Nebraska

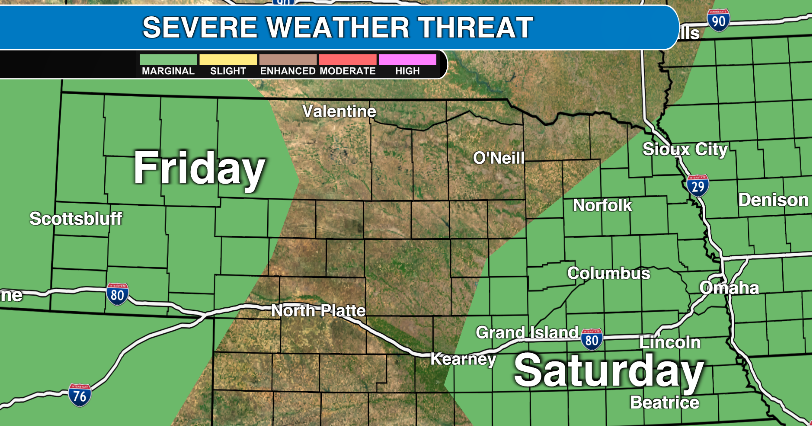

Severe storms possible in western Nebraska Friday, eastern Nebraska Saturday: Matt Holiner’s forecast

{{format_dollars}}

{{start_price}}

{{format_cents}}

{{promotional_format_dollars}}

{{promotional_price}}

{{promotional_format_cents}}

{{term}}

(renews at {{format_dollars}}{{start_price}}{{format_cents}}/month + tax)

{{action_button}}

Nebraska

The Little River Band replacing The Guess Who at Nebraska State Fair

GRAND ISLAND, Neb. (KSNB) – The Nebraska State Fair and 1868 Foundation announced Wednesday that The Little River Band would be coming to the State Fair instead of the previously announced act, “The Guess Who.”

“Concert organizers weren’t sure the previously announced act, The Guess Who, could fulfill their engagement,” a press release from the State Fair stated. “As a result, The Little River Band has been booked to perform on Tuesday night, August 27 in the air-conditioned comfort of the Heartland Events Center.”

The Little River Band started in Australia, and has been around for almost 50 years.

Tickets to see The Little River Band will remain the same amount, and previous ticketholders tickets are still valid for the same seat.

Reserved seats range from $25 to $50 for Tom Dinsdale Automotive VIP seats, plus fees.

If you would prefer a ticket refund, you can contact the Nebraska State Fair Box Office by calling (308) 382-1620 or stopping by the Nebraska Building on or before June 21.

Click here to subscribe to our KSNB Local4 daily digest and breaking news alerts delivered straight to your email inbox.

Copyright 2024 KSNB. All rights reserved.

Nebraska

Principles of good tax policy • Nebraska Examiner

Gov. Jim Pillen is embarking on a policy campaign to sell a new plan meant to lower property taxes. He’s hitting the road making his pitch to voters and state senators in communities around the state.

If you have planned a summer vacation, you know that a great trip does not happen on its own — it takes vision, planning and strong execution. The same is true for state tax policy. Before embarking on a restructuring of Nebraska’s tax system, it’s important to set goals and map out the path to our ideal destination.

We can all agree we want to arrive at a destination where Nebraska has a tax system that allows individuals and businesses to thrive, for our state to compete with our peers, and a system that is fair and equitable for all. How we get there, and what principles we follow, are the primary questions at hand. Achieving meaningful tax reform requires more than a big goal; it must be built upon sound tax policies that will endure for generations to come.

Prior to 2023, Nebraska consistently ranked high among peer states for income tax rates and property tax burdens. Unfortunately, budgets were tight during that time, which limited fiscally responsible means for reducing these taxes. Regardless, our state leaders knew Nebraska had to perform better if it was to successfully compete with peer states for business and job growth and personal prosperity.

Finally, in 2023, Nebraska had its shot. Due to a revenue surplus, in part because ofthe COVID crisis, Nebraska was able to slash its income tax rates to 3.99% over five years and also eliminate community colleges’ ability to levy property tax. These changes significantly enhanced our state’s tax code; however, they did not happen overnight, and they did not happen by accident. Despite this reform, Nebraska still has the seventh highest property tax rate in the country. As we look forward now, we need to consider what goes into good tax policy, and how Nebraska can ensure we get the best outcome for our state.

Budgetary restraint

Foundational to any good tax policy is budgetary restraint. Although Nebraska was able to accomplish significant reforms due to excess revenue, only budgetary restraint can provide sustainable tax relief. That is, future tax reforms should not rely on a tax shift, but instead focus on capping local spending growth and promoting budget restraint.

Simplicity

Good tax policy is also rooted in simplicity. A tax code that is easy to understand and comply with reduces administrative costs and economic distortions. Nebraska’s recent reforms aimed to simplify the tax code by reducing the number of brackets and lowering rates. Eliminating the community college property tax simplified the overall property tax system. Future reforms should continue this trend towards simplicity, making the tax system as straightforward as possible while ensuring that elected officials are accountable to the taxpayer.

Transparency

Transparency is another critical principle of foundational tax reform. A transparent tax system ensures that taxpayers understand how their money is being used and can hold government officials accountable. Transparency also means keeping accountability at the level of government most accessible to the taxpayer. This means local decisions should stay in the hands of local elected officials, not bureaucrats in Lincoln. Nebraska should continue to prioritize transparency, building trust with taxpayers and ensuring that public funds are managed responsibly.

Economic growth

Lastly, economic growth should be a guiding objective. Tax policies that promote investment, job creation and economic expansion benefit all Nebraskans. By keeping tax rates competitive and reducing burdensome regulations, Nebraska can attract new businesses and retain existing ones, driving economic prosperity. Legislators should reject ideas that raise taxes on business inputs and instead focus on policies that spur economic growth throughout our state.

The principles of budgetary restraint, simplicity, transparency and economic growth form the bedrock of sound tax policy. As Nebraska looks to further improve its tax system, these principles will guide us toward a fairer, more prosperous future for all. In the next part of this series, we will explore specific policy solutions to achieve property tax reform, building on this strong and principled foundation.

In conclusion, it is wise to have a clear understanding of the objective before embarking on the journey. For Nebraska, the objective should be statewide population and job growth, business creation and personal prosperity, partnered with state and local spending controls and fiscal policies that help sustain Nebraska’s performance, even through economic turbulence.

Nebraska

Nebraska International Port Of The Plains Inland Port Authority Board discuss progress on rail park

NORTH PLATTE, Neb. (KNOP) – The Nebraska International Port of the Plains discussed the progress on the rail park on Tuesday afternoon.

The discussion centered on the progress of the future Lincoln County rail park located near Hershey. Further discussions centered on a track line that belonged to the Greenbrier Rail Company; the transportation company halted operations in Hershey in 2020, sending 24 employees home.

The company had rail access to re-manufacture, inspect, repair, and assemble rail car wheels, roller bearings, and wheel car assemblies; one of the company’s key clients was Union Pacific. The rail access and facility formerly occupied by Greenbrier.

The Nebraska International Port of the Plains, the entity has the goal of not only having surrounding companies import and export supplies in and out of this facility when completed but to also storing railcars there. As for Nebraska International Port of the Plains chairman Vince Dugan, the reality of this is becoming more and more real.

“Everything is becoming a lot more real. I think we want to coordinate, we want to understand. I think I have a better understanding than I have ever had during the entire process. what we are talking about doing is exactly what the airlines and air carriers do. The airport does not employ the people that take everything off, and the airlines go through a third party, and companies do that, and that is exactly what you are talking about doing with the rail spur,” Dugan said.

The Inland Port Authority discussed tracks that once belonged to the Greenbrier Rail Company but also the products that local businesses could import to the rail park. The board has said that small products will help improve local businesses in distribution as well as their production.

“It’s becoming quite clear to me, and also, I like the specialty product thing because what do we know about specialty products? You get more money for them, you get more value, and that could jump-start us before we consider commodity value products because one thing is for sure we are not going to be the barrier to a successful venture; we are going to make it happen,” Dugan said.

Click here to subscribe to our KNOP News 2 daily digest and breaking news alerts delivered straight to your email inbox.

Copyright 2024 KNOP. All rights reserved.

-

News1 week ago

News1 week agoSkeletal remains found almost 40 years ago identified as woman who disappeared in 1968

-

World1 week ago

World1 week agoUkraine’s military chief admits ‘difficult situation’ in Kharkiv region

-

Movie Reviews1 week ago

Movie Reviews1 week agoAavesham Movie Review

-

Education1 week ago

Education1 week agoVideo: Protesters Scuffle With Police During Pomona College Commencement

-

World1 week ago

World1 week agoEU's divided right wing can disrupt if it finds greater unity: experts

-

News1 week ago

News1 week agoNevada Cross-Tabs: May 2024 Times/Siena Poll

-

News1 week ago

News1 week agoStudent protests caused mostly minor disruptions at several graduation ceremonies

-

World1 week ago

World1 week agoPro-Palestinian university students in the Netherlands uphold protest