California

California needs a fiscal rules revival

On Tuesday, California voters resolve the destiny of Proposition 30. If authorised, the state’s prime private earnings tax fee would exceed 15%, larger than any state within the union. For years now, the Golden State has leaned into larger tax and spend insurance policies, which has despatched companies and people packing. But it surely wasn’t all the time this manner.

Greater than 4 many years in the past, on Election Day 1978, California voters authorised Prop. 13 to roll again property taxes, cap property tax charges, and impose a two-thirds supermajority vote requirement in each homes of the legislature to lift taxes.

The next yr, almost 75% of voters correctly authorised Proposition 4, also called the Gann Restrict. This modification restricted the expansion of appropriations to inhabitants progress and the lesser of the Shopper Value Index or California private earnings progress. Revenues that exceeded the restrict needed to be refunded to taxpayers inside two years. Gann additionally utilized to native governments.

The sort of modification is called a state fiscal rule, which is a proper restraint on spending ranges or progress. Fiscal guidelines should be designed to be efficient, sustainable, and never undermine applicable responses to real fiscal emergencies.

The Gann Restrict, nevertheless, exempted debt service, retirement prices, and unemployment insurance coverage compensation. Sadly, voters authorised quite a few amendments all through the 1980’s that weakened California fiscal guidelines. These amendments required obligatory refunds be spent instantly on schooling, raised the Gann Restrict to a weighted common of inhabitants progress and per capita private earnings progress, and expanded the listing of exemptions. Now these amendments will not be definitely worth the paper they’re printed on.

California ought to look to states like Colorado, the place the Taxpayer’s Invoice of Rights (TABOR) turned 30 years outdated this week and is taken into account the gold customary for state fiscal guidelines.

TABOR limits the quantity of income Colorado lawmakers can retain and spend to an inexpensive components of inhabitants plus inflation progress. If the state authorities collects extra tax income than TABOR permits, the cash is returned to taxpayers as a refund. Since 1992, taxpayers have been refunded $8.2 billion.

TABOR has survived voter authorised modifications, quite a few lawsuits, and numerous assaults from critics who declare it is going to trigger the state financial system to crumble. Regardless of these challenges, TABOR has stored authorities accountable to Coloradans, and the state financial system has remained strong, attracting many new companies – together with from California – reasonably than power firms to seek for a friendlier tax local weather. With out TABOR, the Colorado financial system can be in a a lot completely different place.

Economist Barry Poulson, who served on the Colorado Tax Fee, witnessed this firsthand. In his new American Legislative Trade Council (ALEC) report, TABOR Turns 30, Dr. Poulson recollects how residents in Limon, Colorado rejected a poll measure calling for a big gross sales tax enhance as a result of they understood that the gross sales tax enhance would drive enterprise out of Limon and throughout the border to Kansas.

California has misplaced 1.1 million folks since 2011, and Colorado is steadily gaining residents and companies from California. Governor Newsom’s newest gimmick is to supply rebate checks from the finances surplus brought on by billions of {dollars} in federal help. These one-time checks received’t make California a extra inexpensive place to stay and, if this system continues, will enable the price of dwelling to proceed to skyrocket.

As an alternative, California ought to revive its fiscal guidelines and make them as sturdy as doable. Evaluation from ALEC’s Fiscal Guidelines challenge exhibits that if California had enacted its personal TABOR the identical yr as Colorado, taxpayers would have saved over $100,000, a median of slightly below $3,500 per family per yr, in comparison with the established order.

With its personal Taxpayer’s Invoice of Rights, Californians can be empowered to carry authorities accountable and preserve extra of their hard-earned cash, whereas making the state a extra inexpensive place to stay. Sacramento ought to put apart the gimmicks and revive sturdy fiscal guidelines.

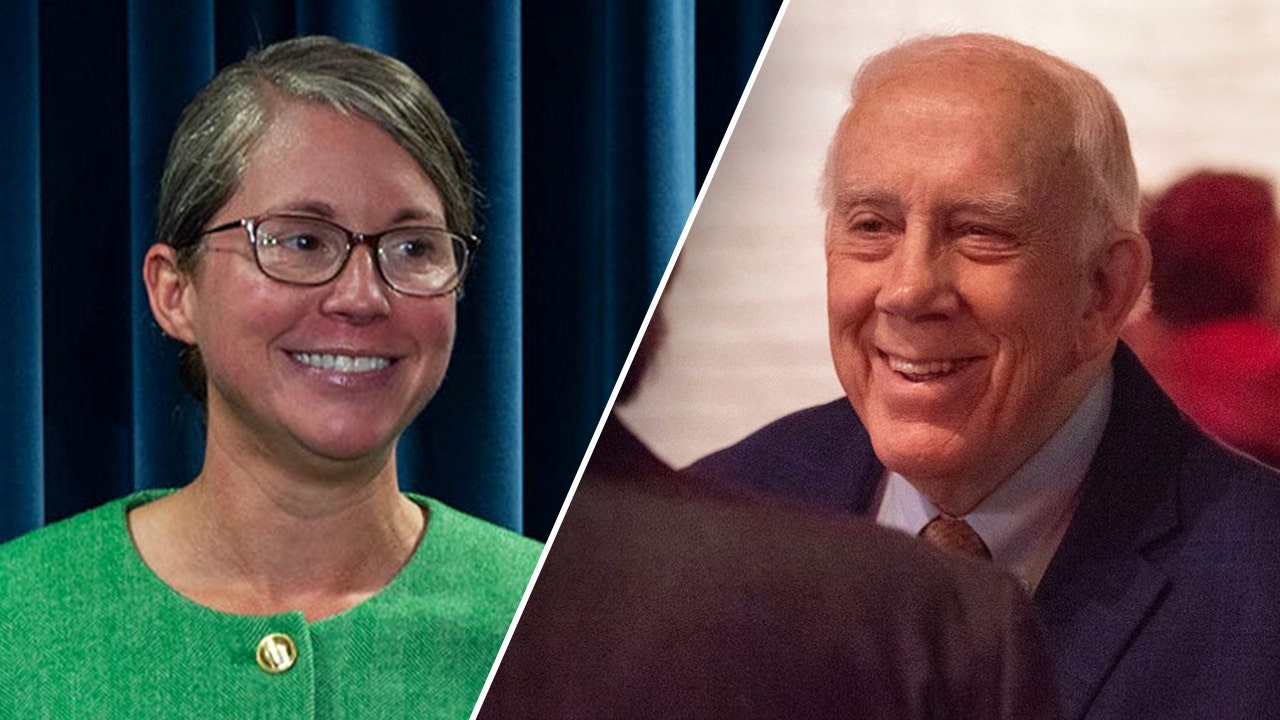

Lee Schalk is the Vice President of Coverage on the American Legislative Trade Council and Thomas Savidge is the Analysis Director of the Heart for State Fiscal Reform on the American Legislative Trade Council.

California

Caitlyn Jenner says she'd 'destroy' Kamala Harris in hypothetical race to be CA gov

Caitlyn Jenner considers another run to become California governor

Caitlyn Jenner, the gold-medal Olympian-turned reality TV personality, is considering another run for Governor of California. This time, she says, if she were to go up against Vice President Kamala Harris, she would “destroy her.”

SAN FRANCISCO – Caitlyn Jenner, the gold-medal Olympian-turned reality TV personality, is considering another run for Governor of California. This time, she says, if she were to go up against Vice President Kamala Harris, she would “destroy her.”

Jenner, who publicly came out as transgender nearly 10 years ago, made a foray into politics when she ran as a Republican during the recall election that attempted to unseat Gov. Gavin Newsom in 2021. Jenner only received one percent of the vote and was not considered a serious candidate.

Jenner posted this week on social media that she’s having conversations with “many people” and hopes to have an announcement soon about whether she will run.

Caitlyn Jenner speaks at the 4th annual Womens March LA: Women Rising at Pershing Square on January 18, 2020 in Los Angeles, California. (Photo by Chelsea Guglielmino/Getty Images)

She has also posted in Trumpian-style all caps: “MAKE CA GREAT AGAIN!”

As for VP Harris, she has not indicated any future plans for when she leaves office. However, a recent poll suggests Harris would have a sizable advantage should she decide to run in 2026. At that point, Newsom cannot run again because of term limits.

If Jenner decides to run and wins, it would mark the nation and state’s first transgender governor.

California

Northern California 6-year-old, parents hailed as heroes for saving woman who crashed into canal

LIVE OAK — A six-year-old and her parents are being called heroes by a Northern California community for jumping into a canal to save a 75-year-old woman who drove off the road.

It happened on Larkin Road near Paseo Avenue in the Sutter County community of Live Oak on Monday.

“I just about lost her, but I didn’t,” said Terry Carpenter, husband of the woman who was rescued. “We got more chances.”

Terry said his wife of 33 years, Robin Carpenter, is the love of his life and soulmate. He is grateful he has been granted more time to spend with her after she survived her car crashing off a two-lane road and overturning into a canal.

“She’s doing really well,” Terry said. “No broken bones, praise the Lord.”

It is what some call a miracle that could have had a much different outcome without a family of good Samaritans.

“Her lips were purple,” said Ashley Martin, who helped rescue the woman. “There wasn’t a breath at all. I was scared.”

Martin and her husband, Cyle Johnson, are being hailed heroes by the Live Oak community for jumping into the canal, cutting Robin out of her seat belt and pulling her head above water until first responders arrived.

“She was literally submerged underwater,” Martin said. “She had a back brace on. Apparently, she just had back surgery. So, I grabbed her brace from down below and I flipped her upward just in a quick motion to get her out of that water.”

The couple said the real hero was their six-year-old daughter, Cayleigh Johnson.

“It was scary,” Cayleigh said. “So the car was going like this, and it just went boom, right into the ditch.”

Cayleigh was playing outside and screamed for her parents who were inside the house near the canal.

I spoke with Robin from her hospital bed over the phone who told us she is in a lot of pain but grateful.

“The thing I can remember is I started falling asleep and then I was going over the bump and I went into the ditch and that’s all I remember,” Robin said.

It was a split-second decision for a family who firefighters said helped save a stranger’s life.

“It’s pretty unique that someone would jump in and help somebody that they don’t even know,” said Battalion Chief for Sutter County Fire Richard Epperson.

Robin is hopeful that she will be released from the hospital on Wednesday in time to be home for Thanksgiving.

“She gets Thanksgiving and Christmas now with her family and grandkids,” Martin said.

Terry and Robin are looking forward to eventually meeting the family who helped save Robin’s life. The family expressed the same feelings about meeting the woman they helped when she is out of the hospital.

“I can’t wait for my baby to get home,” Terry said.

California

California may exclude Tesla from EV rebate program

Spear Invest founder and Chief Investment Officer Ivana Delevska discusses the value of A.I. data centers and the future of driverless cars on ‘Making Money.’

California Gov. Gavin Newsom may exclude Tesla and other automakers from an electric vehicle (EV) rebate program if the incoming Trump administration scraps a federal tax credit for electric car purchases.

Newsom proposed creating a new version of the state’s Clean Vehicle Rebate Program, which was phased out in 2023 after funding more than 594,000 vehicles and saving more than 456 million gallons of fuel, the governor’s office said in a news release on Monday.

“Consumers continue to prove the skeptics wrong – zero-emission vehicles are here to stay,” Newsom said in a statement. “We’re not turning back on a clean transportation future – we’re going to make it more affordable for people to drive vehicles that don’t pollute.”

The proposed rebates would be funded with money from the state’s Greenhouse Gas Reduction Fund, which is funded by polluters under the state’s cap-and-trade program, the governor’s office said. Officials did not say how much the program would cost or save consumers.

NEBRASKA AG LAUNCHES ASSAULT AGAINST CALIFORNIA’S ELECTRIC VEHICLE PUSH

California Gov. Gavin Newsom on Monday proposed creating a new version of the state’s Clean Vehicle Rebate Program if the incoming Trump administration scraps a federal tax credit for electric car purchases. (Photo by Justin Sullivan/Getty Images, File / Getty Images)

They would also include changes to promote innovation and competition in the zero-emission vehicles market – changes that could prevent automakers like Tesla from qualifying for the rebates.

Tesla CEO Elon Musk, who relocated Tesla’s corporate headquarters from California to Texas in 2021, responded to the possibility of having Tesla EVs left out of the program.

Tesla and other automakers may not qualify for the proposed tax credits, according to the governor’s office. (Getty Images, File / Getty Images)

“Even though Tesla is the only company who manufactures their EVs in California! This is insane,” Musk wrote on X, which he also owns.

BENTLEY PUSHES BACK ALL-EV LINEUP TIMELINE TO 2035

Those buying or leasing Tesla vehicles accounted for about 42% of the state’s rebates, The Associated Press reported, citing data from the California Air Resources Board.

Newsom’s office told Fox Business Digital that the proposal is intended to foster market competition, and any potential market cap is subject to negotiation with the state Legislature.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TSLA | TESLA INC. | 338.59 | -13.97 | -3.96% |

“Under a potential market cap, and depending on what the cap is, there’s a possibility that Tesla and other automakers could be excluded,” the governor’s office said. “But that’s again subject to negotiations with the legislature.”

Newsom’s office noted that such market caps have been part of rebate programs since George W. Bush’s administration in 2005.

Newsom has pushed Californians to replace gas-powered vehicles with zero-emission vehicles. (Chip Somodevilla/Getty Images / Getty Images)

Federal tax credits for EVs are currently worth up to $7,500 for new zero-emission vehicles. President-elect Trump has previously vowed to end the credit.

CLICK HERE TO GET THE FOX NEWS APP

California has surpassed 2 million zero-emission vehicles sold, according to the governor’s office. The state, however, could face a $2 billion budget deficit next year, Reuters reported, citing a non-partisan legislative estimate released last week.

-

Science1 week ago

Science1 week agoTrump nominates Dr. Oz to head Medicare and Medicaid and help take on 'illness industrial complex'

-

Politics1 week ago

Politics1 week agoTrump taps FCC member Brendan Carr to lead agency: 'Warrior for Free Speech'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg) Technology1 week ago

Technology1 week agoInside Elon Musk’s messy breakup with OpenAI

-

Lifestyle1 week ago

Lifestyle1 week agoSome in the U.S. farm industry are alarmed by Trump's embrace of RFK Jr. and tariffs

-

World1 week ago

World1 week agoProtesters in Slovakia rally against Robert Fico’s populist government

-

Health4 days ago

Health4 days agoHoliday gatherings can lead to stress eating: Try these 5 tips to control it

-

News1 week ago

News1 week agoThey disagree about a lot, but these singers figure out how to stay in harmony

-

Health2 days ago

Health2 days agoCheekyMD Offers Needle-Free GLP-1s | Woman's World