tries to send cryptocurrency, the malware replaces the recipient’s wallet address with the hacker’s address. As a result, the money ends up in the wrong hands. This makes it a serious risk for anyone involved in digital currencies.

The malware was initially available for rent on a website called styxcrypter.com. Users could pay $75 a month or $350 for a lifetime license. Payments could be made using various cryptocurrencies like Bitcoin and Litecoin. However, as of August 16, the website no longer lists Styx Stealer, which suggests the developer might be moving on to other projects.

Styx Stealer was discovered because the developer accidentally leaked some data during testing. This leak helped cybersecurity experts understand how the malware works. It’s estimated that in the first two months, the malware developer earned about $9,500 in cryptocurrency from their customers.

Fortunately for Windows users, those with up-to-date operating systems are protected from Styx Stealer. This is due to a patch issued last year that fixed a vulnerability in Microsoft Windows Defender, which Styx Stealer relies on to execute its attacks.

Also Read: There is a New QR Code Scam Targeting Crypto Users: Bitrace Report

Crypto

Hedge Funds and Brokerages Dominate Bitcoin Assets, Coinshares 13F Filing Analysis Shows – Finance Bitcoin News

-

Ohio3 days ago

Ohio3 days agoOhio taxpayers sent families $966 million for private school tuition: Capitol Letter

-

Politics1 week ago

Politics1 week agoKamala Harris shuts down anti-Israel protesters during campaign speech in Michigan: 'I'm speaking'

-

Finance1 week ago

Why stocks tumbled today

-

Politics1 week ago

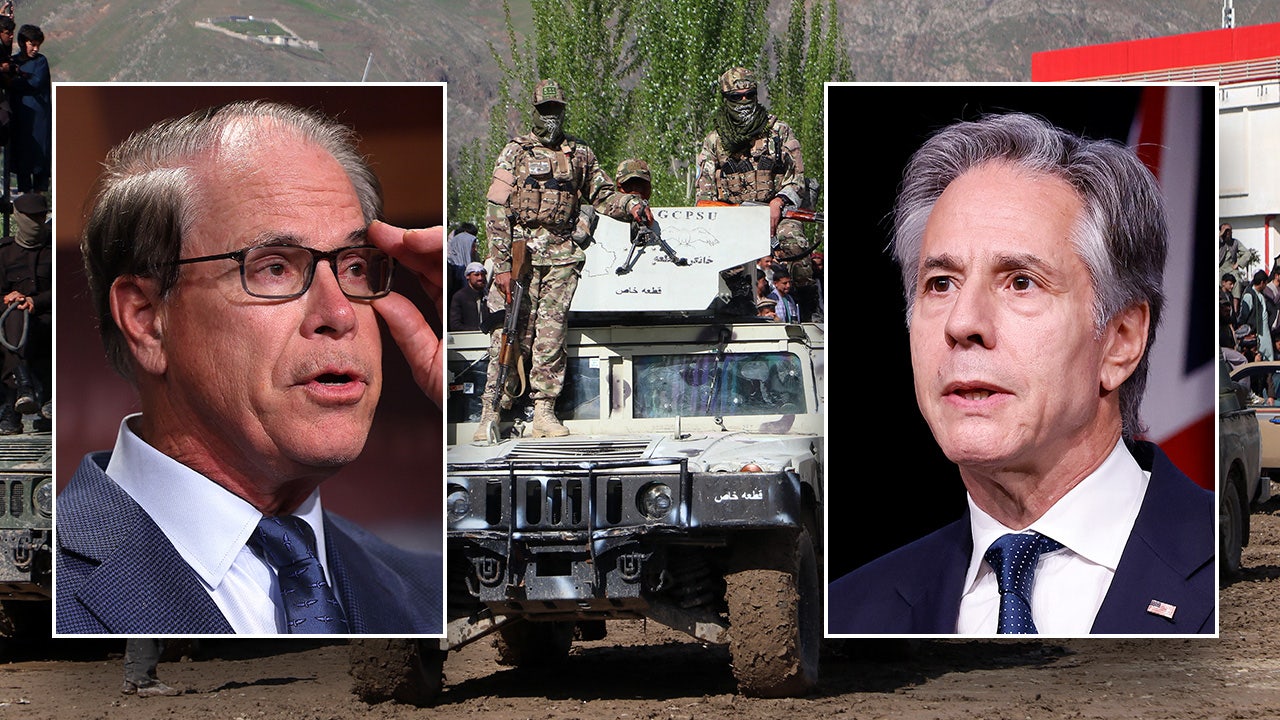

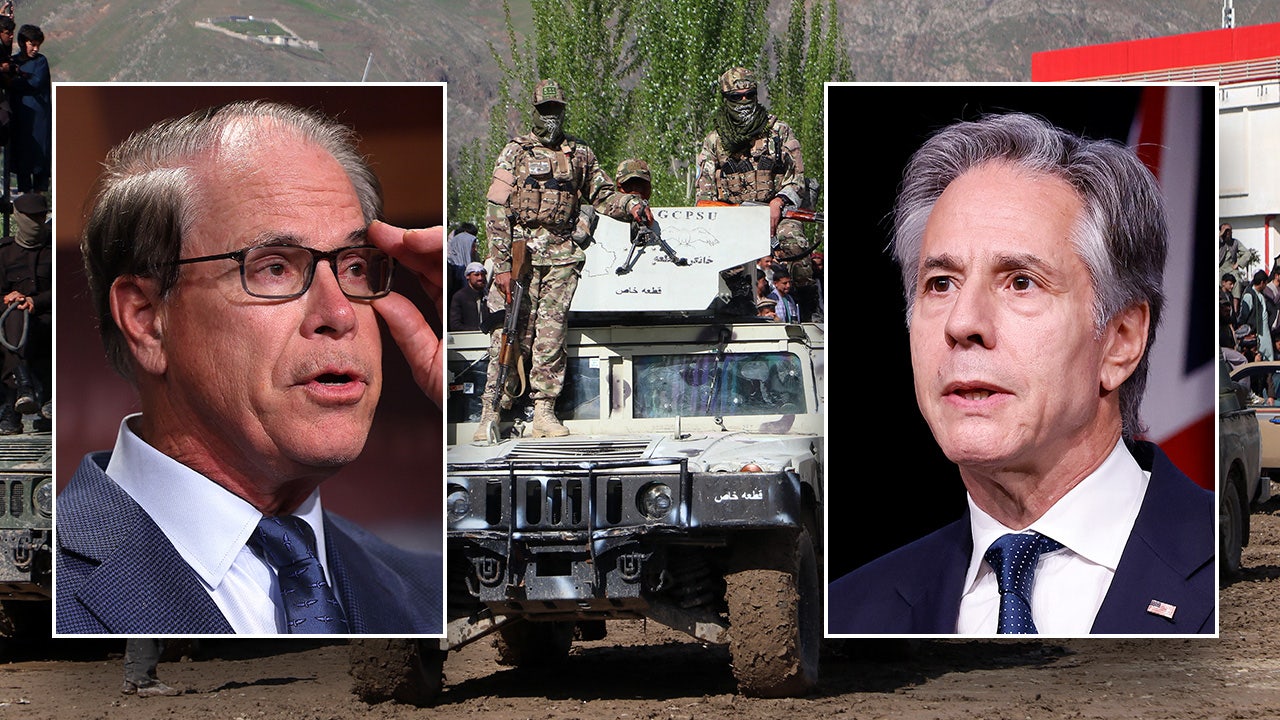

Politics1 week agoBlinken pressured to freeze Afghanistan aid after revelation nearly $300M could have gone to Taliban

-

World5 days ago

World5 days agoWhat could an EU Commissioner do to tackle the housing crisis?

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘It Ends With Us’: What the Critics Are Saying

-

Politics1 week ago

Politics1 week agoTim Walz 'misspoke' about using weapons ‘in war,' Harris campaign says: report

-

Politics1 week ago

Politics1 week agoProgressive women's groups silent on second gentleman Doug Emhoff's affair