Vermont

State Budgets Are So Flush, Even Vermont & California Progressives Are Cutting Taxes

Vermont Capitol constructing in Montpelier

getty

It’s not usually the Vermont statehouse, a legislative physique run by progressive Democrats, passes a tax invoice seen as a mannequin to be adopted by lawmakers in different states, each pink and blue. But that’s the case after the Vermont Legislature’s Could 12 passage of Home Invoice 730, laws chopping the state excise tax price for spirits-based canned cocktails, sometimes called ready-to-drink (RTD) drinks.

HB 730, which is now on Governor Phil Scott’s (R) desk awaiting his consideration, would finish a tax disparity within the grownup beverage market that is a matter in most states and on the federal degree. Presently the federal authorities and most state governments assess the next excise tax price on spirits-based RTD drinks than on competing drinks like grownup seltzers. Regardless of having an alcohol content material just like spirits-based RTD drinks, grownup seltzers like Really and White Claw are assessed a a lot decrease excise tax price just because they’re made with fermented sugar.

HB 730 reduces the state excise tax on spirits-based RTD merchandise from $7.68/gallon to $1.10/gallon, which can present aid to Vermonters amid the best inflation in 4 a long time. HB 730 would additionally enhance client comfort, increasing entry to spirits-based RTD merchandise by permitting 1,030 personal beer and wine retailers to promote them, one thing that’s at the moment prohibited by state regulation.

If Governor Scott indicators HB 730 into regulation, many Vermonters would see tax financial savings on their Fourth of July festivities. That’s as a result of HB 730, if enacted, takes impact on July 1, 2022, the primary day of the brand new fiscal 12 months.

“Not solely are Vermont spirits shoppers inconvenienced by having to go to a separate retailer to buy spirits-based ready-to-drink cocktails, however in addition they incur greater costs because of the extreme tax burden positioned on these merchandise,” stated Jay Hibbard, Distilled Spirits Council of america Senior Vice President of State Authorities Relations. “There isn’t a cause merchandise with the identical or related alcohol content material must be taxed at such wildly various charges. Making a extra equal tax price for spirits-based RTDs will assist Vermont’s distillers, decrease prices for shoppers and usher in income for the state. We thank the Legislature for shifting this measure ahead and encourage Governor Scott to signal the invoice.”

The introduction and passage of comparable payments in different states, with assist from each Democrats and Republicans, demonstrates the bipartisan enchantment of the tax aid and equalization present in HB 730. After the enactment of laws in 2021 to scale back the excise tax price on RTD merchandise in Nebraska and Michigan, a dozen states have thought of such laws in 2022. Arizona is poised to be the following state the place lawmakers reduce taxes on RTD drinks so that they’re taxed at the same price as competing merchandise with roughly the identical alcohol content material. Home Invoice 2627, which might accomplish this aim, is now pending within the Arizona Home of Representatives, which is predicted to adjourn within the subsequent few weeks.

“These two issues proper subsequent to one another are primarily the identical factor however one is charged 16 cents a gallon and the opposite is charged $3 a gallon,” stated Arizona Consultant Jeff Weninger (R) of the disparity in alcohol excise taxation that he and his colleagues are attempting to rectify with HB 2627.

Not everyone seems to be on board with the aim of accelerating fairness in alcohol excise taxation by lowering the tax price on spirits-based RTD merchandise. The primary opposition to such proposals comes from the makers of onerous seltzers that take pleasure in a tax benefit just because they’re made with fermented sugars, regardless of having related alcohol content material as spirits-based RTD drinks.

Tax Reduction Is A Extra Bipartisan Affair In 2022

Vermont isn’t the one state the place Democrats have handed tax cuts this 12 months. In Kansas, for instance, Governor Laura Kelly (R) just lately signed laws phasing out the gross sales tax on groceries over a number of years. The gross sales tax utilized to groceries in Kansas will drop from 6.5% to 4% in 2023, fall once more to 2% in 2024, after which go to zero in 2025.

In the meantime Kelly’s Democratic counterpart in Colorado, Governor Jared Polis, just lately signed into regulation a property tax aid package deal that may save Colorado households and employers $700 million over the following two years.

“Each Colorado home-owner could have their property tax price go down,” Governor Polis stated of the reform package deal he signed on Could 16. “Along with that, there may be an excellent larger property tax reduce for business properties as a result of business properties in Colorado wind up paying, considerably unfairly, a a lot greater price. That’s due to a method that Colorado used to make use of that voters lastly revoked, however its legacy continues to be there.”

The property tax aid invoice enacted by Governor Polis was authorized by a Democrat-led legislature, however handed with bipartisan assist.

“The worst sort of taxes are property taxes the place you might be actually paying the federal government lease on one thing you got that they didn’t enable you to pay for,” stated Colorado Consultant Patrick Neville (R). “So that is the worst sort of taxes and something we are able to do to supply aid for these taxes, I’m on board.”

Even in California — house to the nation’s highest state revenue tax price, the best state gross sales tax price, and among the many highest general tax burdens within the U.S. — main Democrats are proposing tax aid. Governor Gavin Newsom (D), who signed a multi-billion greenback tax hike on employers within the center the pandemic, is now proposing a tax reduce.

In his revised 2022-23 finances plan launched on Could 13, Governor Newsom proposed a complete elimination of the cultivation tax California assesses on hashish. This proposal has gained plaudits from throughout the ideological spectrum.

“This specific tax is exclusive amongst agricultural merchandise in California, and because of the laws handed in 2017 to ascertain tax authorities, it is frequently adjusted for inflation,” writes Purpose Journal’s Scott Shackford. “In consequence, cultivation tax charges really elevated initially of 2022 regardless of this huge black market drawback.”

Other than these blue state tax cuts, Democrats additionally supported vital revenue tax cuts handed in pink states this 12 months. Each Democrat within the South Carolina Home and Senate voted for revenue tax chopping laws this spring. Most Democrats within the Georgia legislature, in the meantime, voted for a invoice signed by Governor Brian Kemp (R) in April that may scale back and flatten Georgia’s private revenue tax. In Mississippi, each Democrat within the Home voted to utterly part out the state revenue tax.

14 states enacted revenue tax aid in 2021. Many extra have adopted go well with this 12 months and there may be nonetheless time left for extra tax cuts to cross in 2022. Colorado residents, for instance, could get an opportunity to enrich the aforementioned property tax aid with a state revenue tax reduce that may seem on the November poll. The developments in state capitals in 2022, even progressive dominated ones like Montpelier and Sacramento, present extra assist for the assertion that we’re in a golden age for state tax aid, a phenomenon that has just lately develop into a extra bipartisan affair.

Vermont

Flooded Fields, Dying Trees: Vermont’s Christmas Tree Farms Grapple with Changing Climate – VTDigger

This story by Fiona Sullivan and Cassandra Hemenway was first published in the Bridge on Dec. 17.

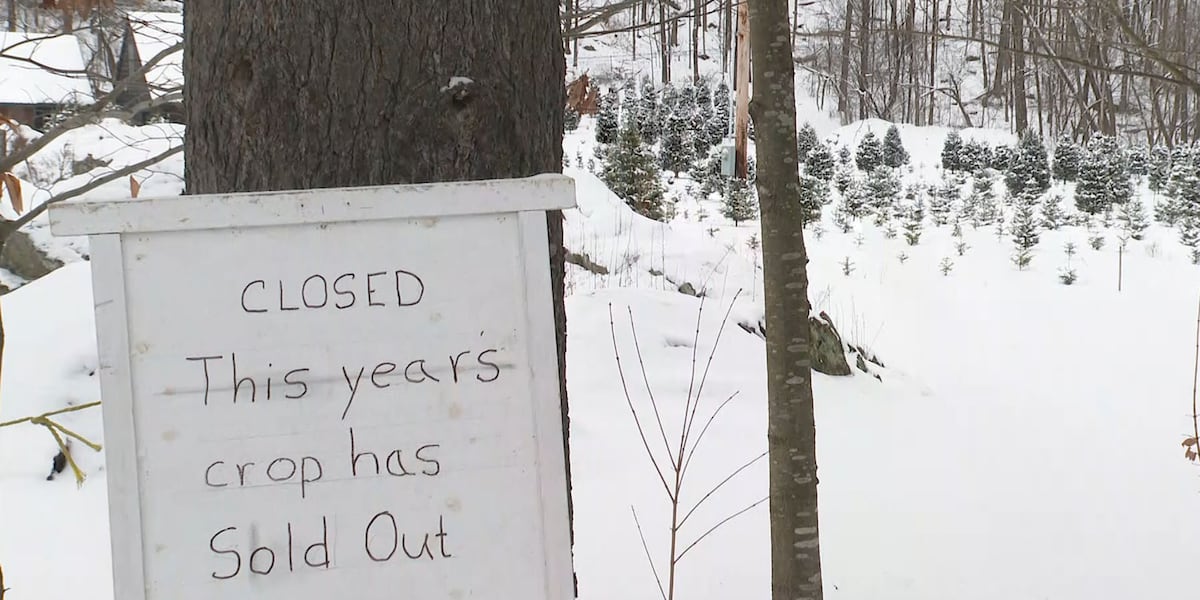

Excess rain caused by climate change could be linked to challenges with growing Christmas trees in Vermont.

“The soil has been saturated for a year or more,” said Steve Moffatt from Moffatt’s Tree Farm in Craftsbury. With saturated soil, Moffatt said, there is a “lack of oxygen, so roots can’t breathe. … when it’s warm and wet in June you get more foliar disease, and the soil is wetter so you get more soil-related diseases.” Moffatt said a “noticeable percentage” of his trees are dead or dying because of soil saturation.

Will Sutton, who co-owns Balsam Acres Christmas Tree Farm in Worcester along with his wife Sue Sutton, said their farm lost 300 trees in the July 2024 flood, and 150 trees were lost in the 2023 flood. As of Sunday, Dec. 15, they had just two trees left for sale.

“We lost a whole year’s worth of trees in the flood,” Will Sutton said, noting that they typically sell about 300 trees at their “choose and cut” location on Elmore Road/Vermont Route 12 each year. “There’s been so much moisture that it’s taking (the soil) longer to drain out, so we’re finding more and more damage to other trees. We culled out 300 trees because of the flood, but we’re now seeing trees that are turning yellow even this late in the season.”

The Suttons have two other fields uphill from their choose-and-cut location, which sits adjacent to the North Branch of the Winooski River. Those fields are not seeing the kinds of tree damage the wetter Route 12 trees are having.

In fact, a study by Trace One notes that Washington County farms are expected to lose a total of $137,148 per year to natural disasters; it goes on to note that “the worst type of natural hazard for Washington County agriculture is riverine flooding, which can inundate farmland, damage crops, and disrupt planting and harvest cycles.”

Back in Craftsbury, Moffatt said he notices a decline in the trees sooner than most people would because his livelihood depends on it. There are “subtle hints,” such as declining color, lack of growth, and a “general look that it’s not that happy.”

Moffatt said he currently grows balsam fir and Fraser fir and has had a similar amount of tree loss between the two species.

Although Fraser fir is more sensitive to cold and has done better with the warmer winters, he said, it is also more sensitive to wet conditions and easily damaged from wet soil. Moffatt also noted that overall there are fewer trees available now compared to 40 years ago. There are fewer people growing trees and planting trees, and, he said, the average age of the tree farmer is 80.

Not all growers have had difficulty growing Christmas trees. Thomas Paine from Paine’s Christmas Trees in Morristown said the effects of climate change are “minimal,” and “the only year we had significant problems [with excess rain] was two years ago.” Much of his soil is gravel and sand, which allows for easy drainage.

Jane Murray from Murray Hill Farm in Waterbury said that although their driveway is muddier than ever before, they have mostly avoided water damage to their trees because they planted on slopes. She said people who planted in valleys have issues, and that most of the damage caused by flooding has been in the Northeast Kingdom.

The Wesley United Methodist Church in Waterbury has stopped selling Christmas trees, at least in 2024. The church’s answering machine states, “We will not be selling Christmas trees this year due to the scarcity of trees and also the higher cost.”

Moffatt maintained “It’s not just me, a lot of people I talk to are having this issue.” He said, “I have to look 10 years down the line.” And with native timber, such as ash, balsam fir, and beech not doing well, he’s considering planting red oak in his other timber lots, he said.

As far as Christmas trees, he is now considering planting trees such as Noble fir and Korean fir, trees that, he said, “I wouldn’t have even considered five years ago.”

Vermont

He was shot in Vermont. Now he wants to go home to the West Bank : Code Switch

Hisham Awartani and his family on the Brown University campus.

Suzanne Gaber

hide caption

toggle caption

Suzanne Gaber

Hisham Awartani and his family on the Brown University campus.

Suzanne Gaber

Hisham Awartani is a college student who was visiting family in Vermont over Thanksgiving break in 2023 when he and two of his friends were shot. All three young men are of Palestinian descent and all three were wearing keffiyehs when the attack happened. They all survived, but Awartani was left paralyzed from the waist down. Over the past year, he’s been recovering and adjusting to a new life that involves using a wheelchair.

Producer Suzanne Gaber has been following Awartani’s story since the shooting — from his physical recovery to the emotional hurdles he’s grappled with at Brown University, where he became a poster child of the divestment movement.

As Awartani prepares to return home to the West Bank for the first time since his injury, Gaber takes us through his year in recovery and what he hopes for as the war in his homeland continues to escalate.

This episode was reported for Notes From America with Kai Wright, a show from WNYC Studios about the unfinished business of our history, and how to break its grip on our future.

Companion Listening:

A Palestinian-American Victim of American Gun Violence Becomes A Reluctant Poster Child (February 19, 2024)

Still In Recovery From Being Shot, Hisham Awartani Commits To a Summer of Activism (June 6, 2024)

Our engineer was Josephine Nyonai.

Vermont

Favorite Vermont Foods and Drinks of 2024 | Seven Days

It can be tough to recall a year’s worth of meals. If you stick to three a day, which food writers rarely do, there are 1,095 to sort through — or 1,098 in a leap year like this one.

Scrolling through photos on my phone — my preferred method of memory jogging — reveals hints of this year’s highlights: my garden’s first asparagus crop, a semi-absurd number of diner meals and a sunny Super Lemonova shared with Adeline Druart, the new CEO of Lawson’s Finest Liquids. My fellow food writer Melissa Pasanen’s camera roll was full of Québécois food and drink from several trips north for work and pleasure. She also found a surprising number of pics of doughnuts, sweet and savory, including a screenshot of the summer special Lobster Doughie at Morse Block Deli & Taps in Barre, which she sadly never tasted herself — though one of our stellar interns did. There’s always next year.

For both of us, 2024 brought farmers market mornings, food truck afternoons and so many restaurant openings that we could barely keep up. As we assembled our favorite bites and sips of the year, we found that most came from new places to eat and drink. We’re happy for the injection of fresh energy, and we feel its positive repercussions in the local food scene.

In Seven Days style, here are this year’s seven favorites from each of us, in no particular order. As you’ll see, it was a good year for biscuits. But also for pawpaws, fancy carrot mochi and vermouth-based cocktails.

— J.B.

Happy as a Clam

Frankie’s, 169 Cherry St., Burlington, 264-7094, frankiesvt.com

If you’ve been paying attention to Vermont’s food scene this year, you won’t be surprised that Melissa and I both had Frankie’s on our favorites list. Why? Melissa summed it up simply: “So many of their dishes.”

I share the sentiment, citing the pork croquettes with a pickled rhubarb sauce that I’d like to drink, electric-green scallop crudo with cucumbers and fermented fennel, sweet corn tortelli, hearty sides of pommes purée and creamed corn, epically savory cabbage, and housemade creemees.

At Frankie’s in Burlington, Hen of the Wood Alums Throw a Party

At Frankie’s in Burlington, Hen of the Wood Alums Throw a Party

By Jordan Barry

First Bite

What I ordered most often at Frankie’s, in some form or another, were the littleneck clams. The swanky-cool restaurant’s proclivity for seafood is a welcome addition to the scene, and the clams are probably as close as its menu gets to a staple. At my first group dinner in the upstairs private dining room, the clams came with crème fraîche, pickled carrots and wild leek focaccia; a month later, with spring onions and green garlic; and in August, with sweet corn, charred jalapeños and pickled zucchini. Consensus, from the first meal on, is that “they slap.”

Cindi Kozak, Jordan Ware and their team have already received national press as one of Eater’s Best New Restaurants in America. I have no insider info or sway, but here’s a prediction: We’ll be writing a story about their James Beard Award nomination in 2025.

— J.B.

Doughnut Double-Down

Twisted Halo Café, 31 Cottonwood Dr., Suite 106, Williston, and 40 Bridge St., Waitsfield, twistedhalocafe.com

In 2024, we continued our food section tradition of kicking off the New Year with doughnuts rather than diets. I drew the short — or was that the long? — straw. The 4:30 a.m. alarm required by the assignment was richly rewarded with Emma Slater’s freshly fried Twisted Halo doughnuts.

Williston-Based Twisted Halo Raises the Bar for Fresh Doughnuts

Williston-Based Twisted Halo Raises the Bar for Fresh Doughnuts

By Melissa Pasanen

Food + Drink Features

In particular, her signature featherlight, crisply crenellated doughnut with a custardy interior is well worth an early wake-up call. Slater calls it a churro, though some might recognize it as an egg-rich, French-style cruller. I prefer it simply dusted with cinnamon sugar, but she dips some in dark chocolate glaze, if that’s your thing.

Extra good news is that this year has brought more days and locations for Twisted Halo. When I wrote about her, Slater was sharing the kitchen at Champion Comics and Coffee in Williston, but as of this month, she and business partner Taylan Hagen have officially assumed the lease and renamed it Twisted Halo Café. Comics are still on offer along with the fresh doughnuts, Tuesday through Sunday.

The Mad River Valley also got lucky. Since late summer, Slater has been operating a Twisted Halo Café in the former Sweet Spot in Waitsfield. In addition to doughnuts, pastries and coffee, that location launched a full breakfast menu in mid-December, with French toast, eggs, and breakfast sandwiches on house-baked brioches, croissants or English muffins.

A doughnut breakfast sandwich isn’t on the menu yet, but so many people have asked about one that “It’s a sign it has to happen,” Slater said.

— M.P.

A Beautiful Beverage

Specs, 7 W. Canal St., Winooski, specs-cafe-bar.com

I’ve found myself drinking less booze over the past year, partly because the local nonalcoholic options are so good and partly because my toddler wakes me up by 6 a.m. most days. When I have a cocktail or two, I tend to choose lower-ABV options. My favorite is the dry vermouth-and-sherry Bamboo, which I’ve had mixed success ordering off-menu around town.

Cue my excitement when Sam Nelis of Specs stirred up an Adonis, the Bamboo’s sweeter counterpart, for me to taste. I’d asked Nelis, in a sort of cheeky way, to share three drinks that sum up his Winooski café-bar-beverage mart. Based on the astonishing array of fortified wines stocked in his shop, I shouldn’t have been surprised that his mind went to the Adonis. (I also shouldn’t have been surprised that we tasted more like 10 drinks, between old-school frothy cappuccinos and his favorite Belgian beer.)

Get to Know Winooski’s Specs Café, Beverage Mart and Future Bar in Three Drinks

Get to Know Winooski’s Specs Café, Beverage Mart and Future Bar in Three Drinks

By Jordan Barry

Drink Up

True to his business’ name, Nelis also presented his specs for the drink. A stirred cocktail that originated in late-1800s New York City, the Adonis contains 1.5 ounces of Contratto vermouth rosso, 1.5 ounces of dry fino sherry, two dashes orange bitters and one dash Angostura bitters. Stir, serve in a coupe and garnish with an orange twist.

I’ve been following his recipe ever since, swapping out the Contratto for whichever fun fortified wine I spot among the 70 options on Specs’ shelves. When Nelis launches the full cocktail bar in spring 2025, I’ll be sure to order one there.

— J.B.

No Passing Fancy

Fancy’s, 88 Oak St., Burlington, 448-2106, fancysbtv.com, now taking reservations

They say absence makes the heart grow fonder, and that does hold true for the dish of carrot mochi I adored on my first visit to Fancy’s, the cozy restaurant that opened in the Old North End in April. The mochi then vanished from the menu, but there was always plenty else frickin’ delicious to eat.

I’ve loved every vegetable-forward dish (and the few with meat or fish) that has sprung from the imagination and kitchen of talented chef-owner Paul Trombly. He is a magician of flavor and texture, as demonstrated by his slender charred eggplants with coconut and South India sambar, as well as his chewy, caramelized halloumi with spiced seeds, date, mint and lemon. Fancy’s smashed cucumber salad is an edible symphony: zippy with lime and soy; crunchy with puffed, curry-dusted rice and candied cashews; and sweet-spicy with mango and house-pickled hot peppers.

At Fancy’s in Burlington, Chef Paul Trombly Delights in Vegetables

At Fancy’s in Burlington, Chef Paul Trombly Delights in Vegetables

By Melissa Pasanen

First Bite

Trombly’s small menu changes regularly based on what local farms supply, and it would be selfish to expect faves to stick around. Still, every time I returned to Fancy’s, I hoped for another bowl of the earthy, intensely carroty “mochi” dumplings, which glutinous rice flour rendered delightfully and unexpectedly bouncy.

Back in the summer, Trombly told me that the moisture-sensitive dumplings were too difficult to make in humid weather. On recent visits, I would not-so-subtly hint that summer was long over. In mid-December, I blinked twice when they finally reappeared on the menu. Each herb-and-cheese-strewn, springy bite was as delicious as my taste memory. Comfort me with carrot mochi.

— M.P.

Do the Jerk

Thingz From Yaad, opening by the end of December at 2026 Williston Rd., South Burlington, thingzfromyaadvt.com

I recently realized that I’m no longer allergic to coconut, and not a moment too soon. In the gray days of March, Shaneall Ferron’s coconut-crusted jerk corn was just the tropical jolt I needed.

Slathered in her signature jerk sauce and rolled in toasted coconut flakes, the skewered cobs were slightly sweet, slightly spicy and, as I wrote in April, “fantastically fun.” They’re a little messy, but that’s what the sticks are for.

Thingz From Yaad Kitchen to Open in South Burlington

Thingz From Yaad Kitchen to Open in South Burlington

By Jordan Barry

Food News

At the time, Ferron operated her Jamaican food biz, Thingz From Yaad, in a former dining hall in Colchester. This month, she plans to open a brick-and-mortar spot in South Burlington. I’ll happily gobble her traditional takes on oxtails or ackee and saltfish, while also looking forward to her new whimsical — and maybe skewered — creations.

— J.B.

My Bologna Has a First Name

Gallus Handcrafted Pasta, 92 Stowe St., Waterbury, 882-8206, gallushandcrafted.com

When our boys were little and their dad occasionally took charge of supper, sometimes he’d buy soft white sandwich bread and bologna and make fried bologna sandwiches. Much as I wrinkled my nose, I have to admit there’s something compelling about the combination of soft, buttery, fried bread and smooth, salty meat with tangy-sweet mayo.

It probably won’t make the chefs at Gallus Handcrafted Pasta in Waterbury happy to know those fried bologna sandwiches came to mind when I first tasted what I’d call a sleeper on their menu.

Gallus Handcrafted Pasta Opens in Waterbury’s Historic Gristmill

Gallus Handcrafted Pasta Opens in Waterbury’s Historic Gristmill

By Melissa Pasanen

First Bite

Gallus, a new venture of chef Eric Warnstedt’s Heirloom Hospitality, opened on June 26 in the historic Waterbury gristmill previously occupied by Warnstedt’s first restaurant, Hen of the Wood. (The latter relocated half a mile away.) Pasta is king there, and I wrote at length about the care with which the pasta team, led by executive chef and co-owner Antonio Rentas, crafts it in yolk-bright, silken sheets.

You’re going to order pasta, of course, but please don’t miss the gnocco fritto, which sit quietly in the menu’s “Share” section with little explanation. The pillowy, savory, fried dough diamonds come topped with wide ribbons of excellent freshly made mortadella (bologna’s relative) from Waitsfield’s 5th Quarter and a just-right drizzle of honey. They are everything that makes a fried bologna sandwich so good — and much more.

— M.P.

It’s All Gravy

Deep City, 112 Lake St., Burlington, 800-1454, deepcityvt.com

Deep City had this spot in the BAG.

Reflecting on the multitude of meals I ate this year, I didn’t find many repeats outside my Addison County takeout staples. But since this spring, when Charles Reeves took over the kitchen at Foam Brewers’ attached restaurant near the Burlington waterfront, I’ve gone out of my way for his iconic buttermilk biscuits slathered in green-tinted, herb-flecked cream gravy. Heck, my husband and I even chose Deep City brunch instead of a fancy dinner for our anniversary this year. I didn’t share.

Reinvented Deep City Brings Penny Cluse Café’s Beloved Brunch Back to Burlington

Reinvented Deep City Brings Penny Cluse Café’s Beloved Brunch Back to Burlington

By Jordan Barry

First Bite

Part of the dish’s appeal is the 24 years of nostalgia baked into every bite: Reeves was the longtime co-owner of the universally beloved Penny Cluse Café with his wife, Holly Cluse. When I covered his early plans to team up with the Foam folks, Reeves said Deep City wouldn’t be Penny 2.0. I’m not the only one who’s glad he changed his mind.

Menu items may have new names — look for the House of Spudology instead of a Bucket-o-Spuds — but the hits are there, including the deeply comforting biscuits and gravy. The starter-size version, called the BAG, is just right if, like me, you also want to get a little choked up over a chile relleno.

— J.B.

Thirsty Like the Wolf

Wolf Tree, 40 Currier St., White River Junction, 698-8409, wolftreevt.com

Ever since Wolf Tree opened in White River Junction in 2019, Jordan and I have had it on our list of destinations for its promising menu of creatively conceived drinks and classy, intimate setting. Unfortunately, it’s a 90-minute drive from Burlington — and, well, cocktails.

I was thrilled for many reasons when a dear friend moved to White River Junction, a town I have long crushed on for its idiosyncratic arts culture and vibrant food and drink scene.

For our “Three to Six Hours” series, my friend and I finished up a full day of exploring WRJ at Wolf Tree, which met all my long-held expectations. I had a hard time choosing from the large menu of intriguing cocktails, which includes a low-alcohol section — helpful for those who lack a designated driver or a local friend on whose floor they can crash.

Three to Six Hours in White River Junction, a Crossroads of Creativity

Three to Six Hours in White River Junction, a Crossroads of Creativity

By Melissa Pasanen

Culture

The Goldilocks, made with pineapple brandy, lemon, sesame orgeat and orange bitters, was just as the menu promised: “not too sweet, not too tart — juuuust right.” I’m planning another sleepover soon.

— M.P.

Butter My Butt and Call Me a Biscuit

Queen City Café, 377 Pine St., Burlington, 489-6412, queencitycafebtv.com

More biscuits! I know, I know. But Queen City Café’s biscuits are the biscuits.

Whether they’re holding together a bacon-laden breakfast sandwich with surprising ease or floating in a gussied-up chicken stew, these flaky, wood-fired biscuits are so good that they had me regularly braving the mess that was Pine Street for much of the year. The vegan one’s no slouch, either.

Queen City Café’s Biscuits Are Hot at Burlington’s Coal Collective

Queen City Café’s Biscuits Are Hot at Burlington’s Coal Collective

By Jordan Barry

First Bite

Chef-owner Sean Richards’ menu reflects both his early cooking career in Tennessee and food memories from his upbringing in Fair Haven — Vermont church lady food, as he put it. If the chef’s fare seems simple, that’s only because of how well he wields his fine-dining chops — and masters the former Myer’s Bagels wood oven. I usually complain about new wood-fired restaurants, given how many we have, but this one I’ll allow.

— J.B.

Pawpaw Patrol

Sugarsnap Farm pawpaws will not be available until October 2025. To grow your own from locally propagated plants, try Perfect Circle Farm in Berlin (perfectcircle.farm) or East Hill Tree Farm in Plainfield (easthilltreefarm.com).

Another year, another round of devastating floods. In the midst of this depressing new normal, an email from business owner and state legislator Abbey Duke landed in my inbox.

Duke has a small Intervale farm that grows some ingredients for her South Burlington-based Sugarsnap Catering. Like all the farms in the river floodplain, it boasts rich soil but now routinely floods during peak growing season. One bright spot, Duke wrote, has been pawpaws. A few trees she planted in 2010 had thrived despite repeated inundations, and her farm was expecting a bumper crop this year.

Say what?

The Tropically Flavored Pawpaw Fruit Thrives in Burlington’s Intervale

The Tropically Flavored Pawpaw Fruit Thrives in Burlington’s Intervale

By Melissa Pasanen

Agriculture

I had barely heard of pawpaws when Duke wrote to me, let alone tasted one, though I knew that some regions of the country have a taste for this cold-tolerant distant relation of soursop and cherimoya. Botanists believe the pawpaw was most likely carried north in the digestive tracts of fruit-loving mastodons.

In October, at peak harvest — the only time one can buy the delicate fresh fruit, which does not ship well — I headed down to the Intervale to see and taste what looked like small mangoes. The Sugarsnap farming team selected a perfectly ripe specimen for me to try. It was really good and shockingly tropical tasting for a locally grown fruit, with notes of coconut and frangipani flower.

Pawpaws won’t save Vermont farms, but they remind us that adaptation has been a constant since the mastodons migrated north.

— M.P.

Tonic Key

Rogue Rabbit, 9 Center St., Burlington, roguerabbitvt.com

I love a chunky pizza slice: Sicilian, Detroit-style and, thanks to Rogue Rabbit, Roman-style pizza al taglio. Abby Temeles and Jacob Shane’s thick square slices easily entered my Burlington lunch rotation this year.

Their casual café’s drink list, though, is what really got me. I loved it so much that I rewrote a Sound of Music classic around their menu: “Espresso with tonic and bitter Negronis / House wine, Vivid Coffee and lots of Peronis / NA Spaghett-i, all kinds of spritz / These are a few of my favorite things.”

Rogue Rabbit’s Pizza al Taglio Squares Up in Burlington

Rogue Rabbit’s Pizza al Taglio Squares Up in Burlington

By Jordan Barry

Food + Drink Features

Since I’m usually at Rogue Rabbit on a workday, the espresso tonic ended up topping that silly list for most consumed. There are quite a few good espresso tonics around Burlington, but whether it’s the pizza pairing or the spot-on proportions of espresso to tonic in the kinda bitter drink, Rogue Rabbit’s is the one I keep going back to.

Now I’ve got a new song to rewrite, with apologies to Sabrina Carpenter: “Thinkin’ ’bout that drink every day, oh / Is it that bitter? I guess so. / I’ll have one for lunch, baby, I know / That’s that tonic espresso.”

— J.B.

Soup Season

Leo & Co., 21 Essex Way, Suite 418, Essex, 857-5386, weareleoand.co

My Jewish grandmothers and mother would have appreciated the deep-dive story I wrote on Montréal’s Jewish food in April. My mum, especially, would have plotzed over the savory chicken liver spread I gobbled down at Snowdon Deli. I similarly plotzed over the unexpectedly delicious matzo ball soup I discovered at the new Leo & Co., much closer to home in Essex.

The counter-service café and market opened in July in the large space that was previously home to Sweet Clover Market. Owner Kayla Silver named her second Essex Experience business for her great-uncle Leo Keiles, who survived the Holocaust. It’s by no means a Jewish deli, but the top-notch matzo ball soup will help me manage until someone opens one of those.

Leo & Co. Brings Creative, Convenient Lunches to Essex

Leo & Co. Brings Creative, Convenient Lunches to Essex

By Melissa Pasanen

Food + Drink Features

The kitchen team roasts chicken bones for the rich broth loaded with veggies. The pair of tender, springy matzo balls in every serving are textbook-perfect and, surprisingly, gluten-free, thanks to Manischewitz gluten-free matzo ball mix.

Leo & Co. also uses a trick that I learned from my New York City grandma. “Always,” she told me with emphasis, “always put seltzer in your matzo balls.”

— M.P.

Flour and Flowers

The Bake Shop at Red Wagon Plants, 2408 Shelburne Falls Rd., Hinesburg, 482-4060, redwagonplants.com

As accidental bakeries go, the Bake Shop at Red Wagon Plants takes the cake. It also takes the cake for pretty much every other kind of bakery.

Through a series of very fortunate-for-us events, bakers Amy Vogler and Carey Nershi teamed up with Julie Rubaud and her Red Wagon Plants team to open an incredible little bakeshop in the nursery’s new herb-processing building. All growing season long, they stocked their glass pastry case with rustic yet refined chive-and-cheddar focaccia, chocolate sourdough, coconut buns, gluten-free brownies, jam pinwheels, banana-chocolate chip cookies, and other sweet and savory delights.

The Bake Shop at Red Wagon Plants Grows in Hinesburg

The Bake Shop at Red Wagon Plants Grows in Hinesburg

By Jordan Barry

Food + Drink Features

Red Wagon was already one of my favorite places. The new shop — with its window framing Camel’s Hump, sit-with-a-stranger-size table, abundant patio garden and meticulously crafted treats — made it practically perfect. It’s hard to choose a favorite item from Vogler and Nershi’s repertoire, so I’ll go with the lighter-than-air orange and golden raisin hot cross bun from the Bake Shop’s first hurrah on March 30.

The bakers are currently taking a break along with the nursery, but they plan to open for the season on April 11 and will pop up before that, on February 15 and March 29. Like the first blooms of spring, their return will be a bright spot to look forward to on winter’s bleakest days.

— J.B.

Noodling Around

Scrag & Roe, 40 Bridge St., Waitsfield, 496-3911, scragandroe.com

When chef Nathan Davis and his former business partner opened Scrag & Roe by the covered bridge in Waitsfield a year ago, the menu was global. The restaurant is still a perfect spot to witness the idiocy of drivers who think their truck will magically clear the bridge’s roof. But, as of September, diners can view such shenanigans while eating from an all-Asian roster.

Davis, now solo owner, makes recipes he fell in love with and learned to cook during six years of living and traveling in Asia. Those include umami-rich, dry-fried shiitake mushrooms with bacon, as well as smashed cucumbers with soy, chile and a slick of sesame oil. They’re all really good, but the standout is his dan dan noodles.

Ski-Town Eats: What’s New at Restaurants Near Vermont’s Slopes

Ski-Town Eats: What’s New at Restaurants Near Vermont’s Slopes

By Jordan Barry and Melissa Pasanen

Food + Drink Features

The bowl of bouncy noodles comes liberally dressed with ground beef in a tongue-tingling sauce that sings with chiles, Sichuan peppercorns, garlic, sesame, black cardamom, orange peel and fermented mustard root. Toasted peanuts add a satisfying crunch. My dining companion and I both deemed the complex, electric blend of flavors and textures craveable.

It’s a bit of a drive, but we’ll be back. Not in a truck.

— M.P.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology5 days ago

Technology5 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps

-

News6 days ago

News6 days agoNovo Nordisk shares tumble as weight-loss drug trial data disappoints

-

Politics6 days ago

Politics6 days agoIllegal immigrant sexually abused child in the U.S. after being removed from the country five times

-

Entertainment6 days ago

Entertainment6 days ago'It's a little holiday gift': Inside the Weeknd's free Santa Monica show for his biggest fans

-

Lifestyle6 days ago

Lifestyle6 days agoThink you can't dance? Get up and try these tips in our comic. We dare you!

-

Technology1 week ago

Technology1 week agoFox News AI Newsletter: OpenAI responds to Elon Musk's lawsuit

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology1 day ago

Technology1 day agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

News2 days ago

News2 days agoFrance’s new premier selects Eric Lombard as finance minister

/cdn.vox-cdn.com/uploads/chorus_asset/file/25784222/247333_EOY_Package_Check_In_CVirginia_ROGUELIKES.jpg)