[1/7]View of a damaged property after the arrival of Hurricane Idalia in Horseshoe Beach, Florida, U.S., August 31, 2023. REUTERS/Julio Cesar Chavez Acquire Licensing Rights

News

Florida’s storm-struck Gulf Coast takes stock as Idalia soaks Carolinas

/cloudfront-us-east-2.images.arcpublishing.com/reuters/3YSJVHVLZNKRBECGCYFLVYMFDQ.jpg)

HORSESHOE BEACH, Florida, Aug 31 (Reuters) – Tropical Storm Idalia drenched the Carolinas with heavy rain before departing the U.S. Eastern Seaboard on Thursday, while officials in Florida, where the tempest made landfall as a major hurricane a day earlier, stepped up recovery and damage-appraisal efforts.

Nearly 36 hours after plowing ashore from the Gulf of Mexico at Keaton Beach in Florida’s Big Bend region, packing Category 3 winds of nearly 125 miles per hour (201 kph), Idalia weakened from a tropical storm to a post-tropical cyclone and drifted out into the Atlantic.

At the height of its fury on Wednesday, Idalia ravaged a wide swath of low-lying and largely rural Gulf Coast landscape and forced emergency teams, some in boats, to rescue dozens of residents who became trapped by floodwaters.

The storm brought fierce winds and drove surging seawater miles inland, strewing the area with fallen trees, power lines and debris. Many buildings were in shambles, and power outages were widespread.

The storm ranked as the most powerful hurricane in more than a century to strike the Big Bend region, a sparsely populated area laced with marshland, rivers and springs where the state’s northern Gulf Coast panhandle curves into the western side of the Florida Peninsula.

The damage and loss of life were less than many had feared, with authorities confirming three traffic-related fatalities linked to the storm in Florida and another in southeastern Georgia.

Idalia’s storm surge – considered the greatest hazard posed by major hurricanes – appeared to have caused no deaths.

Even as Idalia headed out to the Atlantic, the back end of the storm system was producing downpours that were forecast to dump as much as 10 inches (25 cm) of rain in some spots along the coastline of North and South Carolina, the National Weather Service said.

Forecasters had warned of possible life-threatening flash floods in the Carolinas. But local media reports at day’s end said both states had mostly been spared.

Flooding damaged about 40 businesses in the town of Whiteville, North Carolina, marking that state’s most serious brush with Idalia, according to Raleigh-based ABC News affiliate WTVD-TV.

South Carolina’s emergency management center was winding down its operations by afternoon, said Charleston-based station WCSC-TV.

“We were very fortunate this time,” state emergency management chief Kim Stenos was quoted as saying.

‘THE HOUSE IS STILL THERE’

Much of Florida’s Big Bend coast was much less fortunate.

Horseshoe Beach, a community about 30 miles south of landfall, was among those that bore the brunt of Idalia’s impact. Video footage showed scattered remnants of trailer homes sheared from bare concrete foundations. Other trailer homes had toppled and slid into lagoons, and boat docks were reduced to piles of splintered lumber.

John “Sparky” Abrade, a 77-year-old retiree who lives in the community, said he nevertheless felt relieved when he saw the damage to his home, even though the windows were blown out and household items scattered about.

“I’m feeling great. The house is still here,” he said.

Local, state and federal authorities said they would assess the full extent of damage in the days ahead. Insured property losses in Florida were projected to run to $9.36 billion, according to investment bank UBS.

“We’ve seen a lot of heart-breaking damage,” Governor Ron DeSantis said during an afternoon news briefing after touring three communities near where the storm made landfall.

President Joe Biden approved a major disaster declaration for several hard-hit Florida counties, Federal Emergency Management Agency (FEMA) Director Deane Creswell said after touring the area with Decanis. Biden said he plans to visit some of the storm-battered areas on Saturday.

Despite heavy damage to homes in many coastal communities, Idalia proved far less destructive, or lethal, than Hurricane Ian, a Category 5 storm that struck Florida last September, killing 150 people and causing $112 billion in property losses.

The last hurricane documented making landfall on the Big Bend coast with maximum sustained winds of 125 mph was an unnamed storm that struck Cedar Keys in September 1896, devastating the area.

Decanis credited the accuracy of Idalia forecasts tracking its path with helping authorities fine-tune evacuation plans and thus save lives.

“People, particularly in this area – who were in the way of a potential significant storm surge – they did take the proper precautions,” he said.

Across the Southeast, electricity outages from fallen trees, utility poles and power lines were widespread. In all, more than 175,000 homes and businesses were without power in Florida, Georgia and the Carolinas on Thursday, according to Poweroutage.us.

Florida officials said crews would restore most of the state’s electricity within 48 hours.

For some, losses from the storm cut deep.

In Horseshoe Beach, Austin “Buddy” Daniel Ellison, 39, and his father Ronald Daniel Ellison, plodded through the ruins of Ed’s Baitshop, the family’s business. Nearby, their home was badly damaged.

“I ain’t never seen one like this, my Dad never seen one like this,” Buddy Ellison said.

The family was grateful that timely evacuation meant no one was hurt. But the Ellisons said they lacked insurance and will have to leave the area where their family has deep roots.

“This storm is forcing us out of here,” Ronald Ellison said. “As I see it now, it’s over.”

Reporting by Maria Alejandra Cardona in Steinhatchee, Florida, and Marco Bello in Cedar Key, Florida; Additional reporting by Rich McKay and Brendan O’Brien; Writing by Brendan O’Brien and Steve Gorman; Editing by Marguerita Choy, Cynthia Osterman and Miral Fahmy

Our Standards: The Thomson Reuters Trust Principles.

News

Insurers sue rating agency over exposure to Everton bidder 777

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Two US insurers have sued specialist rating agency AM Best in an effort to stop it from downgrading its estimate of their financial strength, in an escalating dispute over their exposure to Everton bidder 777 Partners.

In a lawsuit filed last week, Atlantic Coast Life Insurance and Sentinel Security Life Insurance, part of US insurance group A-Cap, asked a New Jersey court to stop AM Best from “issuing the rating it has prepared” and to force the agency to recalculate it. The planned downgrade would have taken their financial strength rating down three notches, from B++ to B-, they said.

The insurers, which offer life insurance and annuity products to families across America, accused the rating agency of a “fixation” with 777 Re, the Bermuda reinsurer linked to the Miami investment group.

A-Cap has been rushing to take back assets that it ceded to 777 Re through reinsurance transactions, and regulators have pushed it to reduce its exposure to the investment firm, after AM Best raised concerns about the quality of assets held by the reinsurer.

In a separate letter to the court, the plaintiffs’ lawyers argued that the “very existence of [the insurers’] business hangs in the balance”.

The letter also purported to summarise AM Best’s position, saying the agency was refraining from publishing the updated credit rating. That, AM Best reportedly argued, left the market and insurance customers relying on outdated information and left the company at risk of breaching its own policies on prompt publication.

AM Best did not immediately respond to a request for comment.

A-Cap said. “This matter is the subject of litigation and we have already communicated our views on it in the filing referenced. It speaks for itself.”

The A-Cap insurers argued in their suit that AM Best had misunderstood the relationship between the insurers and 777 Re, had taken too dim a view of assets at 777 Re and had not taken into account A-Cap insurers’ progress in reducing their exposure to the reinsurer. They said AM Best had stated in an email that it would apply $1bn in writedowns “largely on assets held outside of the A-Cap insurers’ books”.

The insurers accused the agency of using “flawed methods, improper assumptions, and demonstrably false data” and of a “capricious review process that swung wildly between arbitrary ratings without considering relevant information or co-operating with the A-Cap insurers”.

The insurers said they had provided new information to AM Best relating to the recent “successful recapture” of $510mn of 777 Re-related assets which had been “transferred to a new insurer at par”. In the filing, made on April 23, the insurers said they expected to eliminate their 777 Re exposure by the end of that month.

The scrutiny has taken its toll on 777 Re, which had helped to fund 777 Partners’ investments. The Miami group has stakes in a global portfolio of football clubs, including Genoa in Italy, Vasco da Gama in Brazil, Hertha Berlin in Germany and Standard Liège in Belgium.

777 Partners agreed to buy Everton in September 2023 and had expected to complete the takeover by the end of the calendar year. However, the Premier League has not yet approved its takeover of the Liverpool-based club.

The league has put in place a number of conditions for 777 Partners to meet, including the need to repay £158mn of debt which is owed to lenders including MSP Sports Capital in connection with the new stadium that Everton is building.

In the meantime, 777 Partners has lent more than $200mn to Everton to help meet working capital requirements, said two people briefed on the matter.

News

Have you seen this emotional support gator? Wally's owner says he's lost in Georgia

Joie Henney says his emotional support alligator, Wally, is missing in Georgia after being kidnapped, found and released into a swamp with some 20 other gators.

Heather Khalifa/The Philadelphia Inquirer via AP

hide caption

toggle caption

Heather Khalifa/The Philadelphia Inquirer via AP

Joie Henney says his emotional support alligator, Wally, is missing in Georgia after being kidnapped, found and released into a swamp with some 20 other gators.

Heather Khalifa/The Philadelphia Inquirer via AP

In ordinary times, the social media accounts devoted to Wally Gator document the nearly six-foot-long emotional support alligator’s adventures around Pennsylvania: visiting nursing homes, splashing around in Philadelphia’s Love Park fountain, meeting with the mayor and smiling contentedly in his red harness as various admirers hug and hold him.

In recent days, however, they’ve been overtaken with pleas for help: Wally is missing in Georgia, where his owner Joie Henney says he was kidnapped, recovered and released into a swamp.

Henney and Wally were visiting friends in Brunswick when someone took the gator from his pen in the early morning hours of April 21, the Wallygator Facebook page posted on Saturday.

“Wally was stolen by some jerk who likes to drop alligators off into someone’s yard to terrorize them,” the account posted the following day. “Once discovered they called [Department of Natural Resources], DNR then called a trapper. The trapper came and got Wally and dropped him off in a swamp with about 20 other alligators that same day.”

A spokesperson for the Georgia Department of Resources told NPR on Friday that a permitted trapper had responded to a “nuisance alligator call” in Brunswick on April 21 and later released it “in a remote location.”

They described the way the trapper handled the alligator as “appropriate and routine.” But they could not confirm whether the animal in question is Wally, or where he is now.

The Wallygator Facebook page did not specify the location of the swamp, but urged people to get in touch with Henney to aid in the search and “pray because we need a miracle,” especially given the presence of the other alligators.

“The swamp is very large and the trapper said the chances of them finding Wally is slim to none,” it continued. “But this is Wally … Joie and friends are currently headed to the swamp to search and will continue daily.”

As of Friday, nearly 400 people had donated more than $10,000 to an online fundraiser supporting “travel costs, advising costs and possible legal and veterinary costs” related to Wally’s disappearance.

Henney has not responded to NPR’s requests for comment. But in a post on his personal Facebook page, he thanked supporters for their concern and said there is a no-questions-asked reward for Wally’s safe return.

“Wally is very important to me as well as to a lot of other people that he makes happy and puts joy in their hearts,” he wrote, alongside photos of the two of them cuddling.

Wally has more than 145,000 followers on TikTok, 35,000 on Instagram and 10,000 on Facebook. And that’s not his only claim to fame: He was also the visual reference for Alligator Loki in the Disney+ show Loki.

After Wally made headlines last September for being turned away from a Phillies game, Henney told NPR that Wally, then 8 years old, came into his life at about 18 months.

Henney had long rescued and rehabilitated animals and didn’t set out to keep this one.

“But Wally became special, and he attached to me really super close, so I kept him,” Henney said.

Wally loves chin rubs and giving hugs, and doesn’t bite when people get close to him — something Henney said he’d never seen in his three decades of handling gators.

Wally has been a source of comfort to strangers and friends alike, if social media is any indication. And he was by Henney’s side for a series of difficult moments, including the loss of several family members and his own treatment for prostate cancer.

“He means a lot to me,” Henney said. “Actually, he means as much to me as my children.”

Henney said Wally is the first reptile to be legally certified as an emotional support animal, a process he went through several years ago at his doctor’s suggestion.

Reptiles are permitted as pets under Pennsylvania state law, they just can’t be released into the wild. In Georgia, however, “only licensed or permitted individuals can retain alligators in captivity,” according to the DNR.

On Friday, a post from the Wallygator Facebook account said the DNR had told Henney he would be prosecuted if he catches Wally. The DNR spokesperson declined to comment beyond their statement.

Meanwhile, in a Wally fan Facebook group, worried admirers are discussing the logistical and legal aspects of his situation and suggesting tactics for trying to find him — from flooding the governor’s office with calls to distributing flyers in the area to calling in TV’s Dog the Bounty Hunter.

News

Video: University of Chicago President Says Pro-Palestinian Encampment ‘Cannot Continue’

new video loaded: University of Chicago President Says Pro-Palestinian Encampment ‘Cannot Continue’

Recent episodes in Latest Video

Whether it’s reporting on conflicts abroad and political divisions at home, or covering the latest style trends and scientific developments, Times Video journalists provide a revealing and unforgettable view of the world.

Whether it’s reporting on conflicts abroad and political divisions at home, or covering the latest style trends and scientific developments, Times Video journalists provide a revealing and unforgettable view of the world.

-

News1 week ago

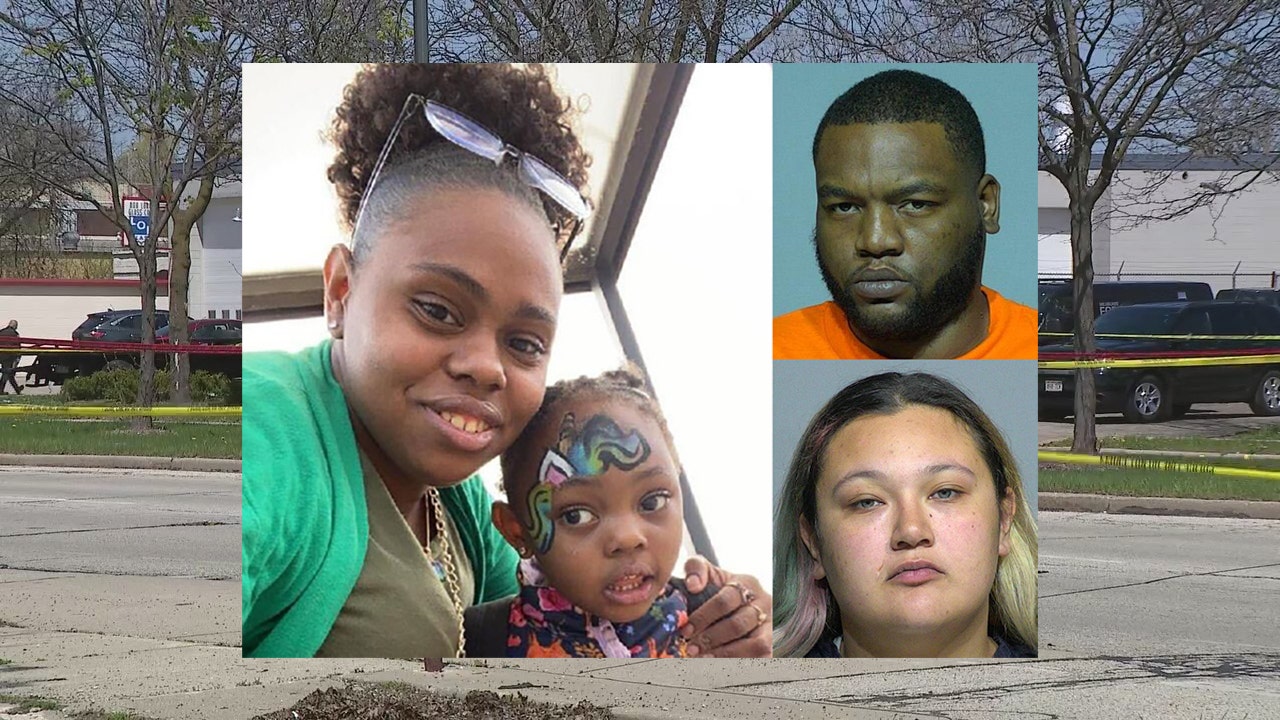

News1 week agoLarry Webb’s deathbed confession solves 2000 cold case murder of Susan and Natasha Carter, 10, whose remains were found hours after he died

-

News1 week ago

News1 week agoFirst cargo ship passes through new channel since Baltimore bridge collapse

-

World1 week ago

World1 week agoHaiti Prime Minister Ariel Henry resigns, transitional council takes power

-

World1 week ago

World1 week agoSpanish PM Pedro Sanchez suspends public duties to 'reflect'

-

World1 week ago

World1 week agoUS secretly sent long-range ATACMS weapons to Ukraine

-

Movie Reviews1 week ago

Movie Reviews1 week agoHumane (2024) – Movie Review

-

News1 week ago

News1 week agoAmerican Airlines passenger alleges discrimination over use of first-class restroom

-

Education1 week ago

Education1 week agoVideo: Johnson Condemns Pro-Palestinian Protests at Columbia University