Business

DeSantis’s Big Event Underscores a Rightward Move for Twitter

What DeSantis means for Twitter

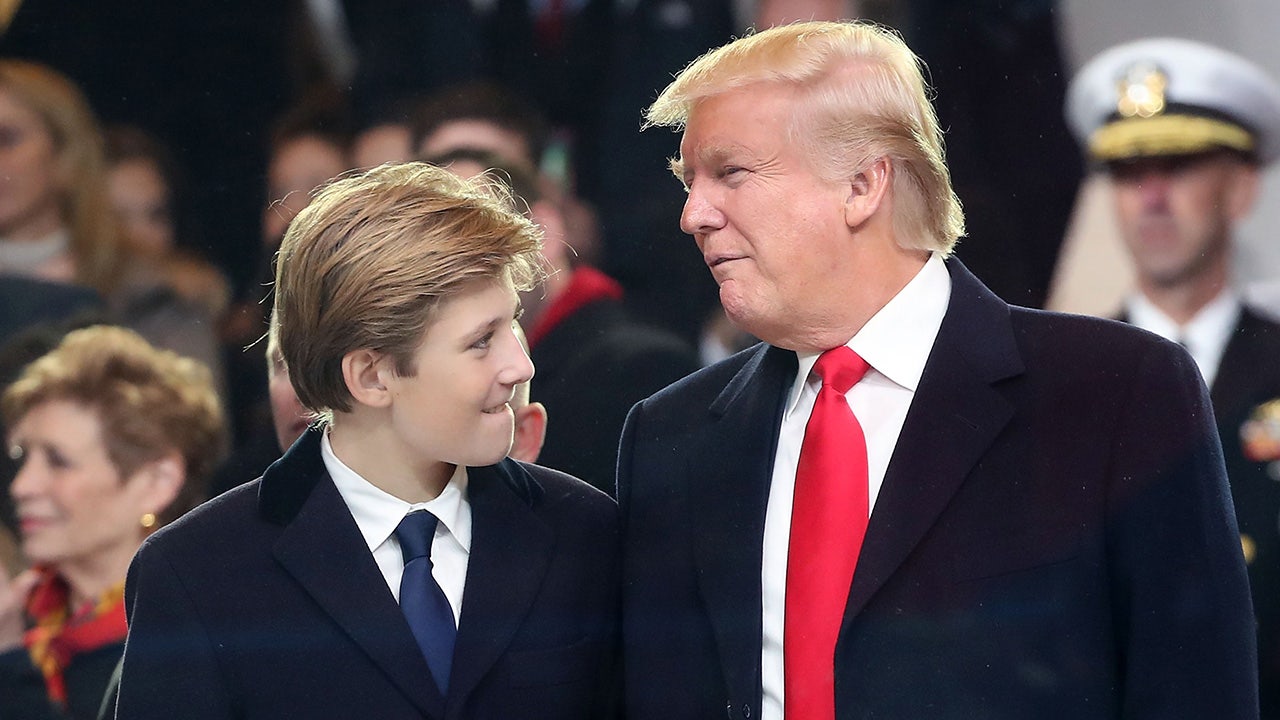

Gov. Ron DeSantis of Florida is expected to finally announce his presidential campaign on Wednesday night — but not on a stalwart of conservative media, like Fox News. Instead, the Republican star will do so live on Twitter, in a conversation with Elon Musk.

The move underscores both that Twitter, under its billionaire owner, has moved to embrace the political right and that Mr. DeSantis’s top business supporters so far are tech-industry libertarians, rather than traditional Republican moguls.

Twitter is becoming a conservative media hot spot in the Musk era. That started last year, when the company lifted bans on thousands of accounts, including ones that had spread misinformation about the pandemic and the 2020 elections.

Since then, Tucker Carlson has said he would revive his show on the social network after losing his Fox News slot, though Mr. Musk has said that Twitter hasn’t signed a deal with him. And The Daily Wire, a conservative media outlet, will reportedly make Twitter the home for all its podcasts.

In some ways, as Axios notes, Twitter is benefiting from conservative dissatisfaction with Fox News, and can claim to be outside the mainstream media world that Rupert Murdoch’s network inhabits.

Mr. Musk himself has more openly embraced the right. Though the billionaire said he voted for President Biden in 2020, the two have since clashed over issues including the White House’s embrace of unions.

While Mr. Musk has expressed support for Mr. DeSantis before, the Twitter owner said on Tuesday that he wasn’t formally backing any Republican candidate. Indeed, earlier this week Mr. Musk retweeted a campaign kickoff video for Senator Tim Scott of South Carolina.

The business consequences for Twitter remain unclear. Mr. Musk’s approach is markedly different from the more politically neutral stance that other social media companies have tried to strike. Twitter has already seen a number of left-leaning users defect to other platforms.

It’s unclear how Mr. Musk’s approach will affect efforts by Twitter’s incoming C.E.O., Linda Yaccarino, to woo mainstream advertisers. While some progress has already been made, skittish brands may be tempted to flee again if the platform grows more overtly political.

Mr. DeSantis’s move highlights his mixed relationship with business. The Florida governor has supported legislation to rein in “Silicon Valley elites.” But he has also won support from tech libertarians including the venture capitalists David Sacks (who is participating in Wednesday’s Twitter event) and Joe Lonsdale.

Outside tech, Mr. DeSantis’s publicly known business supporters include David Horowitz, a real-estate magnate, and the financier Hal Lambert, according to CNBC. But so far they don’t include stalwart Republican donors like Ken Griffin and Steve Schwarzman, some of whom have taken issue with Mr. DeSantis’s social policies.

HERE’S WHAT’S HAPPENING

Target pulls some Pride Month merchandise after threats from customers. The retailer said it had “experienced threats impacting our team members’ sense of safety and well-being while at work,” many tied to swimwear meant for transgender women. That echoes conservative objections to other attempts at catering for transgender customers, including against Bud Light.

Binance reportedly mixed customer money with corporate funds. The world’s largest crypto exchange commingled cash from each in 2020 and 2021, according to Reuters, which cited unnamed sources and bank records. If true, that could violate U.S. financial regulations; Binance denied the report, and Reuters said it had found no evidence that customers lost money.

Meta prepares for more job cuts. The social media giant reportedly plans to lay off thousands more workers on Wednesday. Meta, the parent of Facebook and Instagram, already announced in March that it was laying off 10,000 employees amid a slumping digital advertising market.

Bernard Arnault’s crown as the world’s wealthiest person gets wobblier. The LVMH chief’s net worth fell by $11 billion on Tuesday, amid investor concerns that a slowing U.S. economy will dampen a booming market for luxury goods. Arnault’s fortune is about $191.6 billion on paper, according to Bloomberg — just $11 billion ahead of Elon Musk.

Netflix finally moves to crack down on password-sharing in the U.S. The streaming giant announced that American subscribers would need to start paying $8 a month to add users to their accounts. It’s a push for more revenue, reversing Netflix’s yearslong indifference to shared accounts.

Wall Street is preparing for the worst

With debt-ceiling negotiations bearing no fruit and the “X-date” — the point at which the government will run out of cash to pay its bills — arriving as soon as June 1, the market is starting to price in a worst-case scenario.

Stocks suffered their biggest sell-off in three weeks on Tuesday, and S&P 500 futures on Wednesday morning point to further losses. Citing the deadlocked talks, analysts at JPMorgan Chase suggested that investors dump stocks for cash.

In a further sign of uncertainty, investors are offering more for Microsoft corporate bonds that come due in August than they are for Treasury bills that mature in the same period, a sign they see the government debt as more risky.

Markets are increasingly worried a timely deal might be out of reach. Beyond the current impasse, investors have been worried that Speaker Kevin McCarthy may not be able to win over significant portions of his fellow House Republicans, and he has only a slim majority.

Meanwhile, the three major credit rating agencies would be compelled to downgrade America’s debt if the government missed even a single repayment, The Times’s Joe Rennison reports. Even the prospect of reaching the X-date with no deal could be enough for Moody’s to review its outlook, said William Foster, the agency’s lead U.S. analyst.

Any downgrade would kick the U.S. out of an exclusive club of 12 nations with the highest credit rating, which includes Canada, Germany and Singapore.

Some commentators fear the U.S.’s fiscal reputation has already taken a hit. “We are sending a very negative signal about our ability to run our economy, let alone be an anchor for the rest of the world,” Mohamed El-Erian, an economist and an adviser at Allianz, told CNBC on Tuesday.

What happened to the S.E.C.’s climate disclosure rules?

More than a year has passed since the S.E.C. proposed rules to make companies disclose emissions data and other climate-related risks — and DealBook hears the agency is nowhere close to finalizing them.

Why? The complexity of designing such rules is one reason. But the legal landscape has also changed since last year, making it more difficult to write regulations that could withstand court challenges.

The Supreme Court is inclined to limit agencies’ power. Several justices have embraced what’s known as the “major questions doctrine,” which holds that Congress, not executive-branch regulators, must decide issues of economic and political significance.

It shot to new prominence last June, when the court struck down an E.P.A. rule on power plant emissions.

There’s no clear path to overcoming that doctrine. Gary Gensler, the S.E.C.’s chair, told DealBook last year that the E.P.A. case set a “significant” precedent that would affect the agency’s drafting of climate rules.

The S.E.C. will need to make the case that it has a history of requiring environmental disclosures from companies and the congressional authority to do so. (The agency didn’t respond to a request for comment.)

The S.E.C. is also worried about a challenge on First Amendment grounds. Regulators expect to face lawsuits claiming that the required disclosures are unconstitutional. While the S.E.C. has fought cases like that before, not always successfully, it now faces a conservative supermajority on the Supreme Court that looks dimly at any expansion of executive power.

That said, companies operating globally will still need to prepare for climate disclosures: The European Union and other regions are moving ahead with their own mandates.

“Even if you were, like, an evil C.E.O. trying to replace all journalists with A.I., you would be very unsuccessful.”

— Jonah Peretti, the C.E.O. of Buzzfeed. The digital media publisher, which shut down Buzzfeed News last month, has embraced artificial intelligence in an effort to boost revenues and revive its battered stock price.

The heat is on in the chip war

After Beijing fired back in its trade war with Washington by partially banning some chips from Micron, the Biden administration and its allies are considering investment restrictions that would reduce the extent of Western companies’ business in China.

U.S. and European trade envoys are expected to discuss the matter next week. At the gathering of the Trade and Technology Council, officials are expected to discuss subjects like restricting the flow of investment and intellectual property to China, according to Bloomberg. The wording is still being negotiated, but limits on semiconductor exports are seen as a key part of any framework agreement.

The escalation of tensions follows last weekend’s Group of 7 summit, at which Western leaders pressed China on issues including trade and Taiwan. Seemingly in response, Beijing announced its clampdown on Micron and promised to strengthen ties with Moscow.

Tech companies are getting worried. Jensen Huang, the C.E.O. of the chip giant Nvidia, told The Financial Times that measures like semiconductor export restrictions could hurt U.S. businesses, by driving Chinese customers toward homegrown alternatives. “The U.S. has to be careful,” he said. “China is a very important market for the technology industry.”

More China-U.S. news:

-

Commerce Secretary Gina Raimondo is scheduled to meet on Wednesday with her Chinese counterpart, Wang Wentao, in an effort to “thaw” relations. It would be the first meeting of this kind at cabinet level under the Biden administration.

-

A high-ranking Republican congressman is calling on the Commerce Department to introduce trade curbs on a Chinese chip maker, ChangXin Memory Technologies, in retaliation for Beijing’s move against Micron.

THE SPEED READ

Deals

-

Meta agreed to sell Giphy, a site for the moving images known as GIFs, to Shutterstock at a $260 million loss after being forced to offload it by regulators. (Guardian)

-

Anthropic, a chatbot developer that competes with OpenAI, raised $450 million in new financing led by Spark Capital and Google. (Bloomberg)

-

Virgin Orbit, the bankrupt space satellite start-up backed by Richard Branson, has sold its remaining assets and will shut down. (WaPo)

Policy

Best of the rest

We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com.

Business

TikTok sues U.S. government, saying ban violates 1st Amendment

TikTok, the popular social video app, sued the U.S. government on Tuesday, saying the country’s new law that could ban the app violates 1st Amendment rights to free speech.

President Biden last month signed into law a bill that would effectively ban the service in the U.S. if its Chinese owner, ByteDance, does not sell TikTok’s U.S. operations. Legislators backing the law said a ban or sale was necessary to address national security concerns posed by the app’s ties to China.

“There is no question: the Act will force a shutdown of TikTok by January 19, 2025, silencing the 170 million Americans who use the platform to communicate in ways that cannot be replicated elsewhere,” TikTok and ByteDance said in their filing, referring to the new law.

The Department of Justice declined to comment.

TikTok and ByteDance said in the court filing that it had been trying since 2019 to work with the U.S. government’s Committee on Foreign Investment to address security concerns. Under the terms of a deal spelled out in a 90-page draft agreement, data collected about Tik Tok users in the U.S. was to be handled by Oracle, the U.S. tech giant. The proposed agreement also called for Oracle to inspect TikTok’s programming code for vulnerabilities and for the platform’s content to be subject to independent monitoring, according to the filing in the U.S. Court of Appeals for the D.C. circuit.

If TikTok did not comply, the draft agreement called for the company to be subjected to financial penalties and also included the possibility of suspending TikTok’s operations in the U.S., the businesses said.

“The terms of that negotiated package are far less restrictive than an outright ban,” ByteDance and TikTok said in its filing.

But TikTok and ByteDance said it is unclear why the committee ultimately determined the proposed agreement was insufficient and in March 2023 “insisted that ByteDance would be required to divest the U.S. TikTok business,” according to the filing.

TikTok and ByteDance also noted the new law “offers no support for the idea” that TikTok’s Chinese ownership poses national security risks.

“Speculative risk of harm is simply not enough when First Amendment values are at stake,” the businesses said in their filing.

TikTok is still moving forward with addressing some of the security concerns by partnering with Oracle “on the migration of the U.S. platform and protected U.S. user data to Oracle’s cloud environment,” TikTok and ByteDance said in the filing.

As part of their lawsuit, TikTok and ByteDance are seeking a court order blocking the government from enforcing the new law.

“These are going to be difficult issues to thrash out,” said Carl Tobias, a law professor at University of Richmond.

Tobias said one of the challenges for TikTok and ByteDance is the government’s national security argument. “Federal courts tend to be pretty deferential to those kinds of assertions, especially from Congress,” Tobias said.

Other legal experts said that they believe TikTok has a strong case. Douglas Mirell, a partner at Greenberg Glusker, said that he suspects the government is going to have a significant burden of trying to prove the law is not unconstitutional under the 1st Amendment.

“If I had to choose which side of the case to be on, I would be on TikTok’s side,” said Mirell, who focuses on 1st Amendment issues.

TikTok is a hugely popular app, with more than 1 billion users worldwide and is a key part of the video creator ecosystem. Small businesses rely on TikTok to tout their products and video creators have moved to L.A. to be closer to its Culver City office. The company employs roughly 500 people in Culver City, according to city data.

In its filing, ByteDance argued that carving out TikTok’s U.S. operations from the rest of the company would not be feasible, in part because of the borderless nature of the social video app that allows for international content to be mixed in with U.S. videos.

“Such a limited pool of content, in turn, would dramatically undermine the value and viability of the U.S. TikTok business,” the filing said.

TikTok’s massive popularity — and value — is due in large part to the algorithm its developers designed that seamlessly feeds content to users based on what they have watched previously. TikTok and ByteDance said in its filing, the “Chinese government has made clear that it would not permit a divestment of the recommendation engine that is a key to the success of TikTok in the United States.”

Still, analysts said have predicted that some companies and private equity firms would be interested in buying TikTok even if the coveted algorithm wasn’t part of the deal. Potential buyers could include Oracle and Microsoft, said Daniel Ives, a managing director at Wedbush Securities in an interview with the Times last month.

Business

Column: Disneyland has already turned my hometown into a giant tourist trap. What's next?

Somewhere in my personal papers is a folded up, tattered poster of Mickey Mouse commemorating his long reign as the world’s most famous rodent. It shows scenes from some of his iconic shorts — “Steamboat Willie,” “The Band Concert,” “Brave Little Tailor” — above the legend “Thanks Mickey for 60 Years!”

Signed, Disneyland.

My fourth-grade classmates and I received the posters in the fall of 1988 at Patrick Henry Elementary School in Anaheim, along with a T-shirt of a tuxedoed Mickey wearing sneakers and a free trip to the Happiest Place on Earth for his birthday bash. We cheered alongside kids from around the world and rode rides until the evening. I can still hum parts of the gratingly cheery song from the parade held in Mickey’s honor. (A quick YouTube search confirmed I have the melody right.)

The poster hung on my wall through junior high, even though I was more of a Donald Duck fan. It was a symbol for me that a company whose products and productions I loved cared about us Anaheim kids. How cool was it that one of the world’s most popular theme parks was in my hometown? And how cool was it that they let us kids hang out with Mickey on his birthday for free?

I hadn’t thought about my souvenir for decades until yesterday, when the Anaheim City Council passed yet another Disneyland-friendly ordinance. Zoning regulations will be relaxed so Disney can build new attractions and hotels on its 490-acre campus, and three public roads will be sold to Disney for $40 million.

In return, Disney promises to undertake nearly $2 billion in construction over the next decade, donate $30 million to a yet-to-be-formed public housing trust run by Anaheim, give $8 million toward improving city parks and pay $45 million in “transportation improvements,” according to the website for DisneylandForward, the name Disney has bestowed on its plans.

A Disney-funded study by Cal State Fullerton’s Woods Center for Economic Analysis and Forecasting predicted that the company’s most ambitious proposals — a full build-out of Disneyland and Disney California Adventure, and a new hotel — will create tens of thousands of jobs and generate $244 million in annual tax revenue.

Who could possibly be against this windfall of cash and fun? Me, of course!

The Anaheim City Council unanimously approved the agreement despite the lack of concrete plans from Disney — all it’s revealing right now is “possibilities” inspired by attractions from its theme parks worldwide, according to the DisneylandForward website. There might be more specifics in the Woods Center forecast, but city officials and the public alike can see only a nine-page summary because Disney claims it contains proprietary information.

This cryptic Mouse long ago replaced the Mickey of my childhood memories. By the time I became a reporter, I knew that Disney has long treated Anaheim as a political chamois, looking to squeeze as much as possible out of Orange County’s largest city.

Walt Disney Co. Chief Executive Bob Iger at “Mickey’s 90th Spectacular” at the Shrine Auditorium in 2018.

(Valerie Macon / AFP via Getty Images)

In 1996, the city paid for a $108.2-million parking structure — at the time, the largest in the world — that it leases to Disney for a buck a year, allowing the company to keep all the revenue and eventually assume ownership. A 2017 Times analysis found that Disney had “secured subsidies, incentives, rebates and protections from future taxes” worth more than $1 billion over the previous two decades. Disney has repaid that goodwill with millions of dollars in donations to political action committees that push pro-Mickey candidates.

Two years ago, FBI agents and city-funded independent investigators characterized a Disneyland Resort lobbyist as part of a “cabal” that has undue influence over city politics. Meanwhile, the cost of a one-day pass to the Mouse House has increased from $43 in 2000 to $194 as of last year. Nightly fireworks at the resort scare dogs, set off car alarms in working-class neighborhoods and make the 5 Freeway a smoky mess.

Yet, to paraphrase the most famous quote in “The Usual Suspects,” the greatest trick Disney ever pulled was convincing Anaheimers that its bad side doesn’t exist. The few DisneylandForward skeptics have been easily drowned out by supporters.

Unions? Leaders showed up to support DisneylandForward when the Anaheim City Council first voted on it in April. The council? From Republican Stephen Faessel to progressive Carlos Leon to independent Jose Diaz, they hardly asked any hard-hitting questions. The millions of visitors to the Disneyland Resort, half of whom seem to be my cousins and friends? They’re celebrating like Ewoks at the end of “Return of the Jedi” at the thought of more rides to enjoy and swag to grab.

Only a few of us cranks are pointing to the environmental impact report finding that the construction noise and permanent change in air quality as a result of the expansion would be “significant and unavoidable.” Or pulling out a calculator to crunch the numbers in the Woods Center report.

For instance, the study says that if Disneyland maximizes its acreage and builds a new hotel, that will create 28,352 jobs, translating into $1.8 billion in income for those employees.

Sounds nice and big. But it doesn’t say what kind of jobs and whether they’d be permanent or full time. The $63,487 average yearly salary from those jobs is considered low-income for a one-person household in Orange County, according to the California Department of Housing and Community Development. These are hardly the jobs Anaheimers need to be able to afford to live here, let alone live a good life.

I still remember when Anaheim was a city of factories and blue-collar jobs that allowed my immigrant elders and my cousins to buy homes. Near the granny flat where I lived before transferring to Patrick Henry were a lumberyard, a Kwikset factory and a trucking depot where my dad would pick up cargo containers.

All those places vanished decades ago. Now, there are hipster hangouts, beer gardens and high-priced apartments, because Anaheim leaders took Disney’s lead and transformed my hometown into one giant tourist trap, with longtime residents little better than an afterthought.

Which brings me back to that Mickey Mouse 60th anniversary poster. I eventually took it down because the edges were fraying, and I thought it would be a collectors’ item one day. I thought Disneyland had bestowed on me yet another wonderful prize.

I looked up the poster on eBay recently. I can get one for $20. But, hey: At least I got something free from Disney back in the day.

In 2016, the company vowed to give all Anaheim sixth-graders free Disneyland tickets in honor of its 60th anniversary if they did community service projects.

The promotion was supposed to continue for a decade but was discontinued in 2021, during the pandemic. It has yet to be reinstated, even though Disney just announced that its theme park division increased revenue in the second fiscal quarter to $8.39 billion.

Stay classy, Mouse House!

Business

Q&A: David Simon isn't a starry-eyed dreamer, but he's all in on Hollywood

David Simon is so bullish on Hollywood he’s building a new movie studio there from the ground up and renovating another one that dates to the days of silent films.

They’re the largest of 10 projects the real estate developer has going in Hollywood at a time when many other Los Angeles builders have paused work in the face of high interest rates and construction costs that make it harder to build profitably.

Simon is banking on the lasting stamina of the entertainment industry even as it goes through structural changes in the age of streaming, and the enduring appeal of Hollywood as the place to make movies and television shows.

Through his company BARDAS Investment Group, Simon recently launched construction of Echelon Studios, a $450-million complex on Santa Monica Boulevard west of the 101 Freeway on a site formerly occupied by a Sears store. It will include five soundstages and support facilities, including offices and space to keep trucks, production equipment and actors’ trailers.

Simon recently launched construction of the $450-million Echelon Studios complex, shown in a rendering, on Santa Monica Boulevard on the site previously occupied by a Sears store.

( Bob Hale / Rios)

Less than a mile away on Romaine Street, Simon is preparing to launch a $600-million renovation and expansion of Echelon at Television Center, which was once home to Technicolor’s film manufacturing laboratory and Metro Pictures Corp., which became part of Metro-Goldwyn-Mayer in the 1920s. Among Metro’s stars were Rudolph Valentino, Lillian Gish, Ramon Novarro and Buster Keaton.

Before he founded his own company in 2018, he oversaw two large-scale Hollywood projects for Kilroy Realty: the $420-million office, residential and retail redevelopment of the former CBS headquarters in Hollywood now known as Columbia Square and the $450-million office and residential redevelopment of the former Academy of Motion Picture Arts and Sciences headquarters site now known as On Vine.

The Times spoke with Simon to discuss his Hollywood projects, as well as his predictions about the future of the neighborhood and the local entertainment industry. The interview has been edited for brevity and clarity.

The historic Art Deco Echelon Television Center studio complex in Hollywood, which will undergo a $600-million makeover.

(Luis Sinco / Los Angeles Times)

You chose a long time ago to focus your efforts on Hollywood. What made you think it had a leg up on other real estate markets?

I always knew Hollywood is the biggest brand in the world. Everybody knows what Hollywood is — films, television, celebrity — and that is just a great brand to have while you’re developing. It was surprising that there was not a lot of institutional investment there for many years. What really got me going was the CNN building.

What happened with that building? Larry King used to broadcast his shows there.

We had the opportunity to buy the building in the early 2000s when I was with Broadreach Capital Partners and we didn’t want to lose its high-profile tenant, CNN. They had a deal on the table to move to the Sherman Oaks Galleria.

I remember asking the question, “If we bought the building, would you be interested in staying if we built you a new studio? And the answer was, “Yes,” and we did a 20-year lease with them. That really said to me that there’s a market in Hollywood and there’s really no focus from an institutional landlord mindset, no investment dollars coming in, because there hadn’t been new studios or soundstages built for decades.

You continued to work for other developers until six years ago when you formed your own company. What made you think it was time to take the leap?

We said, “This industry is really growing. There seems to be strong demand for content, streamers are growing and a lot of production is happening.” We thought there was a need to create new and inspiring environments in the entertainment capital of the world for media and content creators.

What’s your company doing now?

We’ve got about 1.6 million square feet in development. All entitlements are in place with the exception of Television Center, which is still going through city approvals. This is all about creating a portfolio of assets that caters to this entertainment user base. Between our two studios we’ll have about 10 soundstages and a nice critical mass.

A lot of other developers are on the sidelines waiting for conditions to improve. Why are you plowing ahead?

My partners at Bain Capital Real Estate and I are not naive to where the world is today, where interest rates are and the cost of debt and construction costs and everything that’s going on in the world. But we’re of the mind that our locations are great. They’re infill locations in the heart of Hollywood.

The demand for media and content is having its ups and downs like any growing industry does. There will be consolidations and things like that, but at the end of the day, that demand is going to continue to be there. And for that demand to be there, quality product, what I call the manufacturing facilities, needs to be put in place and it needs to be state of the art.

Would that slow down the trend of movie and television production leaving L.A. for other cities?

With artificial intelligence, LED screens and other technology [filmmakers] can create scenes inside of a soundstage that feels like you’re in New York or Paris, but you’re really in L.A. The more that content can be created locally, the better for the talent.

-

News1 week ago

News1 week agoPolice enter UCLA anti-war encampment; Arizona repeals Civil War-era abortion ban

-

News1 week ago

News1 week agoSome Florida boaters seen on video dumping trash into ocean have been identified, officials say

-

Education1 week ago

Education1 week agoVideo: President Biden Addresses Campus Protests

-

World1 week ago

World1 week agoUN, EU, US urge Georgia to halt ‘foreign agents’ bill as protests grow

-

World1 week ago

World1 week agoEuropean elections: What do voters want? What have candidates pledged?

-

World1 week ago

World1 week agoIn the upcoming European elections, peace and security matter the most

-

Movie Reviews1 week ago

Movie Reviews1 week agoSabari Movie Review: Varalaxmi Proves She Can Do Female Centric Roles

-

Politics1 week ago

Politics1 week agoAustralian lawmakers send letter urging Biden to drop case against Julian Assange on World Press Freedom Day