Florida

Dennis scores 24 points as No. 13 Baylor fends off Florida to win NIT Season Tip-Off

NEW YORK (AP) — RayJ Dennis scored 22 of his 24 points in the second half and added eight assists to lead No. 13 Baylor to a 95-91 win over Florida on Friday in the championship game of the NIT Season Tip-Off.

Jonathan Tchamwa Tchatchuoa, a 6-foot-8 backup forward, hit a 3-pointer — his only basket of the game — to snap a tie and put Baylor (6-0) ahead for good with 9:56 left as the Bears won their seventh regular-season tournament title under 21-year coach Scott Drew, their fifth since 2016.

“Most teams that did well in these preseason tournaments, usually, it bodes well for postseason, because you’ve got to have something to you to win tournaments like this,” said Drew, who coached Baylor to the national title in 2021.

Jalen Bridges scored 23 points while Langston Love had 16 points and Ja’Kobe Walter 11 for the Bears, who shot 56% from 3-point distance (14 of 25) after shooting just 38.9% (7 of 18) in Wednesday’s 88-72 win over Oregon State.

“I think more time in the arena helped,” Drew said. “I think they felt more comfortable and we just took what the defense gave us.”

Riley Kugel had 25 points and nine rebounds for Florida (4-2), which was trying to win its third regular-season tournament title since 2019. Tyrese Samuel had 18 points, Zyon Pullin scored 17 points and Walter Clayton Jr. added 11 points for the Gators.

The teams were tied 41-41 at halftime. After Florida scored the first seven points, Baylor responded with a 27-10 surge and twice led by as many as 11.

Kugel opened the second half with a dunk for Florida, but the Gators missed 14 of their next 16 shots and fell behind 59-52 when Love sank a pair of free throws with 13:02 left. Kugel converted a 3-point play to begin a 7-0 run that he ended with a fast break layup.

After Tchatchuoa’s 3-pointer, Bridges followed with another 3-pointer on the next possession for Baylor and Florida could not catch up.

“Their third-string center hit that big pick-and-pop 3 in the middle of the floor,” Florida coach Todd Golden said. “Hit two or three in a row as a team. That was the separation.”

Dennis was named the tournament MVP. He was joined on the all-tourney team by Bridges and Walter as well as Florida’s Pullin and Samuel.

BIG PICTURE

Baylor: Reserves scored 26 points for the Bears, including 14 in the second half when Walter — who scored a game-high 24 points Wednesday — was limited to two minutes by foul trouble.

“This is certainly the deepest team that I’ve been on in my four years playing and five years total being in college,” Bridges said. “From one to 13, we’re super talented.”

Florida: The Gators played without 7-foot-1 sophomore Micah Handlogten, who suffered an ankle injury in the opening minute of Wednesday’s 86-71 win over Pitt. Clayton Jr. was also hampered by an illness.

“It didn’t affect us on the offensive end, we still scored 91,” Golden said of Handlogten’s absence. “It was more about the defensive end, I think, where it affected us.”

UP NEXT

Baylor: Heads home to host Nicholls State on Tuesday.

Florida: Plays at Wake Forest on Wednesday.

___

Get poll alerts and updates on AP Top 25 basketball throughout the season. Sign up here

___

AP college basketball: https://apnews.com/hub/ap-top-25-college-basketball-poll and https://apnews.com/hub/college-basketball

Florida

'Cautiously Optimistic' on Florida: Defense Costs Down, but Reinsurance Still a Drag

Analysts with the AM Best financial rating firm and other stakeholders are cautiously optimistic about the resurrection of the Florida property insurance market, 18 months after state lawmakers approved monumental litigation reforms.

That was the sentiment gleaned from a Thursday webinar hosted by the rating company and from an AM Best report on the Florida market, released the same day.

“It’s still a little too early to declare a win in the marketplace, but signals do look promising,” AM Best analyst Josie Novak said.

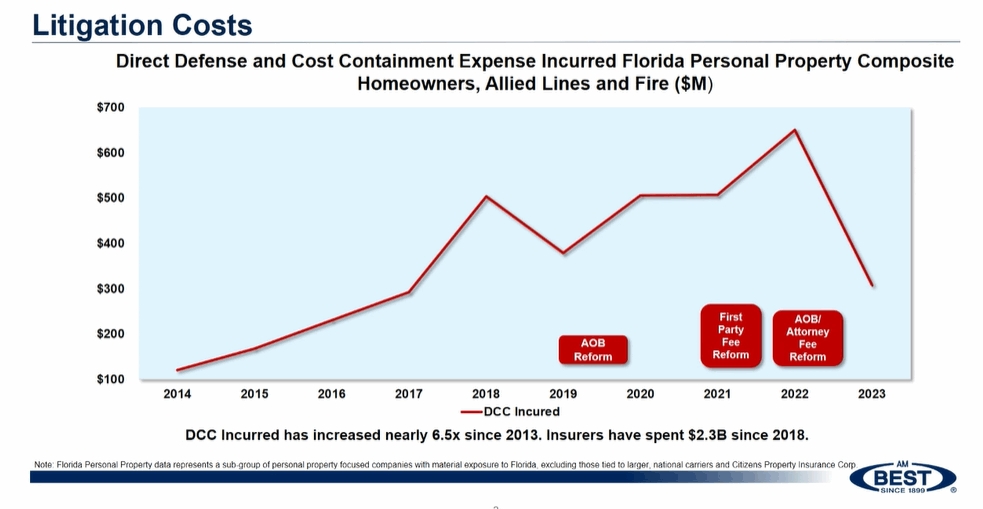

Notably, since the legislation was enacted in late 2022, direct defense and cost containment expense – considered a key measure of the claims litigation burden on carriers – has dropped sharply. In 2022, Florida carriers reported the highest DCC-to-direct-premiums-earned-ratio of all U.S. states, at 8.4%, for homeowners, allied and fire lines. The next-closest state was Louisiana, at 3.6%, AM Best reported.

By the end of 2023, that measure had been cut in half, falling to about $307 million for the 47 insurers that write most of the Florida market, including the state-backed Citizens Property Insurance Corp., but excluding some major national carriers.

“While still early, a downward trend has been observed, indicating the reform has positively impacted results,” the report noted.

While 2023 was a year that saw only one relatively minor hurricane hit Florida, claims and defense costs would have been two to three times higher under under Florida’s pre-reform statutory regime, which had allowed assignments of benefits and one-way attorney fees, said Randy Fuller, the Florida leader for Guy Carpenter, the global reinsurance firm.

Another sign of health in the patient: The combined ratio for Florida-focused carriers, excluding Citizens, dropped to the break-even mark in 2023, outpacing AM Best’s national property insurance composite measure. Citizens’ combined ratio fell to less than 81%.

“These are results that have not been seen since the earlier part of the latest decade,” the report noted.

The expense ratio for the Florida specialists fell to about 26%, down from a high of 35% in 2019. Loss-reserve development for Florida insurance carriers also is showing promise, with favorable numbers for the first time in years, AM Best said.

Florida carriers also added significantly to policyholder surplus last year – without major cash infusions. From 2019 to 2023, the Florida-focused insurers, including those that became insolvent, received $2.6 billion in capital contributions, but surplus grew by just $239 million, the analysis showed.

But in 2023, surplus had jumped by $532 million and that was was not dependent on capital contributions.

The news about the reinsurance market was a little more of a mixed bag. After three years of turmoil, spiking reinsurance rates, limits on coverage and higher retention levels, the 2024 renewals for most Florida carriers seem to be “incredibly stable,” Fuller said.

The legislative changes have created some optimism among most reinsurers, analysts said.

But reinsurance costs are still weighing heavily on insurers, and Florida carriers have a much higher dependency on reinsurance than insurers in other parts of the country – almost 10 times the national average, the AM Best report noted. From 2019 to 2023, unaffiliated ceded premium for the Florida insurers more than doubled, from $3.1 billion to $6.4 billion.

Although many carriers have sharply raised rates for policyholders in recent years, the growth in direct premium written has not kept pace with the growth in ceded premium, the report found.

“The materially higher position indicates greater direct risk borne by Florida specialists, necessitating more effective risk transfer, underwriting, pricing, and risk exposure management,” the report said.

Still, other signs point to improved market conditions, including modest rate decrease requests from several insurers and the approval of eight new carriers for Florida this year. Most of those new companies are reciprocal exchanges, a model that some insurance agents until recently had been unfamiliar with, said Dave Newell, vice president of membership and industry relations for the Florida Association of Insurance Agents.

But once the model was explained to agents, “they have become more comfortable with it,” Newell said in the virtual conference.

The full report can be seen here.

Topics

Florida

Trends

Reinsurance

Florida

Florida Democratic lawmaker reacts to Trump’s verdict

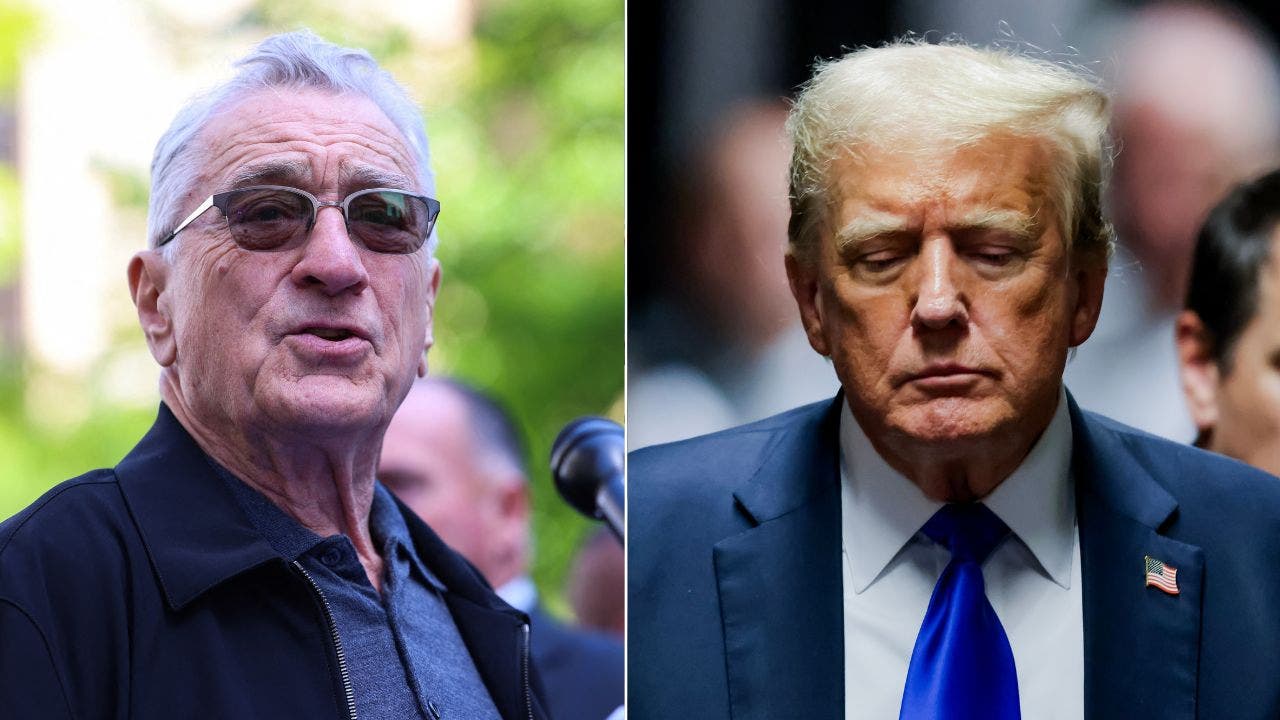

WESTON, Fla. – After a jury found former President Donald Trump guilty Thursday, U.S. Rep. Debbie Wasserman Schultz released a statement saying no one is about the law in the United States.

From Weston, Wasserman Schultz, a Democrat who supports President Joe Biden’s re-election, did not question the legitimacy of the hush-money conviction in New York City.

“No matter what Trump says, a jury determined the facts in this case were clear beyond a reasonable doubt. Yet like any felon, he can appeal this conviction,” Wasserman Schultz wrote.

She also referenced other cases Trump is fighting and accused him of trying to overturn the last election and added that the conviction “affirms that the rich and powerful – and even ex-presidents – still face accountability in America.”

President Joe Biden’s campaign distributed a fundraising appeal after the verdict saying, “We’re THRILLED that justice has finally been served, but this convicted criminal can STILL win back the presidency this fall without a huge surge in Democratic support.”

Copyright 2024 by WPLG Local10.com – All rights reserved.

Florida

Spring Break In Florida Was Way Different When I Was Young – Town-Crier Newspaper

The Sonic BOOMER

My uncle owned a motorcycle store in Broward back when Fort Lauderdale was the exotic vacation destination for college-age spring breakers. This was before Cancun, Cabo San Lucas and Jamaica took over. Back when I was in college, a lot of kids like me paid their own tuition and, therefore, sought out a sunny location that met their primary requirement of being within hitchhiking range.

I didn’t hitchhike to Fort Lauderdale but saved up for two years so I could fly. My cost-saving plan was to take off on a wing and a prayer with a 21-year-old, first-time pilot, who had tacked an index card onto the campus bulletin board. It would be him, two of his friends, two more strangers and me.

Long story short? The weather was so horrific that the control tower sent us out over the gulf so that our inevitable crash wouldn’t be into houses. I may have had a near-death experience before we landed. And then, even though he’d taken my round-trip airfare, the pilot “ran out of money” and re-sold my seat, leaving Florida early without me. Fun times.

But you know, kids. Resilient. I had a place to stay (my uncle’s), so I figured I’d get my refund when I got back to Milwaukee. No sweat. Also, no refund.

But we must return to my story after that 100-word essay detour to What-I-Did-On-My-College-Spring-Break Land.

My uncle owned a motorcycle shop. And, because of that, our family was into motorcycles. Both my brothers became absolute fanatics after working for him a few summers, and even I had a bright yellow 60 cc scooter.

My youngest brother (rapidly approaching retirement age) currently owns a paint and body shop where he has pre-painted more than 30 motorcycle gas tanks in preparation for the idyllic gear-head decades stretching ahead of him. He can’t wait.

My other brother Jim (an unsung creative genius) took a full-size Triumph cycle, “sliced” it in half horizontally with a piece of tempered glass and turned it into a coffee table. As a bonus, there was a one-of-a-kind table lamp which revved to life when you pressed down on the accelerator.

My two brothers displayed these companion pieces of art in a Wisconsin bar during a cycle show, and Jim was immediately offered $30,000 for the set on opening day ($50,000 in today’s money). However, because he’s an artist, he turned that down because “they’re not really for sale” and “anyway, no one has seen them yet.” This museum-quality mentality almost cost him a divorce, in addition to 30 grand.

As for me, I had a great time on my scooter. I didn’t give it up until I flopped my helmet onto my ob/gyn’s examination table at eight-and-a-half months pregnant, and he gently suggested I garage the bike for a while. I ended up selling it because (as he already knew, and I didn’t), it’s not really safe to cram an infant into a wire basket and take off.

Sometimes it’s hard being a girl.

-

News1 week ago

News1 week agoThe states where abortion is on the ballot in November : Consider This from NPR

-

News1 week ago

News1 week agoRead Prosecutors’ Filing on Mar-a-Lago Evidence in Trump Documents Case

-

Politics1 week ago

Politics1 week agoMichael Cohen swore he had nothing derogatory on Trump, his ex-lawyer says – another lie – as testimony ends

-

Politics1 week ago

Politics1 week agoAnti-Israel agitators interrupt Blinken Senate testimony, hauled out by Capitol police

-

World1 week ago

World1 week agoSerbian parliamentary minnow pushes for 'Russian law' equivalent

-

World1 week ago

World1 week agoWho is Ali Bagheri Kani, Iran’s acting foreign minister?

-

Technology1 week ago

Microsoft’s new Windows Copilot Runtime aims to win over AI developers

-

News1 week ago

News1 week agoBuy-now, pay-later returns and disputes are about to get federal oversight

/cdn.vox-cdn.com/uploads/chorus_asset/file/25458338/DSC00620.JPG)