Maryland

Maryland’s Digital Advertising Tax Defeated

A Maryland circuit courtroom choose has struck down Maryland’s first-in-the-nation digital promoting tax (“Digital Advert Tax”). On Oct. 17, 2021, ruling from the bench, the choose held that the legislation violates the federal Web Tax Freedom Act (ITFA), the Commerce Clause of the U.S. Structure, and the First Modification. This GT Alert supplies some observations on this consequential taxpayer victory.

1. The Determination is Unsurprising, however Important

In 2020 the Maryland Normal Meeting handed legal guidelines that allowed Maryland to change into the primary state within the nation to impose a tax on revenues that sure companies derive from offering promoting companies on a digital interface, together with banner promoting, search engine promoting, interstitial promoting and different comparable promoting companies (“digital promoting companies”).1 In 2021, the Maryland Normal Meeting amended the Digital Advert Tax, notably by including a provision that prohibited companies from straight passing on the price of the tax to clients via a separate charge, surcharge, or line merchandise and exempting sure promoting service suppliers.

Certainly, some tax practitioners opined that the Digital Advert Tax, as enacted, can be discovered void and unenforceable, mainly as a result of the tax was a transparent violation of the ITFA.2 In 1998, Congress enacted the ITFA to ban state and native governments from, amongst different issues, imposing “a number of or discriminatory taxes on digital commerce.”3 The ITFA particularly defines what constitutes a “discriminatory tax.” “Discriminatory tax” is outlined to incorporate “any tax imposed by a State . . . on digital commerce that . . . is just not usually imposed and legally collectible by such State . . . on transactions involving related property, items, companies, or data completed via different means. . . .”4 “Digital commerce” is outlined as “any transaction carried out over the Web or via Web entry, comprising the sale, lease, license, provide, or supply of property, items, companies, or data. . . .”5 Given the above, an unlawful discriminatory tax is one imposed on digital commerce that’s not usually imposed on transactions involving related companies completed via different means.

As soon as enacted in 2021, the Digital Advert Tax was challenged on the federal and state stage.6 Each circumstances challenged the tax on the premise that it violated the ITFA, the Commerce Clause, and the Due Course of Clause. A federal choose’s dismissal of a considerable problem – that the tax violated the ITFA – meant that a lot rode on the state-level ITFA problem to the Digital Advert Tax.

Though the Anne Arundel Circuit Court docket choose’s Oct. 17 determination could have expedited the future of the Digital Advert Tax, the Comptroller could nicely attraction the choice to the Maryland Court docket of Particular Appeals, Maryland’s second highest courtroom. That is partly as a result of, though the Digital Advert Tax is barely supposed to be imposed on a restricted variety of companies, the authorized affect of this case transcends the taxation of digital promoting. The case has implications for a way far states can search to increase their tax bases to incorporate sure forms of digital commerce whereas contemplating ITFA restraints.

2. Maryland’s Digital Advert Tax Served as a (Defective) Blueprint for Different States

To date, Maryland’s Digital Advert Tax served as a mannequin for different states to contemplate. That is shocking contemplating the plethora of non-ITFA associated points that additionally plagued the legislation. However in evaluating the circumstances beneath which the tax was born, it appears clear Maryland’s legislation was not the perfect one to function a nationwide mannequin.

2020 was poised to be the 12 months of the Kirwan Fee on Innovation and Excellence in Schooling’s Blueprint for Maryland’s Future, a multi-year initiative devoted to growing and recommending appreciable instructional coverage reforms in Maryland. The reforms span over 10 years and are estimated to value the state an extra $2.6 billion within the fiscal 12 months 2030, in response to the Normal Meeting. So, it was no shock when the legislative session opened with a plethora of tax proposals, looking for to extend state income to fund the Kirwan Fee’s plan, with a tax on digital promoting to function the chief income generator for the multi-year instructional reform plan.

On March 17, 2020, the Normal Meeting introduced it might finish its session on March 18, 2020—resulting from COVID-19—and reconvene in Might. Following the announcement, legislatures hastened to cross legal guidelines, with many centered on funding the Kirwan Fee’s suggestions. These have been the circumstances beneath which the nation’s first tax on digital promoting was handed.

For states trying to enterprise into the taxation of an ecosystem as complicated, huge, and layered as digital promoting, Maryland’s legislation could be used as a roadmap of what to keep away from when embarking on the endeavor of taxing beforehand untaxed digital commerce.

* Greenberg Traurig is just not formally registered to supply authorized companies in Maryland. Particular Maryland legislation questions and Maryland authorized compliance points, nonetheless, may be addressed by attorneys licensed to observe legislation in Maryland.

1 Md. Code Ann. Tax-Gen § 7.5-101(D).

2 See e.g., Maryland State Bar Affiliation Part of Taxation Testimony, Jan. 29, 2020.

3 Pub. L. No. 105-277, Title XI, 112 Stat. 2681 (1998) (enacted as a statutory be aware to 47 U.S.C. § 151); ITFA § 1101(a). Sure provisions of ITFA have been subsequently amended by laws enacted in 2004 and 2007. See Pub. L. No. 108-435, 118 Stat. 2615 (2004); Pub. L. No. 110-108, 121 Stat. 1024 (2007). All references to the ITFA on this Alert consult with the ITFA in its present type, until particularly acknowledged in any other case.

4 ITFA § 1105(2)(A)(I).

5 ITFA § 1105(3).

6 Chamber of Commerce of america of America et al. v. Franchot (Civil No. 21-cv-410 (D. Md., filed Feb. 18, 2021); Comcast of California/Maryland/Pennsylvania/Virginia/West Virginia LLC et al. v. Comptroller of the Treasury of Maryland, Case No. C-02-CV-21-000509 (Md. Cir. Ct Anne Arundel Cty.).

©2022 Greenberg Traurig, LLP. All rights reserved. Nationwide Legislation Evaluate, Quantity XII, Quantity 291

Maryland

University System of Maryland to only allow university-sponsored events on October 7

University of Maryland President William Pines announced this weekend that only university-sponsored activities “that promote reflection” will be held on October 7th.

The day will mark one year since Hamas terrorist attacks in Israel killed around 1,200 people and took around 250 hostages. Israel retaliated, declaring war on Hamas, which has resulted in more than 40,000 people dead, according to Gaza health officials.

This came after the Students for Justice in Palestine (SJP) group had reserved the McKeldin Mall and Jewish organizations on campus had reserved Hornbake Plaza on October 7th to mark the day.

The announcement cancels both of these events.

“Jointly, out of an abundance of caution,” wrote Pines in an email to the campus community, “we concluded to host only university-sponsored events that promote reflection on this day. All other expressive events will be held prior to October 7, and then resume on October 8 in accordance with time, place and manner considerations of the First Amendment.”

This policy is in place for all University System of Maryland Schools.

“The intent is not to abridge students’ right to free expression; the intent is, instead, to be sensitive to the needs of our students. Our university communities may use this day to safely come together to reflect and to share, to learn and to listen, and, yes, to challenge one another. That’s the premise—and the promise—of higher education.”

-University System of Maryland Statement

SJP wrote in a statement on its Instagram account: “We as Students for Justice in Palestine are deeply angered, though not surprised, by the University of Maryland administration’s decision to cancel our reservation for a vigil at McKeldin Mall on October 7th.”

It continues, “Rest assured that we will find ways to mark this one year of genocide and one year of resistance.”

University of Maryland students worried about antisemitism on campus

The Jewish Student Union also posted a statement to its Instagram account.

“We are reassured to learn that Students for Justice in Palestine at the University of Maryland will no longer be permitted to host their event on McKeldin Mall, or anywhere on campus, on October 7th,” the organization writes.

“Only university-sponsored events will occur on October 7th,” they continued. “While this is not an ideal situation, it ensures that our physical and psychological safety is protected on this day of grief.”

In the email from Pines, he noted that a safety assessment had been done and that there was “no immediate or active threat.”

The Jewish Student Union added that they would be holding an event to memorialize the day at Maryland Hillel, a center for Jewish life and students, which is located just off campus.

The UMD Chapter of Jewish Voice for Peace also released a statement standing with SJP “in their anger with the university admin’s decision to cancel our registration to hold a joint vigil on October 7th.”

The email from Pines added that “we encourage our entire community to mark the anniversary of October 7 with remembrance and reflection.”

At the moment, it’s unclear what university-sponsored events will take place on October 7th, at the College Park campus.

Maryland

Best Online Colleges In Maryland Of 2024

Pro Tip

Ensure that your prospective college offers globally recognized credentials if you plan to further your education or practice internationally.

Consider Your Future Goals

Considering your goals when choosing an online college helps you select a program that fits your current needs and prepares you for long-term success.

If you intend to work right after graduation, choose a program that aligns with your desired career path. Look for concentrations or specialized tracks that can provide in-depth knowledge in your field.

However, if you plan to pursue further education such as a master’s or doctoral degree, ensure that credits from your online college are transferable to other schools. Also ensure that the college’s credentials are globally recognized, if you intend to work or study abroad.

Understand Your Expenses and Financing Options

Online colleges in Maryland (particularly private institutions), can be quite expensive, compared to other online schools. According to the National Center for Education Statistics, the average undergraduate tuition and required fees for four-year public schools is $9,750 per year; meanwhile, enrollees in four-year private colleges may pay north of $38,000 per year.

If private university tuition is out of your budget, consider enrolling in a state-owned online school such as the University of Maryland Global Campus, which only requires about $8,000 in annual tuition and fees.

Aside from seeking affordable online programs, here are other ways to fund your college education:

- Complete the FAFSA®

- Apply for institutional scholarships

- Take a private student loan

- Enroll in a work-study program

- Ask your employer about a tuition reimbursement program

Maryland

Maryland voters weigh in on presidential election, governor’s approval in new Gonzales Poll

BALTIMORE – With a little more than two months until election day, the majority of Marylanders surveyed in the new Gonzales Poll would vote for Vice President Kamala Harris over Donald Trump for president.

A total of 820 registered voters in Maryland who indicated they are likely to vote in the 2024 general election were queried for the poll by live telephone interviews, utilizing both landline and cellphone numbers between August 24 and August 30.

A cross-section of interviews was conducted throughout the state, reflecting Maryland’s general election voting patterns, the pollster said.

The Gonzales Poll stated that “the margin of error, per accepted statistical standards, is a range of plus or minus 3.5 percentage points and if the entire population was surveyed, there is a 95% probability that the true numbers would fall within this range.”

Presidential survey

According to the latest Gonzales Poll, 56% of Marylanders surveyed said they would vote for Harris over Trump for president.

The poll says 84% of Democrats support the Harris/Tim Walz ticket and 80% of Republicans support the Trump/JD Vance ticket. Also, 83% of Black voters polled would vote for Harris/Walz.

Among the independents, 38% favor Harris/Walz and 36% prefer Trump/Vance, according to the poll.

Gov. Moore’s approval gets a bump

Maryland Gov. Wes Moore, who led the state’s response to the deadly Francis Scott Key Bridge collapse in March, has the approval of 64% of Marylanders surveyed. Moore has a 35% “mostly soft approval” among Republicans who were surveyed (7% strongly approve, 28% somewhat approve),” the poll shows.

His approval rating increased by 33% since the last Gonzales Poll in the winter.

Last month, the governor spoke at the Democratic National Convention in support of Harris, who was nominated as the party’s presidential candidate.

He framed Harris’ candidacy as “the story of a prosecutor who defended our freedoms and had Maryland’s back when we needed it most. And now MVP: We’ve got yours.”

President Biden’s approval

The Gonzales Poll shows that 53% of Maryland voters surveyed approve of the job President Joe Biden is doing, while 45% disapprove. Seventy-six percent of the Democrats believe Biden is doing a good job in office, and 84% of Republicans disagree.

State transportation and juvenile reform

According to the poll, 95% of Marylanders think it is “important for the State to invest in improving its transportation infrastructure.”

And, when it comes to juvenile crime, voters were asked, “What type of laws, in your opinion, ultimately better help our children under 18 who commit crimes – Laws that are strict, which include things such as juvenile detention and boot camps. This hold individuals responsible and accountable for their behavior; or Laws that are lenient, which include social programs and counseling. This recognizes that society is responsible for much of this behavior?”

The poll shows that 58% of Marylanders are in favor of strict laws, which holds juveniles responsible and accountable for their behavior, and only 34% desire laws that are lenient.

“A majority of nearly every demographic group backs strict laws to inspire a sense of personal responsibility and to best assist our juvenile offenders ultimately realize at least a chance at a successful, happy life,” the poll said.

Is the country going in the right direction?

Fifty percent of Marylanders polled say the country is headed in the right direction, while 45% say the country is headed in the wrong direction.

According to the poll, 93% of Maryland voters who think the country is moving in the right direction are voting for Harris/Walz, and 70% of Maryland voters who think the country is moving in the wrong direction are voting for Trump/Vance.

In the previous poll, 41% of voters said the country was headed in the right direction.

“The mood of voters in Maryland vis-à-vis how they perceive things overall going in the country is a tad less grumpy than it was in winter,” the Gonzales Poll said.

-

Politics1 week ago

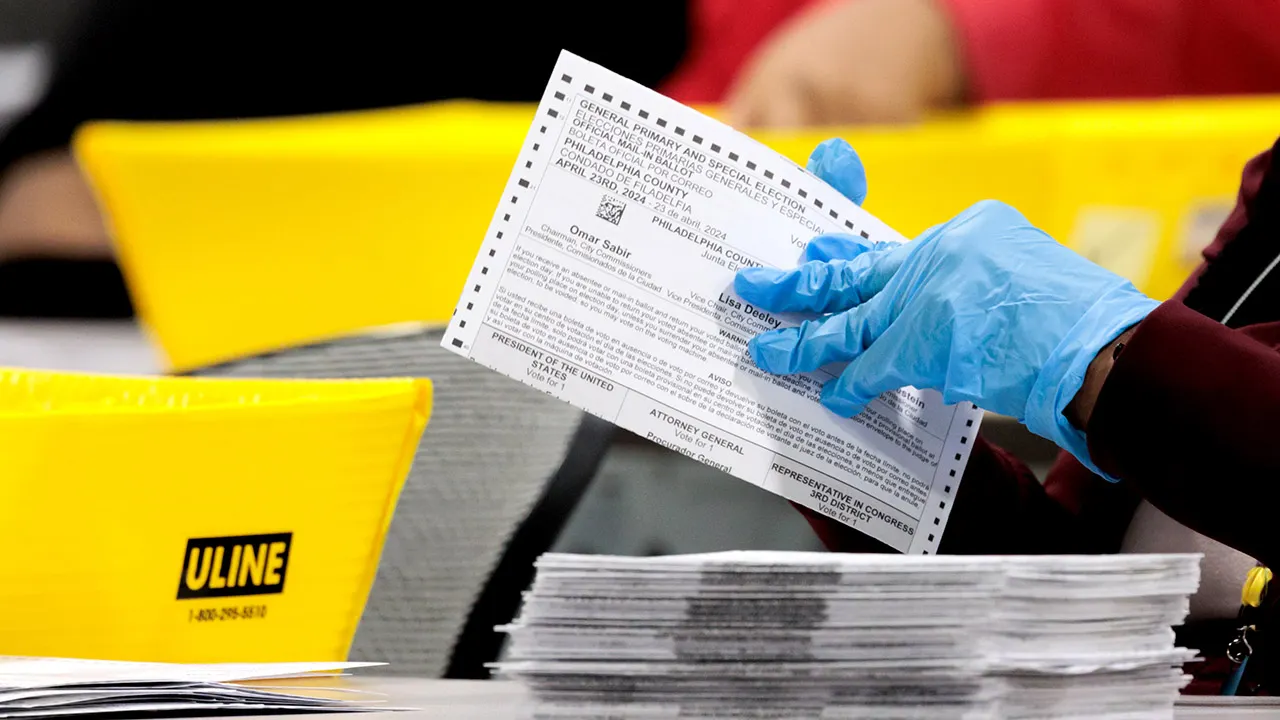

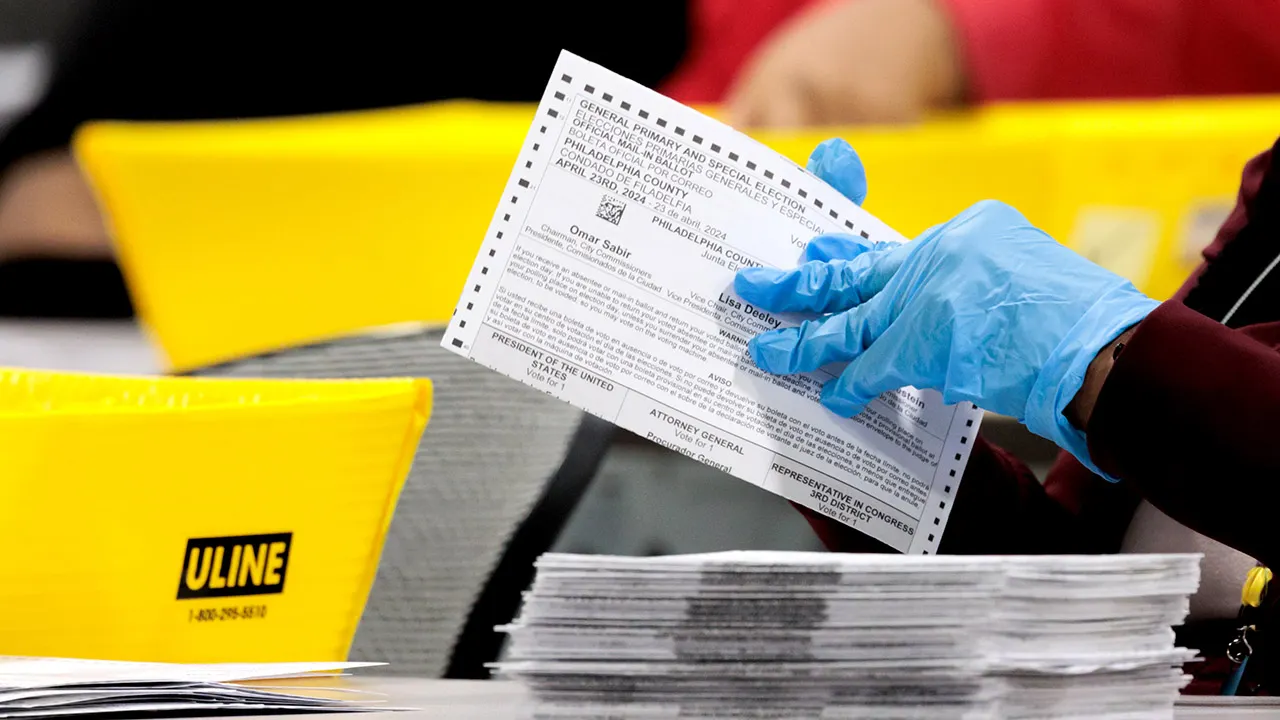

Politics1 week agoWhy won't Pennsylvania voters have results on Election Night?

-

Politics1 week ago

Politics1 week agoTrump sets intense pace with campaign events as questions swirl about Harris' policy positions

-

World1 week ago

World1 week agoPortugal coast hit by 5.3 magnitude earthquake

-

News1 week ago

News1 week agoFormer national security adviser McMaster says he won’t work for Trump again

-

World1 week ago

World1 week agoWho is Telegram CEO Pavel Durov? What to know about his arrest in France

-

Politics1 week ago

Politics1 week agoVP Harris' tiebreaker votes in Senate were key to inflation-boosting Biden policies: expert

-

World1 week ago

World1 week agoPhotos: 300,000 in emergency shelters after Bangladesh floods

-

Science1 week ago

Science1 week agoHow much more water and power does AI computing demand? Tech firms don't want you to know