Business

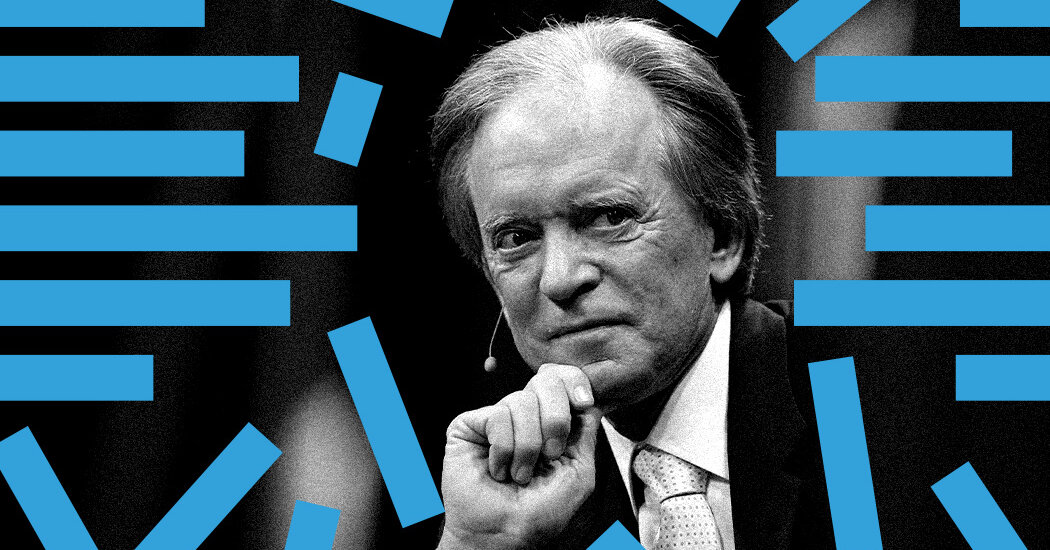

‘The Bond King’ Traces the Arc of a Pioneering Investor

The DealBook e-newsletter delves right into a single matter or theme each weekend, offering reporting and evaluation that provides a greater understanding of an essential concern in enterprise. In the event you don’t already obtain the every day e-newsletter, join right here.

For many years, one of many monetary world’s best-known buyers and market commentators could possibly be discovered not on Wall Avenue however in sun-drenched Newport Seaside, Calif. Invoice Gross, who helped discovered and lead the funding agency PIMCO, earned the nickname “The Bond King” for serving to to revolutionize the once-sleepy world of bond investing — and incomes a fortune alongside the best way.

However behind the aw-shucks, folksy demeanor that Mr. Gross, an Ohio native, offered in public was a hard-nosed dealer who fought to squeeze each greenback out of his trades and dominated Pimco with awe and worry. Mr. Gross incessantly clashed together with his personal colleagues, notably Mohamed El-Erian, the urbane economist he helped rent to be PIMCO’s C.E.O. and co-chief of funding. Mr. El-Erian give up in 2014, and Gross was pushed out months afterward, resurfacing at a smaller rival, Janus.

Mr. Gross retired in 2019, unable to repeat the success he discovered at PIMCO. However he remained within the headlines, due to a dispute with a neighbor over his $1 million Dale Chihuly glass sculpture. Through the feud, Mr. Gross blared the theme to “Gilligan’s Island” on repeat, which finally earned him a suspended sentence for harassment final 12 months.

All of that is vividly chronicled in “The Bond King: How One Man Made a Market, Constructed an Empire, and Misplaced It All,” by the NPR “Planet Cash” host Mary Childs, a e-book seven years within the making and out subsequent week. Ms. Childs spent hours speaking with Gross — who self-published a memoir final week (“I’m Nonetheless Standing: Bond King Invoice Gross and the PIMCO Categorical”) — and quite a few present and former PIMCO colleagues. (Mr. El-Erian participated solely by way of prolonged notes from his lawyer.)

DealBook spoke with Ms. Childs about tracing the arc of the pioneering investor, whose profession helped form an important a part of finance however whose character alienated colleagues and neighbors alike. The dialog has been edited and condensed for readability.

What have been the challenges of writing about Gross?

There have been quite a lot of totally different understandings of Invoice. There was undoubtedly some hero worship. There have been undoubtedly some individuals who seen him as this legend, a deity nearly.

The true problem was, I assumed after I began this e-book that it will finish neatly in 2014 together with his departure from PIMCO and arriving at Janus. However he simply stored doing stuff. And he stored making headlines and making extra information. So I needed to rewrite the ending many instances and simply hold being like, “Oh, OK, a brand new one.”

What’s your response to him placing out his personal e-book?

[Laughter.] My fact-checker checked info with him. So he had some concept of what was within the e-book. And I think that it didn’t completely stack up in a manner that happy him.

If you first began overlaying Gross and PIMCO, what have been your impressions of them?

I knew how influential they have been. I knew that the best way that my sources talked about PIMCO was indicative that this can be a power to be reckoned with.

One factor I discovered fascinating was simply how hard-nosed PIMCO and Gross have been, how they fought so laborious to get a bit extra cash from a commerce and didn’t care if the folks on the opposite aspect hated them for it.

A lot of Wall Avenue and finance is based on relationships. However PIMCO was like, “No, we don’t owe you something — you owe us.”

There’s a story from the ’80s the place a really younger bond salesman, who’s a really massive identify in funding administration now, went right down to have lunch with Invoice. The salesperson was like, “Hey, I’d love your online business.” And Invoice mentioned: “Oh, you want my enterprise. You’re going to lose cash on each commerce with me. And that’s going to be good for you, since you want the knowledge of what I’m doing.”

How a lot of an outlier would you say PIMCO was by way of having that kind of angle?

So far as I perceive it, fairly far on the market.

Had been Invoice and PIMCO extra intelligent than the competitors and counterparties?

Folks all the time inform me: “Nicely, he was the beneficiary of a coin flip. Any individual was going to be one of the best performer. He had the wind at his again for 40 years. In fact he did nicely.” I’m like, that’s simply not it. That’s simply not the total story.

How would you in the end sum him up? What sort of individual did you suppose he’s?

I believe he makes essentially the most sense if you happen to view his actions by means of recreation concept. If you consider him as a gambler, he’s all the time contemplating the percentages; he’s determining how a lot he ought to guess at any given second. And he’s a extremely reflective individual: He was a psych main in faculty, and he thinks so much about himself and his actions and his place on this planet. And that makes him doubly attention-grabbing as a result of I believe he is aware of when he ought to cease himself after which he generally simply doesn’t do it.

Among the most gripping materials have been the interactions between Gross and El-Erian. May that partnership ever have labored?

Mohamed and Invoice simply have such totally different personalities. And each of them, I believe, would say this. Mohamed would possibly say Invoice may be autocratic and form of domineering, and he needs to do what he needs to do and he would possibly make a multitude and that must be cleaned up later. On the flip aspect, Invoice would say about Mohamed, “You’ve simply debated for hours and mentioned nothing.”

One factor I used to be additionally struck by have been the entire cases when Invoice modified his thoughts or appeared to alter his thoughts or ignored issues, and was laborious to work with by being so mercurial. Why do you suppose he acted like this?

Lots of these founder-led corporations rely so closely on the founder, and she or he can form of act nevertheless they need. On this occasion, PIMCO was speculated to be this massive, skilled firm. By the top, Invoice was nonetheless allowed quite a lot of latitude. Founders may be actually tough across the edges. However after a sure level, you must be a giant skilled firm and get polished.

You see it at Bridgewater Associates and different locations the place they’re having a tough time of succession planning. Lots of what makes a founder or entrepreneur profitable is a micromanage-y, perfectionist bent. And that makes studying to take a seat down and step away out of your creation actually laborious.

What kind of stature would you say PIMCO has now? And the way do you suppose Gross is regarded immediately, now that he’s been out of the sport for a few years?

Gross mentioned in one of many court docket hearings within the neighbor dispute that he’s making an attempt to have a popularity to die with. And that simply form of breaks your coronary heart. He was this massive legend. However folks actually latched on to that neighbor story.

PIMCO has been working very laborious to place themselves as a giant, grown-up agency. A standard place. However each time Invoice’s within the headlines, they’re like, “Oh, my God, it’s this once more.”

Why do you suppose Invoice wasn’t in a position to get anyplace near duplicating PIMCO’s success at Janus?

He was beginning contemporary in a market that already was bumping alongside, not within the route that advantages bonds. However I believe the true reply is that he was making an attempt too laborious. He let emotion get the higher of him, and he wished to show to them that he was nonetheless nice.

What have been you considering when the entire neighbor state of affairs was enjoying out? How do his actions replicate on the person you’ve written about and spoken to folks about for years?

I believe the bones of it should not totally stunning. He’s very accustomed to strolling proper as much as the sting of the authorized restrict of one thing proper and sitting down there and being like, “I’m right here, when you’ve got an issue let me know.” He was enjoying the music proper on the authorized restrict. It’s not unlawful to play the “Gilligan’s Island” theme track.

Some sources referred to as it the bond “King Lear.”

PIMCO was a giant winner of measures taken to guard the financial system within the aftermath of the monetary disaster. We’re at one other inflection level out there. Why is now a superb time for folks to choose up a e-book about Invoice Gross?

Within the aftermath of the monetary disaster, we made quite a lot of agreements in an emergency, and I believe quite a lot of these weren’t tremendous examined. Or perhaps we couldn’t provide you with a greater various in the mean time. And I do suppose it’s value analyzing these buildings and the way we received there, and that permits us to suppose extra strategically about what to do subsequent.

You’re seeing a seismic change within the financial system and within the Fed’s relationship to markets. Rates of interest have had this extremely lengthy march decrease, and that has clearly benefited the careers of individuals like Invoice Gross. As we reimagine how our markets work, it’s value occupied with what we like right here and what we don’t.

What do you suppose? Tell us: dealbook@nytimes.com.

Business

How a Businessman Fleeing Fraud Charges Built a Life Offshore

Around midday on Feb. 2, a large wave began its slow rumble toward the Aisland 1, an 800-ton deck barge floating in the waters between Dubai and Iran. On board the vessel were its residents of more than a year: a 58-year-old Italian businessman named Samuele Landi, three sailors, a cook and five cats.

Landi — the ship’s captain — was a gifted computer programmer who in a previous life had been the chief executive of Eutelia, a telecommunications company. He fancied himself an Italian Steve Jobs, though John McAfee, the cybersecurity entrepreneur turned tax fugitive, might have been a more fitting comparison. An avid skydiver and motorcycle racer, Landi liked to live on the edge: of the world, of the law and of life itself. He had made a career of exotic offshore financial schemes; now, adrift, he had become one with them.

“I will die at sea for sure,” he told Oswald Horowitz, a filmmaker who had visited him the previous December. “I’m not going back.”

The barge was Landi’s biggest adventure yet. A rusting rectangular hulk with the footprint of a large commercial aircraft, the Aisland had a deck fitted with six blue shipping containers bolted in place. These were the living quarters, equipped with solar-powered air-conditioners and a desalination system. The barge was otherwise littered with equipment: ropes, crates, fans, tanks of oil and water, a freezer containing pounds of red meat, and a sack of reinforced concrete mix for repairs. A Liberian flag flapped in the breeze.

The story of how Landi ended up living on a leaky barge some 30 miles off the shore of Dubai is a tale of self-preservation. For over a decade, Landi had been a man on the lam. He wasn’t a violent criminal; nor was he a particularly wanted individual, in the grand scheme of things. But since Eutelia was declared bankrupt in 2010 and some of its executives, including Landi, were very publicly tried and convicted of bankruptcy fraud, Landi has been a fugitive from Italian justice — and on land, his options had all but run out.

What distinguished Landi from a run-of-the-mill fraudster, though, was the outlandishness of his maneuvers, which exploited every loophole the globe had to offer. Landi was a libertarian who sought freedom from meddling governments and their cumbersome regulations, but in a select few nations, he found willing accomplices. Landi hid money in Switzerland, skated around extradition treaties while living comfortably in Dubai, registered companies in bespoke tax-free zones, procured diplomatic credentials from Liberia, dabbled in crypto and, finally, took to the sea, where there was no one to tell him what to do.

Landi was able to pull this off thanks to his knowledge of the offshore world, and his story makes him a perfect guide to this vast archipelago of third spaces. It also “embodies all the ways laws can be evaded through these jurisdictions, whether it’s tax laws, extradition laws, regulatory laws or taking advantage of regulatory quirks,” said Vanessa Ogle, a Yale professor working on a book about the history of the offshore world. “Once you develop a mind for it, a whole range of opportunities arises.”

While he lived on the barge, Landi was dreaming up an ambitious plan to establish a floating, modular and completely sovereign city-state in international waters near the nation of Mauritius. This much-discussed concept is known as “seasteading” — like homesteading, just wetter — and its adherents are a mix of survivalists, libertarians and wannabe pirates.

Landi’s barge was a heap, but he was able to keep it afloat in the relatively calm waters of the Persian Gulf by pumping out water and having his crew patch holes when it sprang a leak.

On that day in February, though, their repairs did not hold, and the offshore existence that Landi had built for himself was suddenly imperiled: not by the laws of nations, for once, but by the laws of nature.

Tax Shelters and a Timely Escape

As far as anyone can prove, Samuele Landi lived as a law-abiding private citizen in Arezzo, Italy, until his 30s, when he started working in the telecommunications industry. Landi’s first company, Plug It International, bought easy-to-remember phone numbers from the Italian government, then leased them out at a premium to dial-in fortune tellers, astrologers, weather reports and, of course, phone sex operators. Plug It was fined for misleading consumers about its fees.

In 2003, Plug It merged with another company to become Eutelia, a phone and internet provider. Eutelia was largely a family affair — there were Landis serving as managers and executives, Landis controlling shares and Landis expanding the business abroad. Samuele Landi, who served as Eutelia’s chief executive alongside two of his brothers, led the company as its shares began trading on the Milan Stock Exchange in 2004.

In 2006, the Italian financial police began auditing Eutelia’s books for possible fraud. The authorities discovered plenty — tens of millions of euros were improperly accounted for — and, in the process, found themselves immersed in the ways of the offshore financial world.

Starting as early as 2002, according to sentencing documents from Arezzo’s criminal court, Samuele Landi and five of his relatives had used a series of falsified or inaccurate invoices to siphon money from the business and into tax shelters around the world: a shell company on the Polynesian island of Niue; a UBS account in Monaco; a Romanian L.L.C. in Bucharest fully owned by a Swiss firm. The corporate vehicles they used had few or no employees, produced no tangible work and, according to prosecutors, existed primarily for the purpose of draining Eutelia’s coffers.

Circuitous international grifts aren’t uncommon — consider the revelations in the Panama Papers, the Paradise Papers and other data leaks that detailed how wealthy companies and individuals hide money through complex offshore entities. But Eutelia was a middling business in an ordinary Tuscan town, not a high-flying family office or a lawyered-up conglomerate with branches around the world.

Samuele Landi contested Eutelia’s insolvency. He was also antagonizing employees. In November 2009, while investigations into Eutelia were underway, employees of a Eutelia division that had been spun off occupied their offices in Rome. They camped out in their cubicles for two weeks, complaining that they hadn’t been paid in months. The workers blamed Landi — who was still in charge — for their troubles, and an image of Landi posing, pirate-style, with a cartoon-villain expression and a cutlass between his teeth became a symbol for Eutelia’s misdeeds.

Landi hit back in a manner more befitting a mob boss than a telecom executive. With 15 private guards by his side, he marched into the offices at 5 a.m. one November day, aiming to disrupt the sit-in. Wielding crowbars, the men dragged the workers out of the offices and into the lobby. A television reporter covering the occupation then called the police, who took Landi and his men away.

By the time Eutelia’s court date came around, Landi had high-tailed it for Dubai. At the time, the city-state levied no taxes on foreign citizens, had no extradition agreement with Italy and was developing a reputation as a place where criminals — and their money — could find safe haven.

These accommodations allowed Landi to establish himself quietly in the United Arab Emirates, and to move his wife and their children there.

In the city full of expatriates, Landi blended in. Professionally, he picked up where he had left off. In 2010, he registered Kryptotel, an encrypted mobile-phone software company, in Internet City, one of Dubai’s many free economic zones — gated enclaves where foreign companies enjoy special perks.

At Kryptotel, Landi hired Italians — among them, an old skydiving pal, according to LinkedIn. Commenting on a Facebook thread about his exploits, Landi wrote that he had sought out clients who could pay him in cryptocurrencies and would convert the digital currencies into dollars or dirhams when he needed cash.

Landi clearly had access to funds, though how much of the Eutelia loot ended up in his pockets and for how long was not clear. In the sentencing document, Italian prosecutors noted that Landi previously had access to accounts at the Banca della Svizzera Italiana in Lugano and Julius Baer, a Swiss private bank that reached a half-billion-dollar settlement in 2016 with the United States for helping rich Americans avoid tax. Additionally, Landi had power of attorney over a bank vault and other accounts.

Whatever his net worth, it was enough for a $10,000-a-month villa, a driver and car, private school for his children and trips abroad for his family.

From his villa in Dubai’s Palm Jumeirah, an archipelago of man-made islands, Landi followed the news as lawsuits against him, his family members and other Eutelia executives made their way through the Italian courts. In 2015, Arezzo’s criminal court sentenced Landi’s uncle, cousin and brother to between two and four and a half years in prison for fraudulent bankruptcy and misappropriation of funds. Their appeals failed, and the uncle died in 2016. Two other brothers took plea bargains. The surviving Landis served their time mostly under house arrest because they had no prior convictions, according to a prosecutor.

Samuele Landi’s exit, which made headlines back home, had caused tension within the family, said Paolo Casalini, a friend of Landi’s and a former editor of a local news site, Informarezzo.com, which Landi bought and took over in July 2022. “His brothers didn’t even talk to him anymore,” said Casalini, who was in regular touch with Landi over the years.

(Landi’s wife and sons did not respond to requests for comment; neither did the family members named in the lawsuits. His eldest daughter sent a brief statement saying her father was “a really kind person.”)

Samuele Landi was sentenced to a total of 14 years in prison in absentia for his role in Eutelia’s insolvency, but in Dubai, he was untouchable. There were hometown rumors that he had been arrested in 2017, but Casalini said Landi shrugged them off by sending a photo of himself on the beach, reading the newspaper: “Landi felt safe in Dubai,” Casalini said.

I asked if Landi seemed to miss Arezzo.

“He would say no,” Casalini said. “He said, ‘I’d only come back here for my mother.’”

The Perks of Diplomatic Immunity

On March 22, 2022, Liberia’s president, George Weah, landed in Dubai for a diplomatic visit. At the terminal, a delegation of Liberian officials was there to greet him. Standing a good half-foot taller than his peers was a man with a shiny, white, bald head: Samuele Landi.

Landi was there in his capacity as Liberia’s honorary consul general to Dubai. He had found yet another loophole. This appointment by Liberia — a country he was never a resident of and to which he had no connection by blood or marriage — had effectively granted him immunity from prosecution in Dubai by making him a diplomatic envoy.

He had made his first inroads in Liberia during his Eutelia days, when the firm bought a 60 percent stake worth $21 million in a Monrovia company called Netcom Liberia. For an offshore man of mystery and ill repute, a diplomatic post is a protective cloak that brings with it varying degrees of immunity, not to mention an alternative passport to travel and transact with; a new identity untethered from the past; and a noble (honorable, even) foil.

In the offshore world, this is a “time-honored strategy” going back to the 1920s, Vanessa Ogle, the historian, said. “Honorary consuls can move assets across borders,” she said. “They can have cars with diplomatic plates, the immunity and privilege of not being searched and a diplomatic pouch” to conceal documents. In 2022, the International Consortium of Investigative Journalists found 500 current and former honorary consuls had been accused of crimes or embroiled in controversy.

Many honorary consul gigs are just for show. Not Landi’s. According to three people who spent time with Landi in Dubai, he threw himself into the job, soliciting funds from wealthy Arab donors to build a hospital near Monrovia and hosting a Liberian Independence Day party at his home. He even used his consular powers to help repatriate over dozens of Liberian domestic workers who had been trafficked into Oman. (Alieu Massaquoi, Liberia’s ambassador to the United Arab Emirates, said in a WhatsApp message that he had not met Landi in person and that his office had no record of him. Massaquoi was appointed to his post in 2023, after Landi had moved offshore.)

Landi also used his time in Dubai to consult for a start-up run by an Emirati sheikh. The company, Blue Carbon, made plans to buy up large areas of Liberian forest to offset carbon emissions.

In May 2022, after a Liberian businessman in the United States was apprehended with a fake diplomatic credential, Liberia declared it would recall all of its diplomatic passports. That summer, the Emirates extradited an Italian drug trafficker and mobster who had been living in Dubai for years.

At this point, Landi mapped out his next move: one that took him offshore not just in a metaphorical sense, but in a physical one, too.

The Final Frontier

Landi surprised almost everybody when he moved onto the Aisland 1 on Dec. 22, 2022, with a stray cat and four kittens he had found in a box. His colleagues and friends knew nothing of his plans.

“He wanted to keep his barge a surprise,” said Casalini, who learned of Landi’s move after he posted about it online. “I’m a calm person, but my response was, ‘Are you mad?’”

It was a reasonable question. Landi had begun cryptically speaking, in interviews, about wanting to “escape the Matrix” — a metaphor from the 1999 movie for letting go of constructed social norms and false beliefs.

“He believed we live in a world where we are always being surveilled and manipulated — by 5G, by the Covid vaccines,” said Clément Bonnerot, a journalist with Le Monde who had interviewed Landi while he was at sea. “He identified as a hunted, persecuted man, for whom the most important thing was to be free.”

In December 2023, he told Tony Olsen, a libertarian podcaster: “If you are libertarian like we are, you want your freedom. And your freedom is finished when the freedom of others starts. This is the key point.”

Landi was adept at living at sea. He grew vegetables and made plans to bring aboard chickens and cattle. He wrote a blog, extolling the barge’s lack of mosquitoes and the stunning sunsets and posted lighthearted articles about his adventures. (These have all since been taken down.) He relied on his crew, on semiregular deliveries of food and supplies from Dubai and on his Starlink satellite connection, which allowed him to keep Kryptotel, his cellphone company, in business.

Still, Landi had no illusions about the longevity of his setup. “For the moment,” he told Olsen, the podcaster, from one of his blue containers, Dubai “is tolerating us, but we cannot stay.”

The used barge, which he said he had bought for $200,000, was falling apart, too, to the point that Landi and his men had to teach themselves aquatic welding. “From inside, there are certain dangers because you are exposed to gas,” he told Olsen. “But if you weld from outside, it’s more difficult because you’re in a scuba diving suit fighting the current and waves.”

On land, in the world of nation-states, Landi had reached the end of the line. And that little voice that had led him far from home, under fictitious flags, to inhabit man-made isles and extraterritorial havens, was now telling him to construct a nation of his own.

He would buy a new barge, twice as large, that he would anchor in the Saya de Malha Bank, midway between Seychelles and Mauritius. He would invite friends, family and like-minded libertarians to join him.

Landi even had an architect draw up plans. “On the top deck, he needed a spot where a Gatling gun was going to be mounted,” said Peter de Vries, a designer. “That’s one of these guns that fires 1,000 rounds a minute — very heavy-duty stuff,” he continued. “I actually got the specs for the gun.”

I asked de Vries: Was Landi scared of pirates, the state, his personal enemies?

“Probably all of the above,” de Vries replied. “The world.”

Nevertheless, Landi seemed as cheerful as ever. In footage that Oswald Horowitz, the filmmaker, took late in late 2023, Landi cuts the figure of a self-actualized man. His skin is not so much sunburned as glowing, his laugh is mirthful, and his demeanor determined and a little droll, as though he saw the humor in his predicament.

His endeavor might sound like lunacy to most people — a country, on a barge, in international waters, with guns? — but for a veteran of offshore affairs like Landi, it adhered to a certain logic.

The universe in which Landi had sought shelter is not so exceptional, after all. In fact, it is all around us, hiding in plain sight. We might buy a bottle of Scotch in a duty-free shop, or vacation on a cruise ship with Panama’s or Liberia’s lightly regulated flag of convenience. We might gamble in a casino or admire a da Vinci that has spent decades in an extraterritorial warehouse. Our clothes, our electronics, the computers we use for our desk jobs are likely to have been manufactured in special economic zones by global companies that behave more or less like Samuele Landi: hopping from jurisdiction to jurisdiction in order to make money and shield themselves as best they can from fiscal, regulatory, legal or environmental responsibilities.

Landi turned this ethos into a lifestyle. On the run, he made a life in the spaces above, beneath and between nations

Landi sent his last message to Horowitz on New Year’s Eve. It read: “Move or die.”

A month later, Landi’s barge was around 30 miles from the Dubai coast when the rogue wave hit, breaching the hull and apparently breaking the barge in two. Two members of Landi’s crew survived by clinging onto pieces of wood until a passing vessel rescued them the next day. Landi and the two remaining seafarers were not so lucky.

According to Italian news reports, Landi put out a call for help, but it didn’t come in time.

His body was found several days later, when it washed up on the beach about 40 miles up the coastline from Dubai. A relative flew out to identify the body.

In the seasteading community, Landi is remembered as a heroic figure. “Samuele Landi was the first seasteader to live in international waters for more than a year,” Joe Quirk, the president of the Seasteading Institute, a California nonprofit, wrote in an email. But the organization declined to endorse or recommend his exploits. “Barges,” Quirk wrote, “are not safe.”

Back in Arezzo, not everyone is convinced that Samuele Landi is deceased; rumors swirl about the lack of DNA evidence, and even the city’s mayor can’t quite believe that Arezzo’s most notorious exile is gone.

This was a man who found his way around everything: rules, taxes, borders, the law. Surely, Samuele Landi would resurface.

Sabika Shah Povia contributed reporting.

Business

Column: The richest Americans finished paying their Social Security taxes last week. Most of us will pay all year

Here are some rough calculations of when some of America’s richest individuals fulfilled their Social Security tax obligations for 2025: For Apple Chief Executive Tim Cook, it was at about 2 p.m. on New Year’s Day. For McDonald’s CEO Christopher Kempczinski, sometime on the morning of Jan. 3. For Elon Musk, it was sometime around 12:31 a.m. New Year’s Day.

For most of the rest of us, it won’t happen until next New Year’s Eve.

The real figures on the payroll tax liabilities of the America’s plutocrat class are necessarily murky, for reasons we’ll get to in a moment. But they tell a dismal story nonetheless, as set forth annually by labor economist Teresa Ghilarducci of the New School.

A lot of income escapes the Social Security system; and the escaping income is that from the wealthiest Americans.

— Economist Teresa Ghilarducci

The story is one of rising economic inequality in United States — and more specifically how our tax system is designed to benefit the wealthy rather than ordinary workers. Anyone needing empirical evidence of these conditions need not look beyond the way we fund Social Security, our indispensable federal retirement and disability program.

Although the program is designed to provide universal coverage, the burden of paying for it falls disproportionately on the working class. Under the program’s current structure, benefits are progressive — they come to a larger percentage of lifetime earnings for lower-income retirees — but the tax is regressive, amounting to less as a percentage of income as income rises.

At least 230 of the richest Americans already have paid their Social Security tax for the year, Ghilarducci reports. That’s because wage earnings of $176,100 or more this year — the cap on wages taxed by Social Security — are exempt, and their income is so high that they reached the ceiling within days or even minutes of the New Year’s ball dropping at Times Square.

“A civil engineer earning $176,100 per year looks the same as Elon Musk in the eyes of the Social Security system,” Ghilarducci writes. By contrast, “over 164 million workers (about 94% of us) pay Social Security taxes all year long. The point is a lot of income escapes the Social Security system; and the escaping income is that from the wealthiest Americans.”

One of the most effective Social Security reforms proposed by Democrats is to raise or (preferably) eliminate the payroll tax cap. But that change doesn’t go quite far enough. What’s necessary, as Ghilarducci correctly observes, is to bring more income categories — interest, business receipts, capital gains — into the definition of earnings.

“Taxing the expanded base could more than pay for promised Social Security benefits for 35 years and there would even be some money to eliminate poverty among all Social Security recipients,” she observes.

Here’s a brief primer on the payroll tax, which typically appears on pay stubs under the label “FICA” (for “Federal Insurance Contributions Act”). For Social Security, it comes to 12.4% of gross wage income, shared equally by worker and employer, up to an annually adjusted cap. In 2025, the cap is $176,100, up from $168,600 last year. That means that you’ll pay a maximum of $10,918 directly in Social Security tax this year, with your employer paying the same sum on your behalf. (Self-employed workers have to pay both levies.)

Workers and employers each pay an additional 1.45%, with no cap, to help fund Medicare. The richest taxpayers may also be subject to a 3.8% tax on some of their investment income.

Two aspects of the payroll tax are boons for the wealthy. One is that it applies only to wages, tips, bonuses, commissions, and some fringe benefits — generally, almost anything that appears on the annual W-2 forms workers receive from their employers. “Unearned income” such as interest, dividends and capital gains distributions isn’t counted.

That’s important because unearned income tends to represent a greater share of total income for the wealthy compared with the rank-and-file.

In tax year 2022 (the most recent for which the IRS provides statistics), W-2 income accounted on average for about 75% of the total income reported by households with adjusted gross income of $50,000-$75,000. For households with income of $1 million or more, only about 25% was subject to the payroll tax. For those with income of $10 million or more (averaging about $30.4 million each), only about 12% on average was subject to the payroll tax — and then only up to the FICA cap.

To put it another way, any workers earning wages of $176,100 or less this year will pay 6.2% of their pay in Social Security tax. For someone earning $10 million, assuming all of it comes in wages, the tax rate is 0.11%.

That brings us to the complexities involved in gauging the income of America’s richest individuals, notably top corporate executives. Mostly to reduce corporate and income taxes, companies tend to keep the cash components of their executives’ pay as meager as possible, as opposed to stock and stock options. The latter aren’t subject to the payroll tax.

Apple, for example, listed Cook’s total compensation for 2023 (the most recent year reported) as $63.2 million. But only $3 million of that was in salary, plus another $10.7 million reported as a cash incentive tied to the company’s performance. An additional $2.5 million was paid for items such as security services and personal travel on private aircraft, which Apple requires Cook to use “for security and efficiency reasons.” Cook may have to pay tax on some of those items.

It’s difficult, and in some cases impossible, to figure out how much in cash a top corporate executive actually pockets in any year. The Securities and Exchange Commission implemented a regulation in 2022 mandating that public companies disclose “compensation actually paid” to top executives, ostensibly so shareholders could accurately assess how the money paid to the C-suite corresponded to a company’s performance.

In practice, however, the resulting metrics obscure almost as much as they reveal. Apple, for example, disclosed in its 2024 proxy statement that in 2023 it “actually paid” $106.6 million to Cook — but it also stated that the figure “does not represent cash or equity value realized or paid” to Cook, or to the company’s four other top executives.

Rather, the “actually paid” disclosure is merely a way to adjust the value of stock options and other equity awards given to the executives, as the value of the underlying shares rises or falls. So if you’re trying to determine how much more the bank accounts of executives swelled during the year, this is no help.

Musk’s income from Tesla, his publicly traded electric vehicle company, is especially hard to gauge. (Ghilarducci says she based her estimate of Musk’s potential tax liability on “public data on Musk’s income,” including nonwage income.)

According to Tesla’s disclosure, Musk received no salary, bonus, stock or options from 2021 through 2023. That may have something to do with the issues connected with his groundbreaking $56-billion 2018 pay package, which was challenged in a shareholder lawsuit. The pay package was overturned in January 2024 by Delaware Chancellor Kathaleen McCormick, who found it excessive and not the product of an arm’s length negotiation between Musk and the Tesla board. (Tesla didn’t respond to my request for comment.)

That points to how the wealthy exploit their assets without incurring income tax, whether on ordinary or “unearned” income: They borrow against them. Tesla has disclosed that as of last March, Musk had pledged more than 238.4 million of his Tesla shares — about one-third of the total 715 million shares of which he was listed as beneficial owner — as “collateral to secure certain personal indebtedness.” The pledged stock is worth about $95 billion at the current stock price. The proceeds of loans aren’t generally treated as taxable income unless the loan is forgiven.

Tesla disclosed in its proxy statement in April that the compensation it “actually paid” Musk came to $1.4 billion in 2023. But it stated — as Apple did in relation to Cook’s pay — that the figure did “not reflect the actual amount of compensation earned by or paid to Mr. Musk” that year. It was merely an artifact of adjustments to the putative value of his stock grants as it fluctuated in relation to the value of the underlying shares.

So whether Musk paid his entire payroll tax obligation by 15 minutes into 2025 (as Ghilarducci estimated based on Musk’s total Tesla-connected wealth), or owed nothing and has paid nothing can’t be determined.

All we can say is this: The run-up of wealth among a tiny camp of mega-billionaires comes at great social cost. Conservatives and Republicans in Congress continue to claim that the cost of Social Security, Medicare and Medicaid benefits is an insupportable burden on America, so benefits need to be cut, though President-elect Donald Trump has vowed to preserve entitlements like Social Security and Medicare.

But if the wealthy paid their fair share of the cost of those programs, they might well be solvent, even flush enough for benefits to be expanded and extended, into the limitless future.

Business

Taiwan Suspects a Chinese-Linked Ship of Damaging an Internet Cable

Taiwan is investigating whether a ship linked to China is responsible for damaging one of the undersea cables that connects Taiwan to the internet, the latest reminder of how vulnerable Taiwan’s critical infrastructure is to damage from China.

The incident comes as anxiety in Europe has risen over apparent acts of sabotage, including ones aimed at such undersea communication cables. Two fiber-optic cables under the Baltic Sea were severed in November, prompting officials from Sweden, Finland and Lithuania to halt a Chinese-flagged commercial ship in the area for weeks over its possible involvement.

In Taiwan, communications were quickly rerouted after the damage was detected, and there was no major outage. The island’s main telecommunications provider, Chunghwa Telecom, received a notification on Friday morning that the cable, known as the Trans-Pacific Express Cable, had been damaged. That cable also connects to South Korea, Japan, China and the United States.

That afternoon, Taiwan’s Coast Guard intercepted a cargo vessel off the northern city of Keelung, in an area near where half a dozen cables make landfall. The vessel was owned by a Hong Kong company and crewed by seven Chinese nationals, the Taiwan Coast Guard Administration said.

The damaged cable is one of more than a dozen that help keep Taiwan online. These fragile cables are susceptible to breakage by anchors dragged along the sea floor by the many ships in the busy waters around Taiwan.

Analysts and officials say that while it is difficult to prove whether damage to these cables is intentional, such an act would fit a pattern of intimidation and psychological warfare by China directed at weakening Taiwan’s defenses.

Taiwan said the cargo vessel it intercepted had registered under the flags of both Cameroon and Tanzania. “The possibility of a Chinese flag-of-convenience ship engaging in gray zone harassment cannot be ruled out,” the Coast Guard Administration said on Monday in a statement.

Such harassment, which inconveniences Taiwanese forces but stops short of overt confrontation, has a desensitizing effect over time, according to Yisuo Tzeng, a researcher at the Institute for National Defense and Security Research, a think tank funded by Taiwan’s defense ministry. That puts Taiwan at risk of being caught off guard in the event of a real conflict, Mr. Tzeng said.

Taiwan experiences near-daily incursions into its waters and airspace by the People’s Liberation Army. Last month, China sent nearly 90 naval and coast guard vessels into waters in the area, its largest such operation in almost three decades.

China has also deployed militarized fishing boats and its coast guard fleet in disputes around the South China Sea region, and stepped up patrols just a few miles off the shore of Taiwan’s outer islands, increasing the risk of dangerous confrontations.

Such harassment has been a “defining marker of Chinese coercion against Taiwan for decades, but over the last couple years has really stepped up,” said Gregory Poling, the director of the Asia Maritime Transparency Initiative at the Center for Strategic and International Studies.

And in situations like this one and the recent damage to the cables under the Baltic Sea, it is difficult for the authorities to calibrate their response when a ship’s true identity is uncertain.

“Do you deploy a Coast Guard vessel every time there is an illegal sand dredger or, in this case, a ship that is registered to a flag of convenience and has Chinese ties damages a submarine cable?” Mr. Poling asked.

Ship tracking data and vessel records analyzed by The Times show that the ship may have been broadcasting its positions under a fake name.

Taiwan said the ship appeared to use two sets of Automatic Identification System equipment, which is used to broadcast a ship’s position. On Jan. 3, at the moment that Taiwan said the cable was damaged, a ship named Shun Xing 39 was reporting its AIS positions in the waters off Taiwan’s northeastern coast.

About nine hours later, at around 4:51 p.m. local time, Shun Xing 39 stopped transmitting location data. That was shortly after the time that the Taiwan Coast Guard said it had located the ship and requested that it return to waters outside of Keelung port for an investigation.

One minute later, and 50 feet away, a ship called Xing Shun 39, which had not reported a position since late December, began broadcasting a signal, according to William Conroy, a maritime analyst in Wildwood, Mo., with Semaphore Maritime Solutions, who analyzed AIS data on the ship-tracking platform Starboard.

In the ship-tracking database, both Xing Shun 39 and Shun Xing 39 identify themselves as cargo ships with a class A AIS transponder. Typically, a cargo ship equipped with this class of transponder would be large enough to require registration with the International Maritime Organization and obtain a unique identification number known as an IMO number. Xing Shun 39 has an IMO number, but Shun Xing 39 does not appear in the IMO database. This suggests “Xing Shun 39” is the ship’s real identity and “Shun Xing 39” is fake, according to Mr. Conroy.

The Taiwan Coast Guard has publicly identified the vessel as Shun Xing 39, and said the ship used two AIS systems.

Vessel and corporate records show that Jie Yang Trading Ltd, a Hong Kong-based company, took over as the owner of Xing Shun 39 in April 2024.

The waves were too large to board the cargo vessel to investigate further, the Taiwan Coast Guard Administration said. Taiwan is seeking help from South Korea because the crew of the cargo vessel said it was headed to that country, the administration said.

In 2023, the outlying Matsu Islands, within view of the Chinese coast, endured patchy internet for months after two undersea internet cables broke. These fiber optic cables that connect Taiwan to the internet suffered about 30 such breaks between 2017 and 2023.

The frequent breakages are a reminder that Taiwan’s communication infrastructure must be able to withstand a crisis.

To help ensure that Taiwan can stay online if cables fail, the government has been pursuing a backup, including building a network of low-Earth orbit satellites capable of beaming the internet to Earth from space. Crucially, officials in Taiwan are racing to build their system without the involvement of Elon Musk, whose rocket company, SpaceX, dominates the satellite internet industry, but whose deep business links in China have left them wary.

-

Health1 week ago

Health1 week agoNew Year life lessons from country star: 'Never forget where you came from'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg) Technology1 week ago

Technology1 week agoMeta’s ‘software update issue’ has been breaking Quest headsets for weeks

-

Business6 days ago

Business6 days agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture6 days ago

Culture6 days agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports6 days ago

Sports6 days agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics5 days ago

Politics5 days agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics4 days ago

Politics4 days agoCarter's judicial picks reshaped the federal bench across the country

-

Politics3 days ago

Politics3 days agoWho Are the Recipients of the Presidential Medal of Freedom?