Alaska

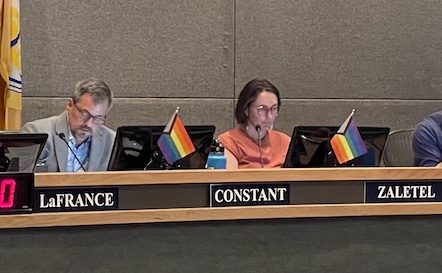

Assembly committee finalizes resolution adopting criteria shelter

/cloudfront-us-east-1.images.arcpublishing.com/gray/2DVWRZKQMVDE7J2IAA4G4C3UCA.jpg)

ANCHORAGE, Alaska (KTUU) – A resolution adopting criteria for a new permanent, year-round low-barrier shelter in Anchorage was finalized on Wednesday.

The decision was made at the final special Housing and Homelessness Committee meeting dedicated to discussing requirements for the shelter. If passed by the Assembly, the criteria settled on Wednesday will be used to help choose the location for a new shelter.

“I think this is a really good, positive step forward,” Assembly member Felix Rivera said. “We’re officially for the first time ever going to adopt site-selection criteria for where shelter should be located within the municipality.”

Rivera believes this is a critical step in the process of establishing the shelter. If the resolution is passed, it would also be the municipality’s first time formally adopting site-selection criteria for a shelter as a matter of public policy.

Some required characteristics of the shelter:

- Every person staying in the shelter must have 50 square feet of space, with additional space required for administration and services.

- The funding must be available in the budget and will be presented to the Assembly as a basis for looking at properties. The cost hasn’t been determined yet.

- The property must be compliant with the Americans with Disabilities Act or easily brought up to compliance with the ADA.

The meeting also included a discussion on opening dates, capital costs, distances to places such as grocery stores and public transportation, and creating a visibility buffer. Some preferred characteristics of the shelter:

- The selected location should have a 500-foot buffer zone from locations with children, such as schools, childcare facilities, and playgrounds.

- The property should be within a quarter mile of public transportation.

- The property should be activated as a shelter between Nov. 1 and Dec. 31.

The finalized criteria should help to narrow down the possible locations for the shelter within the municipality.

“That gets us to the next part of the discussion — which is going to be a tough one — which is locations and figuring out locations for shelter,” Rivera said.

The resolution on site-selection criteria will have a public hearing and is expected to be voted on by the Anchorage Assembly at the July 11 meeting.

Copyright 2023 KTUU. All rights reserved.

Alaska

Opinion: Worried about Alaska’s budget crisis? Fix this obvious tax loophole.

Alaska is facing a persistent budget deficit. The Anchorage Daily News recently reported that without additional revenue, the state could face a shortfall of over $650 million in the next two fiscal years. This isn’t a new problem; Alaska’s spending has exceeded its revenue almost every year since 2012. Alaska is also the only state that receives more funding from the federal government than it does from all of our internal revenue combined. Our legislators will have to choose between devastating cuts to education and other social services, imposing new taxes on Alaskans, repurposing PFD dividends, or fixing tax loopholes that benefit out-of-state billionaires.

The best choice is obvious. The Alaska Constitution instructs the Legislature to ensure that Alaskans get the “maximum benefit” from the development of our natural resources. Yet a special class of businesses — S corporations — has made billions from our public lands without paying state income taxes. The S corporation structure allows these companies to enjoy a single layer of tax through a personal income tax, like private businesses, while protecting themselves from liability, like a traditional corporation. In most states, S corporation owners pay a state personal income tax on their earnings. Other states without a personal income tax, like Texas, impose a franchise tax on S corporations. Alaska is one of only two states in the country that taxes traditional corporations but not S corporations (the other state, Florida, brings in revenue with a sales tax instead).

Fortunately, the Legislature appears poised to correct the S corporation tax loophole. Senate Bill 92 would impose an income tax on oil and gas S corporations operating in Alaska — traditional corporations already pay income taxes in Alaska. The bill would make a meaningful dent in our state budget deficit; the Department of Revenue estimated that SB 92 would bring more than $100 million per year through 2030. That money could fund public schools and critical infrastructure.

Instead, we are giving that revenue away to a billionaire in Texas. In 2020, affiliated S corporations, Hilcorp and Harvest Midstream, acquired all of British Petroleum’s Alaska assets — including its nearly 50% share of the Trans-Alaska Pipeline System. Tens of millions in annual corporate income tax revenue from BP disappeared. While we can’t recover that lost revenue, we can modernize Alaska’s tax code to accommodate the increasing proportion of S corporations in our oil and gas industry.

Alaskans should also be frustrated by the way that the S corporation loophole diverts tax revenue from the state to the federal government. S corporations, like anyone else, write off state income taxes on their federal tax returns. Alaska’s nonsensical tax code means that S corporations pay more income taxes to the federal government while the state gets no revenue at all.

Oil and gas interests have suggested that the state will somehow bring in more revenue by not taxing S corporations. This is a misguided argument that has been proven wrong throughout Alaska’s history. It is foolish to assume that a large company with operations across the country would reinvest extra profits in Alaska. That company is just as likely to transfer the capital to projects in the Lower 48 or simply enrich its billionaire owner. The Legislature can guarantee investment in Alaskans by taxing S corporations and using the revenue to fund public services.

It is equally silly to argue that imposing an income tax would be unfair to S corporations. It is unfair that traditional corporations pay state income taxes while S corporations don’t! Nearly every other state in the country — red or blue — creates a level playing field for business by taxing S corporations. Changing Alaska’s tax code to reflect the national consensus is foreseeable and common sense.

An overwhelming majority of Alaskans in every region of the state — 77% on average — want Hilcorp to pay a state income tax. This unusual consensus reflects the clear right choice on this issue. Do the state legislators representing you care about fiscal responsibility, tax parity, and addressing our budget deficit? Consider giving them a call to find out and to express your support for SB 92.

Catherine Rocchi is the regulatory lead for the Alaska Public Interest Research Group, a nonprofit consumer advocacy group. She holds a bachelor’s degree from Dartmouth College, a law degree from Stanford Law School and a master’s from the Stanford School of Earth. Before joining AKPIRG, she worked as a law clerk at the Alaska Supreme Court.

• • •

The views expressed here are the writer’s and are not necessarily endorsed by the Anchorage Daily News, which welcomes a broad range of viewpoints. To submit a piece for consideration, email commentary(at)adn.com. Send submissions shorter than 200 words to letters@adn.com or click here to submit via any web browser. Read our full guidelines for letters and commentaries here.

Alaska

Private company takes over feasibility assessment and development of $44 billion Alaska LNG project

The long-struggling, $44 billion Alaska LNG project has landed a private partner that will take over majority ownership of the company that seeks to deliver natural gas from the North Slope to Alaskans and the world.

The Glenfarne Group will also lead development of the project to construction and operation after the board of the Alaska Gasline Development Corp. on Thursday agreed to a binding deal with the company, according to a statement from AGDC, a state agency.

“Glenfarne’s financial, project management, and commercial expertise is well matched to lead this vital project forward,” said Brendan Duval, Glenfarne’s founder. “Alaska LNG will provide desperately needed energy security and natural gas cost savings for Alaskans and give Glenfarne unmatched flexibility to simultaneously serve LNG markets in both Asia and Europe through our three LNG projects.”

The change in ownership is significant in part because the state corporation has run the project on its own for nearly a decade, after the major oil companies that were its original partners backed out in 2016.

Glenfarne, founded in 2011, is a New York company that develops, owns and operates energy and infrastructure projects. The company is the developer, owner and operator of Texas LNG, the most recent U.S. LNG project to fully sell its LNG volumes with a total market value over $60 billion, its founder Brendan Duval said in February.

“Alaska LNG will ensure a brighter future for generations of Alaskans and I look forward to working with Glenfarne as they lead Alaska LNG forward,” said Frank Richards, president of the AGDC.

“Today is a historic day for Alaska,” Gov. Mike Dunleavy said. “Alaska LNG will strengthen the U.S. geostrategic position in the North Pacific, provide vital energy security for our residents, our military bases, our businesses, and our Asian allies, and unlock billions in economic benefit at home and abroad.”

The project has seen renewed interest from Asian companies that might serve as investors or gas buyers, and President Donald Trump has touted the pipeline as a key project he’d like to see built.

Trump said in his speech to Congress this month that his administration is working on a “gigantic” natural gas pipeline, referring to Alaska LNG. The project’s gas exports to Asia could be so large that they could help alleviate trade imbalances.

The state gas line corporation declined to release the contract with Glenfarne.

The project envisions development of a roughly 800-mile pipeline delivering natural gas from the North Slope. The gas would be processed at a treatment plant on the North Slope and liquefied in Nikiski on the Kenai Peninsula, then exported to Asian markets in oceangoing tankers.

Richards told the gasline board on Thursday that the deal calls for Glenfarne to assume 75% equity of 8 Star Alaska, the state agency’s project development company. The state gas line agency will hold the remaining ownership.

The state has the option to invest in individual facilities such as the gas treatment plant, he said.

“We’ve reserved the right for investment, for the state, of up to 25% in any of the subprojects or all,” Richards said. “And that will be an ongoing discussion with the Legislature and the administration on if that is an opportunity they would like to take or not.”

Glenfarne will cover the costs of the engineering and design work that needs to be completed before a final decision to build the project is made. Duval said the money will come from a consortium of private investors, but a federal loan guarantee could help support that effort, he said.

“They will fund and resource the Alaskan LNG project to final investment decision,” Richards said. “This covers the entire Alaska LNG project, and not just the initial phase of the pipeline.”

Duval said it’s possible a final investment decision could be made by the end of this year. LNG deliveries could begin in 2030 or 2031, he said.

It is unclear what investors, if any, would provide the large sums of money for construction of the project.

It’s also unclear where the natural gas would come from. The agency has signed a deal with a small oil and gas explorer in Alaska in an effort to provide gas for the first phase. Great Bear Pantheon, however, currently does not produce oil or gas. There’s no guarantee it will produce gas in Alaska.

Richards said the gas line agency is working on securing gas sales precedent agreements with other producers, including for gas at the Point Thomson and Prudhoe Bay fields.

Richards said the agreement with Glenfarne covers the entire Alaska LNG project, and not just the initial phase of the pipeline. “So gas treatment, pipeline and liquefaction (plant). But the priority is going to be the phase-one pipeline and gas for Alaskans,” Richards said.

The first phase of the project has been estimated to cost $11 billion. It calls for the construction of a 750-mile pipeline to deliver the gas from the North Slope to the Interior and Southcentral Alaska, where electric utilities are looking at importing natural gas as Cook Inlet gas dwindles.

After the first-phase construction, the larger project to export the gas can be built, according to the plan. That portion of the project includes the construction of a liquefaction facility.

Richards said he was calling into the meeting from Asia. He said he was on a trade mission with Glenfarne and Gov. Dunleavy to Asian countries, looking for companies that might commit to buying Alaska’s gas or investing in the project.

This is a developing story. Check back for updates.

Alaska

Opinion: Big-game guiding bill in the Alaska Legislature had problems last year — and has problems now

In the 2024 Alaska legislative session, there were companion bills in the Senate and House to create a big game guide concession pilot program on state lands that would have a startup cost of half a million dollars. The organization I represent — Resident Hunters of Alaska — opposed the bills, for reasons I’ll explain later.

The ostensible rationale of these bills was that there were no limits on the number of hunting guides who could operate on state lands, and this was causing all kinds of problems — from conflicts in the field to overharvests of our wildlife. Exclusive guide concessions in certain areas, limiting the number of guides who could operate there, would fix the problems.

The Senate version of the guide concession program bill (Senate Bill 253) was heard in the Senate Resources Committee last session but never moved out of committee. The House version (House Bill 396) was heard in House Resources and passed out of that committee and was awaiting a hearing in House Finance. It was clear that House Finance, with our continuing budget crisis, was not going to pass the bill with a $500,000 fiscal note. It was never heard in House Finance.

In the final hours of the 2024 session, the language of HB 396 – along with other bills that had not passed – was inserted into another bill by Sen. Scott Kawasaki (SB 189) to extend the Alaska Commission on Aging. Legislators well understood that attaching all these other bills to Sen. Kawasaki’s bill to extend the Alaska Commission on Aging did not comply with the “single subject” rule, which was specifically written to prevent these kinds of shenanigans.

Sen. Kawasaki knew, too, that his bill—with all the other legislation now contained in it—didn’t comply with the single subject rule, but he wanted his bill to pass and voted for it, along with most legislators. So, SB 189 to extend the Commission on Aging, along with the guide concession program bill and others, passed the legislature and was sent to the Governor for his signature. You can read the final bill here.

SB 189 was not signed by the governor because he was advised that the way it passed wasn’t legal. However, everything within the final bill — including a guide concession pilot program — did become law, though the guide concession program wasn’t funded.

Subsequently, former Rep. David Eastman sued the legislature over the single subject rule violation. The case is currently awaiting judgment.

Fast forward to the current 2025 legislative session. Legislators were told that to resolve the Eastman lawsuit, everything within SB 189 that violated the single subject rule — including the guide concession program — had to be re-submitted exactly as written the previous session and pass this session.

The current guide concession program bill is Senate Bill 97, sponsored by the Senate Resources Committee. We again recommended some amendments to the bill. If this was going to pass, at least make it so the state was paid back by the guide industry, along with some other fixes to the bill. Some of those amendments were offered in the Senate Resources Committee and had majority support, but the legislative attorney told the committee that any amendments to the bill would not moot the Eastman challenge. The bill needed to pass exactly as written, including with any appropriations.

So, the bill wasn’t amended and SB 97 passed out of Senate Resources and will now go to Senate Finance, where members of that committee won’t question the half-million-dollar fiscal note as they would have under normal circumstances. They will vote to spend money we don’t have, pass the bill, and move it out of committee because they’ve been told that’s the only way to stifle the Eastman lawsuit. The final bill will pass both houses for the same reason.

The situation we are in now is one in which legislators knowingly violated the law the previous session, were called on it by a former legislator they don’t particularly like, and now, in order to fix their mistake, are going to double down on it so that former legislator doesn’t make them look bad. That isn’t the way bills are supposed to become law. You aren’t supposed to violate the law and then fix the mistake by doing an end-run around the process.

The main reason we oppose a guide concession program is that the problem was never “too many guides.” The problem is too many nonresident hunters who are required to hire a guide being given unlimited hunting opportunity by the Board of Game! Limit the number of nonresident sheep hunters, for example, that take 60-90% of the sheep harvested in some areas, and you thereby limit the number of guides they are required to hire. But the Board of Game refuses to limit nonresident sheep hunters, saying they only support a costly guide concession program as a solution.

The Big Game Commercial Services Board is the body that regulates the guide industry and has been saying for nearly twenty years that there are too many guides. They have the duty and authority to limit guides, yet have done nothing to check their own. They also only support a guide concession program as a fix.

Read our letter of opposition to a guide concession program here.

Either board could fix the known problems without such a high cost to the state. The reason they have refused to do so for so long is because a guide concession program is the guide industry’s preferred solution. Unlike other states, in Alaska we don’t look at things from the point of view of what’s best for resident hunters and our wildlife; we look at it from the point of view of what’s best for the guide industry.

Mark Richards is the executive director of Resident Hunters of Alaska.

• • •

The views expressed here are the writer’s and are not necessarily endorsed by the Anchorage Daily News, which welcomes a broad range of viewpoints. To submit a piece for consideration, email commentary(at)adn.com. Send submissions shorter than 200 words to letters@adn.com or click here to submit via any web browser. Read our full guidelines for letters and commentaries here.

-

World1 week ago

World1 week agoCommission warns Alphabet and Apple they're breaking EU digital rules

-

News1 week ago

News1 week agoZelenskyy says he plans to discuss Ukraine ceasefire violations in a call with Trump

-

News1 week ago

News1 week agoTrump’s Ending of Hunter Biden’s Security Detail Raises Questions About Who Gets Protection

-

Technology1 week ago

Technology1 week agoStreaming services keep getting more expensive: all the latest price increases

-

Sports1 week ago

Sports1 week agoThe BookKeeper – Exploring Manchester City’s finances during a season of change

-

Business1 week ago

Business1 week agoTrump Administration Lifts Ban on Sugar Company Central Romana Over Forced Labor

-

News1 week ago

News1 week agoNASA Astronauts Don’t Receive Overtime Pay for Space Mission But Get $5 a Day

-

Culture1 week ago

Culture1 week ago‘Can’t-miss’ Men’s NCAA Tournament games on Thursday and Friday: truTV FTW?